The three sales frameworks every early-stage founder needs. | VC & Startup Jobs.

Frameworks to determine if your pricing strategy is working & Why you shouldn’t ignore your competitors?

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: The three sales frameworks every early-stage founder needs.

Quick Dive:

Questions VCs may ask you - The only guide you need.

5 frameworks to determine if your pricing strategy is working.

Why you shouldn’t ignore your competitors?

Major News: xAI is reportedly burning $1 billion per month, Midjourney launches its first AI video generation model, V1, TikTok launches image-to-video tool, Trump Mobile debuts a gold smartphone, and OpenAI wins $200M U.S. defence AI deal & more.

20+ VC & Startups job opportunities.

FROM OUR PARTNER - ATTIO

🤝 The AI-native CRM built for modern teams…

Attio is the AI-native CRM for the next era of companies.

Sync your email and calendar and instantly transform all your data into a flexible, powerful CRM. With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Start for free with Pro today →

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

The three sales frameworks every early-stage founder needs.

Sales at an early-stage startup often feel like wandering in the dark with a flashlight that barely works. You hear a lot of vague advice: "Just hustle," or "Go get ‘em!" But when you’re the founder or first salesperson trying to land those critical first customers, what you need are tactics, not motivational quotes.

I came across an interesting post shared by Whitney Sales, founder of ThoughtForge, creator of The Sales Method, and one of the sharpest sales minds. She shared three powerful sales frameworks that I believe every founder should know and use.

So I’m sharing some key points, along with my thoughts on them:

1. Start with your own founder story

Why? Because at this stage, you are the first customer.

According to Whitney, “The inception of any company is inevitably linked to the challenge the founder first faced and addressed. This part of the narrative is too often forgotten, and it’s key to connecting with a customer.”

Before you’ve got fancy logos and metrics, you’ve got your pain and your reason for building the product. Use it.

The Exercise: Use this simple story-building template to craft a value-based founder narrative:

"[SUBJECT] [ONCE UPON A TIME], [SITUATION] [CUSTOMER PROBLEM]. [CUSTOMER] and realized [FEATURES OF PROBLEM]. [COST]. [SUBJECT] learned [IDEATION PROCESS]. As a result, [SOLUTION]."

This isn’t fluff. It’s how you relate, build trust, and show the human reason behind your product.

Example: The TalentIQ founder started his first company and lost time and money because a recruiter couldn’t send qualified candidates fast enough. He saw the chaos of 50 tabs open across scattered data sources, and realised recruiters lacked one clean source of truth. That pain led to the product.

You’ve already told this story to yourself, your early hires, and maybe investors. Tell it again, but now to your customers.

2. Tell value-based customer stories

Why? Because the founder’s story won’t always resonate with every buyer.

Whitney says, “If you only have one customer, extract the elements of their use case that are most relatable to your prospect. A beta customer’s story can be as valuable as a paid customer’s story.”

This is where your product’s real-world value starts to come through. It builds credibility and defuses objections.

→ The Exercise: Here’s Whitney’s customer story framework:

“One of my clients, [CUSTOMER NAME], who is in the same [QUALIFICATION CRITERIA], was having the same problem. When I met with their [TITLE], they mentioned that [CUSTOMER PAIN POINT]. [DETAIL]. We implemented [FEATURE], and enabled them to [BENEFIT]. They saw [RESULT].”

📌 Example: A client had onboarding emails that weren’t working users dropped off. Whitney’s team implemented behaviour-based emails that matched user activity. The result? 63% more conversions. $4.2M in revenue unlocked.

Even if you have just one beta user, document their story. Get specific. Then build a bank of these stories, segmented by company size, pain point, industry, or tech stack.

3. Structure your sales calls around stories

Why? Because stories make people open up.

Early sales aren’t about pitching features. It’s about using founder and customer stories to get a prospect to start talking. Whitney emphasises: “The best sign a pitch is working? The customer starts asking you questions.”

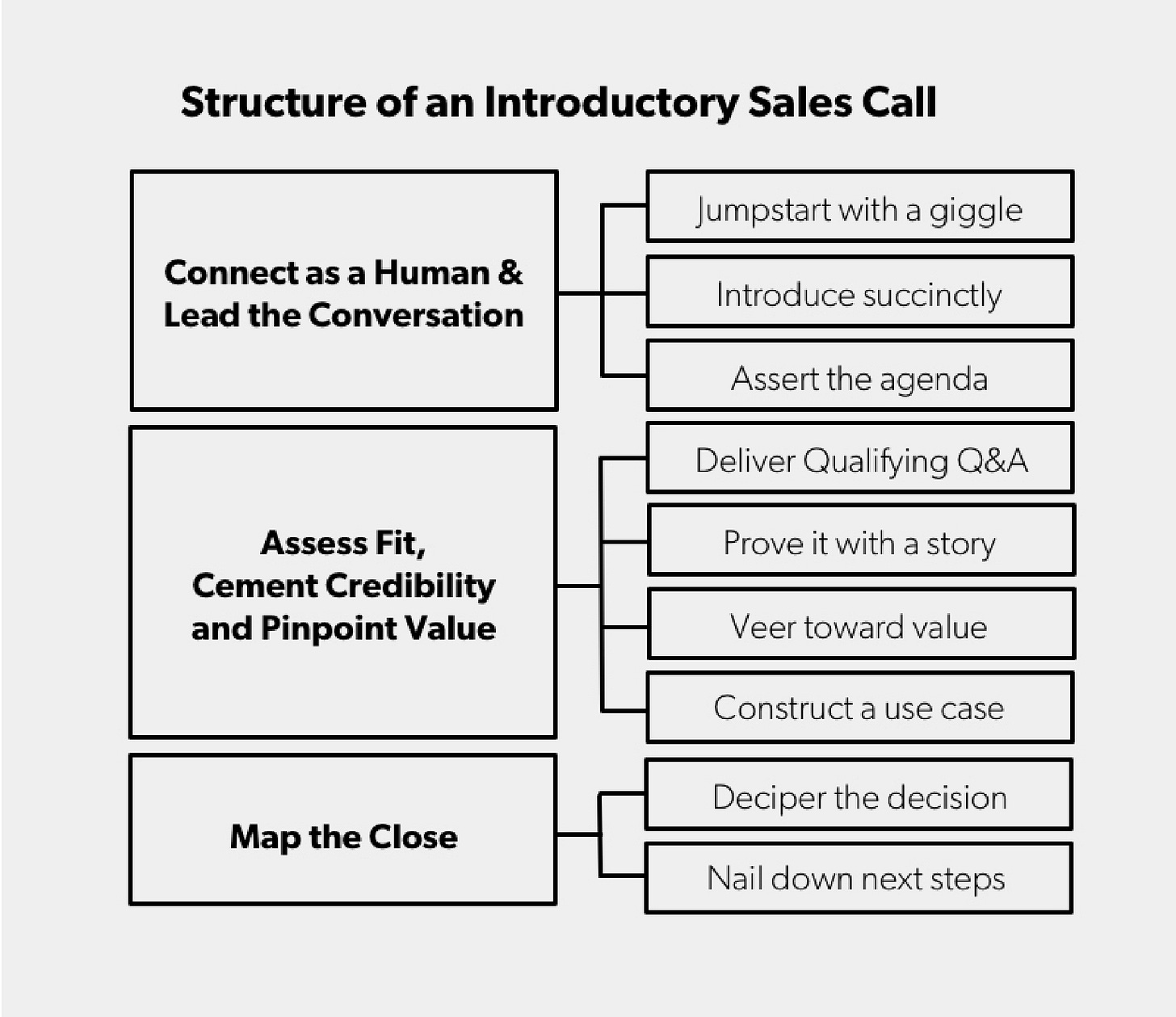

The Structure: Here’s her proven sales conversation flow:

Start human (5–10 min): Crack a joke. Be real. Show you’re not a robot.

Assert the agenda (2 min): “I’d love to understand how you do ___ today, then share how we might help.”

Ask value-based questions (5–10 min): Learn their pain points. What’s costing them time or money?

Tell a customer story (2–3 min): Match their pain to a real use case. Share what worked.

Go deeper into ROI (5–10 min): Tie their pain to your product’s benefits. Use their own words to frame the solution.

Decide or qualify (10+ min): Ask about their budget, timeline, and who else needs to be involved (a.k.a. the classic BANT framework).

Lock next steps (5 min): Don’t end the call on “we’ll be in touch.” Schedule the next meeting now.

If you’re an early-stage founder, your sales pitch is not your deck. Your real pitch is your founding story and your first customer win.

Before you have a product that sells itself, you need stories that speak for it.

Whitney puts it best:

“The first sale founders make with these stories is with themselves. Then they use them to hire, raise money, and attract beta users. Scale happens when these stories are passed on to your salespeople.”

If you're starting from zero, these three frameworks will get you your first few wins. And those first few wins? They’re what unlock everything else.

I highly recommend reading this article.

FROM OUR PARTNER - PARLANCE LABS

🤝 "I don't use RAG, I just retrieve documents"

They say RAG is dead. They're wrong.

Your vector search is failing because nobody taught you to evaluate it properly. While you debug cosine similarity, smart teams ship with tools you've never heard of.

30 minutes to fix what's broken. Real tactics. No theory.

📃 QUICK DIVES

1. 5 frameworks to determine if your pricing strategy is working.

Startup pricing strategies evolve as companies grow through three main stages -

Pre-PMF companies prioritise rapid adoption and feedback, with founders typically owning simple pricing models that optimise for usage over revenue.

Early PMF firms shift focus to repeatability and revenue, introducing more complex pricing owned by product teams or early GTM hires, often using preset tiers or bundles.

At scale, companies maximise value capture with dedicated pricing teams and deal desks, introducing sophisticated elements like varied commitment structures and multiple pricing models.

They're more willing to walk away from suboptimal deals and may eliminate legacy discounts. Square's journey from simple flat pricing to a more nuanced approach as it grew illustrates this evolution, showing how pricing strategy can align with and support a company's overall brand promise and market position.

However, at every stage, one of the hardest parts of managing pricing is knowing whether or not your strategy is having its desired effect.

The reason for this is simple – for the deals you’ve won, it’s nearly impossible to know how much money you might have left on the table based on the customer’s ultimate willingness to pay, and for deals you’ve lost, it’s possible your product’s functionality, or any number of other complications, might have been the primary culprit.

For self-serve pricing, it’s difficult to measure which prospects may have dropped out of the funnel due to pricing vs. which felt they were getting the bargain of the century. The list of complexities goes on.

At the earliest stages, your analysis is going to be less sophisticated and will likely centre around listening to customer feedback.

As your company matures, you’ll have enough data points to analyse wins and losses, customer cohorts, revenue by segment, and other relevant trends.

Here are a few strategies you can employ to get a sense of whether pricing at your company is working as intended:

Competitive reviews and customer surveys

Continue benchmarking your pricing against top competitors. Just as important, talk to customers directly. Ask how they perceive the value you deliver vs. what you charge. Don’t rely only on NPS or support feedback. Create a pricing-specific check-in loop, select a few customers from each segment, and review their price view regularly. You’ll spot gaps early.

Routine price increases

Test controlled price increases with small customer cohorts. Watch for churn, drop in conversion, or resistance. If nothing changes, your customers can likely pay more. One way VCs assess this: ask if customers would still buy the product if the price doubled.

If you’re able to raise prices without friction, you haven’t hit the upper limit of willingness to pay.

Variance analysis

Map every customer’s average sale price (ASP) and segment by attributes like region, company size, or industry. If pricing looks random, it’s likely deal-by-deal and inconsistent. That’s a problem. Look for patterns and identify high and low outliers. Decide whether to normalise them or adjust your packaging. Consistency here supports scalable growth.

Price realisation

Plot your discounting behaviour. Express deal prices as a percentage discount to the rack rate. What’s your median? If it’s consistently over 50%, your list price is too high, or your sales team is too loose on approvals.

High discounting eats margins, slows deals, and creates internal friction. Tighten pricing discipline as you scale.

Sales efficiency and escalation tracking

Track how long deals take, how often they escalate for approvals, and how many pricing negotiations are involved.

If deals are too slow, your pricing may be too high or misaligned.

If they’re closing instantly with no questions, you might be underpriced. Cross-check this with burn multiple and sales efficiency metrics over time.

Processes like those outlined above may be owned by any number of stakeholders (again, this number is largely dependent upon the company stage).

How often you formally revisit pricing is company-specific; for those later-stage companies with dedicated pricing teams, it’s deliberated daily. For pre-PMF companies in heads-down building mode, it’s likely done on an ad hoc basis.

2. Questions VCs may ask you - The only guide you need.

I’ve seen posts claiming that VCs will ask you 250+ questions in a pitch meeting. That’s nonsense. No investor is sitting there running through a checklist that long. (If you know one, let me know—I’d love to meet them.)

Instead, here’s a list of key questions you’re likely to face. These are the ones I used to ask while working with VC firms, and I’ve also gathered insights from leading investors to curate this list.:

Team

Tell me a bit about your background and your co-founder(s)’s background.

How do you all know each other?

How long have you worked together and in what capacity?

Why is your team uniquely motivated to solve this problem?

Why did you pick your co-founder?

Who do you need to hire during the next 18 months to be successful?

When was the last time you had disagreed on a business issue? How did you resolve it?

Do the founders have the knowledge to build the technology or would they need outside help?

What does the cap table look like? (equity distribution across founders)

Problem You’re Solving

What is the specific problem you are solving?

How big/serious of a problem is it?

Why is this a problem?

Who has this problem?

Solution / Product

How are people solving this problem today?

Describe your solution to this problem.

What effort/timing is required to switch from a different solution to yours?

(For deeptech) What is unique about the tech? (Do you have any patents / IP / trademarks?)

What is your product roadmap for the next 6-12 months?

Market / Market timing

Why now?

Why hasn’t this worked/been done before?

How big is this specific market?

How many people does it affect?

How much money are people spending to solve this?

What is your unfair advantage?

Who would you see as your key competitor at the moment? Why?

Customer Acquisition / Unit Economics / Go-To-Market

Who is your customer persona?

Who is the end user?

Who is the buyer?

What does a day-in-a-life look like for these people?

How much are people paying today? (range?)

How much do you think you can charge in the future?

How are you currently getting users / customers? (what customer acq channel(s)?)

How do you think you will get users / customers in the future?

How much does it cost you currently to get a user? And in which channel?

How much does your solution/product cost (COGs)?

How much will it cost in the future?

Why do people buy / use your solution?

What is the sales cycle to-date?

How does the product team interact with current and potential customers? If so, how and how often?

Competition

What differentiates your solution from other alternatives?

Who are you more afraid of: Google or another startup?

Who are you most afraid of?

What happens if a Google (or equiv) does this?

Who are the major players?

What is your moat?

Traction

When did you start the company?

How many customers do you have to date?

Or how many pilots/contracts signed?

When are the start dates of those pilots/contracts?

What are the contingencies?

Or how many LOIs signed? What do those look like?

How much revenue have you generated to date?

(Note: GMV is different from revenue)

As product revenue vs consulting / services revenue?

What are your margins?

Any notable customers?

Are any enterprise customers paying big money?

What does retention or churn look like? (if you know)

What does engagement look like?

Any upsells?

When will your company break even in terms of profitability and cash flow?

Fundraising/plans

How much have you raised to date?

At what terms?

Who are your current investors?

How much are you looking to raise?

What are you looking to achieve (milestones) with this round if everything goes well?

Use of proceeds?

Where are you in your round?

Have the current terms been set? And if so, what are they?

What is your burn rate?

What is your top priority for the next 3-6 months?

What are your capital costs? (if capital intensive, like hardware/e-commerce)

Minimum batch sizes/inventory / etc?

Have you secured a lead investor for the round? If so, who and how much is the lead investing?

That’s it. You don’t need to prepare for 250+ questions. Some questions might even feel frustrating, like “What if Google builds this?” or “How does this become a billion-dollar company?” I know many founders get stuck on these and struggle to answer them.

With the help of leading investors and founders, we’ve prepared a detailed guide that shares important questions investors will ask and how to answer them. You can check it out here.

3. Why you shouldn’t ignore your competitors?

Most startup advice tells you to focus on customers and ignore competitors. That used to work.

But the landscape has changed. Competition shows up fast, often well-funded and with overlapping features. Ignoring them doesn’t help you stay ahead.

I came across this post from Marie Prokopets, co-founder of FYI and Product Habits, on competitors and found it interesting that every founder should consider the following. So sharing a few key points and thoughts on this:

Competitor research = customer research

Studying your competitors isn’t about copying them. It’s about understanding how customer expectations are shifting. The products people use, the features they talk about, the pain points they still complain about all of this is visible in competitor reviews, product pages, and switching behaviour.

You’re likely underestimating the competition

28% of companies do no formal competitor research. Many others treat it as occasional Googling. But real insight comes from structured research — looking at review sites, doing surveys, and even tracking what customers say when they switch tools.

There are four kinds of competitors you should be tracking

Direct competitors: Solving the same problem for the same customer.

Indirect competitors: Similar customers, different solution.

Alternative solutions: Spreadsheets, pen and paper, consultants, anything customers use to solve the same job manually.

Multiple tool solutions: Tools customers stitch together (like Zapier + Airtable) to get the job done.

Ignoring any of these means you’re missing a part of the picture.

Four practical ways to do competitive research

Customer interviews and surveys: Learn why people switch products, what they love or hate, and which features matter most.

Competitor websites: Homepages, pricing pages, and testimonials reveal customer segments, value props, and shifting narratives.

Review sites: G2, Capterra, TrustRadius. These tell you exactly what users think, in their own words.

Switch interviews: Find people who recently switched tools. Map out their journey. Look for patterns. This is how you uncover the emotional triggers behind decisions.

You can even build an MVP to test what your competitors got wrong

At FYI, Marie built a 5-day MVP just to validate whether “search across docs” (the most common solution among competitors) worked. Turns out, it didn’t drive daily use. That single MVP saved them years of product mistakes.

Competitor data isn’t just for benchmarking — it reveals opportunity

You’ll learn where customers are still unsatisfied. You’ll spot shifts in sentiment. You’ll catch trends earlier. And over time, you’ll understand the market better than those who ignore it.

Competitor research isn’t about being reactive. It’s about being informed. And if you do it right, you’ll know more about your customers than your competitors ever will.

You can read original article here: https://producthabits.com/stop-ignoring-competitors

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Circle & Co, a London, UK-based venture firm focused on early-stage consumer tech, raised £11.5M for its solo GP fund led by Sasha Trower. (Read)

Endeavour Catalyst, a New York-based co-investment fund focused on emerging markets, is raising a $300 million Fund V, its largest yet. (Read)

Owl Ventures, a San Francisco-based VC firm focused on edtech, has appointed Lars Fjeldsoe-Nielsen as General Partner to lead its expansion across Europe, Africa, the Middle East, and emerging markets. (Read)

Major Tech Updates

OpenAI has reportedly considered accusing Microsoft of anticompetitive behaviour and seeking regulatory review of their partnership. (Read)

Trump Mobile announced its T1, a gold-colored smartphone priced at $499, which is slated to ship by August with a "Made in USA" claim. (Read)

Sam Altman confirmed Meta offered OpenAI employees $ 100 M+ compensation packages to join its superintelligence team, but none of his top talent accepted. (Read)

Elon Musk’s xAI is reportedly raising $4.3 billion in equity funding, on top of a separate $5 billion debt raise tied to X and xAI. (Read)

Elon Musk's xAI reportedly spends $1 billion monthly on AI model development, a figure Musk disputes, as the company simultaneously seeks $9.3 billion in new funding. (Read)

Midjourney launched V1, an image-to-video model that generates 5-second animated clips from still images, available exclusively through Discord. (Read)

New Startup Deals

Alta, a NYC-based company empowering shoppers with a personalized styling companion, raised $11M in Seed funding. (Read)

Lumion, a Salt Lake City-based trade and technical schools operating platform, raised $10.7 million in seed funding. (Read)

Coralogix, a Boston, MA-based provider an observability platform to monitor and manage data in real time, raised $115M in Series E funding, at $1+ Billion valuation. (Read)

Ramp, a NYC-based provider of a financial operations platform, raised $200M in Series E funding, at $16 Billion valuation. (Read)

Payabli, a Miami, FL-based payments infrastructure platform for software companies, closed a $28M Series B funding round. (Read)

Tennr, a NYC-based provider of an orchestration platform and language models designed to automate the workflows of referral-based care, raised $101m in Series C funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Associate - Episode 1 Venture | UK - Apply Here

Associate (Software Infrastructure) - Omerse Venture | USA - Apply Here

VC Associate - Toyota Venture | UK - Apply Here

Founding Creative Director spacecadet | USA - Apply Here

Venture Capital Junior Analyst - Stepstone Group | USA - Apply Here

Controller - NFX | USA - Apply Here

VC Investor - Founders Factory | Itly - Apply Here

Writer - First round capital | USA - Apply Here

Partner 32 - a16z | USA - Apply Here

Impact Investment Intern - Bharat Climate Startup | India - Apply Here

Senior Associate - Hubspot Venture | USA - Apply Here

Investor Relations Intern - Qualgro Venture | Singapore - Apply Here

VC Associate - Breega | UK - Apply Here

Venture Investments Associate - GSR | USA - Apply Here

Analysts - Healthquad | India - Apply Here

Venture Investments Analyst - GSR | USA - Apply Here

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator

Nice frameworks 🌟