When should startups prioritize PMF Score over NPS? | VC & Startup Jobs.

Size matters to VCs, 30+ Latest Investor Databases & Copy that Converts Framework.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter—where we dive into the world of startups, growth, product building, and venture capital. In today’s newsletter -

Deep Dive: When should startups prioritize PMF Score over NPS?

Quick Dive:

Size Matters to VCs: How to Pitch Your Market to Investors?

30+ Latest Investor Databases for Easier VC Outreach (Free Access).

Framework: Copy that Converts.

Major News: Klarna files for U.S. IPO, Intel's new CEO to receive $1 million as base salary, Apple considered building the iPhone 17 Air without ports & More.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

600+ AI Angel Investors – Save Time on Fundraising.

Excel Template: Early Stage Startup Financial Model For Fundraising.

Validating without launching a framework for early-stage startups.

100 GenAI apps that matter today.

Halving R&D with AI & the impact on valuation.

AI innovator's dilemma.

The rules of a good startup pitch - A must-follow framework for founders.

EvolutionIQ got acquired for $730M — Here's their playbook for building an enduring AI business.

2700+ US angel investors & VC firms contact database (email + LinkedIn link).

Why you should network with investors before you raise.

An insider's guide on how to land your first VC role.

How to launch your own AI business.

Marc Lou on how to find startup ideas.

The definitive framework to find your next scalable user acquisition channel.

Startup legal document pack – essential legal docs for founders.

Palle Broe’s top 30 AI unicorns with the fewest employees.

1000+ Euro tech VC firms database.

Andrew Chen shares DoorDash’s v1.

All-In-One guide to pitch deck storytelling - free template & curated resources.

For AI Enthusiasts: Must-have resources to stay updated on AI tools, trusted by leading founders and investors.

🤝 INVESTMENT OPPORTUNITY WORTH EXPLORING

The Future of Sustainable Construction—Why Investors Are Backing Hempitecture…

Construction is one of the biggest carbon polluters, and conventional insulation is toxic and inefficient. Hempitecture is changing that. As the largest U.S. company bringing hemp-based insulation to market, they’re proving high-performance materials can be carbon-negative.

Why It Matters:

✅ Buildings create 40% of emissions—Hempitecture cuts both operational and embodied carbon.

✅ Hemp insulation is safer, healthier, and more energy-efficient than fibreglass or foam.

✅ $1.1M in NYSERDA funding to expand R&D.

✅ $8.4m from the US Department of Energy to build a second manufacturing plant

Why Investors Are Paying Attention:

$5M+ raised, with investment opportunities still open.

Sales grew 50% YoY in 2023, up 200% in 2024.

The first U.S. hemp insulation factory opened in 2023, with East Coast expansion coming.

Partnered with the Department of Energy & major backers to scale.

Hempitecture is leading the shift to sustainable construction—a rare chance to invest early in a growing industry.

Join the movement—invest today →

PARTNERSHIP WITH US

Get your product in front of over 85,000+ an audience - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

When should startups prioritize PMF Score over NPS?

(PMF Score - Product market fit score & NPS - Net Promoter Score)

One of the common mistakes seen with NPS (Net Promoter Score) is that it is used at the wrong time by most of the founders. Combine this with the fact that it is also a lagging indicator and you get not only misrepresented information but you get it, way, way too late. But there is a simple way to help you make it more effective.

Enter Product Market Fit Score

PMF score simply measures how well your product is meeting your users’ needs.

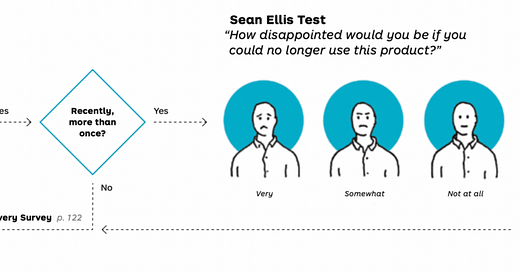

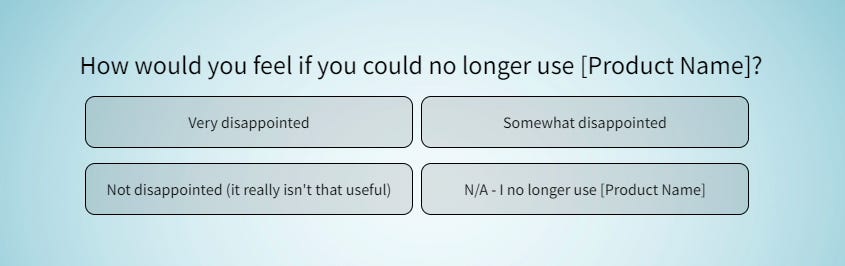

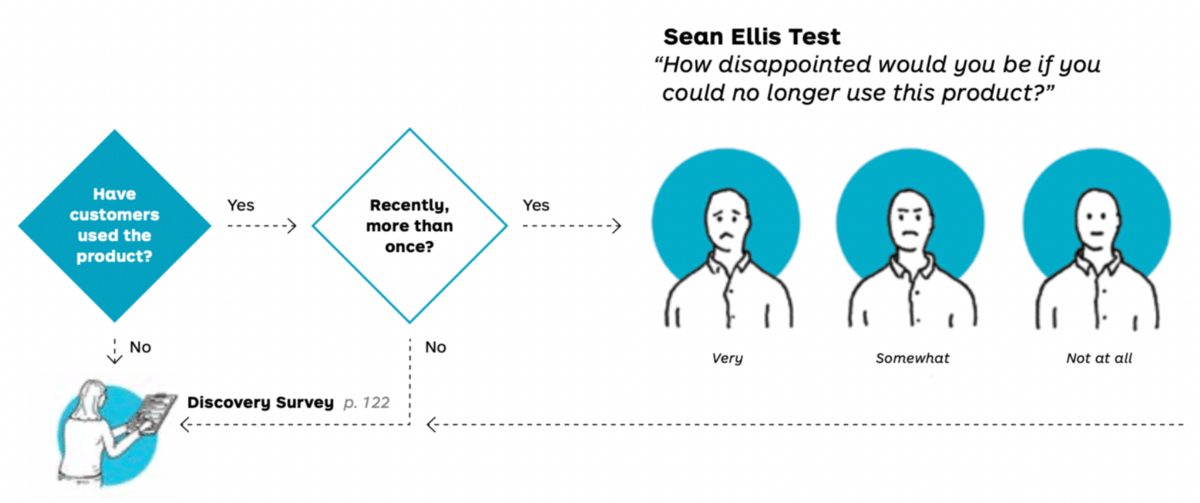

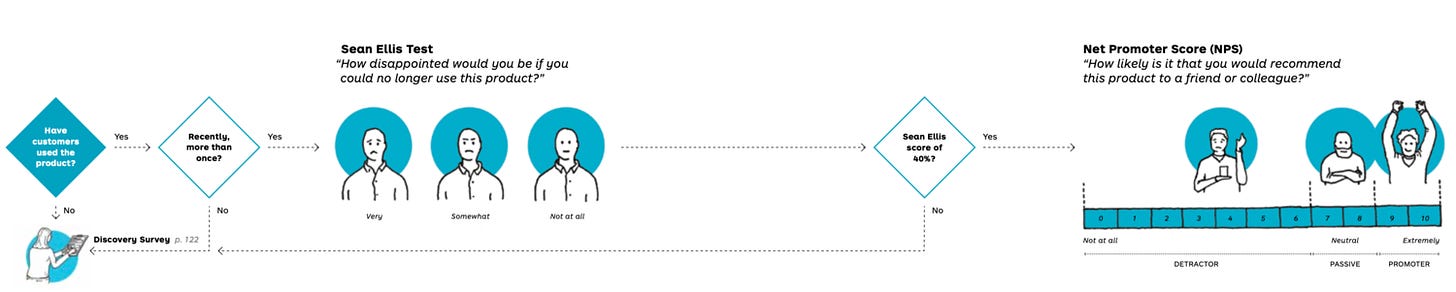

To use it, ask your users how disappointed they’d be if they couldn’t use your product anymore and give them the options of “Very”, “Somewhat”, and “Not at all”

You want over 40% of qualified responses to pick “Very” — that’s an indicator that you’re meeting the core needs of enough users to start hitting actual PMF, which is notoriously tough to measure.

For example -

In 2007, Marc Andreessen, the co-founder of Netscape and a prominent venture capitalist, made a statement that has become a central criticism of the PMF (Product/Market Fit) score.

“You can always feel product/market fit when it’s happening. The customers are buying the product just as fast as you can make it—or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can.”

Basically, you’ll KNOW when you hit PMF without needing a survey to tell you. But the PMF score is still useful as an indicator, before you hit PMF, of whether you’re trending towards it or not. If 28% of responses last month were “Very” but this month it’s 31%, keep doing what you’re doing.

Also — the PMF score was originally created by Sean Ellis, the former Head of Growth at Dropbox who’s also founded multiple startups that were eventually acquired.

When to Use PMF Score

This may seem obvious, but the PMF score is most useful when you’re actively trying to find PMF (either in the early stages of a new idea, or when you’re navigating a pivot).

But this doesn’t only mean in the early days of your startup.

Another, often overlooked point about PMF score is that you should only care about responses given by people who have used your product recently and more than once.

A PMF score from a new user who’s only gone through your signup flow is useless (and not filtering those out can skew the results).

If they haven't experienced the core value proposition recently and more than once, use a discovery survey instead. Include a call-to-action for customer interviews to understand why they signed up. A signup shows the "what" (quantitative), but not the "why" (qualitative).

If they answer "somewhat" or "not at all" disappointed, don't give up. Segment them into groups and dig into why by interviewing them, and looking at referral sources, to understand why the value proposition isn't resonating.

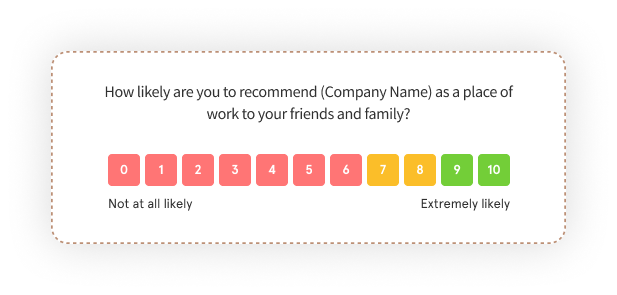

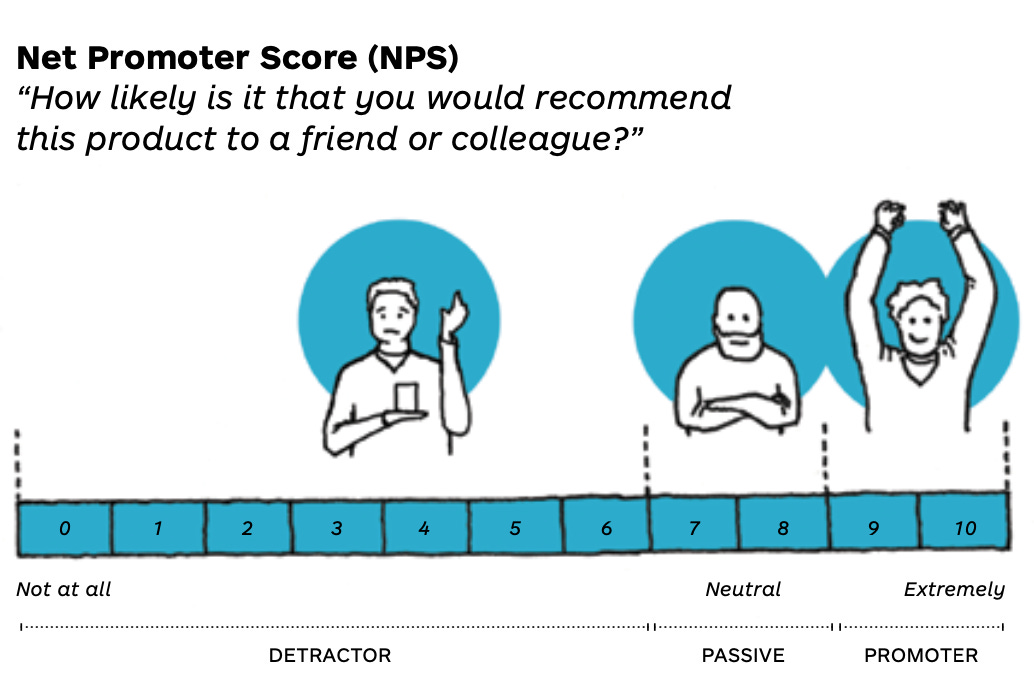

On the other hand, Net Promoter Score (NPS) measures how likely customers are to recommend you and classifies users as Promoters (9-10), Passives (7-8), or Detractors (0-6) based on their responses. A higher percentage of Promoters indicates stronger customer loyalty. If they do recommend it, it drives growth and saves on paid marketing costs.

For Example -

There is much debate on what a good NPS score is depending on the industry, but basically, you are looking at the following calculation:

% PROMOTERS - % DETRACTORS = NPS

If 50% are Promoters, 30% are Passives, and 20% are Detractors, the NPS would be 30 (50% - 20%).

Even with NPS tests, teams often face the situation of customers being extremely likely to recommend the product, yet not being disappointed if the product goes away, resulting in an awkward silence.

This situation happens all too frequently because we aren’t using the appropriate forms of customer research in the correct sequence. You also need to go way beyond surveys but I digress. You can solve this issue only by asking NPS after you’ve found product market fit, which you can help diagnose using the Sean Ellis Test.

If customers recently experienced your core value, use the Sean Ellis Test for fit. If they're not disappointed if your product went away, find out why. If disappointed, use a Net Promoter Score survey later to see if they'd recommend it.

If likely to refer, make it easy with referral programs and make them product ambassadors.

With tweaks to sequencing experiments and discovery, you'll understand customers better.

Nobody wants customers who don't care if your product goes away, but will still recommend it to friends.

So Overall:

PMF (Product Market Fit) Score

Definition: The PMF score measures how well a product is meeting users' needs.

Key Question: "How disappointed would you be if you could no longer use this product?"

NPS (Net Promoter Score)

Definition: NPS measures customer loyalty by asking how likely they are to recommend the product.

Key Question: "How likely are you to recommend this product to a friend or colleague?"

When to Use Each Metric

PMF: Most useful when seeking product-market fit, especially in the early stages or during pivots.

NPS: Suitable for measuring customer satisfaction and loyalty at any stage of product development.

📃 QUICK DIVES

1. Size matters to VCs: How to Pitch Your Market to Investors?

If you're raising venture capital, one of the first questions investors will ask is: How big can this get?

Yet, many founders struggle to present their TAM, SAM, and SOM in a way that resonates with investors. So let’s break down a simple framework to help you do it right.

Why is this important? Because VCs aren’t just looking for great businesses—they’re looking for unicorns. They need to believe your startup can deliver a 50x or even 100x return.

And to achieve that, you need more than just a great idea or solid traction.

You need a market big enough to support billion-dollar growth. Let’s dive in.

TAM: The Billion-Dollar Opportunity

Your Total Addressable Market (TAM) is the absolute biggest version of your opportunity—the theoretical ceiling for your business. It answers the question:

If we captured every single customer in our space, how big could this be?

For example, if you’re building a ride-sharing app, your TAM would be the total amount of money spent on transportation globally. That’s a massive number, easily in the hundreds of billions.

But here’s where many founders slip up—simply Googling "TAM for X industry" and throwing out a number doesn’t cut it.

Investors want to know: How did you get that number?

Pro Tip: Use industry reports from sources like Gartner, Statista, CB Insights, and Clearbit to calculate your TAM. Be specific about your assumptions.

VCs love seeing TAMs measured in tens or hundreds of billions because they’re swinging for the fences. They don’t invest for 2x or 10x returns—they’re aiming for companies that could IPO or get acquired for billions.

That’s why startups in tiny niche markets often struggle to raise VC. If your market isn't VC-scale, consider raising from angel investors instead, who may be fine with smaller but profitable businesses.

One last thing—sometimes, startups create their market. This is what companies like Vinovest (wine investment) or Airbnb (short-term home rentals) did. If you’re taking this path, be ready to explain why this new market will be huge and how you plan to create demand.

SAM: The Market You Can Reach

While TAM is all about vision, Serviceable Addressable Market (SAM) is about execution.

Who can we realistically reach right now, given our current resources and strategy?

Sticking with our ride-sharing example:

Your TAM might include every person who needs transportation globally.

Your SAM might be urban smartphone users in Canada—a much smaller, yet still multi-billion-dollar market.

This is where VCs want to see focus. A startup trying to capture the entire global market from day one is unrealistic. But launching in a high-density, high-spending market, proving traction, and then expanding? That’s smart growth.

Many successful startups start with a hyper-focused SAM before expanding outward. Think:

Uber began in San Francisco.

Airbnb targeted conferences and events in major cities.

Amazon started with just books.

The key? Show that even your initial market is large enough to build a valuable business—and that you have a roadmap for expansion.

How to Present TAM & SAM to Investors

Clarity is everything. Here’s a simple way to frame it in your pitch:

Start with TAM: "The global ride-sharing market is projected to reach $220 billion by 2025."

Narrow it down to SAM: "We're initially targeting urban areas in Canada, a $5 billion market."

Show your expansion plan: "Once we prove our model, we’ll expand to major U.S. cities, growing our SAM to $50 billion within three years."

Make sure to back up every number with solid data. Investors will ask where you got them from, so always have your sources ready.

If possible, use visuals—a simple market-size pyramid or TAM → SAM → SOM (Serviceable Obtainable Market) funnel can make your case much clearer.

When it comes to raising VC money, market size matters—a lot.

TAM shows investors how big the opportunity is.

SAM shows them where you’ll start and how you’ll grow.

The sweet spot? Ambition + realism. Investors love big markets, but they also want to see a clear, achievable path to getting there.

So, next time you pitch, don’t just throw out a massive TAM number and call it a day. Show your work, make your case, and prove you’re building in a market big enough to create a billion-dollar company.

2. 30+ Latest Investor Databases for Easier VC Outreach (Free Access).

We have curated 30+ investors’ contact databases. Some of these lists we found online, others we painstakingly curated with the Venture Curator team. We’ve double-checked everything to make sure it’s accurate, and we hope it makes your fundraising journey easier.

Here’s what’s inside each database:

Investor/VC Name

Portfolio Companies

Stage & Sector Focus

LinkedIn & Twitter Links

Email Contacts (for the selected database)

Here we go: The Ultimate Investor Databases for Free

2000 US VCs Link to Access

VC Firms That Accept Cold Outreach From Founders Link to Access

Best European VC funds Link to Access

Best family offices around the world Link to Access

Corporate venture arms Link to Access

100 VC firms investing in SaaS Link to Access

100 best VC funds in the UK Link to Access

250 US AI Angel Investors Link to Access

The Ultimate List of 750+ Seed Funds Link to Access

300 Australian Early-Stage Investors Link to Access

350 Most Active Angel Investors in the US Link to Access

900 Climate VCs Link to Access

All accelerators by number of investments Link to Access

Data investors in Asia Link to Access

Early-stage web3 investors Link to Access

French VCs Link to Access

Gen AI Investors in Asia Link to Access

250+ Latin America VC Firms & Angel Investors Database: Link to Access

List of VCs Investing in India Link to Access

Top 100 Pension Funds in the World Link to Access

Top 100 Venture Funds by Number of Investments Link to Access

150+ African Angel Investors Contact Database (Email + LinkedIn Link): Link to Access

Top 300 Angel Investors in the Middle East Link to Access

Seed & Series A US VCs (via Folk) Link to Access

Mercury’s Investor Database (most active Seed & Pre-Seed investors) Link to Access

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link): Link to Access

Airtree’s 168+ Australian VC firms: Link to Access

6000+ European VC Firms Contact Database (LinkedIn Links) Link to Access

Deep Tech Investors Mapping (from Hello Tomorrow): Link to Access

VC investors in the Netherlands list: Link to Access

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link): Link to Access

European Tech VC Funds (by EuroVC): Link to Access

2000+ US VCs grouped by Fund stage, Fund focus, and Location: Link to Access

HealthTech Venture Investor List: Link to Access

NYC Early Stage VC firms list: Link to Access

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) Link to Access

I hope this will be useful in your fundraising journey. You can also check out our previous write-up on fundraising on our archive page.

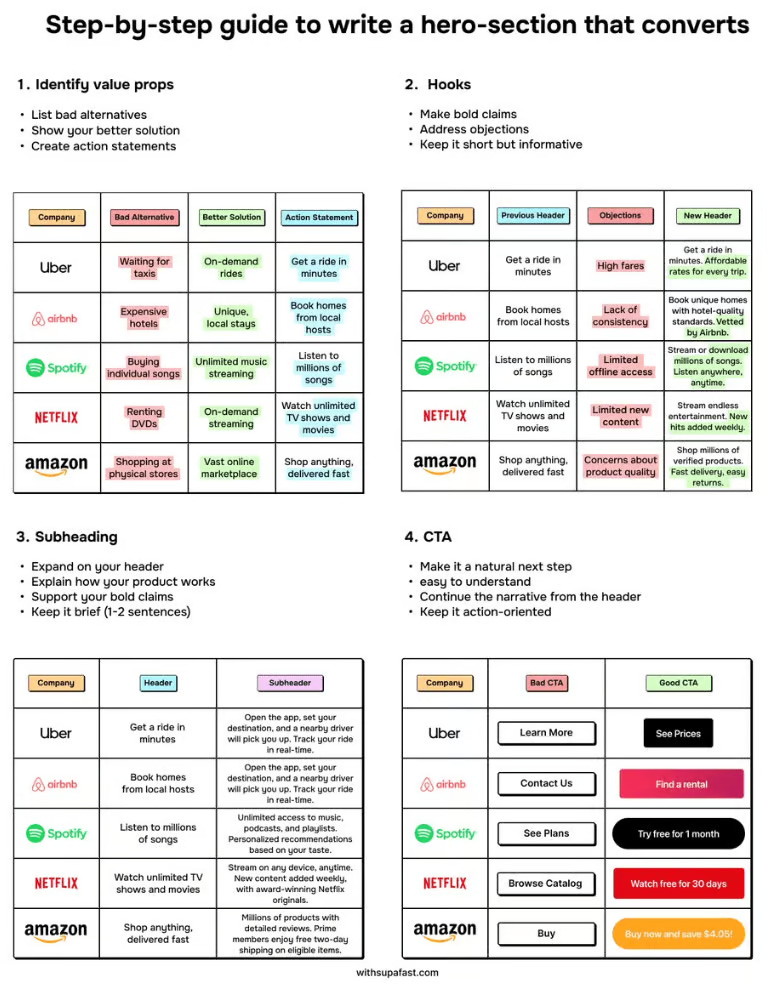

3. Framework: Copy that Converts.

Attention spans aren’t getting shorter.

People are just getting better at making decisions about whether they want to keep paying attention or not.

They might only consider your product for a split second before they decide.

Your landing page, social media content, or ad needs to hook them right away and then hold their attention each step of the way towards a conversion.

Here’s how to improve it:

THIS WEEK’S NEWS RECAP

🗞️ Major News In Tech, VC & Startup Funding

Vento, an Italy-based early-stage VC firm, has launched its second fund, hard-capped at €75 million, to back Italian founders globally. (Read Here)

DeepSeek, the AI startup behind the open reasoning model R1, is now facing stricter government oversight, with China reportedly playing a role in screening potential investors. (Read Here)

Apple is launching the iPhone 17 Air this fall, a slimmer model that blends high-end and low-end features, similar to the MacBook Air. (Read Here)

SoftBank is acquiring Sharp’s Sakai Plant in Osaka for $676 million to convert it into an AI data centre, supporting its push into AI infrastructure. (Read Here)

Google will phase out Assistant on most mobile devices later this year, replacing it with Gemini, which will also expand to tablets, cars, headphones, and smart home devices. (Read Here)

Klarna filed its F-1 prospectus for a U.S. IPO, aiming to raise at least $1 billion at a $15 billion valuation, though pricing details are yet to be disclosed. (Read Here)

Intel’s newly appointed CEO, Lip-Bu Tan, will receive a $1 million base salary and be eligible for an annual cash bonus of up to $2 million, according to a regulatory filing. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 45,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TODAY’S JOB OPPORTUNITIES

💼 Venture Capital & Startup Jobs

All-In-One VC Interview Preparation Guide: With a leading investors group, we have created an all-in-one VC interview preparation guide for aspiring VCs — offering a 30% discount for a limited time. Don’t miss this. (Access Here)

Community Operations Specialist - Outlander VC | USA - Apply Here

Fund Operations Manager - TNB Aura | Singapore - Apply Here

People Operations Associate - Greycroft | USA - Apply Here

Principal - Artha Group | India - Apply Here

General Counsel - Playground Global | USA - Apply Here

Principal - Mavin Ventures | India - Apply Here

Vice President - Agritech - Mavin Venture | India - Apply Here

Part-Time Student at Impact VC - Kopa Venture | Germany - Apply Here

Partner 16 - a16z | USA - Apply Here

Partnerships, Events & Outreach Intern - Succeed Venture | India - Apply Here

Senior Associate - Hubspot Venture | USA - Apply Here

Associate - IIFL Capital | India - Apply Here

Associate - TenOneTen | USA - Apply Here

Venture Partner - Pressplay Venture | Remote - Apply Here

CURATED RESOURCES

Access Curated Resources For Founders & Investors…

Building Cap Table As A Founder: Template to Download.

Excel Template: Early Stage Startup Financial Model For Fundraising.

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources.

Write Your Monthly Investor Update (Email Template Download).

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

1000+ Euro Tech Angel Investors & VC Firms Database.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator