How To Price Your Product: Mistakes You Can’t Afford To Make. | VC Jobs

VC Investment Strategy : Search For Narrative Violations & Timeline to Acheive Product Market Fit....

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: How To Price Your Product - A Simple Framework.

Quick Dive:

Bedrock’s Investment Strategy: Search For Narrative Violations.

Circle’s Founder, Sid Yadav’s Views on Startup Valuation.

How long does it take to achieve Product/Market Fit?

Venture Curator Hub: Access To startup financial modelling Excel sheet, 10000+ verified investors' email contact database & more.

Major News: OpenAI to Open Offices in Singapore, Paris, US Government considers Breakup of Google, Google ordered to open Android to rival app stores & AI pioneers win Nobel Prize in Physics…

Best Tweet Of This Week On Startups, VC & AI.

15+ VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER NOTION

Notion for Startups: 6 Months Free Plus Plan Offer

Thousands of startups use Notion as a connected workspace to create and share docs, take notes, manage projects, and organize knowledge—all in one place.

We’re offering 6 months of new Plus plans, including unlimited Notion AI so you can try it all for free!

Redemption Instructions

To redeem the Notion for Startups offer:

1. Submit an application using our custom link and select The Venture Crew on the partner list.

2. Include our partner key, STARTUP4110P28663.

PARTNERSHIP WITH US

Want to get your brand in front of 62,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form or reply to this email as “Advertise” and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

What 7 Years in VC Taught Me: 93 Untold Truths. (Read)

How I promote my startup if I had 0$ for marketing? (Read)

The deck Wischoff fund was used to raise our $50M Fund III. (Read)

The share of exits in which VCs lost money is at 70%, its highest since 2009. (Read)

An active early-stage fund looking to invest in startups. (Read)

Paul Graham's Framework to Get Startup Ideas. (Read)

AI Agents: A New Architecture for Enterprise Automation. (Read)

Value Monetization in the Age of AI. (Read)

How the young VC quietly built Thrive Capital into the powerhouse leading a $5 Billion OpenAI round. (Read)

Raising a seed round 101 By Lenny. (Read)

TODAY’S DEEP DIVE

How To Price Your Product.

As a startup, one of the biggest challenges will be the pricing of your initial product. You’ll fluctuate between a concern that if you price it too highly the product won’t stick, but if you price it too low, it will be impossible to build a sustainable business around it.

It may be tempting to look for equations and projections to find the best price. But the big secret here is that pricing isn’t a math problem: it’s a judgment problem. All businesses have prices, but most overlook pricing strategy. 85% of businesses report that they do not use thought-through pricing strategies. What’s the alternative? Guessing, I guess!

Many founders forget that - “price is your strongest signal to buyers about the quality of your offering.” It is not the other way around, where your quality offering justifies a high price.

That makes pricing a marketing positioning tool as well, and the long-term health of successful startups comes from understanding the critical role of pricing in your go-to-market and brand strategy.

What is product pricing and why is it important?

Product pricing is how companies decide what to charge for their goods or services. It's a big deal because it affects both how much money a business can make and how customers see the brand.

When a company sets its prices, it's not just picking random numbers.

It's actually sending a message about what kind of product it's selling.

High prices often mean "luxury" or "high-quality," while lower prices might say "affordable" or "good value."

To figure out the right price, businesses usually think about three main things:

What customers get out of it - Is the product saving them time? Solving a problem? Making them feel good?

What other similar products cost - Are we pricier than our competitors? Cheaper? About the same?

What the company stands for - Does the price fit with the company's image and goals?

The tricky part is that pricing isn't just about math. It's also about how people think and feel. A $999 price tag feels very different from $1000, even though it's only a dollar less.

In the end, how you price your product tells customers what you think it's worth.

The Pricing Power Of Economic Value Analysis

When it comes to pricing, especially for unique SaaS products, looking at the economic value you're creating for customers can be super helpful. It's all about figuring out how much money you're actually saving them.

Here's how it works: You add up all the ways your product helps your customer save or make money. This includes stuff like:

Direct cost savings

Time saved by employees (think about their salaries)

Money saved on other tools or systems

Reduced risks

Once you've got that total, you decide what's a fair chunk for you to take. Usually, this ends up being somewhere between 10% and 20% of the total value. It's weird how consistent this range is, but it seems to work for a lot of businesses.

Let's say your software helps three employees do their jobs 50% faster. If they each make about $100,000 a year, you're saving the company around $150,000 in total (half of 3 x $100,000). So you could justify charging about $30,000 a year for your product.

The cool thing about this approach is that it gives you a solid starting point for your pricing. Plus, it gives you a great story to tell your customers about why your product is worth what you're charging. Especially when you're selling to other businesses, being able to say "Look, we typically save our customers about $150,000 a year" can be really powerful.

Just remember, this is a starting point. You'll still need to think about other factors like what competitors are charging and what your target market is willing to pay. However economic value analysis can be a great tool to have in your pricing toolkit.

Other Common Pricing Strategies

Let's talk about some other ways businesses figure out their prices. While value-based pricing is great, it's not the only game in town. Different industries often mix and match pricing strategies to fit their customers and markets.

One simple method is cost-plus pricing. It's pretty straightforward - you figure out how much it costs to make your product, then add a set percentage on top. Like if it costs $1 to make a cup of coffee, you might sell it for $1.20. It's easy to understand, which is why a lot of businesses use it. But it doesn't consider how customers see your product compared to others, which can be a big downside.

Another common approach is competitor-based pricing. This is where you look at what similar businesses are charging and set your prices accordingly. If the coffee shop down the street sells their brew for $2, you might decide to charge $1.90 to undercut them a bit. It's important to stay in line with what people expect to pay, especially in competitive markets. But this method has its problems too. For one, if you're in a new industry, there might not be any competitors to compare yourself to. Plus, bigger companies can often produce things cheaper than startups, so trying to match their prices might mean you're losing money.

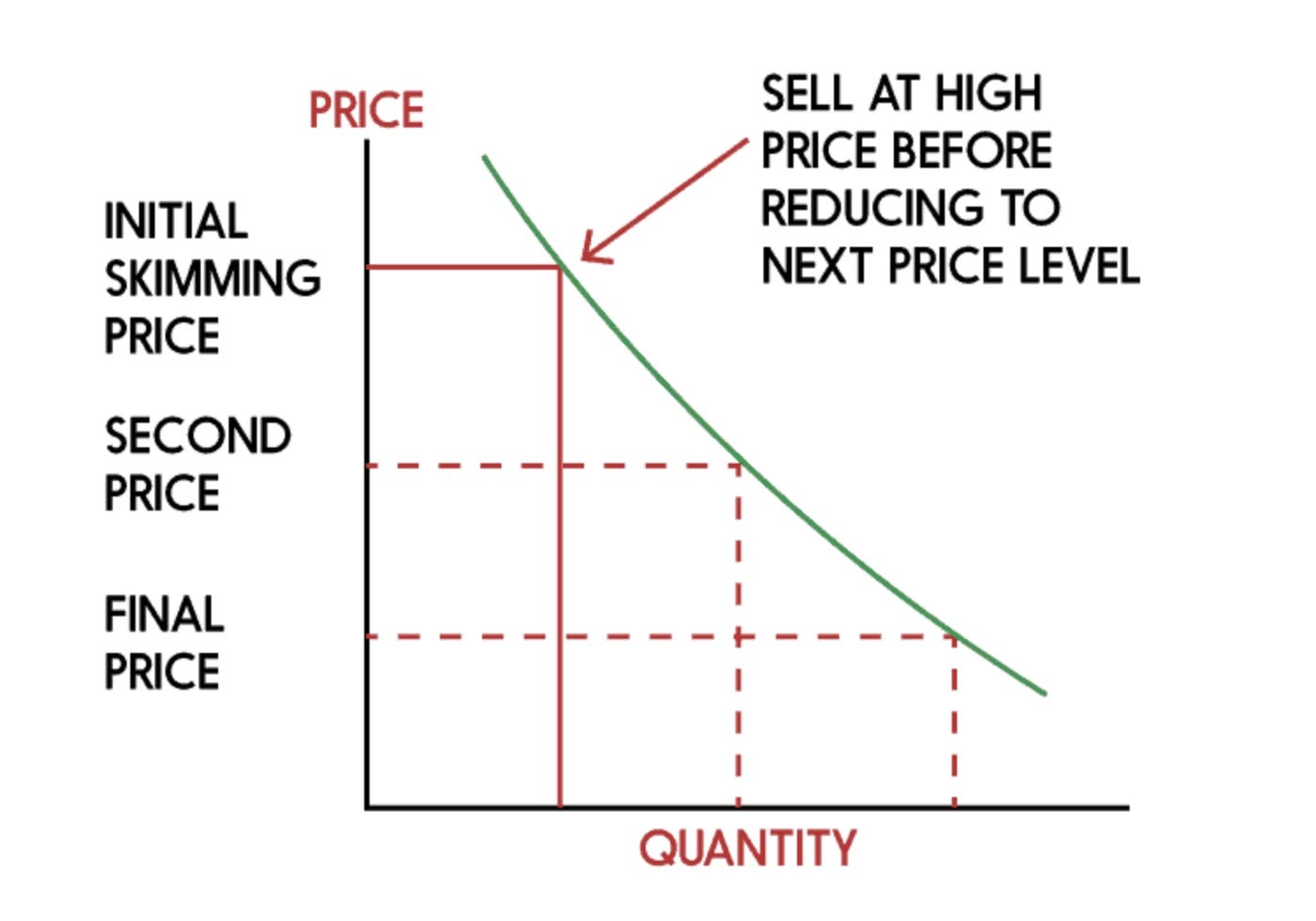

Price Skimming - it's an interesting strategy some companies use when launching new products.

Basically, price skimming is when a company starts off charging a high price for their product, then gradually lowers it over time. It's like they're "skimming" the cream off the top of the market.

You see this a lot with tech gadgets. Think about when a fancy new laptop comes out - it might cost a fortune at first, maybe $3,000. But give it a year, and that same laptop could be selling for $1,000. The company is taking advantage of early adopters who are willing to pay more to have the latest and greatest.

This strategy can work really well, but it's not for everyone. It's best for products that are already getting a lot of buzz, or for well-known companies. If you're a small startup, it might be harder to pull off unless you've got something truly unique to offer.

For price skimming to work, you need to tick a few boxes:

Your product needs to stand out from the crowd

You should have a clear idea of who your initial customers will be (and they should be okay with paying top dollar)

You need to be ready to lower your prices as competitors start to catch up

Penetration Pricing - It's kind of the opposite of price skimming. Instead of starting high and dropping prices later, you start low to get people interested. The idea is to grab a big chunk of the market quickly by offering a great deal. Once you've got customers hooked on your product, you can slowly raise prices to where they should be.

This can be a smart move, but it's not without risks. You need deep pockets to pull it off because you'll be selling at a loss at first. It's not a good fit for every business, but in the right situation, it can help you break into a tough market.

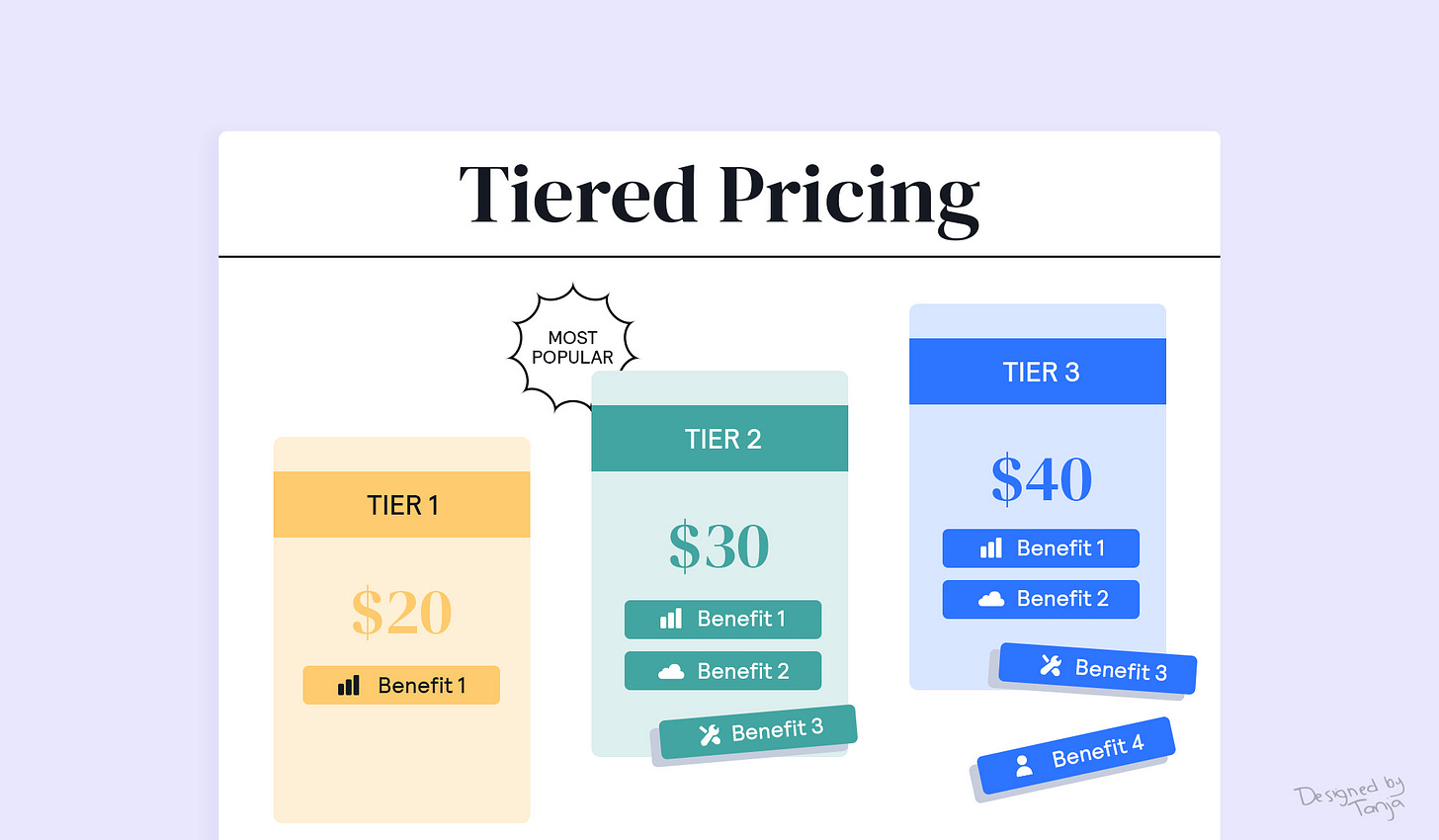

Price Tiers - This is super common in the software world. Instead of one price for everyone, you offer different packages at different price points. Maybe you have a basic version that's cheap, a mid-range option with more features, and a premium package with all the bells and whistles.

The trick here is something called price anchoring. By showing customers a range of prices, you can nudge them towards the option you really want them to pick - usually that middle-tier package. It's like the Goldilocks effect - not too expensive, not too cheap, but just right.

Price tiers are great because they let customers choose what works best for them. Plus, it gives you flexibility to appeal to different types of customers, from budget-conscious folks to those who want all the extras.

Price tiers really shine when you've got different types of customers who need different things from your product. Your photo editing software example nails it.

Think about it:

Students might just need basic tools and can't afford much. A low-cost, stripped-down version works for them.

Amateur photographers probably want more features but still have a budget. They'd go for a mid-range option.

Design agencies need all the bells and whistles and can afford to pay for them. They'd spring for the premium package.

By offering these tiers, you're not just randomly splitting up features. You're tailoring your product to fit what each group needs and can afford. It's about matching value to willingness to pay.

But here's the thing - if you're not dealing with clearly different customer groups, simpler might be better. Too many options can confuse people and make it harder for them to decide. If you've got one main type of customer, a straightforward, single-price approach can be effective. It's clear, easy to understand, and sends a strong message about your product's value.

How to price your product—Price Theory In Action

Once again, there’s no hard-and-fast mathematical formula or system that will be universally effective with pricing. However, there is a best-practice methodology and approach to pricing that can be used to good effect, and will be a useful way for most founders to consider their pricing strategy.

Know the customer:

It starts with understanding your core customer, and how your offering will create value for them. A lot of startups get hung up on their inability to collect the most detailed data at this point. However, a good estimation based on qualitative research is usually more than sufficient, in this instance, to undertake a value-based approach to pricing.

List how you create value:

Once you’ve got the customer profile, the next step is to consider all of the ways that your product creates value for them. It’s a good idea to be able to quantify this with numbers to have a sense of what your product is going to be worth.

Generally speaking, there are five kinds of value to look for:

It replaces something your customers would build for themselves.

It saves time and/or makes tasks more efficient.

It reduces risk (such as a lawsuit or inventory spoilage).

It unlocks a new source of revenue for your customer.

It has direct savings to business operations

At this stage, if you find that your offering is not creating sufficient value for your core customer, then it may be time to go back to step 1 and search for a different or more refined target.

Take your fair share

Consider how differentiated and effective your offering is. Are you a little better? A lot better? Category-redefining better? Take your fair share of the total economic value (somewhere from 10-20 per cent) based on how differentiated you are from your core customer and how competitive your market is.

A combination of desktop research to understand the competition dynamics, and a few key customer interviews to understand their pain points and the depth of value that you’re promising to add to their experience is enough information to arrive at the right price for your product.

How to choose the right pricing strategy for your startup

A founder (who sold his startup for millions dollar) once said to me that pricing is not a math problem, but rather a judgment problem. It has stuck with me ever since because it’s very true: there are no hard-and-fast formulas that you can apply to come up with the ideal pricing for your product.

It’s better to remember three principles that will guide the pricing of the product.

The first is to understand the value that your product offers to a customer.

The second is to understand that your price is always going to be your strongest signal to convey that value.

The third is to understand the impact that the competitive landscape will have on your pricing.

This is hard to get right. Remember, 85 per cent of companies are not happy with their pricing, and that applies to enterprises with all the resources that they have access to as much as it does a startup. However, it is mission-critical to spend the effort in pricing to have true conviction behind your strategy.

Ultimately, the better you understand your customers and the impact your product will have on them, the better placed you’ll be to extract maximum value and establish fierce loyalty in your brand from its earliest moments.

WE CAN HELP YOU

We Write, Design And Model Your Pitch Deck Into a Storytelling Book…

Pitch deck creation can feel daunting, especially for first-time founders. From deciding what information to include to ensuring your visuals are on point, there are a lot of moving pieces to juggle.

And if you're not careful, it's easy to end up with a deck that fails to capture an investor's attention.

That's why Venture Daily Digest is opening up a limited number of exclusive slots to provide hands-on support in building a pitch deck that will leave a lasting impression. Our team of experts, designers, and investors will work closely with you to build your pitch deck.

Schedule a call with us today →

QUICK DIVES

1. Bedrock’s Investment Strategy: Search For Narrative Violations.

Rather than chase popular narratives, Bedrock’s approach is to invest when companies are incongruent with the narrative. Simply put, search for narrative violations, which is contrarian to most investment strategies. Let’s look into how Bedrock used this strategy to find billion-dollar companies.

Narrative violations are some of the best investment chances in technology today. These companies either stand out as unique or challenge what most investors think is possible.

Here are some examples:

SpaceX: Founders Fund invested after a rocket failure, while many thought the company was doomed.

Skype: Andreessen Horowitz invested when others believed Skype was failing.

Lyft: In 2012, people thought Uber would crush Lyft, but Lyft’s innovative approach proved strong.

Investing in ideas that contradict popular beliefs can feel lonely for both investors and entrepreneurs. These companies often struggle to get attention and lack the buzz that comes with more conventional opportunities. However, this obscurity can protect them from competition and underestimation by investors.

When to Invest: Bedrock believes the best time to invest is when a company is most at odds with popular beliefs. Here’s a table showing notable narrative violations over the years:

How to Spot Violations: Narrative violations are highly idiosyncratic, so unearthing them is admittedly more art than science.

One starting point is to identify categories that were narratively hot for investors in the past but that most have cooled on today.

Another starting point is to search for companies that cannot be easily categorized at all. Is Vercel like AWS, Cloudflare, or MongoDB? Perhaps it’s simply one-of-a-kind.

On rare occasions, an entirely new category emerges that offers particularly fertile ground for narrative violations. Today, it may be decentralized apps and protocols.

Avoiding Narrative Traps: While narratives can inspire us and create connections, they can also limit our thinking. In Silicon Valley, both outside narratives and internal beliefs can narrow the focus on what’s popular. This fixation risks missing out on groundbreaking ideas that could change industries.

By looking for entrepreneurs who challenge these narratives today, investors can back some billion-dollar companies.

2. Circle’s Founder, Sid Yadav’s Views on Startup Valuation

Sid grew his startup Circle (an all-in-one community platform) from 0 to $20m+ ARR in 4 years. The last financing was at a $250m valuation a year ago and has nearly doubled all metrics in the past year. He shared that a lot of people often ask him how much Circle is worth today.

After talking to some of the world’s most successful founders and digesting countless material about startup valuations, here’s what Sid thinks about startup valuation:

“A valuation is a number an investor or acquirer comes up with based on analyzing your discounted future cashflows, while the price is a number buyers and sellers agree to act on.

Your price is not necessarily your valuation, since the former is influenced by market dynamics — demand and supply.

If you’re a private company, the valuation is what you want to pay attention to, since the only way for you to gauge the true price would be to have buyers and sellers transacting in the public market.

I like to put myself in the shoes of a potential investor or acquirer.

When they value Circle, they’ll typically look at:

the size of our business today

the growth rate

our market size way out in the future

our ability to serve that market with valuable products

our ability to capture and sustain some of that value for ourselves

macro trends with inflation and interest rates

It’s too late to change #1 and we don’t control #6, but #2-5 are completely in our control. No excuses.

That’s the theory. Here’s a more concrete answer:

A quick heuristic investors use to value fast-growing SaaS companies is a multiple on ARR (annual recurring revenue).

Given the day, my valuation of Circle varies between 10x to 25x our ARR.

On most days in the past 12 months, it’s been closer to 25x — because we truly have a lot going for us compared to other startups on our scale. If a major new prospect investor were to evaluate us for a transaction, I’d typically offer to send them all 50 of my monthly investor updates to back this up.

Once in a blue moon, I get as pessimistic and tell myself that Circle is likely worth a lot less than 25x our ARR.

But I also remind myself that it’s mostly in my control to act on this. It’s my fiduciary duty to maximize shareholder value, so we must.

If we aren’t moving fast enough, we can fix those bottlenecks today. If we’re scaling on the wrong foundations, we can pause and reflect on our fundamentals today. If we aren’t thinking big enough about our market opportunity, we can expand our imagination today.

If a key hire isn’t working out, we can make a performance plan for them today.

Valuations are slightly subjective with some objective grounding, entirely dynamic, and always in flux. They’re a guess at what reality could be, and the subject’s lens matters more than people think.

The key is to treat them as not just a number someone else decided for you, but an intuition you act on. And remember the quote: if you don’t deal with reality, reality will deal with you.”

3. How long does it take to achieve Product/Market Fit?

In my experience, it roughly takes 1-5+ years. And "it's much easier to do this with a small team, low burn, and extreme focus"

- Michael Siebel, Partner-YC.

Harsh Truth: 3 out of 5 startups would never find their PMF, and would fail.

How to determine if you have the Product/Market Fit?

People often say funnily, "Product-market Fit is like porn...when you see it, you just know."

In qualitative terms ...

"When the customers aren’t quite getting much value out of the product/service, word of mouth isn’t spreading, usage isn’t growing that fast (spikes in the months where you advertise), press reviews are kind of “blah”, the sales cycle takes too long, and most of the deals never close" - Marc Andreessen.

Most startups that have raised ($5-$10 Mn) Series A funding, assume they’ve got a product-market fit, just because they’ve raised funding. They're wrong, why do you think 70% of startups that raised Series A still fail, because the no.1 reason was lack of PMF!

You have it ...

On a high level, you've found product market fit when you can repeatably acquire customers for a lower cost (CAC) than what they are worth (LTV) to you

- Elizabeth Yin

“You can always feel when Product/Market Fit is happening. The customers are buying the product just as fast as you can make it - or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company's account.

You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it.” - Marc Andreessen

When product-market fit occurs something magical happens, all of a sudden your customers become your salespeople i.e. they sell for you. - Josh Porter.

Join 35000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

OpenAI's financial outlook indicates potential annual losses could reach $14 billion by 2026. (Read Here)

OpenAI announced plans to open new offices in several cities worldwide, including NYC, Seattle, Paris, Brussels, and Singapore, as part of its global expansion efforts. (Read Here)

Google DeepMind researchers win Nobel Prize in chemistry. (Read Here)

A U.S. judge ordered Google to revamp its mobile app business, allowing Android users to download apps from competing stores and use alternative in-app payment methods following a lawsuit by Epic Games. (Read Here)

Ex-Google Maps team members get $6 Million Sequoia backing to build an AI-powered collaboration board. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 26,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Fund Operations Analyst - Capital Factor y | USA (remote) - Apply Here

Platform Manager - Comcast Venture | USA - Apply Here

Fractional CFO - Sogal | USA - Apply Here

Project Study in Venture Capital - oCCIDENT | Germany - Apply Here

Associate, Portfolio Operations - ICONOQ GROWTH | UK - Apply Here

Associate, Primary Investments - Adam Street Partner | USA - Apply Here

Ventures Associate - Plug and play tech centre | Singapore - Apply Here

Investment Manager, Techstars London - Apply Here

Analyst - Direct and Co-investment - British Capital | UK - Apply Here

Senior Director, Venture Capital and Impact Investing - Sorenson Capital | USA - Apply Here

Investment Associate, Material Science & Sustainable Infrastructure - Playground Global | USA - Apply Here

Investment team - Dexter Venture | India - Apply Here

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

Get access to our all-in-one VC interview preparation guide - check out here, we are giving a 30% discount for a limited time. Don’t miss this.

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

That’s It For Today! Happy Friday. Will meet You on Tuesday!

✍️Written By Sahil R | Venture Crew Team