Beware of “Vibe Revenue” - The Silent Killer of AI Startups. | VC & Startup Jobs.

Grow your startup while raising capital & Why VCs ask these odd questions.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: Why VCs ask these odd questions (and how to answer them).

Quick Dive:

Beware of “Vibe Revenue” - the silent killer of AI startups by Greg Isenberg.

How to grow your startup while raising capital.

Major News: Nvidia CEO calls US China chip ban a failure, iPhone designer Jony Ive joins OpenAI with $6.5 Billion equity deal, Microsoft AI discovers new chemical in 200 hours & Apple plans to let developers build on top of its AI.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

We're gonna need a bigger moat by CBInsights.

OpenAI’s o3, GPT-4.1, and o4-mini Our take on what’s powerful, what’s practical, and what’s still TBD.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link).

Winning at seed investing isn’t just about when to buy, but increasingly also when to sell.

6000+ European VC Firms Contact Database (LinkedIn Links).

The only startup valuation guide you need as a founder.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Getting founders some early liquidity can benefit VCs.

When engineers say "That'll take months!"

Build a consulting business before you build a product business.

We bought HUNDREDS of billboards in San Francisco, for our open source product.

Do Early-Stage startups need a financial model for fundraising?

The AI Model Flood Plus: Meet your new AI alien best friend.

All-In-One Guide To Venture Capital Interview Questions (And How to Answer Them)

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decks built by experts and reviewed by investors. Don’t leave funding to chance[schedule a call today →]

INVESTMENT OPPORTUNITY WORTH EXPLORING…

He’s already IPO’d once – this time’s different

Spencer Rascoff grew Zillow from seed to IPO. But everyday investors missed pre-IPO gains.

"I wish we had done a round accessible to retail investors prior to Zillow's IPO," Rascoff later said.

Now he’s fixing that with Pacaso, his new company disrupting the $1.3T vacation home market. And unlike Zillow, you can invest in Pacaso as a private company.

After 41% gross profit growth last year, Pacaso’s ready for what’s next. They even reserved the Nasdaq ticker PCSO. But no need to wait.

Invest in Pacaso for $2.80/share before Thursday’s deadline →

*This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

Why VCs ask these odd questions (and how to answer Tthem).

During conversations with VCs, entrepreneurs will often encounter a few sneaky questions that have nothing to do with their actual businesses today. Many of these are attempts by investors to learn something specific that they don’t want to ask directly, and there’s usually some kind of hidden meaning behind a given question. Some VCs may just be fishing for more information, but many are looking for specific “right” answers.

It’s a funny dance, and while experienced entrepreneurs know what’s going on and how to respond, these questions can easily trip up a founder going through the fundraising process for the first time.

Previously we have shared 9 weird questions that always made to think founders including:

What if Google Builds It?

I don’t think this can be a venture-scale business.

We’d be interested when we see a bit more traction.

Come back when you have a lead.

Why hasn’t this been done before?

Contact us if you like but we prefer warm introductions.

What’s the moat? (for a seed stage).

How can this be a billion-dollar company?

“Yes but what *traction* do you have?” & “Your valuation is so HIGH now!”

You can read this in our archive post here.

Now, I’m sharing a few more questions that you might hear from VCs. Of course, it’s always best to be honest and authentic so this is not a proposed script, but rather additional context to incorporate into your thinking.

“Where do you see this company going in 5+ years?”

What they’re really asking: “Is there a really big business here and is this founder going to grind it out to get there?” Another sneaky way to ask this question is something like, “Why would you even raise money for this business?”

This is often a way to understand potential founder-investor alignment. As a founder, it’s important to remember that you should really only talk to VCs if you believe you’re working on a venture-scale business that can produce hundreds of millions of dollars or more in revenue or value. In these cases, the goal should be an outsized exit to another company or an IPO.

Obviously, not every company a VC backs accomplishes this (most don’t). And of course, thousands of great businesses are built every year without any need for venture capital. But for most VCs to get a return, they need to make sure that every company in which they invest at least has a shot at larger outcomes.

They also need to believe that the founders they back are in it to build a great business in the long haul and won’t be tempted by smaller-scale exits along the way.

These exits might enrich the founding team but leave the VC with a mediocre outcome. And while there are ways to deal with this along the way (e.g. founder liquidity), you shouldn’t mention it during an early-stage fundraising process.

Answer: “I think about this all the time, and I can’t seem to find any compelling evidence that suggests that this can not be a large, independent, public company.”

“Where are you in your fundraising process?”

What they’re really asking: “How fast do I need to move here as an investor? How much heat is there around this deal? Is this a ‘shopped’ deal?”

In this case, the VC is definitely fishing for information. You may not give them any, but it doesn’t hurt for them to ask. As a founder, your best bet is to convey real momentum if you can. Just know that the VC will remember what you said if things unfold differently.

For example, if you say, “I have a couple of partner meetings next week and think I’ll have a term sheet pretty soon,” then you’d better have some sort of deal in hand by the end of next week. Otherwise, investors will think that you lied, you misread the situation, and/or those other firms passed. Regardless, you’ll be on your heels.

Answer: “We are just starting our process but have had a few meetings and are getting great feedback. Things are moving really fast, so I’d like to get some indication of interest within three to four weeks, and then choose the right partner shortly after that.”

The general advice here is, to tell the truth and convey that you have momentum and are confident that some sort of a deal will come together soon. I wouldn’t overplay your hand around timing or investor interest, however, until you’re very sure that you’re getting a term sheet. But after that, use that term sheet as leverage for other conversations. Even if it’s not from the world’s greatest firm, you can use it as a forcing function to get other VCs to move. But if you don’t have at least 90 percent certainty that a term sheet is coming, then I wouldn’t be as specific.

The suggested answer above is similar to the common response from many good companies. It’s a good response because it communicates a few things:

There are other interested VCs in the mix.

But this deal hasn’t been overly shopped to investors.

And there is a loosely established, reasonable timeline that requires a given investor to move with conviction.

Investors will make up their own minds about whether they believe your reply here, but it’s still a reasonably solid “baseline” response.

As an aside: Never name potential investors unless you’re completely convinced they’ll give you a ringing endorsement should a given VC call them. If you find yourself being pressed for names, you can just say something noncommittal like, “There are only so many investors that are great at X (e.g. early-stage e-commerce), and we are speaking to some of the usual suspects.”

If the investor really presses with no good reason, then they are just being sad and you should move on immediately. The best investors make up their own minds.

FROM OUR PARTNER - AFFINITY

🤝 What 3,000 VC Firms Revealed About Dealmaking in 2025.

Affinity’s 2025 venture capital benchmark report explores key dealmaking trends, strategic opportunities, and the characteristics that set-top firms apart—with data from almost 3,000 VC firms worldwide.

Discover how top firms remain competitive in a shifting market, and get actionable insights on how your firm can outperform.

📃 QUICK DIVES

1. Beware of “Vibe Revenue” By Greg Isenberg.

Greg Isenberg recently put a name to a trend many founders, investors, and operators have been quietly noticing: vibe revenue.

It’s when a product brings in money not because it’s solving a persistent problem but because it’s new, exciting, and everyone wants to try it. The danger? It looks a lot like real product-market fit… until the music stops.

What is vibe revenue?

Vibe revenue comes from curiosity, hype, and FOMO, not from necessity. It’s like when you buy a flashy gadget, use it for a week, and then forget it exists. In the startup world, this kind of revenue often shows up on pitch decks as “ARR,” creating the illusion of sustainable traction.

Especially in AI, we’re seeing a surge of companies with early traction and big VC checks but under the hood, much of the revenue isn’t sticky. Users aren’t deeply engaged. They’re just curious.

Here’s how you can recognize vibe revenue:

Fast early conversions

Strong growth in the first few months

Weak retention after months 3–6

Little to no account expansion

High user churn when competitors pop up

The vibe revenue cycle

Launch a shiny demo – It wows early adopters.

Signups explode – Everyone wants to try the cool new thing.

VCs get excited – The growth graphs look amazing.

A big round is raised – The company is suddenly worth 9 figures.

Reality sets in – The product isn’t critical to the user’s workflow.

Growth plateaus – But few talk about it publicly.

Zombie phase – The money’s there, but the product’s stuck.

Many startups in the AI boom of 2023–2024 are between steps 4 and 5. The reckoning hasn’t hit yet but it’s coming.

The dangerous part? It looks like PMF

For the first few months, vibe revenue mimics real product-market fit. The metrics look great:

Up-and-to-the-right growth

High engagement

Excited early users

But those same users eventually drift away. Why? Because the product never became essential. The honeymoon ends, and so does the hype.

Why AI makes vibe revenue even trickier

The twist in today’s AI wave: these products do work. Unlike past hype cycles (think Web3 or metaverse), AI tools can actually deliver value. ChatGPT, Midjourney, and others create instant “wow” moments.

The problem is sustainability. Are these tools built into daily workflows? Do they solve persistent problems? Or are they just... fun to play with for a while?

Competitive moats disappear overnight

AI products are evolving fast. What felt like a defensible edge one month can be wiped out the next by a newer model, a slicker interface, or a lower price. Users are quick to switch. Loyalty is low. Switching costs are nonexistent.

Even startups that do have early PMF are at risk if they don’t evolve fast enough.

How to tell if it’s vibe revenue

If you’re a founder, investor, or operator, ask yourself:

Are users coming back consistently?

Are they embedding this tool into their daily work?

Is usage growing within existing accounts?

Is retention strong past month 6?

Do people complain when pricing changes—or do they churn without a fight?

Strong cohort retention is the clearest signal of real PMF. If that curve is bending downward, you’ve got a problem.

Strong cohort retention means that users who start using your product keep coming back over time—week after week, month after month.

Real vs. vibe businesses

Real AI businesses:

Replit and Cursor: deeply integrated in developer workflows

Anthropic and OpenAI: foundational infrastructure

Perplexity: shifting from novelty to real research use

Bolt: layered AI on top of years of core product work

Vibe businesses:

AI companions with novelty, no retention

Productivity tools that are just ChatGPT with a new skin

Shiny demos with zero workflow integration

The difference? It’s not the tech. It’s the habitual use.

A coming correction?

We’re likely 12–18 months away from a major shakeout. Companies that raised big based on vibe revenue will struggle to raise again. Some may become “zombies” well-funded but going nowhere. Employees will leave. Investors will lose patience.

But this isn’t an AI winter. The tech is too transformative. What’s coming is a maturity curve where only the strongest survive.

How to build beyond the vibe

If you’re building an AI startup today, focus on:

Retention: Make the product something people can’t work without

Workflow integration: Become a daily tool, not a demo

Defensibility: Through community, proprietary data, and real switching costs

Solving real pain points: Not just delivering impressive outputs

The winning companies won’t be the ones with the most viral demos on X. They’ll be the ones that become indispensable products that still matter long after the initial excitement fades.

Read the full article here: https://gregisenberg.kit.com/posts/vibe-revenue

2. How to grow your startup while raising capital.

Let’s be honest: fundraising is brutal.

It’s like running a full-time sales process you can’t hand off to anyone else. You need to stay endlessly optimistic even if you’ve just been ghosted or rejected for the tenth time that week.

But here’s the part no one talks about: how do you keep growing your startup while fundraising? Many founders ask this question, and I’ve seen quite a few get overwhelmed and frustrated in the process. So I thought I’d share a few thoughts on how to manage both effectively.

Most early-stage startups don’t have the luxury of pressing pause on growth. Yet investors still expect momentum even as you’re deep in back-to-back pitch meetings. That tension is real, especially for tiny teams where the founders are doing everything.

So how do you juggle both?

Step one: prepare to shift gears

Fundraising isn’t a side project. If you’re the CEO, you’ll need to clear your schedule and fully commit to building your deck, telling your story, and closing the round. That means offloading as much of your day-to-day as possible before you hit the fundraising trail.

Look at everything on your plate and ask:

Can I drop this?

Can someone on the team take it over?

Can we hire help or automate it?

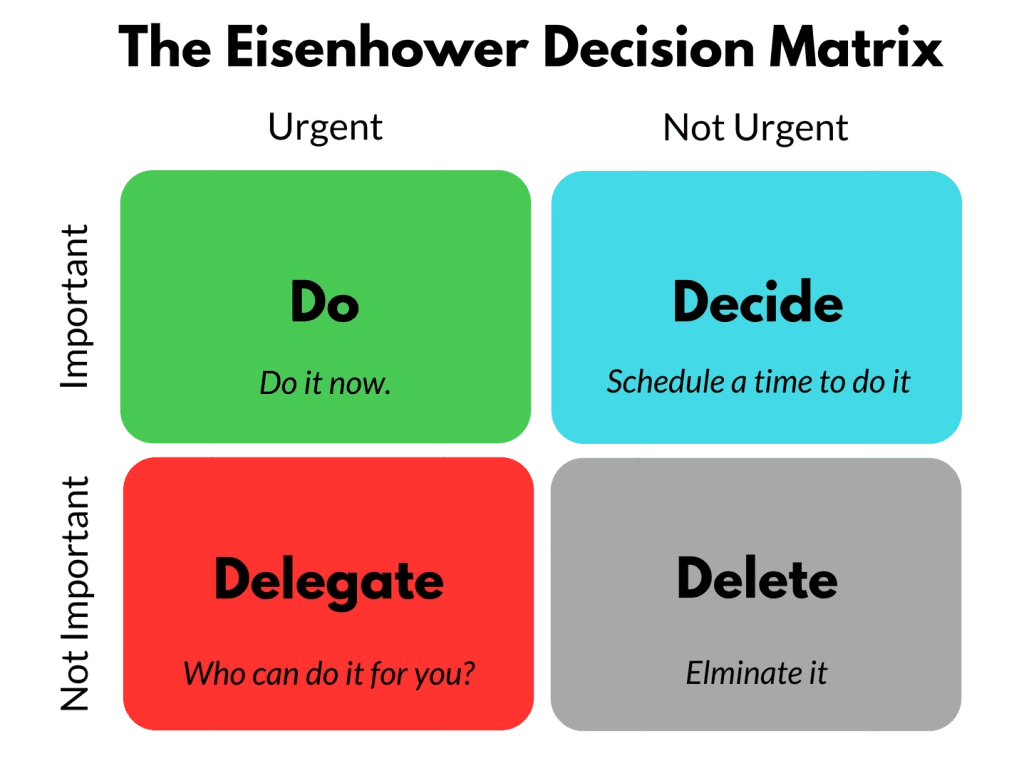

This exercise is about ruthless prioritization. The Eisenhower Matrix can help it’s a simple framework that breaks your work into four buckets:

1. Important + Urgent: Do these now

Think fire drills, things you can’t delay. Ask your co-founder to step up and take the lead here so you can focus on fundraising. Yes, even if they’re introverted and hate sales. Yes, even if they’re in another time zone. This is crunch time, and everyone has to stretch.

2. Urgent but not important: Delegate

Things like customer support, scheduling, or follow-up stuff that needs doing but doesn’t need you. Train your team, outsource, or automate. Document your processes if you haven’t already. It’ll help now and in the long run.

3. Important but not urgent: Schedule

These are meaningful projects that matter but don’t need to happen today. Push them to a post-fundraising timeline. Block off time on your calendar later in the year so they don’t fall through the cracks.

4. Neither important nor urgent: Cut them

Do pet projects or half-baked ideas float around? Let them go. Not everything needs to be done. Freeing up headspace is a win.

Give yourself 1–4 weeks to make the shift

This transition doesn’t happen overnight. Expect it to take a few weeks, depending on how complex your role is. But trust me it’s worth it. Trying to raise money and run your startup without prepping for this handoff is a fast track to burnout.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Scribble Ventures, a San Francisco-based early-stage VC firm led by Elizabeth Weil, closed $80M for Fund III, its largest to date. (Read)

Creator Ventures, a London-based consumer internet-focused VC firm, raised $45M for Fund II, more than doubling its previous $20M fund. (Read)

South Loop Ventures, a Houston-based VC firm, raised $21M for its Fund I to invest in seed and pre-seed startups, with a focus on founders of color. (Read)

Major Tech Updates

OpenAI CEO Sam Altman told employees the company’s next major device won’t be a wearable, but a compact, screenless “AI companion” aware of its surroundings — designed to complement the iPhone and MacBook. (Read)

Google will begin testing ads in AI Mode, its generative AI-powered Search experience, placing relevant ads within and below AI-generated answers; existing Search, Shopping, and Performance Max advertisers are eligible. (Read)

Google unveiled its "Android XR glasses" at the I/O keynote, which have an augmented reality UI in the lenses and are powered by Gemini AI. (Read)

OpenAI has acquired io, the AI device startup founded by Jony Ive, in a $6.5 billion all-equity deal; Ive and his firm LoveFrom will now lead OpenAI’s design efforts. (Read)

Six weeks after Amazon began giving select users early access to Alexa+, a Reuters search found almost no public evidence that people are actually using it. (Read)

After a nearly five-year ban, Fortnite is once again available on Apple’s U.S. App Store, following a court ruling that found Apple violated an injunction promoting fair app competition. (Read)

New Startup Deals

Clair, an NYC-based fintech company offering earned wage access (“EWA”) originated by a national bank, Pathward, N.A., raised over $23M in Series B funding. (Read)

Greenlite AI, a San Francisco, CA-based provider of an AI agent platform for financial services, raised $15M in Series A funding. (Read)

DataHub, a Palo Alto, CA-based provider of an open-source metadata platform, raised $35M in Series B funding. (Read)

Rhizome, a Washington, DC-based provider of a climate resilience planning platform for the power grid, raised $6.5M in Seed funding. (Read)

Siro, a San Francisco-based AI-powered sales coaching platform, raised $50M in Series B funding led by SignalFire. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Managing Director - Generator Accelerator | USA - Apply Here

Investment Manager - Techstar | USA - Apply Here

Venture Partner - 007 Venture Partner | USA - Apply Here

Associate - Rev1 Venture | USA - Apply Here

Investor - Griffin Gaming Partner | USA - Apply Here

Associate - Omerse Venture | USA - Apply Here

Investor Relationship Associate - Bauken Capital | USA - Apply Here

Venture Capital Junior Analyst - Stepstone Group | USA - Apply Here

Venture Capital Managing Director - Connecticut Innovation | USA - Apply Here

Vice President Finance - Spring Tide Venture | USA - Apply Here

Investment Trainee - Hashkey Capital | USA - Apply Here

Full-Time Investment Intern - Inflexor Venture | India - Apply Here

Visiting Analyst VC - Identity Venture | Germany | UK - Apply Here

General Partner - Inviox Capital Partner | UK - Apply Here

Investment Analyst - In Q Tel | Singapore - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator