How to Prove to Investors That This Is the Right Time and You're the Right Company? | VC & Startup Jobs

A Sample VC Memo To Grade Your Startup & Right Way To Ask VCs for Money.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: How to Prove to Investors That This Is the Right Time and You're the Right Company?

Quick Dive:

How Investors Will Grade Your Startup: A Sample VC Memo.

How to Ask VCs for Money? - A Framework From VC Partner.

If you've got less than a year's cash left, you need to read this now

Major News: Apple kills AR glasses project, SoftBank and OpenAI to launch AI joint venture in Japan, Meta considers moving incorporation from Delaware & More.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

How Much Funding Should a Startup Raise? - Marc Andreessen’s Framework. (Read)

Ready-to-go financial modelling template to build your startup financial model that every investor wants to see. (Read)

The Slide Every Investor Wants to See... (Read)

8 unique paths founders take to reach Product-Market Fit. (Read)

Fundraising Simplified: What to Show Investors at Each Stage. (Read)

Big changes in AI to watch for over the next 12 months (Read)

Mistakes this second-time founder isn’t making (Read)

A bad habit of early-stage startups (Read)

The real application AI will have with social apps (Read)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources (Read)

The best handbook on how to scale with cold email (Read)

The harsh realities of being a founder (Read)

The truth about great business partners (Read)

THE MOST EMERGING STARTUP YOU CAN'T-MISS

The VA Agency That's Disrupting the Industry - A Team Overseas

Ever had one of those moments when you're explaining the same task to your VA for the fifth time and think 'There has to be a better way!'? (Trust me, I've been there! )

Meet A Team Overseas - they're flipping the virtual assistance game on its head. While those fancy agencies charge $3K/month but pay EAs only $700, these folks said 'enough!' They're snagging top EAs, paying them $1,400 (finally, fair pay!), and charging clients just $2.5K.

But here's what made me jump out of my chair - these aren't just task-takers. My friend Sarah's EA caught a major sales funnel issue and fixed it before Sarah even noticed. No more endless training, just pure magic!

→ Ready for an EA who gets it? Book a call here with A Team Overseas.

PARTNERSHIP WITH US

Get your product in front of over 85,000+ Tech Enthusiasts - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

How to Prove to Investors That This Is the Right Time and You're the Right Company?

When talking to investors, you’re answering the what (product), why (mission), where (if relevant) and how (strategy and go-to-market).

But founders often ignore another important question: Why now?

Why wouldn’t it have been possible to have built the company five years ago?

Why would five years from now be too late?

The answer is often related to something that is shifting and changing, either in the market or with the technology layer. Anchoring your company with a good “Why now?” slide is a great addition to your story.

Successful companies usually have these things in common:

They were the right company, solving the right problem at the right time. Think of all the startups that cropped up during the early years of the pandemic that were solving specific problems related to accessing health care or presenting meetings.

Showing that you know why you’re launching now as opposed to any other time will create a sense of urgency:

Investors won’t want to miss out on a business that’s solving what they see as an immediate problem. It’s your job to highlight the ways your company can address those issues and why now is the right time to do so.

It’s often possible to see some significant market trends converging, but when it comes to timing, you’re trying to read the future.

In the words of Wayne Gretzky (Ice hockey player), you want to be skating to where the puck will be, not where the puck is.

The “Why now?” question can be answered in several ways, but it usually boils down to at least one of these three things:

technology timing,

market timing or

regulatory timing.

Think about consumer-grade photography drones. Why did they arrive on the scene when they did?

After all, RC planes and helicopters have been around since the 1970s. Compact video cameras (such as GoPros) have been around since the early 2000s. It’s not that the tech didn’t exist; it’s that the technology required was prohibitively expensive for a consumer-grade piece of equipment.

Apple’s iPhone changed that, though. As smartphones became ubiquitous, small camera modules, solid-state accelerometers, radio and GPS chipsets all became dirt cheap, available to hobbyists, and both well documented and hackable. Once the tech got small and cheap enough, building camera-equipped drones was a logical next step.

The most successful startups of our era did three things:

They spotted a trend early and developed a solution to take advantage of that. Google, Facebook and Apple are all good examples here: They weren’t the first search engine, social network or smartphone/computer manufacturers, but they saw an opportunity to make the tech more user-friendly.

They were able to build solutions that were better than anything else out there.

Then they ended up defining the industries they entered, riding the wave to the top.

You can use your timing narrative to reiterate some of the biggest strengths of your startup.

You should explain the macro dynamics of your space, how the market is evolving and how new technological innovations make your company possible when it wouldn’t have been before.

Remind the investors how changes in regulatory frameworks are opening new opportunities. That includes demographic shifts (the population as a whole is ageing); technology shifts (self-driving cars, solar power, electric vehicles, 5G mobile phone networks); market shifts (homeownership numbers, market boom/bust times); significant changes in how work is done (the gig economy, working from home, remote-first companies).

Many of these trends are somewhat predictable, and the best startup founders know how to spot them and leverage them to their advantage.

It’s an opportunity to remind investors how your team has been in this industry for a long time.

Something like, “I saw all of these shifts happen when I was a VP of investment banking at Goldman Sachs for 15 years,” is a great way to remind the investors that you have both experience and in-depth domain knowledge.

The “Why now?” is partially about history, but remember that it’s not a history lesson; it’s about trends.

You can use past data and innovation to draw a trend line toward the future. Combine that with what your company is doing and where it is going. The perfect “why now” slide has a fast-moving puck and a startup moving at breakneck speed to intercept it where it’s going to be in five years.

This is the sort of thing that makes investors salivate; the world’s most significant opportunities are high-risk, high-reward movements. Think big and weave a story of how you are on the right vector to be in the right place at the right time.

🤝 FROM OUR PARTNER

DECKO—Investor-Ready Pitch Decks, Built by VCs

VCs spend just 3 minutes & 44 seconds reviewing a pitch deck. Make every second count.

At DECKO, we craft investor-ready pitch decks from scratch, combining VC-backed content with expert design to help you stand out and raise with confidence.

Why Founders Choose DECKO:

✅ Built by VCs—We craft decks investors want to see

✅ No templates, ever—Every deck is fully customized

✅ Trusted by 300+ startups & VC funds

✅ Startups we’ve worked with have raised $1B+

→ Get 10% off—Just mention The Venture Crew or visit here.

📃 QUICK DIVES

1. How Investors Will Grade Your Startup: A Sample VC Memo.

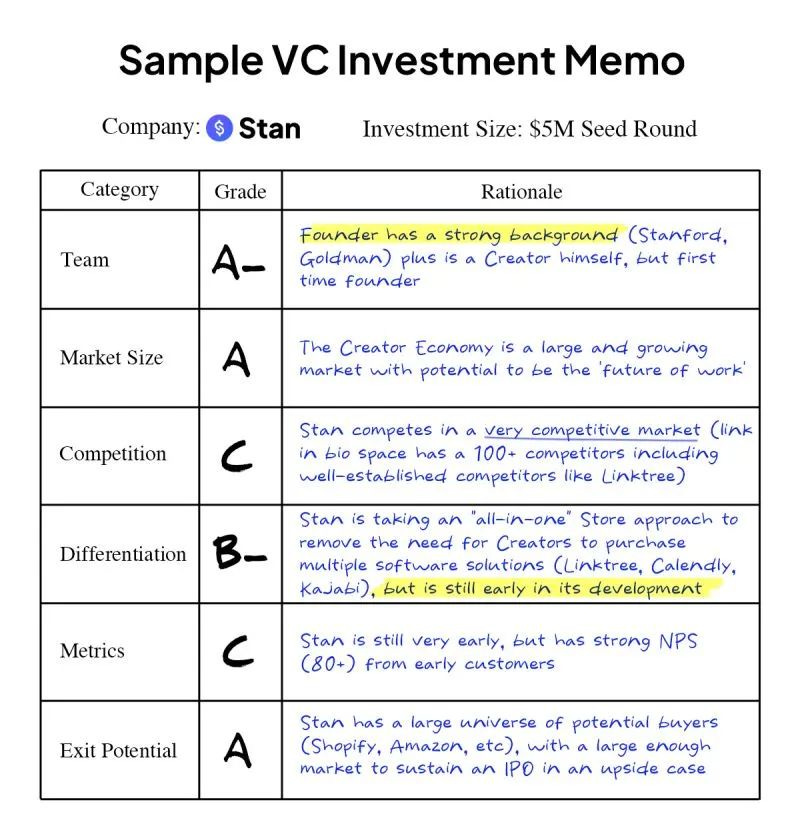

Many founders wonder: How do VCs decide which startups to fund? John Hu, who’s worked at top VC firms like Goldman Sachs and Norwest Venture Partners, shared the exact framework investors use to evaluate startups. He even applied it to his own startup—here’s how each column was rated:

Team: What is the quality of your team? How strong is your “Founder-Market’Fit? Why is your team the best team to solve this problem?

Market Size: How large is this market? Does it have BN$+ potential

Competition: How competitive is this market?

Differentiation: How will you beat the competition? What’s your competitive angle?

Metrics: How strong are your metrics? How strong of a growth indication do they give?

Exit Potential: How many potential buyers are there of your company?

These are great points that founders can consider to grading their startup, but there is a simpler way to grade a startup as 'A' or 'C,' as shared by Herwig Springer -

𝗧𝗲𝗮𝗺

A for taking market feedback over theory.

C for having outside commitments at play.𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗶𝘇𝗲

A for evidence to support target market cap.

C for overestimating the accessible market.𝗖𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝗼𝗻

A for having a key competitive advantage.

C for failing to acknowledge key competitors.𝗗𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁𝗶𝗮𝘁𝗶𝗼𝗻

A for building strong moats like proprietary technology.

C for differentiation based on easily replicable factors.𝗠𝗲𝘁𝗿𝗶𝗰𝘀

A for balancing growth and profitability metrics.

C for focusing on vanity metrics like sign-ups.𝗘𝘅𝗶𝘁 𝗣𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹

A for considering options like M&A.

C for hyperfocusing on one path.

Try it for your startup. Make sure it will be A for each column.

2. How to Ask VCs for Money? - A Framework From VC Partner.

When an investor asks you why you need to raise money, the worst thing you can reply with is that it’s to extend your runway.

Investors care about growth and having a clear set of milestones you think you can hit. They see a lot of opportunities, and the most exciting ones are fires that are already growing that they can throw gasoline on top of.

This is similar to how your customer doesn’t care about your product, they care about the benefit or transformation your product provides for them.

Show them an opportunity that’s growing quickly but could grow faster with some help, rather than one that needs more money to survive a little longer in the hopes of striking gold.

3. If you've got less than a year's cash left, you need to read this now

If you're a founder with less than ~12 months of runway going into 2025, you have to re-read Paul Graham’s The Fatal Pinch. Assume you will NOT get a bridge round, and figure out what other options you have ASAP.

Let me share a key point that every founder should consider while considering their burn rate -

“The "fatal pinch" that happens to a lot of startups. It's when they've got some cash in the bank, but they're bleeding money every month and not growing. They think they'll be fine 'cause they'll just raise more money from investors. Big mistake.

The problem is, that founders often kid themselves about how easy it'll be to get more funding. It's way harder the second time around because:

The company's burning through cash faster now

Investors expect a lot more from companies that have already raised money

The startup is starting to look like a failure

This whole situation is like a nasty feedback loop. Founders think they'll easily raise more money, so they don't try hard enough to become profitable, which makes it even harder to raise money.

To avoid this mess, YC tells founders to act like the money they raise is the last they'll ever get. If you're already in the fatal pinch, you've got three options: shut down, make more money, or spend less (which usually means firing people).

If you decide to keep going, you need to focus on making more money ASAP. This might mean changing what you're selling or doing more consulting-type work. Just be careful not to slide too far into pure consulting.

The good news is, that lots of successful startups have had near-death experiences and survived. You just gotta realize you're in trouble before it's too late. If you're in the fatal pinch, you are.”

🗞️ THIS WEEK’S NEWS RECAP

Major News In Tech. VC & Startup Funding

Conviction Partners, a San Francisco-based AI-focused VC firm, raised a $230M second fund and added ex-Sequoia partner Mike Vernal as GP.

OpenAI introduced "Deep Research," an AI agent for intensive knowledge work, offering in-depth research with citations for finance, science, and policy users, initially limited to 100 queries for ChatGPT Pro.

Apple has discontinued its augmented reality glasses project, codenamed N107, which was intended to rival Meta's Ray-Ban smart glasses, following challenges with technology integration and performance.

SoftBank and OpenAI are launching SB OpenAI Japan, a joint venture offering AI services to corporate clients, with SoftBank committing $3 billion annually to integrate OpenAI’s technology.

Meta Platforms is considering changing its incorporation from Delaware to Texas and has engaged in discussions with Texas officials regarding this potential shift.

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

💼 TODAY’S JOB OPPORTUNITIES

Venture Capital & Startup Jobs

Investor - Griffin Gaming Partner | USA - Apply Here

Technical Investing Associate - Capital One Venture | USA - Apply Here

Analyst - YZR Capital | Germany - Apply Here

Senior Analyst/ Associate - Insignia Venture Partner | Singapore - Apply Here

Investor Relation Associate - Venture Garage | India - Apply Here

Legal Intern - Plug and Play tech center | USA - Apply Here

Investment Manager - Outlier Venture | UK - Apply Here

Chief of Staff - Seed Startup | USA - Apply Here

Chief of Staff - Voyager Venture | USA - Apply Here

Analyst - MongoDB Venture | USA - Apply Here

Venture Partner - Dardania Capital | USA - Apply Here

Research Analyst - Venture Catalyst | India - Apply Here

Investment Analyst Interns - White Whales | India - Apply Here

Access Curated Resources For Founders & Investors…

Building Cap Table As A Founder: Template to Download.

Excel Template: Early Stage Startup Financial Model For Fundraising.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

Write Your Monthly Investor Update (Email Template Download).

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

1000+ Euro Tech Angel Investors & VC Firms Database.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator