How To Raise Money? - Advice From a Founder Who Raised $1 Billion For His Startup | VC Jobs

Antler's Cheatsheet to Raise First Round & Sequoia Capital's PMF Tests.....

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: How To Raise Money? Advice From a Founder Who Raised $1 Billion For Startups.

Quick Dive:

Antler’s Cheatsheet: How much can founders realistically raise in their first round?

Mercury Founder Immad Akhund's Framework: How to Avoid a Startup Death Spiral

Sequoia Capital: Two simple methods to find whether startups have achieved Product-Market Fit (PMF).

Venture Curator Hub: Get Access To 10000+ investors' email contact database & more.

Major News: X faces controversy over using user data for training its AI, Stripe Acquired Its Competitor Lemon Squeezy, OpenAI Launches SearchGPT To Rival Google, Perplexity & Musk To Discuss $5 Billion xAI Investment with Tesla Board

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

ANNOUNCEMENT

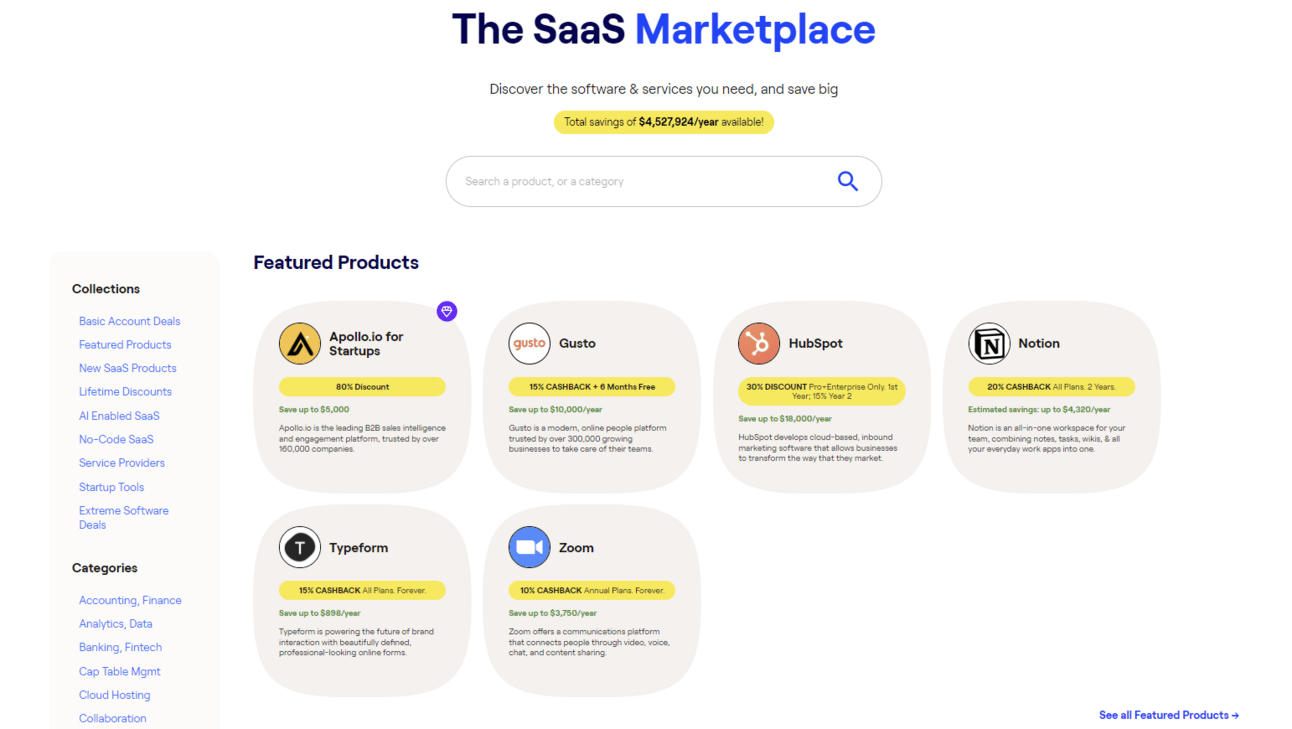

We’re Launching Discount SaaS Marketplace - Discover The Software You Need & Save Big…

Ever feel like you're on a wild goose chase looking for good deals on SaaS tools? Trust me, we've been there. It's a real pain trying to find discounts on stuff like Notion, AWS, HubSpot, Zoom, Dropbox, and all those other must-haves.

Well, guess what? We got fed up and decided to fix this problem ourselves.

Say hello to our Discount SaaS Marketplace!

We've teamed up with over 1000 SaaS startups to hook you up with some sweet deals on all the software you need. No more endless searching or settling for full price.

Here's the deal:

We've got tons of great SaaS tools in one place

Exclusive discounts that'll make your wallet happy

Check us out and start cutting costs today →

PARTNERSHIP WITH US

Want to get your brand in front of 50,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

How To Raise Money? Advice From a Founder Who Raised $1 Billion For Startups

The probability of success for a high-growth company is predicated on your ability to raise capital. As a leader, you will never achieve your maximum entrepreneurial potential without being able to raise capital quickly and successfully.

Capital is the lifeblood of any high-growth company. It has to be treated as a key priority. It can never be outsourced or downgraded to a second priority.

Brett Adcock, the founder and CEO of Figure AI, secured $70 million in its Series A funding round in 2023. Also his previous ventures, Adcock has successfully raised significant capital: Vettery was acquired for $110 million, Archer Aviation went public with a valuation of $2.7 billion and raised over $1 billion. He shared the framework for founders to raise capital. So read along -

“Remember - Investors are looking for certain traits. Without these, you have little chance of raising a single dollar. Let's talk about how you can use the formula to build a repeatable process for raising capital.

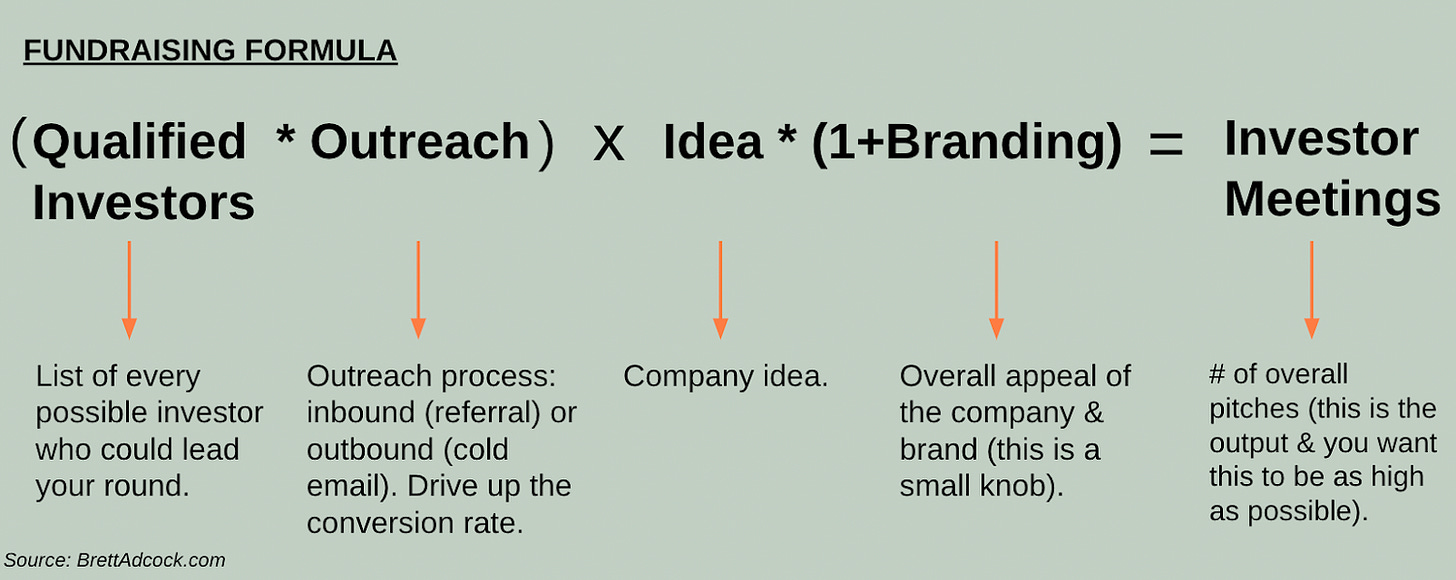

Fundraising Formula:

Image Source: Brett Adcock

You need to maximize the amount of shots on goal in fundraising. Aim to get as many meeting attempts with investors as possible. The above formula for capital raising is a combination of -

the number of qualified investors you are targeting combined with

the company idea & overall branding.

The first step in the fundraising process is defining success. The ultimate goal is to raise capital successfully. If you work backwards from there, getting to a lead investor "term sheet" is the next clear milestone. And if you work backwards once more, the goal is to maximize the number of unique investor meetings.

The Fundraising Formula is a way to compute how to maximize the number of qualified investor meetings. Fundraising is about talking to 200 investors and finding the 1 person who will take a bet on you. I've always experienced really low conversion rates in these efforts - it's never been easy for me to raise capital. And that's quite normal.

Here is the sensitivity to each part of the formula:

Qualified investors: You want to drive this number as high as possible. I speak to so many founders who are "waiting for referrals". This inevitably means this number is too low. You want to identify every possible investor on the planet or else your equation will point to low odds of success.

Outreach: This is your reach-out process to investors. I gauge this as a percentage conversion rate. This will be really sensitive to the way you are reaching out (referral vs. cold email) and the messaging associated with the reach-out process (e.g. subject and body of a cold email). There is an art to this. The per cent conversion rate can greatly increase if you treat it as a recursive project to get better.

Idea: This is the company idea ⸺ and it's fixed. There is very little you can do besides pivot your company to a new idea. The idea will instantly either A) resonate or B) turn off investors based on their industry focus or their internal thesis of the market/industry.

Branding: This is how well-branded or attractive your company is at first glance. You have limited time to impress an investor enough for them to commit to a meeting. There are many ways to drive this up, including a nice investor deck. But ultimately that's a small lever so don't stress too much over this.

Investor Meetings: This is the output of all your hard work. The goal is to drive up the number of qualified investor meetings as high as possible. You want to do 50-200 of these meetings. The more qualified investor meetings, the higher your odds of raising capital.

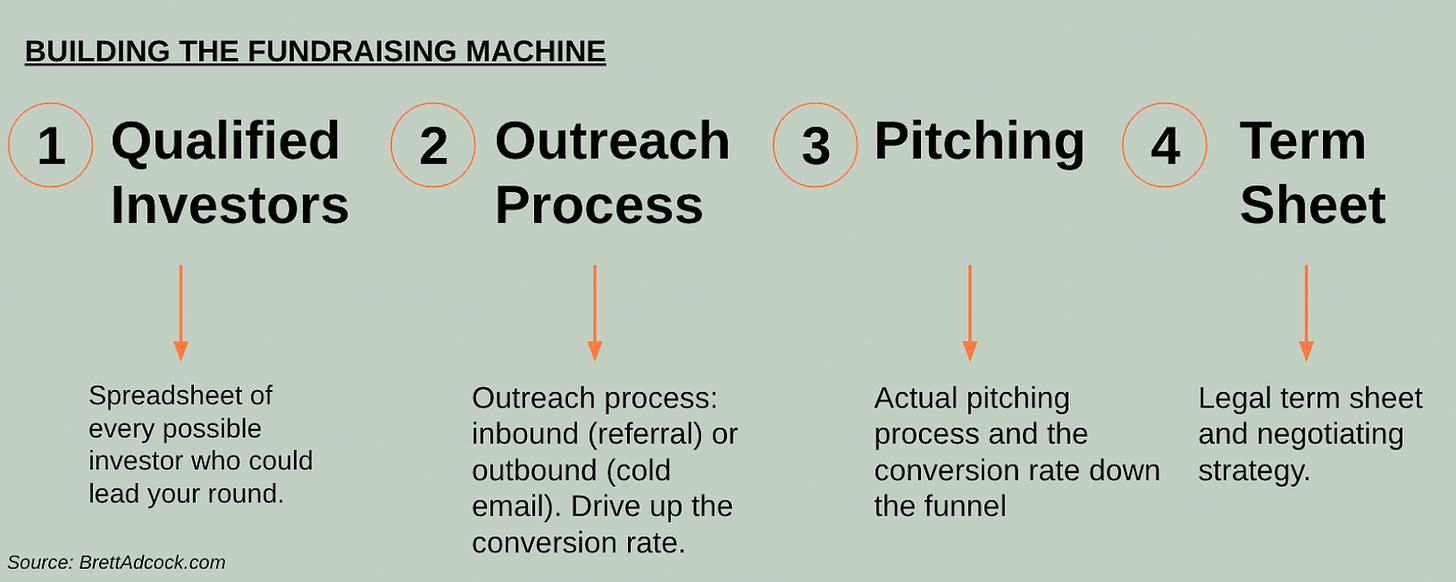

Building the Fundraising Machine:

Image Source: Brett Adcock

I believe in building and executing on a highly structured "machine" for fundraising processes. This machine is something you can wash, rinse, and repeat. This should be similar to how you would run a sales or marketing team.

I track this process in a Google sheet, similar to how you track items in a CRM. Let's break down the key elements of the formula so you can go out and execute it yourself.

Key Elements of a Fundraising Machine:

Qualified List of Investors: This is a list of investors who are tailored specifically to your company. Start with investment groups that match well with your company sector. Research to find an investment partner who covers your specific industry and maturity. Ideally, you have found 100% of every investor on the planet that you think could give you a term sheet.

Outreach Process: Reach out to investors with the goal of setting up a meeting. Try to get as many referrals as possible, then move to outbound for the rest.

Pitching: Your first interaction with the investor that includes them previewing the deck. Optimize the conversion rate from the first meeting to the term sheet.

Term Sheet: Receiving a term sheet is the ultimate goal for the first leg of capital raising. Negotiate quickly and fairly to get the lead investor signed up.

The entire process from start to finish will take at least 3 months. Spend 30 days preparing the investor deck, and data room, mapping out investors, and your cold email template. The next 30-60 days are for investor outreach and meetings. Once you have a term sheet, it generally takes <10 days to negotiate and sign, and you usually close in 30 days.

Additional Capital Raising Insights:

Show metrics and customers that can potentially correlate to long-term success for early investors to understand your product's potential.

Understand VC mandates and match them to your industry to avoid spinning your wheels.

Showcase your "Championship Team" - there's no way you're building a great product without a #1 team.

Aim for 80% of investor pitches to come from outbound processes (cold calls or emails) and 20% from inbound processes (referrals).

Build a well-branded investor deck as it's often the first impression investors have.

Recognize that interested investors move quickly. If they're not hurrying, it's likely a sign you don't have a deal.

Focus on finding a "lead" investor who can give you a term sheet and lead your round.

Balance fundraising time with product development, as fundraising can be distracting for founders.

Remember, fundraising is a competitive process. Once the round is complete, put your attention back to the product and get building. I suggest setting up a quarterly "nurture" sequence to keep investors updated.”

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

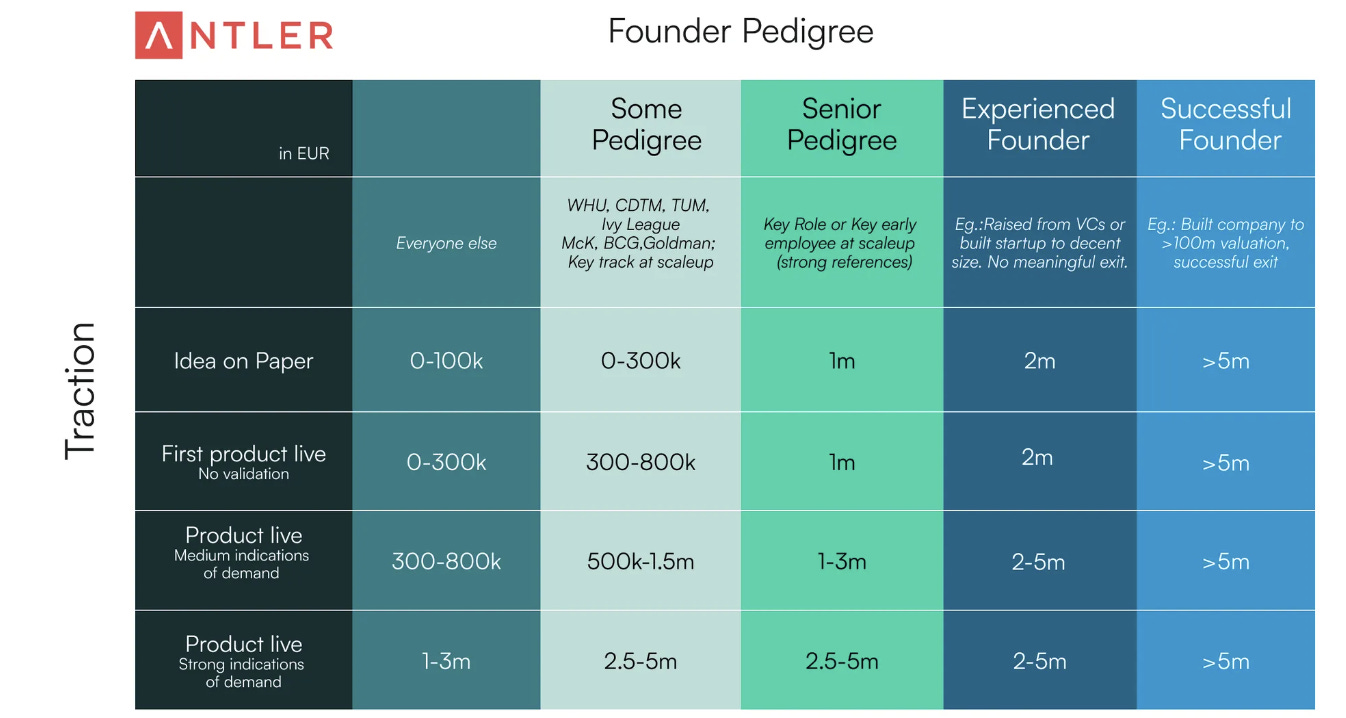

1. Antler’s Cheatsheet: How much can founders realistically raise in their first round?

Antler has shared a cheat sheet to help founders assess their ability to raise capital in the initial funding round -

When it comes to fundraising, two factors can make all the difference: founder pedigree and traction.

Image Source: Antler

Founder Pedigree: The less traction you have, the more your background matters. Investors look at your past to assess whether you can deliver in the future. It's about limiting execution risk.

This isn't necessarily rational. Great founders get overlooked because they don't fit the typical pattern. But with thousands of similar opportunities, it's a real filter for investors.

Traction: Traction beats pedigree. When you present more than just an idea on paper and your product has gained some traction, your ability to raise increases. Lower-profile founders can raise funds when their idea becomes more than just an idea.

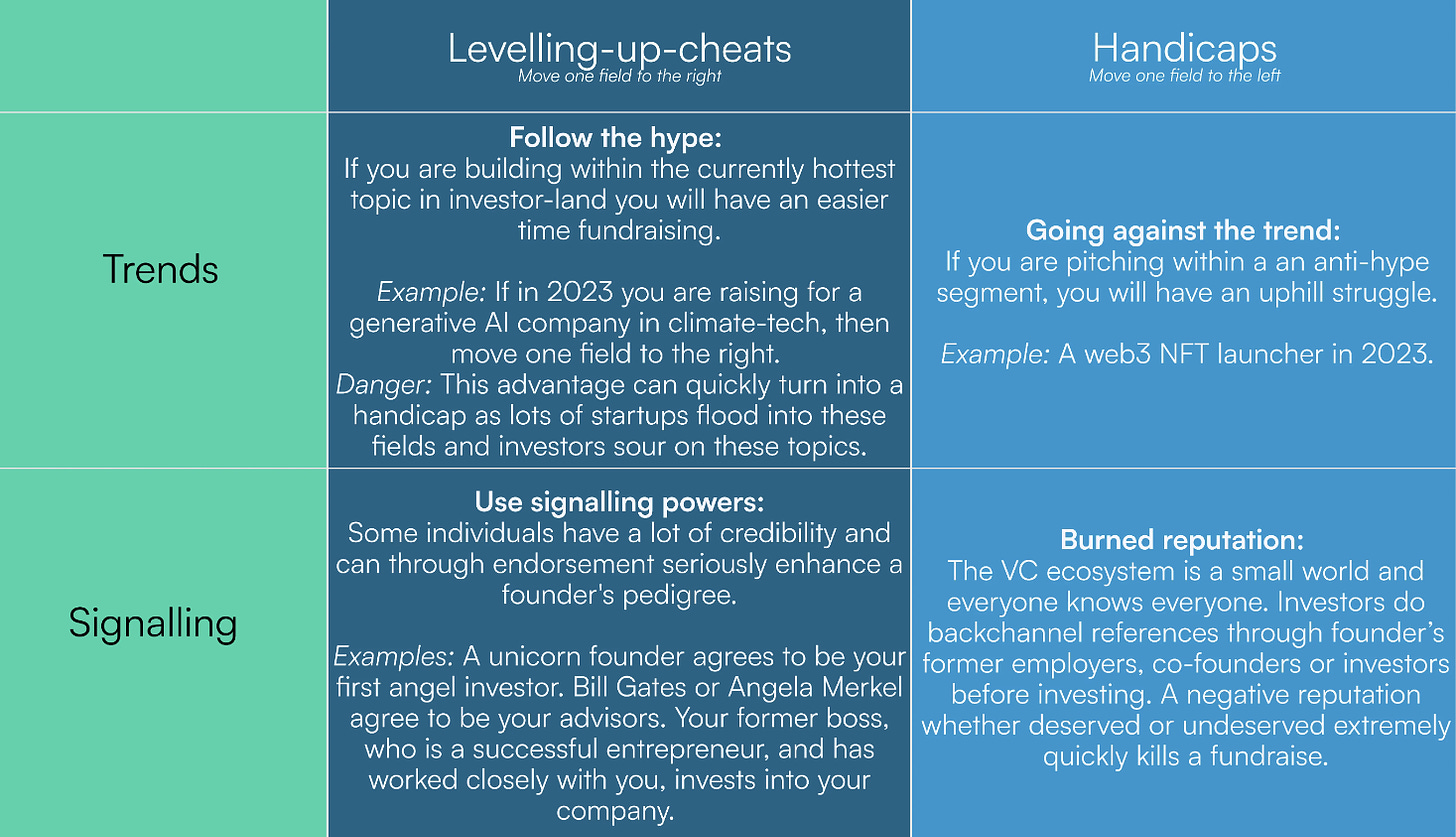

Some factors can change the game -

Image Source: Antler

"Levelling up cheats" moves you to one field to the right in the fundraising matrix, potentially increasing your chances. These might include factors like having a strong co-founder, industry expertise, or unique insights.

"Handicaps" move you to one field left, possibly making fundraising more challenging. These could be factors like a lack of relevant experience or a difficult-to-explain product.

There are two must-haves without which you won't be able to raise, regardless of pedigree or traction:

Fundraising-ability: You need reasonable fundraising skills. Networking, sales skills, storytelling, and running a tight process are crucial.

Market attractiveness: Your market must be significant and attractive. In the early stages, it's binary - either investors get excited about the opportunity, or they don't.

Remember

Valuations are a function of capital raised. Assume 15-25% dilution irrespective of the amount raised. For example, if a team raises 800k, the valuation will likely be between 3.2m - 5.3m.

LinkedIn profile beats pitch deck in very early stages. Many investors will check your LinkedIn before deciding on a first meeting or looking at your pitch deck.

When is this wrong?

Numbers are purely directional. They've been validated with experienced investors, but they're not exact.

This model is primarily for software startups. Biotech & Hardware companies play by different rules.

Copycat models are very binary. Experienced teams can attract large funding, while others struggle to raise anything.

Raising from a rich uncle or family/friends who aren't experienced venture investors follows different rules.

Remember, great founders come from all backgrounds. If you don't fit the "classic" profile, you might need to prove more in the beginning, but there are countless examples of founders without traditional backgrounds building awesome companies.

2. Mercury Founder Immad Akhund's Framework: How to Avoid a Startup Death Spiral

In recent years, many companies have faced challenges such as failing to secure investor funding, leading to bankruptcy, layoffs, and other difficulties. To help prevent these situations, Mercury's founder has shared a framework offering unique insights on how to approach such challenges. He explains:

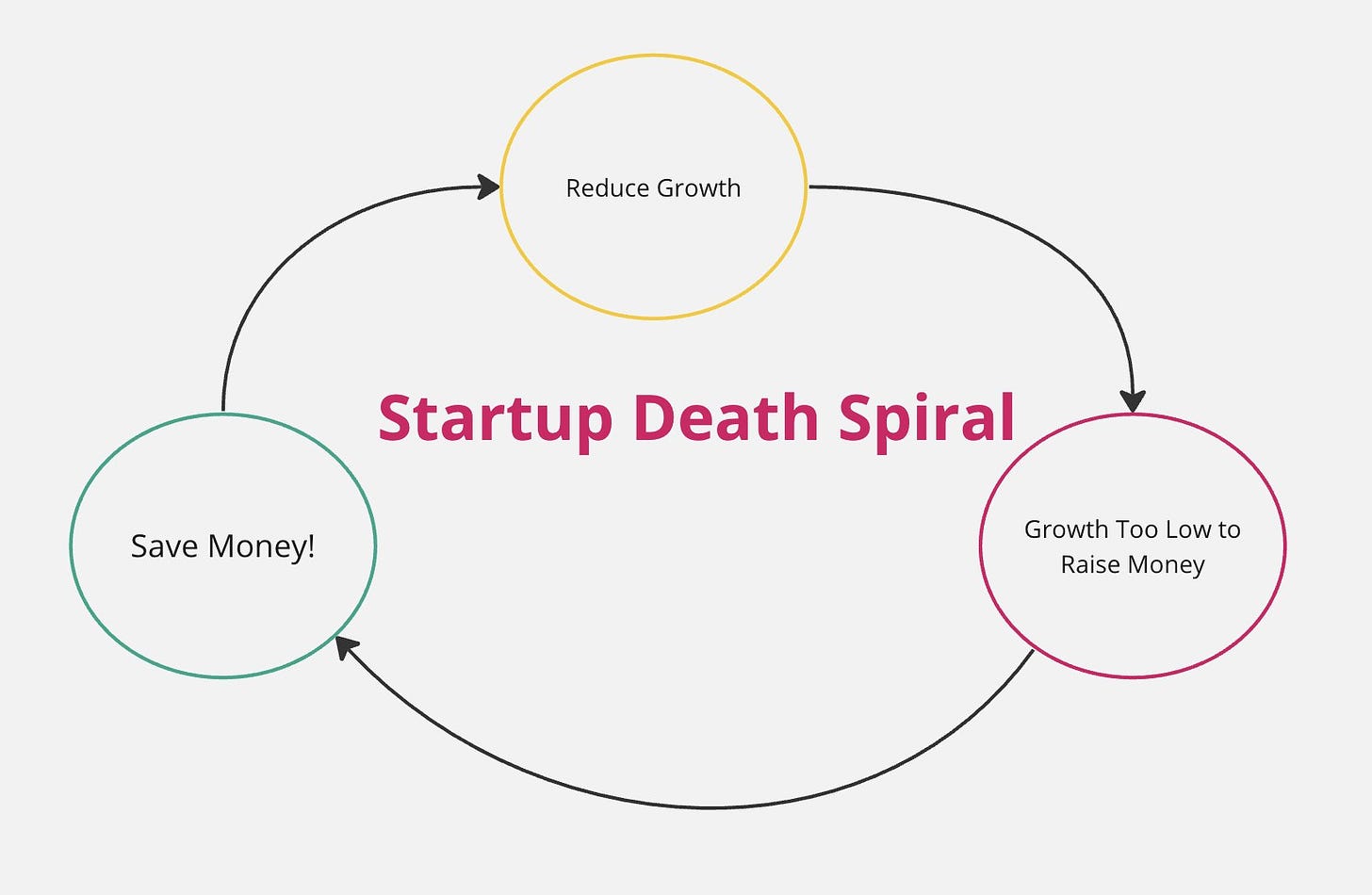

Founders often, fall into this startup death spiral:

Save Money

Leading to Reduced Growth

Leading to Inability to Raise More Money

Back to Step

Source: Immad Akhund Twitter

For most startups, you can save money by reducing spend on advertising or your sales team. When trying to save money this can be an obvious place to cut. This is made worse by the fact that you have to increase your ad spend + sales team to keep growth rates at the same level.

The problem is that when you reduce growth it makes your ability to rise much lower.

For seed-stage companies, you need at least 100% growth and probably more like 200% growth to raise a new round. For later-stage companies, you can get away with less than that but still >50%.

When these companies can't raise new money they go back to trying to save money and hurt their growth further. This can end up being a death spiral that is impossible to escape.

3 points to consider before entering this spiral:

Can you be profitable without raising future money? Reducing growth might be fine in this case

Can you grow in ways that don't require more spending?

Potentially avoid the cuts grow faster and go for broke!

If you are already in this death spiral then you need some sort of hard reset to get out of it. Either a pivot or finding a strong organic (non-paid) growth channel is the solution. No easy answers for this set of companies, unfortunately.

3. Two simple methods to find whether startups have achieved Product-Market Fit (PMF).

Rajan Anandan, Managing Director at Sequoia Capital, shared two simple methods that can help founders find whether they have achieved Product-Market Fit (PMF)

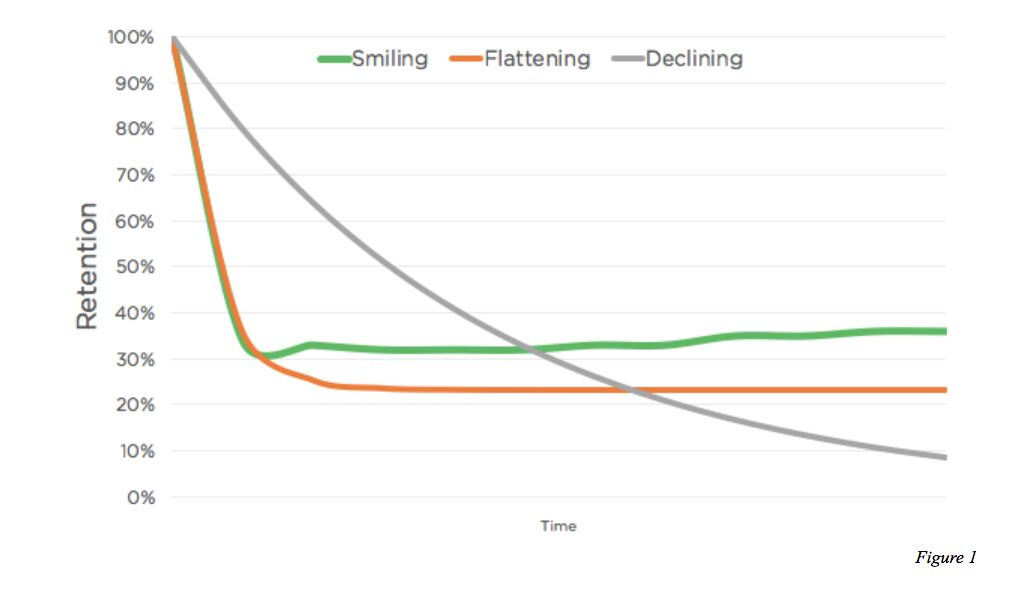

The First is the "Retention Curve" -

"The retention curve is what percentage of your users keep coming back over some time while using your product/service."

Essentially, there are 3 kinds of retention curves, and you should plot this curve by day, week, or month, once you launch your product.

1. Declining Curve (dark grey line), let's say you’ve launched a consumer internet app on day 0, and every week your retention rate declines by 10%, which essentially means that by the end of 3rd month, all your initial users would have churned, then that's a declining curve, which indicates that you don’t have a product-market fit.

2. The Flattening Curve (orange line) is good, although it kind of varies depending upon the category (Health-Tech, EdTech, etc.,) but generically speaking if the retention curve flattens between 20%-40% that could be quite good.

3. Finally the best one is the Smiling Retention Curve (green line), which means that retention drops but then as time goes on you keep reactivating users, which indicates that you're getting close to your product-market fit.

Another question that the founder should think about is -

Do Customers Love Product? Net Promoter Score (NPS) is a metric that organizations use to measure customer loyalty toward their brand, product or service.

NPS works by asking your customers a single question: "How likely are you to recommend our products/services to others?"

NPS = % Promoters (score 9-10) - % Detractors (score 0-6)

If the magic score is = 70% or more, then you have an amazing product-market fit. But if the number declines to 40% or below, then you don’t have it. It's that simple!

Join 30000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

X, formerly Twitter, quietly defaulted user data into its AI training pool for Grok, its conversational AI developed. (More Here)

Stripe has acquired four-year-old competitor Lemon Squeezy, a company that calculates and pays global sales tax for digital products and primarily serves SaaS. (More Here)

Musk To Discuss $5 Billion xAI Investment with Tesla Board. (More Here)

OpenAI unveiled Google’s Competitor SearchGPT, a new search feature designed to provide timely answers from web sources. (More Here)

The Justice Department accused TikTok of collecting data on U.S. users' views and sharing information with ByteDance employees in China. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 20,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

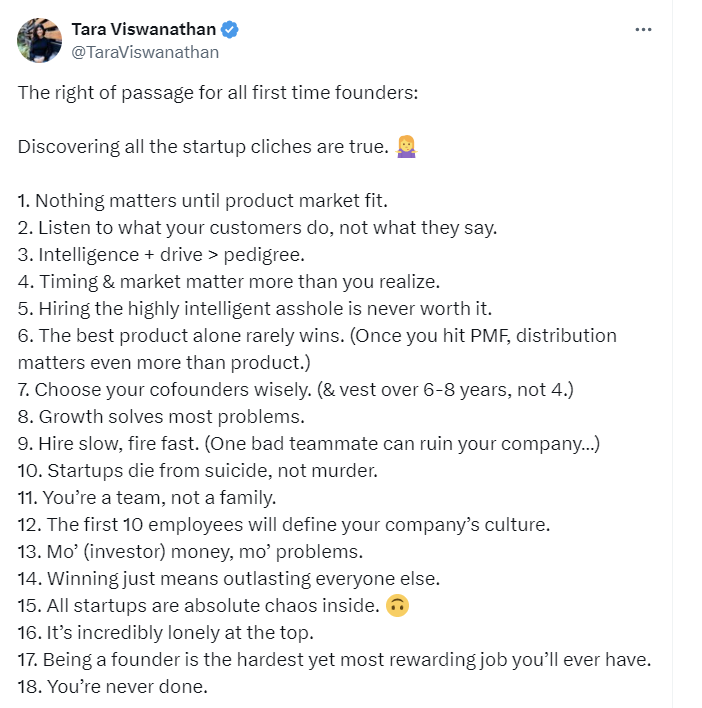

TWEET OF THIS WEEK

Best Tweet I Saw This Week

By Tara Viswanathan ( Founder & CEO Rupa Health)

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 50,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Scouting Manager - Antler | Australia - Apply Here

Venture Analyst - edge case capital partner | USA - Apply Here

Founder Scout (Internship) - Antler | Sweden - Apply Here

Senior Vice President - City Venture | USA - Apply Here

Senior Vice President - City Venture | UK - Apply Here

Investment Principal - Munich Re Venture | USA - Apply Here

Accounts Payable Analyst - Y Combinator | USA - Apply Here

Analyst - Qi Venture | India - Apply Here

Associate - SCB 10X - Apply Here

DevRel - GrayScale Venture | India - Apply Here

Events Lead - Upfront Venture | USA - Apply Here

Marketing & Community Manager - Agfunder | Singapore - Apply Here

Analyst, ClimateTech Venture Creation - Diagram | Canada - Apply Here

Principal - Blackhill fund | India - Apply Here

Portfolio Manager - Scientifica | Italy - Apply Here

🧐 Enterprise Sales Execs Have a Better Chance of Breaking Into Venture Than Finance Execs!

A good framework to understand venture, at least the upper tier of the venture world of repeat founders or experienced operators, or sell-side venture as I termed it above, is to see it as a market where the VC is a purveyor of their brand of capital.

In the case of venture capital firms, all members of the investment team are purveyors of the firm's unique brand of capital. This typically consists of:

$X-Y million (the firm's standard investment amount)

Investment team's (Partner or Investment Lead's) time and expertise

Platform services (recruiting, fundraising support, etc.)

Effectively, VC firms are selling this bundle to founders, with equity in the founders' company being the only currency they accept.

Now, each VC firm's brand of capital is distinct from others, even if the investment amount is the same. This distinction comes from:

We have shared a detailed guide and curated resources in our “Break Into VC” newsletter.

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

That’s It For Today! Happy Tuesday. Will meet You on Thursday!

✍️Written By Sahil R | Venture Crew Team