Build Your MVP Using Y Combinator's Proven Framework. | VC & Startup Jobs.

Antler’s Ability to Raise Cheatsheet & Financial Model Template.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter—where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Y-Combinator's Framework for Building a Successful MVP.

Quick Dive:

Antler’s Ability to Raise Cheatsheet: How much to raise in their first round?

Do Early-Stage Startups Need a Financial Model For Fundraising?

Validating Without Launching

Major News: Intel hires semiconductor veteran Lip-Bu Tan as new CEO, Google unveils Gemma 3, OpenAI launches tools to help businesses build AI agents & Y Combinator founders raising less money.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

The rules of a good startup pitch - A must-follow framework for founders.

EvolutionIQ got acquired for $730M — Here's their playbook for building an enduring AI business.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Why you should network with investors before you raise.

The definitive framework to find your next scalable user acquisition channel.

Startup legal document pack – essential legal docs for founders.

Palle Broe’s top 30 AI unicorns with the fewest employees.

Andrew Chen shares DoorDash’s v1.

All-In-One guide to pitch deck storytelling - free template & curated resources.

For AI Enthusiasts: Must-have resources to stay updated on AI tools, trusted by leading founders and investors.

🤝 INVESTMENT OPPORTUNITY WORTH EXPLORING

The AI Shift That Could Disrupt a $300B Market — Why Investors Are Backing New Sapience

Imagine an AI that doesn’t just guess the next word—it actually understands what it means. New Sapience is pioneering Synthetic Intelligence, a breakthrough that moves beyond today’s AI models. Unlike traditional LLMs, which rely on patterns and probability, this technology learns, comprehends, and applies real-world knowledge—just like a human.

Their vision? AI that thinks, reasons, and interacts with true understanding—not just prediction.

Why It Matters:

✅ $300B+ AI market, yet current models still struggle with bias, misinformation, and high costs.

✅ New Sapience’s tech eliminates these issues, creating AI that thinks, not just predicts.

✅ Massive market potential—8B smartphone users could be future customers.

Why I’m Watching:

$5M+ raised, backed by the co-inventor of the desktop PC.

A team with $350M+ in past exits, including NASA, DARPA, and Lockheed Martin veterans

Early investors get up to 35% bonus stock and exclusive perks.

They’re now raising at just $4/share with a $1,000 minimum investment—positioning early investors before AI reaches human-level comprehension.

Want a stake in the future of AI? Learn more & invest →

PARTNERSHIP WITH US

Get your product in front of over 85,000+ an audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

Y-Combinator's Framework for Building a Successful MVP.

When it comes to building a startup, one of the things that comes to a founder’s mind is creating a Minimum Viable Product (MVP) to test whether their solution to a particular problem is valid or not. However, one of the common mistakes I observe founders making is forgetting about the "Viable" part and just focusing on the product.

This common mistake is observed in 90% of startup founders and the rest 10% of founders who know how to build MVP become startups like Airbnb, twich & stripe etc.

Also, most of the founders mistaken the meaning of MVP - that it’s about considering one feature and building a product. Actually - It’s more than that!

So - In this, we will deep dive into -

Real Meaning of Building Minimal Viable Product (MVP)

How did Airbnb, Twitch, and Stripe build their MVPs?

How did these startups use the Y-Combinator MVP building strategy?

How can you build the MVP for your startup?

So grab your coffee and let’s deep dive into it!

What is an MVP (Minimum Viable Product)?

A minimum viable product (MVP) is a version of a product with just enough features to be usable by early customers …— Wikipedia

What should be your MVP mindset In the Pre-Launch Stage?

Let’s start with the meme above. It’s called the midwit meme.

Many first-time founders (the guy to the left of the bell curve) launch quickly and iterate (continue launching quickly). This is the same for the expert founder (the guy to the right of the bell curve).

But the guy in the middle is the “smart founder”. Let’s call him Benny. Benny wants to do surveys, raise money, build a team, etc. He wants to do it all. Benny learns after a while he should have been like the “dumb guys”.

As a founder, you want to build an MVP, get it to customers, and learn if it helps them or not. Then iterate.

You only really start learning about your users when you put a product in front of them. Not by doing 1000 surveys, gathering a mailing list, or fundraising for half a year.

The amazing thing, your MVP might not even work how you want it to.

Your goal as an early-stage founder:

Launch quickly. (MVP)

Get your first customers.

Talk To Customers & Get Feedback

Iterate (Improve the product)

These goals need to be your guiding principle.

Expect that after 3–5 iterations, your MVP would have changed so much. But that’s a good thing. It means you’ve been listening to your customers.

Try and remember that you are not the hero of your customer’s story. You’re not Harry Potter, you’re Dumbledore who gives him the tools to be the hero of his own story. You serve at the pleasure of the customer.

Is an MVP really the way to go?

Many founders want to build a product (like the iPhone) that blows people out of the water at once. That’s a very steep hill to climb though.

The MVP approach is best. You might have a question that -

But What If My MVP Is Rubbish and they Never Want To Talk To Me Again?

Even the biggest startups had this same fear. YC deals with it every time. It’s okay that you feel this fear. But never act on it.

FEAR- False Expectations Appearing Real

Think about it. If one customer doesn’t like your product, does that kill your startup? No. You can reach out to another customer. You can reach out to the same customer after you’ve made the product better.

The more amazing thing is that most people who speak with startups at an early stage are early adopters. They try out products that are in their rubbish phase. They are used to products not working quite as well as they should.

Early users usually have a problem. They are the only ones brave enough to try untested products that could solve the problem. They are usually there for the long haul to give you feedback on how to make the product better.

Fake Steve Jobs -

These types of founders think they know exactly what the customer needs. Let’s call them fake Steves.

In their minds, Steve Jobs built the iPhone and iPod, such amazing products in one go. The mistake they're making is that’s not true. Many of them remember the 3rd or 4th iteration of these products. The first iPhone had 2G internet, no app store, etc.

You don’t know what the customer needs. The customer alone knows what they need. If you ask them, they will tell you. How you ask them is by showing them your MVP.

Examples of Successful MVPs

1. Airbnb:

This is the first version of AirBnB. They didn’t have a lot of features. If you were an early adopter, here was what you enjoyed.

No payment system.

No map view. You couldn’t see where the house was in the city.

You had to sleep on an airbed. The whole house could not be rented to you.

It was only for conferences.

2. Twitch:

Twitch was the world's leading video platform and community for gamers.

They began as Justin TV with one page.

Only 1 streamer, Justin.

Their video was low res.

But they’re now one of the most popular streaming websites in the world.

Do you know what thing they focused on at the pre-launch stage?

Software MVP

Very fast to build (weeks not months)

Very limited functionality

Appeal to a small set of users

They built a product that people loved, not one that everyone loved. It didn’t solve all the problems. Solve problems step by step.

Who Are These Early Adopters? Why Do They Want To Go Through So Much Pain?

“You want to build your product for customers who have their hair on fire.” What product would you want to buy from me?

Maybe a hose, bucket of water, or something that can bring water. Well, all I have is a brick (my MVP). Walking away won’t even cross your mind. You’re desperate, you’ll buy the brick and hit yourself on the head to kill the fire.

The early adopters are the desperate ones. Forget the ones that are not desperate.

Why surveys don’t work.

You might have had a formal business school education. Now you’re thinking let’s do a survey and learn everything the user needs. Then we build it.

That won’t work either. The customer doesn’t know everything about the answer to their problem. They don’t even know everything about the problem itself. If they did, don’t you think they would build the solution on their own or hire people to do it for them?

It’s your job to know. Surveys help you find out your users' pain but not how to solve it. Only a product can do that.

You give them a product and ask, does this solve your problem? Yes or no and

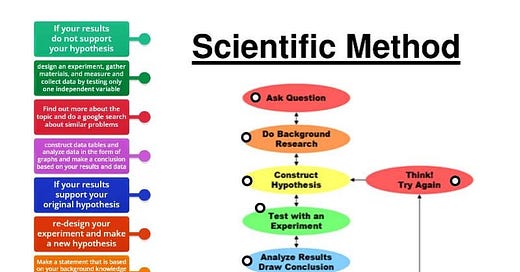

you go down the scientific method flow chart from there.

How To Build An MVP Quickly!

Set a specific deadline for completion.

Give yourself a timeframe. It’s easier to move on if you do. If you allow endless time to build, you’ll never stop building the MVP.

Write down the MVP features.

Don’t keep doing a double take while building. Write everything you want to build down now. Then you won’t have to rethink everything later.

Cut unnecessary features.

At this point, you will cut many features. Think how important is this to solve the user’s problem.

A startup to solve overseas payments doesn't need a chat feature in the MVP. Neither does it need APIs connected to every bank in the world. Both are important but can be skipped for the MVP.

Don’t fall in love with your MVP.

Have you heard married couples say something like: this is not the person I married or fell in love with?

Please please please don’t fall in love with your MVP.

It will change so much as you’re iterating.

If you’re in love with it, you won't want it to change. You’re building an emotional barrier to your growth.

Final Thoughts

“It’s better to have 100 customers that really love your product than 100k that are just ok with it.” — Michael Seibel, Y-Combinator

Those 100 will give you rich feedback that you need to grow. Build for them and the others will come when you have a shiny product.

All these concepts are covered in the Video by Michael Seibel!

📢 INVESTMENT OPPORTUNITY FOR YOU

The Future of Ready-to-Drink Cocktail—Why Investors Are Backing Booz Box

The ready-to-drink (RTD) cocktail market is booming, but Booz Box is doing it differently. Forget the cans—Booz Box delivers premium, spirit-based cocktails in an innovative boxed format, keeping drinks fresh, portable, and more sustainable.

Why It Matters:

The RTD market is valued at $13B+ and growing at 4% annually.

Millennials & Gen Z crave premium, convenient, and eco-friendly alternatives.

Positioned in major retailers like Total Wine, Buy Rite, and Pier 13, capturing high-demand locations.

Why I’m Watching:

Growing traction with distribution in multiple states, including NJ, NY, RI, FL, CA & TX.

Award-winning flavours crafted by top mixologists offer a premium alternative to canned RTDs.

16 investors have already backed Booz Box.

With demand surging for high-quality, convenient cocktails, Booz Box is positioned for rapid growth—and now’s the chance to invest in the future of RTD beverages.

Want to invest in the future of cocktails? Learn more & invest →

📃 QUICK DIVES

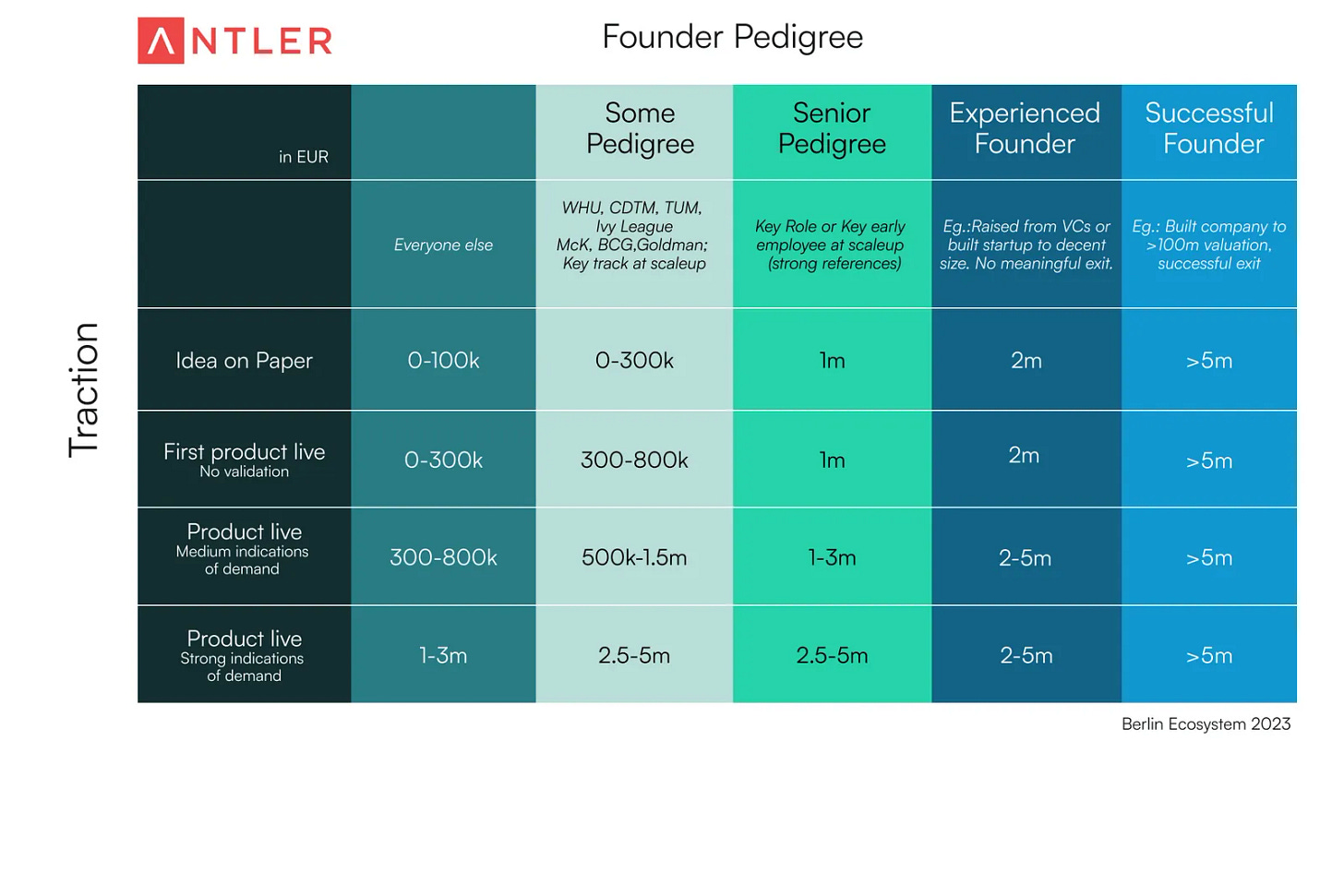

1. Antler’s Ability to Raise Cheatsheet: How much to raise in their first round?

Antler has shared a cheat sheet to help founders assess their ability to raise capital in their initial funding round -

When it comes to fundraising, two factors can make all the difference: Founder pedigree and Traction.

1️⃣ Founder Pedigree: The less traction you have, the more your background matters. Investors look at your past to assess whether you can deliver in the future. It's about limiting execution risk.

This isn't necessarily rational. Great founders get overlooked because they don't fit the typical pattern. But with thousands of similar opportunities, it's a real filter for investors.

2️⃣ Traction: Traction beats pedigree. When you present more than just an idea on paper and your product has gained some traction, your ability to raise increases. Lower-profile founders can raise funds when their idea becomes more than just an idea.

Some factors can change the game.

"Levelling up cheats" moves you to one field to the right in the fundraising matrix, potentially increasing your chances. These might include factors like having a strong co-founder, industry expertise, or unique insights.

"Handicaps" move you to one field left, possibly making fundraising more challenging. These could be factors like a lack of relevant experience or a difficult-to-explain product.

There are two must-haves without which you won't be able to raise, regardless of pedigree or traction:

Fundraising-ability: You need reasonable fundraising skills. Networking, sales skills, storytelling, and running a tight process are crucial.

Market attractiveness: Your market must be significant and attractive. In the early stages, it's binary - either investors get excited about the opportunity, or they don't.

Remember

Valuations are a function of capital raised. Assume 15-25% dilution irrespective of the amount raised. For example, if a team raises 800k, the valuation will likely be between 3.2m - 5.3m.

LinkedIn profile beats pitch deck in very early stages. Many investors will check your LinkedIn before deciding on a first meeting or looking at your pitch deck.

When is this wrong?

Numbers are purely directional. They've been validated with experienced investors, but they're not exact.

This model is primarily for software startups. Biotech & Hardware companies play by different rules.

Copycat models are very binary. Experienced teams can attract large funding, while others struggle to raise anything.

Raising from a rich uncle or family/friends who aren't experienced venture investors follows different rules.

Remember, great founders come from all backgrounds. If you don't fit the "classic" profile, you might need to prove more in the beginning, but there are countless examples of founders without traditional backgrounds building awesome companies.

2. Do Early-Stage Startups Need a Financial Model For Fundraising?

When you learn about entrepreneurship in school you’re taught to have a clear, strong business plan and financial model when you start out, and to use that as a way to communicate the path your business will take.

The real world is much messier. Any plan you had when you started gets changed quickly. Every day or even hour of your time that you devote to your startup needs to be spent getting it off the ground.

The same is true for a financial model. Your projections will be wildly wrong.

Not only that, but the levers you have at your disposal in the model may not end up being what you think they’ll be — the entire business may change, and you likely don’t know enough yet at the pre-seed stage to be sure.

Investors all know this. They see tons of startups and have many first-hand data points showing that everything can change and often does. What they don’t know is if YOU know that.

Investors are looking to de-risk the idea of investing in you. Startups are inherently so risky that they look for ways to think of your startup as less risky than others. One of those ways is to assess your founder mindset — how much do you “get” what being a founder will really be like?

The thinking there is that the more you “get” it the more you’ll be able to anticipate challenges and be emotionally steady when things get rocky.

This is a very common place where first-time founders and founders who don’t have a strong network fail to build trust with an investor. That might not be fair, but it’s true. Two of those signals for how well someone is ready to be a venture-backed founder are:

How well do they know how to prioritize their time?

Whether they realize everything will change from their “plan” or not. Presenting investors with detailed financial projections at the pre-seed stage fails both of those tests.

Ok… So Why is a Financial Model Useful?

VCs who want to see a model use it as a proxy for understanding whether a founder can correctly break down the incentives and value levers in a problem space.

VCs want to trust that if the business needs to change, the founder will be able to quickly figure out how to evaluate new opportunities and position their product for success in a new market. It's just a different way of de-risking an investment opportunity.

The simple takeaway is that each investor is different in what traits they value and how they reach conviction. So Know your investor - talk to their backed founders, and read their content. Think about the type of investor you want as a partner based on their evaluation approach.

You can download the financial model Excel template here.

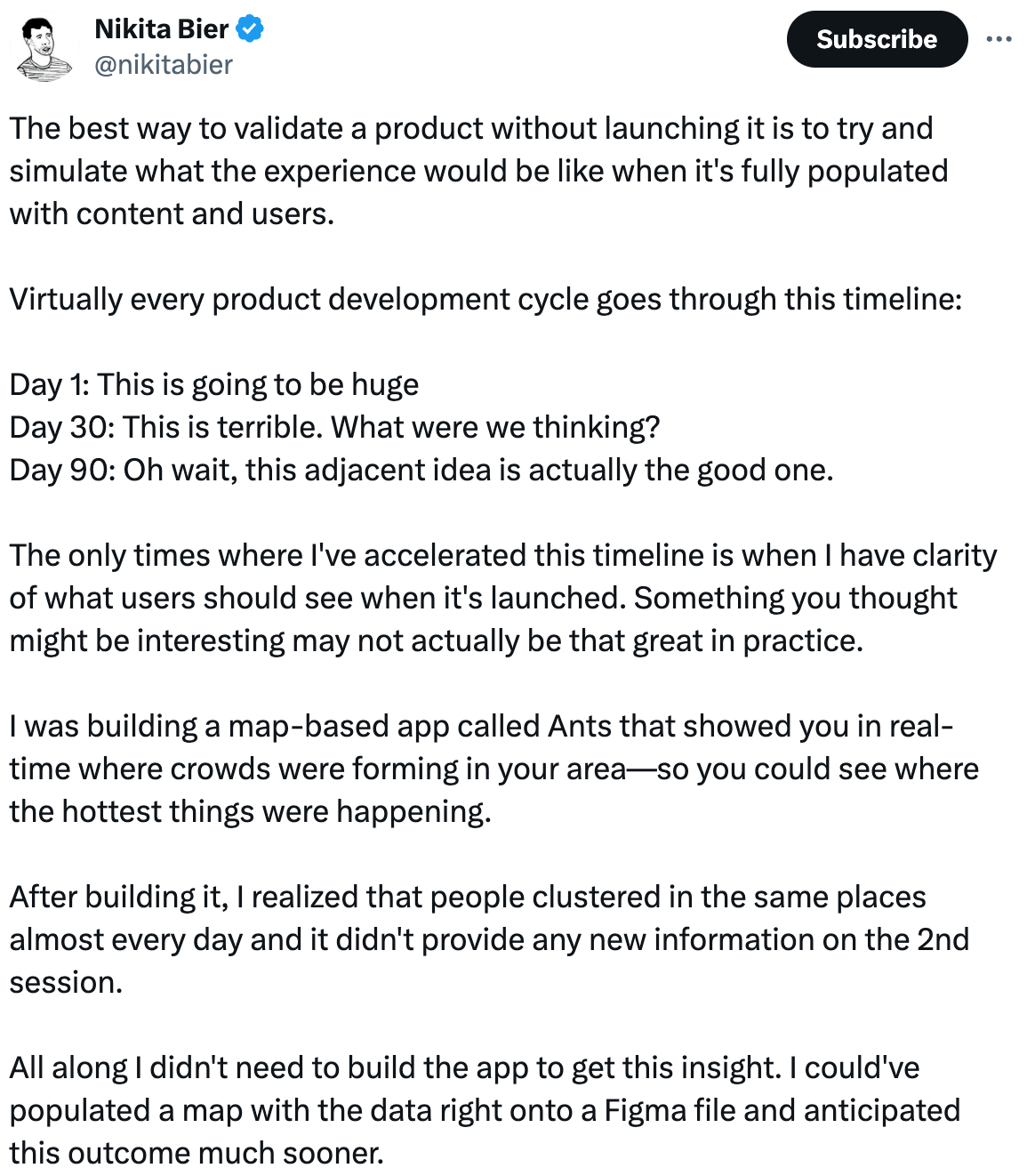

3. Validating Without Launching.

Validating products means endless iterations and quick launches, right?

Not always.

In some industries, like consumer tech, your reputation means everything. As Mark Zuckerberg said in The Social Network, “It has to be cool.”

So how do you make a “cool” product without getting a ton of users on it?

Nikita Bier founded tbh and Gas, grew them to millions of users, and sold both of them for tens of millions (to Facebook and Discord, respectively).

He says the best way to get insights before launch is to simulate the UX:

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC & Startup Funding

Leitmotif, a Palo Alto- and Munich-based venture firm focused on decarbonization, has raised a $300M first fund from Volkswagen Group as its sole LP. (Read Here)

Equator, a venture capital firm focused on African climate tech startups, has raised a $55M first fund to support early-stage companies tackling sustainability challenges. (Read Here)

Meta is piloting an in-house AI training chip developed with TSMC to reduce reliance on Nvidia and cut hardware costs. (Read Here)

Apple is planning significant design updates for its iPhone, iPad, and Mac operating systems, marking the most substantial revamp in years, according to a Bloomberg report. (Read Here)

Some Y Combinator founders are opting to raise less VC funding despite strong investor interest, prioritizing control and lean operations over rapid scaling. (Read Here)

Google has introduced Gemma 3, an updated AI model designed for developers to create applications that can run on various devices and support over 35 languages, along with text, image, and video analysis. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs — offering a 30% discount for a limited time. Don’t miss this. (Access Here)

General Counsel - Playground Global | USA - Apply Here

Principal - Mavin Ventures | India - Apply Here

Vice President - Agritech - Mavin Venture | India - Apply Here

Part-Time Student at Impact VC - Kopa Venture | Germany - Apply Here

Partner 16 - a16z | USA - Apply Here

Partnerships, Events & Outreach Intern - Succeed Venture | India - Apply Here

Senior Associate - Hubspot Venture | USA - Apply Here

2025 Venture Capital Summer Analyst - Stepstone Group | USA - Apply Here

Investor - Griffin Gaming Partner | USA - Apply Here

Investor Relations Intern - January Capital | Singapore - Apply Here

Investment Associate - Quona Capital | India - Apply Here

Investment Analyst (AI/ML) - TDK Venture | USA - Apply Here

Investment Analyst Intern - Tencent | USA - Apply Here

CURATED RESOURCES

Access Curated Resources For Founders & Investors…

Building Cap Table As A Founder: Template to Download.

Excel Template: Early Stage Startup Financial Model For Fundraising.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

Write Your Monthly Investor Update (Email Template Download).

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

1000+ Euro Tech Angel Investors & VC Firms Database.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator