Hidden Trap Of Convertible Note and Liquidation Preference Multiples | Getting First 1000 Customers | Weekend's Reading & More

Hidden Trap That Most Founders Unaware | Getting first 1000 customer & VC Jobs

I stumbled upon a fascinating very old article by one of the late venture capitalists and it really caught my attention. It delves into a hidden trap of convertible note and liquidation preference multiple that most of the founders are unaware of. It blows my mind after reading this, many of you are aware about the convertible note is a really useful financial instrument if you are raising the pre-seed, seed or bridge round. This helps you to maintain your startup valuation but there is one hidden trap that most of the founders are not aware about.

The article I stumbled upon was merely a conceptual story. However, I couldn't resist sharing this valuable insight with all of you by providing a simple mathematical example. Let's cut to the chase and explore the essential paragraph that every entrepreneur should be aware of regarding this trap.

Sponsored By…

Discover VF Capital Management's personalized investment reports!

I'm often asked about the best investment reports out there, and I'm excited to share with you one that truly stands out – VF Capital Management's amazing reports! Trust me, I highly recommend everyone to check them out.

With 80+ years of experience, their team uncovers lucrative opportunities tailored to your goals. Get concise 5-10 minute weekly insights on opportunities in industries like copper, real estate, oil, Mexico and more.

Consider a scenario where a founder discovers that their Series A investors are entitled to a 1X Liquidation Preference, while the Convertible Note (CN) investors have a significantly higher 4X Liquidation Preference.

One can only imagine the challenging situation the founder must be facing with certain investors having a 4X Liquidation Preference.

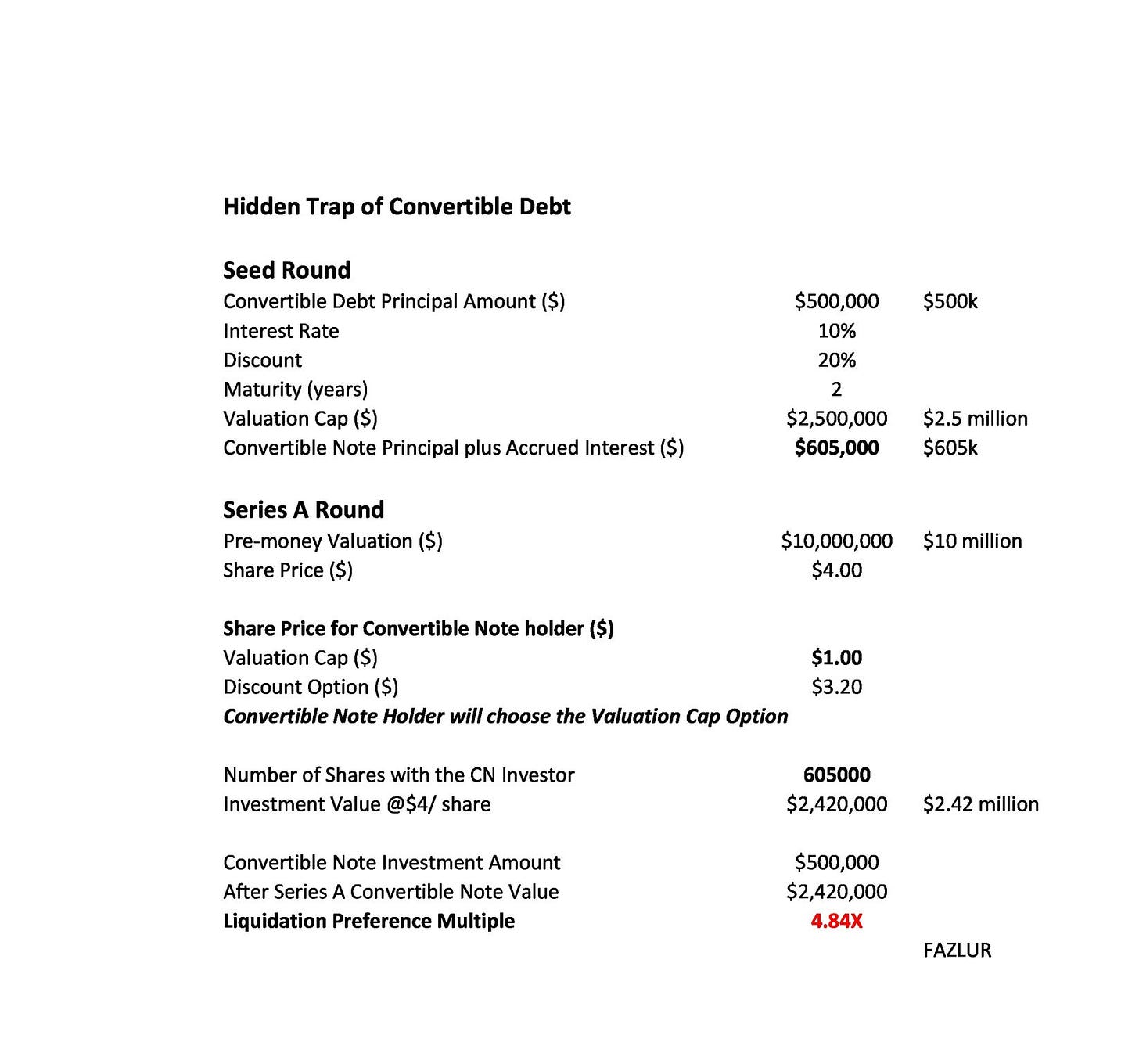

Let’s start with a simple example - consider a founder raising a seed round such that

Seed Round Convertible Note Dynamics:

Principal Amount- $500k

Interest Rate= 10%

Discount- 20%

Valuation Cap= $2.5m

Maturity Years= 2

Convertible Note Principal plus Accrued Interest= $500k*(1+10%)^2= $605k

Now the same founder is raising the Series A round with -

Series A Round Dynamics:

Pre-money Valuation of the company= $10m

Share Price= $4

1X Liquidation Preference (not including Participating/ non-participating for the simplicity purpose)

Convertible Note Conversion Dynamics after Series A:

Share Price (Valuation Cap option)= $4*($2.5m/ $10m)= $1

Share Price (Discount option)= $4*(1-20%)= $3.2

Convertible Note Investor will choose the Valuation Cap Option

Number of Shares with Convertible Note Investors= $605k/ $1= 605,000

Current Share Price= $4

Convertible Note Investors Investment Value= 605,000*$4= $2.42m

Convertible Note Investors Initial investment= $500k

Convertible Note Investors Investment Value after Series A= $2.42m

They are getting $2.42m/ $500k= 4.84X return whereas the Series A investors are getting only 1X Liquidation Preference.

This is excellent for the Convertible Note Investors but not good for the Founders

And that’s why a Founder should always keep the liquidation preference multiples in check.

Here is how.

Join 3600+ investors, operators, innovators and students inducing content every week in our VC Newsletter.

I Was going through an article written by Mark Suster where he offered a suggestion for the Founders which they should include in the agreement.

It goes like this:

“If this note converts at a price higher than the cap…your stock [will] be converted such that you will receive no more than a 1x non-participating liquidation preference plus any agreed interest.”

Issue sub-series of preferred stock.

Founders have an alternative approach to safeguard themselves from the impact of multiple liquidation preferences.

They can incorporate a provision in the convertible note that outlines the creation of a distinct sub-series of preferred stock exclusively for the seed-round noteholders upon conversion.

This unique sub-series is specifically designed to counteract artificially-inflated liquidation preferences and provide added protection to the founders.

Instead of granting 605,000 shares of Series A to the Seed-round convertible noteholders, allocate them 605,000 shares of a new stock series called Series A-2.

Series A-2 would possess identical characteristics to the original Series A, except for the liquidation preference.

While Series A holds a per-share liquidation preference of $4.00, Series A-2 would have a reduced liquidation preference of $1.00 per share. This resolution effectively resolves the issue at hand.

That’s it for today.

I hope this gives the idea about the trap that most founders are unaware of and the ways to tackle it.

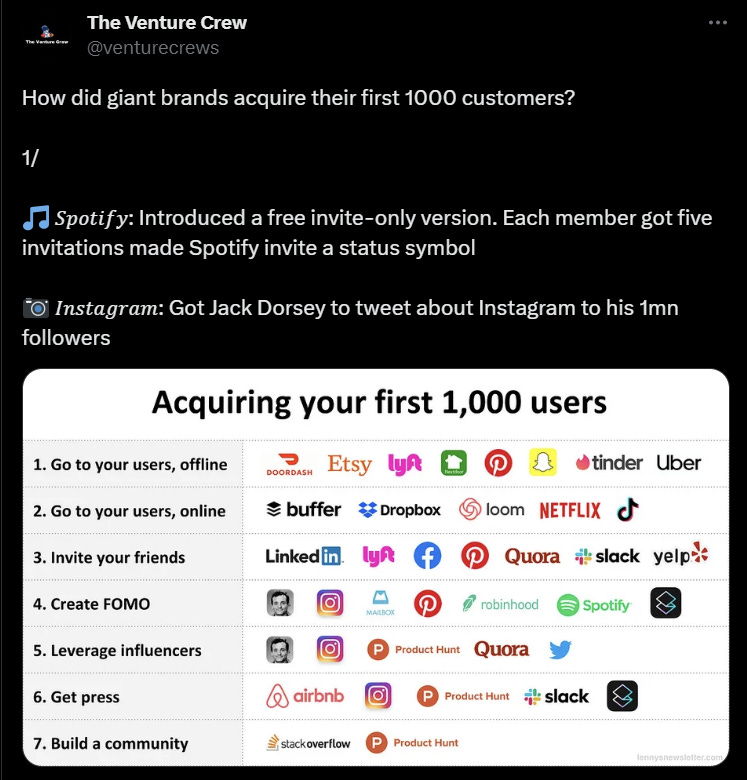

Interesting Tweet On Getting the First 1000 Customers 𓅪

Every early founders always wonder how to acquire the first 1000 customers and this is really hard. You have to try out multiple channels and decide which one is best for you! So here is the interesting tweet. You can check out how the multiple brands used different strategies to acquire the first 1000 customers.

Weekday’s Startups, Product, VC & Tech Reading 📚

Balancing the Art of Valuation with the Science of Dilution - Read Here

Investment Committee 101: how VCs decide to back a startup - Read Here

5 founders discuss why SAFEs are better for early-stage and bridge rounds - Read Here

What to do about your traction slide when you don’t have revenue yet - Read Here

Understanding how VCs think (The Math behind Venture Capital) - Read Here

Today’s Remote Jobs 👨💼

Venture Capital Jobs/Internships

VC Internship - DN Capital - Remote - Apply Here

Investment Associate - TechStar - Hybrid - Apply Here

VC Internship - Cavalary Venture - Hybrid - Apply Here

Research Associate - Cavalary Venture - Apply Here

Operation Intern - Plug & Play - Apply Here

Join our growing community of VC enthusiasts to learn and explore in a more collaborative Way. Join Here

📢 Join The Venture Crew Community of 1200+ Investors, Founders, Operators & VC Enthusiast!

A Community where you’re surrounded by investors, founders, operators, vc enthusiasts & high skills professionals who you can grow with and learn from.

That’s it for today! Will meet you in the coming Monday’s newsletter, Till then happy reading!!

By - The Venture Crew!