How to build an investor CRM (with a template) | This VC turns “dead” markets into billion-dollar bets with this strategy. | VC Jobs.

The simplest test for a $10 billion idea: Delta-4 & More.

👋 Hey, Sahil here — Welcome back to Venture Curator, where we explore how top investors think, how real founders build, and the strategies shaping tomorrow’s companies.

VENTURE CURATORS’ FINDING

📬 My Favourite Finds

Media Posts:

Sam Altman’s startup playbook. (Link)

Breakdown of different paths to Product-Market Fit. (Link)

Best fund admin for emerging VC. (Link)

SEO cheat codes every startup founder should know. (Link)

The best ways to get users organically. (Link)

Marketing Max is on every website’s non-negotiable. (Link)

What investors ask and how to answer: A practical Q&A prep kit for founders. (Link)

Reports/Articles:

The future of software business models over the next decade. (Link)

Free Software & the future of Software business models. (Link)

Cruz Gamboa on why 80% of US startups fail. (Link)

Inside Duolingo's growth engine. (Link)

Who is talking to my users? by Tomasz Tunguz. (Link)

40% of all VC deployed this year has gone to 10 startups. (Link)

FROM OUR PARTNER - GUMMYSEARCH

🤝 Find Startup Opportunities Before Everyone Else.

GummySearch scans Reddit to surface real problems, product requests, and market sentiment, straight from your target audience.

Whether you’re hunting your next startup idea, validating a product, or finding leads, you’ll get the insight edge founders and investors crave.

🤝 PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 DEEP DIVE

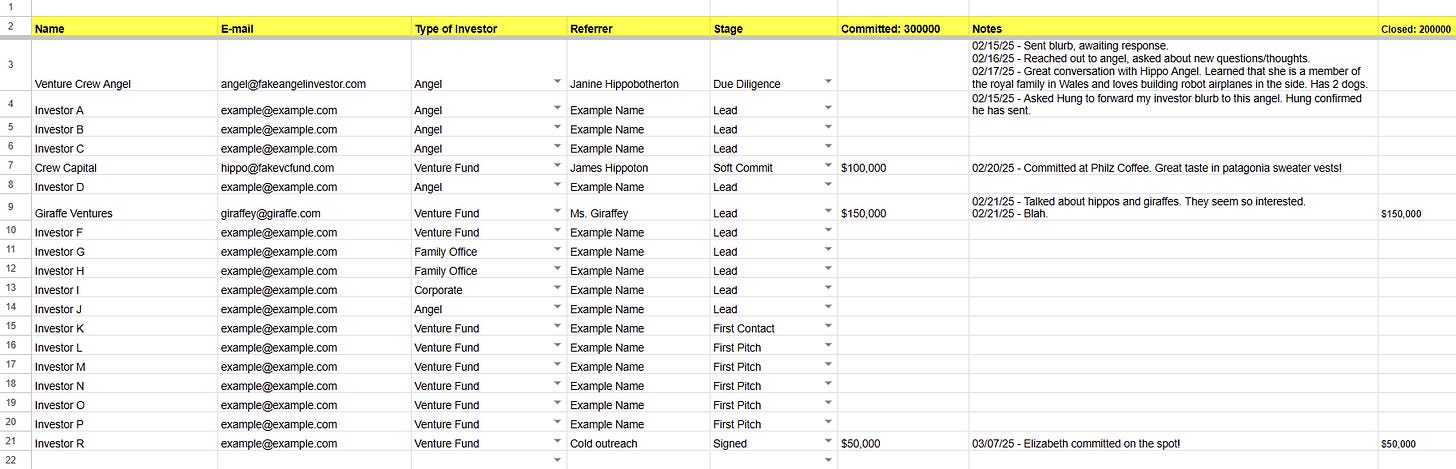

How to Build an Investor CRM (With a Template).

Our controversial take: A great fundraising process is only 20% about pitching. The other 80% is all about organisation.

Yep, you heard that right.

Your pitch, the thing you’ve spent weeks refining and rehearsing, is only a small part of successful fundraising.

“What the heck do y’all mean by the organisation?” - you, probably

If you’re talking to dozens (or even hundreds) of investors, keeping track of who they are, what stage they’re at, and what you last discussed is impossible to do from memory. That’s where an investor CRM (Customer Relationship Management) system comes in.

Some founders use tools like HubSpot, Salesforce, or Pipedrive, but you don’t need fancy software. A simple Google Sheet can do the job. What matters is that it helps you track key details, follow-ups, and next steps, so no potential investor falls through the cracks.

Walking through an investor CRM

This spreadsheet may look like a lot at first. But a CRM is way simpler than you might think.

Basic contact info

To kick things off, add the names and email addresses of the investors that you already know.

Then add the names and email addresses of prospective investors that you would like to build stronger relationships with.

Type of Investor

In the next column, label what type of investor they are (angel investor, venture fund, etc). This will help you tailor your messaging accordingly.

Referrer

The referrer is the person who introduced you to the investor listed in your CRM.

So if ABC sent an email to introduce me to an investor, ABC is the referrer in this example?

This is crucial because your team can see where your leads are coming from. Plus if the introduction is a mutually beneficial one, we get a chance to reach out to the referrer again to say thanks.

Add their names in the next column and let’s keep moving.

Stage

What stage are they at in terms of considering an investment in your company?

These stages can be customized to your situation… but for simplicity, let’s define the stages that most funds used during our fundraising process.

Lead – When someone offers to refer somebody new to you but you haven’t made contact yet.

First Contact – This stage is the first time you both have been able to officially engage. Someone might have sent an email introduction and they may have reciprocated back saying, “Yes, let’s meet!”

First Pitch – This is the first meeting you have with them to pitch your company.

Due Diligence – This comes after the pitch when they’re considering investing. It’s normal for investors to ask to see more materials to help them make a decision.

Soft Commit – This is when they are interested in investing and have given you a dollar amount they want to put towards your company. This is purely a verbal commitment, nothing official, but a positive sign to move them into the next stage.

Signed – This is when the confetti drops from the ceiling because you have received a full commitment from this investor. Whooot!!! 🎊

Rejected and Ghosted – These are the stages where they reject your pitch or never return your messages. But remember, it’s not over yet. There’s still an opportunity to maintain the relationship or even invite them to your biweekly/monthly investors update. They may convert into investors down the road.

Committed

If they have given you a verbal commitment of a certain amount they want to invest, include this number in the Committed column.

Above, you can see three investors committing a combined total of $300,000 as an example.

Notes

The Notes section is the most critical part of the CRM.

It summarizes what you talked about during your calls or emails. Add as many notes as you can along with the dates of each interaction.

These notes are crucial because fundraising is a team sport.

Tracking everything helps your team understand the context of the relationship. So when they interact with this person, they know where each investor is in the process, and can pick up right where their teammate left off.

Closed and Next Contact

Next, we have a Closed column to show how much money you have closed.

This is your time to celebrate your hard work being paid off. Launch the confetti. Take out a bottle of champagne. You deserve it.

Ok, time to get back to work. The last part of the CRM is a Next Contact column. This is a reminder for yourself on when you should reach out to this person again.

So if you're still in the due diligence or soft commit phases, set a clear date here on when you should follow up.

If people have committed, we recommend getting aggressive and following up every two or three days. This shows that you’re committed to making this work and are certain you have given them all the materials they need to feel unblocked on making a decision.

For the people who have rejected or ghosted you, you should keep reaching out.

Remember a rejection is never truly a rejection until you get a hard “no”.

So your investor CRM is a critical tool for successful fundraising.

All your contacts are in one place with detailed information

All the interactions your team has had with each person are tracked so everyone is on the same page

It tracks where everyone is in the fundraising process and gives reminders on when to follow up.

Start your investor CRM as soon as possible. Like, now.

There are paid CRM tools out there to track opens and clicks on emails. But to keep things simple, we recommend starting with a basic spreadsheet.

Here’s a template you can use for your fundraising journey.

Also, if you are looking for a verified investor contact database, fundraising guide & cap table guide, check out here to access all resources.

TOOL FOR FOUNDERS

📑 Legal docs every founder needs, without big legal fees.

Most valuation guides online are useless, no investor insight, no real frameworks.

Setting up your startup legally can get expensive fast. This Startup Legal Document Pack gives you everything you need to incorporate, raise capital, and protect your startup, all in one place.

Built with startup lawyers and VC teams, the templates are clean, editable, and investor-approved.

What’s inside:

C-Corp and LLC formation docs

Founder & equity agreements

SAFE notes, term sheets, and cap tables

Employment, IP, and advisor agreements

NDAs, privacy policies, and service contracts

Just everything you need to launch with confidence.

📄 QUICK WIN

How one VC turns “dead” markets into billion-dollar bets: Narrative Violations Strategy.

I’ve been exploring Bedrock’s investment strategy lately, and their approach is unlike that of most Silicon Valley firms.

Instead of chasing the “next big category” that everyone is talking about, they actively hunt for what they call narrative violations, companies that don’t fit the market’s current story.

Why? Because in venture capital, popular narratives create overcrowded markets:

They attract too much capital

They spawn dozens of clones.

They create hype cycles where early returns are gone before most can get in

A narrative violation is the opposite. It’s when the consensus says this won’t work, this market is dead, or this company will get crushed.

Examples Bedrock highlights:

2010: “Cleantech is dead” → Tesla

2011: “Social gaming is a horrible business” → Roblox

2012: “Dating apps are fads” → Tinder

2014: “Uber will crush all competitors” → Lyft

2016: “Consumer is dead” → Canva

2020: “AI has been overhyped for a decade” → OpenAI

When Bedrock invested in Lyft in 2012, the prevailing belief was that Uber’s ruthlessness would wipe them out.

When they backed Rippling, the narrative was that HR tech was saturated.

When they invested in Vercel, open-source wasn’t seen as enterprise-friendly.

Geoff Lewis, Bedrock’s founder, built the firm on this principle in 2018 with $127M AUM. Today, they manage around $2 billion and have backed over 50 companies, including OpenAI, Bitcoin, and Flock Safety, many of which were at points when the consensus was betting against them.

Why this works:

Immunity from clone wars – When your business isn’t “hot,” no one’s rushing to copy it.

Systematic underestimation – Investors and competitors overlook you, giving you more time to build.

Longer runways – Less capital chasing you means more breathing room.

Bedrock calls out a key danger in venture: the narrative mirage, when investors see a small glimmer of success in a new category and immediately inflate it into a “once-in-a-lifetime opportunity.”

Electric scooter sharing, daily deals, chatbots, all examples where billions poured in, most companies died, and only one or two players survived.

So, Narratives can be inspiring, but they can also become shortcuts for thinking. In venture, those shortcuts often mean missing the real breakthroughs.

If you’re a founder, this should matter to you too.

Building something that violates the popular narrative might feel lonely at first, no hype, no easy press, no VC buzz. But that’s exactly why you can win. By the time the story catches up, you’re already too far ahead.

Don’t just follow the story everyone’s telling. Look for the story no one’s telling yet.

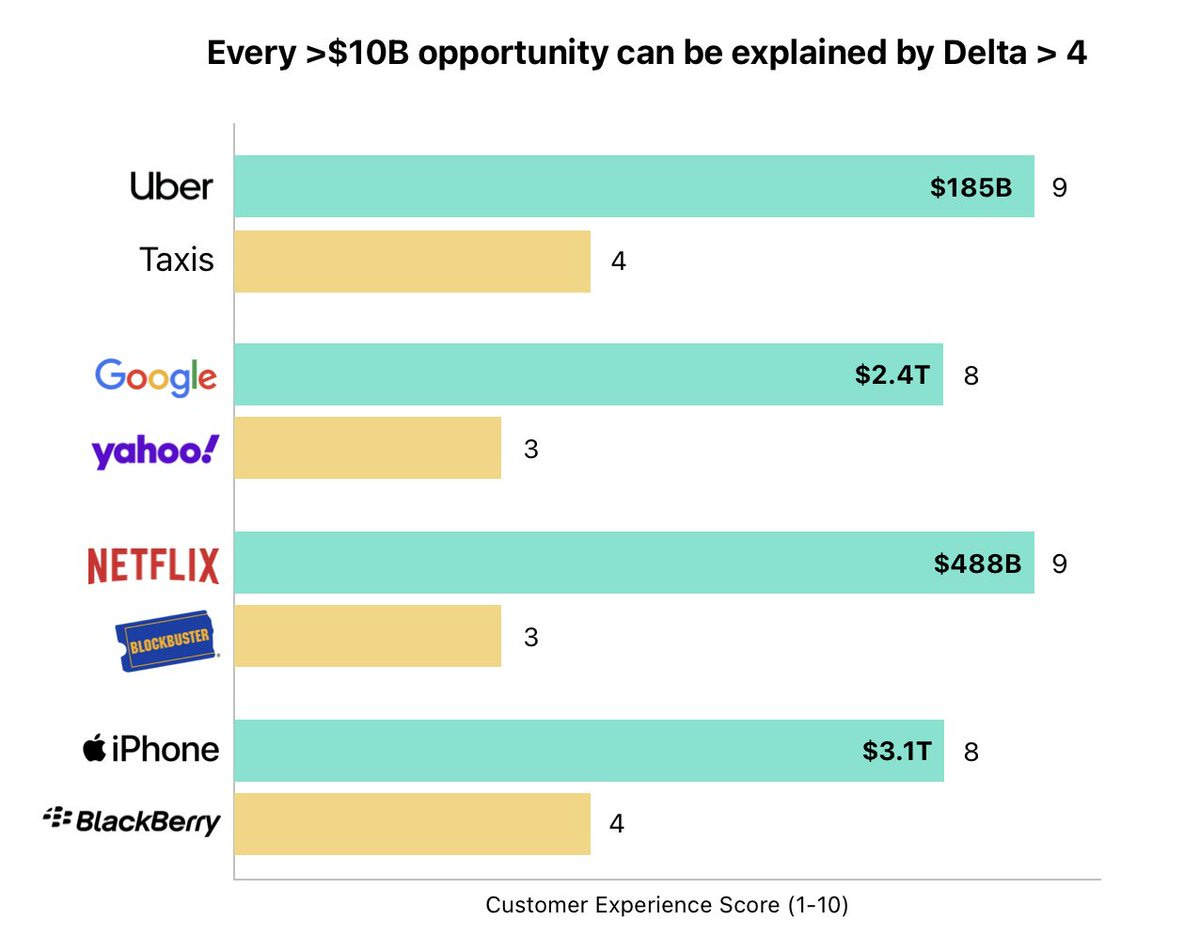

The simplest test for a $10 billion idea: Delta-4.

Most products fail because they’re only slightly better than what exists. The upgrade feels nice, but not enough to make people switch.

A Delta-4 product is different; it’s so much better that once people try it, they never go back.

The “4” means that when the same group of users rates the old way and your way (1-10 scale), your product scores at least 4 points higher.

Less than that, and you’ve built an improvement, not a behaviour-shifting product.

How to build one:

Find a universally hated experience: Look for something people complain about but have accepted as “just how it is.”

Before Uber, getting a taxi meant finding one on the street, hoping it stopped, negotiating a price, and paying in cash.

Before Google Search, finding information meant browsing directories, clicking through slow pages, and often coming up empty.

List every pain point: Don’t stop at the obvious. Map the whole journey and capture all friction, time waste, uncertainty, hidden fees, manual steps, and trust issues.

Uber didn’t just solve “finding a ride.” They solved: locating a driver, knowing the fare upfront, tracking the route, paying without cash, and getting a receipt instantly.

Google didn’t just index the web. It made results instant, ranked by relevance, and accurate enough that you rarely clicked past the first page.

Reimagine, don’t polish

Small tweaks don’t change behaviour. The biggest winners remove the core friction entirely.Netflix didn’t make video rental stores faster: it removed the store.

The iPhone didn’t add a better keyboard: it removed it, creating a touch interface.

Measure your Delta before scaling

Survey 100 users of the old way: “Rate your current experience from 1–10.” Build your MVP, then have the same 100 rate your product. If the gap is +4 or more, you’ve hit Delta-4. If not, remove more friction.Push past “good enough”

Once you’ve reached Delta-4, ask: “What would the 7-star version look like?”Uber could add “driver greets you by name, with your favourite coffee in the cupholder.”

Google could anticipate your query and show the exact answer before you finish typing.

Why this works: A true Delta-4 product does three things:

Creates irreversible behaviour: once switched, users refuse to go back

Inspires loyalty: if you’re down, they’ll wait rather than revert

Drives organic word-of-mouth: people can’t resist telling others

When you combine friction removal, instant value, and moments of delight, you build a product that spreads without ads and is hard to disrupt.

To learn more about Delta-4, highly recommend checking these resources:

Kunal Shah's Delta 4 theory of successful startups. (Link)

Every $10B opportunity can be explained by a simple heuristic: Delta-4 customer experience. (Link)

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

Manager, Venture Investing - Capital One Venture | USA - Apply Here

Chief of Staff - Grey Line Partner | USA - Apply Here

Capital Formation Associate - B Capital Group | USA - Apply Here

Investment Principal - Cota Capital | USA - Apply Here

Investment Fellow - Indian Fund | India - Apply Here

Associate - Baird Capital | USA - Apply Here

Venture Analyst - AC Venture | India - Apply Here

Investment Analyst - Miras Investment | Dubai - Apply Here

2026 Venture Capital Summer Associate - Stepstone Group | USA - Apply Here

Ventures Associate - Point 72 Venture | USA - Apply Here

Marketing & Communications Lead - Endiya Partners | India - Apply Here

Associate - Mighty Capital | USA - Apply Here

Associate - Temasek | USA - Apply Here

Investment Analyst - Beas Capital | India - Apply Here

Investor Relations Analyst - Techstars | USA - Apply Here

Head of Platform - Pledge Venture | UK - Apply Here

🤝 Partnership With Us

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator

Hey Sahil, Thanks for sharing such a detailed and insightful post! The idea of “narrative violations” and finding Delta-4 products is really interesting. I love how you’re looking at things from a different angle. The investor CRM template is super useful too; I can see how it’ll help stay on top of everything during fundraising.