How Startups Like Reddit Raised Funding With Just an Idea, Without Writing A Line Of Code? | VC Remote Jobs & More

"Using this framework, you can raise funding at the idea stage," VC Partner.

Today At Glance

Deep Dive: How Startups Like Reddit Raised Funding With Just an Idea, Without Writing A Line Of Code?

Featured Tweet: “Don't Fall Into the Trap Of Tarpit Ideas, It's worse than Bad Ideas!”, Y-Combinator Partner

Major News In Ecosystem: BlackRock Cuts Startup's Valuation By 95%, Investment Firm Shutdown With 30% Loss on Billion Dollar Fund & More

Must Read on Startups, Venture Capital & Technology

VC Jobs & Internships: From Scout to Partner

FROM OUR PARTNERS

🚀 Want A Byte-Sized Version of Hacker News? - Try TLDR

TLDR covers the most interesting tech, startup, and coding stories in just 5 minutes. No sports, politics, or weather.

→ Check Out TLDR Daily Updates

🤝 PARTNERSHIP WITH US!

Want to promote your startup to our community of 21,500+ entrepreneurs and investors? Fill out the form, our team will reach out to you.

🎉Get A Discount of 20% For Multiple Ads

TODAY’S DEEP DIVE

With This Framework, You Can Raise Funding With An Idea, Even Without Traction.

“Most founders think that investors will only invest if a startup has tons of traction or some million-dollar revenue, but this is not true! I have invested in around 28 startups just based on the idea with zero traction.”

These are the exact words I received from a renowned investor who has been investing for the last couple of years. He shared one of the frameworks on how investors think when the founder pitches them and what things the founder missed to include during the pitch deck presentation, which eventually caused them to miss their chance to raise funds at the idea stage.

I found that framework interesting and thought to share this with you. Also if you look at some startups like Reddit, Wafu and Zenefits had raised million dollar just based on idea without writing a single code. So what makes them differ from other startup? Let’s understand this.

“Just ask yourself a simple question: What makes a startup different from other businesses?

A start-up is a company that is designed or created to grow very quickly. So if you're not building a company that grows very very fast then you're just building a small business and there's nothing wrong with that. However, investors do not like such companies.

So - the first question you should ask yourself:

Is your company growing or more scalable?

If the answer is yes, you need to have evidence for this because early-stage investors want something that can show that your company has the potential to scale. All companies that raised successful funding at the idea stage have evidence, and this evidence is not just a ton of traction or million-dollar revenue. So what it is?

If you are raising funding, you should know the ropes and how to speak the investor's language. For this, it’s important to understand the mindset of investors. How do investors think during the pitch session?

They always think about how this startup will be worth billions of dollars and what’s the conviction for this.They think of all the reasons why this startup should succeed, and sometimes even before building the startup, investors can predict the potential path of that company.

In simple words, you have to show the investors a conviction that your company will do well. However, most of the founders failed in this approach. So how can you successfully convince investors?

Investors always think about startup ideas in three parts -

Problem: It’s the setting for a particular company that allows it to be able to grow quickly.

Solution: The experiment that the founder is running within those conditions for it to grow quickly….

Insight: Why the thing that founders trying to experiment is going to end up successful?

Let’s deep dive into each of these to understand how can you build something that aligns with these terms.

Problem

Founders should solve the problem which is -

Popular: A lot of people have the problem. You should avoid problems that there's a small number of people.

Growing: Find the problem which is growing i.e. large number of people will face problems in the coming time.

Urgent: that needs to be solved very very quickly

Expensive To Solve: if you're able to solve it then you can charge a lot of money for potential

Mandatory: problems that are mandatory right so therefore it's like ah people have this problem and they have to solve it

Frequent: over and over again (super important) - people are gonna encounter over and over and over again and often in a frequent time interval

This doesn’t mean your startup should follow all these criteria. Generally, A successful startup has one of the aspects in their problem and even some have multiple aspects. So if your company is not growing or someone is not excited about your problem that means your startup is not having any of these aspects.

But out of all these aspects, the most important thing successful startups have is Frequency. Most investors like this type of idea as it gives people a lot of opportunity to convert and grow exponentially.

So overall the idela problem (which is VC hackable) looks like this -

Millions of people have the problem.

The market is growing by 20% per year.

The problem is solvable right now, immediately.

Problem that costs a billion dollars to solve or some billion-dollar TAM

The problem is where the law has changed like the healthcare sector boomed when affordable healthcare came into act

problem which needs to be solved multiple times in a day. Example -facebook or slack.

Solution

One of the advice for the solution is - “Don’t Start Here.” What does it mean?

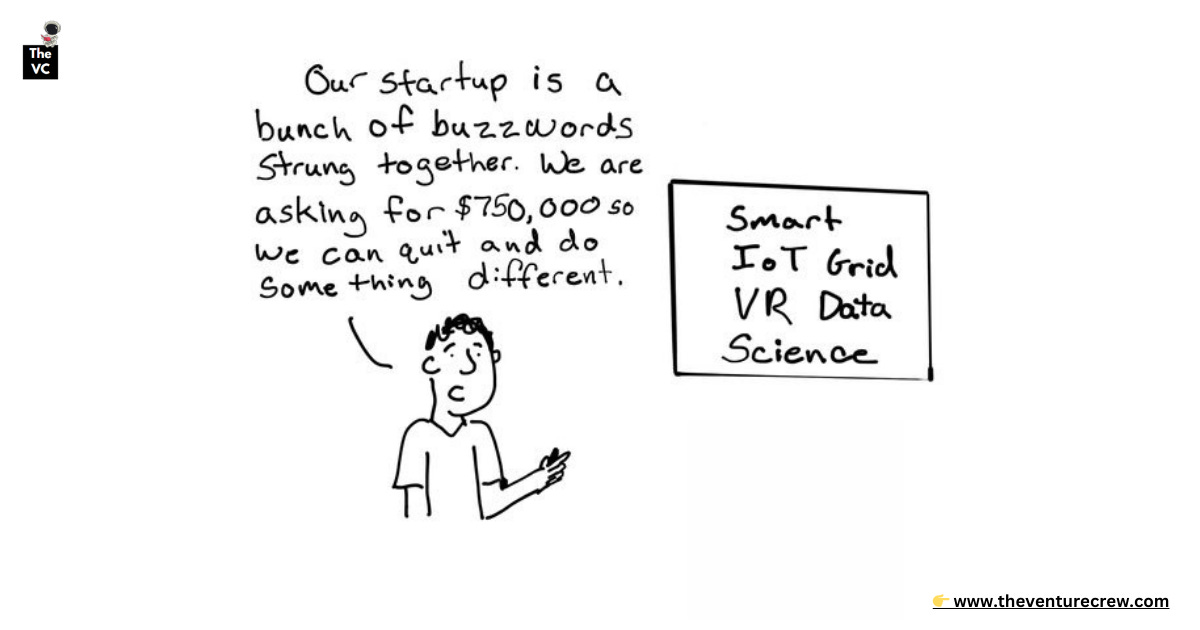

While building a product, most of the founders start with the solution first and then move toward the problem.

For example - most of the founders get excited about a particular technology like blockchain or AI and they think that they want to build something but the question is what kind of problem do they solve? Generally, they just forced themselves to shoehorn the particular tech into the problem. And investors hate this approach.

Most investors look for a startup which is SISP - Solution In Search Of A Problem.

So, Founders should aim that “I am going tosolve this problem - whatever it takes!”

If you are using Problem in search of a solution approach - your startup never going to grow efficiently and if you want your startup to grow efficiently - use the SISP approach.

The last and most important thing - Insights?

What are the reasons - why this solution is going to work out? What are those insights? What’s your unfair advantage? Investors always want to know these things from founders. So during the idea presentation founder should focus on their unfair advantage over the others and why they can win in the market.

Just remember that the unfair advantage should be related to growth.

If not then investors not going to invest in your business. Most of the founders just say that they are solving this problem without explaining why they can win the market or talking about unfair advantage. So how can you explain about your unfair advantage -

So there are five different types of unfair advantage

As a startup, You need to have at least one. If you look at successful startups you will find that they have multiple unfair advantages which lead them to achieve that successful startup tag. As a founder, just ask yourself about these five unfair advantages,

Founder Advantage: Are you among the top experts in the world in solving this problem? If not, it's a weak advantage.

Market Advantage: Is your market growing at least 20% a year? This sets a trend for automatic growth.

Product Advantage: Is your product 10x better than the competition? Clear differentiation is crucial.

Acquisition Advantage: Can your startup grow without relying on paid acquisition? Word-of-mouth is a powerful channel.

Many entrepreneurs believe that demonstrating a successful track record in paid advertising through platforms like Facebook, Twitter, or Google Ads, along with presenting detailed metrics such as Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV), can prove the sustainability of their acquisition model. However, it's crucial to understand that relying solely on paid acquisition can be risky.

If your company's growth strategy heavily depends on paid advertising, it's a vulnerable position to be in. As your popularity surges and revenues reach substantial figures, you'll inevitably attract fierce competition. Think of it as becoming a significant player in a game where newcomers constantly join, making it harder to maintain your edge.

A prime example of this scenario is evident in companies where most of their early growth was fueled by paid acquisitions. Over time, this advantage eroded as the market became saturated, leaving them with limited room for further expansion.

The key is to explore acquisition channels that require little to no financial investment. The most potent and sustainable growth often comes from word-of-mouth referrals. Cultivating a product or service that people naturally want to talk about and share with others can be a game-changer.

In the initial stages of your startup, when funds are tight, focusing on methods that don't require a significant financial outlay is not just a necessity; it's a strategic advantage.

This is why startup advisors often stress the importance of doing things that don't scale at the beginning. It's about finding creative, low-cost, or preferably, no-cost strategies to grow your business organically.

In essence, the real advantage lies in discovering avenues of growth that are inherently free. These organic methods not only conserve your resources but also pave the way for sustainable, long-term success.

Monopoly Advantage: Does your company become stronger and harder to defeat as it grows? Think network effects or winner-takes-all scenarios.

The concept of having a monopoly in the business world isn't about the traditional board game with a monocle-wearing tycoon.

It's about whether, as your company grows, it becomes increasingly challenging for competitors to defeat you. In essence, do you get stronger as you expand?

Companies with network effects in marketplaces exemplify this phenomenon. In these winner-takes-all scenarios, one company tends to dominate. Network effects mean that as my network within the platform grows, so does the strength of my company. The value of the product or service escalates in tandem with the expanding user base.

Just remember that every investor has their approach but this fundamental thing stays the same across startup investing. So if your startup satisfies these three terms on problem, solution and insights basis, no one can stop you from raising money based on an Idea….

FEATURED TWEET

Don't Fall Into the Trap Of Tarpit Ideas, It's worse than Bad Ideas!

A "Tarpit Idea" is an idea that is much more difficult to pull off than it appears and it's very difficult to pull out once in.

The thing about Tarpit Ideas is that they need to be identified before moving towards the solution space and the actual development of the products.…. Read More Here

Join 13,500+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Coatue Management is shutting down its London office after a 30% loss on its $7.6 billion fund. Read More

Google, Discord Layoffs 1000 of employees Read More

Circle Internet Financial, the issuer of the second-largest stablecoin USDC, has confidentially, aiming to go public. Read More

OpenAI has launched the GPT Store, a platform for custom chatbot apps. Read More

Indian Government Banning Eight Crypto Exchanges Including Binance Read More

→ Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? Subscribed To the Venture Daily Digest Newsletter and join 8500+ Avid Readers!

WHAT I READ THIS WEEK

Must Read on Startups & Venture Capital

Gordian Knots in Software Engineering By Tomasz Read Here (Technology)

How to Raise Money by Paul Graham? Read Here (Startups)

How to Improve Your LLM: Combine Evaluations with Analytics Read More (Technology)

What Does It Take To “Do Things That Don’t Scale” For Your Startup? Read More (Startups)

Transit Tech Lab By AVC Read Here (Technology)

Sequoia Capital “Ten Slide” Format For Founders Read More (Startups)

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

VC Intern - G2 Venture Partners | USA - Apply Here

VC Analyst - G2 Venture Partners | USA - Apply here

Investor Relations (Intern) - OneRagtime | France - Apply Here

VC Intern - We Founder Circle | India - Apply Here

Investors Relation - Techstar | USA - Apply Here

Analyst - 500 Southeast Asia | USA - Apply Here

Operation Manager - Hummingbird Venture | UK - Apply Here

Social Media & Influencer Marketing Manager - Papa Oscar Venture | Germany - Apply Here

Partner - 500 Global | USA - Apply Here

VC Fellowship - Hometeam Ventures | US - Apply Here

VC Analyst -Griffin Venture Partner | USA - Apply Here

Investment analyst - Qualgro Venture | Singapore - Apply Here

Senior Associate - Tamar Capital | UK - Apply Here

SENIOR ASSOCIATE - PORTFOLIO MANAGEMENT - GVFL limited | India - Apply Here

→ Want Daily Updates on VC Job Opportunities? Check out VC Crafter 👇

Join our 150+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

That’s It For Today! Will Meet You on Tuesday!

Happy Weekends! 🥂

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team