8 Signs Your Startup Is a Zombie and 3 Things to Do About It ! | VC Remote Jobs & More

Your Startup Is A Zombie? | Limited Partner's Not Taking New Commitment To Invest In VC Funds? | VC Remote Jobs

📢 Today At A Glance

Deep Dive: 8 Signs Your Startup Is a Zombie, and 3 Things to Do About It

Featured Article: Limited Partner's Not Taking New Commitment To Invest In VC Funds?

Major News In Startups:VC Partner Sentence Prison To Fraud Over 50 Investors, Musk's Hyperloop Shutting Down & More

Weekday’s Must Reading on Startups, Venture Capital & Technology

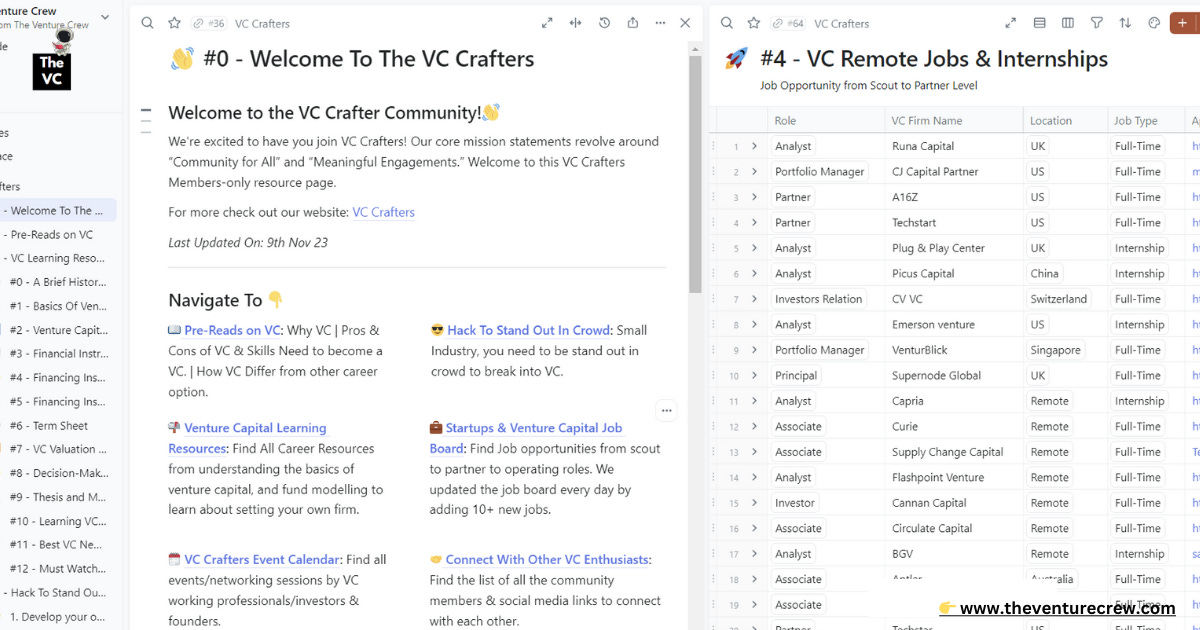

Venture Capital Remote Jobs & Internships: From Scout to Partner

🤝 Break Into VC Is Easy With VC Crafter Community

How can this community help you to break into VC? - Access to Curated VC Learning resources from basics to advanced, VC weekly networking events, Access to curated VC Job board, Weekly 1:1 call, daily community discussion on startups & venture capital…… this will help you to learn and craft your path to VC.

We’ve partnered with multiple VC Firms and referred the right candidate for a Job Opportunity from our community….

Get Access To Job Board & Events →

🤝 Partnership With US!

Want to promote your startup to our community of 20,000+ entrepreneurs and investors? Reply ‘Advertise’ on this email, I’ll share my media kit.

🎉Offer: 15% Off For Multiple Ads

8 Signs Your Startup Is a Zombie, and 3 Things to Do About It!

Knowing when to quit and when to stick with it is a key skill for all startup founders.

Even the best investors in the world aren't right all the time. So most investors apply a portfolio approach (Simple word - Broad Portfolio) to spread their risk and increase the chances of backing a billion-dollar opportunity - Power Law Guys….

In any investor's portfolio, you have three types of startups: the dogs, the stars, and the zombies.

Dogs run out of cash before finding a scalable business model. These companies return nothing to the investors.

Stars are the home runs--the investments that generate 10x returns and make up for all the dogs.

Zombies are companies that are neither dogs nor stars. They make revenue, perhaps enough to break even, but not enough to generate a huge return for investors. Their growth seems stagnant and they can't consistently generate more revenue than costs. They are constantly raising money, are focused more on investors than on customers, and rarely have a unique value proposition that generates exponentially more value for customers than existing solutions. Investors see zombie startups as no longer attractive, and not worth a follow-up investment--which can be the kiss of death for those companies.

What Creates a Zombie

If you have read a book by Seth Godin titled The Dip: A Little Book That Teaches You When to Quit (and When to Stick).

Godin's main idea is that in order to be the best in the world, you must quit the wrong stuff and stick with the right stuff. In the case of startups, it says that after some initial traction, there comes a dip.

From there, one of two things happens:

The dip bounces back and starts to trend upward to scale, or the dip turns into a cliff and never bounces back. Godin proposes that at the bottom of the curve--in the dip--founders have to choose to double down or cut their losses.

The ability to know when to hold them and when to fold them is the difference between dogs and stars.

Zombies happen because some founders get caught up in the dip, and neither flame out nor take off to greatness.

How to Tell If Your Startup Is Doomed

There are many signs that can alert a founder (or investor) that a startup is stalling and zombie-bound. But the following signals can show that you may be in a zombie phase:

You don't want to get out of bed in the morning.

You don't want to go out in public for fear you'll have to explain what you do.

You haven't hit 10 per cent week-over-week growth on any meaningful metric (revenue, active users, etc).

You've been working on the same idea for more than a year and still haven't launched.

You've launched a consumer service and have less than 2 per cent week-over-week growth in signups.

You've launched an enterprise service and have less than 2 per cent week-over-week growth in the revenue pipeline.

You are the CEO and hole yourself up in the offices so you don't have to talk to employees and can read TechCrunch.

You've hired consultants to figure out revenue, culture, or product in a company of less than 10 people.

What You Can Do About It

Accept it. Call it a day, or as some founders choose to, flame out big. Double down on your efforts and fail large instead of quietly fading away.

Pivot one of the parts of your business model. To become a startup unicorn, you likely need an exponential advantage in one of these areas to shift from zombie to star (think: Netflix offers 10x the entertainment of a movie theatre for less than half the cost). There are lots of examples of how a pivot evolved from a zombie into a star: Yelp, YouTube, PayPal, Flickr, Groupon, and Shopify.

Organize an acquihire and make lemonade from your lemons. Sometimes, others can leverage what you have built to drive growth in their business. This is often done through an acquihire (buying a company as a means of hiring that startup's people). While this may not be an optimal outcome, it is often the best choice for zombies.

Unlike on the TV show The Walking Dead, zombie status isn't forever. There are examples of startups pivoting and becoming stars (and many more examples of startups pivoting and becoming dogs).

But what's more important is that the decision you make is making a decision. Do not delude yourself. Let the data set you free.

Featured Article:

Limited Partner's Not Taking New Commitment To Invest In VC Funds?

In conversation with a Limited partner who manages limited partner seeking of ~$10 Billion AUM and invests in US, Europe & Israel VC Funds, He shared a perspective on how LPs view the venture market after covid period & their strategy to invest in VC Funds.

He shared some unknown truths that continue to leave us amazed (I'm still contemplating them as I write this)… Read More Here

🤝 In Partnership With Cash Nut

The CashNut is a free-to-read, daily, curated newsletter that helps understand the latest developments in Technology, Business, Startups, and Economy

📰 This Week’s Major News: Venture Capital, Funding & Tech

VC Partner Sentence Prison To Fraud Over 50 Investors Read More

Sam Altman Raised VC Fund Read More

Hyperloop, Elon Musk’s Pipe Dream, shutting down - Selling all assets & layoffs Read More

SoftBank Selling It's Opportunity Fund. Read More

Google Paying $700M Over Play Store Lawsuit. Read More

Want to receive Daily Morning Venture Insights, Funding Updates And Startup Stories In Your Inbox? - Subscribed To Venture Daily Digest Newsletter and join 7500+ Avid Readers🚀

🗞️ Weekend’s Read On: Startup, Technology & VC

The 4 Questions Startups Should Ask Themselves about Building with Generative AI Read More (Technology & AI)

Airbnb emails to Y-Combinator For Cohort Read More (Startups & Venture Capital)

How founders should approach TAM when venture capital is scarce? Read More (Startups)

How Did The Great Startups Like Airbnb or Instagram Make Pivot Decisions? Read More (Startups & Product)

Data Product Teams: Best Practices for a Modern Data Team! Read More (Technology & AI)

Join 13000+ Founders, VCs and startup Enthusiasts Getting Tactical To Build, Learn and Implement Startups, Technology and Venture Capital.

💼 Venture Capital Jobs & Internships

Investor Relations | NY - Apply Here

Operating Associate - Greycroft | NY, USA - Apply Here

Investment Analyst - SET Venture | USA - Apply Here

Research Analyst - GrowthCap Ventures | India - Apply Here

VC Analyst at Venture Highway | India - Apply Here

Portfolio Manager | Germany - Apply Here

Investor Associate - 500 Southeast Asia | Singapore - Apply Here

Investment Analyst - Adam Street Partners | USA - Apply Here

Investment Associate - Startmate | Australia - Apply Here

VC Analyst - Superseed venture | UK - Apply Here

Director - Innocombio equities | USA - Apply Here

Community Manager - M13 | USA - Apply Here

VC Analyst - Climate Collective | India - Apply Here

Intern - Climate Collective | India - Apply Here

Investment Analyst - Adam Street Partners | USA - Apply Here

Want more Job opportunities Access -

Join our 150+ VC Enthusiast Community - VC Crafters - To Access the VC Network, Job Opportunities, and Weekly events on understanding the VC Industry!

🤝 Partnership With US!

Want to promote your startup to our community of 20,500+ entrepreneurs and investors? Reply ‘Advertise’ on this email, I’ll share my media kit.

🎉Offer: 15% Off For Multiple Ads

That’s It For Today! Will Meet You Next Friday!

Happy Weekends & Merry Christmas! 🎉

Advertise || Investor Database || Break Into VC

✍️Written By Sahil R | Venture Crew Team