Is Freemium Right Choice For Your Company? | VC Jobs

The most important growth metric for early startups & Coinbase Decision Making Framework

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Is Freemium Right Choice For Your Company? - Three Factors for Freemium Strategy.

Quick Dive:

The most important growth metric for early startups.

Coinbase’s Decision-Making Framework.

5 Simple Frameworks to Determine If Your Pricing Strategy Is Working.

Venture Curator Hub: Access To startup financial modelling Excel sheet, 10000+ verified investors' email contact database & more.

Major News: Apple Might Release a $2,000 Vision Headset In 2025, Apple challenges OpenAI's Q* claims, TikTok Knows Exactly How Many Videos Takes to Get Addicted & More.

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER

We Write, Design And Model Your Pitch Deck Into a Storytelling Book…

Pitch deck creation can feel daunting, especially for first-time founders. From deciding what information to include to ensuring your visuals are on point, there are a lot of moving pieces to juggle.

And if you're not careful, it's easy to end up with a deck that fails to capture an investor's attention.

That's why Venture Daily Digest is opening up a limited number of exclusive slots to provide hands-on support in building a pitch deck that will leave a lasting impression. Our team of experts, designers, and investors will work closely with you to build your pitch deck.

Schedule a call with us today →

PARTNERSHIP WITH US

Want to get your brand in front of 62,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form or email us and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

Generative AI's "Service as a software" opportunity By Sequoia Capital. (Read)

How to Turn SlideShare into a Powerful Marketing Tool for Your Startup? (Read)

How Sheryl Sandberg Turned Facebook into a $118 Billion Powerhouse. (Read)

Zombie Funds: Startup investor ranks have fallen another 25%—can they come back to life? (Read)

VC Math Explained To Founders: The High-Stakes Game Of Startup Funding. (Read)

Software has eaten the world but now AI will digest it. (Read)

The anatomy of high-converting homepages. (Read)

A definitive list of everything startups did that didn’t scale. (Read)

TODAY’S DEEP DIVE

Is Freemium the Right Choice For Your Company?

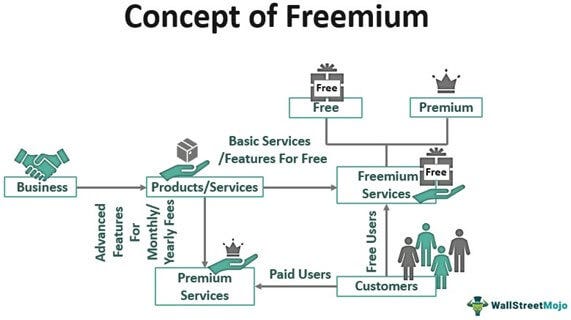

Deciding whether to offer a freemium model is a common dilemma for founders. Many try out freemium strategies, but not all SaaS companies can replicate the success of Dropbox or Typeform. Done wrong, freemium can end up cannibalizing your paid user base while also draining your company’s precious engineering and customer support resources.

In 2019, Typeform's free version attracted about 180,000 new users each month, with a conversion rate of around 3%. Dropbox, on the other hand, successfully transformed its free users into enthusiastic advocates, investing more in engineering than in sales. Both companies used their free options to boost adoption and grow their paid subscriptions, with Dropbox particularly excelling in making enterprise software more accessible to consumers.

How can you tell if a freemium model, like the ones used by Dropbox or Typeform, is right for your business?

Let’s discuss some of the pros and cons of the freemium model.

The downsides of freemium

Many SaaS companies are overly optimistic, thinking that offering a free, simplified version of their product will lead to a surge of signups and eventual revenue from paid users. But there are some important downsides to consider:

Added costs: SaaS businesses usually have high-profit margins, but supporting a large group of free users can eat into those profits. It's not just about server costs—engineering, product development, and customer support all add up. Free users still expect support, and those costs can be significant. For example, Typeform reported that 70% of its support tickets came from free users, costing them $130,000 per month in 2019. For companies with smaller margins or expensive infrastructure, freemium might not be the best fit.

Cannibalization of paying users: While the hope is that free users will eventually pay, it doesn't always work that way. Some people who might have paid right away may stick with the free version instead. This can lead to fewer paying customers than expected. I've seen companies roll out a free tier, thinking it will boost sales, only to watch their paid signups drop. Offering a free plan can sometimes backfire by discouraging people from upgrading.

Balancing product features: A freemium model requires a delicate balance. If you give away too much for free, people won’t feel the need to pay. But if you offer too little, no one will sign up. Typeform does this well by limiting free users to surveys with 10 questions and 100 responses, while paid users get unlimited features. Not all companies find this balance as easily.

Less focus on core users: Offering a freemium plan means you’ll likely have way more non-paying users than paying ones. It can be hard to ignore the feedback from users who make up 90–95% of your base, even if their needs are different from those who pay. For example, Evernote, once the poster child of freemium, lost focus on its core users by trying to cater to everyone. This made their product feel stagnant, a mistake they could have avoided.

Managing the funnel: Widening the top of your funnel with free users makes it even more important to identify the best leads efficiently. If you don’t, your most valuable signups might get lost in all the noise.

The benefits of freemium

Most of the challenges with freemium can be managed if your free plan brings in a lot more users, and you can convert enough of them to paying customers. While freemium usually lowers conversion rates, that’s fine if the boost in signups makes up for it. As long as you maintain steady conversions, the freemium model offers several benefits:

More active users: One of the toughest hurdles for SaaS companies is getting people to actually use their product. Free trials help, but some users are more likely to stick with the product if it’s free from the start. Others might not sign up at all without a free plan.

More brand advocates: Don’t judge a user’s value only by whether they pay. A bigger user base means more potential advocates who can spread the word about your product. For example, users already familiar with Typeform’s brand were twice as likely to become paying customers. Qwilr noticed a similar trend.

Increased virality: The best argument for freemium is if your product has built-in viral potential, like Typeform or Dropbox. However, it’s important to note that free users may not be as active as paying ones, which could lower their impact on referrals. Ideally, you’d design your paywall so free users can still share and drive growth while monetizing other parts of the product.

More feedback: A larger user base also gives you more feedback to work with. Typeform has benefited from learning from a wider audience. Just remember, feedback from free users may or may not be as relevant, depending on your product and market.

Re-engaging trial users: Some users won’t convert to paying customers after a trial ends. A freemium option lets you keep these users engaged, increasing the chances they’ll pay later on.

Making the decision

Now that we've examined the potential benefits and risks of launching a freemium product, how can you determine if it's the right move for your company? The most reliable way to find out is through A/B testing. However, getting solid results can take a long time, especially if you're looking at the impact on virality and your viral cycle is six months or longer.

If you can't wait that long or aren't set up for a full A/B test, consider these "Three Factors for Freemium Strategy":

Does your paid plan have a gross margin of 80–90%?

If you have a lower gross margin — for example because your product is not fully self-service, requires extensive customer support or is extremely costly in terms of tech infrastructure — freemium will probably not work for you.Does your free plan attract the right audience?

If your free users are too different from your paying users, your free-to-paying conversion will be low — and you’ll risk developing your product for the wrong audience.Is your product inherently viral?

If your answer is no, that doesn’t make it a complete no-go, but it does mean that it’s much less likely that freemium is right for you.

In the end, freemium only makes sense if a certain percentage of your free users do one of three things: 1) Eventually convert to paid, 2) refer paying customers, or 3) provide the kind of valuable feedback that will improve your product. A freemium product that fails to achieve any of these effects will merely saddle you with extra costs and distract you from servicing your most important users.

QUICK DIVES

1. The most important growth metric for early startups.

Startups often grapple with choosing the right metrics to focus on. While there are numerous options like user signups, revenue generation, and week-over-week growth, one metric stands out as crucial for early-stage startups: cohort retention rate. This metric is a key indicator of your startup's long-term viability and is sometimes even used to define product-market fit. Let's explore why it's so important and how to measure it effectively.

Many startups make the mistake of calculating retention by looking at their entire user base. However, this approach is flawed because it doesn't account for the differences between new and long-standing users. The correct method is to measure retention by cohort - a group of users who joined around the same time.

To create a cohort retention graph:

Select a group of users who joined within a specific time frame (typically a week or month)

Track how many of these users return or perform a key action over time

Plot this data on a graph showing the percentage retained over time

If your cohort retention chart looks like below, you’re in good shape!

However, if your retention chart looks like the below, despite having a higher retention rate at week 5, you should iterate on your product to look more like the first chart.

Key Considerations for Cohort Retention Graphs:

Adjust the time scale (e.g., days, weeks, months) based on your product's optimal usage frequency

Choose a meaningful retention action for the y-axis (e.g., "visited app," "sent message," "booked trip")

Create separate graphs for different signup methods (e.g., website vs. app) as they may show different patterns

A critical point on the cohort retention graph is where the curve begins to flatten. This typically occurs around 5-8 weeks after signup and indicates your long-term cohort retention rate. This number is crucial for several reasons:

It helps estimate the percentage of signups likely to become long-term users

It can be used for rough calculations in areas like paid user acquisition

It sets a benchmark for evaluating the impact of new features or experiments

Why Retention Matters for Startups

Acquisition vs. Retention: While user acquisition strategies can potentially scale massively (1000x or more), retention strategies typically have a more limited impact (maybe 2x at best).

Financial Impact: High retention rates significantly increase your Lifetime Value (LTV) per user, allowing for higher user acquisition costs.

Sustainability: Strong retention helps your startup weather periods when user acquisition becomes more challenging.

Investor Appeal: Many investors consider retention rates as a key indicator of a startup's potential for long-term success.

In conclusion, while metrics like weekly active users, revenue, and signup rates will fluctuate greatly over time, your retention rate tends to remain relatively stable throughout your startup's lifecycle. That's why it's such a critical metric for early-stage startups to focus on.

Key Takeaways:

Prioritize cohort retention rate as your most crucial early-stage metric

Use cohort analysis to accurately measure your retention rate

If your cohort retention graph shows near-zero long-term retention, improving this should be your top growth priority

Understand that strong retention rates make every aspect of growing your startup easier

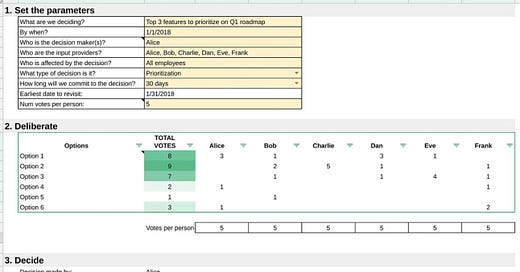

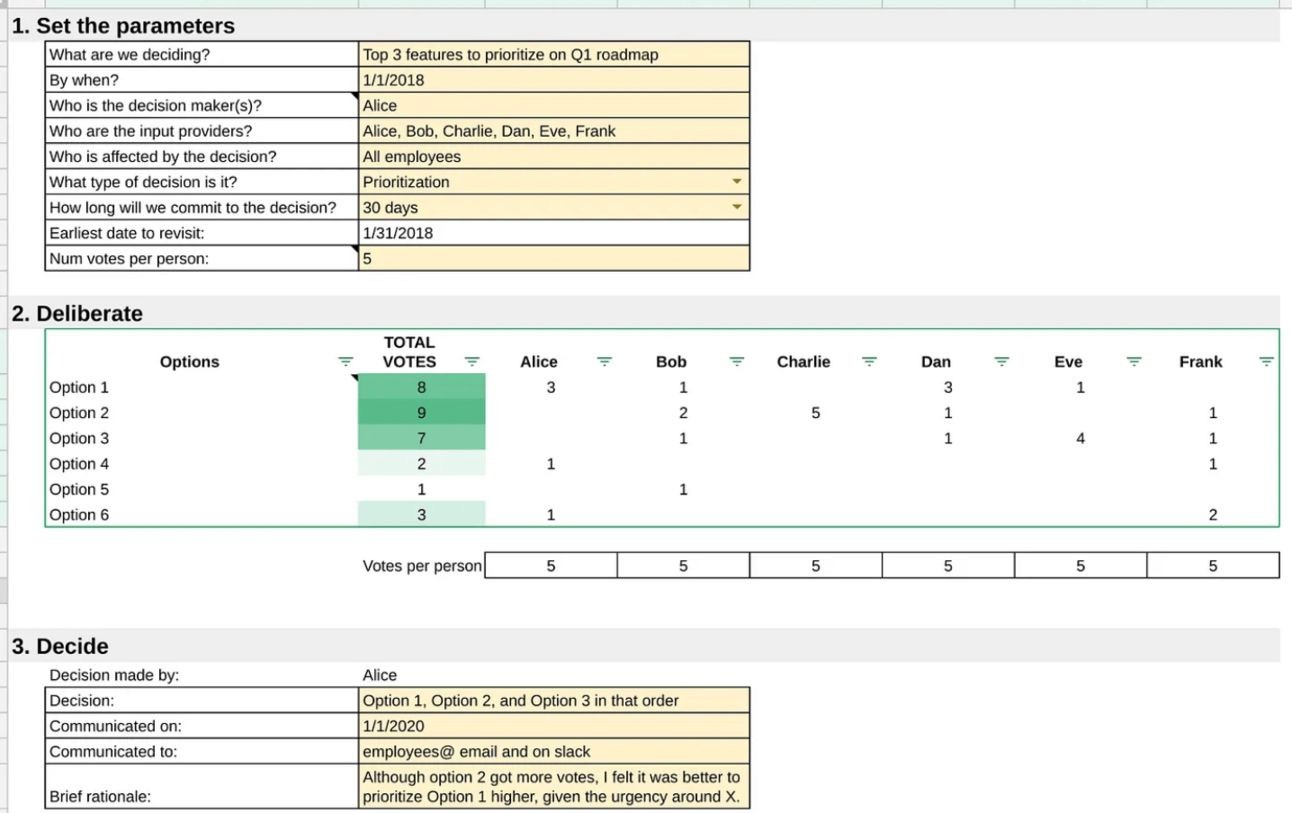

2. Coinbase’s Decision Making Framework.

Low-risk decisions should be made pretty quickly. For high-risk decisions, a decision-making framework can be helpful.

I’ve seen a lot of decision-making frameworks. But I like this one from Brian Armstrong, the founder of Coinbase because it works both for quick 15-minute live meetings and over multi-week strategic decisions.

This framework can be used to decide:

Whether to hire a candidate

What to prioritize next in a product roadmap

Whether to buy or sell a company

A new name for a product or team

And more…

Here’s the template to implement this framework and here’s how to use it.

You might think this template looks overly simplistic, but what I like about it is that it’s just meant to record the context around the decision and provide a clear voting framework.

It forces the actual decision-making process to happen through live conversation. And no matter what you’ll end up with a clear, numerical score for the option that you collectively favour.

3. 5 Simple Frameworks to Determine If Your Pricing Strategy Is Working.

Startup pricing strategies evolve as companies grow through three main stages -

Pre-PMF companies prioritize rapid adoption and feedback, with founders typically owning simple pricing models that optimize for usage over revenue.

Early PMF firms shift focus to repeatability and revenue, introducing more complex pricing owned by product teams or early GTM hires, often using preset tiers or bundles.

At scale, companies maximize value capture with dedicated pricing teams and deal desks, introducing sophisticated elements like varied commitment structures and multiple pricing models. They're more willing to walk away from suboptimal deals and may eliminate legacy discounts. Square's journey from simple flat pricing to a more nuanced approach as it grew illustrates this evolution, showing how pricing strategy can align with and support a company's overall brand promise and market position.

However at every stage, One of the hardest parts of managing pricing is knowing whether or not your strategy is having its desired effect. The reason for this is simple – for the deals you’ve won, it’s nearly impossible to know how much money you might have left on the table based on the customer’s ultimate willingness to pay, and for deals you’ve lost, it’s possible your product’s functionality, or any number of other complications, might have been the primary culprit. For self-serve pricing, it’s difficult to measure which prospects may have dropped out of the funnel due to pricing vs. which felt they were getting the bargain of the century. The list of complexities goes on.

At the earliest stages, your analysis is going to be less sophisticated and will likely centre around listening to customer feedback. As your company matures, you’ll have enough data points to analyze wins and losses, customer cohorts, revenue by segment, and other relevant trends. Here are a few strategies you can employ to get a sense of whether pricing at your company is working as intended:

Ongoing competitive reviews and customer surveys:

Just like you did when outlining your initial pricing strategy, you should continue to track how you price in comparison to your main competitors, and continue to talk to your customers to understand their perception of the value you deliver relative to the price you charge. Some of this feedback may come through via comments in NPS surveys, one-off discussions with account managers or support staff, or other unstructured channels, but we suggest carving out a pricing-specific check-in cadence with a handful of customers from each segment to ensure nothing is too far off the mark.

Routine price increases:

This is the simplest method. You can test pricing increases with a few customers. One popular question especially VCs, like to ask during customer or prospect calls is whether the buyer of a given piece of software would still use it if the price doubled the following year.

While this is an entirely hypothetical scenario, there is an opportunity to implement periodic price increases to gauge how much-untapped willingness to pay exists in your customer base. If you’re able to facilitate these increases on a regular basis with limited churn, you have not yet brushed up against the willingness to pay asymptote for your product.

Variance analysis:

Create a scatter plot of all your current customers and their average sale price (ASP). When you segment your customers by certain characteristics—account size, region, number of employees, etc.—are you able to glean any insights about which price point has yielded the most success with a given set of customers? If the plot is all over the place, the answer will likely be no, which would indicate pricing has been more or less ad hoc on a deal-by-deal basis. If there’s concentration around certain pricing bands, your strategy is, at a minimum, consistent. An almost equally important part of the exercise is to identify outliers (on the low or high side of the spectrum) and decide whether they should be trued up in either direction. While those paying particularly high prices relative to their segment may allow you to capture more value and generate more revenue, you run the risk of them talking to other customers and losing trust in your business.

Price realization:

Create a similar scatter plot to the one mentioned above, but instead of ASPs, express your customers’ pricing in terms of per cent discount to rack rate. What’s your median discount across deals of a certain type? 10%? 40%? 95%? Anything consistently above 50% probably tells you you’re starting too high, especially if discounts of a certain magnitude require explicit sets of approvals (more on this below).Sales efficiency and escalation analysis:

Measure the typical number of touchpoints, redline negotiations, and escalations a deal in a given customer segment requires. As you adjust pricing, are you able to observe any impact on how long and arduous it is for sales reps to close deals? If these figures are much more drawn out than your ideal or expected sales cycle, your pricing is likely too high (and vice versa if deals are closing too fast, if there is such a thing!). As you grow, you will look at burn multiple and sales efficiency metrics, which may also signal if the price is too low or high.

Processes like those outlined above may be owned by any number of stakeholders (again, this number is largely dependent upon the company stage). How often you formally revisit pricing is company-specific; for those later-stage companies with dedicated pricing teams, it’s deliberated daily. For pre-PMF companies in heads-down building mode, it’s likely done on an ad hoc basis.

Join 35000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Internal TikTok documents reveal that users can become addicted to the platform after watching only 260 videos. (More Here)

Apple plans to release a $2,000 Vision headset in 2025, followed by a second-gen Vision Pro in 2026 and smart glasses in 2027. (More Here)

Apple AI researchers question OpenAI's claims about o1's reasoning capabilities. (More Here)

OpenAI launches a new multi-agent framework 'Swarm'. (More Here)

ByteDance's TikTok cuts hundreds of jobs in AI shift. (More Here)

SpaceX catches giant Starship booster in fifth flight test. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 26,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

The types of men who become successful..

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Get access to our all-in-one VC interview preparation guide - check out here, we are giving a 30% discount for a limited time. Don’t miss this.

Director, Network and Investments - MBX Capital | USA - Apply Here

(Consumer) Venture Scout - hEADLINE | Remote - Apply Here

General Partner - ESCALATOR VENTURE | USA - Apply Here

Investment Director Growth Equity - Luminance | Germany - Apply Here

Investment Professional - Titan Capital | India - Apply Here

Investment Manager - Wellington Parter | Germany - Apply Here

Part-Time Student at Impact VC - Kopa Venture | Germany - Apply Here

Senior Associate, Investment - Technology/AI - B Capital Group | USA - Apply Here

Senior Lawyer (6-12 month FTC) - sQUARE | Australia - Apply Here

Chief of Staff Wischoff Venture | USA - Apply Here

Venture Capital Junior Analyst - Stepstone Group | USA - Apply Here

Investor Relations - Southeast Angel | UK - Apply Here

Portfolio Analyst Intern - Plug and play tech centre | USA - Apply Here

Investor Relations Manager - Griffin Gaming Partner | USA - Apply Here

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

That’s It For Today! Happy Tuesday. Will meet You on Friday!

✍️Written By Sahil R | Venture Crew Team