A simple CRM to manage your fundraising process (free template). | VC & Startup Jobs.

Reality of startup life: 17,784 hours, data room guide, How to write LP updates with template?

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: A simple CRM to manage your fundraising process (template included)

Quick Dive:

17,784 hours later: What does startup life look like?

The only data room guide you’ll ever need as a founder: what to share and when.

Why LP updates matter (and how great fund managers write them).

Major News: Elon Musk launches XChat, Apple's ChatGPT rival moves forward, DeepSeek may have used Google’s Gemini to train its latest model, and Meta signs nuclear power deal.

20+ VC & Startups job opportunities.

FROM OUR PARTNER - ATTIO

🤝 The AI-native CRM built for modern teams…

Attio is the AI-native CRM for the next era of companies.

Sync your email and calendar and instantly transform all your data into a flexible, powerful CRM. With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Start for free with Pro today →

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

Excel template: Early-stage startup financial model for fundraising.

100 Trillion Tokens by Tomasz Tunguz.

Mastering the human side of engineering: Lessons from Apple, Palantir and Slack.

This is the only startup valuation guide you need as a founder.

The rise of Cursor: The $300M ARR AI tool that engineers can’t stop using

Lulu Meservey’s launch cheat sheet.

Alex Lieberman on ‘seedstrapping'.

Amanda Zhu on what investors are evaluating at pre-seed and seed.

Leo Polovets on pitch deck minimums.

400+ French angel investors & venture capital firms contact database (Email + LinkedIn Link)

How Mark Hughes’ Solidroad grew to $1M ARR in 9 months.

Eva Christine Reder on a product marketing flywheel for GTM.

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

All-In-One Term Sheet Guide for Founders.

A new framework for AI agent pricing: analysing patterns from 60+ AI agent companies

Naval Ravikant: "Inspiration is perishable — act while the spark is fresh."

How to get Investors to say Yes - Lessons from a Founder who raised $1B.

SaaS Startup Financial Model: All-in-One Excel Template.

📜 TODAY’S DEEP DIVE

A simple CRM to manage your fundraising process (template included)

Our controversial take: A great fundraising process is only 20% about pitching.

The other 80% is all about organisation.

Yep, you heard that right.

Your pitch, the thing you’ve spent weeks refining and rehearsing, is only a small part of successful fundraising.

“What the heck do y’all mean by the organisation?” - you, probably

If you’re talking to dozens (or even hundreds) of investors, keeping track of who they are, what stage they’re at, and what you last discussed is impossible to do from memory. That’s where an investor CRM (Customer Relationship Management) system comes in.

Some founders use tools like HubSpot, Salesforce, or Pipedrive, but you don’t need fancy software. A simple Google Sheet can do the job. What matters is that it helps you track key details, follow-ups, and next steps—so no potential investor falls through the cracks.

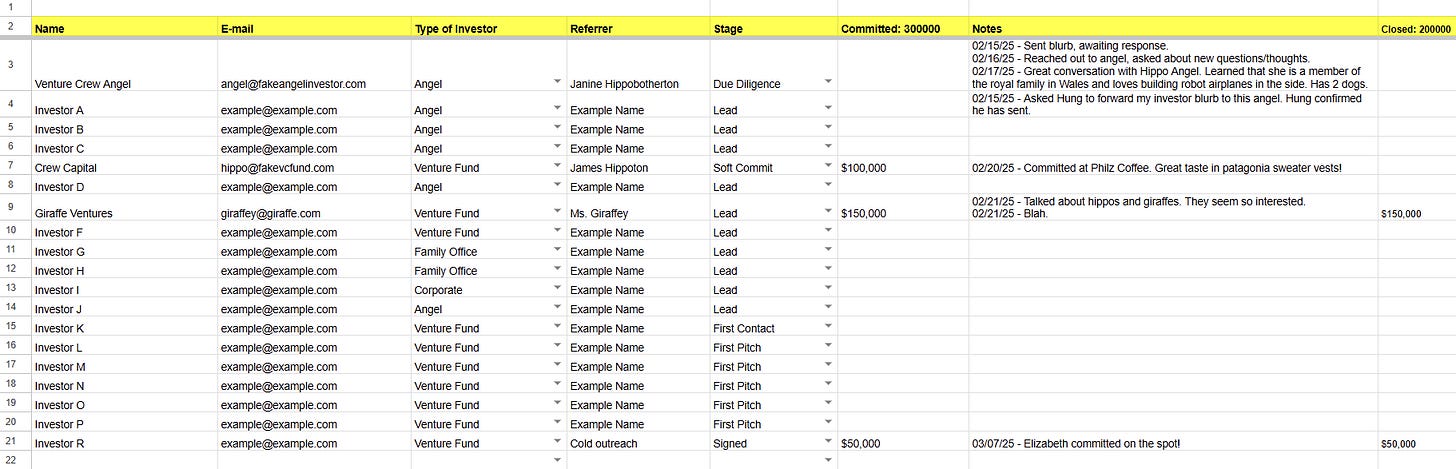

Walking through an investor CRM

This spreadsheet may look like a lot at first. But a CRM is way simpler than you might think.

Basic contact info

To kick things off, add the names and email addresses of the investors that you already know.

Then add the names and email addresses of prospective investors that you would like to build stronger relationships with.

Type of Investor

In the next column, label what type of investor they are (angel investor, venture fund, etc). This will help you tailor your messaging accordingly.

Referrer

The referrer is the person who introduced you to the investor listed in your CRM.

So if ABC sent an email to introduce me to an investor, ABC is the referrer in this example?

This is crucial because your team can see where your leads are coming from. Plus if the introduction is a mutually beneficial one, we get a chance to reach out to the referrer again to say thanks.

Add their names in the next column and let’s keep moving.

Stage

What stage are they at in terms of considering an investment in your company?

These stages can be customized to your situation… but for simplicity, let’s define the stages that most funds used during our fundraising process.

Lead – When someone offers to refer somebody new to you but you haven’t made contact yet.

First Contact – This stage is the first time you both have been able to officially engage. Someone might have sent an email introduction and they may have reciprocated back saying, “Yes, let’s meet!”

First Pitch – This is the first meeting you have with them to pitch your company.

Due Diligence – This comes after the pitch when they’re considering investing. It’s normal for investors to ask to see more materials to help them make a decision.

Soft Commit – This is when they are interested in investing and have given you a dollar amount they want to put towards your company. This is purely a verbal commitment, nothing official, but a positive sign to move them into the next stage.

Signed – This is when the confetti drops from the ceiling because you have received a full commitment from this investor. Whooot!!! 🎊

Rejected and Ghosted – These are the stages where they reject your pitch or never return your messages. But remember, it’s not over yet. There’s still an opportunity to maintain the relationship or even invite them to your biweekly/monthly investors update. They may convert into investors down the road.

Committed

If they have given you a verbal commitment of a certain amount they want to invest, include this number in the Committed column.

Above, you can see three investors committing a combined total of $300,000 as an example.

Notes

The Notes section is the most critical part of the CRM.

It summarizes what you talked about during your calls or emails. Add as many notes as you can along with the dates of each interaction.

These notes are crucial because fundraising is a team sport.

Tracking everything helps your team understand the context of the relationship. So when they interact with this person, they know where each investor is in the process, and can pick up right where their teammate left off.

Closed and Next Contact

Next, we have a Closed column to show how much money you have closed.

This is your time to celebrate your hard work being paid off. Launch the confetti. Take out a bottle of champagne. You deserve it.

Ok, time to get back to work. The last part of the CRM is a Next Contact column. This is a reminder for yourself on when you should reach out to this person again.

So if you're still in the due diligence or soft commit phases, set a clear date here on when you should follow up.

If people have committed, we recommend getting aggressive and following up every two or three days. This shows that you’re committed to making this work and are certain you have given them all the materials they need to feel unblocked on making a decision.

For the people who have rejected or ghosted you, you should keep reaching out.

Remember a rejection is never truly a rejection until you get a hard “no”.

So your investor CRM is a critical tool for successful fundraising.

All your contacts are in one place with detailed information

All the interactions your team has had with each person are tracked so everyone is on the same page

It tracks where everyone is in the fundraising process and gives reminders on when to follow up.

Start your investor CRM as soon as possible. Like, now.

There are paid CRM tools out there to track opens and clicks on emails. But to keep things simple, we recommend starting with a basic spreadsheet.

Here’s a template you can use for your fundraising journey.

Also, you can import this template into the Attio platform to improve it and make your fundraising journey more efficient.*

FROM OUR PARTNER - MECO

🤝 The best new app for newsletter reading…

Reading newsletters in the inbox is frustrating - it is noisy and easy to lose control of subscriptions. Now with Meco, you can enjoy your newsletters in an app built for reading, while giving your inbox space to breathe.

Meco connects to Gmail & Outlook, allowing you to instantly move your newsletters to the app (and clear your inbox.

The experience is packed with features to supercharge your reading, including the ability to group newsletters, set smart filters, bookmark your favourites and read in a scrollable feed.

Over 30k readers are enjoying their newsletters (and decluttering their inbox) with Meco - try the app today →

📃 QUICK DIVES

1. 17,784 hours later: What does startup life look like?

Let’s be honest — the founder journey is often romanticised. But the reality? It’s messy, unpredictable, and deeply personal.

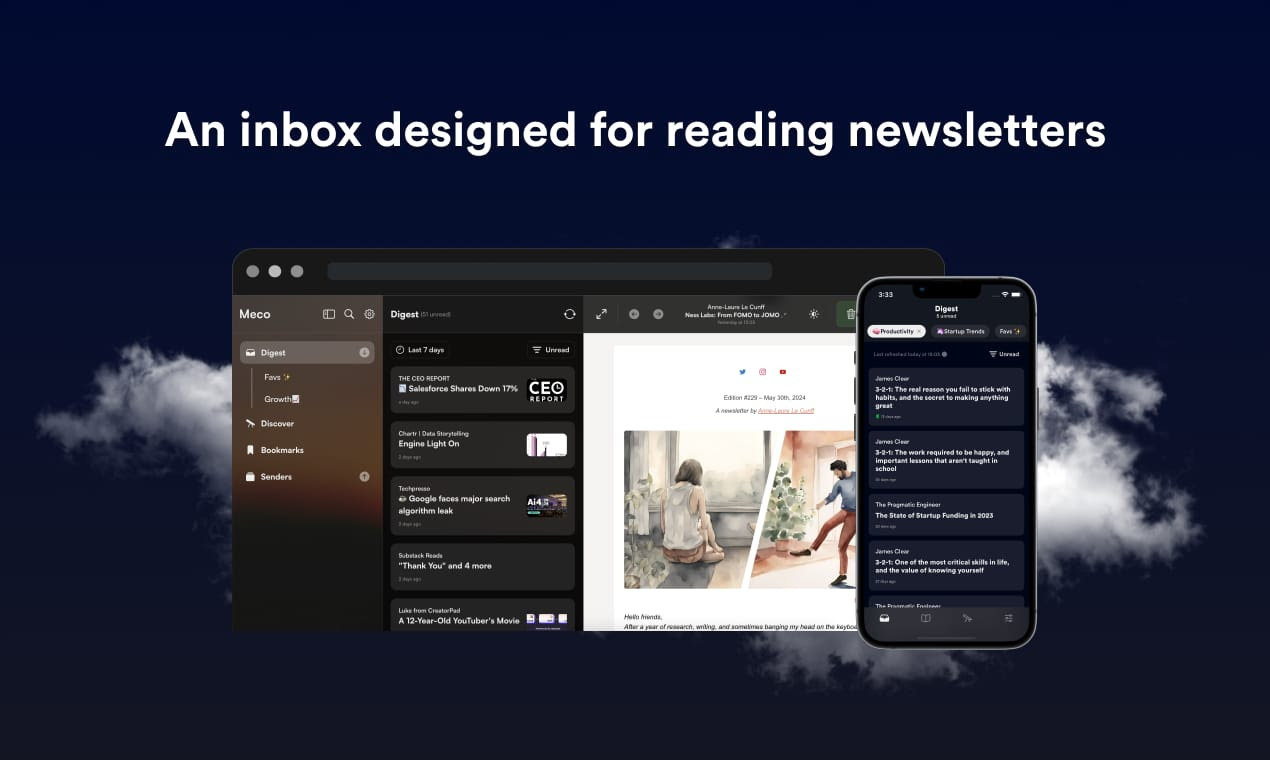

Sam Corcos, co-founder and CEO of Levels, recently opened up about how he spent 17,784 hours over 5 years building his company — and he has the receipts to prove it. He tracked every 15-minute block of his time.

What did he find? Most of the assumptions we have about what it means to be a founder, from burnout to management to strategy, are either misleading or flat-out wrong.

Here’s what you should know if you're building something or thinking about starting.

Burnout Isn’t About Hours:

Sam regularly clocked 50 to 110 hours a week — and still didn’t feel burnt out. Why?

Because the hours weren’t the problem.

"Burnout is more tightly tied to energy-draining work than the number of hours you clock."

He learned that you can work fewer hours and still feel depleted if those hours are spent on misaligned, low-leverage tasks.

So it’s not about working less — it’s about working on what matters to you and to the company. Audit your energy, not just your calendar.

Stay Close to the Product:

In the early days, Sam was hands-on with the code. But as the team grew, he stepped back, trusting ops, product, and engineering leads to take over.

That distance nearly cost the company its product velocity and team clarity.

Eventually, he re-immersed himself in the engineering process, rewrote their approach, and anchored the team around hypothesis-driven development, something inspired by the scientific method and The Lean Startup.

Even if you’re not shipping code, stay close to how value is being delivered. When founders disconnect from the product, momentum stalls fast.

Kill the Calendar Creep:

As the team scaled, Sam’s direct reports tripled — but his time spent on management? Barely changed.

How?

He deleted all recurring 1:1s.

Created shared docs for async updates.

Only met when actual decisions were needed.

"More people doesn’t have to mean more meetings if your systems are tight.”

Meetings should be for movement, not maintenance. Over-communicate in writing. Align through clarity, not calendar invites.

Protect Time to Think:

Looking at five years of data, Sam only spent 5% of his time on strategy, not because it wasn’t a priority, but because real thinking requires space.

So he built in quarterly Think Weeks — no meetings, no distractions, just deep writing and reflection. And it changed the trajectory of Levels multiple times.

Your startup’s direction won’t come from inbox zero. You need a protected, structured space to zoom out and rethink. Don’t treat strategy like a luxury — treat it like a recurring obligation.

Investor Updates > Deck Design:

Sam didn’t spend months polishing pitch decks. Instead, he focused on building a solid business and sending honest, data-rich monthly updates to investors, whether he was raising or not.

That steady cadence turned future raises into warm conversations, not cold pitches.

You don’t build relationships at the moment you need money, you build them with consistency, trust, and clarity well in advance.

Family Doesn’t Kill Output — It Refines It:

Over these five years, Sam got married and became a father. His work hours dropped from 90–110/week to 50–60.

But he didn’t feel less productive. He just stopped doing low-leverage work.

"Productivity isn’t about how many hours you put in, it’s about how intentionally you spend the hours you have.

Big life changes don’t kill your founder capacity, they help you prioritise better. Let them.

The Next 5 Years: Less About How You Work, More About Why

Tracking every 15-minute block of time didn’t give Sam a magic productivity formula. It gave him honesty.

It made it painfully clear when his time wasn’t aligned with company needs — or his own values.

And that’s the point.

“The real job of a founder isn’t just building — it’s choosing. Choosing how to spend your time. And defending those choices.”

TL;DR – If You’re a Founder, Remember This:

Burnout comes from energy-draining work, not long hours.

Don’t give up product ownership too soon — stay close.

Meetings aren’t mandatory. Decisions are.

Strategy needs protected time, not just spontaneous thoughts.

Investor relations are built slowly, long before a raise.

Life outside work will force better prioritisation, lean into it.

Track your time if you want the truth, not just optimisation.

If you’re early in the journey, let this be a prompt: Are you spending your time on what moves the needle or just what screams the loudest?

I highly recommend adding this write-up to your weekend reading, it’s totally worth reading.

2. The only data room guide you’ll ever need as a founder: what to share and when.

As a first-time founder, you might find yourself in a similar situation - excited about a positive response from a potential investor, but suddenly faced with an unfamiliar term: "data room."

A data room is essentially a secure, organised collection of documents that provides detailed information about your company. It's a tool for due diligence, allowing potential investors to dive deep into your business's financials, operations, and potential.

In early-stage venture deals, data rooms play a crucial role at two distinct stages of the investment process.

Stage 1: Pre-Term Sheet

At this point, investors typically have limited information about the company, relying mainly on the pitch deck, website, and publicly available data. They request access to a preliminary data room to perform a quick spot check and gather material for internal discussions with their partners.

This Stage 1 data room helps investors validate their initial interest and prepare for more in-depth conversations about the potential investment.

Here’s a list of the 5 sections and types of content you’ll want to include in your stage 1 data room:

Business Summary / Company Overview

Purpose: provide an overview of the problem you are solving, your solution, and competitors - make it easy for the investor to create a deal memo

Docs to include:

1-page business overview

Links to your company website and social platforms

A PDF copy of your current pitch deck

Traction / Product Market Fit

Purpose: provide data that proves you’re solving a real problem - better yet with a solution to a problem that a lot of people have and are willing to pay meaningful dollars for

Docs to include:

Market sizing - bottom-up or top-down TAM backed by relevant up-to-date data from reputable sources

Customer / User data - how many customers or users do you currently have, how engaged are they

Competitive positioning / Unique Selling Proposition (USP)

Customer acquisition data - CAC, CAC payback

Financials

Purpose: provide a financial overview of your business from the day you started to the present day with forward-facing projections. If you don’t have a financial model built, I highly recommend you check out Sturppy. Sturppy’s is used by 4,000+ startups and allows founders to build an investor-ready financial model without being an expert on finance or financial modelling.

Docs to include:

P&L / Income Statement, Balance Sheet, Cashflow Statement, Financial Projections 1-3 years in the future

Team & Roles

Purpose: provide an overview of your team, their experience, and the roles they play in your business

Docs to include:

Brief profiles on each team member, their role, their prior work experience, their time with the company, and links to their social channels (LinkedIn)

Cap Table

Purpose: provide an overview of who owns equity in the business today.

Docs to include:

Cap table summary

Stage 2: Post-Term Sheet

After receiving and negotiating a term sheet, you enter Stage 2 of the data room process. This stage is crucial for streamlining due diligence before any final agreements are signed. It's wise to create a separate, more detailed data room for this phase, rather than just expanding your Stage 1 room. This approach gives you better control and flexibility, especially when dealing with multiple investors at different stages.

Here’s a list of additional sections and content you’ll want to include:

Entity Formation Documents

Purpose: These documents are mostly needed by the legal team and are a set of documents used to certify your business’s good standing. These docs are going to fluctuate based on where your business is incorporated and the type of business entity you’ve chosen. If you’re a startup in the US, 9/10 if you’re raising venture, you’re going to be established as a Delaware C-Corp

Docs to include:

Shareholder certificate documents

Local/state/federal business licenses/letters of good standing

Articles of incorporation

Bylaws, Tax ID number, Operating agreement between founders, Shareholder meeting minutes/board minutes, Annual meeting notes/minutes

Customer & Partner Contracts

Purpose: Material agreements will vary from company to company based on the nature of the business, but the general gist is to include anything that could significantly impact the business

Docs to include:

Standard terms of service or use between your business and customers

Any agreements or understandings between your company and others with obligations exceeding $25K

Property leases (real estate and personal)

Licenses of any company's IP to 3rd parties

Proof of Intellectual Property

Purpose: If your company has IP and that was part of the pitch, you’re going to have to show proof of that IP. This includes patents, trademarks, copyright, and design

Docs to include:

Evidence that you have the right to the IP that you’re developing

Patent information (proof of filing/issuing)

Trademark registrations

Copyrights

Full cap table documents

Purpose: If you’ve followed this guide, you’ve already shared a summary of your cap table. At stage 2 you’ll likely need to divulge additional details such as:

Docs to include:

Details of previous fundraising rounds or liquidity events

Shareholder certificates

Vesting schedules

ESOP details

Tax Filings

Purpose: Proof that your company is in good standing with the IRS

Docs to include: Tax History, Previous filings, Previous audit statements and any third-party financial evaluations

Information on Any Outstanding Litigation

Purpose: This one is key…failure to divulge pending or outstanding litigation can and will likely result in a very bad outcome for you and your business. Be honest here, have a hard conversation with the investor at this stage in the process.

Also, we have created a detailed guide and included all relevant templates that you need for your data room. All these curated with the help of startups attorneys, VCs. You can access it here:

Startup Legal Document Pack – Essential Legal Docs for Founders.

3. Why LP updates matter (and how great fund managers write them).

Founders send investor updates. VCs should treat LPs the same way.

Regular LP updates are not a formality, they’re a core part of being a thoughtful, transparent fund manager. They help LPs understand how you’re investing their capital, keep them engaged, and position you for stronger relationships and future fundraising.

Ryan and Vedika from Weekend Fund break this down clearly: LP updates are a moment to step out of the daily noise and reflect on the fund at a macro level. They’re also one of the few direct ways LPs can stay close to your thinking, learn from your activity, and meaningfully contribute.

Here’s what seasoned LPs want from updates:

Start with a clear snapshot

Open with a summary: recent investments, major news, key movements in the portfolio. LPs want to know what changed, fast.Show performance, with real data

TVPI, IRR, capital deployed, reserves remaining, capital called, include them all. Don’t oversell. If you’re sharing a markup, it should be from a priced round. Avoid presenting SAFE or note rounds as markups.Explain your decisions

When introducing new investments, go beyond surface-level detail. LPs want to know why you invested your thesis, conviction, timing, team, and traction, and how it fits into the market.Offer a market perspective

Many LPs are investing to learn. Updates are an opportunity to share what you’re seeing: sector dynamics, early signals, experiments, or trends emerging from the portfolio.Include clear LP asks

LPs are often operators or networked investors. Don’t miss the chance to ask for help—whether it's hiring, partnerships, or intros. Specificity drives action.Consistency builds trust

The biggest mistake emerging managers make is inconsistency. Set a rhythm quarterly or bi-monthly and stick to it.Voice matters

Updates don’t need to be overly formal. The best ones reflect your personality and values as a fund. Some LPs even appreciate a glimpse into your personal life or travel plans. It humanises the relationship.

For many LPs, this is their only ongoing lens into how your fund operates. It’s not just a report, it’s a signal of how you think, how you communicate, and how you build long-term trust.

Here’s the VC fund LP template shared by the weekend fund.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Iron Wolf Capital, a Vilnius, Lithuania-based deeptech VC firm, raised €30M of a targeted €100M second seed fund to invest in AI, biotech, energy, and spacetech startups. (Read)

Circle & Co, a London, UK-based venture firm focused on early-stage consumer tech, raised £11.5M for its solo GP fund led by Sasha Trower. (Read)

Andreessen Horowitz (a16z) is expanding its European presence by adding nine new venture scouts in 2025, despite shutting down its London office earlier this year. (Read)

Major Tech Updates

Apple is actively testing its ChatGPT rival, a 150 billion parameter cloud-based model, which reportedly shows competitive performance against recent rollouts. (Read)

Samsung is in talks to invest in Perplexity and pre-install its app and AI assistant on its smartphones. (Read)

Chinese AI lab DeepSeek released a new model, R1-0528, that closely mimics Google’s Gemini outputs, leading to speculation it may have been trained on Gemini data. (Read)

Meta has agreed to buy power from Constellation Energy’s Clinton nuclear plant in Illinois for 20 years, helping keep the reactor running beyond 2027. (Read)

Reddit has filed a lawsuit against Anthropic, alleging the AI company used Reddit’s data for commercial AI training without a license and violated its user agreement. (Read)

Hugging Face released SmolVLA, a compact vision-language-action model for robotics that can run on a MacBook or consumer GPU, trained on community-sourced LeRobot datasets. (Read)

Messages in iOS 26 is set to gain support for polls, with Apple testing Apple Intelligence integration to suggest poll structures from conversation context automatically. (Read)

New Startup Deals

Neuralink, a Fremont, CA-based brain-computer interface startup founded by Elon Musk, has raised $650 million in Series E funding. (Read)

SpyGlass Pharma, an Aliso Viejo, CA-based ophthalmic biotechnology company, raised $75M in Series D funding. (Read)

Antheia, a Menlo Park, CA-based pharmaceutical ingredient manufacturer, raised $56M in Series C funding. (Read)

Amperos Health, a NYC-based company providing Amanda, an AI biller specifically created for healthcare providers, raised $4.2M in Seed funding. (Read)

Speedata, a Tel Aviv, Israel-based company developing a dedicated accelerated processor for big data analytics, raised $44M in Series B funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Program Manager - Generator | USA - Apply Here

Investment Trainee - Hashkey Capital | USA - Apply Here

Investment Associate - Schreiber Ventures | USA - Apply Here

Senior Associate - M12 | USA - Apply Here

Investment Analyst - Peak Sustainability Venture | India - Apply Here

Startup Scouting Partner - 8state venture | UAE - Aplpy Here

Investor - Griffin Gaming Partner | USA - Apply Here

Staff Accountant - Energy Impact Partner | USA - Apply Here

Writer - First Round Capital | USA - Apply Here

Partner 32 - a16z | USA - Apply Here

Partner 36 - a16z | USA - Apply Here

Operations Manager - Fusion Fund | USA - Apply Here

FoF Fund Accountant - Sapphire Venture | USA - Apply Here

Senior Operations Manager - Unusual Venture | USA - Apply Here

Venture Architect Analyst Intern - Stella Capital | USA - Apply Here

Associate - Strategic Partnerships, Venture Capital - Stepstone Group | USA - Apply Here

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator

Just shared a post on how to design a marketing strategy in 2025 packed with insights from building Nyra AI, our AI-powered ad copilot for founders. Would love your feedback https://substack.com/@rittikumar/note/p-165326412?utm_source=notes-share-action 📈