35+ Investor Contact Databases & Access 50+ Decks That Raised Over $450M. | VC & Startup Jobs.

Symptoms vs. problems: the trap every founder must avoid & Problems with you "Ask" slide.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: 35+ Investor Contact Databases & Access 50+ Decks That Raised Over $ 450M.

Quick Dive:

Don’t include your startup valuation number on the “ask slide”.

Symptoms vs. problems: the trap every founder must avoid.

Major News: Perplexity to raise $500M at $14 billion valuation, OpenAI’s Stargate project is in trouble. Mercury CEO launches $26M fund, US and China suspend tariffs for 90 days.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Rise of the AI Wrappers Plus: Google’s Gemini models get their due.

6000+ European VC Firms Contact Database (LinkedIn Links).

Startup legal document pack – essential legal docs for founders.

The Impact of AI on Education & What It Means for Work by Tomasz Tunguz.

The only startup valuation guide you need as a founder.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

Investor data room guide & templates for founders.

For retail investors: Build lasting wealth with our newsletter! Simplifying investing for beginners and retail investors, we provide actionable insights to help you grow your wealth with confidence.

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decksbuilt by experts, and reviewed by investors. Don’t leave funding to chance[schedule a call today →]

TOOL WORTH EXPLORING

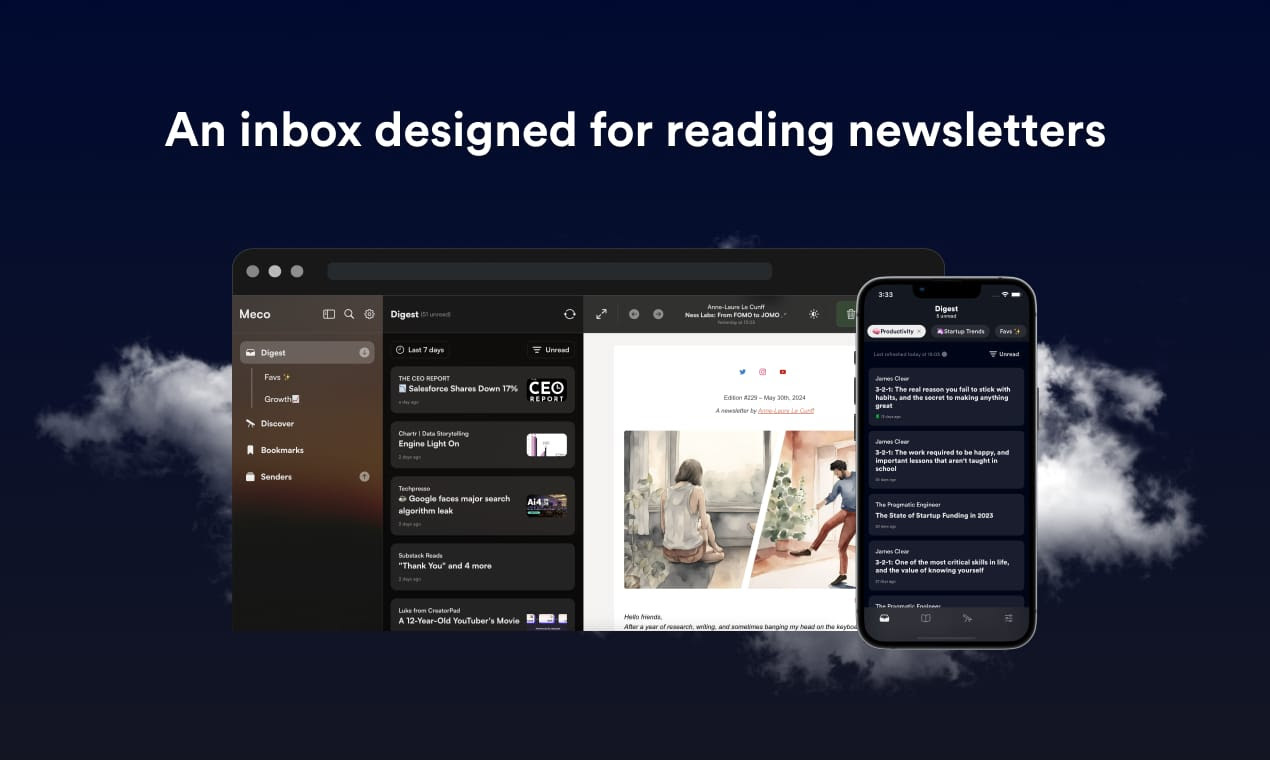

🤝 The best new app for newsletter reading…

Reading newsletters in the inbox is frustrating - it is noisy and easy to lose control of subscriptions. Now with Meco you can enjoy your newsletters in an app built for reading, while giving your inbox space to breathe.

Meco connects to Gmail & Outlook, allowing you to instantly move your newsletters to the app (and clear your inbox.

The experience is packed with features to supercharge your reading, including the ability to group newsletters, set smart filters, bookmark your favourites and read in a scrollable feed.

You can try the experience for free and it is available on ios, Android and web (desktop)

Over 30k readers are enjoying their newsletters (and decluttering their inbox) with Meco - try the app today!

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

35+ Investor Contact Databases & Access 50+ Decks That Raised Over $450M.

This one’s a little different. Normally, we break down topics and share insights, but today we’re giving you something bigger: a massive database of investors. Some of these lists we found online, others we painstakingly curated with the Venture Curator team. We’ve double-checked everything to make sure it’s accurate, and we hope it makes your fundraising journey easier.

Before diving in, feel free to check out our previous fundraising tips on the Archive Page.

Here’s what’s inside each database:

Investor/VC Name

Portfolio Companies

Stage & Sector Focus

LinkedIn & Twitter Links

Email Contacts (for the selected database)

Here we go: The Ultimate Investor Databases for Free

2000 US VCs Link to Access

VC Firms That Accept Cold Outreach From Founders Link to Access

Best European VC funds Link to Access

Best family offices around the world Link to Access

Corporate venture arms Link to Access

100 VC firms investing in SaaS Link to Access

100 best VC funds in the UK Link to Access

250 US AI Angel Investors Link to Access

The Ultimate List of 750+ Seed Funds Link to Access

300 Australian Early-Stage Investors Link to Access

350 Most Active Angel Investors in the US Link to Access

900 Climate VCs Link to Access

All accelerators by number of investments Link to Access

Data investors in Asia Link to Access

Early-stage web3 investors Link to Access

French VCs Link to Access

Gen AI Investors in Asia Link to Access

250+ Latin America VC Firms & Angel Investors Database: Link to Access

List of VCs Investing in India Link to Access

Top 100 Pension Funds in the World Link to Access

Top 100 Venture Funds by Number of Investments Link to Access

150+ African Angel Investors Contact Database (Email + LinkedIn Link): Link to Access

Top 300 Angel Investors in the Middle East Link to Access

Seed & Series A US VCs (via Folk) Link to Access

Mercury’s Investor Database (most active Seed & Pre-Seed investors) Link to Access

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link): Link to Access

Airtree’s 168+ Australian VC firms: Link to Access

6000+ European VC Firms Contact Database (LinkedIn Links) Link to Access

Deep Tech Investors Mapping (from Hello Tomorrow): Link to Access

VC investors in the Netherlands list: Link to Access

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link): Link to Access

European Tech VC Funds (by EuroVC): Link to Access

2000+ US VCs grouped by Fund stage, Fund focus, and Location: Link to Access

HealthTech Venture Investor List: Link to Access

NYC Early Stage VC firms list: Link to Access

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) Link to Access

Many founders struggle to build the right pitch deck that captures investors' attention. So, we’ve curated 50+ decks that have raised over $450M from leading investors.

Here are a few examples:

Maikbou – Raised $3.3M (Seed round)

Pathrise – Raised $3M (Seed round)

Lago – Raised $22M (Seed round)

Apriori – Raised $2.8M (Seed round)

Careerist – Raised $8M (Series A)

Vori – Raised $45M (Series A)

Rippling – Raised $145M (Series B)

Thunkable – Raised $30M (Series B)

Pelago – Raised $58M (Series C)

And many more. Link below -

You can find pitch decks here.

📃 QUICK DIVES

1. Don’t include your startup valuation number on the “ask slide”.

After I published 'How to Talk About Valuation Numbers When Investors Ask?', many founders DMed me asking for more content on this topic, specifically about the common mistakes founders make when discussing valuation. So I thought I’d share some thoughts on that.

There’s one slide that almost every founder gets wrong when they are putting together a pitch deck to raise money from venture capitalists. The slide is usually known as “the ask,” and it typically lives toward the end of the pitch deck.

It is meant to do something pretty straightforward: Explain how much money a startup is raising and for what. It shouldn’t be rocket science, but it’s almost universally a struggle to get right.

Here are the most common mistakes:

Forgetting to include the slide altogether.

Not naming a specific dollar amount you are raising.

Including a valuation on the slide.

Omitting what the funds will be used for.

Listing a specific runway, i.e., “This will keep us running for 18 to 24 months.”

Include the slide

Obviously, the easiest way to fail on this slide is to forget to include it altogether. That’s a mistake. The whole purpose of doing a fundraising process is to raise money, so you may as well go all-in with a clear ask.

Name a specific dollar amount

Quite a few founders are against including any amount at all.

The logic, they argue, is that there are so many different ways to build the company. If they raise $3 million, they go down one path. If they are able to raise $5 million, they go down another. If the fundraising doesn’t go as smoothly as they hoped, and they’re only able to scrape together $1.5 million, they’ll make that work, too.

It’s good to be scrappy and adaptable as a founder, but you need a Plan A: What, in your opinion, is the right amount of money to raise to get the company to the next stage of growth and the next round of funding? Of course, it’s possible that your lead investor wants to push you toward raising more or less than that, but you need to have a solid picture of how you’re going to get from where you are today to where you want to go.

Don’t list a range. Don’t mention that you have 28 different plans for how to make your company successful. The investors are going to want to see that you can be decisive and strategic. Make your Plan A, stick a dollar amount on it, and put that dollar amount on your “ask” slide.

In other words: If you are raising a seed round now, think about what you need to prove to your investors to be able to raise a Series A next. Map all of that out and determine what resources you need to get there. That’s how much money you need if everything goes to plan. Add 30% to 70% as a safety buffer (depending on how good your planning is and how predictable your business is), and that’s how much money you need to raise.

Don’t include a valuation

Another common mistake I see is that founders include the terms of an investment, or the valuation, on a slide. If you put “raising $5 million at a $20 million valuation” on the slide before you have a lead investor, you’re making a mistake. You may have an opinion for what valuation you are hoping for, of course, but that will come out as part of the negotiation later on. The amount of money you need is fixed-ish; what you are willing to give up in order to raise those funds is not.

In the best-case scenario, you find two or three lead investors who end up in a bidding war for the privilege of investing in you. The levers they have available aren’t just the valuation of the company, of course there are plenty of other clauses that are up for negotiation in a funding process.

The one exception to this is if you already have a lead investor and you’re just looking to close out the round. In that case, your “ask” slide can include the name of the lead investor and the terms agreed upon. “Raising $5 million at a $20 million valuation, and Investor X has committed $3 million of the round” can work.

Having said that, if you’re that far into your funding round, there’s probably enough inertia to close out the round; it’s unlikely to be necessary to update this slide once you have a signed term sheet in hand.

Explain what the funds will be used for

You’re running a startup, and you’re going to want to raise money to accomplish something. Makes sense. What doesn’t make any sense at all is how many founders seem to be shy about sharing the details of the plan. A lot of the due diligence process is going to be focused on figuring out whether you are a competent, believable founder and showing that you have a detailed plan and vision for what’s going to happen over the next stretch of time.

Put differently: If I’m going to invest $2 million into your startup, I want to know what that money buys me, in terms of progress for your company.

Ideally, your company has an operating plan as part of the pitch deck, which goes into detail about what is going to happen between this and the next funding round. On the “ask” slide, however, you have the opportunity to summarize in three or four bullet points what you’re going to do with the money.

Typically, you’re going to want to include product, traction, market validation and key hire milestones.

Product — What product milestones do you need to hit in order to raise the next tranche of money? In particular, this includes beta or full product launches, major feature sets in the product pipeline or integrations with partners.

Traction — What business metrics do you need to achieve to raise more money? How many units do you have to sell, how many subscribers do you need, how many customers do you want? Other metrics may also be helpful here your net promoter score (NPS), monthly active users, etc.

Market validation — What can you do to prove that there’s a real market out there willing to pay for the product or service you are peddling?

Key hires — To reach the above goals, you probably need to hire. How many people do you need to hire? When?

Each of these goals should be SMART: specific, measurable, achievable, relevant and time-based. Poor goals are vague: “Improve marketing,” “Get more customers” or “Add features to our product.”

Examples of great SMART goals:

“By Jan 2025, we need 2,000 paying customers on our recurring subscription model.”

“In the next six months, we need to reduce our customer acquisition cost by 20%.”

“Our B2B sales need to improve, so by July we are aiming to hire an experienced VP of sales who can help shape our sales processes.”

Be. Specific.

Never mind the timeline, talk about the milestones

As we hinted at above, it’s important to list the milestones you believe you need to achieve to raise the next round of funding. Note that this is milestone-driven; each goal unlocks the next part of the journey. But that doesn’t mean that you’re explicitly talking about time.

You are not raising money to get 18 months of runway. You are raising money to hit a certain set of milestones. If you can do that in 12 months, then you raise your next round of funding in a year. If you need 24 months, that’s OK, too. Don’t get too hung up on the timeline; some things take more time than you might expect. That makes sense; this is a startup nothing ever goes to plan.

The corollary of this is that you need to bake enough wiggle room into your plans. If you expect something to take 18 months, but it takes 24, it’s a really poor look if you run out of money in month 19.

Remember -

The “ask” slide is one of the most painful slides to get wrong because it shows that you aren’t a very good founder. Perhaps you’re a great technical co-founder, a brilliant salesperson or an incredible marketer, and that’s great but the job of the founder is to have a specific, actionable, reasonable plan in place to navigate through choppy waters.

Having a poor “ask and use of funds” slide is a huge red flag to many investors. After all, investors have a conga line of smart, talented folks coming through the door day in and day out.

To stand out, you can’t just be good at marketing, sales, development or any of the other aspects of running a business. You have to be good at the art of running the business, too and this is one of the slides where you get to show off and prove that you know what you’re doing. Don’t waste that opportunity.

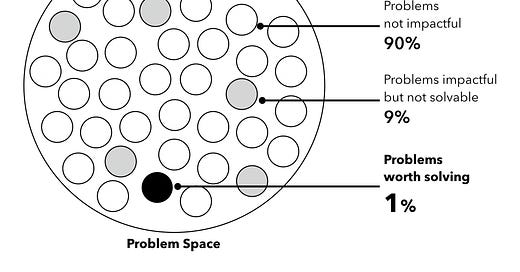

2. Symptoms vs. problems: the trap every founder must avoid.

One of the biggest mistakes first-time founders make is building a product too early before they’ve understood the problem they’re trying to solve.

They get excited after a few customer interviews, feel like they’ve uncovered a massive gap in the market, and dive into building. Sometimes they even get early traction. But too often, the foundation is shaky based on biased assumptions, shallow validation, and a misunderstanding of what the real problem is.

Problem-solution fit comes before product-market fit.

If you skip this step, nothing else matters. You might be solving a symptom not the actual problem. Solving a symptom only gives you a short-term win, not a sustainable business.

Chris Myers, co-founder of BodeTree, puts it perfectly:

"If you react instinctively and without deep thought, you’ll find yourself mistaking that symptom for the problem itself."

This happens more than we think. A founder sees friction in a process and immediately jumps to fix it without asking why that friction exists in the first place.

Use the "Five Whys" to dig deeper

This method, developed by Toyota’s Taiichi Ohno, is simple but powerful. Just keep asking why until you get to the root of the issue. It might take three or five rounds of questioning, but eventually, the real cause shows up.

This isn't just useful for startups it applies to digital projects, internal tools, even operational bottlenecks. Every business problem deserves this level of clarity.

Don’t just assume, validate

Most founders have read The Lean Startup. But reading is not the same as doing.

You need to rigorously test your assumptions, especially around the need for what you're building. Just because someone says, “That’s interesting”, doesn’t mean they’d pay for it or even use it.

Steve Jobs didn’t just wake up and decide people wanted touchscreen phones. He and his team spent over two years unravelling unmet needs before launching the iPhone. They didn’t build what people said they wanted they built what solved the real need.

Common mistakes to avoid

False validation: You talk to a few people, get positive feedback, and assume you’re on to something big. But unless people are actively hacking together their own solution or willing to pay, it’s not real validation.

Confirmation bias: You fall in love with your idea and look for anything that supports it. This clouds your judgment and makes you ignore red flags.

Ignoring the customer journey: Even if your solution has clear benefits, have you considered what the customer has to give up? Time? Familiar habits? Money? New behaviours? If you don’t understand the trade-offs, you’re missing key context.

Validate → then iterate

Once you’ve validated that a real problem exists and that people care deeply enough to want it solved you can start designing and testing solutions. This is where build-measure-learn makes sense.

Don’t waste cycles building a product for a problem you don’t fully understand. Start with clarity, then iterate.

You’ll move faster by moving smarter.

Know what your customer is actually trying to achieve

Henry Ford’s quote still applies:

“If I had asked people what they wanted, they would have said faster horses.”

People didn’t ask for a car. They wanted to get from A to B faster. Ford solved the actual problem, not the request.

That's the shift in mindset you need. What are your customers really trying to do? What outcomes matter to them? If you can define those clearly, you can start innovating around them not just building features.

Every time a customer adopts something new, they’re giving something up time, money, effort, and familiarity.

Your solution needs to deliver more value than the status quo. That’s the only way they’ll switch. And the only way you’ll build something that lasts.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Mercury CEO Immad Akhund has launched a $26M fund to formalize his angel investing, having backed 350+ startups like Airtable, Substack, and Linear since 2016. (Read)

Ex-CIA officer Eric Slesinger launched 201 Ventures, a $22M fund focused solely on European defense tech startups, betting on a growing “grey zone” conflict market. (Read)

Major Tech Updates

Google announced the AI Futures Fund to invest in AI startups from seed to late stage, offering early access to DeepMind models, Google Cloud credits, and expert guidance. (Read)

OpenAI’s Stargate project, which seeks up to $500M for AI infrastructure, is facing delays due to tariff-driven cost uncertainty and investor hesitation. (Read)

Andreessen Horowitz partners say “AI agent” has no agreed definition; it's used loosely, from clever prompts to hypothetical human replacements. (Read)

Saudi Arabia’s Crown Prince Mohammed bin Salman launched Humain, a new AI company funded by the $940B Public Investment Fund (PIF), to build national AI infrastructure. (Read)

New Startup Deals

Theom, a San Jose, CA-based AI-native Data Operations Center (DOC) platform that automates AI & data governance and security, raised $20m in Series A funding. (Read)

Dinari, a Palo Alto, CA-based tokenized equity trading startup, raised $12.7m in Series A funding. (Read)

Upscale AI, a San Francisco, CA-based company using AI for high-quality video creation with machine learning-driven programmatic buying, raised $5.5M in Pre-Seed and Seed funding. (Read)

Glass Imaging, a Los Altos, CA-based company using artificial intelligence to improve digital image quality, raised $20M in Series A funding. (Read)

Stash, a NYC-based investment platform provider, raised $146M in Series H funding. (Read)

TensorStax, a San Francisco, CA-based provider of an agentic platform for data engineering, raised $5M in Seed funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Venture Capital Managing Director - Connecticut Innovation | USA - Apply Here

Visiting Analyst VC - Identity Venture | Germany | UK - Apply Here

Investment Analyst - In Q Tel | Singapore - Apply Here

Portfolio Growth - Point 72 Venture | USA - Apply Here

Associate - SpeedInvest | UK - Apply Here

Investor - Founders Factory | UK - Apply Here

Portfolio Growth - Point 72Venture | USA - Apply Here

Internship - Octopus Venture | UK - Apply Here

Investor - Founders Factory | USA - Apply Here

Investment Fellow(s) - Pi Venture | India - Apply Here

Fundraising Manager - Entrepreneur First | USA - Apply Here

Investment team - Next Bharat Venture | India - Apply Here

Capital Formation Associate - B Capital Group | USA - Apply Here

Chief of Staff - First Round Capital | USA - Apply Here

Venture Capital Analyst - Cervin Family Office | India - Apply Here

Investment Manager - 3M Venture | USA - Apply Here

Analyst / Associate - Kairon Capital | India - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator