Founder-led Growth Strategy: The proven playbook from PayPal’s former growth leader. | VC & Startup Jobs.

Market command matrix, Founders agreement template & Things you should know about valuation.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Founder-led Growth Strategy: The proven playbook from PayPal’s former growth lead.

Quick Dive:

What Every Early-Stage Founder Should Know About Valuations.

Market Command Matrix: When (and When Not) to Fight Your Competitors

How to Create a Founders Agreement That Works? - Free Template.

Major News: Ilya Sutskever’s AI startup raises $2 Billion, Ex-OpenAI staff side with Elon Musk over for-profit transition, Google lays off hundreds in Android and Pixel teams & Mira Murati’s AI startup aims for $2B seed round.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

Vibe Check: o3 Is Here—And It’s Great.

3 charts: No end in sight for VC liquidity crisis.

Investor Data Room Guide & Templates for Founders.

OpenAI slashes AI model safety testing time.

Solo Founder Syndrome (Even If You're Not Alone)

5 Interesting Learnings from Rubrik at $1.1 Billion in ARR.

All-In-One Guide to Venture Capital interview questions (And how to answer them).

Fundraising requirements for each stage

Startup legal document pack – essential legal docs for founders.

Peter Walker on how much equity you should expect to sell per round.

All-In-One guide to pitch deck storytelling - free template & curated resources.

Social AI by Tomasz Tunguz.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Harvard's tax battle threatens endowment.

How AI Unlocks the Future of Software That Learns.

SaaS Startup Financial Model: All-in-One Excel Template.

400+ French angel investors & venture capital firms contact database (Email + LinkedIn Link)

VC Fundability → Cold reachouts - Is a startup VC Fundable & how to cold email VCs?

300+ Australian angel investors & venture capital firms contact database (Email + LinkedIn Link).

Raising money but struggling to connect with the right investors? We help startups reach 85,000+ investors and connect with members of our investor Slack community. Fill out this form to get started. It’s FREE!

For marketers: Skip the AI hype, get real results. Join 10,387+ marketers learning the AI tools and prompts that drove 40% better performance.

FOR FOUNDERS WANTING TO GROW…

🚀 Ship faster. Scale bigger. Win more.

Urban Dynamics is accelerating startups to ship & scale faster. Stay focused on what matters — building features — and stop worrying about the pain of cloud, security, DevOps, and more.

Take advantage of our Product Scalability Workshop for Founders – a dedicated 1-hour workshop tailored to you and scaling your startup fast⚡️availability is limited.

Reserve your slot for April now →

PS - Attending Google Cloud Next? If so, join our community newsletter & Slack to meet up with our team 👋

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

Founder-led Growth Strategy: The proven playbook from PayPal’s former growth lead

Matt Lerner, former growth leader at PayPal and founder of SYSTM, has helped hundreds of startups figure out one thing: how to actually grow. And his answer is clear — early on, founders need to lead growth themselves.

It’s a necessary phase. Because when startups fail, it’s often not the market or the product — it’s that founders didn’t learn fast enough what really drives traction. And no one can learn that for you.

Why founder-led growth matters

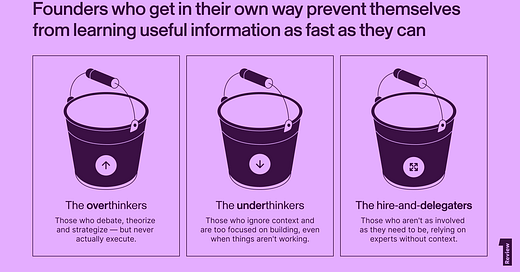

Founders are deeply involved in product and sales early on — but when it comes to growth, many try to delegate too soon. Some get stuck in theory and planning. Some keep building without validating. Others hand growth off to a hire, expecting them to figure it out.

But the first growth hire can't do their job unless the founder has already uncovered what works. You don’t bring in someone to scale chaos — you bring them in to scale signal.

Matt Lerner saw this mistake often as a VC. Founders would pitch go-to-market strategies that looked impressive on a slide, but didn’t stand up to scrutiny. There was no evidence behind them — just ideas. And even if one of those ideas worked, the upside was usually small.

Lerner’s argument is simple:

Growth can’t be delegated until you know what works. You don’t need polished strategy decks — you need signal. That comes from firsthand experience.

At PayPal, Lerner saw that nearly all of their exponential growth could be traced back to just a few key levers:

eBay seller adoption

Developer integrations

Strategic platform partnerships

It wasn’t about doing everything. It was about doing the right things — and finding those things takes founder involvement.

That’s what pushed him to define the concept of a “growth lever” — a small number of activities that drive most of the company’s growth. And finding those levers is the founder’s responsibility.

Step 1: Map the customer journey

Start by mapping your funnel from the moment a user hears about your product to the moment they find value. You’re looking for drop-offs — the stages where people get stuck. You don’t need dashboards or analytics tools to do this. A rough sketch is enough.

What matters is identifying the bottleneck that’s holding back your growth. Then ask yourself: if this stage improved, how much would it impact the rest of the funnel?

One example comes from Popsa, a photobook app that Lerner invested in. The product was solid — users liked it and stuck around. But install rates were low. The team eventually realized the issue wasn’t the product — it was the App Store listing. The tagline “Fast, Easy Photo Books” wasn’t specific enough. People didn’t know what “fast” meant. When they changed it to “Photo Books in 5 Minutes,” their conversion rate quadrupled.

Small change. Huge outcome. That’s the power of fixing the right bottleneck.

Step 2: Understand what’s in your customer’s head

Behavioral data will tell you where people are dropping off. But it won’t tell you why. That’s where qualitative research comes in.

Lerner leans heavily on the Jobs to Be Done framework here. Talk to your actual customers — not leads who didn’t convert, but people who did. Ask them what they were trying to accomplish, why it mattered, and what their process looked like.

You’ll start to uncover patterns — shared goals, repeated anxieties, common alternatives they considered. This is what helps you position your product and smoothen your customer journey.

Smart Tales, an educational app for kids, was struggling with conversions. Customer interviews revealed something surprising: parents didn’t just want their kids to learn — they wanted to give them screen time without guilt. That emotional insight shaped the company’s messaging and improved conversion rates by 65%, without changing the product itself.

Step 3: Run focused experiments

Once you know the bottleneck and understand your customer’s mindset, shift into experimentation. This is where founders often get overwhelmed. There are endless tactics and ideas. But Lerner simplifies it into weekly growth sprints.

Each sprint is designed to answer one question: does this change improve a meaningful metric?

The structure is simple:

Start with an observation and hypothesis

Make a team prediction

Run the experiment for a week or two

Review and decide what to try next

This isn’t about trying to get every test right. Most won’t move the needle. But if you're running experiments tied to clear bottlenecks, you’ll learn something useful every time.

Take Sonic Jobs — a job marketplace with high signup rates but low activation. Their welcome email was too broad. After interviews showed that users looked for specific job types, the team updated the email to include role-specific links like “Amazon driver” and “Warehouse operative.” The result? Activation doubled.

What to do when progress stalls

Sometimes you run a bunch of tests and nothing seems to work. That’s when you zoom out and revisit customer outcomes.

Instead of focusing on why people didn’t convert, focus on why your best customers did. What did they want? What did your product help them accomplish?

If you offer a single clear outcome, you can lean into it. If your product solves multiple problems, use onboarding questions to help customers self-select — just like Calm does. That makes it easier to tailor your messaging, onboarding, and growth strategy to their specific goal.

Eventually, you’ll spot the segment with the most urgent need and the highest willingness to pay. That’s where you double down.

Most growth levers aren't novel — and that’s fine

Founders often overlook great ideas because they feel too obvious or too difficult. But many of the best growth levers aren’t new — they’re just right for your business.

Lerner gives the example of Fatmap, a mapping app with slow-loading content. The team dismissed SEO as a channel because the maps took too long to load. Lerner proposed a workaround: use static images while the map loads in the background. That one shift increased traffic and later contributed to acquisition.

Another trap is “mental resistance” — where you avoid a test because it feels too simple to be meaningful. But if the test aligns with your bottleneck, it’s worth running.

Make growth a company-wide mindset

Even if you’re the one leading growth, you don’t have to do it alone. In fact, your entire team should be plugged into growth.

Start by sharing your North Star Metric across the company. Then ask each team member how their work impacts that metric — and what they could do to improve it. Bake that into their goals.

Lerner also encourages founders to make experiments public. Post them in Slack. Let the team vote on variants. Show that everyone is learning together — especially when things don’t work. That transparency builds confidence and momentum.

The key shift here is cultural: growth isn’t something the “marketing team” does. It’s something the whole company thinks about.

When it’s time to hire for growth

Eventually, you’ll hit a point where you’re doing so many experiments that you need help. That’s when it makes sense to build a growth team — not before.

You don’t need a senior exec. Lerner recommends starting with:

A junior generalist who’s analytical, action-oriented, and curious

Or someone already on the team who’s shown interest in experiments — like an analyst, product manager, or even support lead

The important thing is: hire once you know your levers, and you just need someone to scale what you’ve already figured out.

You wouldn't outsource your product before building version one. Don’t outsource growth before you’ve figured out how your product grows.

Founder-led growth forces you to talk to customers, isolate bottlenecks, and test ideas that get results. It gives you insights into your product, your users, and your positioning that no outside hire can match — and once you’ve built that understanding, you can bring in others to scale it.

This isn’t a detour from building your company. It is building your company. Also you can read this long full post in first round review, worth reading.

We’ve also built multiple guides and frameworks that can be helpful to you in your startup journey:

Excel Template: Early Stage Startup Financial Model For Fundraising.

Startup Legal Document Pack

Building Cap Table As A Founder: Template to Download.

How to write your monthly investor update (Email Template).

SaaS Financial Model Template: Early Stage Startup Financial Model For Fundraising.

INVESTMENT OPPORTUNITY WORTH EXPLORING…

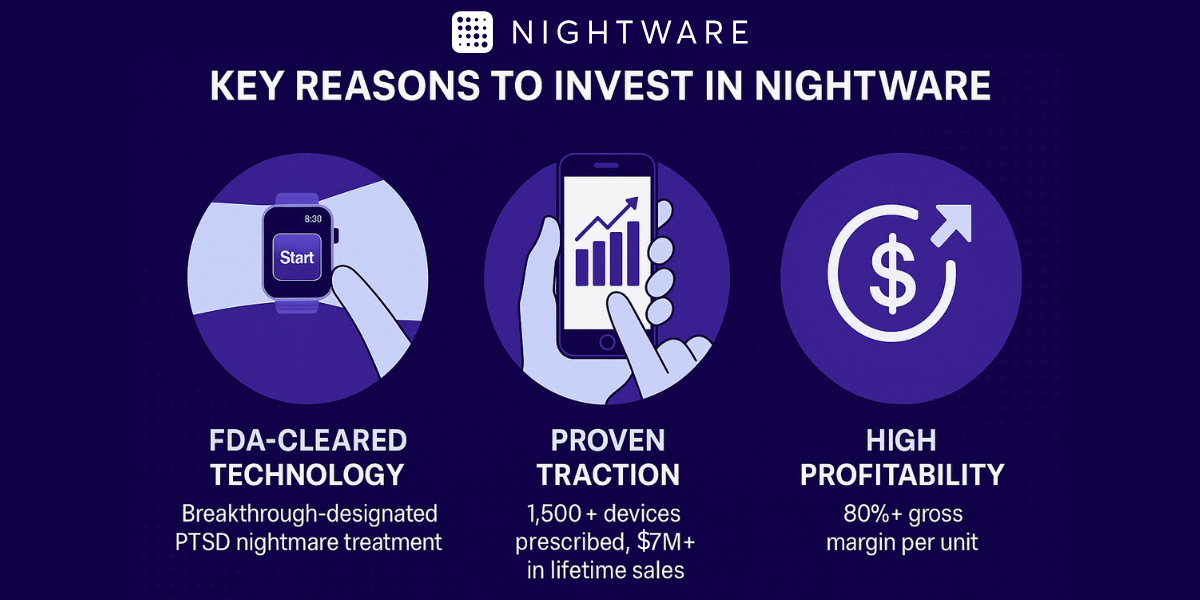

🤝 An AI-Driven, FDA-Cleared Solution for PTSD Nightmares

NightWare is transforming PTSD treatment by using AI-powered, FDA-cleared technology to interrupt severe nightmares caused by PTSD—improving sleep quality and the lives of veterans and trauma survivors.

NightWare is positioned to scale rapidly in a surging market:

$25.3B U.S. sleep disorder market ($13.2B PTSD segment)

1,500+ devices already prescribed ($7M+ lifetime sales)

80%+ gross margins

The investment round closes in less than two weeks—secure your stake today.

Disclaimer: This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

📃 QUICK DIVES

1. What Every Early-Stage Founder Should Know About Valuations.

I’ve seen countless first-time founders confused about startup valuation. So I am covering few question that I received multiple times here:

What determines a company’s valuation?

In its most basic sense, valuation can be calculated by multiplying the outstanding shares by the price per share. The thing is that company valuation is more of an art than a science due to the mix of qualitative and quantitative factors that go into it.

Value of company = Shares outstanding * Price per Share

Below, I share some of the factors that Brad Feld mentions in Venture Deals, followed by my opinion on each:

Stage of the company:

Early-stage valuation is impacted by factors such as entrepreneur experience, the perception of overall opportunity, and the amount being raised.

Later-stage valuation heavily relies on financial performance and projections.

Funding competition: there is a positive correlation between the number of investors who want to fund a company and the valuation of such a company.

Leadership team experience: because there’s a perceived negative correlation between more experienced entrepreneurs and risk, the valuations of companies with more experienced leadership teams will be higher. Note: personal biases will play a role here.

Size and trendiness of the market: Your market size (e.g., TAM, SAM, SOM) and the growing demand of a company’s market will also have a positive correlation with valuation.

An investor’s entry point: Some investors have a valuation investment range. For example, an investor might only invest in companies that are valued at $10M or less.

Financials and other numbers: There is a direct correlation between how well a company’s financials and numbers stack up (against its given industry and competitor benchmarks) with the company’s valuation.

Economic climate: There is a tentative positive correlation between the stock market’s performance and the valuation of a company. That’s to say that if the stock market is performing well, valuations will be higher and vice versa.

If many investors perceive a given company to be less of a risk and more of an investment opportunity (aka shows signs of a successful exit) — due to its strong leadership, market size/trendiness, and numbers — the valuation of a company is likely to be higher than lower. It makes sense, no?

Remember, investors want to invest in the horse that’s most likely to win the race.

What are some methods that investors use to value companies?

Investors may calculate valuation by assessing:

Comparables: the valuation of other companies with a similar profile

Multipliers: industry revenue/EBITDA/EBIT multipliers

Formulas, such as pre-money valuation = ($1M x #Engineers) — ($1M x #MBAs) AND Net Present Value (discounted cash flows)

Venture Capital/Leveraged Buyout Method

Monte Carlo Simulations

You will find more info about all these and another method later.

The most common question that I received from every founder,

Is it mandatory to calculate a company’s value to fundraise?

Valuation in fundraising has several benefits. At a basic level, founders will know exactly how much of the company they’ve sold and they’ll also have a cleaner cap table. Valuation will also make life easier for everyone involved — investors and founders.

That said, companies don’t need to value their companies in order to fundraise, at the start. There are multiple fundraising vehicles that allow for a postponed valuation to take place in a future and larger fundraising. Such mentioned vehicles include, but are not limited to, the:

Convertible Note — Investors give companies money in exchange for an opportunity to buy the stock at a discount in a future financing round. Until then, the “investment” is considered debt that pays interest. If you want to know more about it, check out our previous article.

SAFE (Simple Agreement for Future Equity) by Y Combinator. A SAFE is neither debt nor equity and has no maturity date or accruing interest. You can also check about this in our home page.

Should companies aim for the highest valuation they should get?

No. Because a too-good-to-be-true kind of deal is likely to hurt everyone involved in the next round. If you have a high valuation in one round, then fail to hit the right milestones and end up having to raise at a lower valuation, that’s going to dilute your original shareholders. If that happens, it’s possible that they will block a new financing. No founder wants that — it’s already hard to run a company and fundraise.

Also, if a company raises at higher valuations, the company’s investors will expect a bigger exit and will block a sale if they are not happy with the selling price.

I hope this helps you to get an idea of what’s an important thing to know during valuing your company.

You might still have questions like:

How should I talk about valuation numbers when investors ask?

What are the different valuation methods commonly used in the VC world?

What do VCs expect from founders regarding valuation?

Which method should I use to come up with a valuation number?

How can I used Excel sheet to come up with a valuation number?

Is there any framework I can follow?

We’ve covered all of these questions — along with templates and Excel sheets — in our All-in-One Startup Valuation Guide. You can access it here.

2. Market Command Matrix: When (and When Not) to Fight Your Competitors

Patrick Campbell sold his startup, Profitwell, for $200 million last year — and it was entirely bootstrapped.

Since then he’s started sharing a lot of primary research he’s commissioned into topics that there isn’t a lot of ground truth data on. Most recently, he shared his competitive research playbook and shared this framework — the market command matrix:

The y-axis represents how much of a competitor’s resources they’re piling into your market, and the x-axis represents how aware customers in your market are of the competitor.

The big text in each quadrant is what you should do in response. While the placements on the matrix aren’t exact (for example a “big VC bet” could have dramatically more or less mindshare depending on what stage they’re in), Patrick’s recommendations are good.

Note that he only recommends you take action against the two quadrants on the right — the competitors who your target and/or existing customers are likely to be aware of.

Another note: “all-out attack” may mean exploring partnerships when you both have leverage in different parts of the market — it doesn’t mean burning all your money on paid ads.

He also includes free playbooks on how to handle competitors in each quadrant — the full article is worth a read.

3. How to Create a Founders Agreement That Works? - Free Template.

Starting a business with co-founders is like embarking on a long road trip together. While the journey can be more enjoyable with partners who complement your skills, even the strongest relationships need ground rules. This is where a founder agreement comes in.

Simply put, a founders agreement is a legal contract between company founders that sets clear guidelines for their business relationship. Think of it as a roadmap that outlines everyone's rights, roles, responsibilities, and expectations from day one.

Why You Need One

While not legally required, having a founder agreement is crucial because it:

Prevents misunderstandings by getting everyone on the same page

Provides a clear structure for handling disputes

Shows potential investors you're serious and well-organized

Protects both your business and personal relationships

As Simon Bacher, CEO of Ling, puts it: "My wife and I co-founded our startup, and we saw a founders agreement as essential - think of it like a prenup for your business."

Key Components of a Strong Founders Agreement

1. Basic Company Information

Company name and founders' details

Business mission and goals

Ownership structure

2. Roles and Responsibilities

Each founder's specific duties and areas of authority

Clear job titles and their limitations

Flexibility for role changes as the company grows

3. Decision-Making Powers

Voting rights

Process for major decisions (hiring, firing, strategic changes)

How to handle deadlocks

Veto powers

4. Equity and Vesting

Each founder's ownership percentage

Vesting schedule (typically four years with a one-year cliff)

Conditions for receiving full rights to shares

Compensation plans

5. Commitments and Resources

Expected time commitment from each founder

Initial capital contributions

Intellectual property rights

Other resources (industry connections, expertise)

6. Exit Planning

Conditions for dissolving the company

What happens during an IPO

Handling of unvested shares

Non-compete and non-solicitation terms

Now that you know what goes into this document, here are a few founder’s agreement templates and examples to help you craft your own.

University of Pennsylvania Law: Includes provisions about ownership structure, transfer of ownership, decision-making and dispute resolutions, representations and warranties, and choice of law

Harvard Business School: Includes provisions on ownership, competition restriction, and exit situations

You’re going to go through many ups and downs with your partners. Creating a founders agreement is an excellent way to ensure you’re all protected throughout your business journey.

With the help of startup attorneys, legal associates, and VC teams, we've created a Startup Legal Document Pack filled with investor-ready, easy-to-use, and up-to-date templates. You can check out here.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New VC Launch

Founders Fund has closed a $4.6 billion growth fund, up from its previous $3.4B fund in 2022, signaling renewed VC bullishness. (Read)

Former Y Combinator president Geoff Ralston announced SAIF (Safe Artificial Intelligence Fund) to back early-stage startups focused on AI safety and responsible deployment. (Read)

Major Tech Updates

Figma has filed confidential IPO paperwork, signaling early plans to go public even as other major IPOs like Klarna and StubHub have paused due to trade-related market instability. (Read)

OpenAI is prototyping a ChatGPT-powered social media network featuring a social feed focused on image generation, The Verge reports. (Read)

The U.S. government informed Nvidia it now requires a license to export H20 chips to China, citing national security risks related to supercomputing. (Read)

Meta CEO Mark Zuckerberg testified in court defending his enterprise against government accusations that it illegally sustained a social media monopoly via strategic company purchases like Instagram. (Read)

OpenAI is negotiating a $3 billion acquisition of Windsurf (formerly Codeium), an AI coding assistant startup with $40 million in annual recurring revenue, Bloomberg reports. (Read)

The Trump administration is considering new limits on DeepSeek that may block it from buying Nvidia chips and restrict U.S. access to its AI services. (Read)

Anthropic is preparing to introduce a novel voice interaction function for its Claude AI assistant, with a potential release planned around the end of April 2025. (Read)

New Startup Deals

Loti AI, a Seattle, WA-based leader in likeness protection technology, closed a $16.2M Series A funding. (Read)

Doss, a San Francisco, CA-based AI-powered ERP and data platform, raised $18m in Series A funding. (Read)

Ideem, a Kansas City, MO-based company which specializes in payments online, raised $2.4M in Seed funding. (Read)

Friday Harbor, a Seattle, WA-based provider of an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, raised $6M in Seed funding. (Read)

Corvic AI, a Mountain View, CA-based data-centric AI cognitive infrastructure company, raised $12M in Seed funding. (Read)

Arcana Labs, a Los Angeles, CA-based AI-powered content production platform and studio, raised $5.5m in funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Manager - Captial One Venture | USA - Apply Here

VC Investing Internship - First Momentum Venture | Germany - Apply Here

Legal Associate - Artha India | India - Apply Here

Partner’s Associate - Noba Capital | UK - Apply Here

Pre-MBA Analyst - Healthkois | India - Apply Here

Partner 32 - a16z | USA - Apply Here

Principal - Artha Group | India - Apply Here

Partner - Integral Global Tech Partners | Japan - Apply Here

Investment Associate TCV | USA - Apply Here

Venture Capitalist - IMM Investment Corp | Japan - Apply Here

Growth Associate - B Capital Group | USA - Apply Here

Chief of Staff - First Round Capital | USA - Apply Here

Investment Associate - 888VC | India - Apply Here

Venture Capital Intern - Bosch Venture | USA - Apply Here

Senior Counsel - Greyhound Capital | UK - Apply Here

Associate and Analyst positions - 12 Flags | India - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator