Investors Are Looking for Market Opportunity, Not Just Size | VC Remote Jobs & More

"Stop Pitching The Typical Market-Size Slide. Instead - show that you truly understand the market opportunity from the bottom up..."

Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Today At Glance

Deep Dive: Investors Are Looking for Market Opportunity, Not Just Size !

Featured Post: Venture Capital Fund Metrics Cheat Sheet: Use these tools to Evaluate VC Fund Performance....

Major News In Ecosystem: Solo GP Raising Million Dollar Fund, Hyperfund Running Billion Dollar Crypto Ponzi Scheme & Musk's $56B Tesla Pay Deal.

Must Read on Startups, Venture Capital & Technology

VC Jobs & Internships: From Scout to Partner

FROM OUR PARTNER

VESTBERRY - The Portfolio Intelligence Platform for data-driven VCs

Data Engineering is no longer just a backstage player but is taking centre stage in the VC space.

It is about constructing and maintaining the architectures (think databases, large-scale processing systems) that allow for data availability—a cornerstone for insightful analysis and well-informed decisions.

Turning raw data into usable outputs and insights has great use cases for deal sourcing, due diligence, or portfolio monitoring.

Dive deeper into this video, where we break down the impact of data engineering on the VC industry.

🤝 PARTNERSHIP WITH US!

Want to promote your startup to our community of 21,500+ entrepreneurs and investors? Fill out the form, our team will reach out to you.

🎉Get A Discount of 20% For Multiple Ads

TODAY’S DEEP DIVE

Investors Are Looking For Market Opportunity, Not Just Size.

Every pitch deck needs to have a “Market” slide. Unfortunately, most entrepreneurs get the market slide wrong.

That’s not necessarily their fault. The fault lies in the pitch coaching industry that insists that every deck include a slide with TAM, SAM and SOM. (total addressable market, serviceable addressable market, serviceable obtainable market or variations on these terms.)

You can find templates for this slide all over the internet.

Almost always, the template has three bubbles:

Sometimes they appear side by side, like the porridge bowls of the three bears, and sometimes they are elegantly nested within one another, like a matryoshka doll.

The Mythical Market Size Claim

It’s amazing how this three-bubble market size slide has spread. It seems that everywhere I go on the planet, from Stockholm to Shenzhen, entrepreneurs are using a similar slide.

Typically, entrepreneurs claim,

“Our global TAM is $X billion, but we are going to start out in a certain part of the world, where our SAM is $Y billion. And we conservatively project that our SOM is $Z billion.”

At times, they also show a very precise compound annual growth rate (“with a CAGR of 17.65%”) to demonstrate their analytical rigour.

It’s clear why entrepreneurs try to pump up their market size.

“They’ve been told that venture capital investors are only interested in unicorns, and so they assume that the best way to become a unicorn is to go after the largest market possible.”

Presumably, the thinking is that it is easier to get 2% of a very large market than it is to get 20% of a smaller market. So, they earnestly search for market data that allow them to claim that their TAM is perhaps $56 billion, or $256 billion, or even better, $2.5 trillion.

When this slide appears, most investors chuckle (or weep). Not only are the numbers always exaggerated, they are also irrelevant.

Market Size vs. Market Opportunity

Investors generally don’t give any credence to the market size numbers that founders present to them.

We may still ask founders how big their target market is, but the point of the question is to see how founders think about market segmentation, not to rate the startup based on how big they think the market is.

Savvy investors may prefer that startups go after a market that does not yet exist. Better to create the market than try to unseat established competitors.

Rather than claiming that you can disrupt a huge existing market, what’s more, relevant and compelling is how you answer questions such as:

Who are your target customers?

How will you reach them?

How many can you reach?

How will you convert them?

How many can you convert?

How will you onboard them?

How much will that cost?

What is a customer worth?

How many customers will you acquire this year? Next year? The year after?

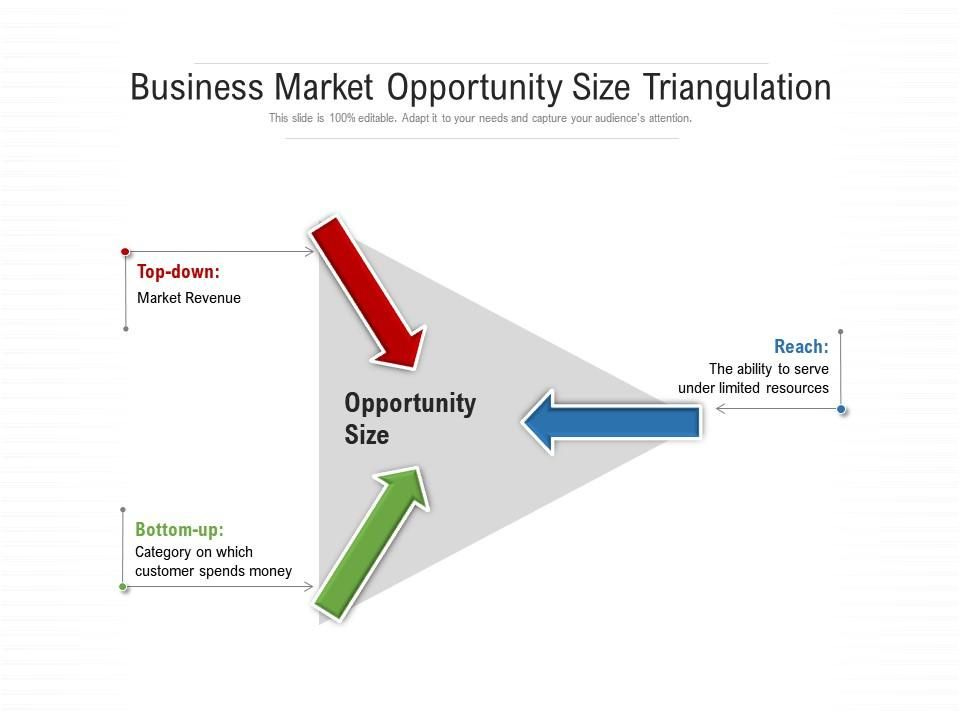

Most investors want to see market opportunity, not market size.

They need to see that you understand who you are going after at the individual customer level, why the customers will love your solution, how you are going to reach target customers and how many customers are likely to convert.

Founders should build a bottom-up model that demonstrates how you will build a big, profitable business, customer by customer. If you are truly innovating, you are creating a new market. Show investors how you are going to build an ever-expanding cadre of delighted customers. Don’t suggest that your focus is on acquiring market share in a large established market.

Show That You Know Your Customer

The typical market size slide is obsolete.

We’ve heard several teams pitch wearable technologies for dogs to track their activity. It’s easy for startups to claim that the TAM for such a product is in the billions. They might state that there are 90 million dogs in the United States alone — at a $9.95 a month subscription, that’s a $10 billion market!

In fact, for the dog wearables business, it doesn’t matter if there are only 20 million dogs or 200 million dogs. What matters is how many dog owners the entrepreneur can convince, one by one, to sign up for this service. That requires defining and understanding the target customers in granular detail. Not “dog owners,” but “urban professionals, aged 25 to 35, earning over $80,000 per year and frequently posting on Instagram who own dogs.” Or something similarly precise, showing that you’ve done your homework.

Entrepreneurs should stop pitching the typical market-size slide. Instead -

They should show investors that they truly understand the market opportunity from the bottom up, customer by customer. Offering a compelling value proposition with their product or service and delighting customers is how they will ultimately succeed.

FEATURED POST

Venture Capital Fund Metrics Cheat Sheet: Use these tools to Evaluate VC Fund Performance....

You’re raising for milestones, not for percentages or runway......

If you are a founder, investor or fund manager this cheat sheet will help you to answer the following questions:

When should you use multiple calculations versus IRR calculations? What are the differences?

How is your particular investment performing right now?

Nine venture capital metrics used to determine fund health and performance are separated into multiple calculations and internal rate of return (IRR) calculations. … Read More Here

Join 14000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

A Delaware judge voided Tesla CEO Elon Musk's $56 billion pay package, deeming the board failed to prove its fairness. Read More

Hackers stole approximately $112 million worth of XRP from Ripple’s Founder Personal Account. Read More

Elon Musk has lost the title of the world's richest person to Bernard Arnault. Read More

The DOJ has filed charges against a crypto fund called HyperFund that allegedly cooked up a Ponzi scheme. Read More

→ Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? Subscribed To the Venture Daily Digest Newsletter and join 9000+ Avid Readers!

WHAT I READ THIS WEEK

Must Read on Startups & Venture Capital

The Fastest Growing Software Sectors in 2024 by Tomasz Tunguz. Read Here

Guy Kawasaki: Get High And To The Right On Uniqueness-Value Graph. Read Here

5 Mistakes That Founders Make in Investor Meetings That Kills Chances of Success. Read More

Experience as a Status Symbol By Tomasz Tunguz. Read Here

Make a Product A Few Love, Not Many Like, At The Start By Peter Thiel. Read Here

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

VP - Raise Global | US - Apply Here

VC Analyst - Pravega Capital | India - Apply Here

VC Associate - Allocator One | Austria - Apply Here

VC Analyst Intern - Freigeist | Germany - Apply Here

VC Analyst - Plug and play | Spain - Apply Here

Associate -True | UK - Apply Here

Senior Analyst - Blue Heron Capital | USA - Apply Here

Venture Capital Intern (Summer 2024) - Jump Investors | USA - Apply Here

VP - Nordstar | UK - Apply Here

Investor Relations Manager - Frontline | UK - Apply Here

Intern - France | France - Apply Here

2024 MBA Summer Internship - 25Madison | USA - Apply Here

VC Intern -Riverwalk Holding | India - Apply Here

Associate - The Partnership Fund | USA - Apply Here

→ Want Daily Updates on VC Job Opportunities? Check out VC Crafter 👇

Join our 200+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

That’s It For Today! Will Meet You on Tuesday

Happy Thursday! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team