Paypal's 'Going Sharp' Stategy To Find Product Market Fit | VC Distributions Sink To 14-Year Low | VC Remote Jobs ....

"Going Sharp", VC Distributions Sink To 14-Year Low, New SAFE Valuation Cap......

Hi, Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive

Paypal's "Going Sharp" Stategy To Find Product Market Fit (PMF) !

Quick Dive

VC Distributions Sink To 14-Year Low.

Solo vs. Team: The Startup Founder Debate.

New SAFE Valuation Caps for Fundraising Success.

Featured Articles:

How to Talk About Valuation Numbers When Investors Ask?Major News:

Softbank's Vision Fund Gain $4 Billion In Q4, Apps Closing Due to X's API Limits, OpenAI's Hits $2 Billion Revenue & Thiel Invested $200M In Crypto.Best Tweet Of This Week On Startups & Technology.

VC Jobs & Internships: From Scout to Partner.

FROM OUR PARTNER

VESTBERRY - The Portfolio Intelligence Platform for data-driven VCs

Data Engineering is no longer just a backstage player but is taking centre stage in the VC space.

It is about constructing and maintaining the architectures (think databases, large-scale processing systems) that allow for data availability—a cornerstone for insightful analysis and well-informed decisions.

Turning raw data into usable outputs and insights has great use cases for deal sourcing, due diligence, or portfolio monitoring.

Dive deeper into this video, where we break down the impact of data engineering on the VC industry.

🤝 PARTNERSHIP WITH US!

Want to promote your startup to our community of 22,000+ entrepreneurs and investors? Fill out the form, our team will reach out to you.

🎉Get A Discount of 20% For Multiple Featured

TODAY’S DEEP DIVE

Paypal's "Going Sharp" Strategy To Find Product Market Fit.

In November 1999, PayPal founded the Product Market Fit (PMF) - When it identified a clear and urgent pain point for a large and growing market: online payments, particularly focusing on eBay users who needed a convenient way to pay and get paid for their online auctions.

The company's growth skyrocketed after it dropped other plans and went all-in on the eBay use case, with the number of users increasing from less than 10,000 at the end of 1999 to 5 million by the summer of 2000.

This is a result of PayPal's sharp startup strategy, which still works today. So, let's deep dive into this strategy and understand how PayPal used this strategy to Find PMF.

Whereas the average startup launches a bunch of features for a bunch of use cases to appeal to many possible users, the Sharp Startup focuses on a few killers features for the most desperate customer segment. In short, it finds a wedge in the market.

The Sharp Startup focuses on the most desperate customer segment. It finds a wedge into the market.

While it’s important to have a larger vision, the Sharp Startup remains opportunistic and agile enough that when it spots this kind of opening in the market, it drops everything else and drives all of its troops through it.

David Sacks, who was leading product at Paypal, shared the story of how Paypal found product-market fit -

“It was November of 1999 when one of their customer service rep forwarded him an email from an eBay power seller. The eBay seller had turned the PayPal logo into a nice-looking button for her auctions and was asking PayPal’s permission to use it.

The irony of this situation was, that this email was forwarded not because of product reasons but because of legal reasons as David Sacks was handling companies’ legal affairs owning to his degree in law from Stanford. It was a potential trademark infringement question. Anyhow, he brought up this email to Luke Nosek (co-founder of PayPal, then CMO of PayPal). They said and I quote (from notes shared by Dave in his blog)

It seemed extraordinary that an eBay seller had taken the time to create her own PayPal auction button. If she cared that much, how many others did too?

PayPal did what great companies do. They captured the opportunity and tested the found product market fit…

They went to the eBay website and searched for ‘PayPal’. Hundreds of auctions appeared in the search results because PayPal was mentioned in the item description as a possible method of payment. This was the AHA! moment and PayPal found its product-market fit. Even more interesting to learn is their plan to implement and capture this moment.

In the meantime, Luke had come up with the signup-referral program. Now see how PayPal productized this idea. They told auctioneers, they were free to use the PayPal logo, in-fact PayPal created a nice logo for them and even inserted it in their auctions, and on top of that gave $10 for every referral (more on referral in the next chapter).

This spread like wildfire in a tight-knit eBay community. Soon, most of the auctions were advertising PayPal. They dropped all other plans and went full steam with this idea. Soon they reached 10,000 users by the end of 1999. By early 2000, they had 100,000 users.

A few months after that they reached a million and by the summer of 2000, they had 5M users. The growth curve looked like a perfect hockey stick.”

It was a classic Sharp strategy: Paypal identified the most desperate customer segment, went all-in on their use case, and found ways to turbo-charge the adoption.

Notably, many of the key features were distribution tricks, not just product enhancements. As a result, PayPal captured the key beachhead market of the nascent online payments space, ahead of its many competitors.

You might be thinking - Paypal got lucky in this! Agree they got lucky for not sending the customer service email to the spam folder.

But you can use this strategy to find PMF for your startup, how? By -

Focusing on solving a specific problem for a specific market.

Leveraging their competitive advantage and network effect.

Being flexible and adaptable to changing market conditions.

That’s It.

TODAY’S QUICK DIVE

VC Distributions Sink To 14-Year Low

Limited partners (LPs) are disappointed with the low capital returns from venture managers, impacting their willingness to reinvest. In 2023, distributions to LPs as a percentage of mature funds' net asset values hit a 14-year low at 32%, according to PitchBook.

Laura Thompson from Sapphire Partners emphasizes the importance of a strong DPI metric during such times. LPs need robust cash distributions to fuel new VC funds, but the current environment, marked by the lowest DPI in over a decade, complicates fundraising for venture managers. The potential for an improved IPO market offers hope, but until then, VCs with low DPI may turn to selling stakes in the secondary market to navigate the challenging landscape.

Solo vs. Team: The Startup Founder Debate

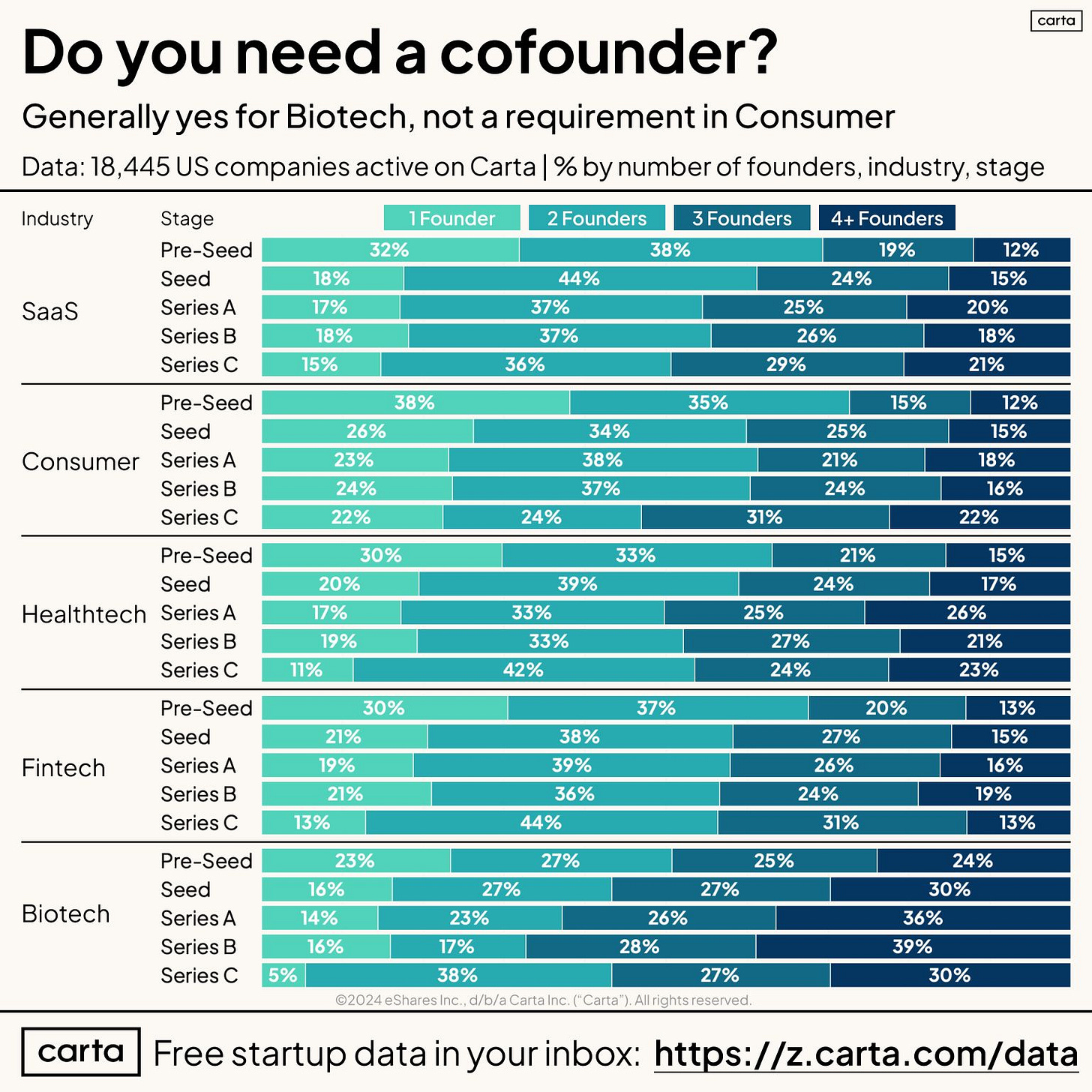

Recent data from Carta, encompassing over 18,000 companies, challenges the notion that startup success requires cofounders.

Solo founders make up 27% of all companies on Carta, dropping to 20% excluding pre-seed. Notably, consumer startups show the highest sustained share of solo founders.

In Series C, larger founding teams are more common, constituting about 15% of Series D companies.

However, the data indicates that solo founder-led companies, comprising 27% in total, are a viable path, challenging the universal need for cofounders in the startup landscape. The reasons for varying team sizes remain unclear, leaving room for interpretation.

New SAFE Valuation Caps for Fundraising Success

In a study of 15,000+ post-money SAFEs signed in 2023 for US companies by Carta, round size was found to be the primary factor determining valuation caps. Medians for round size | valuation cap:

Under $250K | $5M val cap

$250K-$499K | $7M val cap

$500K-$999K | $9M val cap

$1M-$2.4M | $12M val cap

$2.5M-$4.9M | $19M val cap

$5M+ | $30M val cap

This highlights the widespread use of SAFEs across various funding rounds and cautions against blindly using multiple valuation caps, which could lead to significant dilution for founders.

FEATURED POST

How to Talk About Valuation Numbers When Investors Ask?

For Founders, you’re raising money from people who have ‘Asymmetric Information.’ As an entrepreneur, it can feel as intimidating as going to buy a car where the dealer knows the price of every make & model of a car and you’re guessing how much to pay.

Of course, unlike cars, there is no direct comparison across each startup so these are just some general guidelines I tried to cover:

What Expectations Do You Have About Valuation?

What Was The Post Money On Your Last Round And How Much Capital Have You Raised?

The “How much have you raised?”

When SHOULD You Name A Valuation Expectation?

Turning The Information Tables..… Read More Here

Join 14500+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Founders Fund, led by Peter Thiel, has invested $200 million in Bitcoin and ether after a market downturn in 2022. Read More

OpenAI Annual Run Rate Has Hit The $2 Billion Mark. Read More

Arrival, a Tesla rival valued at $13 Billion filed for bankruptcy in the UK, having never sold a single vehicle. Read More

SoftBank's Vision Fund reported a $4 billion gain in Q4 2023, its largest quarterly return in almost three years. Read More

Grammarly is laying off 230 employees worldwide to focus on the AI-enabled workforce. Read More

→ Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? Subscribed To the Venture Daily Digest Newsletter and join 9500+ Avid Readers!

TWEET OF THIS WEEK

Best Tweet I Saw This Week

Historically, access to top-performing managers was considered the most important factor in building a successful venture capital allocation—so much so that venture capital was sometimes jokingly referred to as an “access class.”

This was largely due to the higher persistence of performance of venture capital managers compared with other asset classes, driven by factors such as information asymmetry, access to proprietary deal flow, smaller fund sizes relative to other asset classes and path-dependence stemming from successful past investments… Read More Here

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Senior Research Analyst - Toyota Venture | USA - Apply Here

Marketing Associate - Stellaris Venture Partner | India - Apply Here

Associate - Artha Group | India - Apply Here

Special Opportunities Associate, Investments - S2G Venture | USA - Apply Here

Food & Agriculture Associate, Investments - S2G Venture | USA - Apply Here

Investment Associate - Myriad Venture | USA - Apply Here

Associate - Aramco Ventue | USA - Apply here

Finance Associate- Giant Venture | UK - Apply Here

Investment Associate - Giant Venture | UK - Apply Here

Communications Administrator - Fuel venture | UK - Apply Here

Associate - Investment Manager | Australia - Apply Here

Venture Analyst | Insurtech - Plug and play tech centre | Spain - Apply Here

→ Want Daily Updates on VC Job Opportunities? Check out VC Crafter 👇

Join our 250+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

That’s It For Today! Will Meet You on Thursday!

Happy Tuesday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team