Elad Gil’s framework for spotting billion-dollar markets before they look big. | VC & Startup Jobs.

What investors ask and how to answer, The half-truth of first-mover advantage & Antler's cheatsheet.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Elad Gil’s framework for spotting billion-dollar markets before they look big.

Quick Dive:

What investors ask and how to answer: The only guide you need as founder.

Steve Jobs: 'The half-truth of first-mover advantage'.

Antler’s ability to raise cheatsheet: how much to raise in their first round?

Major News: OpenAI hits $10 billion in annual revenue, Apple delays the launch of next-gen AI-powered Siri again, OpenAI in talks with Saudi investors for $40 billion raise, Meta's AI staff flee to rivals despite $2M salaries.

20+ VC & Startups job opportunities.

DON’T MISS THIS INVESTMENT OPPORTUNITY.

📚 Invest in the Book That’s Rewriting Who Owns the Economy…

What if you could invest in a book that aims to rebalance capitalism itself?

The Elysian, one of Substack’s top-performing publications (read by 150,000+ monthly), is now writing a book and giving investors equity in it. The idea is bold: the economy should be owned by more people, not fewer.

Led by journalist Elle Griffin (featured in The New York Times, BBC, Fast Company, The Information), this isn’t just a book. It’s a live, collaborative project about the future of ownership, how more of us can share in the upside of the economy through employee equity, co-ops, stakeholder models, and new forms of democratic capitalism.

Here’s why early backers are getting in:

A top 5% Substack with loyal readers across OpenAI, Y Combinator, Stripe & Disney

40% of all book profits go back to investors

Potential upside from future formats (audiobook, podcast, docuseries)

This is one of the first times you can co-own a book about creating more owners.

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

Elad Gil’s framework for spotting billion-dollar markets before they look big.

Startup history is full of companies that looked like bad ideas at the start.

An online marketplace for wedding invitations? Too niche.

A payroll tool in a boring, saturated market? Who cares.

Another file storage app? Too late.

And yet, those “nonobvious” bets became Minted, Gusto, and Dropbox.

Elad Gil, a longtime operator and investor (Stripe, Coinbase, Instacart, Airbnb), has a simple thesis:

Nonobvious markets can lead to hypergrowth, if you know how to spot and validate them.

Based on years of experience and interviews with top founders, Gil breaks down four principles and three market types that help you find overlooked opportunities with real upside.

First, start with the market. Not the idea.

Elad’s approach is clear: Market > Team > Idea.

Why? Because even great teams can’t escape bad markets. But great markets tend to give you multiple shots — even if your first idea stumbles.

“Many great teams get taken out by a terrible market. But if you’re in a great market, the idea itself doesn’t matter as much — there are always other shots on goal.”

– Elad Gil

So before building or investing, study the underlying market structure.

Ask:

Is this a growing market with multiple unmet needs?

Is it structured like a winner-take-all, or more like an oligopoly?

Are existing players actually serving users well?

Most people get this wrong because they fall in love with an idea. Instead, fall in love with the market.

Four Principles to Uncover the Nonobvious

1. Use first principles, not hot takes.

Don’t just be contrarian for the sake of it. That’s lazy.

Use first principles thinking to ask:

Is the “common wisdom” still true?

What’s changed in cost, infrastructure, or tech?

Has the assumption just aged out?

Example: Payments used to be avoided like the plague. “Too much fraud risk.”

But then Stripe happened. Fraud tooling, APIs, and internet trust improved and suddenly it became obvious in hindsight.

2. Scratch your own itch — or go deep on real pain.

Gil’s favorite startups often come from founders solving problems they’ve lived.

Gusto founders had family who struggled with bad payroll tools.

Mailgun was built after the team had to manually rebuild the same email infra over and over.

Gil’s own startup, Color Genomics, was sparked by his cofounder’s family health history.

This kind of insight gives you edge and a compass.

“The key is that it's a real problem. Not an idea you plucked out of thin air.”

3. Build product-first. Don't chase vague customer feedback.

“Would you use this?” is a weak signal.

“Would you pay for this right now?” is a real one.

Break into tough markets with a product that works beautifully, even in crowded spaces.

Dropbox beat bigger incumbents by nailing file syncing.

Google flipped the norm by getting users off the site faster, not keeping them longer.

Zeplin built what their designer-engineer team wished already existed.

If customers are nodding but not buying, you don’t have it yet.

4. Look on the fringe. That’s where the future often starts.

New trends start weird. Crypto, social media,and online payments all looked like toys at first.

Gil reminds us:

“Innovation often comes from small communities screwing around with random stuff.”

Pay attention to:

What smart people are tinkering with for fun

What communities are hacking together without outside attention

What you see enthusiasts doing before the mainstream shows up

Three Market Types Worth Digging Into

If you’re looking for overlooked gold, Elad says these are the best hunting grounds:

1. New Tech

Tech that’s early, misunderstood, or still feels like a toy.

The mistake? People underestimate compounding growth.

Ask: Is it doubling year over year? Are costs falling? Is performance improving fast?

Example: In the 1980s, McKinsey told AT&T the total mobile phone market would max out at 900,000 users. That was just off by a few billion.

Tip: Survey your smart friends. What are they playing with or obsessing over?

2. Looks Crowded, But Isn’t

Just because a market is noisy doesn’t mean it’s closed.

Ask: Are the competitors any good? Are users actually satisfied? Is the core product broken?

Gil invested in Checkr and Gusto because he saw startups struggling with those exact things. If you’re being forced to use a broken tool today, that’s a startup opportunity.

Think:

Google, despite AltaVista and Yahoo

Dropbox, despite iCloud and Box

Instagram, despite Myspace and Facebook

The trick is to look where incumbents are weak or slow, then wedge in with a 10x better product.

3. Seems Niche

Gil breaks this down into 4 subtypes:

Too small: Uber started with black cars for rich people. Now it’s infrastructure.

Too boring: Payroll. On-call alerting. File storage. Huge wins, zero sizzle.

Too high-end: Tesla’s $100K Roadster seemed like a toy. Now look.

Too personally unfamiliar: Stitch Fix and Glossier were built from deep user empathy that male investors just didn’t have.

“Your entry market will almost always seem small. But that’s the point — it’s where incumbents aren’t looking.”

One More Layer: Watch for Market Timing

Some ideas are great — just not yet.

Gil warns of two patterns:

False starts: Right idea, bad execution. (Friendster before Facebook)

Boomerangs: Right idea, wrong timing. (Webvan before Instacart)

Don’t just ask “Is this a good idea?”

Ask “Is the infrastructure ready? Are customer habits there yet?”

If not — be patient. Timing kills more ideas than bad execution.

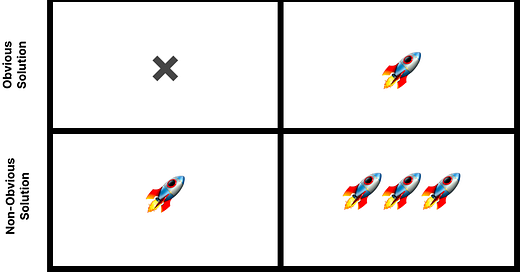

So Overall here’s a useful lens to spot your own nonobvious startup:

What’s a product or tool you hate but are forced to use?

What’s a “boring” problem you or your peers solve manually every month?

What’s something your smart friends are excited about but others roll their eyes at?

That’s where you dig.

“Grab a shovel and dig where it looks weird. That’s usually the spot.”

You can check out a detailed write-up by First Round here.

FROM OUR PARTNER - AFFINITY

🤝 Inside Europe’s top-performing VC firms…

Is your firm focusing on the right metrics? Discover what truly drives VC success in Europe’s venture landscape.

Affinity’s 2025 European Venture Capital Benchmark Report examines data from over 640 VC firms to identify the specific activities and approaches that distinguish market leaders from the pack.

Stop guessing and start measuring what matters most for European venture success.

📃 QUICK DIVES

1. What investors ask and how to answer: The only guide you need as a founder.

Fundraising is never just about your deck. It’s about what happens after the pitch, when the questions start.

VCs will ask:

"What if Google builds this?"

"Why you, and why now?"

"How do you win long-term if others copy you?"

"Why isn’t this just a feature, not a company?"

"What’s the real moat here?"

And if you hesitate or bloat your answer… you lose trust. Fast.

So we have collabroate with leading VCs and founders and build this new Investor Q&A Prep Kit helps founders prepare for those conversations like a pro.

Inside, you’ll get real investor questions, organized into 8 key themes:

Team

Market

Product & Tech

Traction

Business Model & Financials

Vision & Strategy

Risk & Legal

Fundraising Round Details

For each question, you'll see:

What investors are really asking

A proven framework to answer confidently

A clear sample answer

A common mistake most founders make

This is all-in-one guide you need to prepare for VCs’ questions. We are giving early access discount for only 50 readers. If interested, you can access it here.

2. Steve Jobs: 'The half-truth of first-mover advantage'

Being first in the market is often seen as a competitive advantage, but how real is this competitive advantage? For example, do you have to be first – new product, new service, new market, etc?

Moving quickly and striving to establish your business as the ‘go-to’ product/solution in a new market (or niche) sounds like a competitive advantage, but the reality is often very different.

What History Taught Us

If you study any new industry or market, you will find that most pioneers didn’t build truly great products/services/companies, incumbents did!

For Example

Apple was relatively late to the smartphone market. Blackberry, Nokia, and Windows had at least five years of a head start on the first iPhone – released in 2007. Note: By 2009, the iPhone surpassed Blackberry sales.

White Castle had over a decade head start on most hamburger chains but failed to capitalize on it – leaving Ray Kroc and McDonalds to revolutionize the fast-food industry.

Chrysler, Ford, GM, Honda, Nissan, and Toyota all released an electric car in the early 1990s. Tesla didn’t release its first car (Roadster) until 2005. A decade after traditional automakers already had their electric cars on the road.

Facebook was not the first social media site, Six Degrees was in 1997. Facebook didn’t launch until 2004.

When Compaq released their “portable” PC (laptop), there were at least 15 other offerings at the time, but theirs was the first to run software built for IBM.

We can list examples of companies failing to take advantage of being first in the market. Some will argue that timing is the main reason why so many pioneers failed to dominate the market.

Timing is definitely an important factor, but it is not the core reason – execution is. More specifically, excellent product/service execution and great marketing execution.

Steve Jobs’s iPhone, for instance, didn’t become a huge success because it was the first smartphone, but because of excellent product execution (an industry-first 3.5-inch touch-sensitive screen) and extensive marketing to promote it.

On the marketing side, it started with a promise from Steve Jobs, “A device that will deliver all the features of iPods as well as the smartphone.” Creating a lot of excitement well before the first-generation iPhone was revealed to the masses.

The next logical step for Apple was to reach out to influencers (e.g., reporters, reviewers, experts, etc.) to critique the new iPhone. Unsurprisingly, most publications and reviews were favourable, describing the first iPhone as a “breakthrough” device.

So it was all down to a great device? No.

While it had a great design, the iPhone had many adaptation challenges that marketing had to overcome. For example, it had a substantial price tag of $499-$599. At that time, higher than most of its competitors.

Second, customers had to sign up for a two-year contract with AT&T (using a slower EDGE network and not 3G which was faster and available at the time).

While acknowledging these challenges, Apple’s marketing team focused on its unique selling proposition – an industry-first 3.5-inch touch-sensitive screen. As is the case with any significant product launch from Apple, marketing had a healthy budget for television, print, and web ads.

Of course, your business doesn’t have Apple’s resources, but that’s not the key takeaway.

The lesson to learn is that execution (product + marketing) is far more important than being the first to the market.

In many ways, your organization is better off entering the market second, third, or even fourth. Why? A road to new markets (innovative products/services) is paved with mistakes and lessons learned. Expensive lessons that your company can avoid if you pay attention.

For example, being first to the market means educating potential customers on the new product/service – a very time-consuming and expensive marketing exercise. Let the pioneers do that for you.

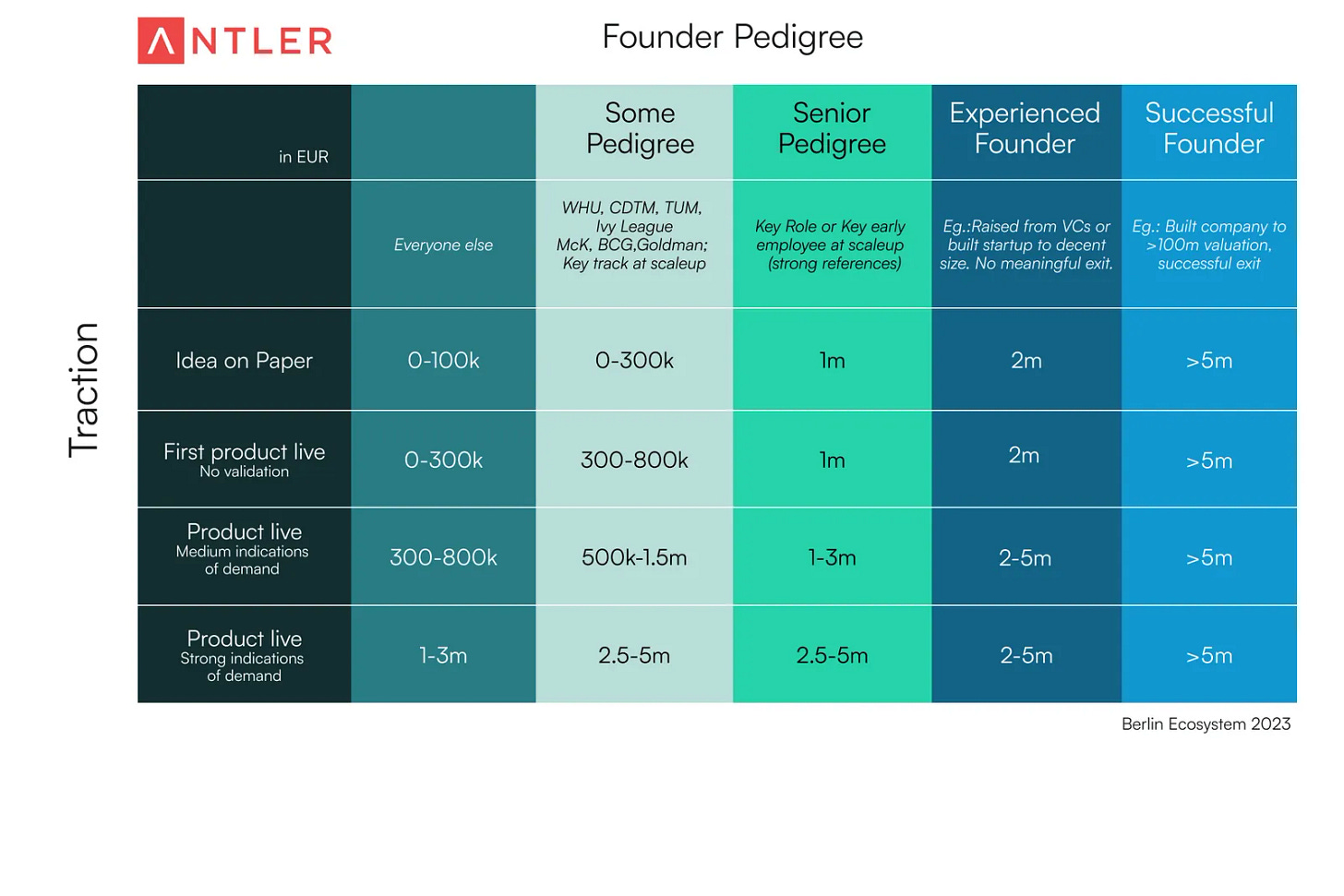

3. Antler’s ability to raise a cheatsheet: how much to raise in their first round?

Antler has shared a cheat sheet to help founders assess their ability to raise capital in their initial funding round -

When it comes to fundraising, two factors can make all the difference: Founder pedigree and Traction.

1️⃣ Founder Pedigree: The less traction you have, the more your background matters. Investors look at your past to assess whether you can deliver in the future. It's about limiting execution risk.

This isn't necessarily rational. Great founders get overlooked because they don't fit the typical pattern. But with thousands of similar opportunities, it's a real filter for investors.

2️⃣ Traction: Traction beats pedigree. When you present more than just an idea on paper and your product has gained some traction, your ability to raise increases. Lower-profile founders can raise funds when their idea becomes more than just an idea.

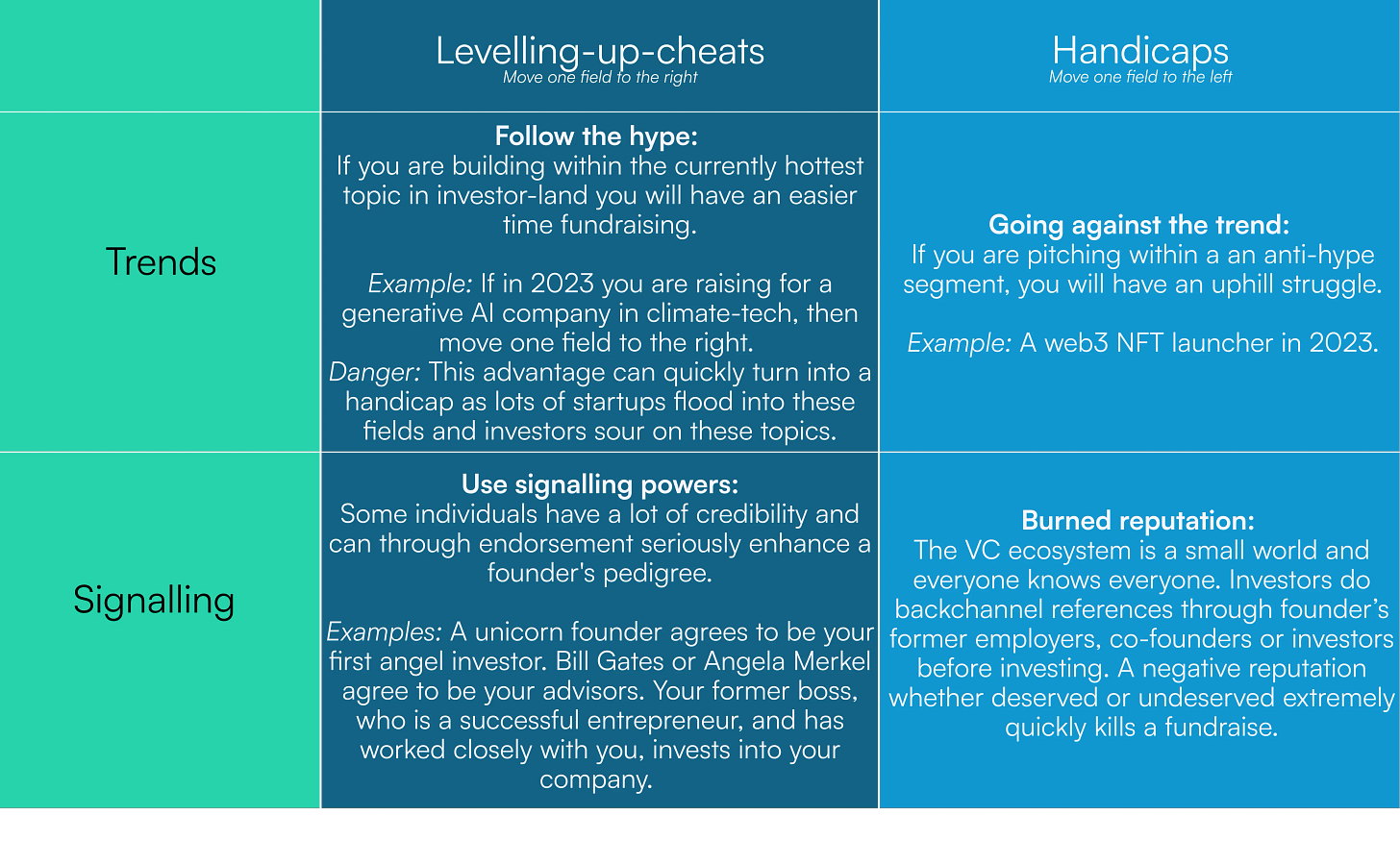

Some factors can change the game.

"Levelling up cheats" moves you to one field to the right in the fundraising matrix, potentially increasing your chances. These might include factors like having a strong co-founder, industry expertise, or unique insights.

"Handicaps" move you to one field left, possibly making fundraising more challenging. These could be factors like a lack of relevant experience or a difficult-to-explain product.

There are two must-haves without which you won't be able to raise, regardless of pedigree or traction:

Fundraising-ability: You need reasonable fundraising skills. Networking, sales skills, storytelling, and running a tight process are crucial.

Market attractiveness: Your market must be significant and attractive. In the early stages, it's binary - either investors get excited about the opportunity, or they don't.

Remember

Valuations are a function of capital raised. Assume 15-25% dilution irrespective of the amount raised. For example, if a team raises 800k, the valuation will likely be between 3.2m - 5.3m.

LinkedIn profile beats pitch deck in very early stages. Many investors will check your LinkedIn before deciding on a first meeting or looking at your pitch deck.

When is this wrong?

Numbers are purely directional. They've been validated with experienced investors, but they're not exact.

This model is primarily for software startups. Biotech & Hardware companies play by different rules.

Copycat models are very binary. Experienced teams can attract large funding, while others struggle to raise anything.

Raising from a rich uncle or family/friends who aren't experienced venture investors follows different rules.

Remember, great founders come from all backgrounds. If you don't fit the "classic" profile, you might need to prove more in the beginning, but there are countless examples of founders without traditional backgrounds building awesome companies.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Plug and Play , Sunnyvale, CA-based fund closed its $50M Fintech & AI Fund with nine institutional investors including EXL. (Read)

Right Side Capital Management, a San Francisco, CA-based venture capital firm, raised $55m for its sixth VC fund. (Read)

Geodesic Capital, a San Francisco, CA-based venture capital firm focused on bridging Silicon Valley and Asia through strategic technology investments, held the first close of the Geodesic Alliance Fund, at $250m. (Read)

Collab Capital, an Atlanta-based venture firm co-founded by Jewel Burks Solomon and Barry Givens, has closed a $75 million Fund II to back early-stage startups. (Read)

Major Tech Updates

OpenAI says it has reached $10 billion in annual recurring revenue, nearly doubling from $5.5 billion the previous year. (Read)

OpenAI upgraded ChatGPT’s Advanced Voice with more lifelike intonation, cadence, and emotional expressiveness. (Read)

Meta has reportedly agreed to buy a 49% stake in Scale AI for $14.8 billion, giving the data-labelling startup a massive valuation boost from its previous $13.8B round. (Read)

OpenAI launched o3-pro, its most advanced reasoning model yet, designed to outperform in science, education, coding, and writing tasks. (Read)

OpenAI CEO Sam Altman claimed that the average ChatGPT query uses 0.000085 gallons of water roughly one-fifteenth of a teaspoon and about 0.34 watt-hours of energy. (Read)

New Startup Deals

XRobotics, a San Francisco, CA-based provider of kitchen robots for pizza-making, raised $2.5M in Seed funding. (Read)

Turnkey, a NYC-based crypto wallet infrastructure company, raised $30M in Series B funding. (Read)

Parlay Finance, a Washington, DC-based provider of an AI-powered loan intelligence system, raised $2M in Seed funding. (Read)

Shovels, a San Francisco, CA-based AI-powered building insights and analytics platform, closed a $5M seed funding round. (Read)

Somnee, a Berkeley, CA-based sleep technology company, raised $10M in Seed funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Venture Capital Junior Analyst - Stepstone Group | USA - Apply Here

VC Investor - Founders Factory | Itly - Apply Here

Investor Relations Intern - Qualgro Venture | Singapore - Apply Here

Program Manager - Generator | USA - Apply Here

Venture Capital General Partner - ELM Street Partner | USA - Apply Here

Corporate Development & Strategy - Figma Venture | USA - Apply Here

Investment Trainee - Hashkey Capital | USA - Apply Here

Associate - Omerse Venture | USA - Apply Here

Associate - Lightspeed | India - Apply Here

Principal - AI Fund | USA - Apply Here

Investment Intern - Stride Venture | Singapore - Apply Here

Investment Partner - Rookridge Venture | UAE - Apply Here

Investment Associate - Application Software - TCV | USA - Apply Here

Investment Associate - Schreiber Ventures | USA - Apply Here

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator