Paul Graham's Views on Competitor Analysis and a Framework for Performing It | VC Jobs

Crowdfunding = Strangers on Cap Table & Circle's Founder Views on Startup Valuation...

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Trending AI Tools of the Week

Deep Dive: Paul Graham's Views on Competitor Analysis and a Framework for Performing It.

Quick Dive:

Read This Before You Raise Crowdfunding for Your Startup…

Coinbase’s Decision-Making Framework.

Circle’s Founder, Sid Yadav’s Views on Startup Valuation

Venture Curator Hub: Get Access To 10000+ verified investors' email contact database & more.

Major News: Microsoft declares OpenAI as a competitor, US Justice Dept. Investigating Nvidia's $700 Million AI Startup Acquisition, a16z, Sequoia Capital-Backed Founder Charged With Fraud & Musk's xAI Acquiring Character AI Startup?

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH BERKELEY SKYDECK

Apply to the Berkeley SkyDeck Accelerator Batch 19!

📣 Calling all early-stage founders: apply to join Berkeley SkyDeck to take your startup to the next level!

SkyDeck is a leading global accelerator, dedicated to fostering entrepreneurship worldwide. Come to SkyDeck, where visionaries take flight, and join the ranks of SkyDeck alums such as MindsDB, Hayden AI, and Loft.

🚀Register for SkyDeck's information sessions to learn more!

PARTNERSHIP WITH US

Want to get your brand in front of 50,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TRENDING AI TOOLS OF THE WEEK

Don’t Miss These AI Tools

Kathy AI: An AI-powered autonomous competitor analyst that researches your competition in real-time, delivers real-time insights, generates reports, and tailors strategies to your needs, seamlessly integrating with your tools and workflows. (Try Here for free)

Ideabuddy: An all-in-one business planning tool powered by AI that helps you visualize, plan and execute your business ideas, all in one single place. (Try Here for free)

TODAY’S DEEP DIVE

Paul Graham's Views on Competitor Analysis and a Framework for Performing It.

Paul Graham on Competition in Early-Stage Startups

Don't Worry about Competitors

When you think you've got a great idea, it's sort of like having a guilty conscience about something. All someone has to do is look at you funny, and you think "Oh my God, they know."

These alarms are almost always false:Companies that seemed like competitors and threats at first glance usually never were when you really looked at it. Even if they were operating in the same area, they had a different goal.

One reason people overreact to competitors is that they overvalue ideas. If ideas really were the key, a competitor with the same idea would be a real threat. But it's usually execution that matters:

All the scares induced by seeing a new competitor pop up are forgotten weeks later. It always comes down to your own product and approach to the market.

This is generally true even if competitors get lots of attention.

Competitors riding on lots of good blogger perception aren't really the winners and can disappear from the map quickly. You need consumers after all.

Hype doesn't make satisfied users, at least not for something as complicated as technology.

Remember, competition can teach you a lot about what not to build or what to prioritize. Many successful companies have been built by executing simple ideas that their competition didn’t pursue. But how should you conduct competitor analysis for your startup? No, I’m not talking about SWOT analysis. You’ll find plenty of articles online explaining why SWOT analysis isn’t worth it. Instead, I’ll share a framework (by Antler) and a practical approach to competitor analysis.

So grab your coffee, and let’s dive in!

The first question you should be asking as you set out to complete a competitor analysis is “Which companies are my competitors?”

That might sound like a ridiculously rudimentary statement on the surface, and to an extent it is. People generally assume that a startup founder will have some kind of intuitive understanding of the competitive landscape at the moment that they have the idea. However, in practice it’s very easy to make a mistake in both directions; to assume that a company is a competitor when it’s not (this is often the case when a startup entrepreneur looks at a massive global company as a competitor), and to be simply unaware of another startup that is their biggest and most challenging rival.

The best way to build your list of competitors is to ask three simple questions:

Who (The Customer):

Who are your target customers (and/or companies)? Chances are any other company that has an overlap in target customer segments is a competitor.

What (The Problem):

If your product, service or solution solves the same problem as another company, then it’s a sign that you’re competitors.

How (Product Category):

How you solve the problem is also an important consideration, and if your technique is comparable to another company, then it’s a sign that you’re a competitor.

So, for example, say that you’re looking to start a small security-managed services organization. You’re promising 24/7 protection for your client’s IT environment, and the associated consulting services that go with that.

You might be offering security, but Norton, McAfee, and the other security vendors are not your competitors. Those companies offer solutions that individuals and companies install themselves, with their IT teams, to secure their environments.

Nor are your competitors the big consulting firms like Deloitte or EY. They help organizations with security, but only as consultants. These companies will then go and source and maintain solutions based on their consultant’s guidance.

Your actual competitors will be the national and local managed services providers. What you are providing to your customers is IT skills and the peace of mind of not having to think about their IT environment. Based on that, your closest competitor might not even have a security focus!

How to find your competitors

The most effective competitor analysis process will account for the startups and small businesses that don’t necessarily dominate the media cycle and may not even appear on the front page of a Google search. There is a broader range of research tools that you should use to generate your list for comparison:

Customer insights: Chat with potential clients to uncover recurring names in your industry.

Social media exploration: Use LinkedIn's "Similar Pages" feature to discover related businesses.

Keyword analysis: Go beyond Google's first page. Use tools like Semrush for deeper competitor research.

Role-play as a customer: Solve the problem your business addresses and note the solutions you find.

Industry events: Attend trade shows and conferences to spot emerging competitors.

Local business directories: Check listings for similar companies in your area.

App store research: If applicable, explore apps solving similar problems to yours.

Patent searches: Look for innovations in your field to identify potential future competitors.

Investor portfolios: Examine what similar startups venture capital firms are funding.

Online forums: Monitor discussions where your target audience seeks solutions.

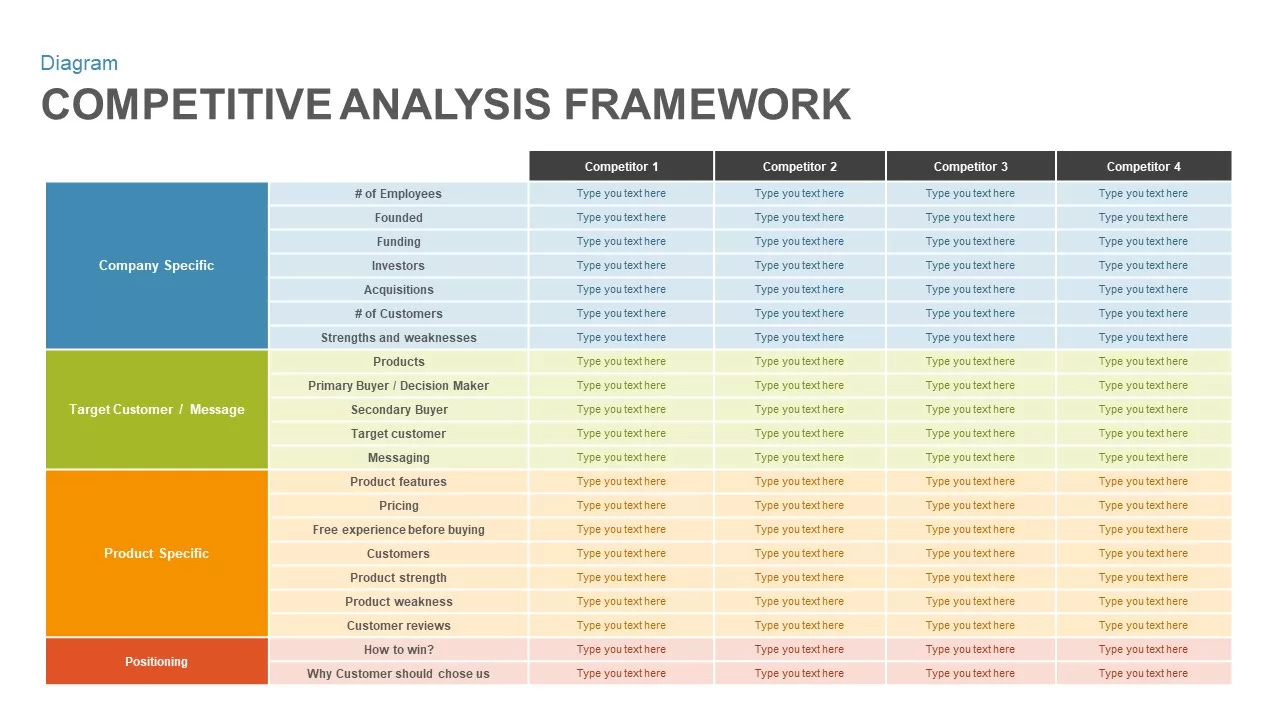

How to conduct a competitive analysis

Now that you've identified your key competitors, it's time to dive into the analysis. The cornerstone of this process is creating a competitor matrix - a powerful tool that gives you a bird's-eye view of your market.

You can easily create this framework in spreadsheet. OR

Start with a simple spreadsheet. Each column represents a competitor, with your own business included. The rows will contain various metrics and information categories. Here's what to include:

Business Overview

Founding date

Company size

Revenue & customers

It is worth understanding the maturity of the businesses that you’re going to be competing against. As a general rule, the lengthier the incumbency, the more difficult it is going to be to win customers, even if there’s mild dissatisfaction with what’s currently on offer, so this information is relevant to the competitive analysis.

GTM/Customer Acquisition

Customer awareness

Customer sentiment

Acquisition channels

In this section, you’ll track how well-developed the market is (just how aware are customers of what is on offer), their mood towards the current offering, and how those customers are engaged and acquired.

Product Offering

Pricing (ASP)

Features

Sales model

Understanding where your product/service’s pricing sits is without a doubt critical in determining your go-to-market, but just as important is understanding how the features compare (since customers usually are willing to pay a premium for excellent features), and how your competitors approach the sales process.

Where can you get this information from?

This is the sticking point; companies will be less than forthcoming with the kind of information that you need to run a competitive analysis at times. However, there are research hacks and tricks that you can use to, at least, arrive at a reasonable ballpark figure.

Public Companies: Check annual reports and investor presentations for financial data and strategic plans.

Private Companies: Estimate revenue by multiplying employee count (from LinkedIn) by $150K-$200K, depending on funding level.

Funding Info: Use Crunchbase or Dealroom to track investment rounds and valuations.

Product Details: Sign up for free trials or demos to experience competitors' offerings firsthand.

Customer Sentiment: Read app store reviews, social media comments, and online forums for unfiltered feedback.

Employee Insights: Explore Glassdoor reviews for internal perspectives on company culture and operations.

Tech Stack: Use tools like BuiltWith to see what technologies competitors are using on their websites.

Marketing Strategies: Follow competitors on social media and sign up for their newsletters to track campaigns.

Pricing: Check public pricing pages or request quotes as a potential customer.

Partnerships: Look for press releases or "Partner" pages on company websites.

Job Listings: Review open positions to gauge growth areas and strategic priorities.

Patent Filings: Search patent databases for insights into R&D focus.

You can leverage this competitive analysis in your pitch deck or business planning. But do investors care about the competitor analysis slide? YES…. but Paul Graham has a different opinion -

Agree or disagree? most Y Combinator startups attendee, spend more time doing competitive analysis. 👀

You can download the Competitor Analysis Excel Sheet Here.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

Excel Template: Competitor Analysis Framework For Early Stage Startups (Access Here)

Early Stage Startup Financial Model Template For Fundraising (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

1. Why Crowdfunding doesn’t Work?

Investing in an early-stage private company is both an opportunity and a privilege. But can the privilege be crowdsourced?

Equity crowdfunding is a great move forward in democratizing investing and introducing more capital to private markets. But, it's generally a bad idea to have ‘strangers’ on your cap table, when you're an early-stage private co, especially before PMF.

Think of this as a bunch of random folks who came to speculate and create noise while you're still figuring out how to make your thing work. There have been many such examples in crypto that eventually added to the controversial reputation of this incredible tech ecosystem.

Crowdfunding finds its best application in real-world assets like real estate, where you can buy a piece of a real cashflow-generating business with a check size of as little as $10. It works for the issuer too, as they require substantial raw capital to make those deals work.

This could also be beneficial for emerging consumer brands that want to give a small ownership stake to their fanbase. But it’s not a good deal for most early-stage companies.

If you have any other thoughts, feel free to share them in the comments.

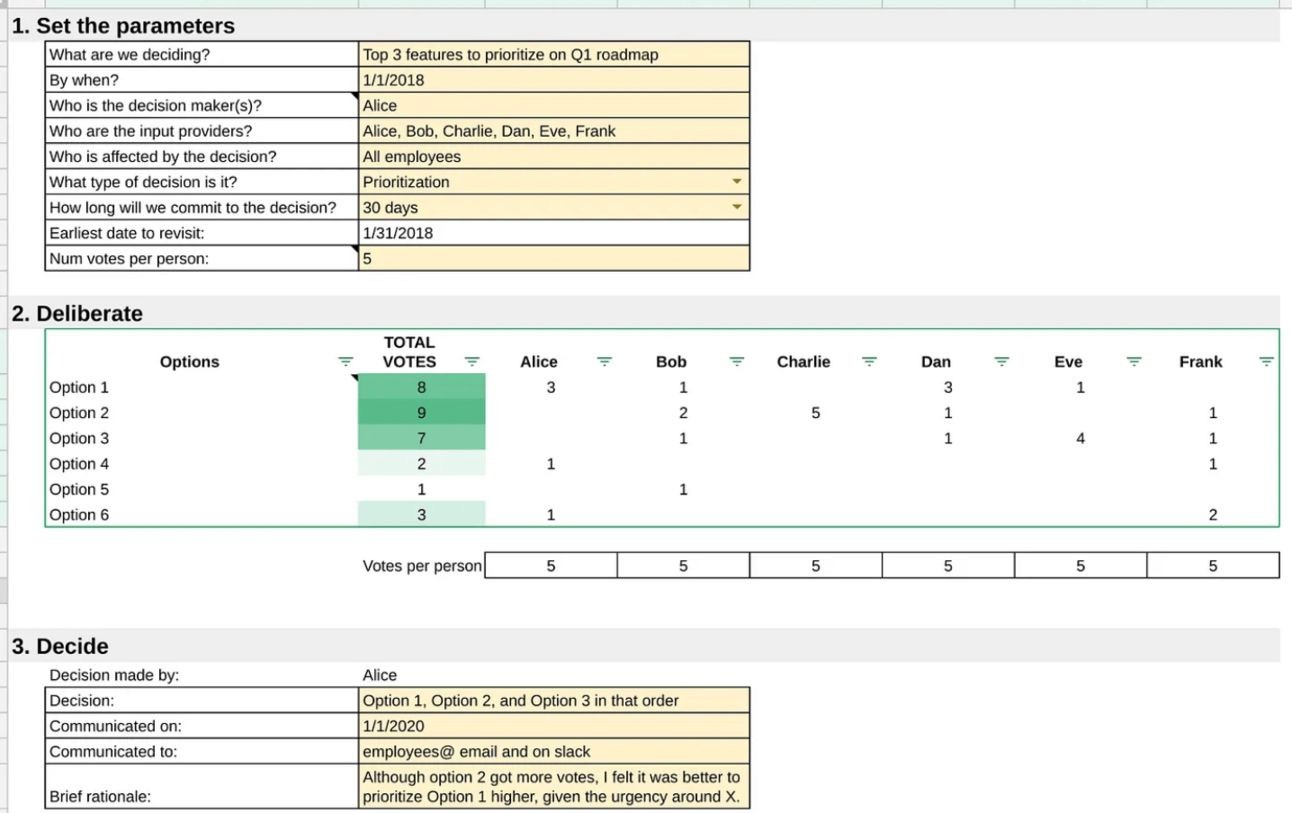

2. Coinbase’s Decision Making Framework.

Low-risk decisions should be made pretty quickly. For high-risk decisions, a decision-making framework can be helpful.

I’ve seen a lot of decision-making frameworks. But I like this one from Brian Armstrong, the founder of Coinbase because it works both for quick 15-minute live meetings and over multi-week strategic decisions.

This framework can be used to decide:

Whether to hire a candidate

What to prioritize next in a product roadmap

Whether to buy or sell a company

A new name for a product or team

And more…

Here’s the template to implement this framework and here’s how to use it.

You might think this template looks overly simplistic, but what I like about it is that it’s just meant to record the context around the decision and provide a clear voting framework.

It forces the actual decision-making process to happen through live conversation. And no matter what you’ll end up with a clear, numerical score for the option that you collectively favour.

3. Circle’s Founder, Sid Yadav’s Views on Startup Valuation

Sid grew his startup Circle (an all-in-one community platform) from 0 to $20m+ ARR in 4 years. The last financing was at a $250m valuation a year ago and has nearly doubled all metrics in the past year. He shared that a lot of people often ask him how much Circle is worth today.

After talking to some of the world’s most successful founders and digesting countless material about startup valuations, here’s what Sid thinks about startup valuation:

“A valuation is a number an investor or acquirer comes up with based on analyzing your discounted future cashflows, while the price is a number buyers and sellers agree to act on.

Your price is not necessarily your valuation, since the former is influenced by market dynamics — demand and supply.

If you’re a private company, the valuation is what you want to pay attention to, since the only way for you to gauge the true price would be to have buyers and sellers transacting in the public market.

I like to put myself in the shoes of a potential investor or acquirer.

When they value Circle, they’ll typically look at:

the size of our business today

the growth rate

our market size way out in the future

our ability to serve that market with valuable products

our ability to capture and sustain some of that value for ourselves

macro trends with inflation and interest rates

It’s too late to change #1 and we don’t control #6, but #2-5 are completely in our control. No excuses.

That’s the theory. Here’s a more concrete answer:

A quick heuristic investors use to value fast-growing SaaS companies is a multiple on ARR (annual recurring revenue).

Given the day, my valuation of Circle varies between 10x to 25x our ARR.

On most days in the past 12 months, it’s been closer to 25x — because we truly have a lot going for us compared to other startups on our scale. If a major new prospect investor were to evaluate us for a transaction, I’d typically offer to send them all 50 of my monthly investor updates to back this up.

Once in a blue moon, I get as pessimistic and tell myself that Circle is likely worth a lot less than 25x our ARR.

But I also remind myself that it’s mostly in my control to act on this. It’s my fiduciary duty to maximize shareholder value, so we must.

If we aren’t moving fast enough, we can fix those bottlenecks today. If we’re scaling on the wrong foundations, we can pause and reflect on our fundamentals today. If we aren’t thinking big enough about our market opportunity, we can expand our imagination today.

If a key hire isn’t working out, we can make a performance plan for them today.

Valuations are slightly subjective with some objective grounding, entirely dynamic, and always in flux. They’re a guess at what reality could be, and the subject’s lens matters more than people think.

The key is to treat them as not just a number someone else decided for you, but an intuition you act on. And remember the quote: if you don’t deal with reality, reality will deal with you.”

Join 31000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

The U.S. Department of Justice is investigating Nvidia's $700 million acquisition of Run: ai on antitrust grounds. (More Here)

Intel plans to cut over 15,000 jobs, about 15% of its workforce, as part of a $10 billion cost savings plan for 2025. (More Here)

BitClout founder Nader Al-Naji, known as "DiamondHands," has been charged by the SEC with fraud and unregistered offering of securities. (More Here)

Over 100 VCs have pledged support for Vice President Kamala Harris under VCs for Kamala. (More Here)

Midjourney releases V6.1 model, which is faster and "generally more beautiful" (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 22,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

From Marc Randolph

Fun Part…

This startup spends $1.8M of $2.5M raised on its domain name. Lots of memes are surfing on the internet…

How Can I Help You?

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 50,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Executive Coordinator & Office Manager - 25Madison | USA - Apply Here

Principal - Woven Capital | Japan - Apply Here

Senior Manager - Visa Venture | USA - Apply Here

Business Development Associate - GrowthCulture Ventures | India - Apply Here

Principal, Investor Relations - Red cell partner | USA - Apply Here

Compliance Officer - Insignia Ventures Partners | Singapore - Apply Here

Visiting Marketing Analyst - Leonax Capital Partner | Germany - Apply Here

Marketing & Communication Internship - Velocity Venture | UK - Apply Here

Executive Assistant / Office Manager - Emerald Bioventure | USA - Apply Here

Finance and Accounting Associate - Energize Capital | USA - Apply Here

Analyst - Roadrunner Venture Studio | USA - Apply Here

Venture Capital Intern - Maki VC | Finland - Apply Here

Deal Sourcing Analyst - CENSIE Capital Partners | India - Apply Here

🧐 Michael Dempsey, managing partner at Compound has advice for aspiring Venture Capitalist

Being a generalist is more fun, but being a young VC generalist is not a good way to get hired....

Michael Dempsey’ X

Michael Dempsey, managing partner at Compound has advice for aspiring Venture capitalists - “A pattern I’ve observed when interviewing younger candidates in the venture is a desire and focus on understanding emerging markets as an investment theme/area of edge.

While I get why that may be intellectually interesting and seem like a good idea, it feels like a minimally creative way to build an edge against average investors (which does not = good returns in VC)…

We have shared a detailed guide and curated resources in our “Break Into VC” newsletter.

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

That’s It For Today! Happy Friday. Will meet You on Tuesday!

✍️Written By Sahil R | Venture Crew Team