Decoding Term Sheets for Founders and Investors in Simple Terms

Simlifying The Term Sheet For First Time Founders

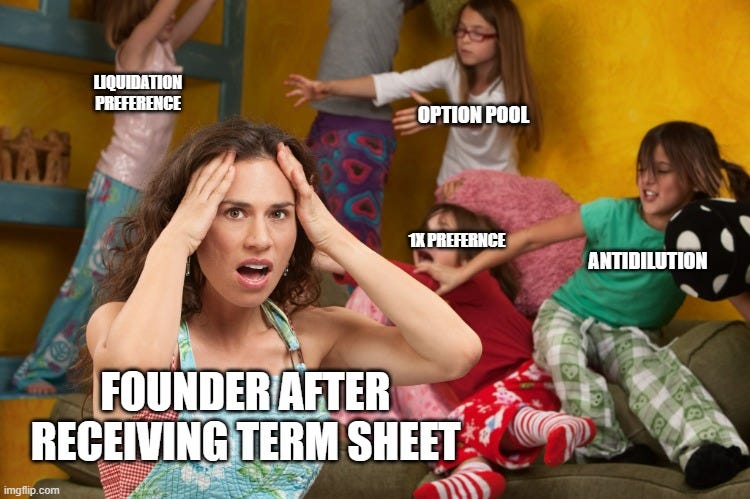

Picture this: you've got a great idea for a startup, and a venture capitalist is interested in funding your project. But before you pop open the champagne, you need to know about one important thing: term sheets. Now, I know what you're thinking, "What the heck is a term sheet?" Don't worry, friend, I've got you covered!

In plain English, a term sheet is a roadmap for the relationship between startups and investors. It lays out the terms of the deal and can impact your business's future success. So, whether you're a founder or a budding investor, buckle up and get ready to learn why understanding term sheets is key to your success.

Subscribed to “The Venture Crew” newsletter to receive daily updates on startups, venture capital, startup investing and vc jobs.

A term sheet is a non-binding legal agreement (non-disclosure and non-sharing) between the founders & investors that shows the investor’s interest in that startup. But signing term sheets doesn’t mean that they will go to invest in your startup.

If you are aware of the VC funding cycle - investors first sign the term sheets which contain finance and governance things then do the due diligence. During the due diligence if they find any red flags that can be resolved then only they will invest in your startup otherwise red flags in the due diligence process lead to the decline of the investment interest in the startup.

So, Understanding the term sheet can help founders to get an idea about the economics, governance, and operational aspects of the term sheet and help in negotiating deals with VCs.

In this, we will solely examine the economic aspects of term sheets, specifically focusing on valuation, investment amount, and liquidation preference. At a later time, we will delve into the governance aspects, including decision-making power, voting rights of investors and founders, and pro-rata rights. I will present the information in a way that is easy for first-time founders and aspiring VCs to understand.

Let's dive in. It’s a long write up, so make sure to read while taking coffee.

Let’s understand this with a simple example -

Consider a startup that got the term sheets from two different VCs ABC & PQR included the investment aspects as follows:

On the left side, you can see the terms like $ invested, Pre-money, Post-money and likewise others. I hope you are aware of these terms. But still, let’s decode the terms with explanation:

Decoding the above term sheet’s economic aspects:

ABC and PQR fund is willing to invest $2M & $4M respectively at a $8M pre-money valuation (Valuation of the company before investor invest their money).

So post-money valuation will be: For ABC Fund $10M and For PQR Fund $12M.

(Post money Valuation = Pre-money valuation + Investment Amount, it’s the valuation of the startup after the investor invests their money)

Equity In Company:

Equity in the company = Investment amount / Post-money Valuation

For Fund ABC, % of stake in company = $2M / $10M = 20%

For Fund PQR, % of stake in company = $4M / $12M = 33%

Option Pool:

It consists of shares of stock reserved for employees of a private company. So to attract talented people and their contribution to the startup, early-stage startups give them shares of their company. the founder has to reserve the Generally startups reserve about 15%-20% of stocks for new employees.

Here in the ABC fund - The startup is reserving 20% company’s stock as an option pool.

In the PQR fund - The startup is reserving around 15% of company stocks as an option pool.

Liquidation Preference:

It is the priority that investors have in receiving proceeds from the sale or liquidation of a company. In layman's terms, it means that the investors with a liquidation preference have the first right to get their money back before any proceeds are distributed to other shareholders.

For example, if an investor has a liquidation preference of 1x, they would get their initial investment back before any proceeds are distributed to other shareholders. If the investor has a liquidation preference of 2x, they would get twice their initial investment before any proceeds are distributed to other shareholders. Here In this term sheet, you can see both VC funds ABC & PQR have 1X liquidation preference.

There are two other terms also involved in it - participation and non-participation liquidation preference. Let’s understand both the terms, participation, and non-participation liquidation preference.

Non-Participation Liquidation Preference:

Upon liquidation, non-participating investors have the choice of receiving their funds in one of two ways: either based on a 1X preference or according to their stake in the company. Investors typically compare the potential returns from each option and select the one that would provide the most benefit for them.

Ex - Suppose for fund PQR - if in liquidation (sale) of a company valued at $10 M. let’s calculate the return for investors from both ways:

1. 1X liquidation means investors get 1X of the investment amount - so $4M OR 2. Based on the percentage of stake - 33% * $10M (Valuation) - $3.3M.

So after calculation, it’s clear that option 1 - 1X liquidation preference gives more return to the investor hence he will choose the 1X option and get a return of $4M. And the rest amount of $6M ($10M - $4M) will distribute to other shareholders.

Participation Liquidation Preference:

During the liquidation of a company, investors with a participation liquidation preference are entitled to receive their funds through both methods - a 1X preference and a percentage of their stake in the company.

Ex - Let’s take the same example as above if the fund PQR took the 1X participation liquidation preference then the calculation would be the same - but investors will get a return from both ways so 1X liquidation preference = $4M and Based on percentage stake = $3.3M. So total return for the investor = $4M + $3.3M = $7.3M and the rest amount of $2.7 ($10M - $7M) will be distributed to another stakeholder.

As a founder, if your company is liquidated and there is a participation liquidation preference in place, your returns will be minimal. Therefore, it's advantageous to have a 1X non-participation liquidation preference in the term sheet. Additionally, most venture funds typically use a 1X non-participation liquidation preference as it aligns the interests of investors and other stakeholders in the event of a company liquidation

Anti-dilution:

Antidilution rights protect venture capitalists in the event of a down round, which occurs when a company's valuation in a current funding round is lower than in a previous round. This can happen due to poor performance or other reasons. In a down round, past investors may request price adjustments to compensate for the lower valuation, allowing them to purchase shares at a lower price than in the seed round.

Investors get anti-dilution protection in two ways, BBWA (Broad-Based Weighted Average) and Full Ratchet. Let’s understand this first in layman's terms.

Let’s take an example, for fund ABC company’s value at $6M in a higher fund round but ABC valued the company at $8M -

so having BBWA antidilution protection, help to adjust the price of the company from $8M to $6M with a $2M amount of investment with a weighted average.

With the same example - If ABC fund has Full Ratchet Antidilution protection. In simple words, Full rachet means price reset. As new investors valued the company at $6M lower than the previous funding round, the previous investors also valued it at $8M, and this reset all the numbers and helped the ABC fund to get more equity in the company. And this leads to more dilution for founders and is not good for them.

So, founders need to look at Anti-dilution protection.

So, these are the important terms that are generally found in every term sheet.

But which of the one term sheet is good for you as a founder?

Ultimately, the decision is yours. Consider whether accepting a large investment now will enable you to achieve the planned growth and increase your startup's valuation in the next funding round. If the answer is yes, then go for it. If not, it might be better to accept a smaller amount and experiment to see if it works.

With this, there are other aspects in the term sheets like cap table, governance, and operational aspects. VC Opened promises you to write on that topic in the coming time.

Both founders and investors need to remember that a “term sheet does not guarantee success, only a strong business does. A term sheet is merely a tool for communicating the terms of the relationship between founders and investors.”

Today’s VC Job:

Venture Capital Fellow - Braven Venture - Remote Role - Apply

VC Intern - First Momentum Venture - Remote Role - Apply

Partner - a16z - Remote Role - Apply

Also, don't forget to join our Slack community, The Venture Crew, to connect with like-minded startup enthusiasts and founders.

Subscribed to “The Venture Crew” newsletter to receive daily updates on startups, venture capital, startup investing and vc jobs.

By - The Venture Crew!

If you want to showcase your startup (promote) in front of innovators, investors and startup enthusiast, please visit: https://theventurecrew.softr.app/

Or write to us at sahil.fuise@gmail.com