Your problem slide is broken. Here's how to fix it.. | VC & Startup Jobs.

Should I fire myself as a CEO?, Search For Narrative Violations Startups & Framework to measure a User’s motivation.

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: What do investors need from the problem slide?

Quick Dive:

Should I fire myself as a CEO?

Bedrock’s investment strategy: Search For Narrative Violations.

Framework to measure a User’s motivation to continue caring about your product?

Major News: Amazon reveals a new robot that can feel, Apple plans to add AI search engines to Safari, Apple made over $10B from US App Store commissions & Figma's big AI update takes on Adobe and Canva.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Y-Combinator just dropped its Requests for Startups (RFS)—a list of ideas they’re eager to fund in 2025.

What is the vibe code for success? By CBInsights.

6000+ European VC Firms Contact Database (LinkedIn Links).

An explosive new distribution channel by Tomasz Tunguz.

Startup legal document pack – essential legal docs for founders.

A CEO of AI applications marks a new era of AI competition.

Working with LLMs: A Few Lessons.

Jack Dorsey’s advice to founders raising venture capital.

How to make craft your moat.

The only startup valuation guide you need as a founder.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

All-In-One Guide To Venture Capital Interview Questions (And How to Answer Them)

Tariffs, Volatility And The Startup Exit Dilemma.

Investor data room guide & templates for founders.

For retail investors: Build lasting wealth with our newsletter! Simplifying investing for beginners and retail investors, we provide actionable insights to help you grow your wealth with confidence.

Need a pitch deck that gets investor meetings? We’ve opened just 3 slots to help founders craft winning decks—built by experts, and reviewed by investors. Don’t leave funding to chance—[schedule a call today →]

FROM OUR PARTNER - ATTIO

🤝 Why Next-Gen Startups Are Switching to Attio.

Attio is the AI-native CRM built for the next era of companies.

Connect your email, and Attio instantly builds your CRM - with every company, every contact, and every interaction enriched and organized.

You can also use AI research agents for complex processes like finding key decision-makers and triaging leads.

Join industry leaders like Flatfile, Replicate, Modal and more.

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

What do investors need from the problem slide?

“We review countless pitch decks from founders every day, and yet over 95% of them fall short on the most critical part: the problem slide,” shared a Pre-Seed/Seed stage VC partner.

He shared -

“Throw half a dozen entrepreneurs in a room together with a whiteboard, and they’ll be able to come up with a thousand business ideas in a couple of hours. It’s the nature of entrepreneurship. Our brains are wired to keep an eye on what could be better and how that gap in the market can be turned into an opportunity. In other words: Ideas are cheap, and nothing is so awesome that it couldn’t possibly be improved.

However, not all problems are worth solving.

There are two common problems with the problem slide. Some founders are tempted to go way into the weeds on this slide, explaining the competitive landscape, market size, customer segments, value propositions and more. I understand the temptation — the problem formulation does touch a large number of aspects of the business — but this is neither the time nor the place.

The other common issue I see in pitch decks is the absence of a problem slide. This happens particularly often with founders who believe that their solution and product slides are so good that the problem itself is obvious and a slide talking about it is redundant. That is a mistake. Even if the problem is universally understood, it’s helpful to see how a founder frames the problem. There are some elegant ways of doing that.

What is the problem?

Being able to clearly outline the problem is a crucial first step toward explaining why people might want a solution. Explaining succinctly and clearly what the problem is can be surprisingly hard for some companies, while others have a much easier path toward a problem statement.

A few examples:

Internet connectivity is poor in many parts of the world. (Solution: Iridium’s satellite hotspot.)

Satellites, once launched into space, are either stuck in their predefined orbits or need to bring complex propulsion systems and fuel with them. (Solution: Atomos space tug boats.)

Training staff is hard and expensive to do consistently. (Solution: Gemba’s VR training platform.)

Limited access to personalized and contextual language learning (Solution: Duolingo - AI-powered language learning app with personalized lessons)

Now, we can argue about what the market size, customer segment and sensibility of each of these problems are, but all of the above are real problems that companies are working to solve.

Who has this problem?

However you choose to frame the problem statement, the issue you are addressing is being experienced by someone, and it helps to explain to your investors how you are thinking about your user base.

Heads up: Don’t go too far into the weeds here; if you need to break down several different customer segments, that might be what a user persona or a customer archetype slide is for. If you feel the desire to hold up the lens of marketing, then your go-to-market slide is the right place for that. In broad strokes, however, you’ll want to give your investors an overview of what you’re doing here.

You can tell this story by using a single example: “Linda often works on the road but can’t always get reliable internet.” Or by hinting at the market size: “20% of all work-from-home workers lose productivity due to unreliable internet.” What direction you choose depends on how you tell your overall story; some narratives work better with a single example that follows the story of the startup you’re raising money for from slide to slide.

How are they currently solving this problem?

A startup rarely comes across a real problem that people aren’t currently solving in any way. Whenever I’m presented with “people aren’t currently solving this because there is no solution” in a pitch deck, that’s an enormous red flag. If people aren’t experiencing enough pain to solve the problem, why would they start solving it now?

For the smart mug Ember, for example, the problem might be “My coffee goes cold when I’m working.” There’s an existing solution: Make new coffee or put your cup in the microwave for a few minutes. The former takes a few minutes and is wasteful with your coffee. The latter takes a minute but may ruin your flow of work.

Here, we can argue whether anyone truly needs an electric coffee mug (I have one, I use it every day and I love it, but I’m a particularly gear-forward nerdy weirdo), but the point is: Ember can point to a problem that many people are experiencing and have existing solutions for. The question becomes “Is Ember’s solution sufficiently better than the existing solution that people are willing to pay $130 to not have to stumble over to the microwave every couple of hours?” That’s a market sizing and go-to-market question; don’t waste your time with that on this slide — that’s a different part of your narrative.

What are they willing to sacrifice for their current solution?

Assuming you found customers who have a current solution to a problem, you can discover what they are currently willing to sacrifice to “solve” their problem. Some problems are solved with money. Others are solved with time. Others again are solved with inconvenience or suffering the pain without solving the problem.

Imagine having to send a letter. The solution to writing an address on the envelope is simple: You use a pen.

Now imagine having to send 30 letters. You could use a pen, but now you might want to load your envelopes into a printer instead and use a mail merge software package to print each of the envelopes.

Now imagine having to send a hundred letters. Perhaps a label printer starts to make more sense because envelopes jam in home printers frustratingly often.

Ten thousand letters? Forget about it — it’s time to start outsourcing and using a direct mail provider. That is a huge financial outlay, but letting machines take care of the printing and shipping makes more sense than stuffing envelopes by hand.

The opportunity for a startup is solving a problem in a way that is — in one dimension or another — better than the existing solutions. That doesn’t necessarily have to mean that it has to be cheaper or even faster smaller or more convenient than the existing solutions, but it has to be more “right” for the target audience than their current options.

What’s wrong with the way they are currently solving this problem?

User research is an essential part of your customer discovery journey. Talking to a lot of different customers about how they solve particular problems is helpful.

Imagine the “problem” you are solving is that offices look sad and lifeless. The solution you’ve come up with is an elegant way of hydroponically growing plants in a way that looks beautiful and needs very little maintenance. To figure out if that even makes sense, you need to learn a lot about how offices currently deal with plants.

Some offices have an office manager who buys plants and sometimes waters them. That only works if they remember to water the plants and know enough about plants to choose the right ones based on the temperature and lighting in the office building. Some offices are effectively “renting” the plants, and the service contract comes with someone who looks after them. Other offices may have landscapers on staff. Some might decide to order posters with photos of plants or use silk or plastic plants.

All of these solutions have their pros and cons; price, convenience, longevity, sustainability, etc. Be aware of all of them, and perhaps highlight the one that is most relevant to your value proposition. Careful, though, again: Your full competitive breakdown goes on the competition slide. Your full differentiated market segmentation goes on the go-to-market slide. And if you have a distinct value proposition, well, you can break that off onto a separate slide, too.

Think company-sized, not product-sized

In the context of fundraising, remember that a feature is not a product. You may create a tool to help people write canned responses to their emails. “Tom sends 900 emails per day, and he finds that he is often saying the same things again and again. He is copying and pasting snippets of text from a Word document he created, but that’s not efficient.”

On the face of it, that’s a real problem worth solving. But is Tom willing to pay for it? Creating it as a standalone company might make sense. Still, it is hard to imagine it being a billion-dollar company. If you get successful enough, other companies will launch templating systems for an email in their core offering. At that point, your business will become irrelevant overnight. To wit, Gmail has templates built-in, and most customer relationship management (CRM) software has snippets and templates built-in, too.

Use great examples!

When telling the story of the problem, it’s helpful to have some examples of how people are currently solving the problem: “Company X had to hire four full-time staff and buy $50,000 of telecoms equipment to set up their SMS infrastructure” is a great way to bring Twilio to life.

“For your web shop, the running of server hardware is painful and unpredictable. If you have a sudden spike in traffic, it can take weeks to get extra capacity, and you might lose millions of dollars as the web pages are unavailable,” is a compelling argument for Amazon Web Services (AWS).

“Linda needs to hire an assistant to deal with her workload” is an excellent argument for automatic account reconciliation and reminder-sending software solutions.

Your job as the founder is to draw a solid, realistic picture of the problem you’re about to solve, explain the pressing need people have for addressing the issue and give an indication of how prevalent the problem is.

Don’t forget to include the risks or costs of what happens if the question remains unsolved. If your “problem slide” ticks all of those boxes, you’re on the right path.”

Using this framework, reply to this email with the problem you are solving. If it’s interesting, will help you to connect with the investors…

FROM OUR PARTNER - CAKE EQUITY

Cake Equity: The intuitive equity platform for fast-growing startups.

Cake is fixing equity management for fast-growing startups. We make tasks like cap table management, and issuing stock options and contracts easier and more affordable.

Most importantly, Cake helps keep your team motivated with equity with the newly released investor & employee experience.

📃 QUICK DIVES

1. Should I fire myself as a CEO?

Andreessen famously said, “If you don’t have anyone on your founding team who is capable of being CEO, then sell your company.”

It’s true early on — having a “professional CEO” is a bad idea. They won’t have as much skin in the game as a founder. There’s a reason founder-led companies grow faster.

With that said, it isn’t true forever.

Speed is your biggest advantage early in your startup’s journey, but the delta between its importance and the importance of other things like..

At some point, you need to expand your skillset and evolve from “founder” to “CEO,” and not every founder pulls it off.

Even if you’re not the CEO, your actual responsibilities will naturally change as the team expands from under 10 to over 100 or 1,000. But how do you know when it’s time (if ever)?

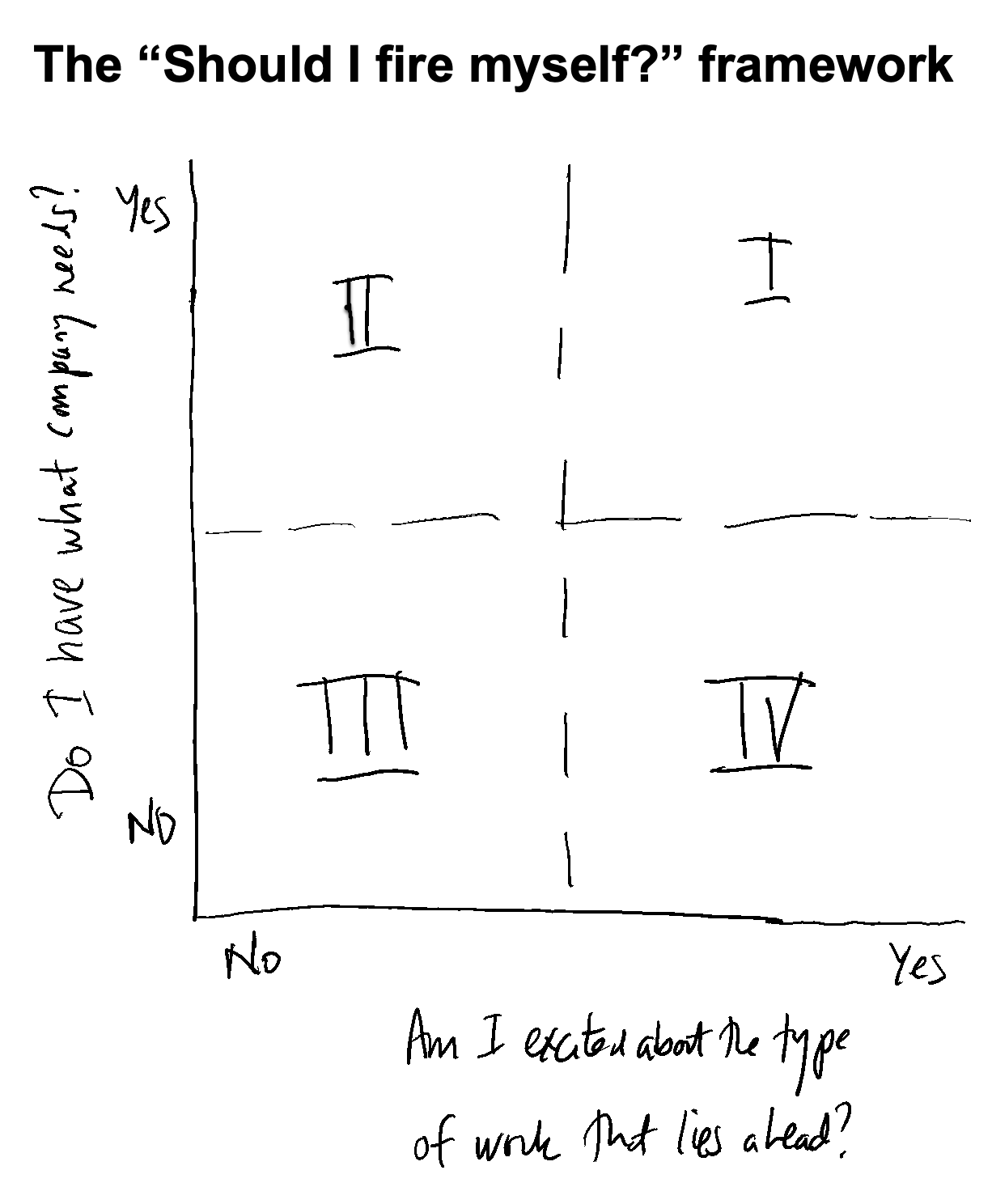

Anand Sanwal, the co-founder and former CEO of CB Insights, created a framework to help.

Consider how excited you are about the company’s future and how equipped you are to execute it. These are variants on skill vs will or attitude vs aptitude frameworks if you've seen those

If you fall into quadrant 3 (above), it may be time to consider stepping aside. Cuz sometimes, "different wars need different generals".

2. Bedrock’s investment strategy: Search For Narrative Violations.

Most investment firms chase popular narratives. Bedrock does the opposite.

Rather than chase popular narratives, Bedrock’s approach is to invest when companies are incongruent with the narrative. Simply put, search for narrative violations, which is contrarian to most investment strategies. Let’s look into how Bedrock used this strategy to find billion-dollar companies.

Narrative violations are some of the best investment chances in technology today. These companies either stand out as unique or challenge what most investors think is possible.

Here are some examples:

SpaceX: Founders Fund invested after a rocket failure, while many thought the company was doomed.

Skype: Andreessen Horowitz invested when others believed Skype was failing.

Lyft: In 2012, people thought Uber would crush Lyft, but Lyft’s innovative approach proved strong.

Investing in ideas that contradict popular beliefs can feel lonely for both investors and entrepreneurs. These companies often struggle to get attention and lack the buzz that comes with more conventional opportunities. However, this obscurity can protect them from competition and underestimation by investors.

When to Invest: Bedrock believes the best time to invest is when a company is most at odds with popular beliefs. Here’s a table showing notable narrative violations over the years:

How to Spot Violations: Narrative violations are highly idiosyncratic, so unearthing them is admittedly more art than science.

One starting point is to identify categories that were narratively hot for investors in the past but that most have cooled on today.

Another starting point is to search for companies that cannot be easily categorized at all. Is Vercel like AWS, Cloudflare, or MongoDB? Perhaps it’s simply one-of-a-kind.

On rare occasions, an entirely new category emerges that offers particularly fertile ground for narrative violations. Today, it may be decentralized apps and protocols.

Avoiding Narrative Traps: While narratives can inspire us and create connections, they can also limit our thinking. In Silicon Valley, both outside narratives and internal beliefs can narrow the focus on what’s popular. This fixation risks missing out on groundbreaking ideas that could change industries.

By looking for entrepreneurs who challenge these narratives today, investors can back some billion-dollar companies.

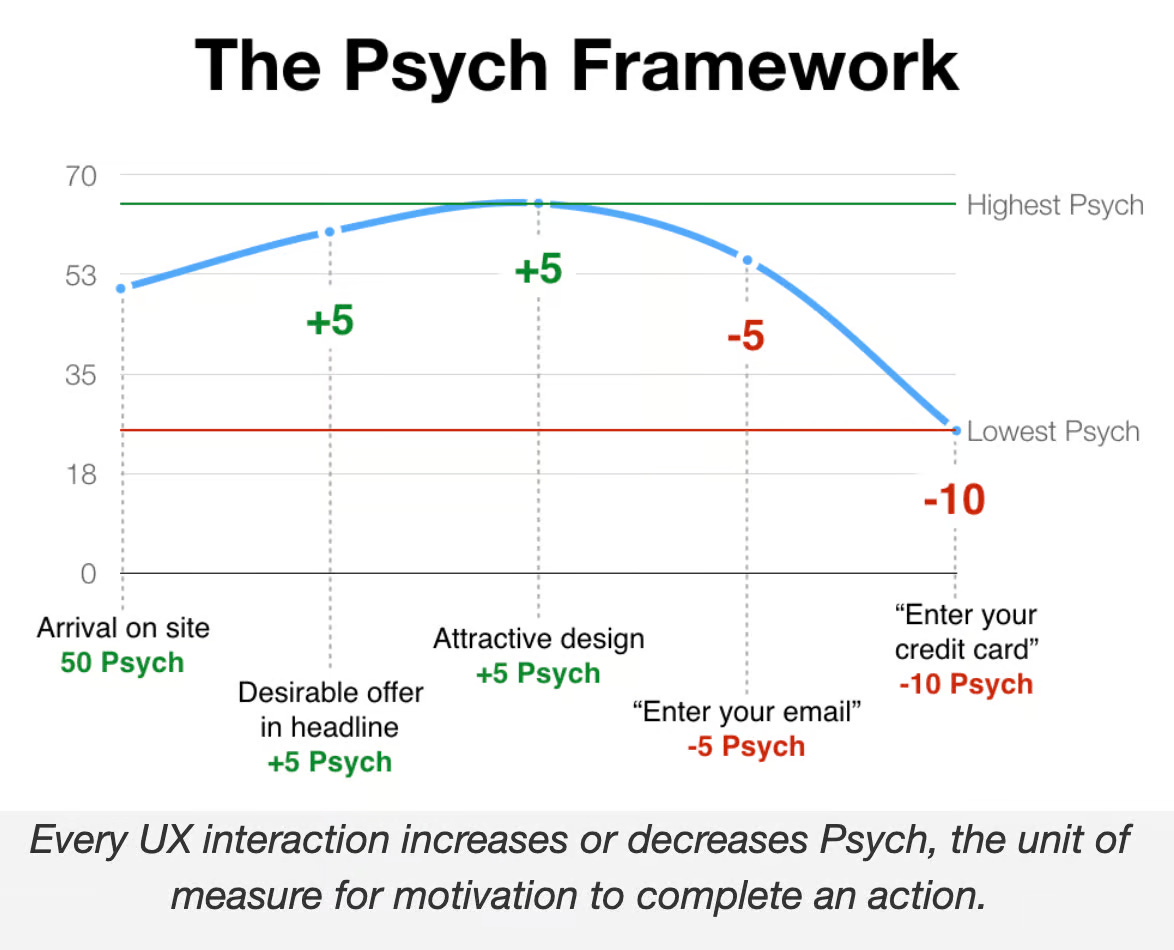

3. Framework to measure a User’s motivation to continue caring about your product?

The Psych Framework tries to help you map it throughout a user journey by framing moments in the journey as either increasing or decreasing motivation and assigning points to each moment. The main principles are:

Every element on a page adds or subtracts emotional energy ("Psych").

Inspiring users is as important as reducing friction.

For example, asking a user to enter information manually will decrease future motivation — you’re “spending” your site’s mental capital with the user to get them to perform that action.

While the actual point values that an action increases or decreases motivation by are likely to vary from user to user, using the framework is a good reminder that you can’t ask for too much from users — you have to give as well, to keep them excited.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New In VC

Marathon Venture Capital, an Athens, Greece-based seed-stage venture firm, closed a new €75M fund, bringing its total assets under management to €175M. (Read)

Ulili Onovakpuri, managing partner at Oakland-based Kapor Capital, is stepping down after more than a decade with the firm. (Read)

Major Tech Updates

Apple is exploring the integration of AI search engines from OpenAI, Perplexity, and Anthropic into Safari, according to Eddy Cue's court testimony. (Read)

Amazon Web Services is developing an AI code-generation tool called “Kiro” that can generate code in near real-time and integrate with third-party AI agents. (Read)

Amazon has introduced Vulcan, a new warehouse robot enhanced with AI, which possesses a tactile sense allowing it to handle items with greater precision. (Read)

Fidji Simo will step down as CEO of Instacart to become OpenAI’s head of applications, reporting directly to CEO Sam Altman. (Read)

New Startup Deals

SimpleClosure, a Santa Monica, CA-based platform to shut down a startup, raised $15m in Series A funding. (Read)

Rove, a San Francisco, CA-based universal airline mile loyalty startup, raised $2M in seed funding from Y Combinator, General Catalyst, and Soma Capital. (Read)

Gardin, an Oxford, UK-based company developing an optical photosynthesis sensor and AI, raised $4.5M in Seed 2 funding. (Read)

Inductive Bio, a NYC-based technology company that advances artificial intelligence (AI) models for small molecule drug discovery, has raised $25M in Series A funding. (Read)

Jericho Security, an NYC-based AI-powered cybersecurity training and conversational phishing defence platform, raised $15M in Series A funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Fundraising Manager - Entrepreneur First | USA - Apply Here

Chief of Staff - First Round Capital | USA - Apply Here

Partner 32 - a16z | USA - Apply Here

Ecosystem Growth Associate - Motion Venture | Singapore - Apply Here

Investment Manager - Antisoma Venture Capital | UK - Apply Here

Analyst - Team8 | USA - Apply Here

Investor - Griffin Gaming Partner | USA - Apply Here

Associate - Rev1 Venture | USA - Apply Here

Investor (AI) - Samsung Next | USA - Apply Here

Investment team - Next Bharat Venture | India - Apply Here

Senior Associate - Disrupt | UAE - Apply Here

Chief of Staff - First Round Capital | USA - Apply Here

Office Manager - Wind Ventures | USA - Apply Here

Venture Investments Associate - GSR | USA - Apply Here

Executive Assistant TCV | UK - Apply Here

Writer - First Round Capital | USA - Apply Here

Venture Scout - Sentiera Venture | USA - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator