Founder Market Fit : An Unsuccessful Video Game Turned Into a $26 Billion Startup. | VC Jobs

Sequoia Capital’s Product-Market-Fit Framework.... & Market Size Vs Opportunity!

👋 Hey Sahil here! Welcome to this bi-weekly✨ free edition✨ venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Founder Market Fit Story: An Unsuccessful Video Game Turned Into a $26 Billion Startup.

Quick Dive:

Framework: How a Seed VC Makes Investment Decisions?

Investors Are Looking For Market Opportunity, Not Just Size...

Don't Include Your Startup Valuation Number On The Slide.

Sequoia Capital’s Product-Market-Fit Framework.

Major News: Musk's AI Company Raised $6 Billion, Perplexity AI Raising $250 Million, NVIDIA Acquired AI Startup For $700 Million & DOJ Seeks Prison, $50M Fine For Binance Founder & More.

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

PARTNERSHIP WITH

We Write, Design And Model Your Pitch Deck Into a Storytelling Book

Deck don’t get you funded, they get you meeting. Without meeting you have no shot at getting funded. Investor meetings get you funded.

An investment associate gets 2000 decks in a year and they spend On average, 4 min on a deck. You have only a few minutes to wow investors. But don’t worry

We are here to help you create a pitch deck into a storytelling book within 4-5 days that gets investors’ attention.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

Founder Market Fit Story: An Unsuccessful Video Game Turned Into a $26 BILLION startup.

In 8 months, it was worth $1B & became the fastest-growing B2B SaaS startup in history. A success story of Slack you might not believe -

After two repetitive failures, Cal Henderson & Stewart Butterfield went on to build the most popular instant messaging and productivity tool used by 77% of the Fortune 100.

Slack launched in 2014, and it blew up immediately. Gaining 8K+ users in 24 hours of launch and earning 12,000+ join requests in just 1 week. It raised $120M only 6 months later valuing the company at $2.7B.

The company kept growing 5-10% PER WEEK and by 2015, it was worth almost $3 Billion. Within two years, they had raised $840M with a company value of $5.1B CRAZY!

Microsoft considered making a bid to acquire Slack (The same year it acquired LinkedIn).

All of this happened without spending a penny on traditional advertising or a Chief Marketing Officer. What makes their story crazier?

Slack was never meant to be a business software tool, but instead started out as a video game company.

The game was called Glitch. In the founder’s own words, Glitch was, “Monty Python crossed with Dr. Seuss on acid.”

Glitch’s surrealist landscapes and extensive customization options were quite famous amongst the fans.

So how the heck did the Glitch team pivot to Slack?

It turns out the team was struggling to communicate with one another. Especially those in other departments. So they built an internal chat app to improve internal company communications.

Stewart Butterfield had a knack for building businesses. He had earned his stripes in Silicon Valley previously as an entrepreneur with a successful exit. If you've heard of Flickr, that was also Stewart's company that he founded and sold to Yahoo in 2005 for $35M

But back to Slack... The team started using it in 2012, and shortly after began focusing all of its internal resources on its capability. They released Slack to the world in 2014, and the rest is history.

Many startups have tried to disrupt aspects of work, but few have managed to do it as effectively & quickly as Slack. 5 key things that enabled them to do just that:

Tiny Speck’s expertise in gaming was a major competitive advantage Butterfield & his team already knew how to make repetitive tasks fun and engaging, as this is core to the gameplay experience.

Result? Slack made work communications fun. They 'gamified' them.Product-led growth and a freemium model got people 'hooked'. With every action a user takes in Slack, they become more invested in the product. Every message sent, every file uploaded, and every gif response shared, drives user buy-in.

Basically - The more someone uses Slack, the more invested in it they become. This is, in part, what made 2,000 messages sent such a crucial metric early on in Slack’s development.

Avoided gating premium features behind paid plans Dissimilar to most software companies, there is almost no meaningful difference between Slack’s freemium tier and its paid product. Slack was free for teams, which created NO sign-up friction. The only real differences are the number of messages that can be indexed and searched, and how many integrations teams can connect to. This made Slack significantly more appealing to small and mid-sized teams interested in trying the product.

The company had a crazy focus on retention When they launched, they already had a small customer experience team of three people working full-time to support new users. Slack's CS team were all over Twitter, looking for comments good & bad. In an interview, Butterfield said: “If you put that all together, we probably get 8,000 Zendesk help tickets and 10,000 tweets per month, and we respond to all of them.”

Slack didn't just build a solid product, they built a great brand as well. Compare it to any other software made to be used by enterprises at that time. The contrast of colours, design, and playfulness makes Slack stand out.

Slack works incredibly well, yes. But the product’s success was just as much about fun as it was about function. Slack’s tagline - “Be Less Busy,” captures exactly what they enabled employees to be.

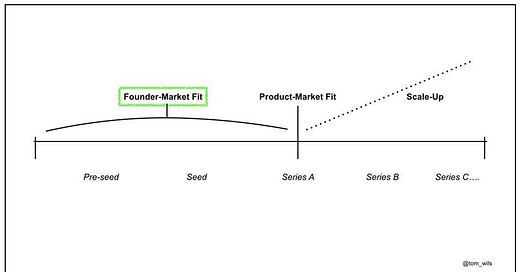

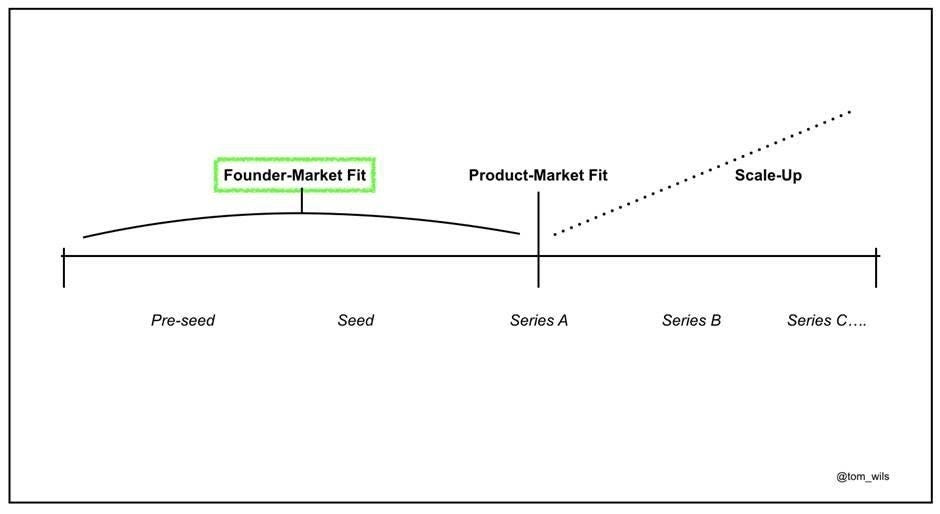

The key to Slack's early success, beyond the features mentioned, was the "Founder Market Fit" (FMF) at the early stage” and most people missed getting this idea.

If you’re reading this newsletter, you likely know and have seen definitions for PMF, and may be familiar with FMF (but might not have seen it concisely defined anywhere):

PMF → “When people who know they want your product are happy with what you're offering”

FMF → “When founders are obsessed with a big, fast-growing market they understand well”

The Slack team perfectly embodied FMF. The founders were intimately familiar with the challenges of team communication and collaboration from their prior experiences. They were passionate about solving those problems in a market they understood extremely well.

So if you're a founder trying to get your startup off the ground, take a page from Slack's playbook on knowing when to pivot and double down on what you and your team know like the back of your hands. That "founder-market fit" where you deeply grok the problems and have first-hand expertise? That's what can supercharge your early traction and impact.

✨ Join Our Premium Venture Curator Newsletter & Community

With our biweekly free newsletters (Tuesday & Thursday), we are launching our premium newsletter. Every Sunday (full newsletter), we will share actionable premium content with you on startups, venture capital, AI, and more.

A subscription gets you:

⭐ Premium Subscribers Posts (Every Sunday )

⭐ Daily Premium Content, Discussion, Curated Article & Weekly events list Through Substack Community Chat.

⭐ Access To Founders Resources (10000+ verified Investors’ email contact database, fundraising resources, discount marketplace & more…).

QUICK DIVES

1. How a Seed VC Makes Investment Decisions?

While making investment decisions, VCs ask themselves three big questions, that revolve around the founder, the target market & founder-market fit.

1. Is this an awesome founder?

2. Is this a market I want to have an investment in? This incorporates both the total size potential of the opportunity and the attractiveness of the market itself.

3. Is there a strong founder market fit? Is this an authentic idea, and does the capability of the founding team map well towards the needs of the market in the early stages of the business?

If the answers check out, investors use a framework to dive deeper into gauging the opportunity, like:

If 1=yes (good founder), 2=no (poor market): Generally skeptical, but open-minded if the founder is exceptional. Markets tend to win, but a truly extraordinary founder could convince you the market is viable.

If 1=yes, 2=yes (good market), 3=no (poor founder/market fit): Difficult to invest pre-product without evidence of product/market fit. Founder/market fit is crucial early on, but exceptional early metrics can mitigate the risk.

If 1=YES YES YES (extraordinary founder): A rare exception where you might back the founder regardless of market attractiveness. Reevaluate your market assessment if an exceptional founder sees an opportunity.

If 1=Yes, 2=yes, 3=yes (good founder, market, and fit): Seriously consider investing pre-launch when all factors align favourably.

If 1=No (unimpressive founder), 2=yes, 3=yes: Need evidence of product/market fit or traction. Hard to get excited without believing in the founders, but stay open-minded as first impressions can be misleading. Integrity issues are a no-go.

2. Investors Are Looking For Market Opportunity, Not Just Size...

Market slide often misses the mark due to a standardized approach by pitch coaching. This template mandates the inclusion of TAM, SAM, and SOM in three bubbles. You can find such templates all over the internet. 👀

Everywhere I found that entrepreneur claims “Our global TAM is $X B, but we are going to start in a certain part where our SAM is $Y B. And we project that our SOM is $Z B”

It’s clear why entrepreneurs try to pump up their market size. They’ve been told that VC only interested in unicorns, and so they assume that the best way to become a unicorn is to go for the largest market.

The thinking is that it's easier to get 2% of a very large market than it is to get 20% of a smaller market. So, they search for market data that allows them to claim that their TAM is $56B, or $256B, or even better, $2.5T.

When this slide appears, most investors chuckle. Investors generally don’t give any credence to the market size. We may still ask founders how big their target market is, but the point is to see 'how founders think about segmentation, not to rate the startup based on how big they think.'

Savvy investors prefer startups to go after a market that doesn't yet exist. Better to create the market than try to unseat established competitors. Rather than claiming that you can disrupt an existing market, what’s more relevant and compelling is how you answer questions such as:

1. Who are your target customers?

2. How will you reach them?

3. How many can you reach?

4. How will you convert them?

5. How many can you convert?

6. How will you onboard them?

7. How much will that cost?

8. What is a customer worth?

9. How many customers will you acquire this year, Next year, or The year after?

Most investors want to see a market opportunity, not market size. They need to see that you understand more about your approach to reaching & onboarding customers.

Founders should build a bottom-up model that demonstrates how you will build a big, profitable, customer-by-customer business. Don’t suggest that your focus is on acquiring market share in a large market.

We’ve heard several pitch on wearable technologies for dogs. They claim - there are 90M dogs in the US alone — at $9.95 a month subscription, that’s a $10B market! But the truth is It doesn’t matter if there are only 20M or 200M dogs. What matters is how many dog owners the entrepreneur can convince, one by one, to sign up for this service.

Define your target precisely, like "urban professionals, 25-35, earning $80,000+, active Instagram users, and dog owners."

Entrepreneurs should stop pitching the typical market-size slide. Instead, they should show investors that they understand the market opportunity customer by customer.

3. Don't Include Your Startup Valuation Number On The Slide.

One common mistake that founders make is including the company's valuation on a slide deck.

If you put “raising $5 million at a $20 million valuation” on the slide before you have a lead investor, you’re making a mistake.

You may have an opinion for what valuation you are hoping for, of course, but that will come out as part of the negotiation later on. The amount of money you need is fixed-ish; what you are willing to give up to raise those funds is not.

In the best-case scenario, you find two or three lead investors who end up in a bidding war for the privilege of investing in you. The levers they have available aren’t just the valuation of the company, of course — there are plenty of other clauses that are up for negotiation in a funding process.

The one exception to this is if you already have a lead investor and you’re just looking to close out the round. In that case, your “ask” slide can include the name of the lead investor and the terms agreed upon.

“Raising $5 million at a $20 million valuation, and Investor X has committed $3 million of the round” can work.

Having said that, if you’re that far into your funding round, there’s probably enough inertia to close out the round; it’s unlikely to be necessary to update this slide once you have a signed term sheet in hand.

So if you are raising the first funding round for your startup - don't include your valuation number before you have a lead investor.

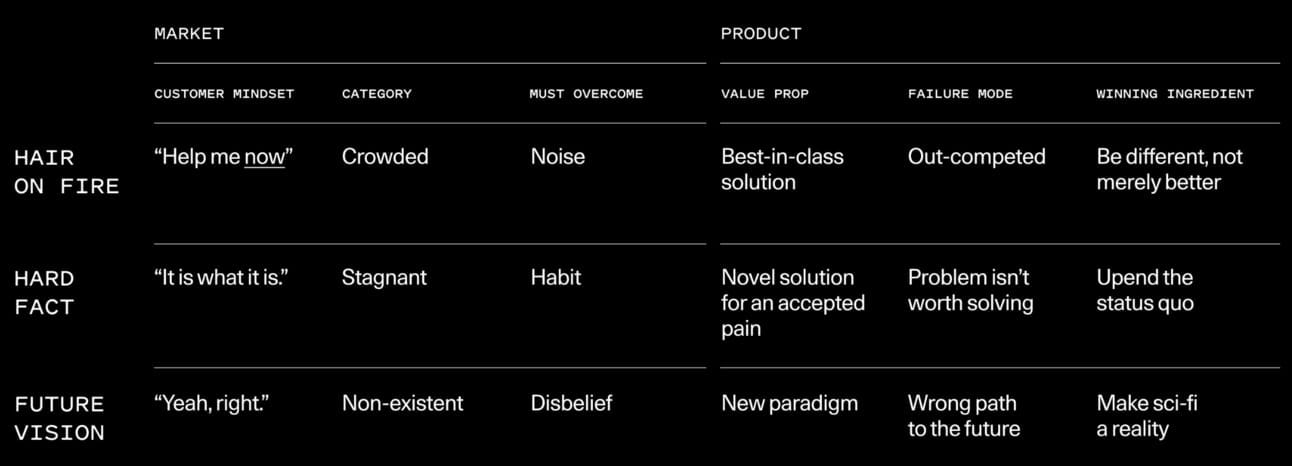

4. Sequoia Capital’s Product-Market-Fit Framework.

Every founder wants to reach PMF, but what are the paths to get there?

Sequoia Capital’s Arc accelerator team put together a framework for early-stage founders that outlines 3 ways to reach PMF:

Hair on Fire → You’re solving an obvious but important problem in, likely, a crowded market and do it better than anyone else (example: Zoom, during the pandemic).

Hard Fact → You challenge a conventionally accepted fact and demonstrate an alternative (example: Superhuman).

Future Vision → You skate to where the puck is going. Your customers don’t even realize how much they need your solution until they use it (for example: Tesla).

Join 18000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

xAI, Musk's AI firm, raises $6B at $18B valuation from Sequoia, Future Ventures, Valor Equity, Gigafund. Read Here

Stripe to allow crypto payments via USDC on Solana, Ethereum, and Polygon, re-entering crypto space. Read Here

Nvidia is acquiring AI startup - Run: ai for $700 Million & IBM is to Acquire HashiCorp for $6.4 Billion in a Cloud Management Deal. Read Here

DOJ Seeks 3-Year Prison, $50M Fine for Binance's CZ Zha for violating federal sanctions and money laundering laws. Read Here

Perplexity, the San Francisco-based AI search engine startup, is raising at least $250 million more at a valuation between $2.5 billion and $3 billion. Read Here

→ Get the most important startup funding, venture capital & tech news. Join 13,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

A quick thread on the AR-VR market by a16z investment team.

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Internship Investment team - Cherry Venture | UK - Apply Here

Sr. Associate - Raakutem Capital | USA - Apply Here

Venture Capital Analyst - Internship - Siemens Energy Partner | UAE - Apply Here

Director, Strategic Investment Fund - Bill & Melinda Gates Foundation | US - Apply Here

Investment Associate - in motion venture | UK - Apply Here

Investment Associate - renegade partner | USA- Apply Here

Creative Associate - Morrison Seger Venture Capital Partners | USA - Apply Here

Venture Studio Lead - Founders Factory | Germany - Apply Here

Talent Investor Analyst (internship) - Entrepreneur First | Germany - Apply Here

Investor Relations - Inovexus | France - Apply Here

Venture Capital Intern - Grunhas Venture | India - Apply Here

Summer 2024 Internships - Azolla Venture | USA - Apply Here

Some Tips To Break Into VC:

“The Six Most Popular Venture Capital Interview Questions (And How to Answer Them).”

Why this role, at this firm?

What sectors/startups are of interest to you right now and why?

Walk us through how you would screen potential opportunities.

What do you think of our portfolio? Which investments do you like? Which would you have passed on?

What VC resources do you read/subscribe to?

What are the trade-offs between traditional equity financing and convertible notes?…. Read More Here

→ Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

→ Looking to hire for your VC Firm?

We have a curated list of VC enthusiasts - from leading universities, ex-founders, and operators. Get free access here.

That’s It For Today! Happy Weekend!

Advertise || Join The Community

✍️Written By Sahil R | Venture Crew Team

Love this. Will never get tired of Slack's success story.

Slack has become a benchmark of what my friends call: “the next Microsoft dream” should look like. The most intriguing part of the slack story is the fact the it grew initially until recently without a marketing budget.

As one headline puts it, it’s a company who’s CEO was helped by the media. Thanks for making me have a deep thought on what a Big Dream, and Quality product and word of mouth can do to a business!!!