B2B SaaS benchmarks VCs use to spot PMF, AI tools used by a16z partner & Zuck’s “superintelligence” memo.

Framework for successful monetisation & Elad Gil: Six AI markets are now locked.

👋 Hey, Sahil here — Welcome back to Venture Curator, where we explore how top investors think, how real founders build, and the strategies shaping tomorrow’s companies. Today’s edition features even more carefully curated content.

Big idea + report of the week :

B2B SaaS benchmarks VCs use to spot product-market fit.

The quiet shift in VC: LPs moving money from giants to nimble funds.

Elad Gil: Six AI markets are now locked — here’s your next move.

Frameworks & insightful posts :

AI tools used by a16z partner Olivia Moore.

The 9-step framework for successful monetisation.

The 60-second pitch formula that gets investors to say “Yes”.

What founders can learn from Zuck’s “superintelligence” memo.

HIGHLY RECOMMENDED FOR FOUNDERS

Investor Q&A Prep Kit: Answer Tough Questions Like a Pro.

Your pitch deck gets you in the door. Your answers keep you in the game.

This Investor Q&A Prep Kit is built with insights from top VCs and founders, giving you the exact questions investors ask, plus frameworks, sample answers, and the hidden meaning behind each one.

What’s inside:

100+ real investor questions across 8 categories (team, market, traction, product, fundraising details, and more)

Frameworks for answering with clarity and confidence

Common mistakes to avoid so you don’t lose trust mid-pitch

Whether you’re about to raise or fine-tune your responses, this is the prep resource you’ll revisit every round.

🤝 PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

START WITH

🧠 Big idea + report of the week

B2B SaaS benchmarks VCs use to spot product-market fit.

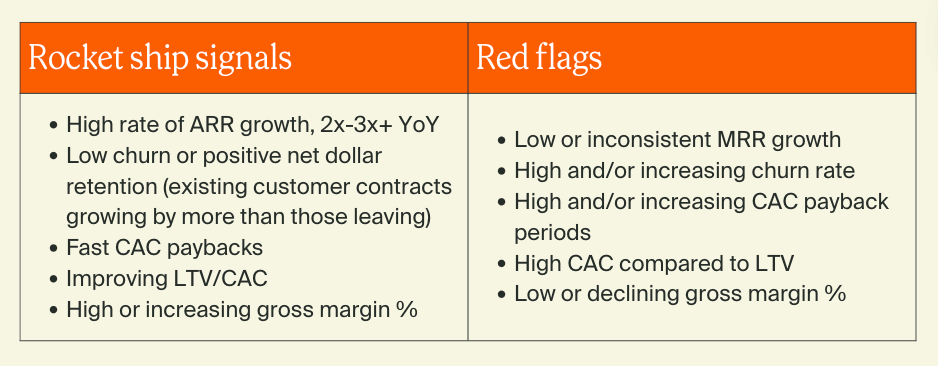

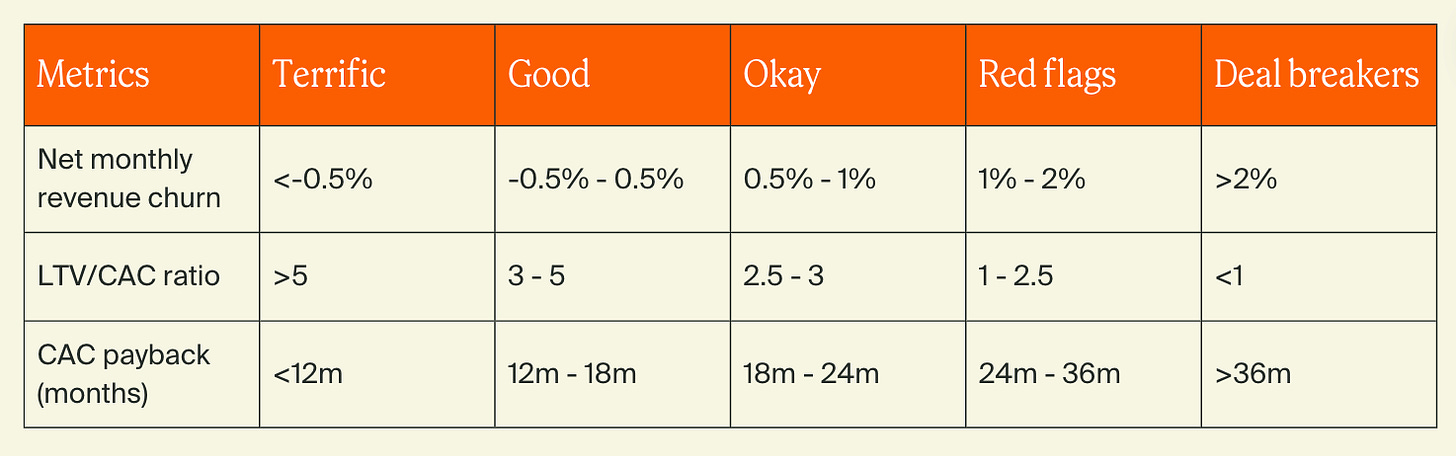

When VCs look at your numbers, they’re not chasing perfect metrics; they’re looking for signals of product-market fit. The best founders know which metrics scream “rocket ship” and which ones raise red flags.

Here are the big ones to watch:

LTV/CAC ratio: How much value you get from a customer vs. what it costs to acquire them.

Series A–C sweet spot: LTV/CAC > 3.

Product-led growth examples like Atlassian have ultra-low CAC because the product sells itself.

High CAC can still work (Salesforce) if LTV is high enough.

Gross margin %: Shows how much revenue you keep after variable costs like hosting and support. High margins = more cash to reinvest.

Net revenue churn: The gold standard for SaaS retention.

Negative churn (net revenue retention > 100%) is a strong PMF signal.

If you have “project-based” customers who churn but return, show that with cohort analysis.

CAC payback period: How fast you recoup acquisition spend.

Faster payback = lower cash burn and less dilution.

Long payback is fine if expansion revenue drives LTV up.

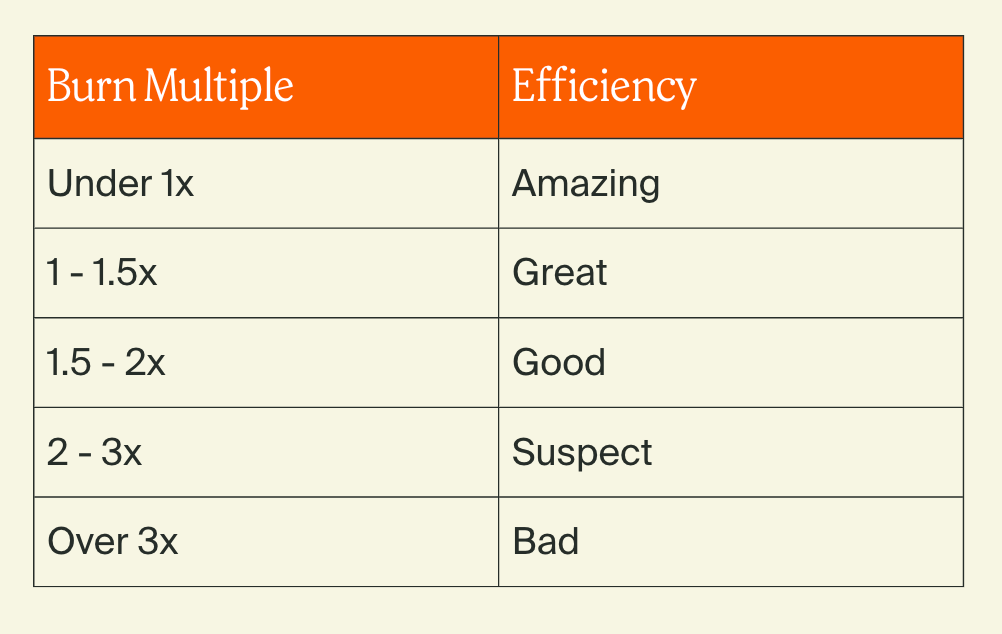

Burn multiple: Net burn ÷ net new ARR. Lower = more efficient. David Sacks’ rule of thumb is widely used here.

ARR growth & Rule of 40: Sustainable ARR growth + EBITDA margin should ideally sum to 40% or more. It’s a favourite investor shortcut for measuring the balance between growth and profitability.

VCs don’t judge one number in isolation. A longer CAC payback is fine if churn is low. High churn is fine if CAC is near zero and customers keep coming back. Show the full picture, especially through cohorts, and make it easy for investors to see the link between capital efficiency and growth. (Airtree: B2B SaaS Benchmarks)

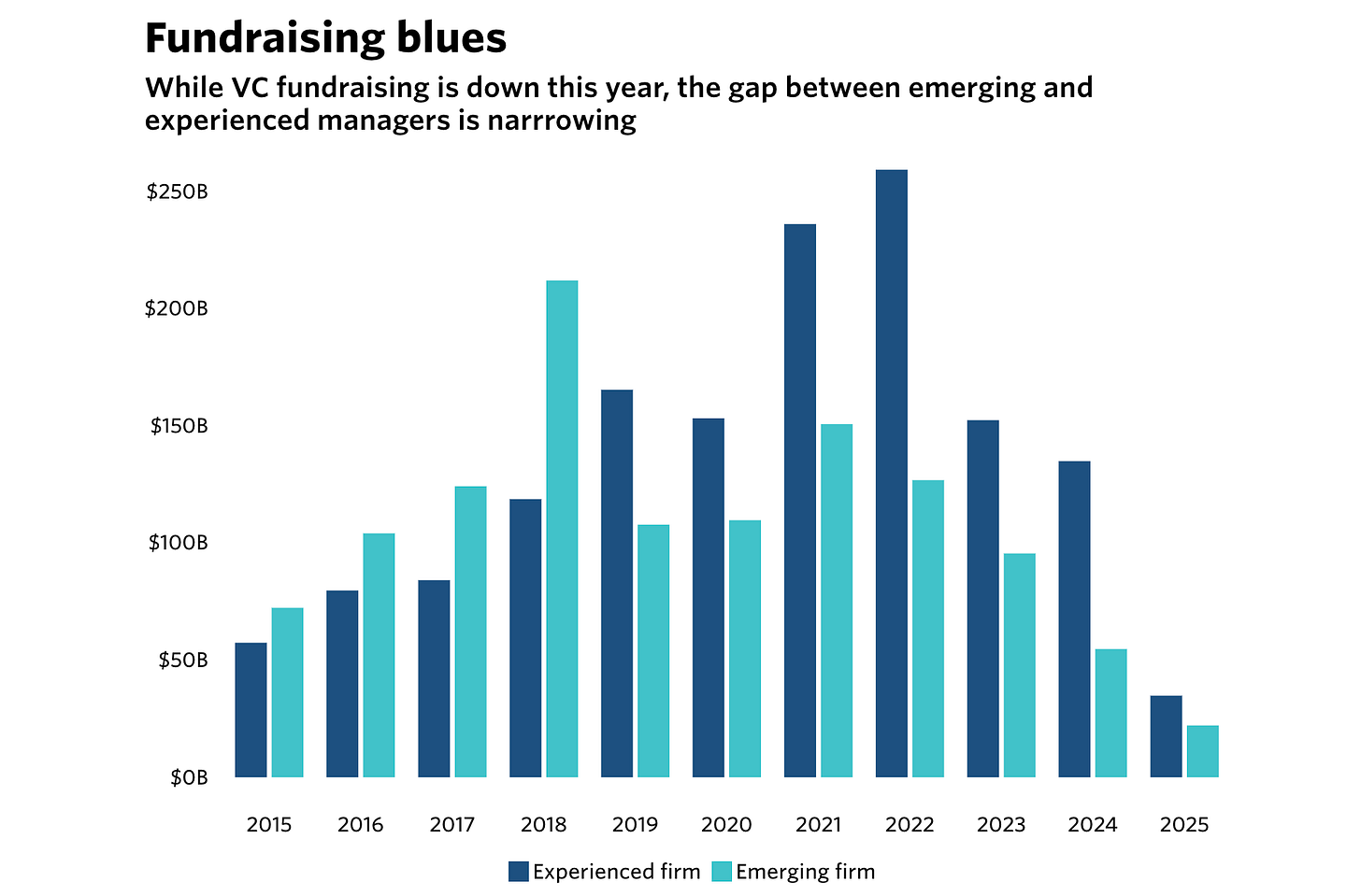

The quiet shift in VC: LPs moving money from giants to nimble funds.

VC fundraising is expected to reach a decade low this year, even as the LPs that are investing show a greater appetite for emerging managers.

According to pitchbook - VC fundraising is still in a slump, but the share going to emerging managers (fewer than 4 funds raised) is climbing, 39% of commitments this year vs. 29% in 2024.

Why? LPs are realizing nimble, smaller funds often deliver outsized returns:

Closer to innovation: Many are former operators plugged into industry shifts, especially in AI, giving them early deal access.

Smaller & faster: Micro-funds and solo GPs can move quickly, slip into competitive rounds, and align better with founders.

Higher upside potential: It’s easier for a $50M fund to return 5x than a $10B fund.

But challenges remain:

Liquidity bottleneck: Without big exits, LPs have less capital to recycle.

Track record pressure: First-time GPs must win over LPs with narrative, networks, and early “killer” deals.

Competition surge: More people want to launch funds than there is LP demand.

The signal: LPs are adapting to the new VC normal. Once the exit market reopens, expect more capital to flow toward emerging managers riding big tech shifts like AI.

Elad Gil : Six AI markets are now locked — here’s your next move.

For the last few years, AI markets felt like the Wild West, too many players, unclear winners, models improving so fast that product bets aged in months.

But Elad Gil says we’ve hit a turning point: some markets have now “crystalized,” with leaders that are likely to dominate for the next 1–2 years.

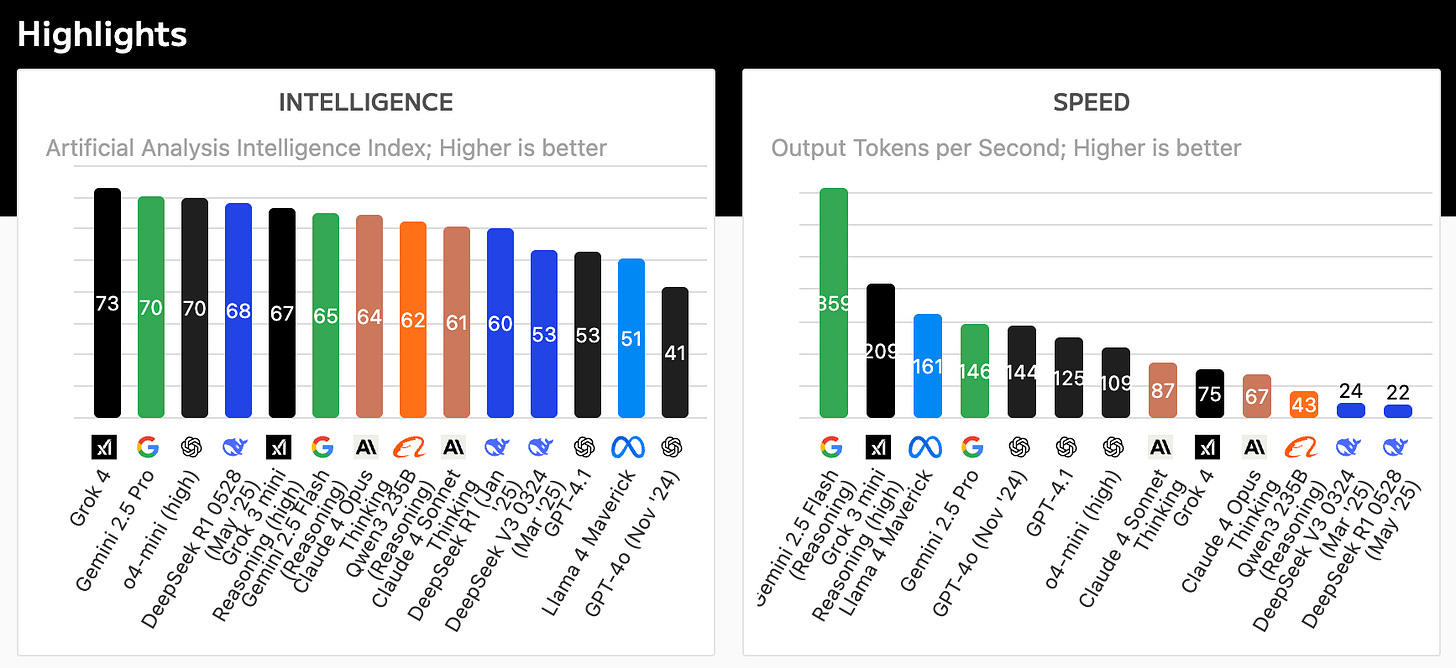

Where winners are clear:

Foundation models (LLMs): Dominated by Anthropic, OpenAI/Microsoft, Google Gemini, Meta (LLaMA), Mistral, and X.AI. Billions in capital + cloud partnerships make new entrants unlikely without a major breakthrough.

Code: GitHub Copilot, Claude Code, Cursor, Windsurf, OpenAI, Replit, and Lovable are ahead, but the debate between agentic vs IDE workflows is still open.

Legal: Harvey and CaseText have become go-to solutions for law firms and enterprises, with room for expansion into broader professional services.

Medical scribing: Abridge, Ambience, Commure, and Microsoft Nuance lead here, with potential to move deeper into healthcare workflows.

Customer experience: Decagon and Sierra are strong early winners, while incumbents like Intercom and Zendesk integrate AI to defend market share.

Search & IR: Google, OpenAI (ChatGPT), Meta, and Perplexity (the main startup here) are shaping how search evolves with agents.

Markets still up for grabs: Accounting, compliance (e.g., pharma), financial analysis tools, sales agents, AI-first security, and other specialized verticals. These could crystalize as models improve or GTM strategies mature.

Big shifts to watch:

The move from “AI chat” to agentic workflows that take actions, not just give answers.

The “GPT ladder” effect, each leap in model capability unlocks entirely new markets.

A shift from selling seats to selling units of cognition, pricing AI output like human labor.

AI roll-ups, buying companies outright to integrate AI faster than selling them software.

Founders should note: capital moats are already forming in established markets. The bigger wins might now come from spotting the next wave before it crystallizes.

SOMETHING MORE

🧩 Frameworks & insightful posts

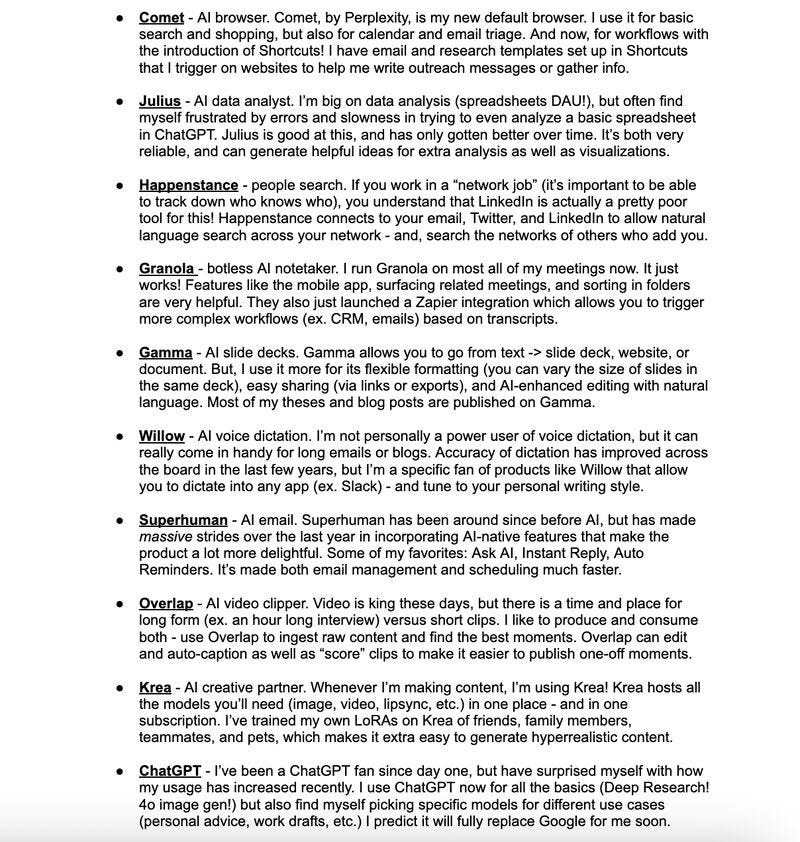

AI tools used by a16z partner Olivia Moore.

Many people wonder what top investors actually use AI tools for in their day-to-day life, not just for making better investment decisions, but also for staying productive.

Olivia Moore, an AI Partner at Andreessen Horowitz, tests dozens of products every week, but only a handful make it into her daily AI stack.

Here’s what she relies on:

Comet (Perplexity): Default AI browser for research, calendar/email triage, and automated outreach workflows.

Julius AI: A quick, accurate AI data analyst for spreadsheet insights and visualizations.

Happenstance: AI-powered people search across email, LinkedIn, and Twitter to map networks.

Granola: AI meeting notes with smart triggers for post-meeting workflows.

Gamma: AI slide decks, docs, and websites, with flexible formatting and sharing.

Willow: AI voice dictation tuned to personal writing style.

Superhuman: AI-enhanced email with Ask AI, Instant Reply, and Auto Reminders.

Overlap: AI video clipping and auto-captioning for long-form content.

Krea: AI creative partner for generating hyperrealistic visuals.

ChatGPT: For deep research, personal advice, and drafting.

She’s also experimenting with Serif (AI email assistant), Tako (trusted data + graphics), and SnapCalorie (AI nutrition tracker).

Even at the center of AI investing, the tools that stick are the ones that fit seamlessly into existing workflows and deliver daily value, not just novelty.

The 9-step framework for successful monetisation.

Most founders design the product first and figure out the price later. Madhavan Ramanujam (author of Monetising Innovation) says this is why 72% of new products miss revenue or profit goals. His advice? Flip it. Start with pricing conversations before you write a single line of code.

Here’s his 9-step framework to avoid the four big pricing failures, Feature Shock, Minivation, Hidden Gems, and Undead products:

1. Have the willingness-to-pay talk early: Before you build, ask customers:

“What’s an acceptable price?”

“What’s expensive?”

“What’s prohibitively expensive?” The answers tell you if it’s worth building, what to include, and what to leave out.

2. Segment, one size fits none: Different groups value (and pay for) the same product differently. A package for each segment, like water that’s free at a fountain but $10 as Liquid Death.

3. Configure & bundle smartly : Identify must-have, nice-to-have, and deal-killer features. Bundle it in a way that lifts overall spend without overwhelming users.

4. Choose your monetisation model wisely: How you charge matters more than what you charge. Michelin switched to per-kilometre pricing for truck tyres and increased profits, even when tyres lasted longer.

5. Pick the right pricing strategy

Maximisation: Short-term revenue

Penetration: Land-and-expand

Skimming: Serve high-WTP early adopters first, then expand

6. Build an outside-in business case: Base projections on customer WTP and price elasticity, not just internal targets. Keep it as a living document.

7. Communicate value, not features: Customers buy benefits. Involve sales and marketing early to frame value from day one.

8. Use behavioural pricing: Small tweaks in pricing tiers, decoy plans, and psychological thresholds can lift ARPU by double digits without changing the product.

9. Maintain price integrity: Don’t rush to cut prices. First, diagnose if it’s a value, communication, quality, or sales approach issue.

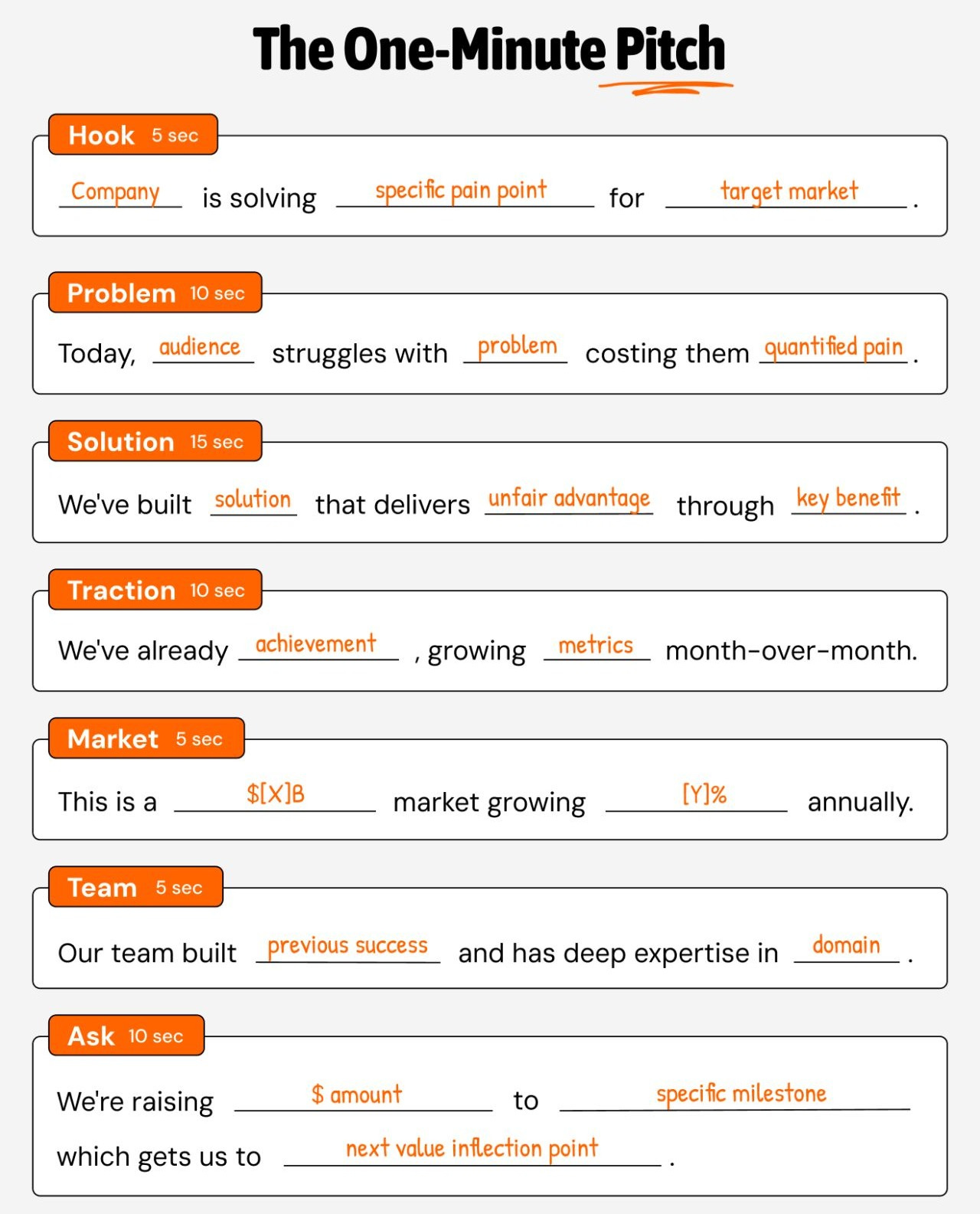

The 60-second pitch formula that gets investors to say “Yes”.

Most founders don’t fail to raise because of a bad idea; they lose the investor’s attention by saying too much. The ones who raise aren’t always the smartest. They’re the clearest.

Here’s the 1-minute pitch structure shared by Yurii:

1. Hook (5 sec)

Lead with the simplest statement of what you do. “We’re solving [specific pain] for [target market].”

2. Problem (10 sec)

Make them feel the pain you’re solving. “Today, [audience] struggles with [problem], costing them [quantified pain].”

3. Solution (15 sec)

Show how you fix it and why it’s different. “We’ve built [solution] that delivers [unfair advantage] through [key benefit].”

4. Traction (10 sec)

Prove it’s working. “We’ve already [achievement], growing [metrics] month-over-month.”

5. Market (5 sec)

Show the size of the prize. “This is a $[X]B market growing [Y]% annually.”

6. Team (5 sec)

Build confidence in execution. “Our team built [previous success] and has deep expertise in [domain].”

7. Ask (10 sec)

Make the investment ask crystal clear. “We’re raising [$ amount] to [milestone], which gets us to [next value inflection point].”

If you can’t explain your business in 60 seconds, investors won’t remember it. Keep it clear, keep it tight, and lead with only what matters most.

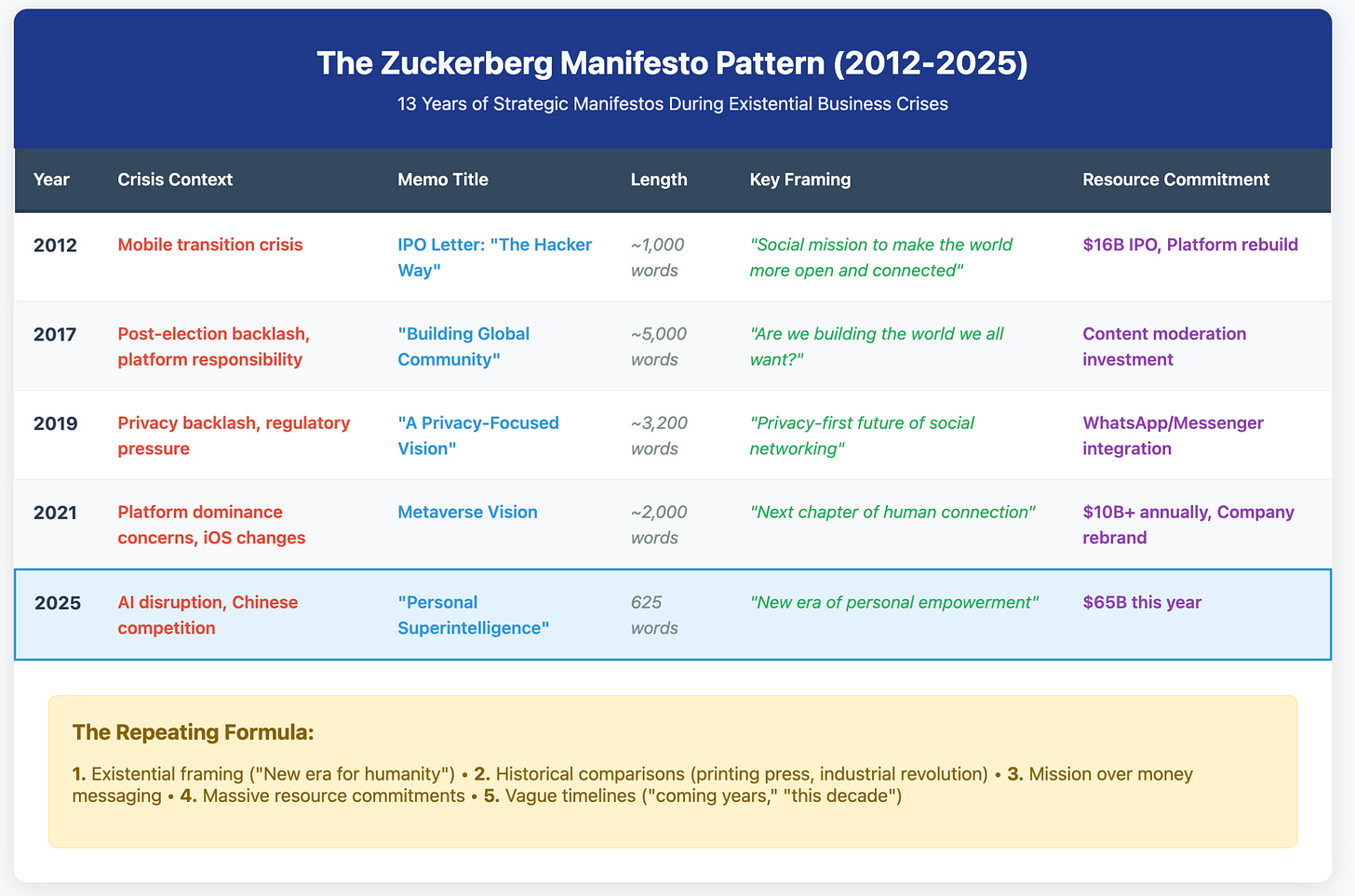

What founders can learn from Zuck’s “superintelligence” memo.

Last week, Mark Zuckerberg released a memo about superintelligence and what it will mean for both Meta and the world at large.

It's worth asking: Why did the company publish this memo? Who is the target audience, and what is Zuck saying between the lines? Om Malik decodes the short note, explaining that it follows the same formula for all of Zuck's memos since 2012.

Frame the moment as existential, “a new era for humanity”

Compare it to historic shifts, the printing press, Industrial Revolution

Lead with mission, not money

Commit billions in resources

Keep timelines vague (“this decade,” “coming years”)

Why now?

Meta is playing catch-up after OpenAI’s breakout success.

LLaMA’s open-source success built an ecosystem but didn’t capture much value.

Chinese rivals are now moving faster and cheaper in open-source AI.

Meta AI’s consumer product still lags far behind ChatGPT, Claude, and Gemini.

Zuck’s real move:

Reframes AI as “personal superintelligence” to stand apart from competitors’ generic “AI” narrative.

Positions Meta as empowering individuals, vs. the “AI replaces jobs” framing hitting OpenAI and others.

Tries to lean on Meta’s strongest asset, the richest dataset of human relationships and preferences, to build AI assistants with deep social context.

Zuckerberg’s biggest skill is knowing when to burn the boats and pivot the whole company. Most CEOs defend their existing moats.

He abandons them to protect Meta’s true asset attention and relationships and then migrates them to the next interface. But… execution is the hard part. The metaverse ate $50B with little to show. This superintelligence push could meet the same fate if the product gap with rivals isn’t closed fast.

EXPLORE MORE

💡 Reports, Articles and a few interesting stuffs

The slide every investor wants to see. (Link)

A must-read guide for aspiring Venture Capitalists. (Link)

Venture capital fund metrics cheat sheet. (Link)

What it means if you’re managing your co-founder. (Link)

3 things it comes down to for short-form marketing. (Link)

The founder’s guide to building in public (With 20+ real examples) (Link)

NEWS RECAP

🗞️ This week in startups & VC

New In VC

Expanse, a Chicago, Illinois based asset management firm built with a family office perspective, is announcing their $18M inaugural fund. (Read)

Deciens Capital, an Albuquerque, NM-based venture capital firm focused on financial services innovation, closed Fund III, at $93.33m. (Read)

OrbiMed, a NYC-based global healthcare investment firm, raised $1.86 billion in commitments. (Read)

Airtree Ventures, a Sydney, Australia-based venture capital firm, closed two funds totalling AUS$650m. (Read)

New Startup Deals

Clay, a sales automation startup, has raised a $100 million Series C round at a $3.1 billion valuation, led by CapitalG. (Read)

Resolvd AI, a NYC-based provider of a solution that automates complex reconciliation workflows, raised $1.6M in a Pre-Seed funding. (Read)

RunReveal, an Austin, TX-based security data platform provider, raised $7m in seed funding. (Read)

WiseBee, a NY-based autonomous security startup, raised $2.5m in pre-seed funding. (Read)

Elion, a NYC-based provider of an AI-powered research and intelligence platform for healthcare technology, raised $9.3M in Seed funding. (Read)

Asylon Robotics, a Norristown, PA-based provider of robotic perimeter security technology, raised $24M in Series B funding. (Read)

Bit2Me, a Madrid, Spain-based provider of a digital asset platform, raised $30M in funding. (Read)

Casap, a NYC-based company which specializes in intelligent automation for dispute and fraud operations, raised $25M in Series A funding. (Read)

Subzero Labs, a NYC-based provider of decentralized programmable networks, raised $20M in initial funding. (Read)

Strand Therapeutics, a Boston, MA-based company which specializes in new mRNA-based therapeutics, raised $153M in Series B funding. (Read)

TODAY’S JOB OPPORTUNITIES

💼 Venture capital & startup jobs

Associate - Mighty Capital | USA - Apply Here

Associate - Temasek | USA - Apply Here

Investment Analyst - Beas Capital | India - Apply Here

Investor Relations Analyst - Techstars | USA - Apply Here

Head of Platform - Pledge Venture | UK - Apply Here

Chief of Staff - Penny Jar Capital | USA - Apply Here

Analyst / Senior Analyst - Updaya Social Venture | India - Apply Here

Analyst - Adams Street Partners | USA - Apply Here

Associate - Iconique Capital | USA - Apply Here

Program Manager - generator | USA - Apply Here

Investment Analyst - Zeta Capital | India - Apply Here

Associate - OMERSE Venture | USA - Apply Here

Investment Analyst - Caanan | USA - Apply Here

Associate Telescope Partner | USA - Apply Here

Healthcare Analyst - General Investment Management | UK - Apply Here

Investor (AI) - Samsung next | USA - Apply Here

Investment Analyst - Miras Investment | Dubai - Apply Here

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator