How big is AI spending, really? | Using ChatGPT for competitive analysis. | Measuring real efficiency in venture exits.

How many emails does it take for someone to buy a product? & B2C startup idea validation framework.

👋 Hey, Sahil here — Welcome back to Venture Curator, where we explore how top investors think, how real founders build, and the strategies shaping tomorrow’s companies.

Big idea + report of the week :

How big is AI spend, really? Bigger than you think.

If funding is up, why are female founders losing VC share?

Frameworks & insightful posts :

How to use ChatGPT for competitive analysis.

How many emails does it take for someone to buy a product?

B2C startup idea validation framework.

Measuring true efficiency in Venture exits (RBCx’s exit velocity index)

FROM OUR PARTNER - RINGS AI

🤝 Meet Rings: an AI-native XRM for modern VCs

Rings AI emerges from stealth tomorrow with $7M in seed funding from leading investors like Founders Fund and Galaxy.

Rings is the proactive extended CRM (XRM) built for investors, by a former founder of a 9-figure VC. The AI-native platform combines a powerful sourcing engine with relationship analytics and a comprehensive CRM.

Almost 20 VCs are using Rings to get access to more deals, track deal flow and simplify fundraising.

Consolidate your tech stack with Rings →

🤝 PARTNERSHIP WITH US

Get your product in front of over 103,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

START WITH

🧠 Big idea + report of the week

How big is AI spend, really? Bigger than you think.

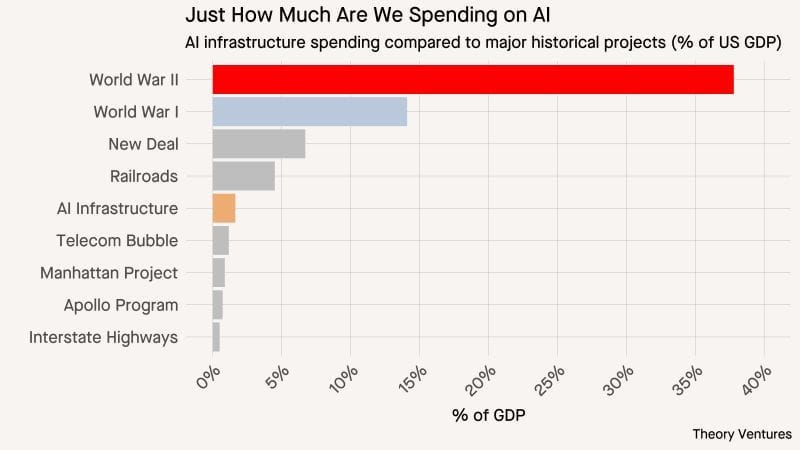

Fresh analysis comparing AI infrastructure investment to the largest capital mobilisations in U.S. history shows just how fast the AI economy is scaling and how far it still has to go.

AI vs historical megacycles:

World War II remains the biggest economic mobilisation ever at 37.8% of GDP, followed by WWI (12.3%), the New Deal (7.7%), and the railroad boom (6.0%).

AI infra spend is already at 1.6% of GDP — bigger than the entire telecom bubble at its peak (1.2%).

Corporate CAPEX is exploding:

Microsoft: $140B

Google: $92B

Meta: $71B

And OpenAI alone is reportedly planning $295B by 2030, signalling the scale of the compute arms race.

What 2030 could look like:

If OpenAI represents ~30% of total AI infra spend, the market would hit $983B annually by 2030, roughly 2.8% of U.S. GDP.

Hitting the railroad era’s 6% equivalent would require ~$2.1T per year, meaning today’s tech giants would need to 5–7x their current spend.

AI infra spending has already become one of America’s largest investment categories, and it’s only in the early innings.

While still far from the scale of wartime mobilisation, the compounding CAPEX cycle from OpenAI, Microsoft, Google, and Meta could reshape the U.S. economic landscape for the next decade.

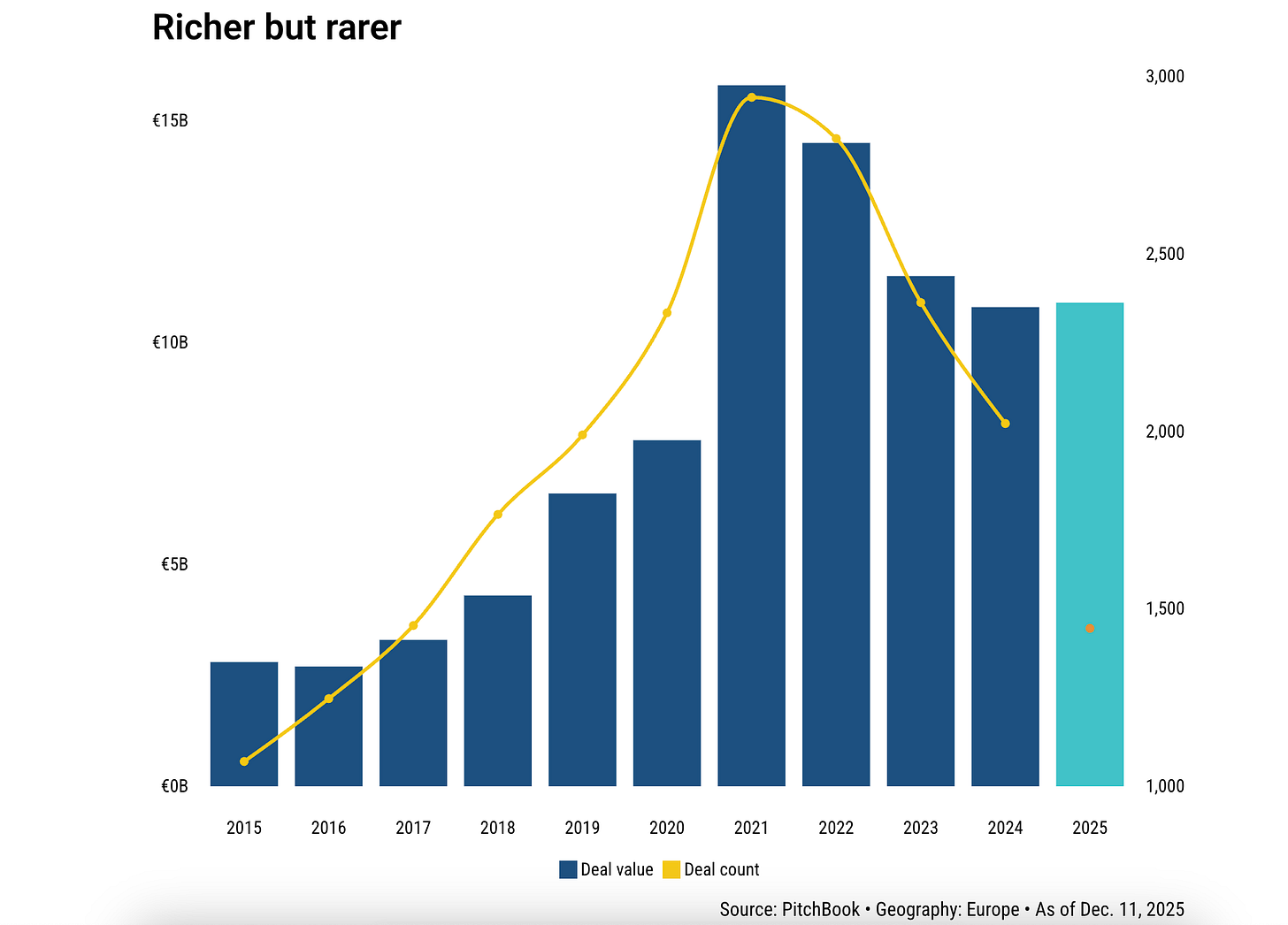

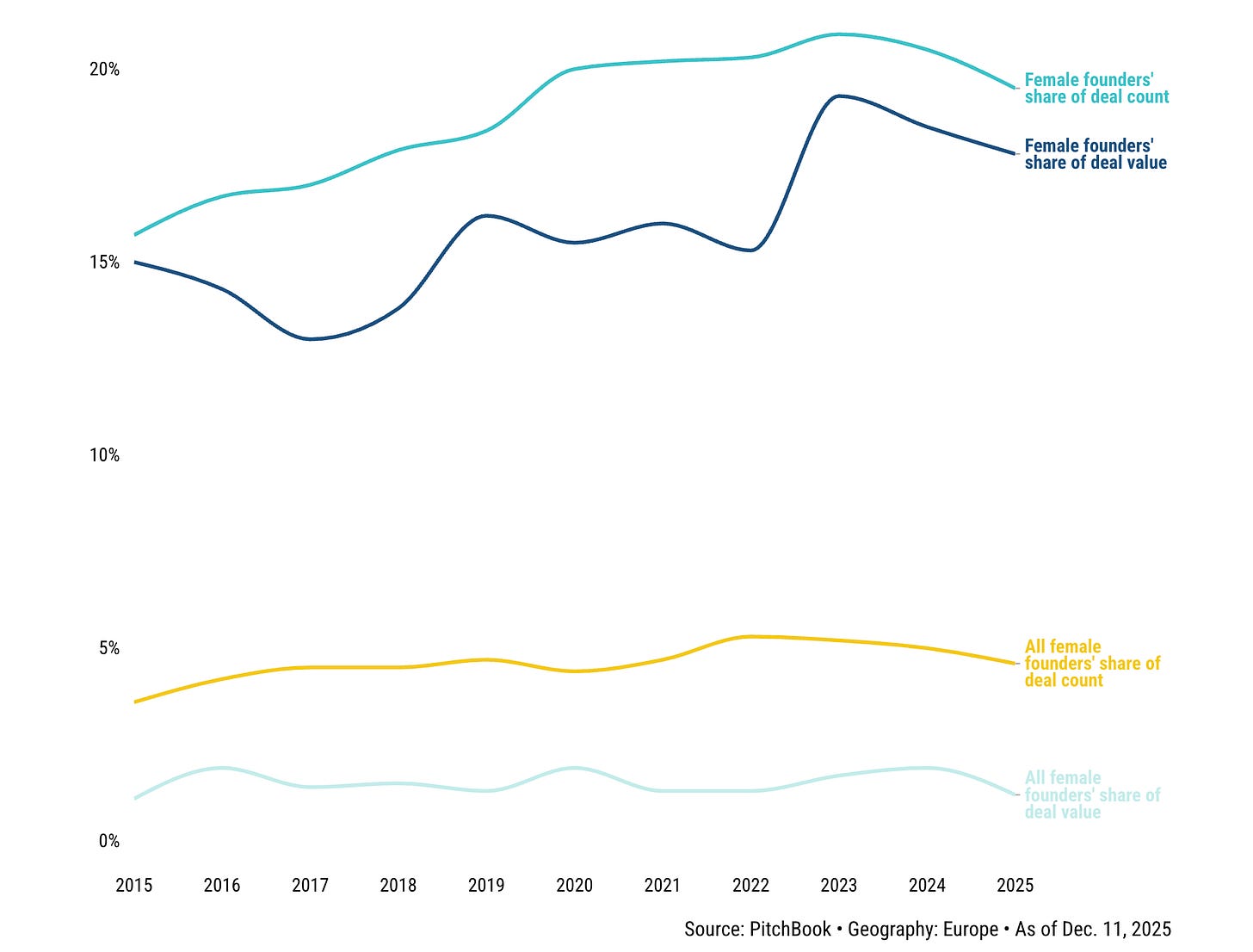

If funding is up, why are female founders losing VC share?

VC funding for female-founded startups in Europe ticked up in 2025. But beneath the headline number, the picture is more concerning.

According to PitchBook, women-led startups raised €10.9B this year, slightly higher than 2024’s €10.8B. Yet their share of total VC deal value fell to 17.8%, down from 18.5% last year — the second consecutive annual decline.

So while absolute dollars are up, relative influence is slipping.

The same pattern shows up in deal activity:

Deal counts for women-led startups declined alongside the broader market

Female founders remain underrepresented vs. 2024 levels, both by volume and value

The gap is widening, not closing

The situation is even tougher for all-female founding teams.

At the current pace, they’re unlikely to cross €1B in funding this year — the first time that’s happened since 2020

Their share of total VC funding has dropped to 1.2%, the lowest level in nearly a decade

Even AI — the most capital-rich sector — hasn’t changed the dynamic.

Female founders accounted for just 17.1% of AI deal count, the lowest share since 2016

They captured only 12.9% of AI deal value, despite record investment flowing into the category

One structural reason keeps coming up: who controls the checks.

Only 15% of decision-makers at European VC firms (€50M+ AUM) are women

Just 8.3% of firms have a majority of female check writers

Big rounds still happen, but they’re rare and concentrated:

Binance’s $2B investment from Abu Dhabi-based MGX (largest female-founded deal this year)

Verdiva Bio’s $411M Series A led by General Atlantic and Forbion

Synthesia’s reported $200M GV-led round, valuing it at $4B

Funding for Europe’s female founders is no longer collapsing — but it’s quietly losing share. Without more women in GP and decision-making roles, rising totals may continue to mask a shrinking slice of the VC pie.

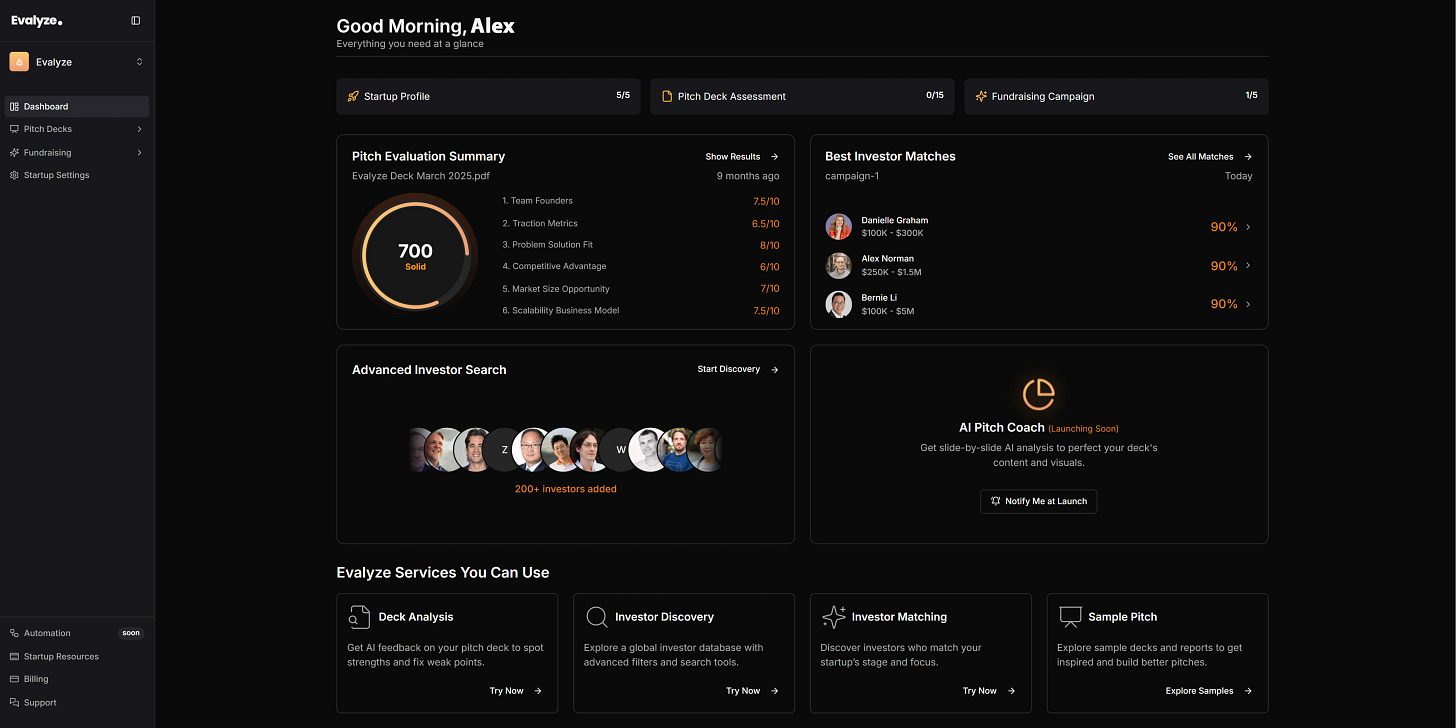

FROM OUR PARTNER - EVALYZE

🤝 Turn your pitch deck into investor meetings

Fundraising moves your startup forward, but it also eats weeks of research and cold emails that go nowhere.

Evalyze scans your pitch deck with AI, gives you an Investor Readiness Score with clear suggestions, then automatically matches you with angels and VCs that best fit your startup from 12,000+ verified investors.

With peak fundraising starting in January, founders who show up early with a sharp deck and strong-fit matches get real conversations faster. Start the year ready to raise.

SOMETHING MORE

🧩 Frameworks & insightful posts

How to use ChatGPT for competitive analysis.

Most founders assume they know who their competitors are. They pick names from memory, or from who they see on X. But the truth is, your actual competitors — the ones stealing traffic, attention, and customer mindshare — often aren’t even on your radar.

That’s where ChatGPT comes in.

The team behind WTF is SEO? shared a brilliant workflow showing how editors use ChatGPT to run competitive analysis fast, and it works just as well for founders and operators.

1. Identify who your real competitors are

Most companies define competitors based on intuition (“we compete with X because we’re in the same space”). But ChatGPT can reveal how Google and readers see your rivals.

Try prompts like:

“Who are the biggest competitors for [your brand]?”

“Which sites rank for the same [topic/keyword] as [your brand]?”

“What are the strengths and weaknesses of [competitor] compared to [my company]?”

“Give me three reasons why [my company] can’t keep up with [competitor]. Return as a table.”

These prompts generate search-driven competitor maps, not just your internal mental model.

2. Run top-level SEO and content gap audits

Once ChatGPT surfaces key competitors, go deeper:

“Provide a keyword overlap audit between [your brand] and [competitor] for [5 priority topics].”

“Which ‘how’, ‘where’, or ‘when’ queries does [competitor] dominate?”

“Summarize the topic authority of [competitor] in 200 words.”

You’ll get a first-draft view of what competitors own — before pulling verified data from tools like Ahrefs, Semrush, or Similarweb.

3. Use ChatGPT to wrangle raw data

ChatGPT can help clean, sort, and summarise large sets of URLs or headlines for quick insights.

For example:

Export all homepage URLs using the SEO Pro Chrome extension.

Upload the list and ask: “Categorize these URLs by type (news, evergreen, affiliate, live blog) and identify trends.”

It’s an instant snapshot of how your competitors use homepage real estate — and what topics dominate their link architecture.

4. Analyze headline patterns

Good headlines drive both SEO and clicks. ChatGPT can help you benchmark headline style, tone, and framing:

Upload headline samples from two sites.

Ask: “Compare tone, structure, and common framing patterns. Which ones are most engaging and why?”

You’ll get comparative tables showing tone, word choice, structure, and engagement cues — a starting point for editorial best practices.

5. Turn insights into experiments

Use ChatGPT’s summaries as hypotheses, not final answers. Validate everything with analytics or search data, but the AI gives you the first 80% of structure fast — freeing you to spend time on deeper validation and creative positioning.

This same workflow applies outside journalism:

SaaS founders can benchmark landing page messaging across competitors.

E-commerce teams can analyse product naming or ad copy tone.

Newsletter creators can compare headline and CTA performance by niche.

Check out the detailed write-up here.

How many emails does it take for someone to buy a product?

Most creators think 3–5 emails are enough to sell their product. But the truth? That barely scratches the surface.

Nicolas Cole (co-founder of Ship 30 for 30) shared data from 20+ cohorts, 10,000+ students, and millions in sales, and the answer shocked a lot of people:

On average, it takes nearly 20 emails before someone finally buys. Sometimes more. (The founder can easily create a simple email newsletter to sell their products)

At first, Cole and his team made the same mistake most of us do: worrying that sending “too many emails” would annoy people. But the data proved the opposite. As long as you keep giving away free education and insights, more emails = more sales.

The key: split your launch sequence into two clear halves.

Part 1: 100% education (emails 1–10)

Goal: build authority and remind them your product exists. Each email is 99% free value, 1% soft CTA.

#1 Plain pitch: what you sell, the problem it solves, how to buy.

#2 Who it’s for: 3 archetypes you serve best.

#3 10 biggest problems: why common fixes fail and why your approach is different.

#4 Desired outcomes: top 3 results your audience wants (and how you help).

#5 Your story: past struggles, transformation, credibility.

#6 Stop/Start: what to quit doing, what to do instead.

#7 Myths: common false beliefs + reframes.

#8 Quick tips: actionable advice they can use today.

#9 Mistakes: traps people fall into, how to avoid them.

#10 Templates: share one, hint at more inside your product.

Part 2: 100% sales (emails 11–20)

Goal: force a decision—buy or unsubscribe.

#11 Everything included: break down your product clearly.

#12 Bonuses: extra perks they get.

#13 Testimonials roundup: social proof at scale.

#14 Future pacing: where will they be in 1 year (with vs. without your product)?

#15 Testimonial deep dive: one student’s full journey.

#16 Tale of 2 archetypes: buyer vs. non-buyer outcomes.

#17 On-the-fence survey: ask why they haven’t bought (time, readiness, cost).

#18 Behind the scenes: peek into modules/resources.

#19 Disappearing bonus: add urgency with a 48-hour perk.

#20 Disappearing discount: final 48-hour price incentive.

Why it works

Buyers need repetition: the average person doesn’t convert after a few nudges; they need to be reminded, educated, and reassured.

The first half builds trust and authority; the second half applies pressure and urgency.

If you’re not willing to craft 20 emails, don’t be surprised if sales stay flat.

If you’re launching a product, map your next sequence using this exact 20-email framework. Write the first 10 as pure education, then switch gears into direct selling. More emails = more sales.

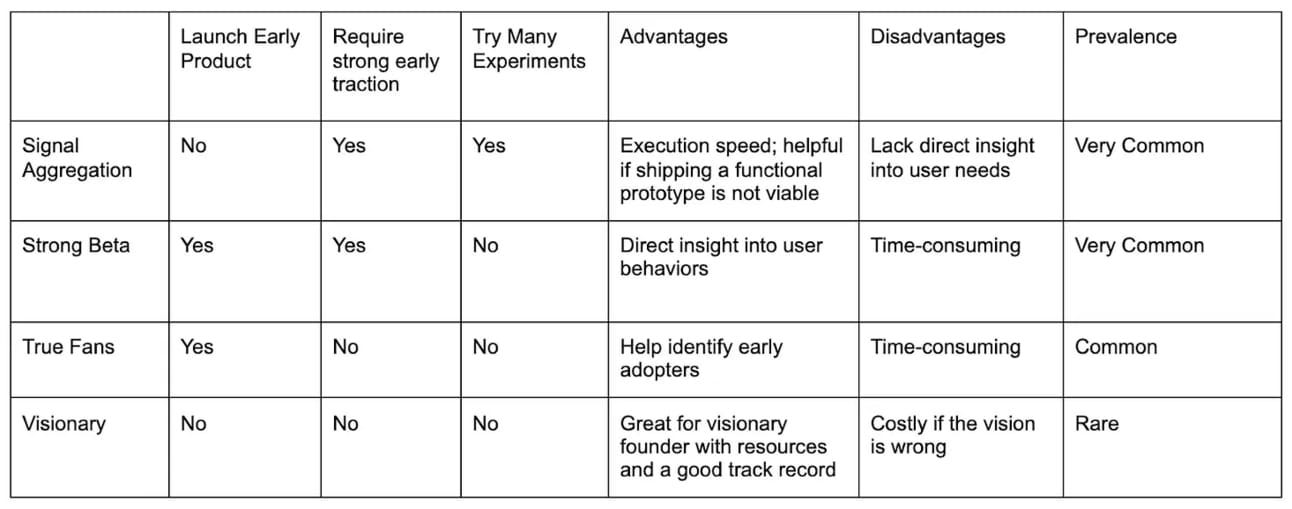

B2C startup idea validation framework.

Most ideas, especially in B2C, get validated in one of four ways:

This framework defines the differences between each path to validation.

Signal Aggregation

Founders should test an idea’s viability through small experiments that provide evidence (signals) of potential success before building a full product.

Common signals include landing page sign-ups, social media engagement, ad click-through rates, and customer interview feedback.

Strong Beta

Achieving strong early traction with a beta product is another popular validation approach for founders. Success metrics vary across industries, e.g., high user numbers and retention for consumer social apps, and healthy revenue for B2C marketplaces.

The process typically starts with a hypothesis for solving a problem. The founder builds a basic version to test the hypothesis. Beta products are often rudimentary, lacking polish, due to the emphasis on speed over perfection.

This approach aligns with the lean methodology of launching quickly and iterating based on feedback.

True Fans

This approach is similar to the Strong Beta approach, as it involves launching a beta product. However, instead of focusing on significant traction metrics like revenue or user acquisition, the founder seeks to identify a small group of fanatic users who deeply love the product despite its limited features.

The key is finding 20-50 users who would be disappointed if the product were to go away. These passionate fans, rather than large user numbers, serve as the validation signal.

Visionary

This approach is the least common among the founders interviewed, as it requires a clear vision and plan for the product from the outset.

Typically, the founder has a close personal connection to the problem being solved and a strong understanding of what needs to be done to address it.

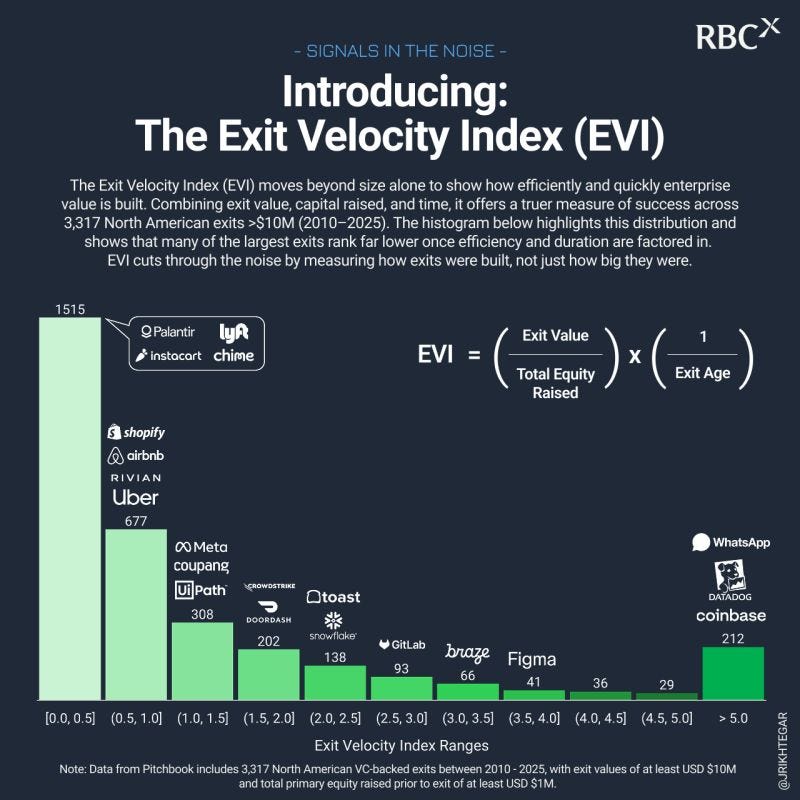

Measuring true efficiency in Venture exits (RBCx’s exit velocity index)

John Rikhtegar introduces the Exit Velocity Index (EVI).

Not all billion-dollar exits are equal. RBCx’s new Exit Velocity Index (EVI) ranks how efficiently startups create value, not just how big they get.

EVI = (Exit Value / Total Equity Raised) × (1 / Exit Age)

It measures how fast and capital-efficient a company built enterprise value across 3,317 North American VC-backed exits ($10M+, 2010–2025).

1. Big doesn’t mean efficient.

Mega-exits like Uber, Palantir, Instacart, and Lyft rank far lower once you factor in how much capital they burned and how long it took to exit.

→ Example: Uber’s EVI ≈ 5.3x, while Mir’s $400M exit on $2M raised in 2 years scored EVI = 100, outperforming even WhatsApp’s legendary $22B exit.

2. Time kills velocity.

Companies that took 15–20 years to exit (Yahoo, Reddit, ServiceTitan, Procore) scored among the lowest EVIs despite large outcomes.

→ Median exit age of the top 100: 10 years.

3. Capital efficiency defines winners.

Median capital efficiency: 13.9x, but only 0.8% of exits achieved EVI > 20.

That tiny group includes WhatsApp, Datadog, Coinbase, and a few under-the-radar mid-sized acquisitions.

Key takeaways

EVI reframes success: size alone is a poor measure of performance.

Efficiency and speed compound returns: shorter build times and leaner raises often beat mega-funded unicorns.

For LPs and founders: benchmark by EVI, not just valuation. It reveals who built durable value fast, not just who raised the most.

EXPLORE MORE

💡 Reports, Articles and a few interesting stuffs

Teens, social media and AI chatbots 2025. (Link)

Investor outreach email sequence pack: 20+ proven templates used & approved by VCs. (Link)

Has the cost of building software just dropped 90%? (Link)

We built an AI that actually knows how to fix things. (Link)

NEWS RECAP

🗞️ This week in startups & VC

New In VC

Lightspeed just raised a record $9B across six funds, marking the largest raise in its 25-year history. (Link)

Factorial Capital, a NYC-based early-stage venture capital firm focused on AI, closed its Fund II at $25m. (Link)

Brainworks Ventures, a San Francisco, CA-based AI-native venture capital firm, launched a $50m fund specifically designed for what they call “the new mathematics of AI-native companies.” (Link)

ALM Ventures, a Mountain View, CA-based venture capital firm, launched ALM Ventures Fund I, a $100m early-stage fund dedicated to humanoid robots, embodied AI, and spatial intelligence. (Link)

New Startup Deals

Link Cell Therapies, a San Francisco, CA-based oncology cell therapy company, raised $60M in Series A funding. (Link)

HP-1, a London, UK-based startup developing products to stay focused, raised nearly £1M in funding. (Link)

Auxira Health, a Chicago, IL-based virtual cardiology company, raised $7.8M in Seed funding. (Link)

Sun King, a Nairobi, Kenya-based solar energy company, raised $40M in Equity funding. (Link)

Valinor, a San Francisco, CA-based AI company leveraging machine learning models to increase the probability of clinical trial success, raised $13M in Seed funding. (Link)

Serval, a San Francisco, CA-based provider of an AI-native IT service management (ITSM) platform, raised $75m in Series B funding, achieving a $1 billion valuation. (Link)

TODAY’S JOB OPPORTUNITIES

💼 Venture capital & startup jobs

All-In-One VC Interview Preparation Guide: With a leading investor group, we have created an all-in-one VC interview preparation guide for aspiring VCs. Don’t miss this. (Access Here)

Senior Analyst - Iconiq Capital | USA - Apply Here

Associate, Secondary Investments - Adam Street Partner | USA - Apply Here

Chief of Staff – DeVC - Z47 | India - Apply Here

Lead, Growth Platform & Communications -Tall Venture | USA - Apply Here

VC Investment Intern - First Momentum Venture | USA - Apply Here

VC Investor - Quamtum Light | UK - Apply Here

Head of Operations - Sagest Capital | USA - Apply Here

Portfolio Management Lead - Yzi Labs | Remote - Apply Here

Office Manager - Seedcamp | USA - Apply Here

Intern, Investor Relations Operations - B Capital Group | Singapore - Apply Here

(Senior) Investment Manager - Finch Capital | USA - Apply Here

Partner - a16z | USA - Apply Here

Investment Associate - Energy Impact Partner | London - Apply Here

VC Intern | lvlp Venture | Remote - Apply Here

Visiting Analyst - Seedcamp | UK - Apply Here

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator

Really well-structued overview of B2C validation paths. The True Fans approach is underrated compared to chasing big beta numbers, espeically for products where retention matters more than virality. I've seen too many founders optimize for vanity signup metrics when 20 genuinely dissapointed users would tell them more about product-market fit than 2000 lukewarm signups ever could.