Don’t Include Your Startup Valuation Number On The Slide. | VC Jobs

Validating Without Launching & Superhuman's Framework To Validate Startup Idea..

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Emerging Startups / AI Tools of the Week

Deep Dive: Don’t Include Your Startup Valuation Number On The Slide.

Quick Dive:

How Investors Will Grade Your Startup: A Sample VC Memo On A $5M Seed Round.

How Did Superhuman Validate Its Idea and Get Their First 5,000 Users?

Validating Without Launching

Venture Curator Hub: Get Access To Early-stage startup financial modelling Excel sheet, 10000+ verified investors' email contact database & more.

Major News: Founder of Failed Fintech Synapse Raised $11 Million For Robotics Startup, Tim Draper Leads $2.5 M For Crypto Startup, Anthropic’s Claude Surpasses $1M in Mobile App Revenue & Microsoft's New Open-Source AI Model

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER

We’re Opening 3 Slots to Help Founders Build Pitch Deck (Content + Design)

Decks get you meetings. Without meetings, you have no shot at getting funded. Investor meetings get you funded.

However, most founders fail to impress investors through their pitch decks. Many make mistakes by adding the wrong content and including too many - around 10-15 - slides. Investors don't like that.

If you're feeling confused while building a pitch deck, we can help. We've created an internal team of experts, designers, and investors to build and review your pitch deck.

PARTNERSHIP WITH US

Our newsletters now reach over 53,000 founders, investors, executives, and operators. We offer opportunities for brands to connect with our highly engaged audience through sponsorships. Interested in promoting your brand? Complete our brief form, and we'll contact you with details.

EMERGING STARTUPS / AI TOOLS OF THE WEEK

Don’t Miss These..

Meco: An app that organizes newsletters from Gmail and Outlook, offering a dedicated reading experience with features like grouping, filtering, and bookmarking. It helps declutter your inbox and enhances newsletter consumption, available for free on iOS and the web. (Try Meco For Free)

Jazon AI: 100% Autonomous AI Sales development representative that does the research on each prospect and sends personalized emails, replies to their concerns and follows up until it books a meeting. (Try Jazon for free)

TODAY’S DEEP DIVE

Don’t Include Your Startup Valuation Number On The Slide.

There’s one slide that almost every founder gets wrong when they are putting together a pitch deck to raise money from venture capitalists. The slide is usually known as “the ask,” and it typically lives toward the end of the pitch deck.

It is meant to do something pretty straightforward: Explain how much money a startup is raising and for what. It shouldn’t be rocket science, but it’s almost universally a struggle to get right.

Here are the most common mistakes:

Forgetting to include the slide altogether.

Not naming a specific dollar amount you are raising.

Including a valuation on the slide.

Omitting what the funds will be used for.

Listing a specific runway, i.e., “This will keep us running for 18 to 24 months.”

Let’s explore in detail why these mistakes are so detrimental to your fundraising process and how you can best include these points in your deck.

Include the slide

Obviously, the easiest way to fail on this slide is to forget to include it altogether. That’s a mistake. The whole purpose of doing a fundraising process is to raise money, so you may as well go all-in with a clear ask.

Name a specific dollar amount

Quite a few founders are against including any amount at all. The logic, they argue, is that there are so many different ways to build the company. If they raise $3 million, they go down one path. If they are able to raise $5 million, they go down another. If the fundraising doesn’t go as smoothly as they hoped, and they’re only able to scrape together $1.5 million, they’ll make that work, too.

It’s good to be scrappy and adaptable as a founder, but you need a Plan A: What, in your opinion, is the right amount of money to raise to get the company to the next stage of growth and the next round of funding? Of course, it’s possible that your lead investor wants to push you toward raising more or less than that, but you need to have a solid picture of how you’re going to get from where you are today to where you want to go.

Don’t list a range. Don’t mention that you have 28 different plans for how to make your company successful. The investors are going to want to see that you can be decisive and strategic. Make your Plan A, stick a dollar amount on it, and put that dollar amount on your “ask” slide.

In other words: If you are raising a seed round now, think about what you need to prove to your investors to be able to raise a Series A next. Map all of that out and determine what resources you need to get there. That’s how much money you need if everything goes to plan. Add 30% to 70% as a safety buffer (depending on how good your planning is and how predictable your business is), and that’s how much money you need to raise.

Don’t include a valuation

Another common mistake I see is that founders include the terms of an investment, or the valuation, on a slide. If you put “raising $5 million at a $20 million valuation” on the slide before you have a lead investor, you’re making a mistake. You may have an opinion for what valuation you are hoping for, of course, but that will come out as part of the negotiation later on. The amount of money you need is fixed-ish; what you are willing to give up in order to raise those funds is not.

In the best-case scenario, you find two or three lead investors who end up in a bidding war for the privilege of investing in you. The levers they have available aren’t just the valuation of the company, of course — there are plenty of other clauses that are up for negotiation in a funding process.

The one exception to this is if you already have a lead investor and you’re just looking to close out the round. In that case, your “ask” slide can include the name of the lead investor and the terms agreed upon. “Raising $5 million at a $20 million valuation, and Investor X has committed $3 million of the round” can work.

Having said that, if you’re that far into your funding round, there’s probably enough inertia to close out the round; it’s unlikely to be necessary to update this slide once you have a signed term sheet in hand.

Explain what the funds will be used for

You’re running a startup, and you’re going to want to raise money to accomplish something. Makes sense. What doesn’t make any sense at all is how many founders seem to be shy about sharing the details of the plan. A lot of the due diligence process is going to be focused on figuring out whether you are a competent, believable founder and showing that you have a detailed plan and vision for what’s going to happen over the next stretch of time.

Put differently: If I’m going to invest $2 million into your startup, I want to know what that money buys me, in terms of progress for your company.

Ideally, your company has an operating plan as part of the pitch deck, which goes into detail about what is going to happen between this and the next funding round. On the “ask” slide, however, you have the opportunity to summarize in three or four bullet points what you’re going to do with the money.

Typically, you’re going to want to include product, traction, market validation and key hire milestones.

Product — What product milestones do you need to hit in order to raise the next tranche of money? In particular, this includes beta or full product launches, major feature sets in the product pipeline or integrations with partners.

Traction — What business metrics do you need to achieve in order to raise more money? How many units do you have to sell, how many subscribers do you need, how many customers do you want? Other metrics may also be helpful here — your net promoter score (NPS), monthly active users, etc.

Market validation — What can you do to prove that there’s a real market out there willing to pay for the product or service you are peddling?

Key hires — In order to reach the above goals, you probably need to hire. How many people do you need to hire? When?

Each of these goals should be SMART: specific, measurable, achievable, relevant and time-based. Poor goals are vague: “Improve marketing,” or “Get more customers” or “Add features to our product.”

Examples of great SMART goals:

“By Jan 2025, we need 2,000 paying customers on our recurring subscription model.”

“In the next six months, we need to reduce our customer acquisition cost by 20%.”

“Our B2B sales need to improve, so by July we are aiming to hire an experienced VP of sales who can help shape our sales processes.”

Be. Specific.

Never mind the timeline — talk about the milestones

As we hinted at above, it’s important to list the milestones you believe you need to achieve to raise the next round of funding. Note that this is milestone-driven; each goal unlocks the next part of the journey. But that doesn’t mean that you’re explicitly talking about time.

You are not raising money to get 18 months of runway. You are raising money to hit a certain set of milestones. If you can do that in 12 months, then you raise your next round of funding in a year. If you need 24 months, that’s OK, too. Don’t get too hung up on the timeline; some things take more time than you might expect. That makes sense; this is a startup — nothing ever goes to plan.

The corollary of this is that you need to bake enough wiggle room into your plans. If you expect something to take 18 months, but it takes 24, it’s a really poor look if you run out of money in month 19.

Clarity is crucial

The “ask” slide is one of the most painful slides to get wrong because it shows that you aren’t a very good founder. Perhaps you’re a great technical co-founder, a brilliant salesperson or an incredible marketer, and that’s great — but the job of the founder is to have a specific, actionable, reasonable plan in place to navigate through choppy waters.

Having a poor “ask and use of funds” slide is a huge red flag to many investors. After all, investors have a conga line of smart, talented folks coming through the door day in and day out.

To stand out, you can’t just be good at marketing, sales, development or any of the other aspects of running a business. You have to be good at the art of running the business, too — and this is one of the slides where you get to show off and prove that you know what you’re doing. Don’t waste that opportunity.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

1. How Investors Will Grade Your Startup: A Sample VC Memo On A $5M Seed Round.

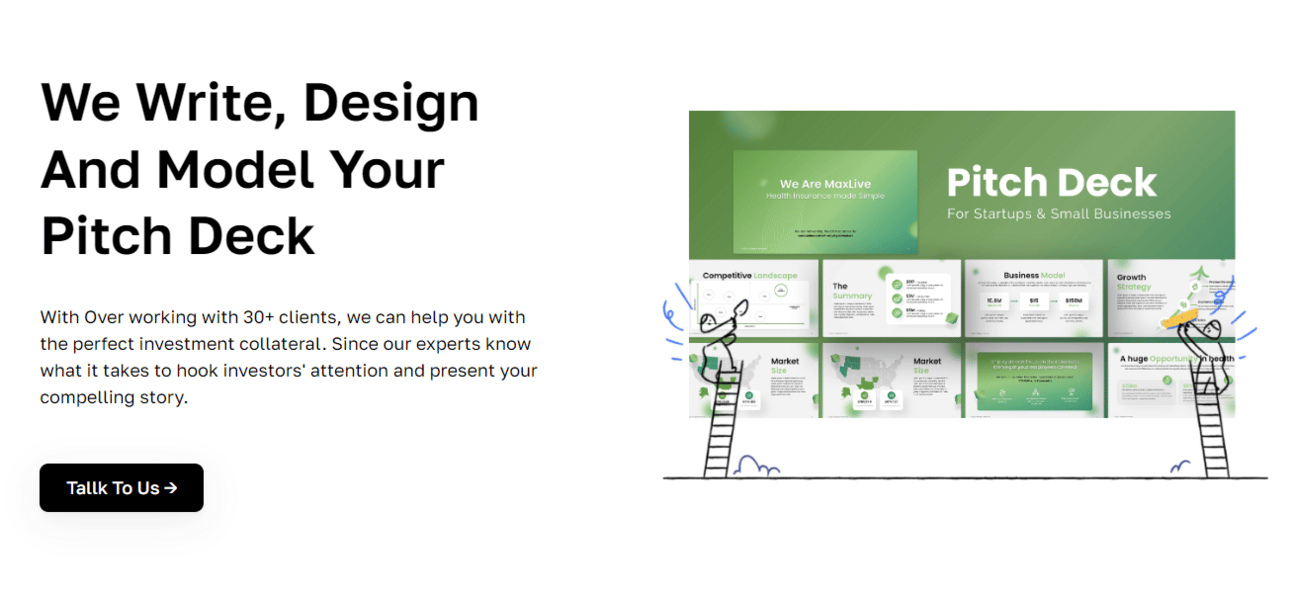

This framework was shared by John Hu, an entrepreneur with experience at leading venture capital firms such as Goldman Sachs and Norwest Venture Partners. John is currently building his own startup called Stan. He applied this framework to evaluate his own venture, rating each category.

Team: What is the quality of your team? How strong is your “Founder-Market’Fit? Why is your team the best team to solve this problem?

Market Size: How large is this market? Does it have BN$+ potential

Competition: How competitive is this market?

Differentiation: How will you beat the competition? What’s your competitive angle?

Metrics: How strong are your metrics? How strong of a growth indication do they give?

Exit Potential: How many potential buyers are there of your company?

These are great points that founders can consider to grading their startup, but there is a simpler way to grade a startup as 'A' or 'C,' as shared by Herwig Springer -

𝗧𝗲𝗮𝗺

A for taking market feedback over theory.

C for having outside commitments at play.𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗶𝘇𝗲

A for evidence to support target market cap.

C for overestimating the accessible market.𝗖𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝗼𝗻

A for having a key competitive advantage.

C for failing to acknowledge key competitors.𝗗𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁𝗶𝗮𝘁𝗶𝗼𝗻

A for building strong moats like proprietary technology.

C for differentiation based on easily replicable factors.𝗠𝗲𝘁𝗿𝗶𝗰𝘀

A for balancing growth and profitability metrics.

C for focusing on vanity metrics like sign-ups.𝗘𝘅𝗶𝘁 𝗣𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹

A for considering options like M&A.

C for hyperfocusing on one path.

2. How Did Superhuman Validate Its Idea and Get Their First 5,000 Users?

When you have an idea — you have a hypothesis.

It doesn’t matter how big or small the idea is, or whether you even consciously think about hypotheses — there’s always a reason you believe it will work.

Before you go outside in shorts — check the weather.

Before you eat old leftovers — sniff it.

Before you start a company — find out if it’s a good idea. And just like you don’t want to wait too long to figure out if that 3-day-old Chinese food was bad — you don’t want to end up building something nobody wants and wasting potential years of your life. No pressure.

You can’t (successfully) grow a bad idea.

Figuring out if you’re onto something starts by knowing what your hypothesis is, and then asking what’s the quickest way you can validate it.

Let’s look at how Superhuman did it.

In the first year of Superhuman, as we were primarily building, we threw up a landing page. It was a terrible landing page, a basic Squarespace thing, that took us all of 2 hours to put together. All you could do on this page was throw in your email address. And when you threw in your email address, you got an automatic email from me, with two questions:

1. What do you use for email today?2. What were your pet peeves about it?

I had two hypotheses going in.

Hypothesis number one was that for Gmail, people were upset about how slow it had gotten, how it wasn’t working properly offline and how they had to use Gmail plugins to make it do the things that they wanted to do.

Then for third-party email clients, people were upset about how buggy they were, how unstable they were, and how they don’t sync properly. All of which are still true today.

Part of the validation came from people responding to their page’s value statement (enough for many founders). But, if they saw themes in the answers — they’d know they were right, and they’d know what the biggest problems to focus on were.

I personally would have added one more question in there, something like “What do you do professionally?”. This would have been a useful way to start learning about their audience — i.e CEO’s who use Gmail are annoyed about how slow it is.

Anyway, throwing up a landing page only works if people go there. So here’s what Superhuman did to get traffic.

They focused on getting press and creating FOMO

The best way to do it is to pick one or two events a year where you can insert yourself into the cultural zeitgeist. For us, one such event was when Mailbox was being shut down. It was the perfect narrative, “I’m over here, come look at my company.” […] I currently have one of the most widely read articles on how to survive an acquisition. It was written in response to the Mailbox shutdown. […] That post ended up on Medium, and was syndicated to qz.com. We were able to insert it into the Zeitgeist. That article probably took me three days of doing nothing else, and another day of shopping it around. So four days all in. But those four days bought north of 5,000 signups.

Inserting yourself into the Zeitgeist means taking advantage of something relevant and timely — something people are talking about — and getting involved in the conversation.

Mailbox was a popular email client that promised a more efficient email experience, and when people were talking about its shutdown, it created a nice gap for Rahul and his team to make Superhuman relevant.

This is a creative marketing strategy that’s good for press and growth spurts, but not a growth engine you can rely on. But it worked great as a turbo-boost for Superhuman and it got them their first 5,000 users.

So, if there is a trend or existing cultural momentum you can build on, lean into it. But what if there isn’t? What other ways can you reach people to validate your idea?

First, know who your target audience is. Then, try one of the 7 other strategies that account for every consumer apps early growth:

Go to your users, offline. Find out where your users are hanging out in real life and meet them there. Snapchat went to malls, and Tinder went around college campuses.

Go to your users, online. Find the groups and forums where people are talking and meet them there. Dropbox went to Hackernews, and TikTok went to the App Store.

Invite your friends. Ask your friends if they’re from your target audience to join. Examples of founders who went the friend route are Slack, LinkedIn, and me and this newsletter. Thanks for joining first Joe!

Create FOMO. This requires having a strong value proposition or an inherently social product. Superhuman, Robinhood, and Clubhouse are the best examples here of companies that created FOMO with their waitlists.

Use influencers. Find out who the influencers are in your target market, and then get them to talk about your product. Good examples here are ProductHunt and Twitter.

Get press. Is there a unique, compelling, fresh story you could pitch to the press? This overlaps with entering the zeitgeist but also stands alone. We know Superhuman did this, but Slack and Instagram used press well.

Build a community. This takes more time, but building a community early gives you a great platform to leverage later. Producthunt started building a community with a mailing list, and Stackoverflow used their founder’s communities.

Okay, so Superhuman got press and created FOMO to get early users and validate their hypothesis that people had an issue with email.

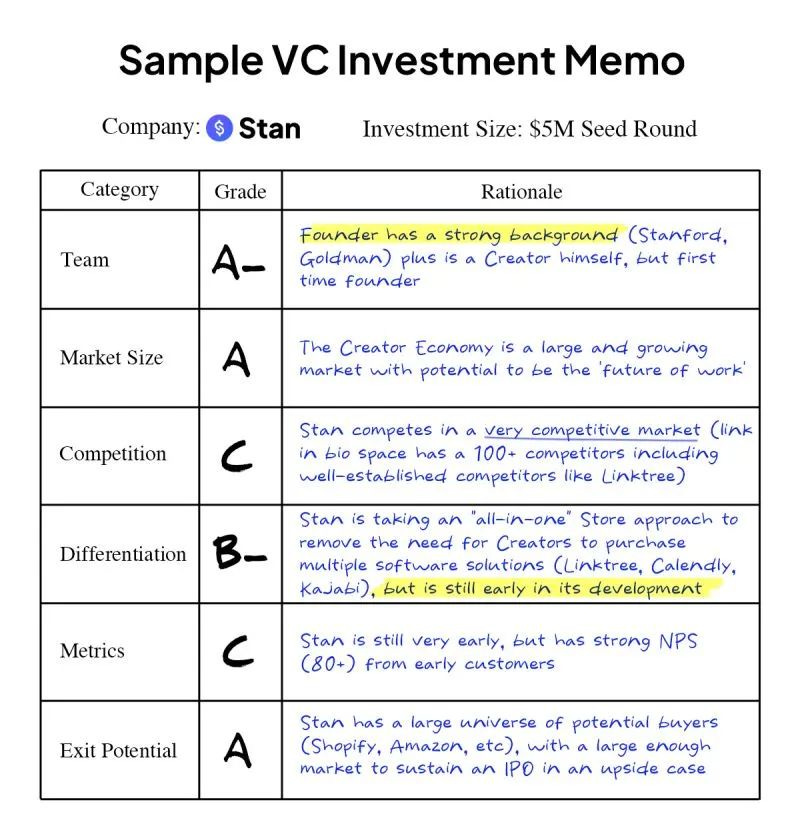

3. Validating Without Launching

Validating products means endless iterations and quick launches, right?

Not always.

In some industries, like consumer tech, your reputation means everything. As Mark Zuckerberg said in The Social Network, “it has to be cool.”

So how do you make a “cool” product without getting a ton of users on it?

Nikita Bier founded tbh and Gas, grew them to millions of users, and sold both of them for tens of millions (to Facebook and Discord, respectively).

He says the best way to get insights before launch is to simulate the UX:

Join 31000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Sankaet Pathak, founder of the bankrupt fintech Synapse, has launched a new robotics startup called Foundation, raising $11 million in pre-seed funding despite unresolved issues at his previous venture. (More Here)

Apple will allow iPhone users in the EU to delete native apps, including Safari and the App Store, in response to the bloc's Digital Markets Act. (More Here)

Tim Draper leads $2.5 Million In Crypto Startup - Ark Labs. (More Here)

Anthropic's AI app Claude crossed $1 million in gross mobile app revenue in 16 weeks, with nearly half from U.S. users. (More Here)

Over 1,000 venture capitalists, managing $276 billion in assets, have signed a pledge supporting Kamala Harris for the U.S. presidency. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 22,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

How Can I Help You?

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 50,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

VC Investment Analyst - S4S | USA - Apply Here

Human Resources and Talent - SG Innovate | Singapore - Apply Here

Climate Partner - 500 Global | India - Apply Here

Communications Working Student - Redalpine | Germany - Apply Here

2024 DRF Investment Partner - Dorm Room fund | USA - Apply Here

Entrepreneur in Residence - Techstar | USA - Apply Here

Finance/Admin Intern - TNB Aura | Singapore - Apply Here

Principal Chief Financial Officer - ITI Growth Opportunity Fund | India - Apply Here

Growth-stage Investment Principal - Redalpine | Germany - Apply Here

Operations Associate - Techstar | USA - Apply Here

Venture Capital Internship - Failup venture | Finland - Apply Here

Senior Associate - Aroya Venture Partner | India - Apply Here

Investment Analyst - Automotive Venture | USA - Apply Here

Fund Accountant - Endiya partner | India - Apply Here

Deals Team (MBA / Graduate Internship) - Fall '24 Newlin Ventures | USA - Apply Here

Venture Capital Intern - AeroX Venture | USA - Apply Here

Private Market Analyst - Micro venture | USA - Apply Here

🧐 Exclusive Resources For Aspiring Venture Capitalists by VC Partners

We have launched our all-in-one VC Interview guide (how to answer) for aspiring venture capitalists. For the first 50 aspiring venture capitalists, we are offering a 50% discount. Check out here…

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

Scheduled a call with us to build your pitch deck…

That’s It For Today! Happy Tuesday. Will meet You on Friday!

✍️Written By Sahil R | Venture Crew Team

Thank you for making this valuable information available. I really appreciate it !