How to get VCs to bet on you, even in a crowded market. | VC & Startup Jobs.

When Product Markets Become Collective Traps & B2C Startup Idea Validation Framework.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: How to get VCs to bet on you, even in a crowded market.

Quick Dive:

When Product Markets Become Collective Traps.

Jessica Livingston: More customer support tickets are a sign of product-market fit.

B2C Startup Idea Validation Framework.

Major News: Klarna CEO’s family office turned $3.6M into OpenAI shares in io’s $6.5B acquisition, Apple plans smart glasses launch in 2026, Apple reportedly abandons smartwatch camera plans & Valve CEO's Neuralink rival expects first chip this year.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

All-In-One Term Sheet Guide for Founders.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link).

New report shows the staggering AI cash surge — and the rise of the 'zombiecorn'.

GPs rush to secure funding as uncertainty fuels liquidity fears.

100 Trillion Tokens by Tomasz Tunguz.

Mastering the human side of engineering: Lessons from Apple, Palantir and Slack.

The rise of Cursor: The $300M ARR AI tool that engineers can’t stop using.

Leo Polovets on pitch deck minimums.

The effects of funding on software spend.

Seed-to-Series A Conversion Rates Decline Across Sectors.

Do Early-Stage startups need a financial model for fundraising?

You need a better testing strategy: A/B Testing Is Broken.

All-In-One Guide To Venture Capital Interview Questions (And How to Answer Them)

Startup dealmaking continues its drop from investor-friendly peak

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decks built by experts and reviewed by investors. Don’t leave funding to chance[schedule a call today →]

DON’T MISS THIS INVESTMENT OPPORTUNITY.

🤝 Keep This Stock Ticker on Your Watchlist.

They may not be trading on the Nasdaq yet, but Pacaso just reserved the ticker PCSO. No wonder people are excited to invest now in Pacaso as a private company.

Founded by the man who took Zillow from seed to IPO, Pacaso brings co-ownership to a $1.3T market. They’ve transacted $ 1 B+ worth of luxury homes across 2,000+ buyers. Top firms like SoftBank even invested.

After 41% gross profit growth last year, Pacaso’s ready for what’s next. And until 5/29, you can invest in Pacaso for just $2.80/share.

Invest in Pacaso before Thursday’s deadline →

*This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

How to get VCs to bet on you, even in a crowded market.

Here’s a well-known secret: VCs hate crowded spaces.

If a bunch of companies are chasing the same problem, it means brutal competition for customers, which usually means higher costs and slower growth. Not exactly what investors dream of.

But here’s the flip side: some companies do win in crowded markets. And when the market is big enough, VCs will still invest. The key? They need to believe they’re betting on the right startup.

So, if you’re a founder building in a competitive space, the real question is: how do you stand out?

That’s exactly what we’re diving into today.

To make this real, let’s talk about a space that’s super crowded: AI. (Agree??)

Specifically, AI-powered sales development representatives (SDRs) tools help sales teams find and qualify leads faster.

(From my VC friend: We see at least one AI SDR startup every week. There are plenty more out there raising money. So yeah, it’s competitive.)

That said, sales as an industry has a huge total addressable market (TAM), and AI is, well, everywhere right now. VCs want to invest in this space. But only if they believe a startup can return 100 their money. (Can your startup return VC funds?)

Which brings us to the challenge:

How do you prove you won’t stall after some early traction?

How do you avoid insanely high customer acquisition costs?

How do you convince VCs you’re the one to bet on?

The answer: find a market wedge.

The Market Wedge Strategy

A wedge is simply a strategy to win a large market by initially capturing (1) a tiny part of a larger market or (2) a large part of a small adjacent market.

So if you want to break into a crowded market, don’t try to be “just another AI sales tool.” Instead, specialise.

Example: Instead of being a generic AI SDR, you could be the AI SDR for veterinarians.

Why? Because focusing on a niche:

Gives you a clear target audience with a unique need.

Makes customer acquisition way easier.

Helps you stand out from the sea of generic competitors.

But VCs won’t just ask, “What’s your wedge?” They’ll ask, “How do you grow beyond it?”

Here’s where your expansion strategy comes in:

Vertical Expansion – Offer more services to your niche.

You start with AI-powered sales for vets.

Then add appointment scheduling, inventory management, etc.

Horizontal Expansion – Expand to similar industries.

What other businesses are similar to vet clinics?

Maybe dental offices? Physical therapy clinics?

The key is to show investors that you’re thinking beyond today’s niche and into tomorrow’s empire.

Getting Customers (Without Burning Cash)

A wedge is great. But without customers, it’s just a nice idea. VCs want to see that you can acquire customers efficiently.

If you already have industry connections amazing. Maybe you:

Come from a family of veterinarians.

Worked in the industry and have built relationships.

But what if you don’t have these connections? That’s where partnerships can be a game-changer.

For example, if you’re targeting veterinarians, you could:

Partner with a Medical Association to tap into their network.

Work with private equity firms that acquire vet clinics (and need them to grow).

Get backing from VCs specialising in pet tech, who can open doors.

The goal is simple: show VCs you can acquire customers from day one without breaking the bank.

Here’s another tip: VCs love learning.

If a founder teaches them something they didn’t know, it makes them way more likely to invest.

That means your job is to be the expert. You should know more about your niche than anyone in the room.

How do you prove that?

Challenge common assumptions: “Everyone thinks X about the veterinary industry, but actually, it’s Y.”

Drop surprising insights: “Did you know 73% of pet owners would pay more for AI-enhanced vet services?” (Okay, I made that up, but you get the idea.)

Offer a fresh perspective: Explain why your approach makes more sense than the status quo.

And don’t shy away from the competition. Yes, the market is crowded but that’s because the opportunity is massive. If you can prove you understand the market better than anyone else, you position yourself as the founder VCs want to back.

So, if you’re in a crowded space and want to win investors over, here’s what you need to do:

Find your market wedge a niche that gives you an entry point.

Show how you’ll expand beyond that wedge over time.

Prove you can acquire customers efficiently (without insane costs).

Know your market better than anyone else in the room.

In a crowded market, the loudest voices don’t win the smartest, most strategic ones do.

So be different. Challenge assumptions. And make it impossible for investors to ignore you.

Who knows? Maybe your AI-powered vet sales tool is the next unicorn. Just don’t forget the little people when you make it big.

FROM OUR PARTNER - AFFINITY

🤝 Find Your Next Deal Faster, With Less Friction, With Affinity.

For dealmakers who rely on relationships, Affinity enables firms to find, manage, and close more deals. By automating relationship insights, Affinity saves time on manual data entry and helps teams act with full confidence, knowing every connection’s history.

Join over 3,000 organisations worldwide transforming their dealmaking.

Start closing more deals today with Affinity →

📃 QUICK DIVES

1. When Product Markets Become Collective Traps.

Most of us assume that if people are using a product, it must be making their lives better. But what if that’s not true?

In a powerful new study from the University of Chicago’s Leonardo Bursztyn, the study shows that platforms like TikTok and Instagram may actually reduce overall well-being, even for the people who actively use them.

Here’s how they tested this idea:

They ran a large online experiment with 1,000 college students to understand the true value of social media. The twist? They measured not just how much people enjoy using these platforms, but how much it bothers them not to use them when everyone else does.

Key findings:

On average, TikTok users would need to be paid $59 to give it up for a month. But when asked how much they’d pay to shut down everyone’s accounts, including their own, they’d actually be willing to pay $28 for that.

For Instagram, users would need $47 to step away, but would pay $10 to take the whole platform offline for themselves and their peers.

It gets starker: non-users of TikTok said they’d pay $67 just to make everyone else delete their accounts. For Instagram, it was $39.

Once you factor in the “spillover effects” (aka, the Fear of Missing Out), the paper finds that 64% of TikTok users and 48% of Instagram users are actually worse off because these platforms exist at all.

The catch: they’d feel even worse if they alone opted out while everyone else stayed online. So they stay trapped by network effects.

Why this matters:

The study introduces a concept called a “collective trap”: situations where the popularity of a product increases pressure to participate, even when it makes many people unhappy.

It also shows this dynamic isn’t limited to social media. The same effects appear in luxury goods and tech:

44% of luxury brand owners (e.g., Gucci, Rolex) said they’d rather live in a world where none of those brands existed.

A staggering 91% of iPhone users said they’d prefer Apple release new iPhones only every other year. Among non-iPhone users, it was 94%.

In short, just because a product is widely used doesn’t mean it’s making people better off.

Here’s what founders should take away:

Don’t confuse usage with genuine value.

Just because people are logging in doesn’t mean they want to be there. Some users stick around because they fear being left out, not because they’re deriving real utility. That’s not sustainable, and it's not product love.Look deeper than metrics like DAUs, Power user curves and retention.

Ask yourself: Would people still use this if their friends didn’t? Would they pay to make the whole thing disappear? These questions reveal whether you're creating value or just building a collective trap.Design to serve, not pressure.

Platforms built on FOMO, guilt, or status-chasing may grow fast, but they risk turning into zero-sum ecosystems. Instead, ask: Does my product make people feel better, more empowered, more fulfilled, independently of what others are doing?Build for intrinsic utility.

Products that people use because they want to, not because they have to, are far more likely to build lasting impact and trust.Consider negative externalities.

Think about what your product does to non-users. If your success creates social pressure, envy, or disconnection for others, don’t ignore it. That’s part of your real-world footprint.

Full paper: When Product Markets Become Collective Traps (BFI)

2. Jessica Livingston: More customer support tickets are a sign of product-market fit.

A counterintuitive tip about startups is that more customer support tickets are a sign of product-market fit.

If users didn’t love the solution your product was offering to a painful problem, they wouldn’t care enough to write in support tickets. And more tickets = more users.

But when support tickets grow at an exponential rate, they become a problem where you simply can’t get to all of them and still work on the product, growing it, managing the team, talking to investors, etc.

So how do you solve that?

Most people’s first instinct is to hire a customer support person, but this is almost always the wrong first move:

You take yourself further away from your users, making it more complex to understand their issues.

If your startup keeps growing, you’ll just have the same problem again soon.

Instead, take Jessica Livingston’s (Founding Partner of Y-Combinator) advice (below) and focus on making the product better.

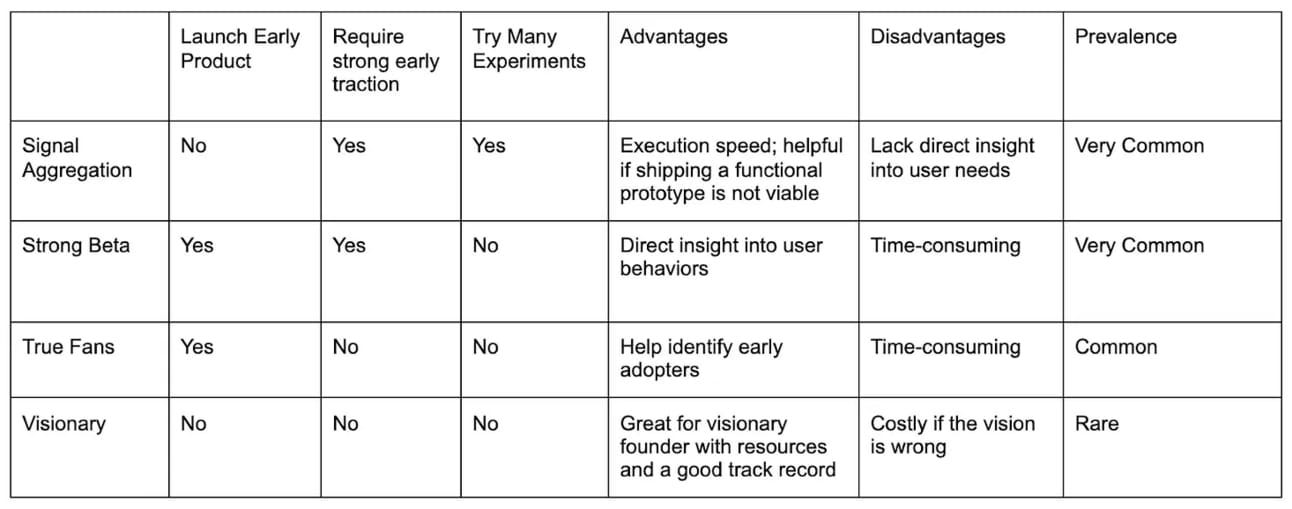

3. B2C Startup Idea Validation Framework.

Most ideas, especially in B2C, get validated in one of four ways:

This framework defines the differences between each path to validation.

Signal Aggregation

Founders should test an idea's viability through small experiments that provide evidence (signals) of potential success before building a full product.

Common signals include landing page sign-ups, social media engagement, ad click-through rates, and customer interview feedback.

Strong Beta

Achieving strong early traction with a beta product is another popular validation approach for founders. Success metrics vary across industries, e.g., high user numbers and retention for consumer social apps, and healthy revenue for B2C marketplaces.

The process typically starts with a hypothesis for solving a problem. The founder builds a basic version to test the hypothesis. Beta products are often rudimentary, lacking polish, due to the emphasis on speed over perfection. This approach aligns with the lean methodology of launching quickly and iterating based on feedback.

True Fans

This approach is similar to the Strong Beta approach, as it involves launching a beta product. However, instead of focusing on significant traction metrics like revenue or user acquisition, the founder seeks to identify a small group of fanatic users who deeply love the product despite its limited features. The key is finding 20-50 users who would be disappointed if the product were to go away. These passionate fans, rather than large user numbers, serve as the validation signal.

Visionary

This approach is the least common among the founders interviewed, as it requires a clear vision and plan for the product from the outset. Typically, the founder has a close personal connection to the problem being solved and a strong understanding of what needs to be done to address it.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Klarna CEO Sebastian Siemiatkowski revealed that his family office, Flat Capital, invested $3.6M in Jony Ive’s io just six months before its $6.5B all-stock acquisition by OpenAI, earning significant returns in OpenAI shares. (Read)

VCs like Khosla Ventures, General Catalyst, and Thrive Capital are testing a private-equity-style strategy: acquiring mature businesses (e.g., call centres, HOAs) and optimising them with AI for scale and efficiency. (Read)

Major Tech Updates

Tinder CEO Faye Iosotaluno will step down in July after leading the company since January 2024 and focusing on AI-powered personalisation to improve recommendations. (Read)

Apple is preparing to mass-produce prototypes of its smart glasses later this year and aims for a commercial launch by the end of 2026, according to Bloomberg. (Read)

Amazon is testing AI-powered audio product summaries featuring "AI-powered shopping experts" discussing key product features, customer reviews, and web information. (Read)

Nvidia plans to release a new AI chip for China, priced significantly lower than the H20, with mass production anticipated to begin as early as June. (Read)

Starfish Neuroscience, Gabe Newell's startup, revealed plans to produce its first electrophysiology chip later this year, designed for recording brain activity and brain stimulation. (Read)

Trump warned Apple it must manufacture iPhones in the U.S. or face a 25% tariff, citing dissatisfaction with production shifting to India. (Read)

New Startup Deals

PlaySafe ID, a London, UK-based provider of a gaming cybersecurity platform, raised $1.12M in pre-seed funding. (Read)

Slash, a San Francisco, CA-based banking platform provider, raised $41M in Series B funding, at a $370M valuation. (Read)

Siro, a NYC-based provider of an AI-powered conversation intelligence platform for in-person sales, raised $50M in Series B funding. (Read)

RevenueCat, a San Francisco, CA-based provider of a platform for managing consumer app monetisation, raised $50M in Series C funding. (Read)

StackHawk, a San Francisco, CA-based shift-left API security platform allowing teams to keep up with the pace of AI-driven development, raised $12M in additional funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Writer - First Round Capital | USA - Apply Here

Associate - Omerse Venture | USA - Apply Here

Managing Director - Generator Accelerator | USA - Apply Here

Investment Analyst - EXEO Fund | USA - Apply Here

Investment Analyst - 12 Flag | India - Apply Here

Associate - Capital One Venture | USA - Apply Here

Corporate Venture Capital Fund - Thomson Venture | USA - Apply Here

Investment Manager - Techstar | USA - Apply Here

Chief of Staff & Head of Administrative Operations - Beyond Alpha Venture | USA - Apply Here

Finance Associate - Good Capital | India - Apply Here

Venture Partner - 007 Venture Partner | USA - Apply Here

Venture Partner - Taise Venture | USA - Apply Here

Partner 36 - a16z | USA - Apply Here

Venture Partner - Moivre Venture | UK - Apply Here

Associate - Rev1 Venture | USA - Apply Here

Investment Analyst - Lumikai Fund | India - Apply Here

Investor - Griffin Gaming Partner | USA - Apply Here

Associate - Omerse Venture | USA - Apply Here

Investment Analyst - In Q Tel | Singapore - Apply Here

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator