How to run competitive analysis with ChatGPT? | How AI will change different types of consumer purchases.

The DeepSeek hype was fake... & Handle multiple ICPs as a solo founder?

👋 Hey, Sahil here — Welcome back to Venture Curator, where we explore how top investors think, how real founders build, and the strategies shaping tomorrow’s companies. Today’s edition features even more carefully curated content.

Big idea + report of the week :

How AI will change different types of consumer purchases.

PitchBook study: Why LPs might be overestimating VC skill.

How much alpha can skilled manager selection generate in private markets?

Frameworks & insightful posts :

How to handle multiple ICPs as a solo founder?

The DeepSeek hype was fake, and it just exposed a new kind of market manipulation.

How to use ChatGPT for competitive analysis?

What founders can learn from Figma hitting $1B ARR

FROM OUR PARTNER - ROCKET

🤝 Go from prompt to live product in minutes

Build production-ready web or mobile apps using only a prompt or Figma design.

Rocket is the vibe solutioning tool that handles the full stack—UI, backend logic, AI workflows and clean code deployment-ready. No coding libraries, no engineering handoffs.

Get started completely free with 1 M tokens to build your first app risk-free. Ideal for developers, product teams, and innovators who want to iterate faster and ship products that work from day one.

Get Started with Rocket.new →

🤝 PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

START WITH

🧠 Big idea + report of the week

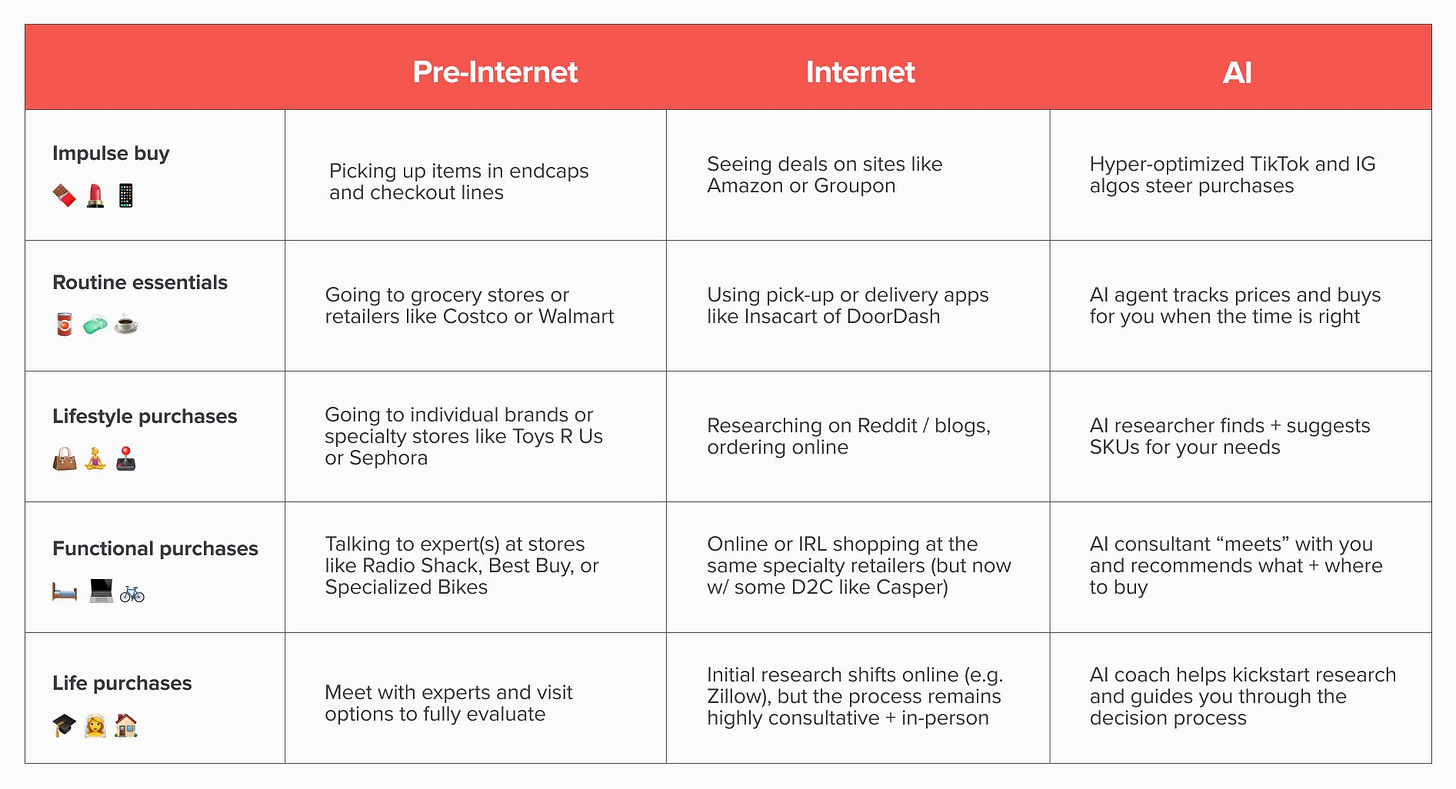

How AI will change different types of consumer purchases.

AI will change the way we shop - from where we find products to how we evaluate them, when we buy, and much more.

This raises a question: What types of purchases will be disrupted, and where does opportunity exist in the age of AI?

a16z recently shared a framework from Justine Moore and Alex Rampell that categorises consumer commerce into five categories based on the level of consideration required for a purchase.

The takeaway: AI will disrupt these categories at different speeds, and the biggest near-term opportunities sit in the middle.

Impulse buys

Candy bars at checkout, funny shirts on TikTok, no research, no deliberation. AI’s role is limited to hyper-targeted, personalised ads that appear at the right moment.

Routine essentials

Groceries, cleaning supplies, pet food. You know what you like, but AI can act as an autopilot buyer, tracking prices, predicting when you’ll run out, and ordering at the best deal.

Lifestyle purchases

Luxury skincare, a designer bag, home décor, researched, but not life-changing. AI can serve as a personal shopper, finding, ranking, and explaining the best picks based on your taste, past purchases, and style.

Functional purchases

Laptops, sofas, bikes, high-cost, long-term items. AI’s role here is deep research plus consultation: a back-and-forth “expert” conversation that compares across brands and matches your exact needs.

Life purchases

Homes, cars, weddings, degrees, rare, high-stakes decisions. You won’t fully outsource them, but AI coaches can guide research, flag risks, and even help negotiate terms.

The opportunity:

The middle three, routine essentials, lifestyle purchases, and functional purchases are where AI can create the biggest disruption fast. They’re big markets with enough complexity for AI to add value, but not so high-stakes that people resist automation.

PitchBook study: Why LPs might be overestimating VC skill

PitchBook’s new analysis (2004–2024) challenges one of the biggest assumptions in venture capital, that picking top-tier GPs automatically delivers outsized returns.

LPs who were “highly skilled” at selecting top VCs added only ~61 basis points annually in return over 25 years — about 15% cumulatively. In buyouts, the advantage was nearly the same (~16% cumulative).

The data suggests that luck plays a bigger role in VC. PitchBook found that a top-fund portfolio outperformed a random one 98.1% of the time in VC versus 99.9% in buyouts.

The dispersion between the best and worst VC funds remains extreme (top quartile IRR: 10–30%, bottom quartile: -25%), but recent performance since the 2021 downturn has narrowed that gap.

Much of the alpha once credited to “manager skill” may instead stem from market timing and access — top funds like Sequoia or Founders Fund remain closed circles with data that often isn’t captured in public benchmarks.

As one investor put it, “While luck influences outcomes, you can’t build a repeatable strategy around it.”

LPs might not gain as much alpha from “picking winners” as they think — unless they can access the truly elite funds where reputation, network, and timing still compound advantage.

How much alpha can skilled manager selection generate in private markets?

PitchBook’s new Q4 2025 Allocator Solutions report analyses two decades (2004–2024) of performance to quantify how much manager selection skill really adds for LPs in venture capital and other private markets.

Key insights for VCs and LPs:

Manager selection skill matters—but less than assumed. Even a “high-skill” LP only adds 0.61% annualised alpha in VC portfolios over 25 years, compared to random selection.

Luck plays a major role. A VC portfolio with skilled selection outperformed a random one 98.1% of the time—lower than 99.9% in buyouts, highlighting venture’s volatility and timing risk.

Dispersion is wide but less predictive. Despite top VC quartile IRRs (10–30%) and bottom quartile (-25%), timing and access matter more than skill.

Buyouts still yield steadier alpha. Across simulations, buyout funds produced slightly higher average alpha and more consistent “win rates.”

LP takeaway: Access to elite VC funds—those with proven networks and allocation barriers—still matters more than incremental selection skill.

The idea that LPs can “out-pick” the market in venture is overstated. The data suggests venture returns depend more on access, timing, and luck than pure skill.

TOOL FOR FOUNDERS

📑 Startup Legal Pack: VC-Ready Docs in One Place

Messy or missing legal docs slow founders down and turn off investors.

The Startup Legal Document Pack gives you everything you need to incorporate, protect equity, and raise confidently.

What’s inside:

Incorporation docs & founder agreements

SAFE notes, term sheets, cap tables

Employment, IP, and advisor agreements

NDAs, privacy policies & customer contracts

Built with startup attorneys and VC teams. Investor-ready. Easy to use.

SOMETHING MORE

🧩 Frameworks & insightful posts

How to handle multiple ICPs as a solo founder?

Arvid Kahl — bootstrapped founder of Podscan — shared a great breakdown of one of the hardest problems solo founders face: juggling multiple Ideal Customer Profiles (ICPs) without losing focus or burning out.

Here’s what he’s learned building a profitable SaaS that serves marketers, PR agencies, founders, newsrooms, and even SEO professionals — all at once.

1. Don’t serve everyone at the same time

Your product might technically help multiple audiences, but trying to target them all simultaneously just spreads your effort too thin.

→ Arvid’s approach: Time-box your focus. Spend a few weeks improving features or messaging for one ICP at a time, measure results, then switch. This makes learnings clearer and reduces context-switch chaos.

2. Use demos as discovery tools

Offering a demo isn’t just sales — it’s classification. Arvid found that demo calls revealed which bucket customers belonged to (founders, PR teams, analysts, etc.), what “job” they were trying to get done, and what language resonated with them.

Pro tip: Ask precise questions during demos: “What problem are you trying to solve today?” “What other tools are you using?” “What would make this 10x better?”

3. Create landing pages for each ICP

Different people care about different outcomes.

News agencies: highlight real-time trend tracking.

PR agencies: focus on reputation monitoring and alerting.

Founders: emphasize automation, API access, and integration.

Each ICP gets its own landing page and messaging tailored to their goals — not generic “features.”

4. Automate onboarding classification

Podscan uses lightweight onboarding questions and email domain analysis (even an AI-assisted background lookup) to auto-classify new signups.

This allows Arvid to customise the first-use experience — showing each user what matters most to their role.

5. Adapt your marketing tone per audience

Each ICP speaks a different language:

Founders: casual, meme-friendly, community-driven.

PR agencies: formal, outcome-focused, polished.

Analysts: quiet and private — they won’t share your tool publicly because it’s their competitive edge.

Tailor tone, channel, and outreach accordingly. Cold emails might work for one group but not another.

6. Leverage word-of-mouth where it works

Founders and API users spread products through peer networks. Marketers and analysts usually don’t. Arvid amplifies every mention on social media to reinforce that organic growth loop.

7. Focus on sequencing, not splitting

Trying to serve multiple ICPs is fine — if you do it intentionally. Focus on one group’s success, then move to the next. Each vertical teaches you something that strengthens the product for everyone else.

“The key is not trying to be everything to everyone at once, but being very intentional about when and how you serve each group.”

Handle each ICP like a time-boxed experiment. Speak their language. And don’t fear complexity — embrace it strategically.

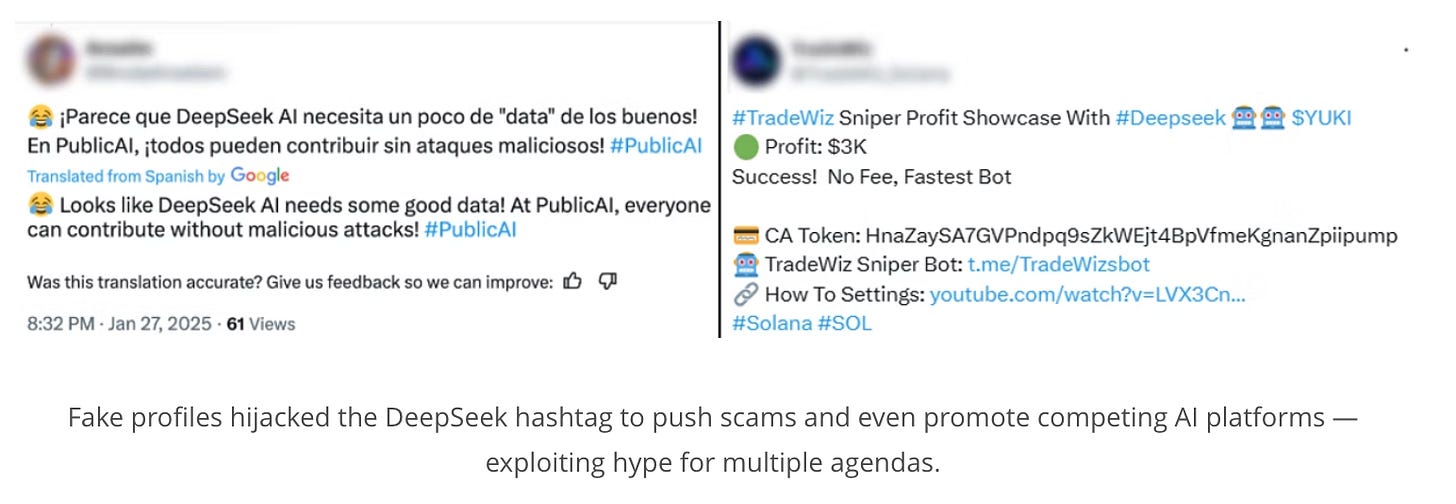

The DeepSeek hype was fake, and it just exposed a new kind of market manipulation.

When DeepSeek’s AI model “launched,” it looked like China’s answer to OpenAI — surging to the top of app charts, trending across X, and even rattling US markets. But new disinformation analysis shows the frenzy wasn’t organic at all.

It was manufactured.

What really happened

Researchers analysed 41,864 profiles discussing DeepSeek.

They found 3,388 fake accounts, responsible for 15% of all engagement on X (double the usual bot baseline).

Those accounts posted 2,158 times in a single day, flooding hashtags, commenting on each other’s posts, and inserting themselves into authentic conversations to look credible. Almost half were created in 2024 — right before DeepSeek’s rollout.

This wasn’t amateur hype. It was a coordinated disinformation playbook.

How fake networks created “AI buzz”

Mutual amplification: bots liked and replied to each other to simulate popularity.

Piggybacking on virality: they hijacked large creator posts to spread DeepSeek mentions.

Integration: bots engaged with real users to pass as genuine fans.

Synchronisation: identical praise posts dropped in bursts to the game platform's visibility.

The result: a global perception of momentum that didn’t actually exist.

Why this matters for tech & investors

Fake AI hype isn’t just annoying — it’s market-moving.

DeepSeek’s “buzz” briefly wiped billions in US market value as investors reacted.

It distorted narratives about China’s progress in AI.

It showed that disinformation tactics once used in politics are now shaping tech adoption and investment sentiment.

The new risk for companies

Leaders can’t tell where genuine traction ends and synthetic hype begins. If boardrooms, PR teams, or investors base decisions on distorted signals, strategy becomes reactionary to fiction.

What to do about it

Organizations now need AI-driven disinformation detection the same way they once needed threat intelligence.

0–30 days: Monitor social and media spikes in real time.

31–60 days: Run “bot hype” simulations to test response readiness.

61–90 days: Build playbooks for investor comms, reputation defense, and rapid debunking.

Building these systems internally is nearly impossible — it requires cross-platform data pipelines, model training, and 24/7 monitoring. Buying specialized detection tools offers faster coverage and early warning.

DeepSeek’s fake virality is the first major proof that AI hype can be weaponized — not just to sell software, but to manipulate perception, valuations, and national narratives.

And in an AI era where hype is currency, knowing what’s real might soon become every company’s most valuable competitive edge.

How to use ChatGPT for competitive analysis

Most founders assume they know who their competitors are. They pick names from memory, or from who they see on X. But the truth is, your actual competitors — the ones stealing traffic, attention, and customer mindshare — often aren’t even on your radar.

That’s where ChatGPT comes in.

The team behind WTF is SEO? shared a brilliant workflow showing how editors use ChatGPT to run competitive analysis fast, and it works just as well for founders and operators.

1. Identify who your real competitors are

Most companies define competitors based on intuition (“we compete with X because we’re in the same space”). But ChatGPT can reveal how Google and readers see your rivals.

Try prompts like:

“Who are the biggest competitors for [your brand]?”

“Which sites rank for the same [topic/keyword] as [your brand]?”

“What are the strengths and weaknesses of [competitor] compared to [my company]?”

“Give me three reasons why [my company] can’t keep up with [competitor]. Return as a table.”

These prompts generate search-driven competitor maps, not just your internal mental model.

2. Run top-level SEO and content gap audits

Once ChatGPT surfaces key competitors, go deeper:

“Provide a keyword overlap audit between [your brand] and [competitor] for [5 priority topics].”

“Which ‘how’, ‘where’, or ‘when’ queries does [competitor] dominate?”

“Summarize the topic authority of [competitor] in 200 words.”

You’ll get a first-draft view of what competitors own — before pulling verified data from tools like Ahrefs, Semrush, or Similarweb.

3. Use ChatGPT to wrangle raw data

ChatGPT can help clean, sort, and summarise large sets of URLs or headlines for quick insights.

For example:

Export all homepage URLs using the SEO Pro Chrome extension.

Upload the list and ask: “Categorize these URLs by type (news, evergreen, affiliate, live blog) and identify trends.”

It’s an instant snapshot of how your competitors use homepage real estate — and what topics dominate their link architecture.

4. Analyze headline patterns

Good headlines drive both SEO and clicks. ChatGPT can help you benchmark headline style, tone, and framing:

Upload headline samples from two sites.

Ask: “Compare tone, structure, and common framing patterns. Which ones are most engaging and why?”

You’ll get comparative tables showing tone, word choice, structure, and engagement cues — a starting point for editorial best practices.

5. Turn insights into experiments

Use ChatGPT’s summaries as hypotheses, not final answers. Validate everything with analytics or search data, but the AI gives you the first 80% of structure fast — freeing you to spend time on deeper validation and creative positioning.

This same workflow applies outside journalism:

SaaS founders can benchmark landing page messaging across competitors.

E-commerce teams can analyse product naming or ad copy tone.

Newsletter creators can compare headline and CTA performance by niche.

Check out the detailed write-up here.

What founders can learn from Figma hitting $1B ARR

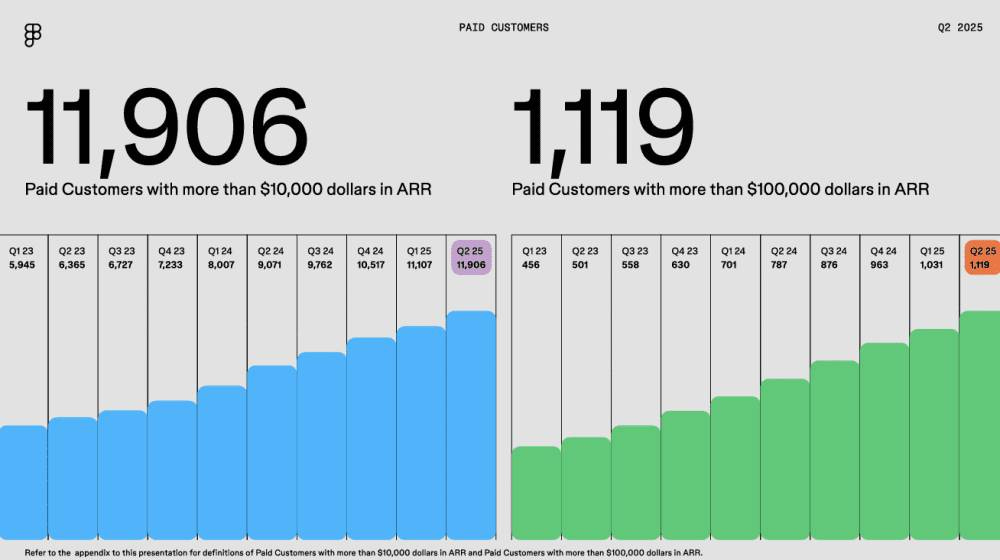

Figma just crossed $1 billion in ARR, growing 41% year-over-year, with over $100M in net income and 24% free cash flow margins.

While most SaaS companies are slowing down, Figma is compounding like it’s still early. Here are 5 takeaways founders should actually learn from this moment:

1. Enterprise expansion becomes your engine at scale

Figma now has 1,119 customers paying $100K+, up 16% QoQ. That small cohort likely drives 40–60% of total revenue.

Enterprise expansion is the new growth motion once you pass $50M ARR. Track your $100K+ customers as a separate cohort early — they’ll define your long-term growth curve.

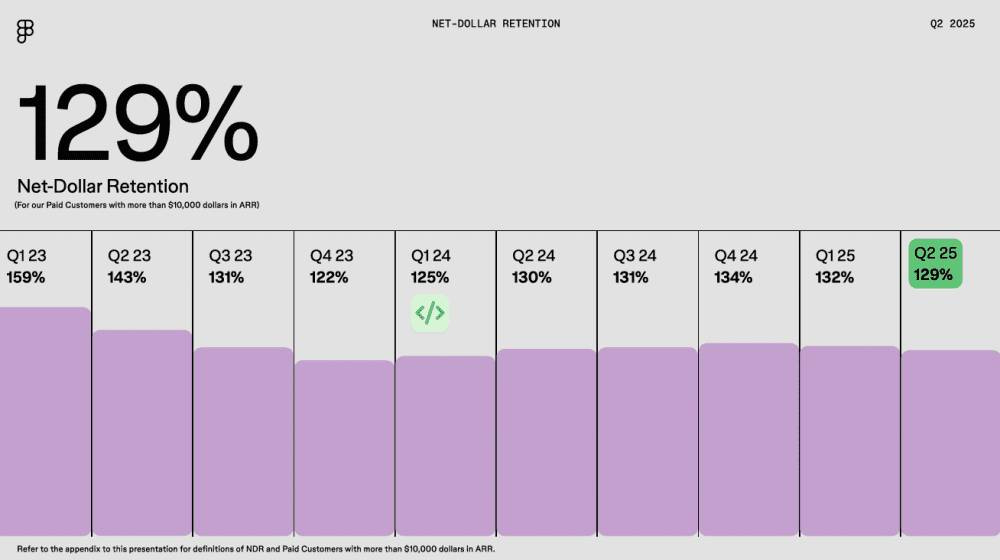

2. Retention defines greatness — not just acquisition

Figma’s 129% net dollar retention has stayed steady for six straight quarters.

That means existing customers are growing 29% annually without new logos.

Hitting 120%+ NDR after $100M ARR puts you in elite company. Optimise for expansion before chasing new leads.

3. 40%+ growth at $1B ARR is rare

At this scale, most SaaS giants slow to 25–30% growth. Figma’s still compounding at 41%, joining a small club with Snowflake and MongoDB.

Growth this durable usually signals efficiency, not burn. It means they’ve nailed distribution, pricing, and product velocity simultaneously.

4. Mid-market is the next enterprise

Figma’s mid-tier ($10K–$100K ARR) has nearly 11K customers — the “pre-enterprise” layer.

Don’t underestimate mid-market. It’s where long-term expansion hides. Moving 20% of those accounts upmarket can add hundreds of millions in ARR.

5. Profitability while investing = mastery

Figma is still spending heavily on AI and product R&D, yet maintaining 24% free cash flow margins and a Rule of 40 score of 46.

The real game isn’t just hitting profitability — it’s balancing reinvestment and cash efficiency without losing speed.

Figma didn’t scale by chasing hype — it scaled by compounding quality, expansion, and retention.

In 2025, when many SaaS companies are struggling to grow and stay efficient, Figma is proving the best products can still do both.

If you’re building in SaaS:

Start tracking enterprise cohorts early.

Build for expansion, not replacement.

And keep your growth efficient enough to outlast hype cycles.

EXPLORE MORE

💡 Reports, Articles and a few interesting stuffs

Data-driven prototyping for elite results.

Jeff Bezos’ decision-making framework every founder should know (from 2015 shareholder letter).

How to gett cited in AI answers.

IPOs and (some) VC liquidity finally arrived in Q3

The number one fundraising mistake founders make.

The math of hypergrowth: two paths to the same goal.

Amanda Zhu on how she got to $2M in founder-led sales.

B2B marketing in 2026: Distribution is the Monopoly.

Sam Altman on Sora, Energy and Building an AI Empire.

Goldilocks and the 3 Secondaries.

NEWS RECAP

🗞️ This week in startups & VC

New In VC

Sugar Free Capital, a NYC-based venture capital firm, has launched with its $32m inaugural fund. (Link)

TCG Crossover, a Palo Alto, CA-, and San Francisco, CA- and NYC-based healthcare investment firm, closed its third fund, TCGX Fund III, with $1.3 Billion in capital commitments. (Link)

Wave Function Ventures, a Los Angeles, CA-based early stage venture capital firm, closes its $15M Fund I. (Link)

New Startup Deals

HiOctave, a San Francisco, CA-based AI software company helping small and mid‑sized businesses (SMBs) automate and personalize customer experiences, announced its launch and $15M in funding. (Link)

Reo.Dev, a San Francisco, Calif. — based intent platform built specifically for developer-first software companies, raised $4m in seed funding. (Link)

Energy Robotics, a Darmstadt, Germany-based company providing an AI software platform for autonomous inspection with robots and drones, raised $13.5M in Series A funding. (Link)

Attuned Intelligence, an Orlando, FL-based healthcare AI company, raised $13M in Seed funding. (Link)

Bee Maps, a San Francisco, CA-based company providing map data, raised $32M in funding. (Link)

MediView XR, a Cleveland, OH-based company which specializes in augmented reality (AR) surgical navigation, guidance, and image fusion, raised $24M in Series A funding. (Link)

TODAY’S JOB OPPORTUNITIES

💼 Venture capital & startup jobs

All-In-One VC Interview Preparation Guide: With a leading investor group, we have created an all-in-one VC interview preparation guide for aspiring VCs. Don’t miss this. (Access Here)

Operations / Program Analyst - Entrepreneur First | India - Apply Here

VP of Fundraising - Scale Asia Venture | Japan - Apply Here

Research Analyst - Positive Sum | USA - Apply Here

Fund Operations Associate - TNB Aura | Singapore - Apply Here

Analyst - Nightdragon | USA - Apply Here

Investment Analyst - Lunicorn Venture | USA - Apply Here

Valuation & Investment Data Analyst - Techstar | USA - Apply Here

Investment Analyst - Rocket Capital | India - Apply Here

VC Intern - NAVER U HUB | USA - Apply Here

Investor - AI Tools - Samsung next | USA - Apply Here

Associate - Venture Capital - Artha Venture Fund | India - Apply Here

Executive Assistant - AN Venture Partner | USA - Apply Here

Investor Relations Manager - Beco Capital | UK - Apply Here

Senior Associate - Strike Capital | USA - Apply Here

Investment Associate - Beco Capital | UAE - Apply Here

Head of Platform - Pledge Venture | UK - Apply Here

Trade Operations Lead - Manhattan Venture Partner | USA - Apply Here

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator