Marc Andreessen's Guide to Finding Product-Market Fit! | VC Remote Jobs

PMF Is Like Porn...When You See It, You Just Know!....

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Marc Andreessen's Guide To Finding Product Market Fit!

Quick Dive

GPs plan to ramp up fees in coming year.

How many years does it take the average startup to get to each venture stage?

Featured Article:

Hidden Trap Of Convertible Note and Liquidation Preference MultiplesMajor News:

Apple Shutdown EV Project, Microsoft Invested $16 Million In OpenAI's Rival, Stripe's Valuation Rebounds To $65 Billion & Apple's $1 Billion Investment For AI.VC Weekly Board: Founder & Investors Community Announcement…

VC Jobs & Internships: From Scout to Partner.

FROM OUR PARTNER

This Harvard-founded AI Startup Grew 5x in 2023 (And You Can Invest)

Paywalls. They’re everywhere, with billions of readers hitting them every single day! Enter Zette.ai.

Zette.ai is an AI news startup transforming how we access journalism. With just a click, Zette.ai lets you unlock articles that you find interesting—all while using AI recommendations to send the coolest content your way.

They’ve already raised a $1.7 million oversubscribed pre-seed, have 50,000+ readers with a 5x year-over-year growth rate, and boast top partnership deals with 110 leading publishers, from Forbes to Pulitzer-Prize winning news outlets.

You’re invited to join the journey: Venture Curator readers can invest in Zette.ai before the public!

Invest as little as $250 in Zette on Wefunder before early bird terms sell out.

Partnership With US:

Promote your startup to our community of 23,000+ entrepreneurs and investors. Fill out the form, our team will reach out to you….

TODAY’S DEEP DIVE

Marc Andreessen's Guide to Finding Product-Market Fit!

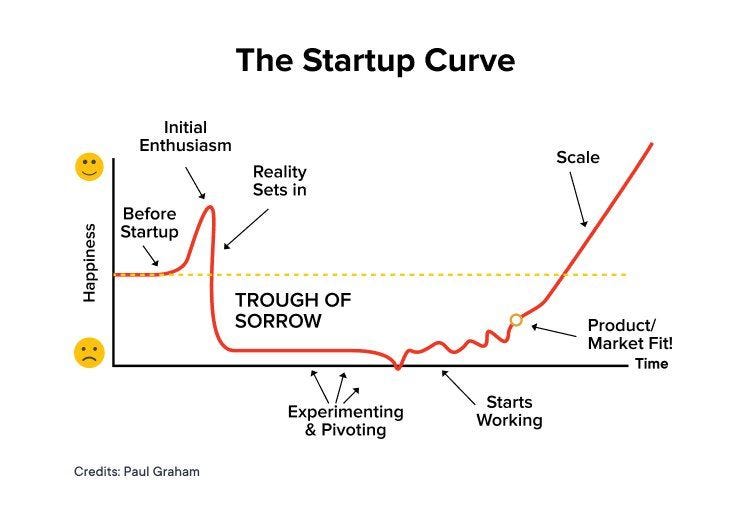

Product-market fit is one of those concepts that seems easy to understand as a concept but in practice, hard or impossible to articulate what it means.

Most people lazily say "Product-market fit is like porn...when you see it, you just know!" But what does that mean? So in today’s newsletter will try to share one of the most exhaustive and practical guides to find PMF. Let’s deep dive into it:

What is Product Market Fit?

Product/Market Fit can be concretely defined as a scenario:

When users/customers begin to use/buy your product/service and recognize its value proposition.

They continue to buy from you (high retention)

They rave about the great experiences with your company and encourage others to buy from you (strong word of mouth).

And, you are able replicate to this same experience with every new referred user/customer.

We can then say that you've achieved the product/market fit

How Do Experts Define Product/Market Fit?

"Product Market Fit means being in a good market with a product that can satisfy that market"

- Marc Andreessen.

"Product-Market Fit is all about making something that (lots of) people want"

- Paul Graham, Y Combinator.

"Product/Market Fit is when (people) your customers sell for you (strong word of mouth)"

- Josh Porter.

Product/Market Fit is the only thing that matters

- Marc Andreessen.

Why is Product Market Fit so important?

90% of startups and 70% of startups that raised Series A end up as failures!

Lack of Product/Market Fit is the most common reason behind "why startups fail."

"Finding the Product/Market Fit is the hardest challenge for all startups", not now as this guide will help you find PMF.

If you're an early-stage startup then product/market fit should be your only focus in your journey instead of fundraising. Start working on the PMF if you still haven't.

Scaling a Pre-product market fit startup is almost a sure-shot way to kill it!

In 1999, I built a failed dot com. Initially raised from F&F, and scaled before product-market fit. Never did I find it (PMF). Kept on raising in future - $3 M, then $20 M on $100 M valuation. Hired dozens of high-priced executives, bought a fancy space in LA, and even made an acquisition. Don't (ever) be like me - Micah Rosenbloom.

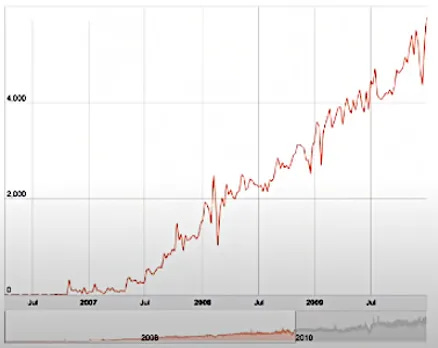

"The most successful technology companies (i.e. Facebook, LinkedIn, Twitter, etc.,) first got their product/market fit right before even stepping on the accelerator (of growth)."

How long does it take to achieve Product/Market Fit?

It takes time for a startup to find product/market fit. In my experience, it roughly takes 1-5+ years. And "it's much easier to do this with a small team, low burn, and extreme focus" - Michael Siebel, Partner-YC.

Harsh Truth: 3 out of 5 startups would never find their PMF, and would fail.

How to determine if you have the Product/Market Fit?

People often say funnily, "Product-market Fit is like porn...when you see it, you just know."

In qualitative terms ...

"When the customers aren’t quite getting much value out of the product/service, word of mouth isn’t spreading, usage isn’t growing that fast (spikes in the months where you advertise), press reviews are kind of “blah”, the sales cycle takes too long, and most of the deals never close" - Marc Andreessen.

Most startups that have raised ($5-$10 Mn) Series A funding, assume they’ve got a product-market fit, just because they’ve raised funding. They're wrong, why do you think 70% of startups that raised Series A still fail, because the no.1 reason was lack of PMF!

You have it ...

On a high level, you've found product market fit when you can repeatably acquire customers for a lower cost (CAC) than what they are worth (LTV) to you

- Elizabeth Yin

“You can always feel when Product/Market Fit is happening. The customers are buying the product just as fast as you can make it - or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company's account.

You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it.” - Marc Andreessen

When product-market fit occurs something magical happens, all of a sudden your customers become your salespeople i.e. they sell for you - Josh Porter.

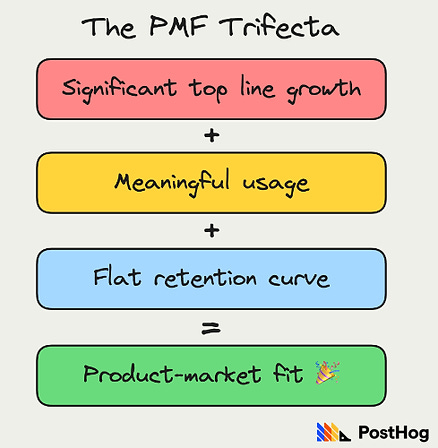

What metrics to track and analyze, whether you've achieved the Product/Market Fit?

Let's delve into quantitative metrics of finding Product/Market Fit:

A. Product/Market Fit Metrics for SaaS Businesses

David Rusenko recommends that founders offering SaaS should track the below f metrics to evaluate Product/Market Fit:

Returning Usage (Day 1,3,7,30 retention): Look at people who sign up to your site/app and then look at the number of people who return back within 1,3,7,30 day/s. This should indicate whether things are working or aren't.

A Net Promoter Score (NPS) of > 50 means you’re doing well.

Paying Customer Renewal Rates or Retention: Renewal rate is defined as the number of people who are eligible to renew and what percentage of people actually renewed is a lot better metric than churn. Churn rate (Churned customers / total customers) is a lot easier to measure, but it can be deceiving at times.

Growth Rate: Consistent growth of at least 15% in MRR and ARR is a strong indicator of Product/Market Fit. Irregular spikes, flattening, or declining growth are some of the red flags to watch for.

Market Share: How quickly are you gaining/losing the market share?

Customer Lifetime Value (CLV) vs. Customer Acquisition Costs (CAC): A ratio of 3X and a CAC payback of < 18 months is ideal for SaaS startups.

B. Product/Market Fit Survey

Rahul Vora in this article shares how he used a "simple survey" to assess whether his venture (Superhuman) has achieved the Product/Market Fit. Here's how you can replicate it:

Survey all your users with this simple question:

Q. How disappointed would you feel if you could no longer use our product/service?

Very disappointed

Somewhat disappointed

Not disappointed

The magic number that indicates the Product Market Fit is when > 40% of users respond as “very disappointed.” The companies that struggle on the same can barely even touch 40%.

51% of Slack users responded that they would be very disappointed without Slack, revealing that it had indeed attained product/market fit.

C. Retention and Customer Love

Rajan Anandan MD, Sequoia Capital recommends two simple methods to evaluate, whether you've achieved the product/market fit:

The retention curve is what percentage of your users keep coming back over some time while using your product/service.

Essentially, there are 3 kinds of retention curves, and you should plot this curve by day, week, or month, once you launch your product.

a. Declining Curve (dark grey line), let's say you’ve launched a consumer internet app on day 0, and every week your retention rate declines by 10%, which essentially means that by the end of 3rd month, all your initial users would have churned, then that's a declining curve, which indicates that you don’t have a product-market fit.

b. Flattening Curve (orange line) is actually good, although it kind of varies depending upon the category (HealthTech, EdTech, etc.,) but generically speaking if the retention curve flattens between 20%-40% that could be quite good.

c. Finally the best one is the Smiling Retention Curve (green line), which means that retention drops but then as time goes on you keep reactivating users, which indicates that you're getting close to your product-market fit.

C2. Do Customers Love You?

Net Promoter Score (NPS) is a metric that organizations use to measure customer loyalty toward their brand, product or service. NPS works by asking your customers a single question: "How likely are you to recommend our products/services to others?"

NPS = % Promoters (score 9-10) - % Detractors (score 0-6)

If the magic score is = 70% or more, then you have an amazing product-market fit. But if the number declines to 40% or below, then you don’t have it. It's that simple!

What if you don't have a Product/Market Fit?

Encourage founders to continue to talk to customers, care about their customers, learn about their problems, and solve them effectively - Michael Siebel, Partner-YC.

Most founders seek ineffective shortcuts to achieve Product/Market Fit (PMF) i.e. hiring a ton of engineers, bringing on senior executives, running after key partnerships, etc. These shortcuts never work.

If you don't have Product/Market Fit, keep your burn low, and keep iterating fast with a lean team. You may get pressure to spend from your VCs (this usually happens), push back hard - Elizabeth Yin, Co-founder of Hustle Fund.

If you haven't reached Product/Market Fit, avoid growing your team above 10 people. Post-raising a seed round, most founders are tempted to grow the team. Smaller teams can adapt/iterate much quicker - Immad Akhund, Co-founder & CEO, Mercury.

That’s it for today.

If you want me to answer your questions on fundraising and product building in the upcoming newsletter, feel free to post your questions in this form.

TODAY’S QUICK DIVE

GPs plan to ramp up fees in a show of confidence

In a recent survey conducted by Dynamo Software with 100 global alternative asset managers, approximately 20% of respondents expressed plans to increase management fees in the next 12 months. This marks a significant rise from just over 5% at the beginning of 2023.

The shift is attributed to growing confidence among General Partners (GPs) as they anticipate a recovery in dealmaking after a challenging period marked by higher interest rates, depressed exits, and market uncertainty in 2023. The report suggests that improved dealmaking conditions in 2024 will empower GPs to negotiate better terms with Limited Partners (LPs), balancing fee structures against anticipated returns.

Despite signs of improvement in fund performance in H1 2023, some industry experts view the survey results as potentially overly optimistic, highlighting that, from their perspective, overall fee percentages have not seen significant changes. However, there is a noted decline in the common practice of GPs offering fee discounts to LPs, a tactic used during fundraising challenges.

This shift is seen as indicative of a potentially permanent change in fundraising timelines, with LPs less incentivized to commit early without discounts. Additionally, the increasing size of funds is expected to contribute to a higher overall dollar count for fees, even if fee percentages remain consistent.

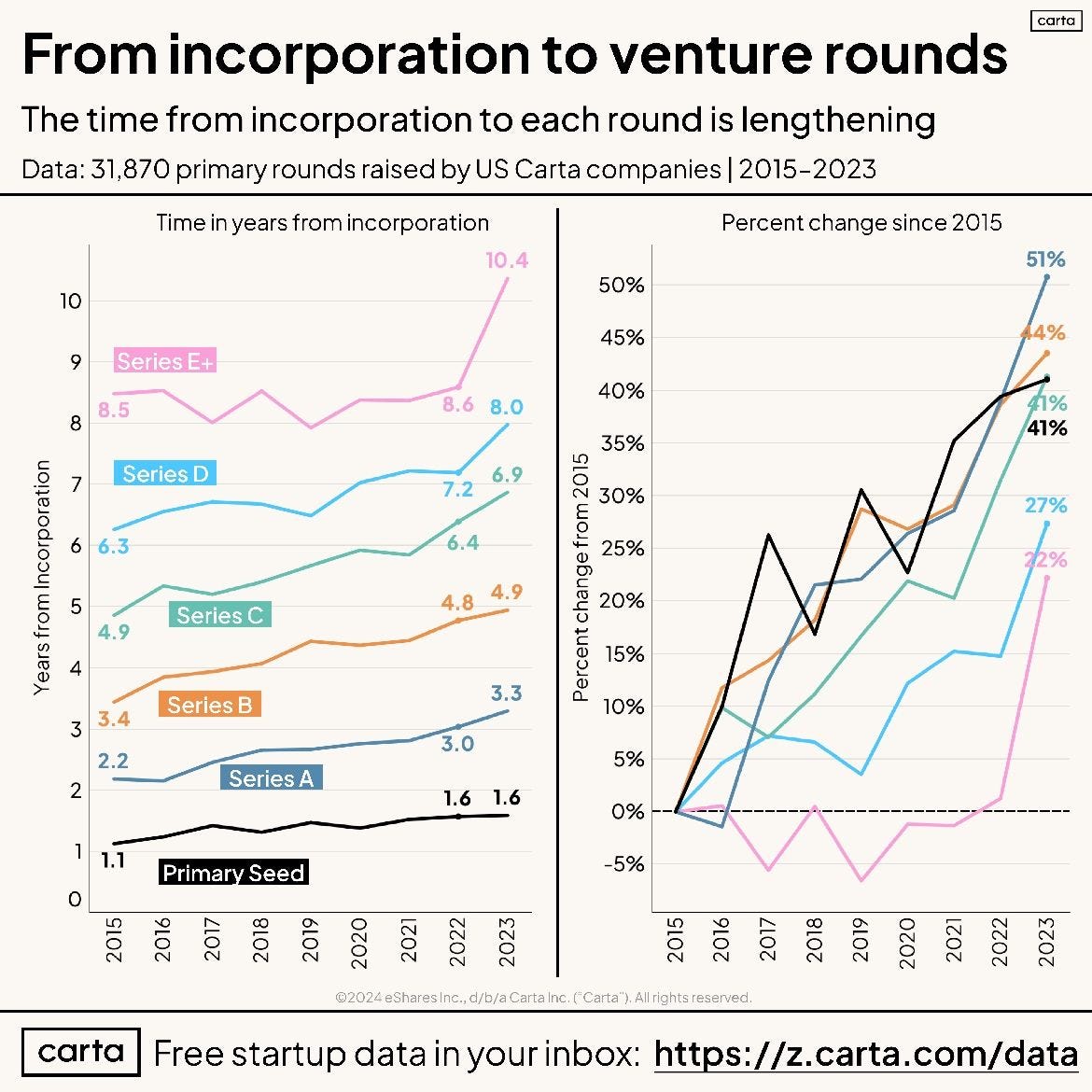

How many years does it take the average startup to get to each venture stage?

A recent analysis of over 31,000 primary fundraises on Carta since 2015 reveals intriguing trends.

Notably, the average time from incorporation to each venture round has been steadily increasing. As of 2023, the numbers tell: Seed rounds taking 1.6 years, Series A at 3.3 years, and subsequent rounds following suit.

Several factors contribute to this shift, including companies opting for more funding through SAFEs, and elongating the time to initiate priced round raises.

FEATURED POST

Hidden Trap Of Convertible Note and Liquidation Preference Multiples

Young entrepreneurs often get screwed by their angel investors on convertible notes and I know I can’t convince you not to do it so I’d like to offer one simple bit of advice to help you avoid getting screwed.

When you do a convertible note with a cap that converts into the next round of funding, one of the unintended consequences is that if you’re successful and raise at a larger price than your cap the early angels often get “multiple liquidation preferences” on their dollars in.

Here’s how it works..… Read More Here

Join 15000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Stripe's valuation rebounds to $65 billion as payments giant buys back employee shares. Read More

Apple CEO Tim Cook announced at the annual shareholders meeting plans to invest $1 Billion in GenAI. Read More

OpenAI moved to dismiss a lawsuit from the New York Times, alleging the media outlet paid someone to hack OpenAI’s products in support of the lawsuit. Read More

Mistral AI, OpenAI’s Rival Partnered With Microsoft and Raised $16M. Read More

Apple has decided to shut down its electric vehicle project after Spending $162 Billion. Read More

→ Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? Subscribed To the Venture Daily Digest Newsletter and join 10000+ Avid Readers!

TWEET OF THIS WEEK

Best Tweet I Saw This Week

Hardware Is Hard.

Even Sam Altman Said this thing,

If You Want To Build A Big Company, Start A Hard Company.

"It's easier to build a hard company than an easy one. If you're building a photo-sharing app, nobody bothers. But if you're building flying cars, supersonic aeroplanes or nuclear power startups people proactively want to help you for free because they want to be a part of this interesting thing.

And live example is Elon Musk! Everyone wants to see Elon be successful in his businesses - SpaceX, Neuralink, Tesla & others."

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Investors Relation - Cardumen Capital | Spain - Apply Here

Head of Network Development & Community - Marcato Partner | USA - Apply Here

Investment Manager -Circulate Capital | INDIA - Apply Here

Senior Ventures Associate - Plug and play tech venture | Spain - Apply Here

Investment Analyst -D11Z Venture | India - Apply Here

Marketing Intern - Antler | Singapore - Apply Here

Investment Associate, Engineered Biology - PLayground Global | USA - Apply Here

Analyst - Giffin Venture | USA - Apply Here

Principal - Rethink Venture | Germany - Apply Here

Associate Rackhourse Venture Partner | USA - Apply Here

Investment Analyst - Panacea Innovation | UK - Apply Here

Investment Analyst - DeepTech & AI - PeakXV | India - Apply Here

→ Looking To Break Into Venture Capital?

Looking to get access to daily job updates, resources for learning about venture capital, weekly VC and startup events, daily discussion sessions, and tips/tricks to break into VC? We've got you covered….

Join Our VC Enthusiast Community, VC Crafter To learn, network & craft a path to venture capital.

That’s It For Today! Will Meet You on Tesday!

Happy Thursday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team