Antler’s Framework To Find The Right Problem To Solve. | VC Jobs

How VCs Evaluate Founders, The Consumer Subscription Trifecta & 8 Signs Your Startup Is a Zombie.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: Antler’s Framework To Find The Right Problem To Solve.

Quick Dive:

NFX's Framework: How VCs Evaluate Founders?

The Consumer Subscription on Trifecta: What Makes Consumer AI Subscriptions Work?

8 Signs Your Startup Is a Zombie and how to avoid it.

Major News: Nvidia unveils AI avatar assistant for desktop, Samsung will let you rent a robot, Former Google engineer is co-founding a nonprofit to AGI & Elon Musk agrees that we’ve exhausted AI training data.

20+ VC & Startups Jobs Opportunities.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

Marc Andreessen shared a step-wise guide to building and achieving product-market fit (PMF).

AI is eating VC A chart from CB insights talks about how in 2024, AI startups pulled 37% of VC funding and 17%of deals all-time high.

Build your MVP with an experienced developer & designer at $3400 within 2-4 weeks.

Jensen Huang On Nvidia’s seed round: You need these three things to raise money from investors.

33 ways to grow your startup with AI.

Y-Combinator requests founders to Avoid These Startup Ideas.

VC partner shared his framework to evaluate AI startup’s tech stack.

Product launch checklist, a simple distribution strategy to get early customers.

Meco is the best free web app used to read newsletters in distraction-free systematic ways.

How to promote your startup with $0, 8 different ways to promote your product for zero marketing budget startups.

Early-stage startup financial model template for fundraising, simply put your numbers and get the right financial model.

A MESSAGE FROM SUPERHUMAN

🤝 Your Time Matters. Your Inbox Should Know That.

In the life of a founder, the inbox is both a necessity and a challenge. Every deal, opportunity, and conversation is buried under a flood of noise. Superhuman is designed to change that.

Imagine an inbox that knows what’s most important and drafts reply to messages before you look at them — and every action takes seconds instead of minutes. Superhuman transforms email into a tool for clarity, focus, and action.

This January, start your year with a platform built to help leaders like you get more done and save 4+ hours every single week.

With your first month free, nothing is holding you back.

Partnership With Us: Want to get your brand in front of 85,000+ readers like founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

Antler’s Framework To Find The Right Problem To Solve.

The Classical school of Economics chanted, "Supply, creates its demand!” Fast forward to the modern era, the “supply first'' days are long gone. We live in an age of abundance, and new-age entrepreneurs must find the customer demand before creating supply. In modern entrepreneurship, this saying has reversed: "Demand creates its supply."

Where do you think demand originates from?

The answer is simple: From a problem waiting to be solved!

If you closely look at any long-lasting business, you'll realise that its core idea germinated from solving customers’ heartfelt problems. A significant and market-relevant problem. No surprise that Uri Levine, the founder of Waze, suggests, "Fall in love with the problem, not the solution." In this writeup we will dive into -

Great companies focus on solving heartfelt problems.

What defines a heart-felt problem?

The five characteristics of heartfelt problems

How do you identify if a heart-felt problem is worth solving?

Great companies focus on solving heart-felt problems

A study conducted by the Harvard Business Review confirmed that 85% of executives believe that their organisations diagnose problems poorly. Most of them agree that this results in poor time and cost management and lost opportunity costs.

Problem-solving involves finding innovative and creative solutions to address societal, technological, or business-related problems.

Take, for example, WhatsApp's story. When its founders started the company, their main focus was on solving heart-felt problems concerning the high cost of international communication. This societal problem has existed for centuries since empires started to take over the world.

WhatsApp wasn’t the only player in this space—Viber, Google Allo, Kik, Skype, and even FB Messenger were competing in the market.

The team at WhatsApp recognised that mobile carriers and other apps were going against the customer problem. Competitors like Viber and Skype limited the experience by charging for international VOIP calls, and mobile carriers were charging exorbitant prices for international SMS.

WhatsApp doubled down on the customer problem and created features like free calls, free instant messaging, and only 99 cents for the app.

The bet paid off, and they grew by 100M users every month. The exit? A whopping $19 billion from Meta with only a team of 32 people.

What does this tell us?

Customer problems are the North Star for all great companies.

WhatsApp was able to focus relentlessly on the need for cheaper and faster international communication. Every decision they made focused on making communication more affordable and quicker for their users.

Customer problems don’t change; it’s only technology and customer behaviour that does.

WhatsApp wasn’t the first app to democratise communication, and Amazon wasn’t the first e-commerce company. If it’s a valuable problem, someone is already solving it. So don’t jump into solutions too quickly for fear of losing market share.

“Competing on a solution is a zero-sum game that eventually leads to a feature war, then a price war and all value is eventually destroyed.

In the startup world, the onus lies on founders to fall in love with the customer problem. When the customer problem is clear, founders can create solutions from new customer behaviours and emerg

ing technology trends to create innovative businesses.

So how do you identify a heart-felt problem for your customers? Let’s take a look.

What defines a heart-felt problem?

Customer problems exist across multiple layers. There’s a surface layer where they tell you a solution they have in mind—like I want to save money making international calls. But at its core, all problems distil down to one or a few of these emotions:

Security

Attention

Control

Meaning & purpose

Privacy

Community

Intimacy

Status

Achievement

How many of these emotional problems do you think WhatsApp solves?

Great entrepreneurs look beyond the customer-suggested problems. They ask “5 whys” until they get to the emotional reason that causes a customer to seek out a product.

Take the case of Slack, a workplace communication tool that has revolutionised how offices communicate.

Before Slack existed, office communication relied on email. The email was designed to be formal and disposable. However, Slack channels allowed teams with a shared interest to create more inclusive communication for everyone.

Suddenly, people working on the same project can create a project channel with a “searchable log of all communication and knowledge” (which is what SLACK stands for). What used to be an email thread now has a permanent space to foster a discussion around a common goal.

People can create project channels, shared interest channels, to company announcements. Giving internal teams shared meaning and purpose for the company they work in.

Companies are not buying Slack to replace emails but are buying Slack for the sense of community, meaning and shared purpose.

The five characteristics of heartfelt problems

Here are the five characteristics of heart-felt problems. The deeper the pain, the more value you can get from your customers:

Emotional — the problem must have an emotion attached to it

Functional — the problem must fulfil the basic functional need of the problem

Frequent — the problem must happen frequently enough for the user to justify the value

Urgent — the problem must have an impending deadline

Unavoidable — the problem must not have an easier way to get around the problem

It’s the entrepreneur's job to identify these five characteristics of a heart-felt problem and provide a solution to solve it well.

So, how do you identify if a heart-felt problem is worth solving?

"In a great market—a market with lots of real potential customers, the market pulls product out of the startup. Conversely, in a terrible market, you can have the best product in the world, and it doesn’t matter—you’re going to fail."

- Marc Andreessen

You’ll need to generate product ideas from market research and then identify customers' problems in that market to solve.

The first step is to research the market you want to be a part of. The opportunity size is based on how much your customer is spending to solve the problem right now. This information can come from industry research, government websites, and annual reports of key competitors, or you may even need to commission research if it’s too niche.

Useful tools to gather information about your market: Statistica, AnswerThePublic & Gartner etc.

Once you’ve gathered the market size of your product, you can start to identify the heart-felt problems for your customers.

You need to get out of your comfort zone and speak with your target customers. Put yourself in their shoes, and think about the problem you’re trying to solve.

Ask yourself:

If this customer problem exists, where would your customers go to solve it?

Chances are there are existing communities or media channels that connect your potential customers. Go there.

Don’t be afraid to speak with your competitor’s customers to understand why they purchased the product and what problem it was solving for them. It’s a free market.

The goal is to find your small set of early adopter customers—people who will tell their friends about your product. Look for the most profitable customer segment to start there.

Don’t fall into the trap of trying to target “everyone” (it’s a trap). You’ll spread yourself too thin and lose sight of the core customer problem.

There is no magic number of how many customer interviews you speak with. I like to start with five customers first, then adjust my questions every five customers until I’ve honed in on a deep enough problem with a large enough market size.

For B2B products, you’ll need to be more creative and treat customer interviews as a networking opportunity. You need to rely on introductions, conferences, meetups, host events, or even work in the industry to build a network. You need to pay it forward long before you can draw on the favours for customer insights.

Using the Jobs-To-Be-Done interview popularised by Clayton Christensen is an excellent method to speak with customers.

The trick is to find a deep customer problem in a market that is large enough to sustain your vision. 99% of the world’s problems are not worth solving but if you persist, you’ll eventually find one.

That’s it.

If you're a founder seeking guidance, look no further than the must-follow resources meticulously developed by Antler's Academy. (Featured Article)

FROM OUR PARTNER

🤝 FoundersEdge: Venture Fund built by Founders, for Founders

FoundersEdge is a venture fund created by founders who know what it takes to build game-changing companies. We invest at the intersection of AI and user experience, backing ambitious teams redefining how technology can be intuitive, powerful, and accessible.

Funs thesis:

The next wave of transformative companies will focus on making AI more accessible and human-centred. These companies aren’t just adding a chatbot—they’re rethinking user experience from the ground up as an AI-first journey. We’re often the first to check into pre-seed startups that share this vision.

For founders:

We’ve been in your shoes. As founders ourselves, we understand the challenges you face. Beyond capital, we offer deep technical expertise in AI/ML, UX design guidance, and access to a strategic network of seasoned founders and operators. At FoundersEdge, we believe founders are the ultimate edge for future founders.

For co-investors:

We partner with those who share our founder-first mindset, collaborating to give early-stage companies the edge they need to succeed.

Learn more about FoundersEdge →

QUICK DIVES

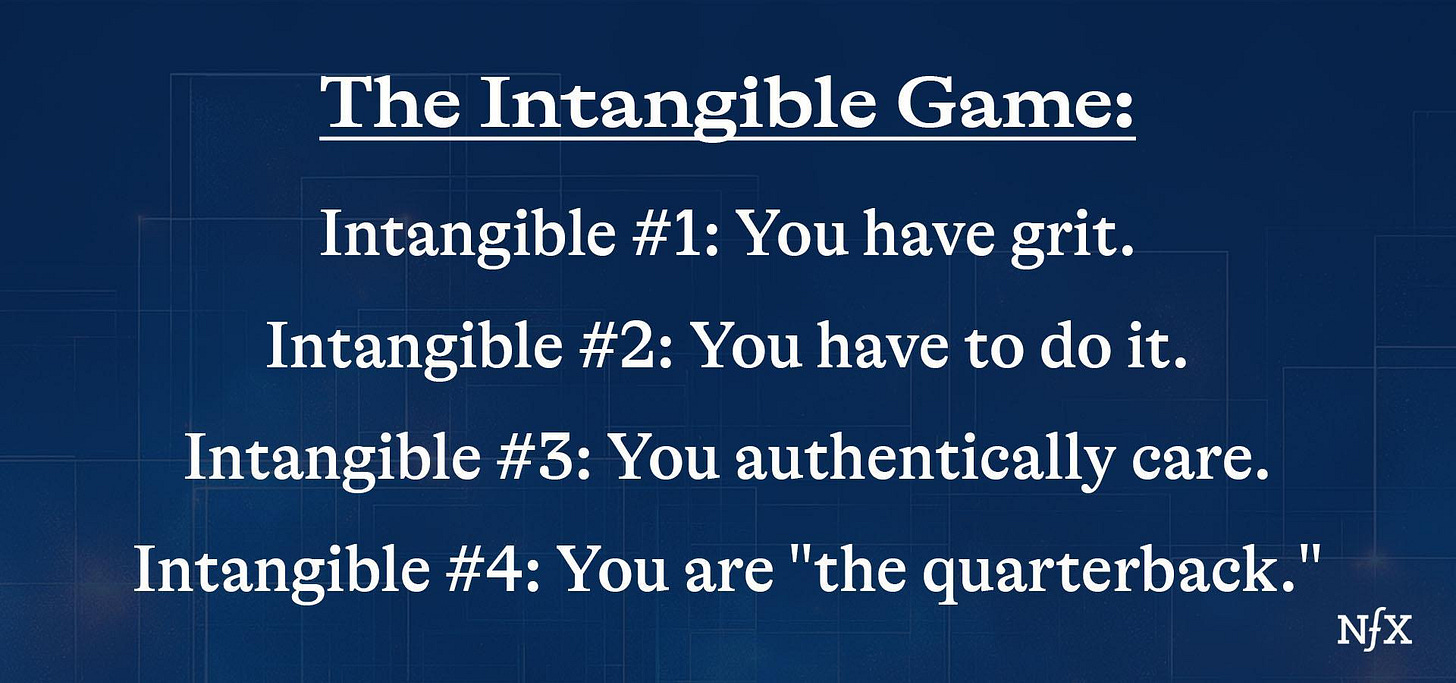

1. NFX's Framework: How VCs Evaluate Founders?

You've just wrapped up your pitch. The screen goes dark after the Zoom call, or you step out of the conference room, feeling confident. But what's going through the investors' minds at that crucial moment?

NFX has shared great insights and investors' frameworks for how they evaluate founders. I'll share some key points and notes for you to consider...

The Moment of Truth

When the door closes, there's an almost electric moment as investors exchange glances. It always goes one of two ways:

Scenario A: Pure electricity. The partners can barely contain their excitement. They're ready to start due diligence immediately, eager to call their colleagues about this amazing founder they just met.

Scenario B: Silence. Maybe a few shrugs. That ineffable feeling that this just isn't the one.

Here's the hard truth: that initial gut reaction matters more than anyone in venture capital likes to admit. If you land in Scenario B, climbing out of that hole is incredibly difficult. Worse yet, most VCs won't give you the real reason why. Some might even string you along while they wait to see if other prominent firms bite.

The People Factor

What many founders don't realize is that even in deep tech and biotech, where breakthrough IP and massive market potential are crucial, the decision often comes down to the people. In software, where pivots are practically guaranteed, this becomes even more critical.

When we invest at the seed stage, we're not just betting on your idea or technology – we're betting on you. We need to believe you're the person who can navigate the marathon from seed funding to a massive exit. This is precisely why it's such difficult feedback to give: it feels deeply personal and seemingly not actionable.

The "Compelling" Factor

When investors get truly excited about a founder, there's one word that consistently comes up in partner meetings: "compelling." It's frustratingly vague, but it speaks to a fundamental truth in venture capital – that ineffable quality that makes us think, "We have to invest in this person."

Think of it like scouting quarterbacks in football. Beyond the measurable metrics – arm strength, accuracy, speed – there are those crucial "intangibles" that separate the good from the great. It's that feeling you get watching Tom Brady or Patrick Mahomes with two minutes left in the fourth quarter. You just know they're going to find a way to win.

The Four Critical Intangibles

1. Unbreakable Grit

Starting a company isn't just challenging – it's an exercise in sustained suffering. Your health will take a hit. Relationships will strain. You'll battle constant FOMO and imposter syndrome, watching others seemingly race ahead while you struggle. During my time as CEO, I called it the "clenching feeling of death" in my gut.

Before you even think about pitching VCs, look yourself in the mirror and ask: Do you truly want this life? Many first-time founders jump in without understanding the real cost. Even Jensen Huang recently admitted he wouldn't do it again. Your ability to convince investors you can endure this journey starts with truly convincing yourself.

2. The Founder's Compulsion

The best founders don't start companies because they want to – they do it because they have to. It's not a choice; it's a compulsion. This manifests in countless small ways: your browser history is filled with market research, your friends are tired of hearing about your ideas, and your mind constantly living in the future you're trying to build.

3. Authentic Passion

Beyond basic founder-market fit lies something deeper: genuine care for your market and mission. You can't fake this long-term, and VCs can sense the difference. If you truly care, you'll naturally do the extra things that put you ahead of competitors. You'll instinctively know the difference between meaningful innovation and incremental improvement.

As Naval Ravikant says, you escape competition through authenticity. This isn't about faking it till you make it – it's about being genuinely obsessed with your mission.

4. The Quarterback Mindset

The most compelling founders demonstrate a rare form of multifaceted competence. They excel at both the strategic view and the tactical details. They can articulate the big vision while showing mastery of the small things – like responding to emails promptly with the perfect balance of insight and precision.

This is the quarterback quality: knowing exactly where the ball needs to go and having the skills to get it there, even under pressure.

The Real Pitch: It's About You

Here's what many founders miss: in that pitch room, you're selling yourself as much as your company. If you're getting consistent "no's," it might not be your idea or market – it could be how VCs perceive you as a leader.

This can be tough feedback to receive, which is why most VCs won't give it. And remember: not every VC will see you the same way. You won't be for everyone, and that's fine. What matters is finding the investors who recognize your intangibles and believe in your ability to lead.

The key is understanding that your personal qualities – your grit, compulsion, authentic passion, and leadership – are just as crucial as your deck, your tech, or your market size. Master this hidden game, and you might find fundraising becomes surprisingly straightforward.

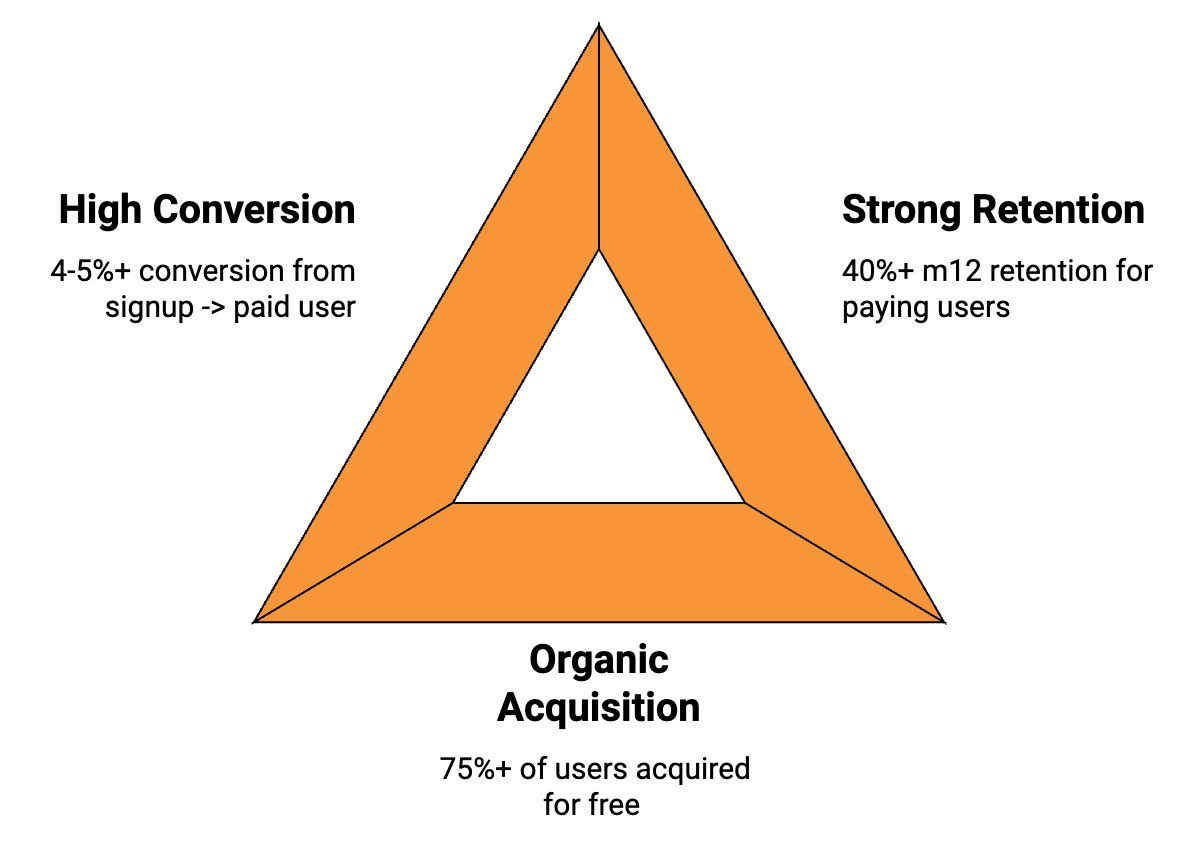

2. The Consumer Subscription Trifecta: What Makes Consumer AI Subscriptions Work?

After working with founders in the Consumer AI space - Olivia, a partner at a16z, noticed a clear pattern that makes subscription businesses work. She shared -

Most successful companies nail at least two of these three metrics, but the truly exceptional ones hit all three:

High Conversion (4-5%+ from signup to paid)

Strong Retention (40%+ of paying users still active after 12 months)

Organic Acquisition (75%+ of users coming in for free)

Let's break down what happens when you have different combinations:

High Conversion + Strong Retention (but paid acquisition): You can make money and potentially turn a profit, but everything hinges on managing your customer acquisition costs (CAC). Your growth will be limited by how quickly you can recoup your marketing spend.

High Conversion + Organic Acquisition (but poor retention): You'll build both users and revenue, but low lifetime values are your Achilles' heel. There's not much room for error since each customer isn't worth as much in the long run.

Strong Retention + Organic Acquisition (but low conversion): You'll grow your user base quickly, and people love your product. The challenge? Turning that love into revenue. You've built a great product, but haven't quite cracked the business model yet.

The Dream Scenario - All Three: This is what investors get excited about. You have a business that fills itself with users, converts them efficiently, and keeps them around. Even if these numbers dip as you scale beyond early adopters, you have enough cushion to stay healthy.

Think of it like a bucket - you want it to fill itself (organic acquisition), not leak much (retention) and contain something valuable (paying users). Hit all three, and you've got something special.

3. 8 Signs Your Startup Is a Zombie and how to avoid it.

Knowing when to quit and when to stick with it is a key skill for all startup founders.

Even the best investors in the world aren’t right all the time. So most investors apply a portfolio approach (Simple word — Broad Portfolio) to spread their risk and increase the chances of backing a billion-dollar opportunity — Power Law Guys….

In any investor’s portfolio, you have three types of startups: the dogs, the stars, and the zombies.

Dogs run out of cash before finding a scalable business model. These companies return nothing to the investors.

Stars are the home runs — the investments that generate 10x returns and make up for all the dogs.

Zombies are companies that are neither dogs nor stars. They make revenue, perhaps enough to break even, but not enough to generate a huge return for investors. Their growth seems stagnant and they can’t consistently generate more revenue than costs. They are constantly raising money, are focused more on investors than on customers, and rarely have a unique value proposition that generates exponentially more value for customers than existing solutions.

Investors see zombie startups as no longer attractive, and not worth a follow-up investment — which can be the kiss of death for those companies.

What Creates a Zombie

If you have read a book by Seth Godin titled The Dip: A Little Book That Teaches You When to Quit (and When to Stick).

Godin’s main idea is that to be the best in the world, you must quit the wrong stuff and stick with the right stuff. In the case of startups, it says that after some initial traction, there comes a dip.

From there, one of two things happens:

The dip bounces back and starts to trend upward to scale, or the dip turns into a cliff and never bounces back. Godin proposes that at the bottom of the curve — in the dip — founders have to choose to double down or cut their losses.

The ability to know when to hold them and when to fold them is the difference between dogs and stars. Zombies happen because some founders get caught up in the dip, and neither flame out nor take off to greatness.

How to Tell If Your Startup Is Doomed

Many signs can alert a founder (or investor) that a startup is stalling and zombie-bound. But the following signals can show that you may be in a zombie phase:

You don’t want to get out of bed in the morning.

You don’t want to go out in public for fear you’ll have to explain what you do.

You haven’t hit 10 per cent week-over-week growth on any meaningful metric (revenue, active users, etc).

You’ve been working on the same idea for more than a year and still haven’t launched.

You’ve launched a consumer service and have less than 2 per cent week-over-week growth in signups.

You’ve launched an enterprise service and have less than 2 per cent week-over-week growth in the revenue pipeline.

You are the CEO and hole yourself up in the offices so you don’t have to talk to employees and can read TechCrunch.

You’ve hired consultants to figure out revenue, culture, or product in a company of less than 10 people.

What You Can Do About It

Accept it. Call it a day, or as some founders choose to, flame out big. Double down on your efforts and fail large instead of quietly fading away.

Pivot one of the parts of your business model. To become a startup unicorn, you likely need an exponential advantage in one of these areas to shift from zombie to star (think: Netflix offers 10x the entertainment of a movie theatre for less than half the cost). There are lots of examples of how a pivot evolved from a zombie into a star: Yelp, YouTube, PayPal, Flickr, Groupon, and Shopify.

Organize an acquihire and make lemonade from your lemons. Sometimes, others can leverage what you have built to drive growth in their business. This is often done through an acquihire (buying a company as a means of hiring that startup’s people). While this may not be an optimal outcome, it is often the best choice for zombies.

Unlike on the TV show The Walking Dead, zombie status isn’t forever. There are examples of startups pivoting and becoming stars (and many more examples of startups pivoting and becoming dogs).

But what’s more important is that the decision you make is making a decision. Do not delude yourself.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Defiant, a London- and Lisbon-based early-stage VC firm, has raised $30M for its debut fund, targeting $70M. (Link)

Apple is reportedly developing a new app called Invites, spotted in iOS 18.3 beta code, to share visually rich event details and invitee lists. (Link)

Nvidia's R2X avatar, unveiled at CES 2025, is a desktop AI assistant that combines video game-like visuals with LLMs like GPT-4o or xAI's Grok for enhanced functionality. (Link)

Elon Musk's xAI has launched a beta iOS app for its chatbot Grok, now available in countries like the U.S., Australia, and India. (Link)

Elon Musk agrees that we’ve exhausted AI training data. (Link)

A former Google Engineer is co-founding a nonprofit to build benchmarks for AGI. (Link)

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Most aspiring VCs don’t know how to prepare for VC interviews. I’ve interviewed candidates for analyst and associate roles, and many struggle to answer even the basic question: Why do you want to become a VC?

That’s why, together with a few VC partners, I’ve created an all-in-one VC Interview Preparation Guide. For a limited time, we’re offering a 30% discount. Don’t miss out!

27 Y-Combinator Backed Startups hiring For Remote roles - Apply Here

Investor Relations Associate - Invitro Capital | USA - Apply Here

Program Manager - Generator | USA - Apply Here

Corporate Partnerships Associate - Plug and Play Tech Center | USA - Apply Here

Head of Operations - True Wealth Venture | USA (Remote) - Apply Here

Venture Fellow - DeVC | India - Apply Here

VC Associate, Growth Team - SpeedInvest | UK - Apply Here

VC Associate - Breega | UK - Apply Here

MBA Internship Summer 2025 - 25madison | USA - Apply Here

Associate - Engine Venture | USA - Apply Here

Investment Associate - EIT Urban Mobility | Spain - Apply Here

Venture Capital Junior Analyst - Stepstone Group | USA - Apply Here

Investor Relations Manager - Griffin Gaming Partner | USA - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator