The Only Market Sizing Guide Every Founder Needs. | VC & Startup Jobs

4 startup timing scenarios & Hierarchy of engagement by Benchmark Partner

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: The Only Market-Sizing Guide Every Founder Needs

Quick Dive:

4 Startup Timing Scenarios: Is now the right time to launch?

Hierarchy of engagement By Sarah Tavel.

How to measure if your startup has network effects.

Major News: Mistral AI plans IPO, Perplexity launches Sonar, an API for AI search, Anthropic raises $1B from Google, and Meta is building Oakley smart glasses for athletes.

20+ VC & Startups job opportunities.

📬 VENTURE CURATORS’ FINDING

My favourite finds of the week.

11 hidden signs investors aren’t interested in your startup.

A16Z partner on pricing consumer AI products.

Midjourney founder on raising VC funding for your startup.

The math behind venture capital - a guide for Aspiring Venture Capitalists.

For AI enthusiasts: Top resources trusted by MIT students and experts from OpenAI and NVIDIA.

How does Perplexity convince top VCs to invest at an early stage?

There is something bad going on with SEO.

For founders & investors: Get first-in-class early-stage startups to your inbox every week.

Tips on making investor update a valuable asset

5 things to know when building successful paywalls.

Burnout is a SLOW POISON that’s killing ambitious entrepreneurs every day.

The Buyer's Pyramid: understanding customer readiness to buy your product.

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link).

Financial modelling template to build your startup financial model that every investor wants to see.

Paul Graham's advice on how to convince investors.

Jason Calacanis's 5 rules for pitching startup ideas.

🧾 TOP-TIER VC INSIGHTS

Affinity’s Guide: Early Deal Sourcing Secrets from VC Leaders

At a time when 42% of VCs cite increased competition as a key challenge, how do you ensure your firm stays ahead?

Sourcing the highest quality deals as early as possible is key. Affinity's new deal sourcing guide offers practical insights from industry leaders at Kleiner Perkins, Intel Capital, and more.

PARTNERSHIP WITH US

Get your product in front of over 85,000+ Tech Enthusiasts - Our newsletter is read by thousands of tech professionals, founders, investors and managers worldwide. Get in touch today.

📜 TODAY’S DEEP DIVE

The Only Market Sizing Guide Every Founder Needs

I've shared a few articles on how to convince investors that your market is big enough (You can check out the archive page). However, I've recently noticed a troubling trend in startup decks. While many teams have strong experience and are solving significant problems, founders often stumble when asked about market size. Some even struggle to explain their approach to calculating it. This lack of clarity is a major red flag for any startup.

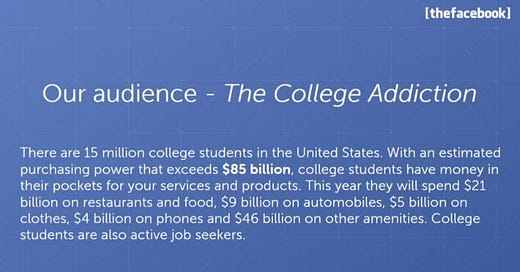

Let me share a great example of market research done right—right at the inception of a business. Facebook (now Meta) is almost ubiquitous in modern life. However, it wasn’t always like that. When Facebook was new, the entire social media sphere was effectively untested and unproven. Facebook (then TheFacebook) needed to prove a lot—not least that there was an actual audience for it. Here’s an actual slide from those early days:

It makes a pretty compelling argument, right? Without Facebook having such a successful proposition early in its life, it may have never had the opportunity to grow into what it is today, but investors bought into the promise of tapping into the college students market, and the rest is history.

So, how did Facebook arrive at those numbers, and how can you do the same for your startup? This write-up is all about market size. I promise that after reading this article, you’ll never have doubts about calculating market size. Let’s dive in!

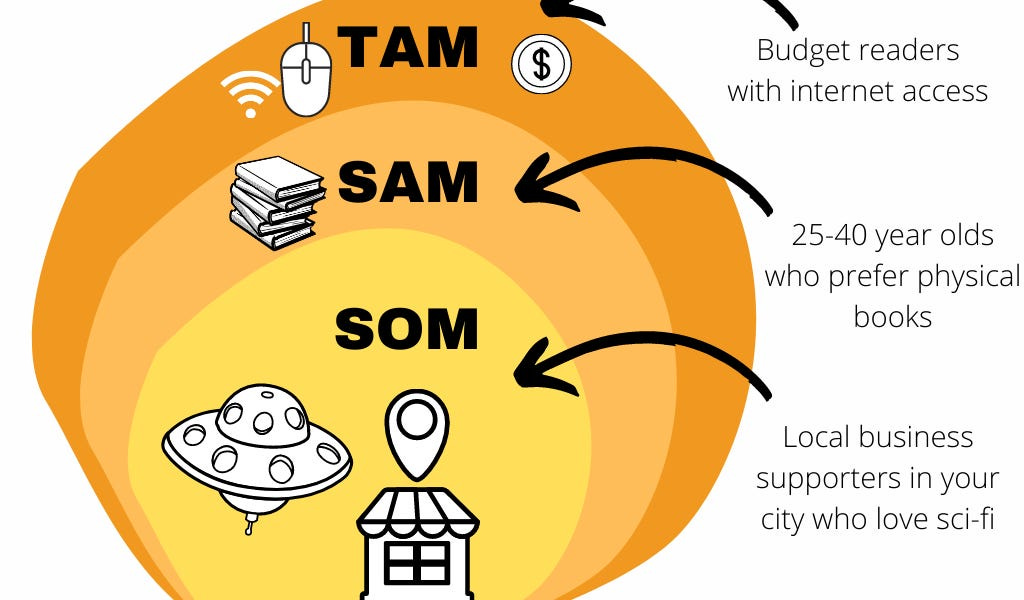

What is TAM, SAM & SOM

TAM = Total Addressable Market (Or Total Available Market)

This represents the revenue opportunity that a company has if it has a full 100% of the market share, and there is no competition.

SAM = Serviceable Addressable Market

This represents the “slice” of the TAM “pie” that can be served by a company’s products and services.

SOM = Serviceable Obtainable Market

This represents the actual amount of the market that is being served by the company’s products and services.

These three terms are related to one another, and are generally depicted as a series of three circles -

Of the three, TAM is the foundation, so we’ll start by calculating that first.

Total addressable market (TAM)

TAM is the “pie in the sky” number. It represents the absolute maximum possible revenue that a business could generate in the market, if every single potential customer is converted into a paying customer, and each of those customers is providing the full maximum revenue.

It’s a useful number as it helps to understand the potential scale of the business, and can help to establish a seed of the go-to-market strategy. However, it’s not a realistic goal. No matter how well you execute the business strategy, you’ll never reach the TAM number, because it assumes that you’re the only provider of the product or service and have zero competition.

How to calculate TAM

When calculating TAM, there are a few different approaches you can take. These include:

Top Down Approach

The top-down approach starts with a broad market size and narrows it down to your specific market segment. This method typically relies on industry reports and market research studies.

Step 1: Identify the total market size using industry data from reputable sources such as Gartner, Forrester, or industry-specific reports.

Step 2: Segment this data to reflect your specific market. For example, if you are targeting small businesses with your software, you would narrow the data to show the number of small businesses in your market.

Step 3: Apply relevant percentages to reflect the portion of the market you can realistically target.

Example: If the overall software market is $100 billion and small businesses represent 20% of this market, your TAM would be $20 billion.

Bottom-Up Approach

Alternatively, you can make TAM calculations based on previous sales and pricing.

ake the total number of potential customers in a market, and multiply that number by the annual contract value (ACV).

The ACV is the amount of revenue that you would gain from each customer contract, on average.

This is a simple equation. Say you sell medical software, at an average of $1,000 for a year’s license. The only customers that are going to be interested in this software are hospitals, of which there are 1,352 hospitals in the particular country. Your TAM, therefore, is $1.35 million.

Value Theory Approach

The third method of determining TAM is a little more subjective but particularly useful for entrepreneurs in highly innovative sectors, or those that aren’t yet selling a product. The value theory approach is based on how much customers are willing to pay for your product or service in exchange for the value that they’re getting for it.

The calculation is the same as the bottom-up approach, above, but rather than calculating the average sale price, you’re looking at what a comparable product sells for, and what premium your superior product could attract.

To use the medical software example above, say that your software is the first in the space that sits in the cloud and allows hospital administrators to access the software from anywhere. In this instance, you would want to include the premium that administrators would pay for that convenience to the TAM, to represent the greater expected revenue you would get from each customer for your unique feature.

Service Available Market (SAM)

With the SAM, we start getting a little more realistic about things. SAM is a calculation that understands that no product can service an entire market.

How to calculate SAM

Calculating SAM is a continuation of the bottom-up approach that you used to calculate TAM. This is the point where you start to get more realistic about just how much of your product you can sell.

Every startup entrepreneur fantasizes that their product will be relevant to everyone in their category, but that of course is not the case.

To continue our example above, perhaps your product has a set of features that make it more relevant to the public hospital sector than the private hospital sector. A percentage of the private hospitals in the particular country might still purchase the solution (more if your sales team is good!), but the SAM calculation would therefore be based on the number of public hospitals in that country. There are 695 of them, meaning that with an ACV (Annual Contract Value) of $1,000, the SAM for your software package is $695,000.

Service Obtainable Market (SOM)

Finally, we come to SOM. This represents the actual amount of the market that is being served by your company’s products and services, and while it’s only relevant once you’re in the market, it becomes a critical component in assessing your startup and its potential going forward.

How to calculate SOM

You’ll want to start calculating SOM once your business is in the market and has customers.

The SOM is determined by calculating last year’s market share, multiplied by this year’s SAM value.

First, you need to determine market share. Say there are only two businesses that sell software with this functionality, and your business sold $400,000 in software last year. Your market share is that number, divided by the SAM (around 0.58, or 58%). Your rival has the remaining 42%.

Now, say there were an additional 20 hospitals brought online in the year. The new SAM for the next year is $715,000. Your SOM is determined by multiplying the market share from last year with the SAM for this year—or roughly $414,700 in this example.

If you end up earning more for the year than that number, then you’re taking market share from your rival. If you earn less, then you’ll want to explore why your competitor is gaining traction.

Note:

While SOM measures market share, and therefore is 0 until your business is in the market, there are, of course, ways to estimate the market share that your product will target once in the market. For illustrative purposes—for example, when pitching to VCs—creating hypothetical SOM scenarios in this way might be a useful exercise for a founder.

Why Do TAM, SAM and SOM matter to a startup?

Investor attraction: TAM especially tells a story that can attract investors. They prefer a "Goldilocks" TAM - not too high (suggests saturation) or too low (limited growth potential).

Growth potential: A larger TAM allows startups to show how they can expand their market, either by adapting their product or entering new markets.

Market positioning: In saturated markets, the gap between TAM, SAM, and SOM indicates the difficulty and cost of acquiring customers, which affects investor interest.

Funding prospects: A small TAM may limit large funding rounds unless expansion potential can be demonstrated.

Strategy development: Understanding these metrics helps startups identify underserved segments within mature markets where they can quickly gain market share.

Five things you should consider while creating a market-size slide

First, opt for a bottom-up approach over a top-down. This shows you've done original research and analysis, rather than just grabbing numbers off Google.

It demonstrates how you see your startup fitting into the market. Second, don't inflate your numbers. Stick to your core audience - if you're targeting Gen Z in a particular country, don't include millennials or global figures. Third, be clear about geography. Unless you're aiming for global operations from the start, make sure your TAM data reflects your specific target market.

Fourth, be prepared for scrutiny on pricing. If you're pre-revenue, your TAM will involve assumptions about the average selling price. Make sure these are defensible and have the math ready when investors ask. Finally, show a vision for future growth. Highlight how your product roadmap could expand your TAM over time. Think about how Facebook started with college students but now includes boomers and Gen-X. A well-crafted TAM slide can set you up for success with investors, so it's worth putting in the effort to get it right.

That’s it.

🤝 FROM OUR PARTNER - RNO1

RNO1 Has a Message for You: Your Design Deserves to Lead

Let’s be real—your app or website is the face of your brand. It’s your first impression, and in today’s competitive markets, it needs to do more than just look good; it has to grab attention, keep users engaged, and inspire action.

At RNO1, we get it. That’s why we create Radical Digital Experiences that aren’t just visually stunning but are designed to help your brand truly shine.

Whether it’s a sleek app interface or a bold, immersive website, we focus on making your audience say, “Wow.” Our team excels at crafting designs that seamlessly blend creativity with strategy, ensuring every detail resonates with your audience.

Imagine a design that keeps users coming back for more and drives measurable results for your business.

You’ve got the vision. Let’s make sure the world sees it in all its glory.

📃 QUICK DIVES

1. 4 Startup Timing Scenarios: Is now the right time to launch?

What makes or breaks a startup? Is it the idea, team, funding, business model, or just plain luck? You’re probably thinking, "If I have all of these locked in, I’m golden!" But there’s one factor that founders often underestimate: timing.

In fact, bad timing is one of the top reasons 90% of startups fail. You can have the best team and an amazing product, but if the market isn’t ready for you (or has already moved on), it’s game over.

So how do you figure out if the timing is right? It starts with understanding the kind of market you’re entering. Here are the four market scenarios every founder should know:

1. Small Market, Not Growing

If the market is tiny and shows no signs of growth, stop right there. Think selling fax machines or landline phones today—there’s no story to tell here. Venture capitalists won’t bite, and you’ll struggle to scale.

2. Large Market, Growth in the Past

The smartphone market is a good example. Imagine launching a new smartphone brand today—you’d be up against giants like Apple and Samsung with their massive resources. Even with the best product, you’ll bleed money trying to compete.

But there’s a silver lining. Some “crowded” markets can still have opportunities for new ideas. Pinterest, Instagram, and Snapchat all launched when social networks seemed dominated by Facebook and Twitter. They found niches by enabling new use cases: pinning, filtered photos, and disappearing messages.

3. Small Market, Too Early

Being early is as bad as being wrong. Many great ideas have failed simply because the market wasn’t ready. Remember WebVan (online groceries in the '90s)? Or WebTV (Internet-connected TVs before broadband was a thing)? Both burned through millions and failed.

How to avoid this? Use Sam Altman’s test: Do enthusiasts use this tech all day, every day? If they don’t, it’s likely a fake trend.

4. Small Market, Growing Quickly

This is the sweet spot. Small, fast-growing markets are where magic happens. Large companies often ignore these opportunities because they’re too small to justify a big investment. But for startups, this is your playground.

Examples? The rise of smartphones, cloud computing, and remote work created billion-dollar opportunities for companies like WhatsApp, AWS, and Zoom. These shifts were driven by new technology, changing behaviour, or both.

Want to find these opportunities? Stay curious, try new tools, and position yourself to move fast when the timing is right.

So overall -

Small, stagnant markets? Don’t bother.

Large, saturated markets? You’re fighting giants with a slingshot.

Early markets? You’ll burn cash waiting for the world to catch up.

But if you find that small, fast-growing market? That’s your golden ticket. It’s where startups thrive, incumbents snooze, and opportunities feel endless.

The truth is, that startup success is as much about timing as it is about execution. Show up too late, and the party’s over. Show up too early, and no one’s there. But show up just in time? That’s where you win.

2. Hierarchy of engagement By Sarah Tavel.

Sarah Tavel, General Partner at Benchmark, developed a way to understand user engagement called the Hierarchy of Engagement.

Level 1: Develop a “core action” you want users to take. Most often the core action is the action most correlated with retention. Facebook was growing your friend list.

Level 2: Enable network effects. Make sure that more people = more value on the network. Using our FB example, the more friends you have on FB the harder it is to leave.

Level 3: Flywheels and more flywheels. Once you have engaged users, make sure the time they’re engaged creates more engagement from other users — create an infinite engagement glitch in the matrix. For FB, having more friends on the platform meant you would invite more friends to join the platform. (Link)

3. How to measure if your startup has network effects.

Network Effects – the magic sauce behind some of the biggest companies in the world. Twitter, Amazon, Apple, Meta, Uber, and Tesla have all leveraged network effects to build massive moats and dominate their markets.

But what are network effects? In simple terms: the more people use your product, the more valuable it becomes. Think of WhatsApp: we use it because everyone we know is already on it. The value of the platform grows with each additional user.

Here’s a wild stat: A study by NFX found that 70% of the value created by tech companies since 1994 comes from network effects. Crazy, right?

So, how can you tell if your startup has network effects? It’s not as simple as a “yes” or “no.” Network effects fall along a spectrum, evolving with your product, users, and competition. Here’s a quick breakdown of how to measure it:

Acquisition Metrics

Organic vs. Paid Users: Is your proportion of organic users growing? Over time, network effects should reduce reliance on paid growth.

Source of Traffic: Are more users coming directly to your platform instead of via ads or third-party sites? (Think OpenTable – early on, traffic came through restaurant widgets, but later, users went straight to OpenTable.)

Competitor Metrics

Multi-Tenanting: How many of your users also use competitor platforms? Reducing this is key to building loyalty.

Switching Costs: Is it easy for users to switch to other platforms? The harder you make it (e.g., by creating a sticky experience), the better your network effects.

Engagement Metrics

Retention Cohorts: Are newer users sticking around longer as the network grows?

Power Users: Are more users becoming highly active? A right-leaning power user curve means engagement is improving.

Location Trends: For local networks, older geographies should have higher retention as network density increases.

Economics Metrics

Pricing Power: Can you charge more over time without losing users? Strong network effects increase what users are willing to pay.

Unit Economics: Track market-by-market data (especially for local networks). Over time, CAC should drop, organic growth should rise, and profitability should improve.

The TL;DR? Network effects aren’t binary, but understanding the dynamics behind them can help you unlock sustainable growth. Focus on the right metrics to measure what’s working and where to improve.

🗞️ THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Anthropic has secured a $1 billion investment from Google, increasing Google’s total stake in the AI company to $3 billion.

Scale AI, valued at $13.8B, faces its third lawsuit in a month, with workers claiming psychological trauma from reviewing violent content on its Outlier platform without proper safeguards.

President Trump expressed a willingness for Elon Musk or Larry Ellison to acquire TikTok and proposed a joint venture with the U.S. government.

Meta is reportedly developing Oakley-branded smart glasses, named "Supernova 2," targeting athletes and featuring a centrally placed camera to appeal to cyclists and outdoor sports enthusiasts.

French AI lab Mistral, valued at $6 billion, plans an IPO, CEO Arthur Mensch revealed at the World Economic Forum, emphasizing the company is “not for sale.”

→ Get the most important startup funding, venture capital & tech news. Join 40,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

💼 TODAY’S JOB OPPORTUNITIES

Venture Capital & Startup Jobs

Associate - Omerse Venture | USA - Apply Here

Artificial Intelligence Engineer Intern - Baz AI | USA - Apply Here

Legal Operations Associate - 500 Global | UAE - Apply Here

Intern, Primary Investments - Adam Street Partner | Singapore - Apply Here

Ventures Analyst - Plug & Play Tech Center | USA - Apply Here

Part-Time Student at Impact VC - Kopa Venture | Germany - Apply Here

Investment Manager - Outlier Venture | UK - Apply Here

Investment Manager, Techstars London - Apply Here

Ventures Associate - Plug and Play tech center | USA - Apply Here

Investment Research Intern - Malpani Venture | India - Apply Here

Chief of Staff - Seed Startup | USA - Apply Here

Remote Product Owner - Soar Financials | Remote - Apply Here

UI/UX Designer - Files | USA - Apply Here

Social Media Coordinator - B2B Cybersecurity - Pylon - Apply Here

Chief of Staff - Voyager Venture | USA - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

🔴 Share Venture Curator

You currently have 0 referrals, only 5 away from receiving a 🎁 gift that includes 20 different investors’ contact database lists - Venture Curator