How to Talk About Valuation Numbers When Investor Ask? | VC Jobs

Carta’s Founder's Equity Playbook & Defensibility & Competition By Elad Gil.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: How to Talk About Valuation Numbers When Investor Ask?

Quick Dive:

Carta’s Founder's Equity Playbook: Must-Read Guide For Founders.

Venture firm Profits Are at a Historic Low.

Defensibility & Competition: Are early SaaS or AI companies ever defensible - By Elad Gil?

Major News: Musk's xAI Corp Raising $6 Billion, Microsoft and NASA Launch AI Earth Copilot, US to Deploy World’s First Alien-Hunting System & More

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

FEATURED STARTUP

The Most Emerging Startup You Can't Miss…

You know how finding reliable overseas talent can be a total nightmare? (Been there, done that, got the horror stories!) Well, A Team Overseas is doing something that made me go "Why didn't anyone think of this before?!"

Here's the tea: Most agencies are charging businesses a whopping $3K/month for virtual assistants but only paying them $700-800. Yikes! These folks looked at that system and said "Nope, we're doing better." They're connecting you with Executive Assistants who've crushed it at big agencies but were tired of getting the short end of the stick.

The best part? They're paying their EAs a fair $1,400/month (literally double!) while charging businesses just $2.5K. Math nerds, you're seeing this right - everyone wins!

But wait - it gets better. These aren't your typical "just tell me what to do" VAs. We're talking about pros who've managed complex projects, know how to think three steps ahead, and understand your business goals. The kind who'll message you saying "Hey, I noticed XYZ and here's how we can improve it" before you even spot the issue.

Look, I'm usually sceptical about these things (occupational hazard, sorry!), but this is legit changing the game for both businesses AND talent.

If you're drowning in tasks or tired of micromanaging overseas teams, you must check this out.

Partnership With Us: Want to get your brand in front of 66,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

Observations on what happening currently in pre-seed and seed rounds (Read)

29 business moats that helped shape the world’s most massive companies. (Read)

The Real Risk of AI's Failure. (Read)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources. (Read)

OpenAI Email Archives (from Musk v. Altman) (Read)

This former founder is looking for early-stage startups to invest in (Read)

The playbook to grow consumer mobile apps (Read)

8 keys to making Meta ads work for founders (Read)

34 growth tactics to get your first 1000 customers (Read)

The Power of Collaborative Product Development. (Read)

All-In-One Startup Metrics Guide - What to track, when and why. (Read)

Building Cap Table As A Founder: Template to Download. (Read)

TODAY’S DEEP DIVE

How to Talk About Valuation Numbers When Investor Ask?

[A few weeks back, I had a call with an investor who has a decade of experience investing in startups globally as a VC (let's call them Investor-A). We discussed how founders can approach the topic of valuation when investors ask. I thought I'd share some of the key points with you!]

One of the hardest things about the fund-raising process for entrepreneurs is that you’re trying to raise money from people who have “asymmetric information.”

VC firms see thousands of deals and have a refined sense of how the market is valuing deals because they get price signals across all of these deals.

As an entrepreneur, it can feel as intimidating as going to buy a car where the dealer knows the price of every make & model of a car and you’re guessing at how much to pay.

Of course, unlike cars, there is no direct comparison across each startup so these are just some general guidelines to try and even the information field. So, grab your coffee and let’s deep dive into it.

What Expectations Do You Have About Valuation?

It is not uncommon for a VC to ask about your price expectations in this fundraising process. It’s a legitimate question as the VC is in “price discovery” mode and wants a sense of whether you’re in his or her valuation range.

It’s a tough dance but, here is what Investor-A suggest:

In most cases don’t name an actual price

Your job is to “anchor” by giving the VC a general range without saying it. Call this “price signalling.”

Turn the tables on the VC by politely saying, “Given you must have a sense of our general valuation, how do you feel the market is pricing rounds like ours these days? After all — we only raise once every 1–2 years!”

Why shouldn’t most founders just name a price? For starters, it’s the job of the “buyer” to name a price and you don’t want to name your valuation if it ends up being lower than the VC would have paid or a price too high that the VC simply pulls out of the process.

So Then Why Anchor?

If you don’t give signals to a VC of what your general expectations are it’s hard for them to know whether you have realistic expectations relative to their perceived value of you and whether you want to keep them in the process rather than just having them pull out based on what they THINK you might want on valuation.

Any great negotiation starts by anchoring the other party’s expectations and then testing their reaction.

How you talk about valuation will of course depend on how well your business is performing and how much demand you have from other investors. If I leave out the immediate “up and to the right” companies and talk about most others who have made good progress since the last funding but the next round isn’t a slam dunk, you might consider something like if asked about your expectations:

We closed our last round at a $17 million post-money valuation and we had raised $3.5 million.

We closed it 20 months ago and we feel like we’ve made great progress

We’re hoping to raise $5–7 million in this round

We know roughly how VCs price rounds and we think we’ll likely be within the normal range of expectations

But obviously, we’re going to let the market tell us what the right valuation is. We only raise every 2 years so the market will have a better feel for it than we will

We’re optimizing for the best long-term fit for a VC and who we think will help us create the most value. We’re not optimizing for the highest price. But obviously, we want a fair price.

How do you generally think about valuation for a company at our stage? (this is seeking feedback / testing your response)

Here you’ve set a bunch of signals without naming your price. What a VC heard was:

The price has to be higher than $17 million, which was the last round. It was 20 months ago and the founder told me she has made great progress (code words for the higher price expected)

She is raising $5–7 million and knows the range of valuations for this amount. If I assume 20–25% dilution that implies a price of between $20–28 million pre-money valuation ($25-$35m post-money). Maybe she wants slightly higher but she certainly won’t want lower.

She has told me she’s not trying to shop this for the highest price. I’m not so naive as to completely believe that — every entrepreneur will go for the highest reasonable price with a VC they like so I at least need to put my best foot forward. But if I’m in the ballpark of fair she won’t game me and push for the highest price as the only part of her decision.

What Was The Post Money On Your Last Round And How Much Capital Have You Raised?

It’s not uncommon for a VC to ask you how much capital you’ve raised and what the post-money valuation was on your last round.

I know that some founders feel uncomfortable with this as though they might somehow be sharing something so confidential that it ultimately hurts you. These are straightforward questions, the answers will have no bearing on your ultimate success and if you want to know the truth most VCs have access to databases like Pitchbook that have all of this information anyway.

So Why Does A VC Ask You?

In the first place, they’re looking for “fit” with their firm. If you’re talking with a typical Seed/A/B round firm they often have ownership targets in the company in which they invest. Since they have limited capital and limited time availability they often try to make concentrated investments across companies in which they have the highest conviction.

If a firm typically invests $5 million in its first check and its target is to own 20% or more that means that most of its deals are in the $15–20 million pre-money range. If you’re raising at $40 million pre then you might be out of their strike zone.

Many VCs will have a distribution curve where they’ll do a small number of early-stage deals (say $1.5–3 million invested at a $6–10m pre-money), a larger number of “down the fairway” deals ($4–5 million at a $15–25 million pre) and a few later-stage deals (say $8–10 million at a $30–40 million pre).

Of course, there are smaller funds that are more price sensitive and want to invest earlier and later stage funds with more capital to deploy and write larger checks a higher prices so understanding what is that VC’s “norm” is important.

A second thing a VC may be trying to determine is whether your last-round valuation was significantly over-priced.

Of course, valuation is in the eye of the beholder but if that VC thinks your last round valuation was way too high then he or she is more likely to politely pass rather than try and talk down your valuation now.

VCs hate “down rounds” and many don’t even like “flat rounds.” There are some simple reasons. For starters, VCs don’t like to piss off a bunch of your previous-round VCs because they’ll likely have to work with them in other deals. They also don’t want to become a shareholder in a company where every other shareholder starts by being annoyed with them.

But there is also another very rational reason. If a VC prices a flat or down round it means that management teams are often taking too much dilution. Every VC knows that talented founders or executives who don’t own enough of the company or perceive they will have enough upside will eventually start thinking about their next company and are less likely to stick around. So a VC doesn’t want to price a deal in which the founder feels aggrieved from day one but takes your money anyway because he or she doesn’t have a choice.

Every VC has a story where they did the flat round anyway and the founder said,

“I don’t mind! I know our last round valuation was too high.”

In nearly 100% of those cases, the founder expresses his or her frustration a year later (and 2 years later and 4 years later). The memory isn’t “Boy, you stepped in at a time when we were having a tough time getting other VCs to see the value in our company — thank you!” it is more likely a softer version of “You took advantage of us when we had no other options.”

It is this muscle memory that makes the VC want to pass on the next down or flat round. In a market where there is always another great deal to evaluate, why sign up for one where you know there are going to be bruised egos from the get-go?

The “How much have you raised?” The question is usually a VC trying to determine whether you’ve been capital-efficient with the funds you’ve raised to date. If you’ve raised large amounts of money and can’t show much progress you’ve got a tougher time to explain the past than if you’ve been frugal and over-achieved.

Investor’s advice to founders on the questions of “How much did you raise in the last round?” and “What was the post-money valuation of your last round?” -

is to start with just the data. If you don’t perceive that you have any potential “issues” (raised too much, price too high) then this should be a non-event. If you are aware you may have some issues or if you are constantly getting feedback that you may have issues then it’s a smart strategy for you to develop a set of talking points to get in front of the issue when asked.

Are Your Existing Investors Participating In This Round?

This is a delicate dance as well. Each new investor knows that the people who have the MOST asymmetric information on your performance are the previous round investors. They not only know all of your data and how you’re doing relative to the competition, but they also have a good view of how well your management team is performing together and whether you’re a good leader.

On the one hand, a new potential investor will want to know that your existing investors are willing to continue to invest heavily in this round and at the same price that they are paying, on the other hand, they want to invest enough of the round to hit their ownership targets and may not want existing investors to take their full pro-rata investments.

Before raising capital you need to have a conversation with your existing investors to get a sense of what they’re thinking or at a minimum you better have an intuitive feel for it. Assuming that most of your existing investors are supportive but want a new outside lead, Investor-A recommends answering this something like this:

Our existing investors of course want to participate in this round. They will likely want to do their pro rata investments — some might even want slightly more.

I know that new firms have ownership targets. I feel confident I can meet these. If it becomes sensitive between a new investor’s needs and previous investors — I’m not going to tell my investors they can’t participate but I feel confident I can work with them to keep the sizes of their checks reasonable.

What a VC hears when you say this:

My existing investors are supportive. I will eventually call them anyway to confirm but I can continue my investment assuming they are supportive

In the future, if we raise a larger round this entrepreneur won’t try to screw me by forcing me not to take my pro rata rights because they weren’t throwing existing investors under the bus with me

This entrepreneur is sophisticated enough to know that fund-raising is a dance in which I need to meet the needs of both new investors and previous investors. They will work with me so I can get close to my ownership targets.

When SHOULD You Name A Valuation Expectation?

There are some types of rounds where just naming price might be a better option.

Strategics (ie industry investors vs. VCs).

For some reason, many strategic investors don’t like to lead rounds and they don’t like to name a price. This isn’t true of all strategics but it is true for many of them — particularly those who don’t have a long history in VC. Having a price helps them to evaluate the deal better. Often they’re much better at a “yes/no” decision than naming a price. If you name your valuation you sometimes have to give them a rationale on how similar companies are valued so they can justify their internal case. Knowing that other institutional investors (including your insiders) are paying the same price as them in this round helps.Many Investors.

When you are raising for 8–10 new sources vs. 1–2 sometimes it’s easier just to name price. One reason you might be raising from so many sources is that you haven’t found it easy to find a strong lead investor (for say $20 million) but many sources are willing to write you smaller checks (of say $2–3 million each). Many investors can also be in the opposite situation where you’re so successful that everybody wants to invest. In either case, having a price target can help you get momentum.

Turning The Information Tables

Final point. If done in the right way, each VC meeting can be a great opportunity for you to get feedback on how investors are seeing market valuations in the time that you’re raising (valuations change based on the overall funding economy) and also a chance to hear about how the VCs think about your valuation and/or let you know whether or not you have any perceived problems.

You might politely ask questions like:

Does your firm have a target ownership range?

Do you typically like to lead and do you ever follow?

Are there firms you like to co-invest with?

Does our fundraising size sound reasonable to you?

Are there any valuation concerns you might have that we can address now?

Your goal in forming questions is to get signalling back from the VC.

Remember that fund-raising is a two-way process and you have every right to ask questions that help orient you just as a good VC will ask questions of you.

PARTNERSHIP WITH US

We Write, Design & Model Your Pitch Deck.

Decks get you meetings. Without meetings, you have no shot at getting funded. Investor meetings get you funded.

However, most founders fail to impress investors through their pitch decks. Many make mistakes by adding the wrong content and including too many - around 10-15 - slides. Investors don't like that.

If you're feeling confused while building a pitch deck, we can help. We've created an internal team of experts, designers, and investors to build and review your pitch deck.

Schedule a call with us today →

QUICK DIVES

1. Carta’s Founder's Equity Playbook: Must-Read Guide For Founders.

Carta shared 50 slides of startup data covering everything from co-founder equity through seed round fundraising. Let's break down how ownership evolves in the early years of a startup, following the natural progression of building a company.

Best Practices for Founder Equity:

Don't Default to Equal Splits

For 2 founders, the typical split is 55/45

Consider factors like idea origination, full-time commitment, domain expertise

Always Use Vesting

Standard: 4-year vesting (consider up to 6 years)

Usually no cliff for founders

Use Restricted Stock Awards (RSAs)

Document Everything

Get agreements in writing

Clearly define roles and expectations

Plan for contingencies (what if someone leaves?)

Building Your Team:

Advisors (0.25-1% equity)

Use NSOs (Non-qualified Stock Options)

2-year vesting

Short cliff period

Clear expectations in writing

Early Employees (Team Building)

Use ISOs (Incentive Stock Options)

4-year vesting

1-year cliff

Set aside 10-15% option pool

Fundraising Strategy

Before You Raise:

Ask Yourself:

Do you really need outside capital?

Have you explored bootstrapping?

Can you reach profitability without funding?

If You Decide to Raise: SAFE Notes (Simple Agreement for Future Equity)

Key Terms to Negotiate:

Valuation Cap

Post-money cap = clearer ownership math

Example: $1M on $10M post-money cap = ~10% ownership

Discount Rate

Typical range: 15-25%

Applies at conversion

Important Side Letters

MFN (Most Favored Nation)

Information Rights

Pro-rata Rights

Practical Tips for Managing Equity

Model Everything

Use Carta's free tools

Model multiple scenarios

Consider future rounds

Protect Your Equity

Always use vesting

Get legal review

Plan for dilution

Communicate Clearly

Be transparent with co-founders

Document all equity decisions

Keep the cap table updated

Common Mistakes to Avoid

Skipping vesting schedules

Equal splits without discussion

Giving too much equity too early

Not planning for dilution

Ignoring legal documentation

Promising equity without board approval

Final Thoughts

Remember: Your equity is your most valuable currency in the early days. Every equity decision you make early on will impact your ownership at exit. Be thoughtful, be strategic, and always plan ahead.

Track your numbers using tools like Carta, and don't hesitate to seek legal counsel for important equity decisions. Your goal is to retain enough ownership to stay motivated while building a team and raising capital to grow your company.

You can even watch a detailed video here.

2. Venture firm Profits Are at a Historic Low.

Silicon Valley venture capital firms are facing an interesting dilemma: While they're great at finding promising startups to invest in, they're struggling to make money back from these investments. Here's what's happening:

Current State of Returns

2023 Returns: VCs returned only $26 billion to investors (lowest since 2011)

Investment Deficit: VCs invested $60 billion more than they collected in 2023 (the highest deficit in 26 years of PitchBook data)

Investment Trends: The past three years have recorded the highest VC investments since 1998

Major Valuations and Deals

High-Profile AI Investments

OpenAI: Recently raised $6.6 billion

Current Valuation: $157 billion

Notable Failed Acquisitions

Adobe-Figma Deal: $20 billion acquisition cancelled due to regulatory concerns

Google-Wiz Deal: $23 billion potential acquisition fell through

Wiz's Current Status: Recently completed a tender offer valuing it at $16 billion

Major Private Companies and Transactions

Stripe Financing: Raised $6.5 billion in 2023

Stripe Valuation: $50 billion

Recent Activity: Stripe and investors bought over $1 billion of shares from current/former employees

Sequoia's Move: Bought $861 million of its shares in Stripe

The Unicorn Problem

Current Status: Over 1,400 startups valued at $1+ billion ("unicorns")

Timeline Issue: At historic IPO rates, it would take more than 20 years for all current unicorns to go public

Company Age: Many startups are now 13-15 years old, far exceeding traditional timelines

Signs of Change Some companies are making moves toward public markets:

ServiceTitan: Planning IPO in December 2024

Klarna: Recently filed for U.S. IPO

Stripe: Third most valuable U.S. startup (after SpaceX and OpenAI)

Market Impact The situation affects multiple stakeholders:

University Endowments: Not receiving expected returns

Pension Funds: Experiencing lower distributions

Private Market Investors: Stuck with illiquid investments

Startup Employees: Limited options for cashing out shares

Industry Response VCs are adopting various strategies:

Private Equity Solutions: Exploring sales to PE firms

Self-Purchasing: Buying their stakes

Tender Offers: Facilitating private share sales for employees

Extended Private Funding: Continuing to fund companies without forcing public markets

This situation represents a significant shift in the venture capital model, where the traditional paths to liquidity (IPOs and acquisitions) have become increasingly challenging. The industry's ability to adapt to these changes while maintaining investor confidence will be crucial for its future success.

The question remains whether regulatory changes or market conditions will shift to allow more exits, or if the industry will need to fundamentally restructure its approach to generating returns for investors. As Thomas Laffont of Coatue Management starkly put it, "We are bleeding cash as an industry."

3. Defensibility & Competition: Are early SaaS or AI companies ever defensible - By Elad Gil?

Elad Gil shared an interesting writeup on startup defensibility that particularly caught my attention, as it addresses a burning question in today's AI landscape - are companies building on top of foundation models like GPT truly defensible? Also, it answers one question - Are early SaaS or AI companies ever defensible?

Most successful SaaS companies weren't inherently defensible when they started. Picture this: a small team of 2-5 people, building for 6-12 months. Technically, anyone could clone what they built. Yet many such "easily replicable" startups went on to become industry giants.

The secret sauce? Building defensibility over time. Gil outlines several ways companies develop their moats:

Network Effects:

Think of how Slack becomes more valuable as more team members join

Or how Uber created a powerful feedback loop between drivers and riders in each city

These effects can be local (within a company) or global (across the platform)

Platform & Integration Moats:

Salesforce is sticky because thousands of companies have built their systems around it

Enterprise systems like SAP or Epic become deeply embedded through complex, multi-quarter implementation processes

Each integration makes it harder for customers to switch

Product Expansion:

Companies like Workday and Rippling bundle multiple products that are usually bought separately

Building a massive product footprint makes it hard for newcomers to compete

Starting with a focused solution, then expanding breadth and depth over time

Strategic Deals & Sales:

Early access to APIs or data (like some companies getting privileged access to GPT-4)

Multi-year enterprise contracts that lock in customers

Complex enterprise sales processes involving security reviews, IT approvals, and procurement

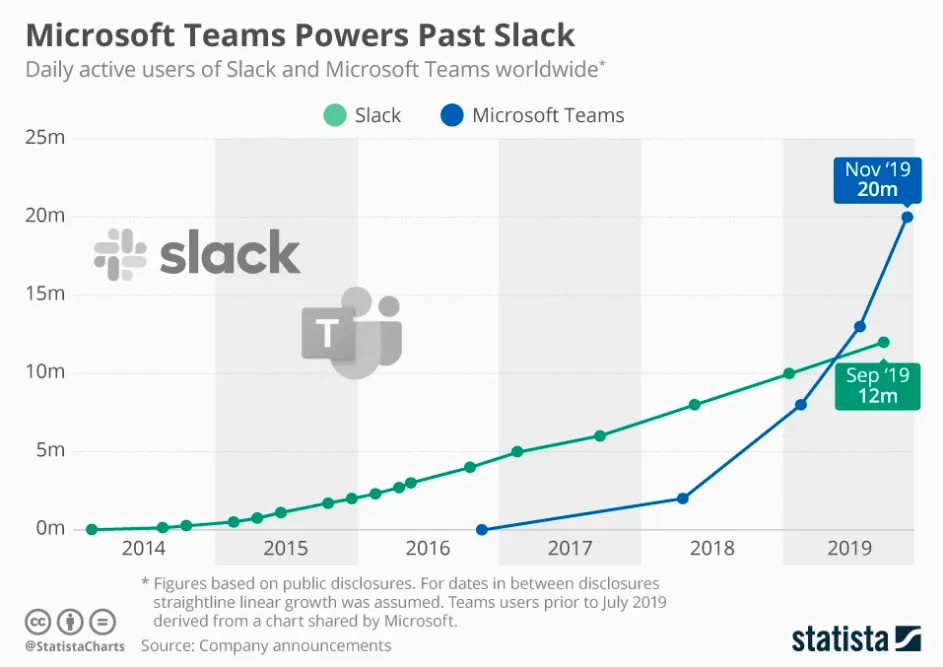

What's particularly interesting is Gil's take on competition. In a startup's first 4-5 years, the main competition usually comes from other startups. The real incumbent threat typically emerges later, often through bundling (think Microsoft Teams vs Slack).

However, in obvious markets like today's generative AI, incumbents like Microsoft, Github, and Notion are moving much faster.

For AI startups worried about being "just another wrapper," Gil's message is clear: focus on serving customer needs exceptionally well rather than obsessing over early defensibility. Keep shipping, keep expanding your product, and build your moats systematically. Whether through proprietary datasets, becoming an essential workflow, or building strong sales relationships, defensibility often emerges naturally through execution.

The real danger isn't a lack of early defensibility - it's fast-moving incumbents who can easily add similar features as a natural extension of their existing products. This is particularly relevant now, as we're seeing rapid moves from major players in the AI space.

So overall: don't let concerns about perfect defensibility stop you from building. Focus on creating genuine user value, maintain rapid execution, and let your moats develop over time through deliberate expansion and deepening of your product offering.

This perspective feels particularly relevant in today's AI landscape, where we're seeing a gold rush of companies building on foundation models. The winners won't necessarily be those with the most unique technical moats on day one, but those who execute relentlessly to solve real customer problems while systematically building their defensive positions.

You can read the detailed write-up here.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Elon Musk's xAI Corp is raising approximately $5-6 billion in new funding, primarily from Middle Eastern sovereign funds, which could value the company at $45-50 billion. (Read Here)

NASA and Microsoft have partnered to launch an AI chatbot called 'Earth Copilot' to help the public understand and answer questions about the planet. (Read Here)

Google has introduced a Gemini-powered AI image generator in Google Docs, allowing users to create clip art, similar to Microsoft's AI-generated art in its Office suite. (Read Here)

ByteDance, TikTok's parent company, has reportedly valued itself at $300 billion in a recent share buyback, though this valuation had previously dropped to $223 billion last year. (Read Here)

Anthropic collaborates with the US Department of Energy's nuclear experts to ensure its AI model, Claude 3 Sonnet, does not inadvertently disclose sensitive nuclear weapon information. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 28,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

2025 Venture Capital Summer Analyst - Stepstone Group | USA - Apply Here

Legal Counsel - Wavemaker Partners | Singapore - Apply Here

Chief of Staff - Akkadian Venture | USA - Apply Here

Accounting & Finance Associate - Redalpine | Swiss - Apply Here

Partner 18, Deal Operations - a16z | USA - Apply Here

Partner 18, Digital Community Manager - A16Z | USA - Apply Here

Director, NYS Innovation Venture Capital Fund - NWyVenture | USA - Apply Here

Associate Investor - The Westly Group | USA - Apply Here

Venture Capital Associate - Octave | USA - Apply Here

Portfolio Management Lead - Atlassian Venture | USA - Apply Here

Portfolio Management Lead - Atlassian Venture | USA - Apply Here

Internships - Dallas Ventrue Capital | India - Apply Here

MBA Associate - Founder Collective | USA - Apply Here

Internship/Stage - VC Analyst & Program Manager - Sopra Venture | France - Apply Here

Associate - 360 Once| India - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Get access to our all-in-one VC interview preparation guide—check it out here. For a limited time, we are offering a 30% discount. Don’t miss this. (Access Here)

Early Stage Startup Financial Model Template For Fundraising (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)