How To Determine If You Have The Product-Market Fit? - From a16z, Sequoia Capital’s Partners. | VC & Startup Jobs.

VC Follows the PE Curve & Founder to CEO - The Mindset Shift Framework.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: How To Determine If You Have The Product-Market Fit? - From a16z, Sequoia Capital’s Partners…

Quick Dive:

VC Follows the PE Curve: How do Trends in PE Impact the Venture Industry?

From Founder to CEO: The Mindset Shift Framework.

Major News: Elon Musk’s xAI acquires X, Frank Rotman leaves QED to build music startup, OpenAI peels back ChatGPT’s safeguards around image creation & More.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

Elon Musk on the Realities of Startups.

Y-Combinator Guide: How to design a better pitch deck...

Verified 2700+ US angel investors & VC firm contact database (email + LinkedIn link).

Eniac VC cofounder on seed stage pitch red flags.

Why a16z is investing up to $1M in very early stage startups.

Where’s the Business Model in chat-based search?

Ankur Nagpal’s The $1M ARR Growth Playbook.

250+ Latin America VC Firms & Angel Investors Database.

Four ingredients of hypergrowth are now available to every startup.

The New AI Risk Curve.

SaaS Startup Financial Model: All-in-One Excel Template.

Startup legal document pack – essential legal docs for founders.

Marketing is dead. Long live the algorithm.

2024 VC fund performance.

1000+ Euro Tech VC Firms Database.

For AI Enthusiasts: Must-have resources to stay updated on AI tools, trusted by leading founders and investors.

FOR FOUNDERS WANTING TO GROW...

🚀 Ship faster. Scale bigger. Win more.

Urban Dynamics is accelerating startups to ship & scale faster. Stay focused on what matters — building features — and stop worrying about the pain of cloud, security, DevOps, and more.

Take advantage of our Product Scalability Workshop for Founders – a dedicated 1-hour workshop tailored to you and scaling your startup fast⚡️availability is limited.

Reserve your slot for April now →

PS - Attending Google Cloud Next on April 9- 11? If so, join our community newsletter & Slack to meet up with our team 👋

PARTNERSHIP WITH US

Get your product in front of over 85,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

How To Determine If You Have The Product-Market Fit? - From a16z, Sequoia Capital’s Partners…

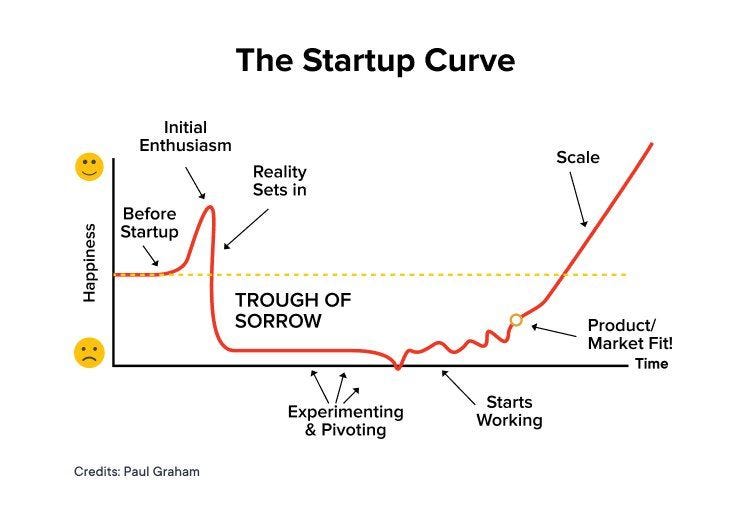

Product-market fit is one of those concepts that seems easy to understand as a concept but in practice, hard or impossible to articulate what it means.

Most people lazily say "Product-market fit is like porn...when you see it, you just know!" But what does that mean? So in today’s newsletter, I will try to share one of the most exhaustive and practical guides to find PMF. Let’s dive deep into it:

What is Product Market Fit?

Product/Market Fit can be concretely defined as a scenario:

When users/customers begin to use/buy your product/service and recognize its value proposition.

They continue to buy from you (high retention)

They rave about the great experiences with your company and encourage others to buy from you (strong word of mouth).

And, you can replicate this same experience with every new referred user/customer.

We can then say that you've achieved the product/market fit

How Do Experts Define Product/Market Fit?

"Product Market Fit means being in a good market with a product that can satisfy that market" - Marc Andreessen.

"Product-Market Fit is all about making something that (lots of) people want"

- Paul Graham, Y Combinator.

"Product/Market Fit is when (people) your customers sell for you (strong word of mouth)"

- Josh Porter.

Product/Market Fit is the only thing that matters

- Marc Andreessen.

Why is Product Market Fit so important?

90% of startups and 70% of startups that raised Series A end up as failures!

Lack of Product/Market Fit is the most common reason behind "why startups fail."

"Finding the Product/Market Fit is the hardest challenge for all startups", not now as this guide will help you find PMF.

If you're an early-stage startup then product/market fit should be your only focus in your journey instead of fundraising. Start working on the PMF if you still haven't.

Scaling a Pre-product market fit startup is almost a sure-shot way to kill it!

In 1999, I built a failed dot com. Initially raised from F&F, and scaled before product-market fit. Never did I find it (PMF). Kept on raising in future - $3 M, then $20 M on $100 M valuation. Hired dozens of high-priced executives, bought a fancy space in LA, and even made an acquisition. Don't (ever) be like me - Micah Rosenbloom.

"The most successful technology companies (i.e. Facebook, LinkedIn, Twitter, etc.) first got their product/market fit right before even stepping on the accelerator (of growth)."

How long does it take to achieve Product/Market Fit?

It takes time for a startup to find product/market fit. In my experience, it roughly takes 1-5+ years. And "it's much easier to do this with a small team, low burn, and extreme focus" - Michael Siebel, Partner-YC.

Harsh Truth: 3 out of 5 startups would never find their PMF and would fail.

People often say funnily, "Product-market Fit is like porn...when you see it, you just know."

In qualitative terms ...

When the customers aren’t quite getting much value out of the product/service, word of mouth isn’t spreading, usage isn’t growing that fast (spikes in the months where you advertise), press reviews are kind of “blah”, the sales cycle takes too long, and most of the deals never close

Most startups that have raised ($5-$10 Mn) Series A funding, assume they’ve got a product-market fit, just because they’ve raised funding. They're wrong, why do you think 70% of startups that raised Series A still fail, because the no.1 reason was lack of PMF!

You have it ...

On a high level, you've found product market fit when you can repeatably acquire customers for a lower cost (CAC) than what they are worth (LTV) to you

- Elizabeth Yin (Hustle Fund)

“You can always feel when Product/Market Fit is happening. The customers are buying the product just as fast as you can make it - or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company's account.

You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it.” - Marc Andreessen

When product-market fit occurs something magical happens, all of a sudden your customers become your salespeople i.e. they sell for you - Josh Porter.

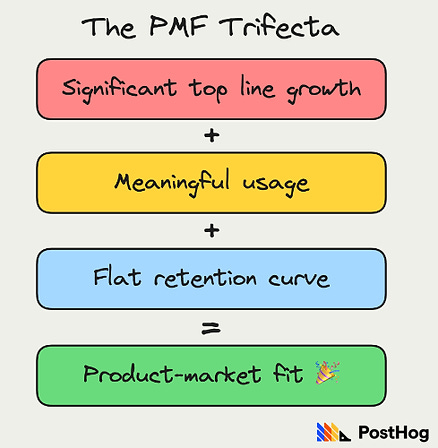

What metrics do you track and analyze to determine whether you've achieved the Product/Market Fit?

Let's delve into quantitative metrics of finding Product/Market Fit:

A. Product/Market Fit Metrics for SaaS Businesses

David Rusenko recommends that founders offering SaaS should track the below 6 metrics to evaluate Product/Market Fit:

Returning Usage (Day 1,3,7,30 retention): Look at people who sign up to your site/app and then look at the number of people who return back within 1,3,7,30 day/s. This should indicate whether things are working or aren't.

A Net Promoter Score (NPS) of > 50 means you’re doing well.

Paying Customer Renewal Rates or Retention: Renewal rate is defined as the number of people who are eligible to renew and what percentage of people actually renewed is a lot better metric than churn. The churn rate (Churned customers / total customers) is a lot easier to measure, but it can be deceiving at times.

Growth Rate: Consistent growth of at least 15% in MRR and ARR is a strong indicator of Product/Market Fit. Irregular spikes, flattening, or declining growth are some of the red flags to watch for.

Market Share: How quickly are you gaining/losing the market share?

Customer Lifetime Value (CLV) vs. Customer Acquisition Costs (CAC): A ratio of 3X and a CAC payback of < 18 months is ideal for SaaS startups.

B. Product/Market Fit Survey

Rahul Vora in this article, shares how he used a "simple survey" to assess whether his venture (Superhuman) has achieved the Product/Market Fit. Here's how you can replicate it:

Survey all your users with this simple question:

Q. How disappointed would you feel if you could no longer use our product/service?

Very disappointed

Somewhat disappointed

Not disappointed

The magic number that indicates the Product Market Fit is when > 40% of users respond as “very disappointed.” The companies that struggle on the same can barely even touch 40%.

51% of Slack users responded that they would be very disappointed without Slack, revealing that it had indeed attained product/market fit.

C. Retention and Customer Love

Rajan Anandan MD, Sequoia Capital, recommends two simple methods to evaluate whether you've achieved the product/market fit:

The retention curve is what percentage of your users keep coming back over some time while using your product/service.

Essentially, there are 3 kinds of retention curves, and you should plot this curve by day, week, or month, once you launch your product.

a. Declining Curve (dark grey line), let's say you’ve launched a consumer internet app on day 0, and every week your retention rate declines by 10%, which essentially means that by the end of 3rd month, all your initial users would have churned, then that's a declining curve, which indicates that you don’t have a product-market fit.

b. Flattening Curve (orange line) is actually good, although it kind of varies depending upon the category (HealthTech, EdTech, etc.,) but generically speaking if the retention curve flattens between 20%-40% that could be quite good.

c. Finally, the best one is the Smiling Retention Curve (green line), which means that retention drop,s but then as time goes ,on you keep reactivating users, which indicates that you're getting close to your product-market fit.

C2. Do Customers Love You?

Net Promoter Score (NPS) is a metric that organizations use to measure customer loyalty toward their brand, product or service. NPS works by asking your customers a single question: "How likely are you to recommend our products/services to others?"

NPS = % Promoters (score 9-10) - % Detractors (score 0-6)

If the magic score is = 70% or more, then you have an amazing product-market fit. But if the number declines to 40% or below, then you don’t have it. It's that simple!

What if you don't have a Product/Market Fit?

Encourage founders to continue to talk to customers, care about their customers, learn about their problems, and solve them effectively - Michael Siebel, Partner-YC.

Most founders seek ineffective shortcuts to achieve Product/Market Fit (PMF) i.e. hiring a ton of engineers, bringing on senior executives, running after key partnerships, etc. These shortcuts never work.

If you don't have Product/Market Fit, keep your burn low, and keep iterating fast with a lean team. You may get pressure to spend from your VCs (this usually happens), push back hard - Elizabeth Yin, Co-founder of Hustle Fund.

If you haven't reached Product/Market Fit, avoid growing your team above 10 people. After raising a seed round, most founders are tempted to grow the team. Smaller teams can adapt/iterate much quicker - Immad Akhund, Co-founder & CEO, Mercury.

That’s it.

We’ve also built multiple guides and frameworks that can be helpful to you in your startup journey:

Excel Template: Early Stage Startup Financial Model For Fundraising.

SaaS Financial Model Template: Early Stage Startup Financial Model For Fundraising.

Building Cap Table As A Founder: Template to Download.

How to write your monthly investor update (Email Template).

Startup Legal Document Pack

Investor CRM Template – The Ultimate Fundraising Tracker

📢 LAUNCHING — A GLOBAL COMMUNITY FOR VCs & ANGEL INVESTORS

Join Venture Crew’s Investor Community (VCs & Angels)

With 85,000+ existing newsletter subscribers, we’re now launching an exclusive Slack community for angel investors and venture capitalists from around the world.

By joining, you’ll get access to:

Vetted early-stage startup deals

Weekly networking sessions & LP-GP events

Daily updates on startup fundraises, venture trends & market signals

Investor-only tools, resources & deal rooms

💬 Is This Free? Yes — 100% free to join. No hidden fees.

The goal: learn faster, invest smarter, build together. Don’t miss this opportunity!

📃 QUICK DIVES

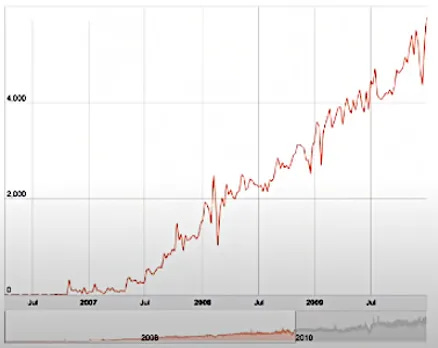

1. VC Follows the PE Curve: How do Trends in PE Impact the Venture Industry?

Sometimes, a report reveals more than trends—it shows where the entire industry is moving. This is one of those articles.

In the latest Global Private Equity report published by Bain, while it focuses on the $5 trillion PE universe, it doubles as a crystal ball for the $2 trillion venture capital world. What happens in private equity tends to trickle down to venture, often with a delay but always with impact.

The private markets have exploded in size—from $716 billion in 2000 to $15 trillion by 2023. That growth was fueled by low interest rates and rising multiples. But the levers are shifting. Bain’s report outlines key changes that are already reshaping private equity and are now starting to show up in venture.

Let’s look at three PE trends that are crossing over into VC:

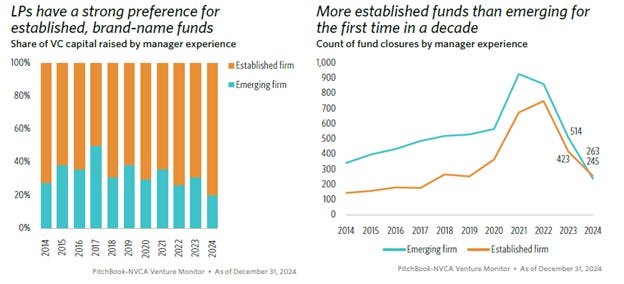

1. Capital is moving to quality

In both PE and VC, LPs are consolidating bets around experienced, brand-name firms. Fundraising dropped across the board in 2024, but mega-funds still pulled in most of the capital.

In private equity, just 10 firms captured over a third of the total raised. In venture, Andreessen Horowitz alone raised 11% of all capital last year. Meanwhile, emerging managers are struggling. For the first time in a decade, more established VC firms raised funds than emerging ones. It’s a tough time to be new and small.

2. Liquidity is getting creative

With distributions slowing and exits drying up, firms are under pressure to return capital. In PE, secondaries, NAV loans, dividend recaps, and continuation funds are becoming standard tools. Venture is following suit. VC distributions are now just 6.5% of NAV—down significantly. As a result, secondaries are booming.

The venture secondary market is now estimated at $130 billion a year.

New funds are forming around this, and multi-stage firms are registering as RIAs so they can do more in this space.

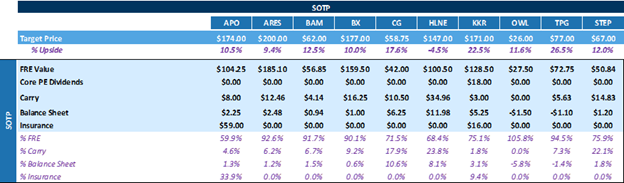

3. GPs are going public

Private equity firms like Blackstone and KKR have been public for years. Now, the venture is catching up.

General Catalyst is reportedly exploring an IPO, and there are whispers about a16z doing the same. Going public gives GPs access to permanent capital and new revenue from management fees—an increasingly important line item. According to Goldman Sachs, listed alt managers are valued more on fee-related earnings than on carry these days.

Here’s what’s coming in VC:

Fee compression is real. The 2/20 model is under pressure, and retail-oriented products with lower fees are gaining ground.

New LP bases are reshaping fundraising. Sovereign wealth funds and retail investors are set to drive 60% of AUM growth in the next decade.

Strategic M&A is heating up. VC is starting to mirror PE, with firms like General Catalyst expanding through deals in Europe and India.

The venture world is cyclical, and tech supercycles still matter. But structurally, VC is marching down the same path as PE—just with a bit of a lag.

I would highly recommend reading this article by Signalrank.

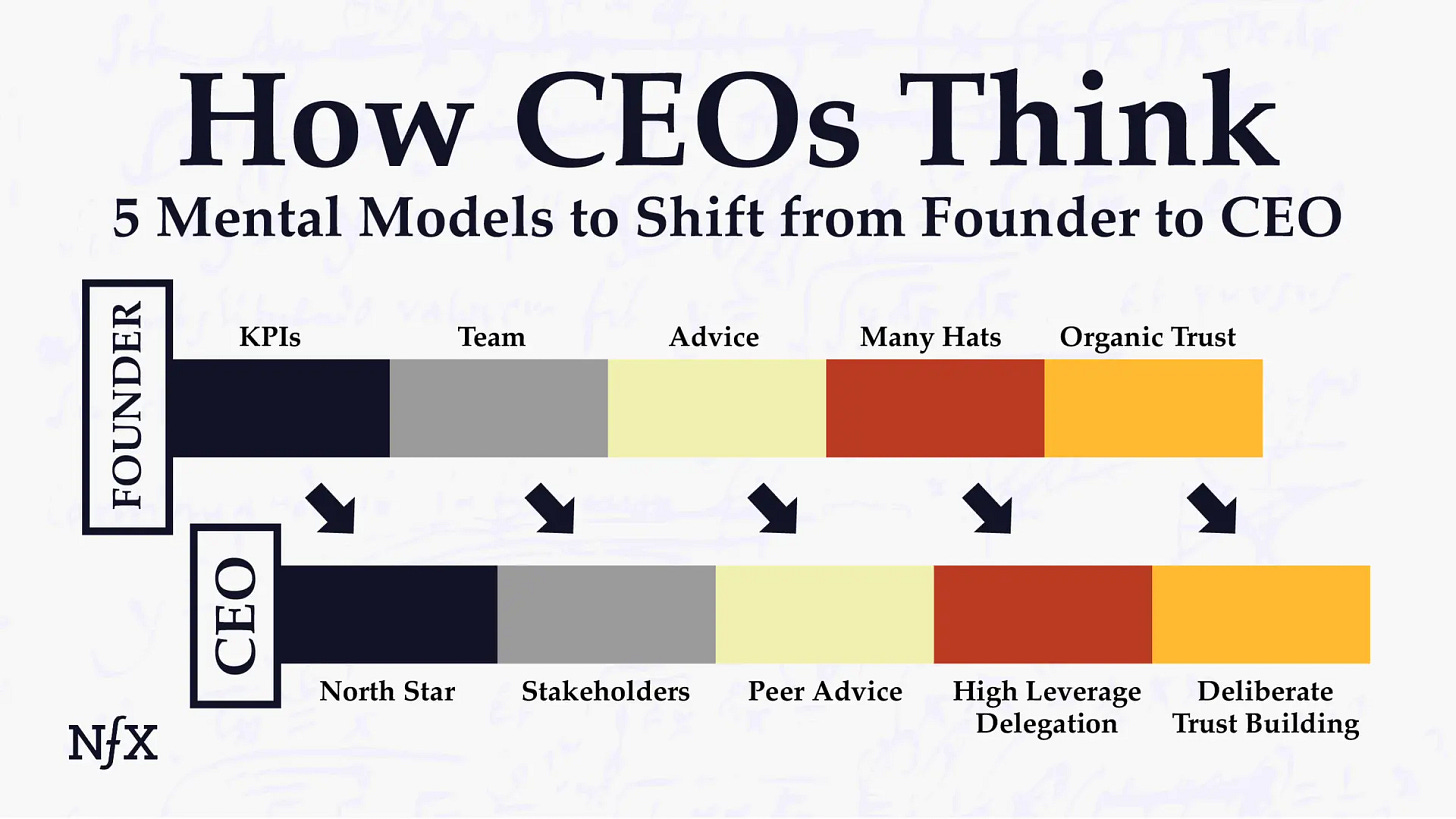

2. From Founder to CEO: The Mindset Shift Framework.

In my startup investing journey, I’ve met countless founders building great products — sharp, fast, and obsessed with solving real problems. But as the company started to grow, many hit the same invisible wall. It’s no longer just about product-market fit. It’s about scaling yourself as a leader. That leap from founder mode to CEO mode is where many stall.

The team at NFX shared one of the best frameworks I’ve seen to make that shift. If you’re building something today — whether you’re a solo founder or already at 50+ headcount — these five mental shifts are worth studying:

1. Pick a Clear North Star

The best leaders simplify. When chaos hits — and it will — your job is to keep the company pointed in one direction. That means choosing one clear objective that guides every decision: product, hiring, funding, messaging.

This isn’t just about metrics. It’s about who you're serving and why. Without this, every new opportunity becomes a distraction.

Ask yourself:

What is the one thing we must win at?

Who benefits the most if we win?

Then orient everything around that answer. Alignment follows clarity.

2. Understand All Your Constituents

At first, it’s just your team. Then come customers, early users, investors, partners, and press — each with their own priorities.

Great CEOs don’t just acknowledge this — they operationalize it. They build internal scorecards that identify:

Who are our key stakeholders?

What does success look like for each group?

Where do their needs align or conflict?

That clarity helps you navigate trade-offs with confidence and reduces internal friction as you scale.

3. Actively Seek Advice & Feedback

Speed without reflection is dangerous. The smartest founders treat themselves like a product — always in beta, always learning.

The highest-leverage learning comes from:

Peers solving similar problems

Mentors who’ve been through the journey

Candid feedback from your own team

Don’t wait for feedback. Design for it:

Anonymous team surveys

360 reviews

Founder groups or therapist check-ins

Regular reflection cycles

The faster you learn, the faster your company evolves.

4. Learn to Leverage Your Time & Delegate

Founders often equate control with progress. But as a company grows, your job becomes creating clarity and getting out of the way.

The goal:

Focus on high-leverage areas (hiring, culture, vision, capital)

Build trust systems so leaders can own their areas

Avoid becoming the bottleneck

Still want to stay hands-on? Keep only what you’re world-class at. Delegate the rest.

Your time is your most valuable asset — treat it like gold.

5. Build Trust Through Authenticity

Leadership at scale isn’t about charisma. It’s about trust. And trust comes from being real, being consistent, and doing what you say.

As you grow, most people in the company won’t know you directly. That means:

Authentic communication matters more than polished words

Transparency builds long-term loyalty

Small integrity slips get magnified fast

You don’t need to pretend to be “the CEO type.” You need to be yourself, clearly and confidently.

Founders who scale into CEOs don’t do it by chance. They rewire how they think. They learn to focus, to let go, to build trust, and to listen. NFX’s mental models provide a compass for that journey.

If you’re building right now, bookmark this. Revisit it often. At the heart of every enduring company is a founder who chose to grow.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

Frank Rotman, co-founder of QED Investors, will step into a partner emeritus role by January 2026 to start building his own ventures — with his first startup aimed at the music industry.

Musk’s AI startup xAI has acquired his social media platform X (formerly Twitter) in an all-stock deal, valuing xAI at $80 billion and X at $33 billion (after subtracting $12 billion in debt).

OpenAI’s new GPT-4o image generator enables ChatGPT to depict public figures, racial features, and even hateful symbols in educational or neutral contexts — a major shift from its previous moderation stance.

Google is discontinuing the popular Nest Protect smoke and carbon monoxide detector, which has been a common fixture in homes, and the less popular.

Apple is reportedly developing a revamped Health app with a built-in AI coach, aiming to provide personalized health and wellness advice using data from users' medical devices.

Former Intel CEO Pat Gelsinger has joined deep tech VC firm Playground Global as a general partner.

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Analyst - MongoDB Venture | USA - Apply Here

Associate – Deep-Tech & Defense Investments - Indusbridge Capital | India - Apply Here

Fund Controller - white star capital - Apply Here'

Program & Events Manager - Plug and Play Tech Center | USA - Apply Here

Summer Venture Capital Associate - Acumen - Apply Here

Venture Scout - First momentum Venture | Remote - Apply Here

Principal - Venture Capital - Artha Group | India - Apply Here

Investment Principal -M12 | USA - Apply Here

Investment Analyst - Node VC - Apply Here

Investor Relations -Kotak Mahindra | India - Apply Here

Associate Director - Operations -Upaya Social Venture | India - Apply Here

Junior Partner - Outlander VC | USA - Apply Here'

Investment Associate - Galvanize Group | USA - Apply Here

Principal - Stepstone Group | USA - Apply Here

Deal Sourcing Manager - Tracxn | India - Apply Here

Finance Associate - Thomvest | USA - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator