Where to post your startup and get first users?, a16z’s new benchmarks for AI startups. | VC & Startup Jobs.

New benchmarks for AI startups, Understanding customer readiness to buy & Super Mario marketing framework.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Where to post your startup and get first users.

Quick Dive:

New benchmarks for AI startups: Speed, retention, and what VCs expect.

The Buyer's Pyramid: understanding customer readiness to buy your product.

Super Mario marketing framework.

Major News: Cursor raised $900 Million, Amazon tests humanoid robots for package delivery, Trump–Musk clash wipes out $150B in Tesla’s market value, Meta plans over $10 billion investment in Scale AI & TikTok US ban deadline extended again.

20+ VC & Startups job opportunities.

FROM OUR PARTNER - ATTIO

🤝 The AI-native CRM built for modern teams…

Attio is the AI-native CRM for the next era of companies.

Sync your email and calendar and instantly transform all your data into a flexible, powerful CRM. With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Start for free with Pro today →

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

How your marketing team can adopt AI in one day.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Patterns Across 5 Years of YC Investing by Tomasz Tunguz.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link).

Why You Need To Care About Product.

The Rise of ‘Vibe Hacking’ Is the Next AI Nightmare.

Startup legal document pack – essential legal docs for founders.

Stop Overthinking AI Subscriptions.

Trends in Artificial Intelligence by Bondcap.

The only startup valuation guide you need as a founder.

The only data room guide you’ll ever need as a founder: what to share and when..

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

Investor data room guide & templates for founders.

📜 TODAY’S DEEP DIVE

Where to post your startup and get first users.

If you're building something new, one of the hardest (and most underestimated) parts is getting your first users.

You’ve spent days, maybe weeks, writing code, designing the UI, and pushing features live. But when it's time to share it with the world, you're stuck wondering:

Where do I even post this? Who’s going to care?

The truth is: distribution matters as much as the product, especially in the early days. And you don’t need a growth team to get started. What you do need is a list of places where early adopters, builders, and curious users hang out and where sharing your startup can actually move the needle.

Here’s a practical breakdown of where to post your startup from launch platforms to niche communities to software directories that can help you go from invisible to discovered.

Launch platforms:

Great for buzz, validation, and early adopters who love trying new tools.

ProductHunt - use this guide to plan your launch

Software directories:

Think of these as long-term SEO and trust-building channels. Great for credibility.

Lifetime deals platforms & groups:

Useful if you want early cash, rapid feedback, and distribution all at once.

Subreddits (always check the rules before posting anything):

Not for everyone, but if you post with context and care, it’s a goldmine. You can even check out our guide on how to use Reddit to onabrod customers for your startup.

You can find more startup listing ideas here. Also, if you’re running an AI startup, you can check out this list.

📃 QUICK DIVES

1. New benchmarks for AI startups: Speed, retention, and what VCs expect.

One of the most common refrains in the generative AI era is that “startups are growing faster than ever”, and often doing so with fewer resources.

There are some jaw-dropping outliers:

Lovable reached $50M in revenue in just six months.

Cursor hit $100M in its first year.

Gamma made $50M with under $25M raised.

But these are the top 0.1% stories. For everyone else building in AI: what does “working” actually look like?

Before the AI wave, benchmarks were simple. A great enterprise SaaS startup achieved $1M ARR in its first year. Consumer startups? They often delayed monetisation until they had millions of users relying on ad revenue or upsells later.

Now? Things have changed. a16z shared detailed benchmark data from hundreds of AI startups, and the new standards are clear:

1. Faster revenue, faster rounds

Across the companies a16z reviewed, the bar has moved up.

The median AI enterprise startup now reaches $2.1M ARR in its first year.

The median consumer AI startup hits $4.2M ARR in the same time.

Top quartile consumer AI apps? $8.7M ARR in 12 months.

And both groups are raising Series A rounds in under 9 months from monetisation.

For founders, this means: just being “good” isn’t enough anymore. The old $1M ARR mark is now the lower end of what VCs expect. Speed to revenue and speed to iterate are your biggest leverage points.

And even if you’re not monetising yet, your shipping velocity and product iteration pace need to signal that you’re building toward that trajectory fast.

In AI, speed has become a moat.

2. The gap between “good” and “exceptional” is growing

Not only are metrics improving across the board, but the best startups are pulling away even faster.

Top AI companies aren’t just peaking early. They’re sustaining and accelerating growth after the first 12 months, unlike in the pre-AI era, where growth often slowed after year one.

But it’s not all about revenue. Series A investors still look at usage and retention metrics, even if it’s only 6 to 12 months of data. Later-stage rounds will go deeper: high top-line growth won’t make up for weak engagement or poor retention.

So while revenue speed gets you noticed, retention keeps you in the game.

3. Consumer AI companies are now serious businesses, and often outperforming B2B

It’s no longer just B2B that VCs see as “real.” Today’s AI-native consumer startups are not only monetising earlier, they’re often doing so at higher ARPUs than their pre-AI predecessors.

Why? Many B2C AI apps are training their models. When they launch a new version, they see step-function revenue spikes. Usage and revenue surge with each release, often plateauing until the next big product update.

Even if conversion to paid is lower, once users do pay, they stick. According to a16z’s data:

Paid user retention between months 1 to month 6 is nearly identical to what was seen in top pre-AI prosumer apps.

That means these aren’t just AI tourists — they’re active, valuable users.

Olivia Moore notes that 90% of the top 50 AI consumer apps are already monetising, despite lower conversion rates. And they’re doing so with a higher ARPU than pre-AI models.

But there’s a catch:

Some AI startups are accidentally going viral in countries that are hard to monetise, Brazil, China, and India. So even if user numbers look great, you have to ask:

What % of users are converting?

Are they coming from high-intent, monetizable geographies?

What do free users cost you (especially with GPU-heavy AI products)?

A $0 CAC doesn’t help much if free users cost more to serve than they bring in. Founders are now restricting access for unprofitable free users from low-converting markets or channels.

So the bar has shifted, and founders need to think differently.

Speed wins: Whether it's revenue, iteration, or product launches, velocity gets you funded.

Retention matters more than vanity metrics: Strip out AI tourists. Focus on paid or engaged users.

Consumer AI is a real business model: With the right product and monetisation loop, B2C can outperform B2B.

Not all traffic is created equal: Direct and organic traffic means intent. Viral growth in low-converting regions can be misleading.

This isn’t just hype. The data from a16z, based on real metrics from hundreds of companies, proves it: the best AI startups are growing faster, monetising earlier, and holding onto users better than ever.

In this new era, “working” doesn’t just mean having a cool demo or hitting $1M ARR. It means sustained speed, smart monetisation, and retention that scales.

2. The Buyer's Pyramid: understanding customer readiness to buy your product.

“Figuring out” your startup’s TAM is somewhat useless. Most of the time, it’s made up (TAM - Totally Made-Up Number) or at least very generous, and everyone knows it. But the real sin about TAM is that it’s just one giant number.

Sure, you have SAM and SOM as well, but those aren’t much better. They don’t tell you anything actionable, like, for example, how ready to buy your market is.

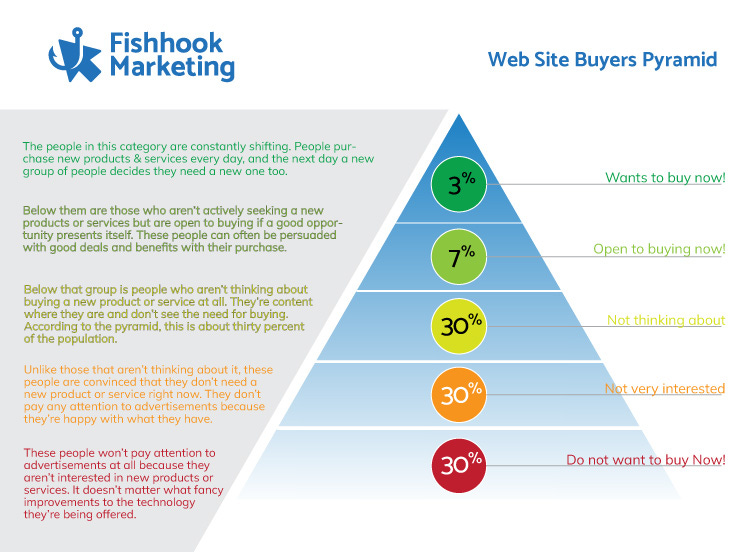

The Buyer’s Pyramid is a framework that divides your potential market into five categories based on how likely they are to buy your product or service. Alert: only 3% of your audience is actively shopping for what you offer.

Here’s the breakdown:

Know They’re Not Interested (30%)

The toughest audience—people who’ve recently purchased or are firmly against buying. It’s not worth wasting your ad budget here.

Think They’re Not Interested (30%)

This group believes they don’t need what you’re offering, but with the right messaging, you can nudge them toward seeing the value of your product.

Not Thinking About It (30%)

These people are comfortable they don’t feel the need to buy right now. However, they’ll eventually move up the pyramid when their current solution becomes outdated or inconvenient.

Open to Buying (6-7%)

This group isn’t actively looking but could be convinced with the right offer. Think: discounts, special promotions, or solutions to a problem they didn’t know they had.

Buying Now (3%)

These are your hot the tiny sliver of people ready to purchase. They’re already doing research, comparing options, and looking for the best deal. This group is your low-hanging fruit, but also your most competitive audience.

Most businesses spend too much time chasing the top 3%, fighting over the same small pool of customers. The Buyer’s Pyramid shows that 67% of your potential market is in the middle layers, waiting to be educated, nurtured, and persuaded.

What I like about the framework is that you can use different strategies for each distinct user group, track performance with simple tagging when potential customers are in your funnel, and audit whether you’re spending your time and money most effectively with sales and marketing.

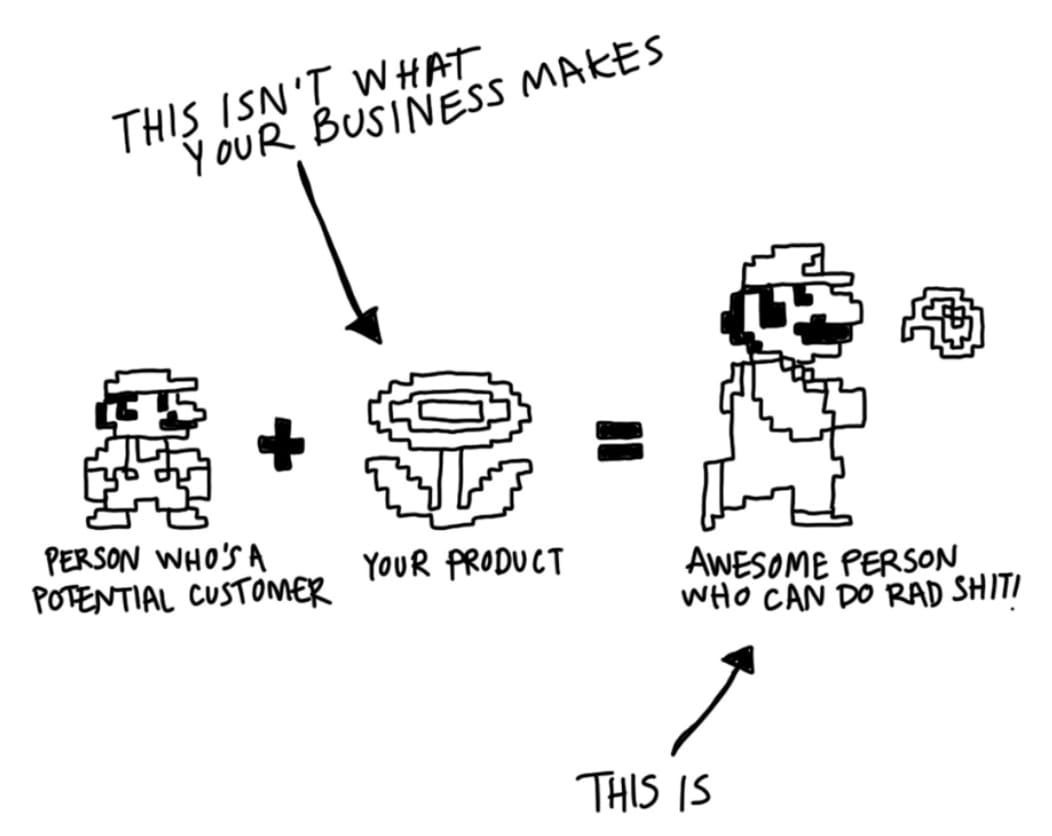

3. Super Mario marketing framework.

Your customers don’t care about your product. At all. This sounds harsh, but it’s true. They have no vested interest in it.

They only care about what your product can do for them. Here’s an easy example with Super Mario:

Mario → Your customer who needs help navigating their world.

Your Product → In a vacuum, this does nothing for Mario. It simply exists.

Mario, Using Your Product → Suddenly, Mario has new abilities and can conquer their problems.

The takeaway? Avoid selling and marketing based on what your product can do.

Focus entirely on the transformation and future state that your customers will be in once they buy and use your product. It’s all about the benefits, not the features. What can your product’s features do for your users?

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

North America dominates AI VC funding despite political uncertainty: North American AI startups raised $69.7B across 1,528 deals from February to May 2025, far outpacing Europe ($6.4B) and Asia ($3B). (Read)

Amplify Partners, a Menlo Park, and San Francisco, CA-based venture capital firm, announced that it has raised $900m for three funds. (Read)

Denver Ventures, a Denver, CO-based newly formed venture capital firm, launched with the close of its first dedicated seed fund, Denver Ventures Seed Fund I, at over $20m. (Read)

Major Tech Updates

AI search engine Perplexity processed 780 million queries in May, with 20% month-over-month growth, CEO Aravind Srinivas said. (Read)

Google has released an updated preview of Gemini 2.5 Pro, with improvements in coding, math, science, and reasoning benchmarks. (Read)

Amazon is reportedly developing artificial intelligence software for humanoid robots designed for package delivery, testing them in a dedicated "humanoid park" in the US. (Read)

Elon Musk’s public clash with President Trump could create turbulence for xAI’s $5 billion debt raise, as investors grow wary of political risks tied to Musk. (Read)

Meta is negotiating a multi-billion dollar investment in Scale AI, potentially exceeding $10 billion, which would mark its largest external AI bet to date. (Read)

The U.S. Department of Commerce has suspended licenses for companies like Westinghouse and Emerson to export nuclear equipment to China amid an escalating trade war. (Read)

New Startup Deals

Anysphere, a San Francisco-based AI startup behind the coding assistant Cursor, has raised $900 million at a $9.9 billion valuation. (Read)

Anduril, a U.S.-based defence tech startup, raised $2.5 billion in Series G funding at a $30.5 billion valuation. (Read)

Signify Bio, a Dallas, TX-based biotechnology company harnessing the human body for the production of in situ protein therapeutics, raised $15M in initial funding. (Read)

Impart Security, a San Francisco, CA-based provider of an AI security platform, raised $12M in Series A funding. (Read)

Latent Technology, a London, UK-based platform for game developers to create lifelike character animations in real time, raised an $8m seed funding. (Read)

Lendurai, a Tallinn, Estonia-based company which specializes in tactical autonomous UAVs for GPS-denied operations, raised €5.57M in seed funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

VC Investor - Founders Factory | Itly - Apply Here

Program Manager - Generator | USA - Apply Here

Corporate Development & Strategy - Figma Venture | USA - Apply Here

Investment Trainee - Hashkey Capital | USA - Apply Here

Principal - AI Fund | USA - Apply Here

Investment Associate - Application Software - TCV | USA - Apply Here

Investment Associate - Schreiber Ventures | USA - Apply Here

Senior Associate - M12 | USA - Apply Here

Venture Capital Manager - Dow Venture Capital | USA - Apply Here

Investment Analyst - Peak Sustainability Venture | India - Apply Here

Investor - Founders Factory | UK - Apply Here

Venture Capital Managing Director - Connecticut Innovation | USA - Apply Here

Investment Trainee - Hashkey Capital | USA - Apply Here

Full-Time Investment Intern - Inflexor Venture | India - Apply Here

Visiting Analyst VC - Identity Venture | Germany | UK - Apply Here

General Partner - Inviox Capital Partner | UK - Apply Here

Investor (AI) - Samsung Next | USA - Apply Here

Startup Scouting Partner - 8state venture | UAE - Aplpy Here

Investor - Griffin Gaming Partner | USA - Apply Here

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator

Super useful! Really glad you included the spreadsheet too.