How To Price Your Product: Mistakes You Can’t Afford To Make. | VC & Startup Jobs.

Marc Andreessen’s "Onion Theory Of Risk", The Quiet Rise of Secondaries & Early-Stage Product?

👋 Hey, Sahil here! Welcome to this bi-weekly venture curator newsletter, where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: How To Price Your Product: Mistakes You Can’t Afford To Make.

Quick Dive:

Marc Andreessen’s "Onion Theory Of Risk" : How Top Founders Raise Money.

The Quiet Rise of Secondaries in Venture Capital.

What do Investors Really Look for in an Early-Stage Product?

Major News: Ilya Sutskever’s AI startup raises $2 Billion, Ex-OpenAI staff side with Elon Musk over for-profit transition, Google lays off hundreds in Android and Pixel teams & Mira Murati’s AI startup aims for $2B seed round.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

The Real AI Bottleneck: Bad UX Plus: The race to design for agents, and a guide for AI in the workplace

How Venture Is Unbundling: A New Era for GPs and LPs.

Why VC firms with stronger networks produce higher returns

A Science-based Guide to Thinking Creatively—With LLMs Creativity isn’t magic.

All-In-One guide to pitch deck storytelling - free template & curated resources.

10 Product Growth Lessons From 4 Million Users.

Excel Template: Early Stage Startup Financial Model For Fundraising.

The New King of Tech

How AI Unlocks the Future of Software That Learns.

All-In-One Guide to Venture Capital interview questions (And how to answer them).

Startup legal document pack – essential legal docs for founders.

SaaS Startup Financial Model: All-in-One Excel Template.

400+ French angel investors & venture capital firms contact database (Email + LinkedIn Link)

VC Fundability → Cold reachouts - Is a startup VC Fundable & how to cold email VCs ?

300+ Australian angel investors & venture capital firms contact database (Email + LinkedIn Link).

Raising money but struggling to connect with the right investors? We help startups reach 85,000+ investors and connect with members of our investor Slack community. Fill out this form to get started. It’s FREE!

For marketers: Skip the AI hype, get real results. Join 10,387+ marketers learning the AI tools and prompts that drove 40% better performance.

INVESTMENT OPPORTUNITY WORTH EXPLORING…

🩺 The Future of Cancer Detection—Why Investors Are Backing Cizzle Bio

Early detection saves lives—but 75% of lung cancer cases are found too late.

Cizzle Bio’s patented CIZ1B biomarker blood test detects early-stage lung cancer with 95% sensitivity, offering a simple, cost-effective way to screen high-risk patients before symptoms appear.

The market is massive: Cancer biomarker diagnostics are projected to hit $ 95b+ by 2032.

Backed by industry leaders like Moffitt Cancer Centre and BBI Solutions.

Projected 1,033% revenue growth YoY by Year 3 with market adoption.

Protected by multiple patents & led by biotech veterans.

With lung cancer still the deadliest cancer globally, Cizzle Bio is poised to reshape outcomes—and investors now have a rare early opportunity to be part of it.

PARTNERSHIP WITH US

Get your product in front of over 95,000+ audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

How To Price Your Product.

As a startup, one of the biggest challenges will be the pricing of your initial product. You’ll fluctuate between a concern that if you price it too highly the product won’t stick, but if you price it too low, it will be impossible to build a sustainable business around it.

It may be tempting to look for equations and projections to find the best price. But the big secret here is that pricing isn’t a math problem: it’s a judgment problem. All businesses have prices, but most overlook pricing strategy. 85% of businesses report that they do not use thought-through pricing strategies. What’s the alternative? Guessing, I guess!

Many founders forget that - “price is your strongest signal to buyers about the quality of your offering.” It is not the other way around, where your quality offering justifies a high price.

That makes pricing a marketing positioning tool as well, and the long-term health of successful startups comes from understanding the critical role of pricing in your go-to-market and brand strategy.

What is product pricing and why is it important?

Product pricing is how companies decide what to charge for their goods or services. It's a big deal because it affects both how much money a business can make and how customers see the brand.

When a company sets its prices, it's not just picking random numbers.

It's actually sending a message about what kind of product it's selling.

High prices often mean "luxury" or "high-quality," while lower prices might say "affordable" or "good value."

To figure out the right price, businesses usually think about three main things:

What customers get out of it - Is the product saving them time? Solving a problem? Making them feel good?

What other similar products cost - Are we pricier than our competitors? Cheaper? About the same?

What the company stands for - Does the price fit with the company's image and goals?

The tricky part is that pricing isn't just about math. It's also about how people think and feel. A $999 price tag feels very different from $1000, even though it's only a dollar less.

In the end, how you price your product tells customers what you think it's worth.

The Pricing Power Of Economic Value Analysis

When it comes to pricing, especially for unique SaaS products, looking at the economic value you're creating for customers can be super helpful. It's all about figuring out how much money you're actually saving them.

Here's how it works: You add up all the ways your product helps your customer save or make money. This includes stuff like:

Direct cost savings

Time saved by employees (think about their salaries)

Money saved on other tools or systems

Reduced risks

Once you've got that total, you decide what's a fair chunk for you to take. Usually, this ends up being somewhere between 10% and 20% of the total value. It's weird how consistent this range is, but it seems to work for a lot of businesses.

Let's say your software helps three employees do their jobs 50% faster. If they each make about $100,000 a year, you're saving the company around $150,000 in total (half of 3 x $100,000). So you could justify charging about $30,000 a year for your product.

The cool thing about this approach is that it gives you a solid starting point for your pricing. Plus, it gives you a great story to tell your customers about why your product is worth what you're charging. Especially when you're selling to other businesses, being able to say "Look, we typically save our customers about $150,000 a year" can be really powerful.

Just remember, this is a starting point. You'll still need to think about other factors like what competitors are charging and what your target market is willing to pay. However economic value analysis can be a great tool to have in your pricing toolkit.

Other Common Pricing Strategies

Let's talk about some other ways businesses figure out their prices. While value-based pricing is great, it's not the only game in town. Different industries often mix and match pricing strategies to fit their customers and markets.

One simple method is cost-plus pricing. It's pretty straightforward - you figure out how much it costs to make your product, then add a set percentage on top. Like if it costs $1 to make a cup of coffee, you might sell it for $1.20. It's easy to understand, which is why a lot of businesses use it. But it doesn't consider how customers see your product compared to others, which can be a big downside.

Another common approach is competitor-based pricing. This is where you look at what similar businesses are charging and set your prices accordingly. If the coffee shop down the street sells their brew for $2, you might decide to charge $1.90 to undercut them a bit. It's important to stay in line with what people expect to pay, especially in competitive markets. But this method has its problems too. For one, if you're in a new industry, there might not be any competitors to compare yourself to. Plus, bigger companies can often produce things cheaper than startups, so trying to match their prices might mean you're losing money.

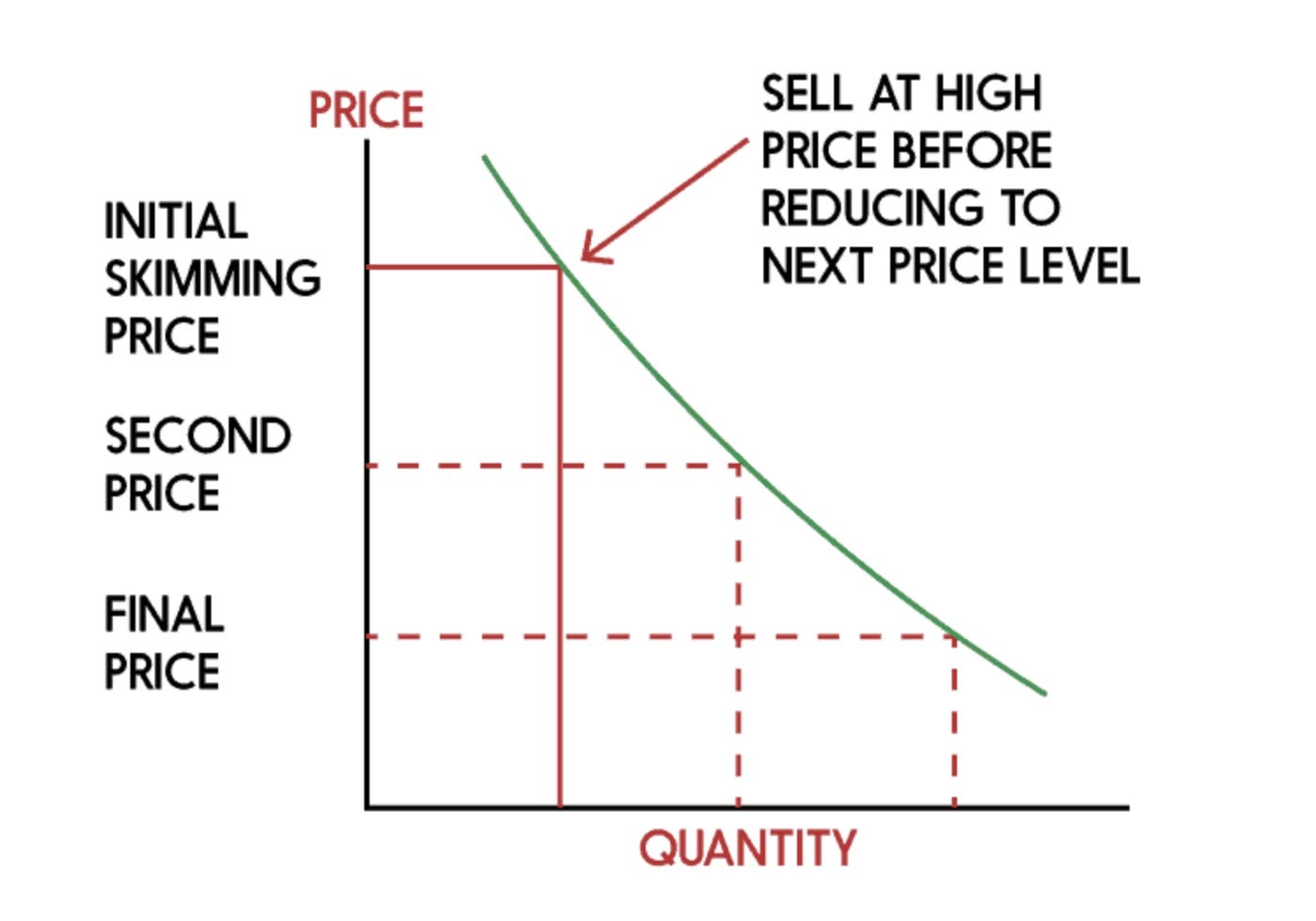

Price Skimming - it's an interesting strategy some companies use when launching new products.

Basically, price skimming is when a company starts off charging a high price for their product, then gradually lowers it over time. It's like they're "skimming" the cream off the top of the market.

You see this a lot with tech gadgets. Think about when a fancy new laptop comes out - it might cost a fortune at first, maybe $3,000. But give it a year, and that same laptop could be selling for $1,000. The company is taking advantage of early adopters who are willing to pay more to have the latest and greatest.

This strategy can work really well, but it's not for everyone. It's best for products that are already getting a lot of buzz, or for well-known companies. If you're a small startup, it might be harder to pull off unless you've got something truly unique to offer.

For price skimming to work, you need to tick a few boxes:

Your product needs to stand out from the crowd

You should have a clear idea of who your initial customers will be (and they should be okay with paying top dollar)

You need to be ready to lower your prices as competitors start to catch up

Penetration Pricing - It's kind of the opposite of price skimming. Instead of starting high and dropping prices later, you start low to get people interested. The idea is to grab a big chunk of the market quickly by offering a great deal. Once you've got customers hooked on your product, you can slowly raise prices to where they should be.

This can be a smart move, but it's not without risks. You need deep pockets to pull it off because you'll be selling at a loss at first. It's not a good fit for every business, but in the right situation, it can help you break into a tough market.

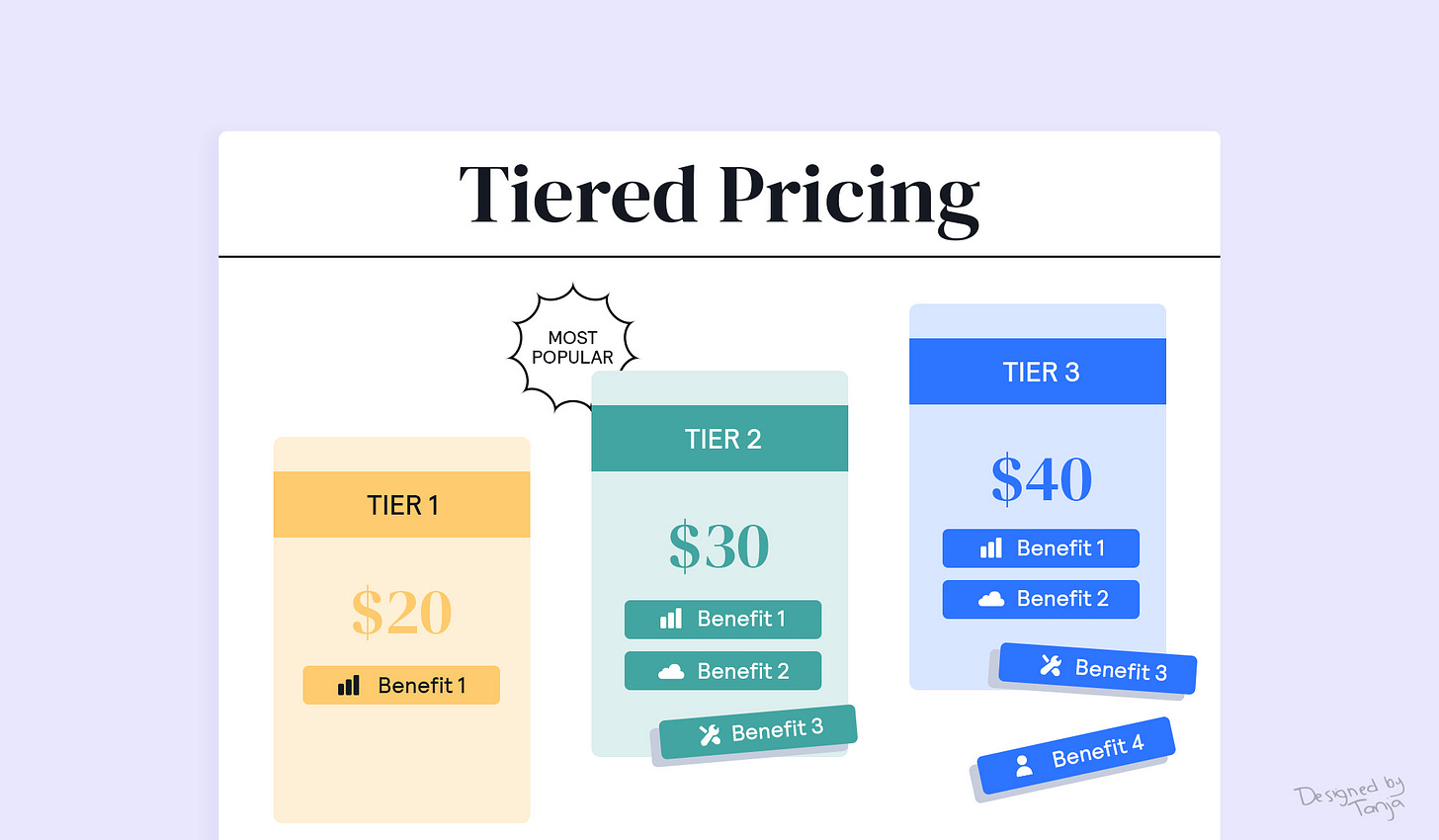

Price Tiers - This is super common in the software world. Instead of one price for everyone, you offer different packages at different price points. Maybe you have a basic version that's cheap, a mid-range option with more features, and a premium package with all the bells and whistles.

The trick here is something called price anchoring. By showing customers a range of prices, you can nudge them towards the option you really want them to pick - usually that middle-tier package. It's like the Goldilocks effect - not too expensive, not too cheap, but just right.

Price tiers are great because they let customers choose what works best for them. Plus, it gives you flexibility to appeal to different types of customers, from budget-conscious folks to those who want all the extras.

Price tiers really shine when you've got different types of customers who need different things from your product. Your photo editing software example nails it.

Think about it:

Students might just need basic tools and can't afford much. A low-cost, stripped-down version works for them.

Amateur photographers probably want more features but still have a budget. They'd go for a mid-range option.

Design agencies need all the bells and whistles and can afford to pay for them. They'd spring for the premium package.

By offering these tiers, you're not just randomly splitting up features. You're tailoring your product to fit what each group needs and can afford. It's about matching value to willingness to pay.

But here's the thing - if you're not dealing with clearly different customer groups, simpler might be better. Too many options can confuse people and make it harder for them to decide. If you've got one main type of customer, a straightforward, single-price approach can be effective. It's clear, easy to understand, and sends a strong message about your product's value.

How to price your product—Price Theory In Action

Once again, there’s no hard-and-fast mathematical formula or system that will be universally effective with pricing. However, there is a best-practice methodology and approach to pricing that can be used to good effect, and will be a useful way for most founders to consider their pricing strategy.

Know the customer:

It starts with understanding your core customer, and how your offering will create value for them. A lot of startups get hung up on their inability to collect the most detailed data at this point. However, a good estimation based on qualitative research is usually more than sufficient, in this instance, to undertake a value-based approach to pricing.

List how you create value:

Once you’ve got the customer profile, the next step is to consider all of the ways that your product creates value for them. It’s a good idea to be able to quantify this with numbers to have a sense of what your product is going to be worth.

Generally speaking, there are five kinds of value to look for:

It replaces something your customers would build for themselves.

It saves time and/or makes tasks more efficient.

It reduces risk (such as a lawsuit or inventory spoilage).

It unlocks a new source of revenue for your customer.

It has direct savings to business operations

At this stage, if you find that your offering is not creating sufficient value for your core customer, then it may be time to go back to step 1 and search for a different or more refined target.

Take your fair share

Consider how differentiated and effective your offering is. Are you a little better? A lot better? Category-redefining better? Take your fair share of the total economic value (somewhere from 10-20 per cent) based on how differentiated you are from your core customer and how competitive your market is.

A combination of desktop research to understand the competition dynamics, and a few key customer interviews to understand their pain points and the depth of value that you’re promising to add to their experience is enough information to arrive at the right price for your product.

How to choose the right pricing strategy for your startup

A founder (who sold his startup for millions dollar) once said to me that pricing is not a math problem, but rather a judgment problem. It has stuck with me ever since because it’s very true: there are no hard-and-fast formulas that you can apply to come up with the ideal pricing for your product.

It’s better to remember three principles that will guide the pricing of the product.

The first is to understand the value that your product offers to a customer.

The second is to understand that your price is always going to be your strongest signal to convey that value.

The third is to understand the impact that the competitive landscape will have on your pricing.

This is hard to get right. Remember, 85 per cent of companies are not happy with their pricing, and that applies to enterprises with all the resources that they have access to as much as it does a startup. However, it is mission-critical to spend the effort in pricing to have true conviction behind your strategy.

Ultimately, the better you understand your customers and the impact your product will have on them, the better placed you’ll be to extract maximum value and establish fierce loyalty in your brand from its earliest moments. That’s it.

We’ve also built multiple guides and frameworks that can be helpful to you in your startup journey:

Excel Template: Early Stage Startup Financial Model For Fundraising.

Startup Legal Document Pack

Building Cap Table As A Founder: Template to Download.

How to write your monthly investor update (Email Template).

SaaS Financial Model Template: Early Stage Startup Financial Model For Fundraising.

INSIDE VC : THE MUST-JOIN EVENT FOR 2025 TRENDS

🚀 What does market consolidation mean for venture capital in 2025?

Mercedes Bent, Venture Partner at Lightspeed Venture Partners, will share her perspective with Affinity in an exclusive webinar on May 8.

As the investment landscape shifts, she’ll break down key dealmaking trends, what top firms are doing differently, and how to position your firm for success.

Don’t miss this chance to gain exclusive insights. Register now →

📃 QUICK DIVES

1. Marc Andreessen’s "Onion Theory Of Risk" : How Top Founders Raise Money.

Only 1% of founders successfully raise venture capital. The other 99%? They struggle—not because their ideas are bad, but because they don’t understand one key thing: the relationship between risk and cash.

The top 1% know how investors think. They understand that startups are just layers of risk—and funding isn’t about removing those risks with money, it’s about using money to peel them away.

Most founders miss this twice:

First, when raising cash (they don't frame the risk right)

Then, when spending it (they don’t reduce the right risks)

It’s called the Onion Theory of Risk. It says -

As a startup (especially before Seed funding), you are just layer upon layer of risk. Even after you get your first round of funding, it’s not the money that makes those risks go away, it’s what you do with it.

So initially - You can think of a startup as having every conceivable kind of risk.

Risks like -

Founding Team Risks: Whether the founders will be able to work together effectively.

Product Risk: Can the team build the product?

Technical Risk: Suppose you need a machine learning breakthrough or something similar. Will you have something to make it work, or will you be able to achieve that?

Launch Risk: Will the launch go well?

Market Acceptance Risk: Will customers accept your product?

Revenue Risk/Cost of Sales Risk: Will a sales force be able to sell the product for enough money to cover the cost of sales?

If you have a startup in the consumer product space then - viral growth risk. So a startup at the very beginning is just a long list of risks.

And what only 1% of founders accomplish is peeling away each layer of risk from the initial fundraising round; where 99% fail to achieve this.

How Does This Work?

With each funding round, such as a seed round, as a founder, you can attempt to peel away the layers of risks, such as the founding team risk, the product risk, and perhaps the initial launch risk.

Again - if you are raising the Series A round, try to peel away the next level of product risk, maybe you can peel away some of the recruiting risk as you get your full engineering team built. Maybe you peel away some of your customer risk because you get your first five customers….

So the way you can think about it is, that you are peeling away risk as you go, you are peeling away your risk by achieving milestones.

As you achieve milestones, you are both making progress in your business and you are justifying raising more capital.

How Can You Pitch To Investors With This Edge?

If you are raising the pre-seed / seed (first funding round) - you can say that -

“With the amount of personal investment or from family friends - I have achieved the milestones and eliminated these risks. Now I am raising Seed round - Here are my milestones, here are my risks, and by the time I go to raise series A round here is the state I will be in.”

Then you can calibrate the amount of money you raise and spend to the risks that you are pulling out of the business.

You might be thinking that - everyone knows this but this is not true - 99% of founders failed to think systematically about how the money gets raised deployed and pitched to investors.

That’s why - 1% of founders stand to differ from the rest founders. They understand the risk and cash (raised & spent) relationship and use it in a systematic way to express to the investors.

2. The Quiet Rise of Secondaries in Venture Capital.

For years, we’ve been told founders make money when their company goes public or gets acquired. IPOs and M&As — those were the gold standard.

But that’s not really the story anymore.

Today, a growing number of founders are making real money before the final exit, by selling a portion of their shares through secondaries. And this isn’t a small shift — it's a structural change in venture.

In fact, according to new analysis by Tomasz Tunguz, secondaries now account for the majority of exit dollars for venture-backed founders. Read that again. The majority.

Why this shift?

Ever since the ZIRP era ended in 2022, IPO windows have remained shut and M&A activity has slowed down. (Interesting read - why IPOs are over.) Liquidity — once abundant — got stuck. But markets adapt. And capital found a new path: secondary transactions.

For context:

Primary shares are new shares sold to raise money for the company.

Secondary shares are when existing shareholders (founders, employees, early VCs) sell some of their stock to newer investors.

What used to be a rare event — maybe a founder cashing out a small stake in a late-stage round — is now becoming the norm. In 2024, secondaries made up 71% of exit dollars in venture-backed companies. That’s a complete reversal of what was standard just a few years ago.

Tunguz compares this shift to the world of private equity, where secondaries have long been part of the playbook. Over the last decade, private equity firms have averaged around 28% of liquidity through secondaries. Venture is simply catching up.

And this is likely here to stay.

Founders have tasted liquidity earlier in the journey — and taking that option away won’t be easy. Plus, with the bar for IPOs rising (target ARR has grown from ~$80M in 2008 to ~$250M today), secondaries offer a more realistic way to reward early builders without waiting a decade.

Takeaway: Secondaries aren’t just a stopgap while IPO markets are cold. They’re becoming a core part of how founders — and their teams — realize value. And they’re pushing venture capital to look more like private equity in how it manages liquidity along the way.

But how does the trend look in 2025? That’s why I recommend joining this event by Affinity where Mercedes Bent, Venture Partner at Lightspeed, on May 8 for key insights on evolving dealmaking trends, the behaviors of top-performing firms, and the strategies investors are using to thrive in a competitive market.

3. What do Investors Really Look for in an Early-Stage Product?

Most founders spend way too much time building out the product before talking to investors. This especially applies to software startups.

Most VCs already know you don’t need millions to build an app these days. Thanks to tools like Webflow, Replit, and AWS, it’s easier than ever to launch something. So showing up with a super-polished product doesn’t impress them as much as you think.

What they really want to understand is how you’re thinking — about your product, your customers, and your strategy.

If you’re raising at the pre-seed stage, here’s what investors are really looking for:

Your MVP (and why you built it that way)

Who your ideal customer is (and how you chose them)

Your bigger vision for the product

1. Your MVP

Your MVP (Minimum Viable Product) is basically the scrappy, early version of your product. It’s not supposed to be perfect — it might be clunky and bare-bones. That’s fine.

What matters is why you built this version.

Say you’re making a sales enablement tool, and your MVP includes a content manager. Why start there instead of something like call analysis?

Be ready to explain what you learned from early users that led you to prioritize certain features. Investors want to follow your thinking — your logic tells them how you understand your market, not just your product.

They don’t need to agree with every decision, but they do want to see that there’s thought and strategy behind them.

2. Your ideal customer persona

You should have 1 or 2 clear types of users you’re building for right now.

For example: “An account executive at a Fortune 500 tech company.” Now go deep.

What problems do they face every day?

What tools are they using now?

What’s broken or frustrating about those tools?

VCs want to know that you’ve really done the homework — that you’ve talked to potential customers and understand them well enough to win them over.

Trying to serve everyone right away is a common trap. Resist it. Focus instead on deeply serving one or two customer personas. If you nail that, it shows investors you’re serious about retention and expansion.

3. Your long-term vision

Now zoom out. Where could this product go next? What would it take to grow into something big — maybe even massive?

You don’t need a 5-year feature roadmap. But you do need to paint a picture of how your MVP is just the start.

Think of it like chess. Your MVP is your first move, but you need to be thinking a few moves ahead.

What milestones will unlock growth?

What new types of users could you reach?

What’s the path to becoming a $100M+ company?

This is what gets VCs excited — not what your app looks like today, but what it could become tomorrow.

So when pitching your product, it’s not about having the slickest UI or all the bells and whistles.

It’s about clearly showing:

Why you built the MVP the way you did

Why you’re targeting specific users

Where this could all go if things work out

That’s what VCs really want to understand.

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC, & Startup Funding

New VC Launch

Symphonic Capital, founded by Sydney Thomas, raises $13.5M for its inaugural fund to back early-stage startups in healthcare and financial services. (Read)

Revent, a Berlin-based VC focused on “planetary and societal health,” has closed a €100M ($109M) Fund II to back climate, healthcare, and economic empowerment startups. (Read)

Major Tech Updates

Thinking Machines Lab, led by former OpenAI CTO Mira Murati, is reportedly aiming to raise $2 billion in seed funding at a valuation of at least $10 billion, per Business Insider. (Read)

Evaluating reasoning models like OpenAI’s o1 and Anthropic’s Claude 3.7 Sonnet can cost thousands of dollars, with o1 costing nearly $2,800 across key benchmarks, due to the high token output required for multi-step tasks. (Read)

Albert Saniger, founder of AI shopping startup Nate, was charged with fraud for allegedly misleading investors about the company’s automation capabilities. (Read)

President Trump's new tariff structure exempts smartphones and computer chips from global duties, sparing tech consumers from potential price increases. (Read)

Twelve former OpenAI employees filed an amicus brief supporting Elon Musk’s lawsuit, arguing that OpenAI’s plan to restructure as a for-profit entity violates its nonprofit mission. (Read)

New Startup Deals

Ilya Sutskever’s AI startup Safe Superintelligence (SSI) has reportedly raised $2 billion in a new round led by Greenoaks, valuing the company at $32 billion. (Read)

Dealstack, a London, UK-based provider of a private capital management platform, raised $5.5m in seed funding round. (Read)

Tessell, a San Francisco, CA-based multi-cloud database-as-a-service (DBaaS) provider, raised $60m in Series B funding. (Read)

Aiper, an Atlanta, GA-based cordless robotic pool cleaning company, announced an agreement for a new financing round totaling $100m. (Read)

illumicell AI, a Boston, MA-based techmed startup, raised $2M in pre-seed funding. (Read)

Alinea Invest, a New York based fintech startup, raised $10.4m in Series A funding. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve for free. Subscribe to the Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs, offering a 30% discount for a limited time. Don’t miss it. (Access Here)

Investment Manager/Principal - ABB Venture | Remote - Apply Here

Associate Fintech - Speedinvest | UK - Apply Here

Investment Analyst (Internship) - Velocity Venture | Singapore - Apply Here

Finance Associate - Thomvest | USA - Apply Here

Investment Associate - Greyhound Capitak | UK - Apply Here

Associate / Senior Associate - Physis Capital | India - Apply Here

Senior Associate - Hubspot Venture | USA - Apply Here

Principal - Stepstone Group | USA - Apply Here

Investment Analyst - M13 | USA - Apply Here

Investment Manager - Sagana | Africa - Apply Here

Intern | Two Sigma Venture | USA - Apply Here

Principal - Pioneer Square Lab | USA - Apply Here

Communications Intern - Nourish Venture | USA - Apply Here

Werkstudent - Venture Capital - Growth Partner | Germany - Apply Here

Principal - Artha Group | India - Apply Here

Pre-MBA Analyst - Healthkois | Indai - Apply Here

Associate and Analyst positions - 12 Flags | India - Apply Here

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator