How Successful Startups Solved the Chicken and Egg Problem: A Case Study of Tinder, Uber and Airbnb! | VC Jobs

Product Discovery Framework By YC Backed Startup Founder & 4 Scenarios of Startup Timing.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: The Chicken and Egg Problem: Tinder, Airbnb & Uber Case Study.

Quick Dive:

Product Discovery Framework By YC Backed Startup Founder.

Is now the right time?: The 4 Scenarios of Startup Timing.

Chris Dixon On Good Startup Ideas & Where To Find Them.

Major News: China Raises $48 Billion For Semiconductor Fund, Musk's AI Startup Raised $6 Billion From a16z, Lenovo Raising $2 Billion Via Convertible Bonds & Former OpenAI Researchers Joining Its Rival Anthropic.

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH DRAPER UNIVERSITY

Build your Web3 startup on Stellar & receive $20K in grant funding.

Draper University has partnered with the Stellar Development Foundation to grow 30 Web3 startups on Stellar.

We are the #1 early-stage backers of decentralization and Web3. Our alumni include Lemon Cash, Highstreet, QTUM and more.

Join our 3-week Silicon Valley residency, the Stellar Astro Hacker House. Learn how we support Web3 startups to fundraise, hire elite talent, and grow their user base to the moon.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

The Chicken and Egg Problem: Tinder, Airbnb & Uber Case Study

The Chicken and Egg problem it's a problem of marketplace-type businesses.

When you are launching a two-sided platform, you need supply and demand. And it creates a big problem for founders, putting a high barrier to entry. You need to find not just users, but two different types of users (which is x2 times harder).

Users on one side of the business model find the platform useful only if the other side also exists.

For example, people buy video game consoles only if there are games they can play. Game developers make games for a console only if there are enough people who use it.

Image Source: UX Planet

A lot of founders have this question- How to solve The Chicken and Egg problem? So We have reviewed several very popular marketplaces, that everybody knows, to show how they successfully addressed this issue.

Tinder. 15,000 first users

Everybody heard about Tinder. Today (in 2024) Tinder facilitates over 13 million matches daily. But how it was in the first days of service? How did they overcome the nightmare of all marketplaces? Here is an interesting story behind it.

Whitney Wolfe, Co-Founder of Tinder, packed her suitcase and set off to travel around the country.

In each city, she made a presentation to the women's communities, motivating them to register in the app, and explaining how it's cool and useful.

Then she gave presentations to male communities, showing the app that is full of those local girls, who already registered.

When Whitney returned from a trip, 15,000 first users already used the application.

“Her pitch was pretty genius. She would go to chapters of her sorority, do her presentation, and have all the girls at the meetings install the app. Then she’d go to the corresponding brother fraternity—they’d open the app and see all these cute girls they knew...”

In 2014 Whitney left Tinder and founded Bumble (the biggest competitor of Tinder).

Dating? Definitely, this girl knows how to make money on it.

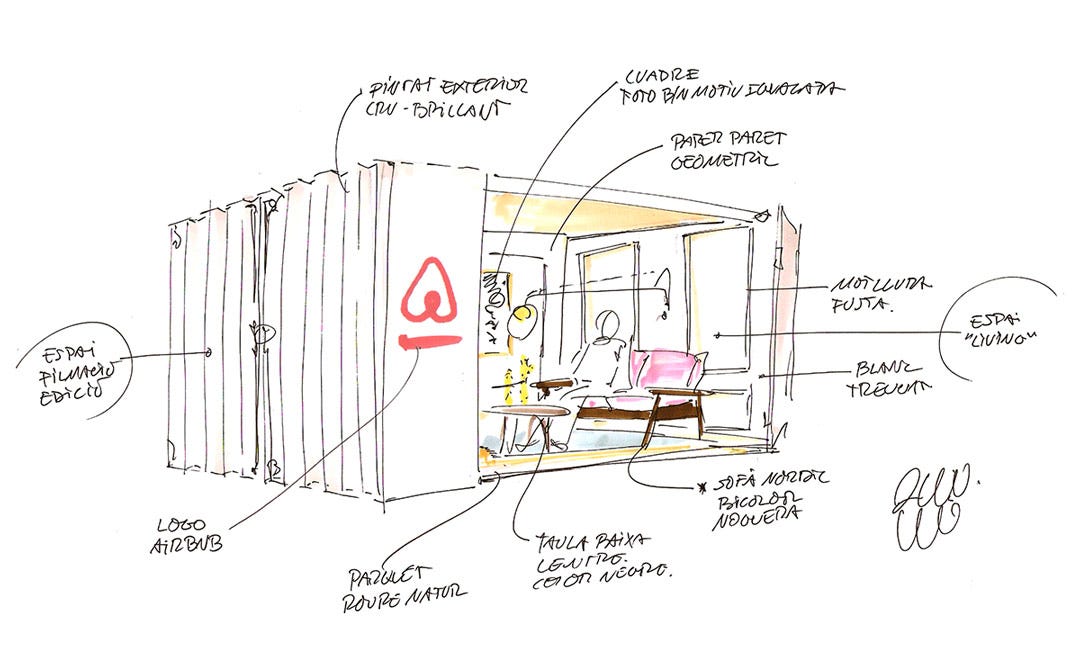

Airbnb. 6,000 first users

Today Airbnb is a huge company with a $95B valuation. But in 2008 they were just starting with an idea of air beds and breakfasts for strangers. And like all marketplaces, they faced The Chicken and Egg problem:

Landlords are not interested in adding their apartments to the service without visitors.

Tenants have nothing to rent on the platform.

How did Airbnb get out of the situation? (it’s already a legendary example)

They created a script that scanned all landlord’s offers on Craigslist and collected their emails.

Then the same script sent a letter on behalf of a pretty young girl who "liked the apartment so much" and asked the owner to add his apartment to Airbnb.

So Airbnb quickly acquired 60,000 first landlords, which solved The Chicken and Egg problem.

What’s more, they made it easy for users to post listings on Craigslist through Airbnb with one click.

Later Craigslist closed this backdoor for collecting emails, but the main idea in the approach. If you need first users, you can simply copy them from somewhere. Besides, such holes appear regularly at many services. You just need to check such opportunities.

Uber

Uber’s story began in Paris in 2008. Two friends, Travis Kalanick and Garrett Camp, were attending the LeWeb, an annual tech conference the Economist describes as “where revolutionaries gather to plot the future".

Rumour has it that the concept for Uber was born one winter night during the conference when the pair was unable to get a cab. Initially, the idea was for a timeshare limo service that could be ordered via an app. After the conference, the entrepreneurs went their separate ways, but when Camp returned to San Francisco, he continued to be fixated on the idea and bought the domain name UberCab.com.

To get their first drivers, Travis cold-called black car drivers and offered to pay them an hourly rate while they tried out the platform. 3 of the 10 drivers that he called, agreed to give it a try.

Then, to incentivize passengers, they offered free rides at local events in the tech-savvy San Francisco community and worked hard to make each experience the best it could be. According to Kalanick, word of mouth was the biggest driver of sales and Uber spent almost nothing on traditional marketing.

“I’m talking old school word of mouth, you know at the water cooler in the office, at a restaurant when you’re paying the bill, at a party with friends — ‘Who’s Ubering home?’ 95% of all our riders have heard about Uber from other Uber riders.”

— Travis Kalanick

“When someone sees the ease of use, the fact that they press a button on their phone and in under 5 minutes a car appears, they inevitably become a brand advocate.”

Entering new markets.

Since Uber’s main competition was taxicab companies, the startup researched which cities had the biggest discrepancy between supply and demand for taxis. They then launched during times when that demand was likely to be the highest, for example during the holidays when people tend to stay out late partying. It also ran promotions during large concerts or sporting events, when big crowds of people all needed cabs at the same time, and an individual might be more likely to take a chance on an unfamiliar company named Uber.

In that way, the company acquired a large group of customers in one swoop. “First, they figured out how to get a bunch of customers all in one night, when the demand was high. Then, they made sure this first group of users had a great experience and brought in the next wave of customers via word-of-mouth,” says Teixeira. The company banked on the fact that once users realized how easy it was, it was only a matter of time before they started using it to go to work, then shopping for groceries, and so on.

Launching in situations of high demand and low supply also helps startups acquire the right type of customers—those early adopters who might be more forgiving of a company while it works out the kinks.

But what is the secret?

Besides the fact that you need first users (and you see that startups use different hacks how to get these users on the board, creativity should help you overcome this problem too), you have to satisfy these users with your service.

It can be quality, speed, usability, great support, etc. A long list of possible options. But the main idea - make your customers really happy.

Some founders say that getting your idea off the ground “it's a numbers game”. But it’s not. It’s a way how you treat your first customers. Do they stay happy by sharing your link with all their friends, or writing a 1-star review in App Store?

Paul Graham, Co-Founder of Y Combinator, wrote a famous essay

“Do things that don’t scale” where he described all the main things for early-stage startups. He said:

“All you need from a launch is some initial core of users. How well you’re doing a few months later will depend more on how happy you made those users than how many there were of them.”

QUICK DIVES

1. Product Discovery Framework By YC Backed Startup Founder

Chris posted this framework in January of 2022.

Since then, he’s founded a YC-backed startup that makes it incredibly simple and easy to send transactional emails and sequences for any company, with a revenue growth chart that looks like this:

Here’s the framework:

Pick a customer you enjoy talking to

Talk to 15 of them to be sure you do (and can get in touch with them)

Ask them to tell you a problem that’s more important than an 8 on a scale of 1-10

If that problem is generalizable, make the smallest MVP you can (no code required, if possible)

Ask the 15 people if they’d pay for what you built, or would pay if you prioritized a certain feature they ask for

Repeat, with 50 new people. If the feature requests you’re getting are too varied, you may be solving the wrong problem.

Super practical and simple, but true! If you can’t find people to pay for your product, you likely don’t have a product that can turn into a business. Click into the thread to read it in full.

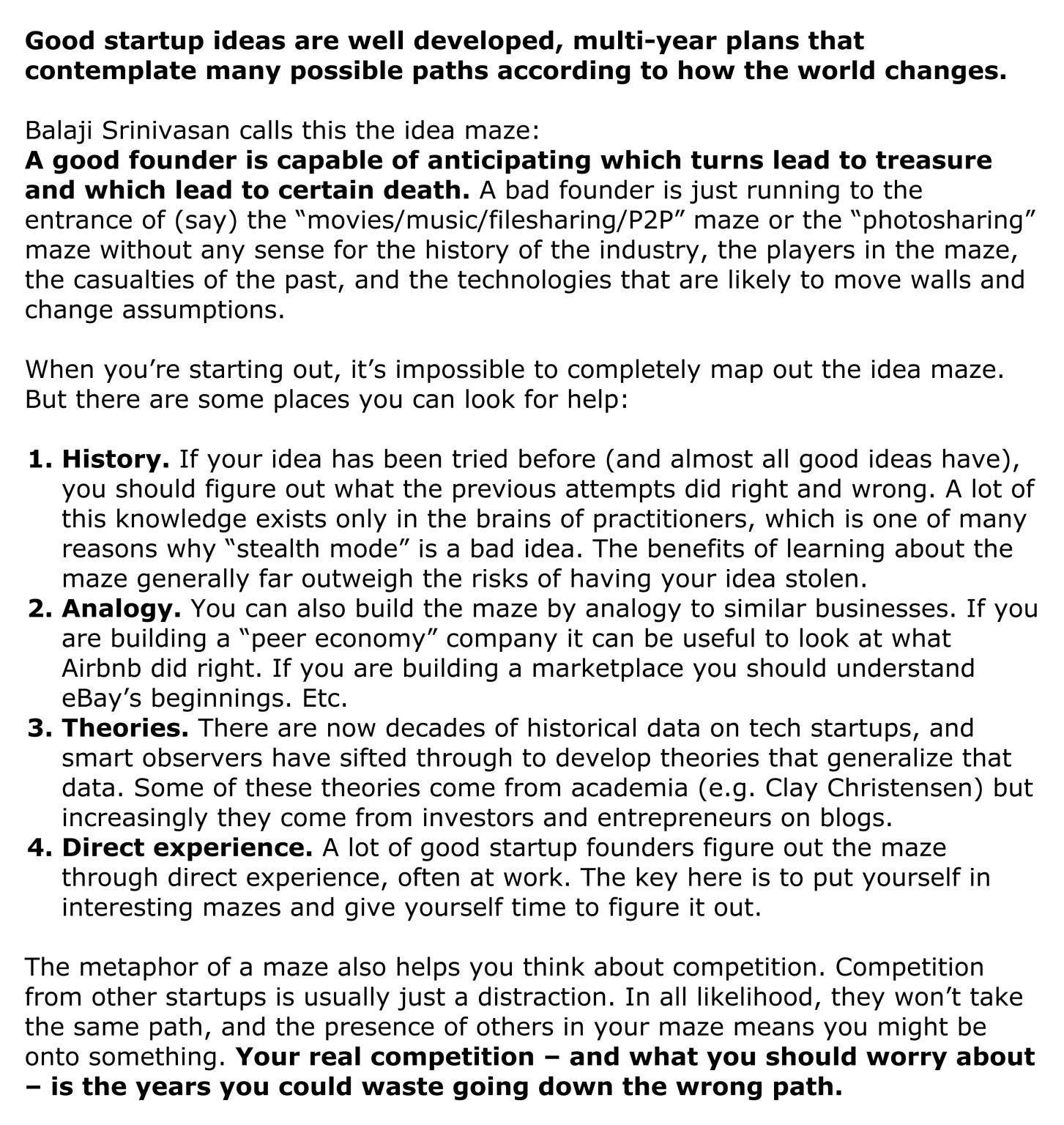

2. Chris Dixon On Good Startup Ideas & Where To Find Them

People often think that startups succeed just by coming up with a great idea for a product. They imagine that once an entrepreneur has that "aha!" moment, success is guaranteed. But this view ignores the years of hard work entrepreneurs put in, and the fact that most startups change a lot over time.

To counter this mistaken belief, many in the startup world say things like "execution is everything" and "ideas don't matter."

But the truth is, ideas do matter - just not in the narrow way most people think of startup ideas. While a brilliant idea alone won't lead to success, good ideas are important starting points.

The real challenge is in taking that initial idea and tirelessly working to turn it into reality while being flexible enough to adapt and pivot the idea as needed.

The most successful startups balance having a compelling vision with the ability to refine and transform that vision based on market needs. Chris Dixon shared -

3. Is now the right time?: The 4 Scenarios of Startup Timing.

What makes a startup successful - Is it an idea, team, funding, business model, talent or luck? What do you think? But wait one thing is missing here & that’s “Timing”! You might be thinking if I have a great idea with a talented team and a strong unit economics business model no one can stop me! But that’s where most of the startup founder failed to determine the timing phase of their startup.

“90% of startups failed and one reason is just bad timing. The founder just failed to determine the timing phase of their startup. So How can you determine?

If you want to start the next $100M revenue, $1B+ valuation company, you have to find a market that is small enough but growing quickly.

These are four types of markets you can find yourself in as a startup:

Your startup’s fate depends on if and when there is growth in the market you’re addressing.

Let’s look at each one and break them down.

Small Market, Not Growing

If you find yourself building a small market with no path to growth, your efforts will be futile. There are few startups in this bucket, as they tend to be about selling or servicing old technologies: Don’t start a company selling or servicing fax machines, copiers, landline phones, or photo film.

There’s no story to get to growth, and it will be impossible to find venture dollars.

Large Market, Growth In The Past

Imagine starting a new smartphone manufacturer today. You’d be battling incumbents all day, and just to get your product on shelves, you’d have to invest tremendous amounts of money into building table stakes features. The larger incumbents can use their existing revenue streams to fund development, while you’ll have to give away your company piecemeal to VCs.

These are markets best left to large companies with more resources, as they can quickly deploy large teams and lots of capital to address whatever opportunity they see.

But even they might be too late if the market has already made up its mind: Just think about how Microsoft failed with Windows Mobile.

There is one special case here: Elad Gil calls them “crowded uncrowded markets”. There are markets that are seemingly “over” but still have opportunities for new and differentiated entrants. For example, this was the case for social networks in 2010:

When Pinterest, Instagram, and Snapchat came around in 2010 and 2011, respectively, it seemed like the social space had been won by Facebook and Twitter.

But all three enabled new use cases: Pinning articles from the web, sharing filtered photos, and disappearing messages, features that made sense on their own and weren’t catered to by the incumbents.

In my opinion, all three of these players are just barely squeezed by, but it validates that investing in a market like this sometimes does work.

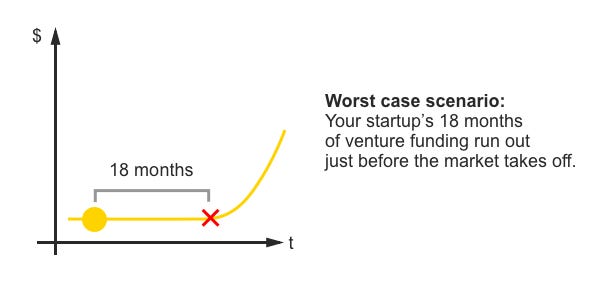

Small Market, Too Early

You found a brilliant startup idea, but you found it just a bit too early for your venture funding to last long enough for the market to take off. Your startup didn’t take hold in time and your startup crashed and burned.

The annals of startup history are littered with stories like this:

WebVan burned through almost $400M in venture funding in the late 1990s only to crash and burn, yet ordering groceries online is commonplace today.

WebTV pioneered Internet-connected TVs in the 1990s but was a failure as a product — meanwhile today it’s more common for a TV to be Internet-connected than not.

Dodgeball pioneered social location sharing via text messages as early as 2003. The company was acquired and the product was later shut down. Checking into locations is now common behaviour on Facebook and similar platforms.

Being early is the same as being wrong:

Venture rounds are raised with an 18-month time horizon, and if the market you’re addressing doesn’t grow during that time, you have to fold.

If you’re an established entrepreneur with a strong track record, you can win these markets, as you’ll be able to raise more money and give yourself a longer time horizon. For example, Elon Musk, coming off of PayPal’s success relied on boatloads of venture funding for Tesla and SpaceX — companies that went years before finding product-market fit.

To avoid the fate of the companies above, recommend applying what is called the “Sam Altman test” of distinguishing fake trends from real trends -

"Ask yourself whether enthusiasts of your technology actually use it all day. For example, VR is cool, but even enthusiasts of the technology don’t use it on a daily basis.”

Small Market, Growing Quickly

This is where you want your startup to be. The ideal scenario is that you arrive just in time. Large incumbents are still paralyzed: A forward-looking executive may have spotted an opportunity, but it’s too small to make a serious investment, which at large companies often occurs in increments of 50 headcount, and requires getting lots of internal buy-in.

The common thread in opportunities that are of this shape is that they are powered by either a shift in user behaviour, a shift in technology, or both. Here are a few examples:

Each of these shifts enabled multiple $1B startups. But you had to be there right when they happened.

To find opportunities like this, you have to be an early adopter, try all the new products, and not be tied up with other projects just when the opportunity hits.

So Overall -

Don't waste time with small non-growing markets.

Large mature markets are extremely difficult due to incumbent advantages. Rare "crowded uncrowded" opportunities exist.

For small markets with potential future growth, raise large VC rounds and conserve spend.

Target a small rapidly growing market enabled by tech/behavior shift - fundraising, sales, and hiring will be a breeze.

(This article shared by Gabor Cselle)

Join 25000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

China has set up a new state-backed investment fund with a registered capital of 344 billion yuan ($47.5 billion) to boost the country's semiconductor industry. More Here

Lenovo Group is raising $2 billion by issuing zero-coupon convertible bonds to Saudi Arabian company Alat. More Here

Robinhood Markets launched its first-ever $1 billion share buyback plan, to be executed over two to three years starting from the third quarter. More Here

Jan Leike, a former OpenAI researcher, has joined Anthropic to lead a new "superalignment" team focused on AI safety and security. More Here

BlackRock's iShares Bitcoin Trust (IBIT) has become the world's largest fund for Bitcoin, amassing nearly $20 billion in total assets. More Here

Mistral, the French AI startup valued at $6 billion, has released Codestral, its first generative AI model for coding trained on over 80 programming languages. More Here

→ Get the most important startup funding, venture capital & tech news. Join 20,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

General Partner - R3i Capital | Singapore - Apply Here

Associate Counsel, Investments and Portfolio - 500 Global | USA - Apply Here

Associate, Primary Investments - Adam Street partner | USA - Apply Here

Head of Investor Relations - Cavalary Venture | Germany - Apply Here

Investment Analyst - Algorand Venture | Remote - Apply Here

Investment Director - Flight Fund | USA - Apply Here

Investment Analyst - Aperion Venture Partner - Apply Here

Principal - Artha Venture Fund | India - Apply Here

Analyst - Crescent Venture | UAE - Apply Here

VC Operations Intern - Antler - Apply Here

Senior Manager - Diageo India Venture | India - Apply Here

Investment Operations Associate - Keyhorse Capital | USA - Apply Here

Investment Director - E CBF | USA - Apply Here

Tech Associate - Capital | Germany - Apply Here

🧐 Some Tips To Break Into VC:

Target applying to a new VC firm To Get a Job or Internship, How?

You often hear about funds raising millions, right? Well, here’s a tip: target these funds for internships!

Why a new fund? Every new fund has a new investment thesis different from the last one. That’s why they’re always on the lookout for talent that aligns with their new investment approach. Most of the time, these funds don’t advertise job opportunities publicly. They prefer finding new people through their networks. This is your chance to shine! Email them and stand out that you are a perfect fit for their new fund.

How to find this new fund? Stay updated by reading news about the establishment of new funds. To make it easy for you, we share our newsletter with over 4000 people every morning. In the newsletter, we provide updates on new fund establishments, startup fundraising, major news in various sectors, and more.

For further details, you can check it out here: Venture Daily Digest

How to apply and stand out?

Apply: When applying, email them. Stand out: Since you're cold-emailing partners or other professionals, keep your email concise and to the point. To stand out, share a startup deal that aligns with their new fund. Include a brief investment memo outlining the opportunity.

Also, highlight your experience that could add value to their fund in your email. The most important part here is - to share the startup deal that matches their investment thesis. This shows your ability to source quality startup deals and present them with an investment thesis, explaining why they should invest in that startup. This showcases your structured thinking regarding investment decisions.

→ Looking To Break Into Venture Capital?: Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

→ Looking to hire for your VC Firm?: We have a curated list of VC enthusiasts - from leading universities, ex-founders, and operators. Get free access here.

FROM OUR PARTNERS

Build your Web3 startup on Stellar & receive $20K in grant funding with Draper University’s Stellar Program: Apply Here

The Venture Crew helps You Write, Design And Model Your Pitch Deck Into a Storytelling Book. Contact Us Today