Do this before building an MVP: the Minimum Viable Test. | VC & Startup Jobs.

a16z framework to identify ICP & recognize problems with high sales potential.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Do this before building an MVP: The Minimum Viable Testing process for startup ideas.

Quick Dive:

a16z’s framework for identifying your ideal customer profile (ICP).

How to recognise great problems with high sales potential?

Major News: Google releases app to run AI models on phones, Anthropic triples revenue to $3 billion, Apple to rename all operating systems, Hugging Face unveils two open source humanoid robots & Musk reportedly tried to block OpenAI UAE AI deal.

20+ VC & Startups job opportunities.

INVESTMENT OPPORTUNITY FOR YOU

⚙️ Electrifying Heavy Machines: Why Investors Are Backing RISE Robotics

Hydraulics are slow, inefficient, dirty, and outdated. RISE Robotics is replacing them with Beltdraulic™, a patented, all-electric system that’s 3x faster, 3x more efficient, zero-emission and 100% fluid-free.

Already powering next-gen defence, logistics, and industrial platforms, RISE has:

$9.1M in revenue and 20+ global patents

$22M raised from Techstars, MIT’s The Engine, and Fortistar Capital

A GUINNESS WORLD RECORD™ for the World’s Strongest Robotic Arm Prototype

Won multiple defence contracts and will soon launch a commercial product

Raised over $2.2M from over 1,100 investors on Wefunder

As industries shift toward cleaner, smarter, AI-compatible machines, RISE is disrupting a $ 600 B+ industry.

Invest now before this round closes →

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

Excel template: Early-stage startup financial model for fundraising.

It’s never been harder to make it in Venture Capital.

Startup Legal Document Pack – Essential Legal Docs for Founders. Built with the help of startup lawyers and VCs.

AI Eats the World - 2025 Strategic Tech Trends by Benedict Evans.

This AI companion app hit $500,000/month, just 11 months after launch.

State of Climate Tech 2024 Report.

Investor data room guide & templates for founders.

Eric Partaker on how to build a sales pipeline.

Krista Morgan on how to get to profitability.

John Rush on every growth method he's tried.

Troy Munson on the 6 things he does for cold emails.

Book of Scouting Reports: 2025’s AI 100.

📜 TODAY’S DEEP DIVE

Do this before building an MVP: The Minimum Viable Testing process for startup ideas.

Start with MVTs. Test your assumptions. Build when it matters.

We’ve all heard it before:

“Build something small. Ship it fast. Get feedback. Iterate.”

But in reality, most MVPs aren’t minimal. They’re bloated. Overbuilt. Full of features that don't matter. And worst of all, they don’t answer the most important question:

Will people care?

That’s why Gagan Biyani, co-founder of Udemy, Sprig, and Maven, shared a new concept that he called - The Minimum Viable Test (MVT).

The MVP Trap

Gagan’s seen it over and over, founders getting trapped in a fake loop of progress:

You dream big, start building a small version of the vision.

You add onboarding, a dashboard, maybe even a sleek UI.

You ship it, only to realise… You still don’t know if anyone needs it.

And worse: now you’re stuck. Stuck with a half-working product, some early users, maybe a few signups... But no clarity.

In the MVP world, you throw things at the wall and pray something sticks.

In the MVT world, you move with deliberate testing and conviction.

What is a Minimum Viable Test?

An MVT is a focused experiment that tests a critical assumption your startup needs to survive.

It’s not about launching a product.

It’s about learning if the world wants what you're promising before you build anything.

Gagan puts it like this:

An MVP tries to simulate a full car.

An MVT just checks whether an electric engine works better than a gas one.

The 3-Step MVT Framework

Here’s how to apply this as a founder:

Nail your value proposition

Before testing anything, ask:

What are users already trying to do?

What problem are they frustrated by?

What clear, simple promise can you make to solve that?

Good example: “We’ll get a healthy meal to your door in 15 minutes.”

Bad example: “We’re a reimagined last-mile logistics platform optimised for culinary efficiency.”

Keep it simple. Your value prop should feel like something your user would actually say, not pitch deck jargon.

List your riskiest assumptions

Every startup has hidden landmines. Your job is to dig them up early.

Ask yourself:

Why might this not work?

What’s the thing that, if false, kills the idea?

Five major risk categories:

Demand risk – Do people want this?

Execution risk – Can you deliver this well?

Monetisation risk – Will they pay enough?

Market size risk – Is this more than a niche?

Distribution risk – Can you reliably reach your customer?

Write them all down. Then circle the one that would ruin everything if it’s wrong. That’s what you test.

3. Design your atomic test

This is where most founders mess up. They try to validate everything at once and learn nothing.

Instead:

Pick one hypothesis to test

Create a narrow experiment

Focus on one real action your customer must take

Don’t ask: “Would you pay for this?” Ask: “Here’s the payment link. Want to try it now?”

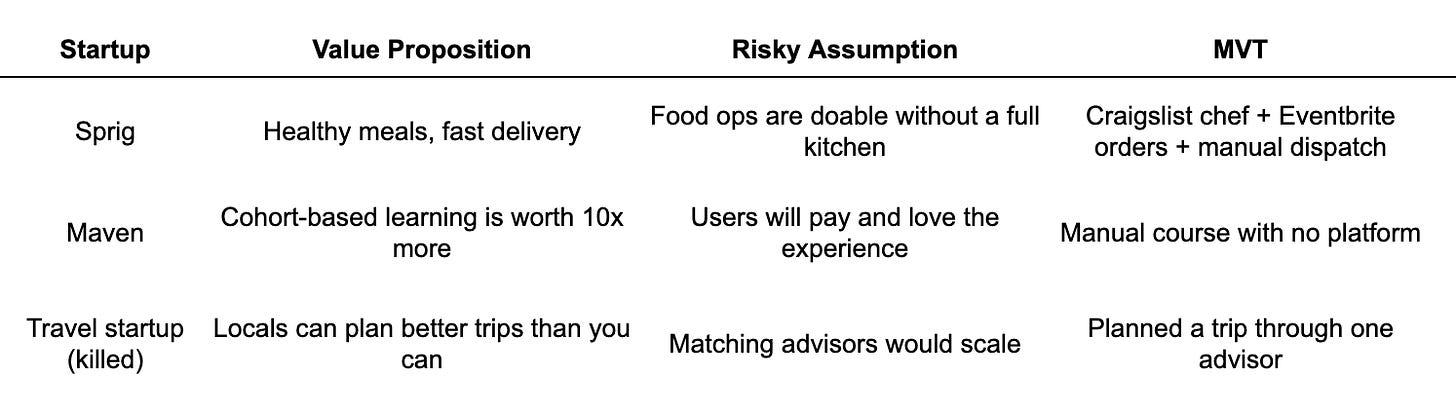

What MVTs Actually Look Like

Think of these tests like rough sketches, not product demos.

Even tests that “fail” can save you years of wasted time.

What Happens When You Skip MVTs

You build features nobody uses.

You attract a co-founder or team before knowing if you’re on to something.

You fall into the traction treadmill — chasing fake metrics from a half-working MVP instead of starting over with clarity.

As Gagan says: You are nothing until customers want what you’ve built.

Real-World Result: What Happened After MVTs?

Maven

Ran 5 MVTs in 9 months.

Didn’t touch the code until the demand was proven.

Made $1M in revenue within 4 months of launch.

Skipped the MVP entirely and went straight to real company-building.

Sprig

Validated food ops with small MVTs.

Built MVP only after operations looked promising.

Hit $1M run-rate in first 6 months.

What This Means For You

If you’re an early-stage founder thinking about building:

Ask yourself:

What assumptions are you making?

What’s the fastest, simplest behavioural test to validate them?

Are you building because users want it, or because you need to feel progress?

Then go run that test. Not a deck. Not a Notion doc. Not another brainstorming session.

A real test. With real users. Right now.

So, the MVT isn’t a way to prevent failure. It’s how you fail smarter, faster, and more informed.

You don’t need to code to learn. You don’t need a team to validate. You don’t need traction to make progress.

You just need curiosity, a risky question, and the guts to test it.

You can read detailed writeup by Gagan here: https://review.firstround.com/the-minimum-viable-testing-process-for-evaluating-startup-ideas/

FROM OUR PARTNER - AFFINITY

🤝 Where next-gen CRMs meet deal flow intelligence - Affinity.

Affinity is a relationship intelligence platform that empowers dealmakers in relationship-driven industries to find and win better deals more quickly.

With industry-leading automated relationship insights and technology, Affinity frees dealmakers from manual data entry, equipping teams to act with confidence, knowing the full context and history of every relationship.

Trusted by over 3,000 organisations worldwide, Affinity is your partner for smarter dealmaking.

Get started with Affinity today and unlock the power of your network →

📃 QUICK DIVES

1. a16z’s framework for identifying your ideal customer profile (ICP).

Most founders think they know their ICP. Ask them who their ideal customer is, and you’ll hear answers like “mid-sized companies that use cloud tools” or “enterprises with large data teams.”

That might sound good on paper, but in reality, it's too broad to guide your go-to-market motion.

As your company grows, a vague ICP becomes a silent killer, leading to high CAC, wasted marketing spend, low conversion rates, and confusion across your product and sales teams.

Especially in today’s fast-growing AI-native world, knowing exactly who your product is built for is what separates high-growth companies from the rest.

Your ICP is more than a general persona. It’s a living blueprint of who your product solves for best, and where you can win consistently.

Start with this test: Do you actually know your ICP?

A strong ICP should be clear, measurable, and deeply actionable across your org. Ask yourself:

Can you define your ICP’s company size or revenue range?

Can you specify the industry, geography, and business model (e.g., B2B SaaS, ecommerce)?

Do you know the job titles and roles of the decision-makers involved?

Can you describe the specific pain points your product solves for them?

Do you know what tech stack they use and what buying behaviour they follow?

If you can’t answer these clearly, it’s time to revisit and refine.

The Five-Question Framework

Use this set of questions to either define your ICP from scratch or stress test what you already have.

The key: don’t just answer these yourself, ask across the company. Sales, CS, Product, and Marketing will all see the ICP differently, and your job is to pull those insights together.

1. Which of your current customers gets the most out of your product?

These are the people who buy fast, stay long, and tell others about you. Don’t just look at the biggest accounts, focus on customers with:

High LTV

Short sales cycles

Strong retention and expansion

Talk to them. Understand why they chose your product, what it helps them do, and what they'd miss if it disappeared.

2. What traits do your best customers have in common?

Look for patterns:

Company size, industry, and team structure

Geography and maturity (startup vs. legacy enterprise)

Tech stack (e.g., cloud data warehouse, GitHub)

Buying behaviour, are they early adopters or part of the traditional 70%?

The more specific you get, the easier it becomes to target the right prospects and say no to the wrong ones.

3. What recurring objections do you hear from churned or lost customers?

This question helps you identify whom not to sell to. Look for patterns in why customers didn’t convert or churned early:

Was it a product misfit?

Did you lose on price?

Was there a blocker in procurement, security, or integration?

Not every loss means the ICP is off, but if you hear the same reasons again and again, it probably is.

4. Which customers are easiest to upsell—and why?

Upsellability is one of the strongest signals of true ICP fit. If a small team adopts your product and it organically spreads across the org, that’s gold. It means:

You're solving a meaningful problem across multiple departments

Your product’s value is clear without needing a heavy sales push

You're likely aligned with their existing workflows and compliance needs

False signals (like one-time big deals) can trick you. Focus on those who expand naturally.

5. What do the customers of your closest competitors have in common?

Sometimes your competitor’s ICP reveals opportunities or gaps:

Are they winning deals in industries you’ve ignored?

Are they closing customers you’ve lost?

Do they have features that help them unlock a market you’ve struggled with?

Study their customer base, then use RevOps data to see where your ICP overlaps—or where you can carve out a unique lane.

Refining Your ICP as You Grow

Your ICP is not static. As your product evolves, so should your understanding of who it’s for.

Say you’ve been targeting commercial teams for years, but you launch a new feature, like supporting over 10,000 seats. That one capability might suddenly make you a strong fit for the mid-market or enterprise segment.

This shift changes your ICP and requires corresponding shifts in:

Sales strategy

Pricing

Onboarding experience

Compliance and security posture

Marketing messaging

Revisit your ICP every time your product meaningfully expands. Don’t wait until the market tells you you’re out of sync.

Why this work matters

A great ICP does more than help you close more deals. It gives your team focus. It helps you say no to bad-fit customers. It shapes what you build, how you sell, and where you invest.

Most importantly, it makes your growth more efficient.

Because no matter how good your marketing or sales team is, you can’t force traction in a segment where the problem doesn’t exist, or where your solution doesn’t stand out.

Get your ICP right, and you’ll see:

Lower CAC

Shorter sales cycles

Better retention

Higher LTV

Clearer roadmap priorities

A more aligned, faster-moving team

Clarity becomes your competitive edge. The tighter your definition, the easier it becomes to win and keep winning in the right markets.

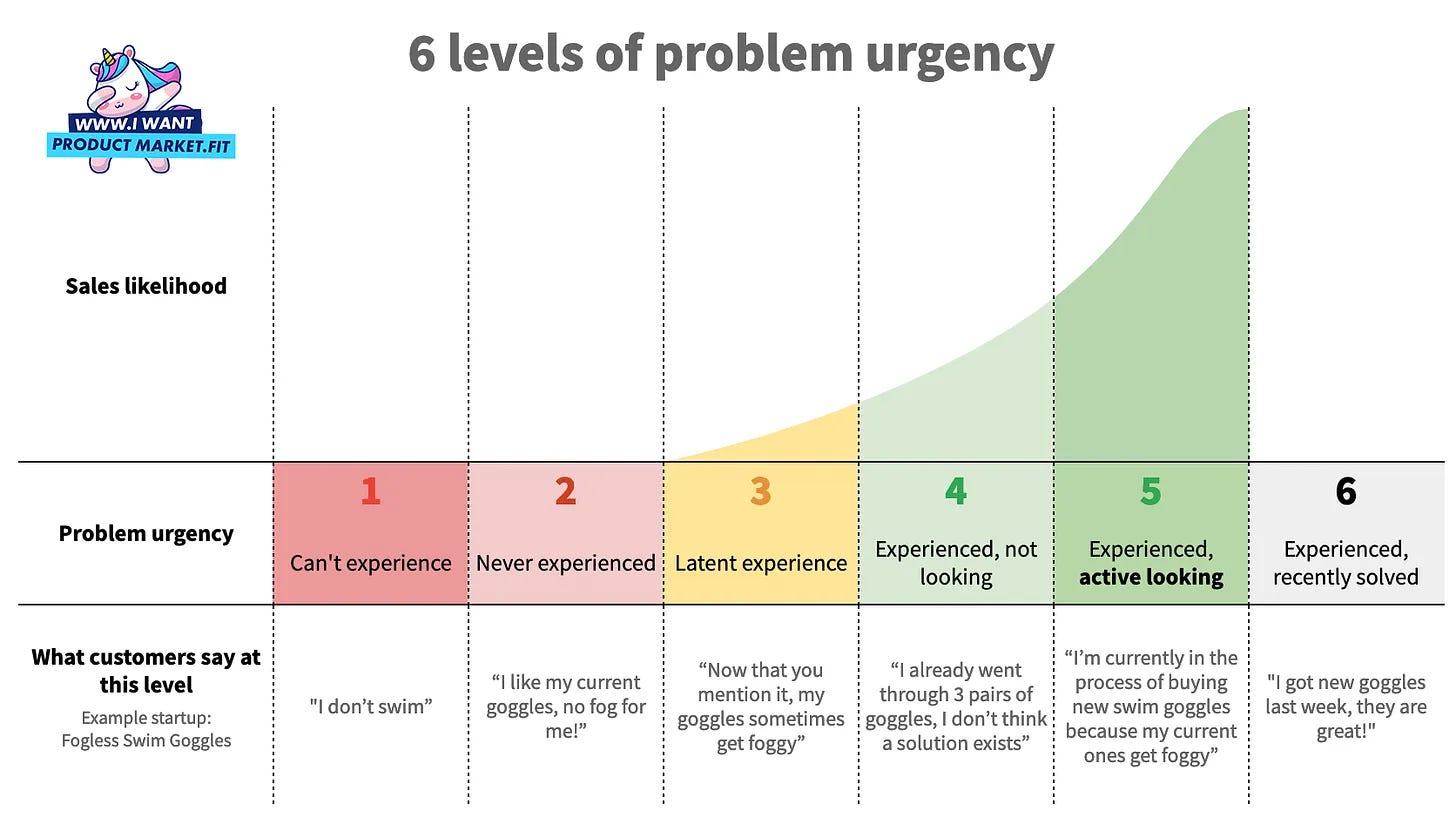

2. How to recognise great problems with high sales potential?

Everyone talks about solving customer problems, but not all problems are worth solving, as some lack sales potential. Consider this: while some customers may be indifferent to your solution, others are desperate for help. Understanding this difference is crucial.

Jeroen Coelen has shared 6 ways people relate to problems, and only some of them lead to actual sales. Let me break it down:

Level 1: Cannot experience

These people don't understand the problem at all

Skip them - their feedback won't help

Level 2: Never Experienced

They've never faced the problem

Not worth pursuing as customers

Level 3: Just Realising

Have the problem, but hadn't noticed it before

Good for testing your marketing message

Can become customers if your pitch works

Level 4: Gave Up Looking

Have the problem, but stopped trying to fix it

High sales potential if your solution is better

They're tired of bad solutions

Level 5: Actively Looking

Best potential customers

Ready to buy now

Hard to find and decide quickly

Level 6: Just Found Solution

Don't try to sell to them

Learn from what solution they chose

What to do based on who you find:

Finding Level 1-2: Wrong target market. Change who you're talking to.

Finding Level 3: Adjust your target market or wait for them to realise they need help

Finding Level 4-5: Perfect! Focus on selling.

Finding Level 6: You're too late. Find ways to reach people earlier.

Remember: Only Levels 3, 4, and 5 are likely to buy. Focus on them.

Also, many founders became discouraged and demotivated when they couldn't find customers to try their product at an early stage. I highly recommend focusing on customers who are at Levels 4-5, i.e. people with hair on fire.

Jeroen Coelen has shared two more articles where he discusses how to use this model to identify launch customers for your beachhead market, including a case study. I highly recommend reading these articles.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Early AI investor Elad Gil is now backing startups that acquire traditional service firms (like law firms) and scale them using generative AI, improving margins and enabling aggressive roll-up strategies. (Read)

Zeal Capital Partners, a Washington, D.C.–based venture firm, has closed Fund II with $82 million to back early-stage companies in fintech, healthcare, and the future of work. (Read)

Iron Wolf Capital, a Vilnius, Lithuania-based deeptech VC firm, raised €30M of a targeted €100M second seed fund to invest in AI, biotech, energy, and spacetech startups. (Read)

Major Tech Updates

Google has launched the AI Edge Gallery app, letting users download and run Hugging Face AI models locally on Android devices, with iOS support coming soon. (Read)

In closing arguments, Google and DOJ lawyers duelled over its search deals and how the rise of AI could change the Internet as we know it. (Read)

OpenAI plans for ChatGPT to become a super assistant, a personalized gateway handling diverse tasks and acting on behalf of users across many digital channels. (Read)

Anthropic’s annualized revenue has surged to $3 billion, up from $1 billion just five months ago, driven by corporate interest in generative AI. (Read)

Apple will shift to naming OS versions by year, starting with iOS 26, replacing the current sequential system. (Read)

Hugging Face introduced two open source humanoid robots: HopeJR, a full-size robot with 66 degrees of freedom, and Reachy Mini, a desktop AI testing bot. (Read)

Nvidia and AMD will release new AI chips in China that comply with U.S. export restrictions, Nvidia’s is codenamed “B20,” and AMD’s is the Radeon AI PRO R9700. (Read)

New Startup Deals

Vima Therapeutics, a Cambridge, MA-based clinical-stage biotechnology company, raised $60M in Series A funding. (Read)

Unbound, a San Francisco, CA-based company providing generative AI tools for IT and security teams, raised $4M in funding. (Read)

RoxFit, a York, UK-based provider of a hybrid fitness platform, raised £800K in funding. (Read)

Grammarly, a San Francisco-based AI writing assistant company, secured $1 billion in nondilutive funding from General Catalyst’s Customer Value Fund. (Read)

Empathy, a NYC-based lost support and legacy planning technology company, raised $72M in Series C funding. (Read)

ClickHouse, Inc., a San Francisco, CA-based leader in real-time analytics, data warehousing, observability, and AI/ML, raised $350m in Series C financing. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Investment Trainee - Hashkey Capital | USA - Apply Here

Senior Associate - M12 | USA - Apply Here

Startup Scouting Partner - 8state venture | UAE - Aplpy Here

Staff Accountant - Energy Impact Partner | USA - Apply Here

Writer - First Round Capital | USA - Apply Here

Partner 32 - a16z | USA - Apply Here

Senior Operations Manager - Unusual Venture | USA - Apply Here

Associate - Omerse Venture | USA - Apply Here

Investor Relationship Associate - Bauken Capital | USA - Apply Here

Venture Capital Managing Director - Connecticut Innovation | USA - Apply Here

Investment Trainee - Hashkey Capital | USA - Apply Here

Full-Time Investment Intern - Inflexor Venture | India - Apply Here

Visiting Analyst VC - Identity Venture | Germany | UK - Apply Here

General Partner - Inviox Capital Partner | UK - Apply Here

Investor (AI) - Samsung Next | USA - Apply Here

Senior Analyst - Chiratae Venture | India - Apply Here

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator