Most founders ask the wrong questions in VC fundraising meetings—don’t be one of them. | VC & Startup Jobs.

140+ YC Startup Landing Pages, Venture Capital 3.0: Every Founder Should Know? & Fundraising Quickly With Tranches.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: What Founders Should Ask VCs During Fundraising Meetings?

Quick Dive:

Venture Capital 3.0: What Founders Need to Know Now?

How To Close Your Fundraising Quickly With Tranches: A Practical Guide.

A look at 140+ YC startup landing pages that raised over $200M.

Major News: Trump’s tariffs kill TikTok deal, MidJourney unveils new AI model, Klarna delays IPO amid tariff turmoil, Meta’s new AI model benchmarks mislead & more.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

The race is on to redesign everything for AI agents: billion-dollar markets to be seized.

The Impact of Tariffs on Series As.

Wiz’s $32B GTM Playbook: Unpacking the Formula.

This man created a $92B empire by quietly acquiring 600+ SaaS companies: the story of Mark Leonard, an acquisition legend.

Verified 2700+ US angel investors & VC firm contact database (email + LinkedIn link).

Tried AI? You Are Not ‘Most Americans. ’

The mantra of this AI age: Don’t repeat yourself.

Maturity Frameworks: A Hidden Gem in Your GTM Strategy.

Trump’s tariffs send consumer startups into full-on panic.

OpenAI's product launches are stirring something which Apple hasn't in a while.

Tracing the thoughts of an LLM - large language model.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Write Smarter, Not Harder: How to Use AI Without Losing Your Soul.

400+ French angel investors & venture capital firms contact database (Email + LinkedIn Link)

Startup legal document pack – essential legal docs for founders.

How trade actions will affect PE, VC, M&A and private credit.

SaaS Startup Financial Model: All-in-One Excel Template.

300+ Australian angel investors & venture capital firms contact database (Email + LinkedIn Link).

Raising money but struggling to connect with the right investors? We help startups reach 85,000+ investors and connect with members of our investor Slack community. Fill out this form to get started. It’s FREE!

FOR FOUNDERS WANTING TO GROW…

🚀 Ship faster. Scale bigger. Win more.

Urban Dynamics is accelerating startups to ship & scale faster. Stay focused on what matters — building features — and stop worrying about the pain of cloud, security, DevOps, and more.

Take advantage of our Product Scalability Workshop for Founders – a dedicated 1-hour workshop tailored to you and scaling your startup fast⚡️availability is limited.

Reserve your slot for April now →

PS - Attending Google Cloud Next on April 9- 11? If so, join our community newsletter & Slack to meet up with our team 👋

PARTNERSHIP WITH US

Get your product in front of over 85,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

What Founders Should ask VCs During Fundraising Meetings?

Top-performing founders know a key secret: when meeting with VCs, don't just focus on securing their money—focus on learning from them.

Most VC meetings won't end with a check, but that doesn't mean they're a waste of time. Each meeting is a chance to build your company using the insights you gain from the VC, not just the funding you might receive.

Remember, investors have seen countless startups, invested in many, and have a broad view of the market. That experience is incredibly valuable, and it’s right there in front of you. They hear and see things that you might not. This wealth of knowledge is yours to tap into—you just need to ask the right questions.

Yet, many founders make the mistake of only asking, “How long will it take to get a response?”

I’ve noticed that some founders approach VC meetings as if the investors are above them, rushing through the meeting like it’s a rapid-fire round. Don’t do that. Approach the meeting with the right mindset: come in as an equal, ready to collaborate and engage in meaningful discussion.

Here are a few of my suggestions for making the most of your VC meetings:

Spend the first part of the meeting explaining what you know about your business—focus on sharing insights, not just pitching. The majority of the time should be used to ask the VC questions and engage in a collaborative dialogue.

Aim for a ratio like this: If you have 10 minutes, explain for 4 and discuss for 6. If you have 30 minutes, explain for 8 and discuss for 22. If you have an hour, explain for 12 minutes and discuss for the rest. Keep a large appendix in your deck for reference during the discussion.

To help founders get into the right mindset, I’ve pulled (Shared by GP) together a few questions that have seen in pitch meetings. These are questions every founder should consider asking when meeting with VCs. We’re sharing them to encourage founders to start real conversations and build genuine relationships with investors—from the very first meeting. Remember, these relationships could last decades, even if the VC doesn’t invest this time.

More than just asking these questions, it’s crucial to approach meetings with a mindset focused on learning and finding the right fit between the founder and the VC.

How you phrase things can make a difference. Try asking from the perspective of “this company I’ve shown you,” as that’s how the VC views it.

Understanding How Your Company Is Perceived

You have a busy schedule and many meetings. What made you want to take this one? What were you hoping to learn?

Does my deck accurately reflect the business as I’ve described it today?

How would you describe this business to your partners?

What concerns might your partners have when they review this business?

How does this company fit within your current portfolio?

Turning the Tables

Is there anything you think I’m underestimating or being overly optimistic about?

What are the main risks or barriers to success you see? Any concerns that might lead you not to invest?

Based on what I’ve shared, do you see any patterns (good or bad) from similar businesses?

How many companies have you seen targeting the same sector?

Have you seen similar businesses succeed or fail recently?

How common is this idea? Have you encountered anything like it before?

Does this startup remind you of any successful companies? Any analogies that come to mind?

Are there companies this startup could naturally partner with now or soon?

Is anything in this business aligning with trends you’re seeing elsewhere?

Now that you’ve heard more about the business, what sectors would you place it in?

Does our TAM (Total Addressable Market) calculation make sense to you?

Here’s how we calculated TAM—do you see another way to approach it?

Could we redefine our market to make it larger, like Airbnb going from home rentals to hotels?

What do you think of the niche we’re targeting? Is there a sub-segment where you see strong potential?

Do you think this could be a billion-dollar company? Why or why not?

I’m considering adding a few smaller checks from angels and advisors to this round. Can you think of anyone who would be valuable to advise me, even if you don’t invest? (I’m not asking for an introduction.)

Besides your firm, who do you think would be the ideal investor for this type of business? Does anyone specific come to mind? (Again, not asking for an introduction.)

If you had someone else help you evaluate this company, whose opinion would you trust?

I know the chances of you investing are slim, but out of curiosity, who else do you think I should be talking to?

What’s the main metric that would prove this is a solid business?

What traction metrics would make investing a no-brainer? Where do we stand on the proof ladder based on what you know?

What’s your experience with companies using the distribution channels I’m planning to use? What lessons have you learned from them?

If this company is worth $2B in the future, what path do you think it would have taken to get there?

On a scale of 1 to 10, how strong do you think our founder-market or founder-product fit is?

Based on our meeting, do I seem like the kind of person who can make this business succeed?

How does my team compare to other teams you’ve invested in?

What are the strengths and weaknesses of the team I’ve built so far?

Who would you recommend adding to this team within the next year?

What cultural traits do you think are essential for this company’s success? Should we be aggressive, careful, highly compliant, rule-breaking, sales-driven, or tech-driven?

The best meetings VCs have with founders are collaborative, not one-sided pitches. They feel like conversations between equals, setting the stage for a potential 7-10-year partnership to build something great.

When you ask VCs about your company, listen to their feedback without becoming defensive. Embracing criticism and overcoming the fear of rejection can make the fundraising process far more valuable.

Consider using some of the questions from this list that resonate with you and will help you gain deeper insights into your business from the VC’s perspective.

We’ve also built multiple guides and frameworks that can be helpful to you in your startup journey:

Excel Template: Early Stage Startup Financial Model For Fundraising.

Startup Legal Document Pack

Building Cap Table As A Founder: Template to Download.

How to write your monthly investor update (Email Template).

SaaS Financial Model Template: Early Stage Startup Financial Model For Fundraising.

Investor CRM Template – The Ultimate Fundraising Tracker

🤝 FROM OUR PARTNER - FIRSTBASE

Founders have trusted Firstbase for years to help them launch and manage U.S. companies.

They also handle U.S. business tax filings for startups.

If you run a U.S. C-Corp or Single-Member LLC, your tax filing deadline is April 15 with the IRS and states.

When you subscribe, they’ll automatically file a 6-month extension for you. Avoid late penalties and buy time through October 15.

You’ll also get:

A dedicated tax expert

Unlimited Q&A and support

Help maximizing tax credits (like R&D)

Subscribe and Firstbase will take care of your extension instantly.

📃 QUICK DIVES

1. Venture Capital 3.0: What Founders Need to Know Now ?

NFX recently published an excellent piece titled "How Venture Capital 3.0 Impacts Founders in the AI Age" by James Currier. It’s worth a full read, but I’ve distilled the key shifts — along with what they might mean if you’re building or raising right now.

The first big point: it’s never been a better time to raise capital. We’ve moved from a world of 150 VCs in the mid-90s to over thousands active investors today. This isn't just about tech bros with checkbooks. It's a sign that venture has become a widely adopted financing tool — not just for software, but for climate, defense, space, bio, and more.

Founders benefit from this competition: more capital chasing deals means better valuations, more support, and a growing appetite for outlier ideas.

Despite media narratives about a slowdown, NFX argues the VC industry will continue expanding.

Why? Because inefficiency still exists in early-stage investing — meaning returns are still attractive. New LPs are entering. VC is spreading across geographies and sectors. AI is making it easier to identify opportunities, and the job itself still attracts top talent. In short, the structural drivers for growth are strong. Even if returns normalize, the sheer number of players is likely to grow.

We’re now in Venture Capital 3.0.

The first era was a cottage industry, small and low-profile.

VC 2.0 scaled with the rise of software and the internet — blogs, Twitter, accelerators, and TechCrunch helped demystify fundraising.

VC 3.0, which kicked off around 2022, is defined by ubiquity. Venture is everywhere — touching every sector and becoming deeply intertwined with AI.

But the nature of the game is also changing. Software, in many ways, was the perfect VC product — fast to build, scalable, high margins, winner-take-all dynamics. New sectors will require more grit from founders and more rigor from investors.

If software was the gold rush, these new frontiers are more like hard rock mining. The 100x returns will still exist — but they’ll be harder to find and take longer to build.

Another shift is cultural. As mega-funds emerge, some will begin to behave more like private equity firms — structured deals, more control, less romance. Founders may increasingly face investors who optimize for efficiency rather than vision.

It’s not necessarily bad, but the personality and incentives of your investor will matter more than ever.

Then there’s AI. It’s already reshaping how VCs work — from sourcing and evaluating deals to portfolio support. VCs are moving from passive to proactive, reaching out cold to founders based on digital signals like LinkedIn updates or revenue milestones. You may find yourself fielding outreach earlier than ever before — often from firms you've never met. AI will also influence how decisions get made. While few firms openly admit it, AI will increasingly help filter, score, and compare investment opportunities.

There is a bear case: too much money chasing too few great startups, rising valuations, shrinking alpha, fewer IPOs, and an eventual reversion to a smaller, more concentrated industry dominated by 20 large funds. But NFX is betting that the opposite happens — that the inefficiencies, new LP flows, sector expansion, and AI-fueled deal flow will drive continued growth.

So what does all this mean for you if you're building? The good news:

you’ll likely raise at higher valuations,

you’ll see more investor interest, and

more VCs will go out of their way to offer help.

They have to — it’s competitive out there.

The flip side: you’ll also face more competition from well-funded peers, some investors may act more like operators than partners, and navigating inbound interest will require real focus. Being in demand is great — but distraction is expensive.

Dilution probably won’t change much. Valuations will rise, but so will round sizes, and the ownership math still has to work for funds. What will change is how much capital you have access to and how early it might come. Whether that’s helpful or harmful will depend on your ability to stay disciplined.

2. How To Close Your Fundraising Quickly With Tranches: A Practical Guide.

As a founder, you're probably eager to wrap up your round and get back to building your company. Makes sense - fundraising can be a huge time sink.

One powerful strategy I've seen work well is using tranches. Let me break down what this means and how you can use it effectively.

What exactly are tranches? Simply put, tranches are different pricing tiers in your fundraising round. Instead of raising everything at one valuation, you segment your raise into parts. The early investors usually get in at a lower valuation, creating an incentive for quick decisions.

Why consider using tranches? Early-stage startups are inherently risky, and getting that first check is often the biggest hurdle. VCs tend to move faster when they see other investors already committed. By offering early investors a better deal, you're not just rewarding them - you're creating momentum for your entire raise.

How do investors typically react? Most sophisticated investors understand the game. They know that whether they got in at $5M or $10M won't matter much if the company becomes really valuable. That said, there are some unwritten rules:

Never offer worse terms to later investors than what early ones got

Be honest about your strategy and intentions

Don't string investors along just to create FOMO

What's the best way to communicate new tranches? Keep it natural. Something like: "We opened a small initial allocation to move quickly, and now we're raising the rest at a fair cap." Or if you're extending the round, "We're seeing strong interest beyond our initial target, so we're considering taking on additional capital while managing dilution."

How many tranches should you use? Keep it simple - two or three maximum. Any more gets messy and complicated to manage.

How should you size each tranche? You've got three main approaches:

Small first tranche, bigger second (great for speed)

Large first tranche, small follow-on (better for controlling dilution)

Flexible sizing based on market response (good when you're testing the waters)

Remember, tranches are just a tool to help you close your round efficiently. Used thoughtfully, they can create positive momentum and get you back to focusing on what really matters - building your company.

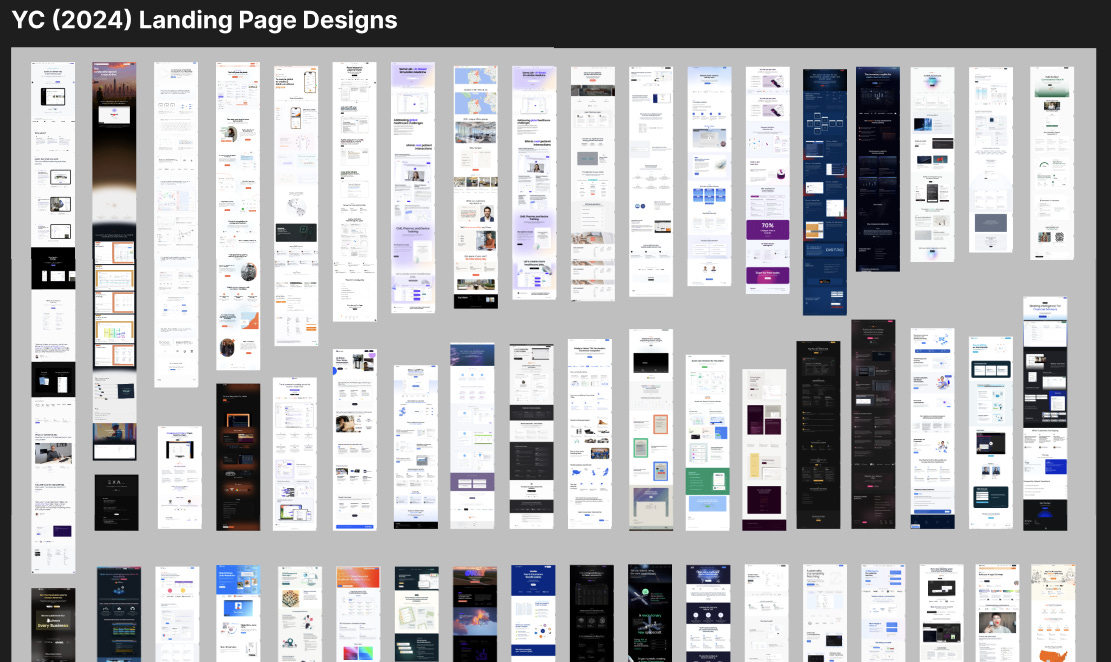

3. A look at 140+ YC startup landing pages that raised over $200M.

Landing pages are one of the most overlooked assets in an early-stage startup’s journey. But they matter—a lot. Your landing page is often the first thing investors, potential users, and early hires see. It communicates what you’re building, who it’s for, and why it matters—all in under 30 seconds.

And yet, many founders treat it as an afterthought. They focus heavily on product, which makes sense, but forget that messaging and design are how your product earns its first shot. The most common mistakes? Being too vague, too technical, or too “cool.” A great landing page doesn’t try to be clever—it works hard to be clear.

Maximilian Fleitmann recently shared a swipe file of landing pages from the YC Winter 2024 batch. It features over 140 startups that have collectively raised more than $200 million. We went through it and found a lot to learn—especially in how these teams write headlines, structure their messaging, and guide visitors to take action.

These aren’t just well-designed pages—they’re great examples of how early-stage startups communicate clearly, build trust, and create momentum from day one.

If you’re launching soon, raising capital, or just want to sharpen how you present your startup, this is one of the best collections out there.

Check out here: [Figma Link]

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New VC Launch

Ballistic Ventures, a San Francisco-based cybersecurity-focused VC firm co-founded by Ted Schlein, is raising a new $100M fund, per an SEC filing. (Read)

Construct Capital, a Washington, D.C.-based early-stage VC firm focused on manufacturing, transportation, and defense tech, raised a $300M third fund. (Read)

Major Tech Updates

A TikTok deal to establish a US-based company with majority American ownership was suspended after China signaled disapproval following President Trump's increased tariffs on Chinese goods. (Read)

Midjourney launched its V7 image model, featuring improved prompt adherence, image quality, and detail coherence — and personalization is now enabled by default. (Read)

Meta has released three new AI models — Scout, Maverick, and Behemoth — under its Llama 4 family, trained on text, image, and video data with a focus on visual understanding and efficiency via mixture-of-experts architecture. (Read)

Klarna and StubHub have postponed their planned IPOs due to stock market volatility triggered by President Trump’s sweeping new tariffs, according to The Wall Street Journal. (Read)

New Startup Deals

Vallor, a Miami, FL-based provider of an AI-agent platform that puts procurement contracts on autopilot, raised $4M in Seed funding. (Read)

Turbine, a NYC-based debt platform for limited partners in VC and private equity funds, raised $22M in equity funding. (Read)

SpinLaunch, a Long Beach, CA-based space solutions company, received $12M. (Read)

Sedna Communications, a London, UK-based AI-driven platform for maritime and supply chain businesses, received $10M. (Read)

Adaptive Security, a NYC-based provider of AI-powered social engineering prevention solutions, raised $43M in funding. (Read)

Phonic, a San Francisco, CA-based speech-to-speech platform for building lifelike, conversational voice agents, raised $4M in funding. (Read)

Unframe, a Cupertino, CA-based AI platform for global enterprises, raised $50M in funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Technical Investing Associate - Capital One | USA - Apply Here

Manager - Amgen Venture | USA - Apply Here

Investor - Griffin Venture Partner | USA - Apply Here

Analysts - Unitus Capital | India - Apply Here

Venture Analyst - Shearwater Capital | Australia - Apply Here

Venture Intern - Foundation Capital | USA - Apply Here

Events and Operations Intern - Plug and Play Tech Center | UK - Apply Here

Senior Associate - Hubspot Venture | USA - Apply Here

Investment Analyst - M13 | USA - Apply Here

Investment Manager - Sagana | Africa - Apply Here

Werkstudent - Venture Capital - Growth Partner | Germany - Apply Here

Principal - Artha Group | India - Apply Here

Corporate Development & Strategy - Figma Venture | USA - Apply Here

Deal Sourcing Manager - Tracxn | India - Apply Here

Finance Associate - Thomvest | USA - Apply Here

Vice President - Family Office Relationships - Artha Group | India - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator

This is so actionable. I love myself some good questions. Saved this post for when the time comes