Why Do Great Ideas Often Fail The 'Elevator Pitch' Test? | VC Jobs

"Land - Expand" Strategy To Get Yes From VCs & How Investors Will Grade Your Startup ?

👋 Hey Sahil here! Welcome to this bi-weekly✨ free edition✨ venture curator newsletter. Each week, I tackle questionsabout building products, startups, growth, and venture capital! In today’s newsletter -

Deep Dive: How to Improve Your Odds of Getting to Yes with a VC — “Land and Expand” Strategy?

Quick Dive:

Why Do Great Ideas Often Fail The 'Elevator Pitch' Test?

How Investors Will Grade Your Startup: A Sample VC Memo On A $5M Seed Round.

Ask Slide In Pitch Deck: How Can We Explain What The Funds Will Be Used For?

Steve Jobs - ‘Don’t Ask Your Customers What They Want, Why?’

Major News: Spotify's CEO Launches Healthcare Startup, Tether's $200 Million Investment In Brain Implant Startup, OpenAI Raised $15 Million For $175M Startup Fund & Yuga Labs, creator of the Bored Ape Yacht Club Announced Layoff.

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH RYSE

Window Is Closing To Invest Alongside The Sharks

VCs know how difficult it is to spot promising early investment opportunities. Even the all-knowing Sharks from Shark Tank declined the offer to buy 10% of Ring for $700K.

It’s a decision they would regret when Amazon acquired Ring, turning the $700K into $10M. But what made Ring blow up and change doorbells forever? Retail distribution.

RYSE has launched in +100 Best Buys, but did you know that they pitched on Canada’s Shark Tank, and Dragons Den and received two offers?

Exits in the smart home industry have yielded massive returns for early investors (look at Ring and Nest's billion-dollar acquisitions) and the Dragons think they’ve spotted a winner in RYSE.

Don’t make the same mistake the sharks did - invest now.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

How to Improve Your Odds of Getting to Yes with a VC — “Land and Expand” Strategy?

(In a recent conversation with an experienced early-stage investor, we explored strategies for improving a founder's chances with VCs. He shared a great framework that even I felt many founders were unaware of. So, I wanted to share that framework with you in this write-up.)

“ Raising capital is a sales & marketing process. As a founder - Your company is the product and you’re selling an equity ownership in your company but much more broadly you’re selling trust & confidence that you’re going to build something enormously valuable and that you’re going to be enjoyable to work hand-in-hand with over the coming decade of each other’s lives.

To understand how to “get to yes” with a VC you first need to -

Understand how VC partners make decisions and then you can understand how to increase your odds of closing a deal.

VC Partners

Start by understanding how many partners are at the firm you are approaching. It’s pretty easy since nearly every VC lists its partners on the website. Some firms are trickier since they artificially call everybody “partner” but they’re not all “investment partners.” It’s super easy to suss all this out.

Find a portfolio company or two that they’ve invested in. Find one that’s on the earlier-stage size or one that was raised a long time ago and never scaled and get to know the founder & CEO.

They can likely give you the entire playbook of the partnership if you build a meaningful relationship with them and they trust you. The key to your “consigliere” is that they can’t be crazy busy because they’re scaling at meteoric rates.

What do you want to know?

How many partners are there?

Which partners are active and which are less active?

Who in the firm has the “pull” to get deals done when they want to?

Which partners work well with which other partners?

Who are the most optimistic partners and who are the most generally skeptical partners?

How does the partnership typically make its final investment decisions?

Decision Dynamics

Each firm makes decisions in different ways so understanding the firm’s decision framework matters. Some firms are “consensus-driven” and look for unanimity in the decision or near unanimity. Some partnerships are “conviction driven” meaning they’re looking for a super-committed partner who will slam his or her proverbial fist on the table to push through a deal.

Those partnerships want to know that the “sponsor” of the deal is willing to have his or her head on the chopping block advocating for this deal. In larger partnerships, you often have “shadow partners” who serve as the role of an advocate (or detractor) to the main sponsoring partner.

In any event, the process is you meet a partner (whether you went direct or first built support from an associate) and that partner decides whether to bring you to meet more people and eventually to a “full partner meeting” which in most firms is on Monday. Usually, after a Monday partner meeting you get a pretty strong:

Yes, the term sheet coming

No, sorry we’re passing

Maybe, we need to do more due diligence/analysis/work

I always counsel founders that “good news comes early” so if you haven’t heard by Tuesday at noon chances are it wasn’t likely a clean “yes.”

The Role of “Other” Partners

You also need to be aware that every partnership has partners who are not full-time investment partners. These can be called: Operating Partners, Venture Partners, Board Partners or similar.

These are often seasoned executives who influence the firm but aren’t carrying a full load of annual new investments. They might sponsor an occasional deal, they might be looking to jump in and run a company or they might take the board seat if the firm invests. Every partnership is different so it’s worth knowing whether you’re talking with an investment partner or another partner and what their actual role in the firm and investment decisions is

Source: Google Images

The Role of Non-Partner Investment Staff

Most VCs have investment staff who are not yet partners. These can be called Analysts, Associates, Principals or similar. The “A’s” typically don’t have investment authority and Principals depend from firm to firm.

The role of these investment staff varies firm-to-firm but they often entail:

Sourcing deals for partners

Helping with initial deal screening with a partner

Helping with due diligence (competitive assessments, customer calls, reference checking, market sizing, technology reviews, etc.)

Building models to evaluate the deal and/or reviewing customer files, company financials, business plans, etc.

Adding colour to partner discussions during a Monday partner meeting

Completing due diligence post partner meeting for thorny questions that were raised

How a Monday Partner Meeting Works

(Generally Monday - Vary from firm to firm)

You come in (online meet sometimes) and usually have between 45 minutes to an hour to present. The best companies build a deck and a cadence to use up 50–60% of the time and save a buffer for discussions. If the questions aren’t organically flowing you have “pocket slides” after the main deck you can pull out to share more information or analysis.

You leave. The sponsoring partner often outlines his or her thesis and then feedback on the company is offered. Sometimes these are love fests but usually, they are pretty brutal takedowns of why a company would or would not work.

A vote happens at what’s called an “investment committee” and the sponsoring partner is tasked with what comes next.

Some firms have formal voting systems and if the vote passes the deal gets done. Some firms have broad discussions and then resolve the final investment decision until the sponsoring partner answers more questions. Some firms — whether they have voting or not — have a “super user” partner that has all the juice in the vote whether that’s formal or not. Some partnerships allow “vetos” and others don’t.

What Happens When There’s Dissent on the Investment Decision?

If the firm is consensus driven a deal will be killed.

If a firm has a voting policy and a set number of “no’s” come in the deal is killed.

If a firm has a “super user” partner or a “veto right” and somebody kills a deal then the deal is dead. In some firms, dissent is tolerated but then the sponsoring partner has to show ownership of the concerns raised by the dissenters.

Investor A said that he has sat in some meetings where they decided in 20 minutes and in some meetings where an argument lasted 2 hours. Honestly, it can be draining (Investor A Said)….

Investor A shared experience of his firm on decision making:

“We’re conviction driven

If somebody has deep conviction “against” a decision would be postponed and a small group might caucus later with more information answered

We have 4 full-time investment partners and every partner has an equal say. We also take input from our board partners and our non-partner investment staff.

We operate a policy of “no retribution” and “no reciprocity.” This is critical to build a cohesive venture capital firm. If you have retribution (you argued against my last deal so I’ll argue against yours) you have animosity. Anybody who knows VC knows that this retribution-type behaviour exits and is corrosive. Reciprocity is equally destructive. It says “You approved my last deal so I feel bad and will approve yours even though I don’t love it.” This produces shit deals getting done.”

How to Land and Expand

This was a long walk where investor A tried to bury the lede. But one advice he has for every founder is that “you not leave your entire outcome simply to your sponsoring partner and/or associate.”

Think about it … if you have 4 investment partners and a whole supporting cast of influencers and you have only met with one partner and then you appear in front of a committee of deciders who have never met you before — that’s a lot riding on your pitch and the willingness of the sponsoring partner to advocate.

This is Sales 101.

You find a champion but then you find reasons to meet other staff before the meeting where your fate would be decided. VCs are busy people and just because one partner is showing you time doesn’t mean others easily will before a partner meeting.

Find productive reasons why your sponsoring partner or associate can introduce you to other partners. Maybe you have some knowledge they would find valuable? Maybe they’ve worked with a similar company to yours before. Maybe you go from meeting a partner to meeting 3 associates to broaden your relationships and learn more about the firm. Maybe they even help you meet other partners?

There are a million methods for building broader relationships in any buying organization but there is one key lesson that can’t be ignored. The more people you have in that partner meeting who come in with a stronger sense for what you do and the more you have answered their biases and concerns in advance the higher the probability of getting to yes.

Summary

Every VC firm is different and the decision processes vary; however, they all form the basis sponsor / supporting staff structure and the more people you know when the investment committee happens the higher the probability of success.

Remember, it’s not easy for anybody. Even the ones who tell you they’re “crushing it.”

That’s it!”

✨ Join Our Premium Venture Curator Newsletter & Community

With our biweekly free newsletters (Tuesday & Thursday), we are launching our premium newsletter. Every Sunday (full newsletter), we will share actionable premium content with you on startups, venture capital, AI, and more.

A $5 subscription gets you:

⭐ Premium Subscribers Posts (Every Sunday)

⭐ Daily Premium Content, Discussion, Curated Article & Weekly events list Through Substack Community Chat.

⭐ Access To Founders Resources (10000+ verified Investors’ email contact database, fundraising resources, discount marketplace & more…).

QUICK DIVES

1. Why Do Great Ideas Often Fail The 'Elevator Pitch' Test?

In 1993, Jensen Huang pitched a startup idea to his former boss, Wilf Corrigan.

After Jensen's pitch, Wilf said, “I have no idea what you just said. That was one of the worst pitches I've ever heard.”

Wilf then called the renowned venture capitalist Don Valentine, and said,

“Don, I'm going to send a kid over to you. He's one of the best employees I've ever had. I'm not sure what he's doing, but I think you should give him money.”

As the founder of Sequoia Capital, Valentine had made early investments in companies like Apple, Atari, and Wilf's LSI Logic (which had generated a $150 million return through its 1983 IPO).

So, walking in to pitch to Valentine, Jensen (then 29 years old) was nervous, and therefore, “I did a horrible job with the pitch.”

“Well, that wasn’t very good,” Valentine said. “But Wilf says to give you money, so against my better judgment, I’m going to give you money.”

With funding from Sequoia, Jensen and his co-founders, Curtis Priem and Chris Malachowsky, started Nvidia—initially, a company focused on creating graphics processing units (GPUs) to improve the quality of video game graphics.

Over time, Nvidia's GPUs and other computing technologies would spread beyond gaming to a deep, broad list of industries, including self-driving cars, AI, medical imaging, weather forecasting, and on and on. As a result, Nvidia (at the time of this writing) is the 3rd most valuable company in the world, worth around $2.2 trillion.

Takeaway: Pixar co-founder Ed Catmull talks about how great ideas often fail the “elevator pitch” test.

“The way to pass the elevator pitch test,” Catmull says, “is to pick an idea that other people are already familiar with. So if you pick something that hasn't been done before, you will fail the elevator pitch test.”

After hearing Jensen's pitch, both Wilf Corrigan and Don Valentine said Jensen's idea sounded terrible. Jensen’s idea repeatedly failed the elevator pitch test, but it went on to birth one of the most valuable companies in the world.

(Primarily Shared by Billy Oppenheimer)

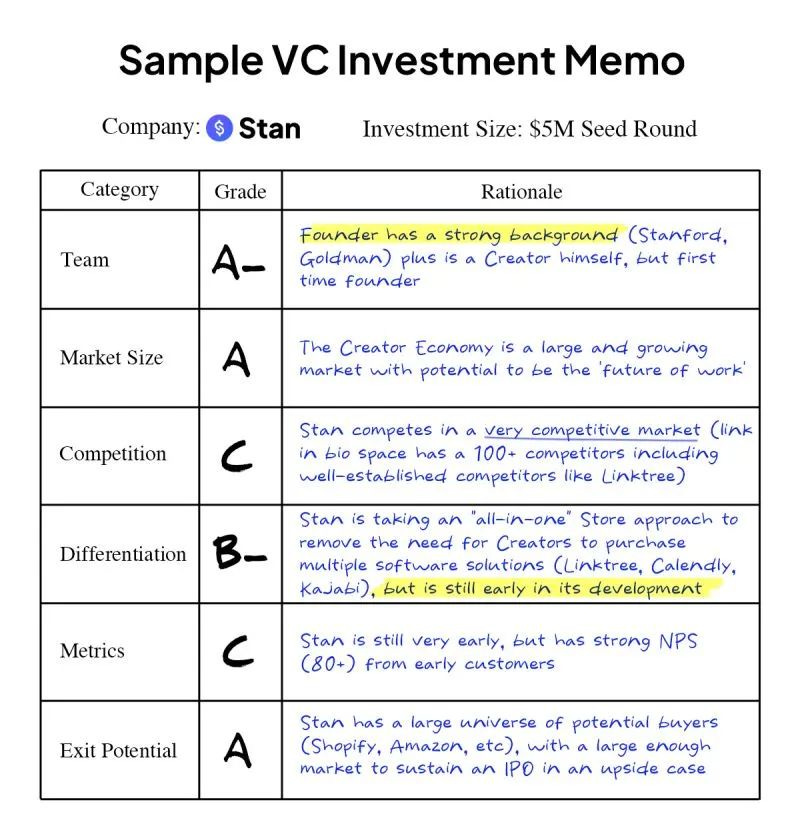

2. How Investors Will Grade Your Startup: A Sample VC Memo On A $5M Seed Round.

Shared by John Hu who’s worked for top VC firms like Goldman Sachs and Norwest Venture Partner and currently building his own start-up Stan. He used this framework for his own startup and rated each column:

Team: What is the quality of your team? How strong is your “Founder-Market’Fit? Why is your team the best team to solve this problem?

Market Size: How large is this market? Does it have BN$+ potential

Competition: How competitive is this market?

Differentiation: How will you beat the competition? What’s your competitive angle?

Metrics: How strong are your metrics? How strong of a growth indication do they give?

Exit Potential: How many potential buyers are there of your company?

These are great points that founders can consider to grading their startup, but there is a simpler way to grade a startup as 'A' or 'C,' as shared by Herwig Springer -

𝗧𝗲𝗮𝗺

A for taking market feedback over theory.

C for having outside commitments at play.𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗶𝘇𝗲

A for evidence to support target market cap.

C for overestimating the accessible market.𝗖𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝗼𝗻

A for having a key competitive advantage.

C for failing to acknowledge key competitors.𝗗𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁𝗶𝗮𝘁𝗶𝗼𝗻

A for building strong moats like proprietary technology.

C for differentiation based on easily replicable factors.𝗠𝗲𝘁𝗿𝗶𝗰𝘀

A for balancing growth and profitability metrics.

C for focusing on vanity metrics like sign-ups.𝗘𝘅𝗶𝘁 𝗣𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹

A for considering options like M&A.

C for hyperfocusing on one path.

3. Ask Slide In Pitch Deck: How Can We Explain What The Funds Will Be Used For?

You’re running a startup, and you’re going to want to raise money to accomplish something. Makes sense. What doesn’t make any sense at all is how many founders seem to be shy about sharing the details of the plan. A lot of the due diligence process is going to be focused on figuring out whether you are a competent, believable founder and showing that you have a detailed plan and vision for what’s going to happen over the next stretch of time.

Put differently: If I’m going to invest $2 million into your startup, I want to know what that money buys me, in terms of progress for your company.

Ideally, your company has an operating plan as part of the pitch deck, which goes into detail about what is going to happen between this and the next funding round. On the “ask” slide, however, you have the opportunity to summarize in three or four bullet points what you’re going to do with the money.

Typically, you’re going to want to include product, traction, market validation and key hire milestones.

Product — What product milestones do you need to hit in order to raise the next tranche of money? In particular, this includes beta or full product launches, major feature sets in the product pipeline or integrations with partners.

Traction — What business metrics do you need to achieve in order to raise more money? How many units do you have to sell, how many subscribers do you need, how many customers do you want? Other metrics may also be helpful here — your net promoter score (NPS), monthly active users, etc.

Market validation — What can you do to prove that there’s a real market out there willing to pay for the product or service you are peddling?

Key hires — In order to reach the above goals, you probably need to hire. How many people do you need to hire? When?

Each of these goals should be SMART: specific, measurable, achievable, relevant and time-based. Poor goals are vague: “Improve marketing,” “Get more customers” or “Add features to our product.”

Examples of great SMART goals:

“By June 2025, we need 2,000 paying customers on our recurring subscription model.”

“In the next six months, we need to reduce our customer acquisition cost by 20%.”

“Our B2B sales need to improve, so by July we are aiming to hire an experienced VP of sales who can help shape our sales processes.”

Be. Specific.

4. Steve Jobs - ‘Don’t Ask Your Customers What They Want, Why?’

Jobs’ product-creation philosophy was to avoid asking customers what they wanted because their answers would be predicated on what they already knew based on existing products.

On the contrary, instead of focusing just on the functional needs of customers, he observed what they were trying to accomplish on a social and emotional level as well. He then brainstormed with creative minds and engineers to come up with innovations to help people achieve their goals in both life and work.

Henry Ford, the man who founded the Ford Motor Company, was another industrial designer who operated under the same guiding principle. An unrelenting fervent supporter of new technology, he worked to continually improve the design and manufacturing processes of his products. In contrast to traditional methods of market research, he did not solicit feedback from customers when making product decisions.

“If I’d done what my customers wanted, then I would have built a faster horse,” he famously declared.

Having said that, I believe Henry and Steve had a keen eye for human behaviour.

They’ve freed designers (and engineers) to look at different ways to commercialize innovations and avoid making the common blunder of letting the “voice of the customer” decide the course of their evolution.

Likewise, Apple’s success with this approach can be seen in their Macintosh version, which provided a whole new computing experience for customers.

Join 18000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Spotify's CEO Daniel Ek has co-founded a healthcare startup called Neko Health, which offers full-body scans for early disease detection at $230. Read Here

Tether, the stablecoin company, has invested $200 million in Blackrock Neurotech, a U.S. brain implant firm, acquiring a majority stake. Read Here

OpenAI Startup Fund raises an additional $15 million, totalling $175 million in capital under the venture capital fund. Read Here

xAI, Musk's AI firm, raises $6B at $18B valuation from Sequoia, Future Ventures, Valor Equity, Gigafund. Read Here

Dustin Moskovitz, a Facebook co-founder, accused Tesla of being "the next Enron" by misleading consumers about its self-driving software and vehicle ranges. Read Here

→ Get the most important startup funding, venture capital & tech news. Join 13,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

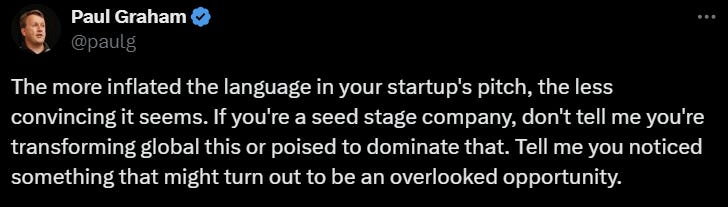

TWEET OF THIS WEEK

Best Tweet I Saw This Week

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Intern (Community & Platform) - January Capital | Singapore - Apply Here

Chief of staff - Aegis Venture | USA - Apply Here

Foundry Fellowship - Blackbird Venture | Australia - Apply Here

Investment Partner - M12 | USA - Apply Here

Managing Partner - M12 | USA - Apply Here

Senior Associate - Healthy Velocity Capital | USA - Apply Here

Partner - iNHITE VENTURE | USA - Apply Here

Investment Director/VP - Revx capital | India - Apply Here

Investment Associate 2024 - Trubridge Capital Partner | USA - Apply Here

Investor Relations -meta prop | USA - Apply Here

Analyst -Emerson Collective | USA - Apply Here

Investment Manager - CJ Investment | USA - Apply Here

Associate Director -Endless Frontier Lab | USA - Apply Here

Investment Analyst - Willow growth partner |USA - Apply Here

Some Tips To Break Into VC:

“5 ways to evaluate a startup you want to pitch in a VC interview without speaking to the founder: “

Evaluate the founder's background on LinkedIn. Does it fit with the problem they are solving?

Look at the year it was founded. Have they been around a long time? Remember VC requires scale quickly

Look to see if they have notable logos or customers on their website

Evaluate their fundraises / investors to date

Calculate the market size. Is this a big enough market to achieve a $1B+ outcome?

(Share by Nicole DeTommaso)

→ Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

→ Looking to hire for your VC Firm?

We have a curated list of VC enthusiasts - from leading universities, ex-founders, and operators. Get free access here.

That’s It For Today! Happy Tuesday!

Advertise || Join The Community

✍️Written By Sahil R | Venture Crew Team

This is one of the best in understanding VC decisions dynamics. This is what Robert Greene in his Power book will say, keep the friends close but the enemies closer. Thanks for sharing