How to Build an Investor Data Room? - Don’t Make These Mistakes. | VC Jobs

a16z request: What AI Startups to Build in 2025, US Startup Employees Don't Care About Equity & More.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: How to Build an Investor Data Room? - Don’t Make These Mistakes.

Quick Dive:

a16z's Guide: What AI Startups to Build in 2025.

How to Find the Right Customers for Your MVP?

Are US Startup Employees Exercising Their Vested Options When They Leave?

Major News: Apple Intelligence generates false BBC headline, Meta asks California to block OpenAI’s conversion to for-profit, G2 Venture Partner's $750 Million Fund & More

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER - FOUNDERSEDGE

FoundersEdge is a venture fund created by founders who know what it takes to build game-changing companies. We invest at the intersection of AI and user experience, backing ambitious teams redefining how technology can be intuitive, powerful, and accessible.

Our thesis:

The next wave of transformative companies will focus on making AI more accessible and human-centred. These companies aren’t just adding a chatbot—they’re rethinking user experience from the ground up as an AI-first journey. We’re often the first to check into pre-seed startups that share this vision.

For founders:

We’ve been in your shoes. As founders ourselves, we understand the challenges you face. Beyond capital, we offer deep technical expertise in AI/ML, UX design guidance, and access to a strategic network of seasoned founders and operators. At FoundersEdge, we believe founders are the ultimate edge for future founders.

For co-investors:

We partner with those who share our founder-first mindset, collaborating to give early-stage companies the edge they need to succeed.

→ Learn more about us at FoundersEdge.

Partnership With Us: Want to get your brand in front of 70,000+ readers like founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

Early Stage Startup Financial Model Template For Fundraising (Access Here)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources (Access Here)

How do Investors Evaluate AI Startups' Tech Stacks? (Read)

How do we recognise great problems with high sales potential? (Read)

When Should Startups Prioritize PMF Score over NPS? (Read)

The Consumer Subscription Trifecta: What Makes Consumer AI Subscriptions Work? (Read)

How to Create A Value Proposition: A Four-Step Framework. (Read)

How much time should founders typically allocate to fundraising, from Elizabeth Yin (Hustle Fund Cofounder)? (Read)

How many hours do Y Combinator founders work? A poll from YC’s internal forum. (Read)

8 lead generation pillars and 24 tools For Startup Founders. (Read)

Duolingo on how to win with gamified design. (Read)

Sam Altman - ‘Don't Run Toward Ideas Where There Is Oversupply of Founder Relative To Market Demand.’ (Read)

The Best Time to Invest in a Company is When it Most Violates a Popular Narrative… (Read)

Building a VC fund is harder than you think - Wischoff Fund Journey (Read)

The playbook teams are using to crush viral app growth (Read)

TODAY’S DEEP DIVE

How to Build an Investor Data Room? - Don’t Make These Mistakes.

As a first-time founder, you might find yourself in this situation - excited about a positive response from a potential investor, but suddenly faced with an unfamiliar term: 'data room.'

A data room is essentially a secure, organized collection of documents that provides detailed information about your company. It's a tool for due diligence, allowing potential investors to examine your business's financials, operations, and potential in depth.

But before diving into how to build an investor data room, let me share an important insight: Don't send all your data to investors too early in the process.

Just because investors request data room access doesn't necessarily mean you're making progress. Many founders make the mistake of sending all their information at once (even before the first investor call) and end up getting ghosted by VCs. The best way to avoid this is to create a two-stage data room approach:

A pre-term sheet data room

A post-term sheet data room

This structured approach helps protect your sensitive information while maintaining investor engagement throughout the fundraising process.

Stage 1: Pre-Term Sheet

At this point, investors typically have limited information about the company, relying mainly on the pitch deck, website, and publicly available data. They request access to a preliminary data room to perform a quick spot check and gather material for internal discussions with their partners.

This Stage 1 data room helps investors validate their initial interest and prepare for more in-depth conversations about the potential investment.

Here’s a list of the 5 sections and types of content you’ll want to include in your stage 1 data room:

Business Summary / Company Overview

Purpose: provide an overview of the problem you are solving, your solution, and competitors - make it easy for the investor to create a deal memo

Docs to include:

1-page business overview

Links to your company website and social platforms

A PDF copy of your current pitch deck

Traction / Product Market Fit

Purpose: provide data that proves you’re solving a real problem - better yet with a solution to a problem that a lot of people have and are willing to pay meaningful dollars for

Docs to include:

Market sizing - bottom-up or top-down TAM backed by relevant up-to-date data from reputable sources

Customer / User data - how many customers or users do you currently have, how engaged are they

Competitive positioning / Unique Selling Proposition (USP)

Customer acquisition data - CAC, CAC payback

Financials

Purpose: provide a financial overview of your business from the day you started to the present day with forward-facing projections. If you don’t have a financial model built, I highly recommend you check out Sturppy. Sturppy’s is used by 4,000+ startups and allows founders to build an investor-ready financial model without being an expert on finance or financial modelling.

Docs to include:

P&L / Income Statement, Balance Sheet, Cashflow Statement, Financial Projections 1-3 years in the future

Team & Roles

Purpose: provide an overview of your team, their experience, and the roles they play in your business

Docs to include:

Brief profiles on each team member, their role, their prior work experience, their time with the company, and links to their social channels (LinkedIn)

Cap Table

Purpose: provide an overview of who owns equity in the business today.

Docs to include:

Cap table summary

After receiving and negotiating a term sheet, you enter Stage 2 of the data room process.

Stage 2: Post-Term Sheet

This stage is crucial for streamlining due diligence before any final agreements are signed. It's wise to create a separate, more detailed data room for this phase, rather than just expanding your Stage 1 room. This approach gives you better control and flexibility, especially when dealing with multiple investors at different stages.

Here’s a list of additional sections and content you’ll want to include:

Entity Formation Documents

Purpose: These documents are mostly needed by the legal team and are the set of documents used to certify your business’s good standings. These docs are going to fluctuate based on where your business is incorporated and the type of business entity you’ve chosen. If you’re a startup in the US, 9/10 if you’re raising venture, you’re going to be established as a Delaware C-Corp

Docs to include:

Shareholder certificate documents

Local/state/federal business licenses/letters of good standing

Articles of incorporation

Bylaws, Tax ID number, Operating agreement between founders, Shareholder meeting minutes/board minutes, Annual meeting notes/minutes

Customer & Partner Contracts

Purpose: Material agreements will vary from company to company based on the nature of the business but the general gist is to include anything that could significantly impact the business

Docs to include:

Standard terms of service or use between your business and customers

Any agreements or understandings between your company and others with obligations exceeding $25K

Property leases (real estate and personal)

Licenses of any company IP to 3rd parties

Proof of Intellectual Property

Purpose: If your company has IP and that was part of the pitch, you’re going to have to show proof of that IP. This includes patents, trademarks, copyrights, design

Docs to include:

Evidence that you have the right to the IP that you’re developing

Patent information (proof of filing/issuing)

Trademark registrations

Copyrights

Full cap table documents

Purpose: If you’ve followed this guide, you’ve already shared a summary of your cap table. At stage 2 you’ll likely need to divulge additional details such as:

Docs to include:

Details of previous fundraising rounds or liquidity events

Shareholder certificates

Vesting schedules

ESOP details

Tax Filings

Purpose: Proof that your company is in good standing with the IRS

Docs to include: Tax History, Previous filings, Previous audit statements and any third-party financial evaluations

Information on Any Outstanding Litigation

Purpose: This one is key…failure to divulge pending or outstanding litigation can and will likely result in a very bad outcome for you and your business. Be honest here, have a hard conversation with the investor at this stage in the process.

Just remember - unless you’ve received a term sheet and you’re asked to share (and you will be asked if you’ve received a term sheet and decide to move forward) don’t share (Stage 2 data room data) it until it’s requested.

Also, many founders ask about what solution to use to create and store all this data. Let me address that:

If you're a founder on a budget, Google Drive works perfectly fine as your data room. There's no need to spend money on fancy solutions. Some of you might worry about privacy, security, analytics, and tracking - but honestly, at your early stage, these aren't critical concerns.

Google Drive is secure enough, costs nothing, and most importantly - investors are already familiar with it. Save your money for things that actually move your business forward. That’s it.

Also, I highly recommend checking out this article titled - “Why you should never have a data room — the most counter-intuitive fund-raising advice you’ll ever get” by Mark Suster.

FROM OUR PARTNER - DEALMAKER

The New Capital Stack: Why Leading Companies Are Adding Retail Capital to Their Growth Strategy

The traditional capital stack is getting a powerful upgrade.

Forward-thinking companies are discovering how retail capital can transform their funding strategy while building lasting customer relationships.

QUICK DIVES

1. a16z's Guide: What AI Startups to Build in 2025.

Recently a16z shared a detailed article asking AI founders to work on the following ideas for 2025. Here's a comprehensive breakdown of the most promising opportunities:

Infrastructure & Computing Revolution

The next frontier in AI infrastructure involves building massive "AI Hypercenters" - think of data centres but dramatically larger, capable of handling the intense computing needs of next-gen AI models.

However, there's also a parallel push toward smaller, more efficient AI models that can run directly on our phones and devices. This dual approach aims to make AI both more powerful and more accessible while maintaining privacy through local processing.

Enterprise Transformation

A major shift is happening in how businesses operate. Taking inspiration from Klarna, who boldly replaced Salesforce with their own AI system, more companies are expected to overhaul their legacy systems with AI-native solutions.

The vision is to have AI assistants for every white-collar role, automating mundane tasks and augmenting decision-making capabilities. Particularly interesting is the use of AI to simplify compliance and regulations in complex industries like banking and healthcare.

The Search Evolution

Google's dominance in search is facing its first real challenge in years. New AI-powered search tools are emerging that don't just provide links but deliver precise answers and insights.

We're seeing specialized search engines for specific domains - legal research, scientific papers, academic content - that provide deeper, more relevant results than traditional search engines.

Consumer AI Innovation

The consumer space is seeing exciting developments in creative tools with real-time AI feedback. Imagine having an AI music collaborator that adapts to your style in real-time, or video generation tools that can create content specifically optimized for different platforms and purposes.

Personal AI assistants are becoming more sophisticated, learning from your digital footprint to provide truly personalized support.

Healthcare Transformation

In healthcare, AI is opening new possibilities for treating common diseases and making healthcare more accessible. The focus is on practical applications: AI-powered diagnostics, remote monitoring systems, and solutions for healthcare staffing challenges.

The goal is to make quality healthcare more accessible while reducing the burden on healthcare workers.

The Path to Success For founders looking to build in this space, a16z emphasizes that success won't just come from having cool technology. The winning companies will be those that:

Create solutions that are genuinely hard to replicate

Design intuitive interfaces that make complex technology accessible

Focus on solving real problems with a clear return on investment

Build systems that can scale across multiple industries

This is an exciting time for founders who can identify genuine problems and solve them with practical AI applications. The key isn't just to build impressive technology, but to create solutions that deliver real value and can build sustainable businesses.

2. How to Find the Right Customers for Your MVP?

While building MVP (Minimal Viable Product), Founders act like the “minimal” part is the goal. Or worse, that every potential customer should want it. In the real world, not every customer is going to get excited about your minimum feature.

The reality is that the MVP is

a tactic to reduce wasted engineering hours (code left on the floor).

to get the product in the hands of early visionary customers as soon as possible.

You’re selling the vision and delivering the minimum feature to visionaries, not everyone.

Why A Minimal Viable Product (Minimum Feature Set)?

The MVP is the inverse of what most sales and marketing groups ask of their development teams. Usually, the cry is for more features, typically based on “Here’s what I heard from the last customer I visited.”

The premise is that a very small group of visionary customers will guide your features until you find a profitable business. Rather than asking customers explicitly about features X, Y or Z.

One approach to defining the minimum features set is to ask “What is the smallest or least complicated problem that the customer will pay us to solve?”

This rigour of “no new features until you’ve exhausted the search for a business model” counters a natural tendency of people who talk to customers – you tend to collect a list of features that if added, will get one additional customer to buy. Soon you have a ten-page feature list just to sell ten customers.

Most customers will not want a product with a minimal feature. The majority of customers will hate it. So why do it? Because you are selling the first version of your product to Earlyvangelists.

Earlyvangelists = Early Adopter + Internal Evangelist

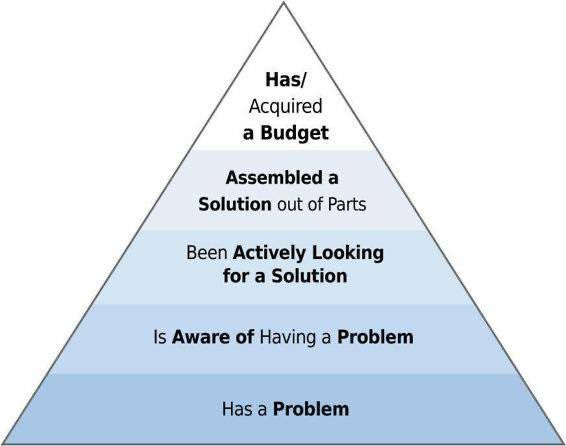

“Earlyvangelists are risk-taking customers who envision your startup's potential to solve a critical problem for them, and have the budget to buy in early.” Earlyvangelists can be identified by these characteristics (attached image):

They have a problem.

They understand they have a problem.

They are actively searching for a solution and have a timetable for finding it.

The problem is painful enough that they have cobbled together an interim solution.

They have, or can quickly acquire, dollars to purchase the product to solve their problem.

Early evangelists buy into the vision before the product itself. They need to fall in love with the idea. This vision will keep them committed through the inevitable mistakes and challenges.

But early evangelists will stick with you through good and bad because they share your vision.

3. Are US Startup Employees Exercising Their Vested Options When They Leave?

According to the recent Carta report (Shared by Peter Walker), it’s clear that - Startup employees don't care much about equity.

At least, that's what many of them are telling us about their exercise decisions.

To become a real company stock, startup equity has to jump two hurdles. First, it has to vest - meaning the employee has to remain at the company for a specific amount of time.

Second, it has to be exercised, or purchased by the employee.

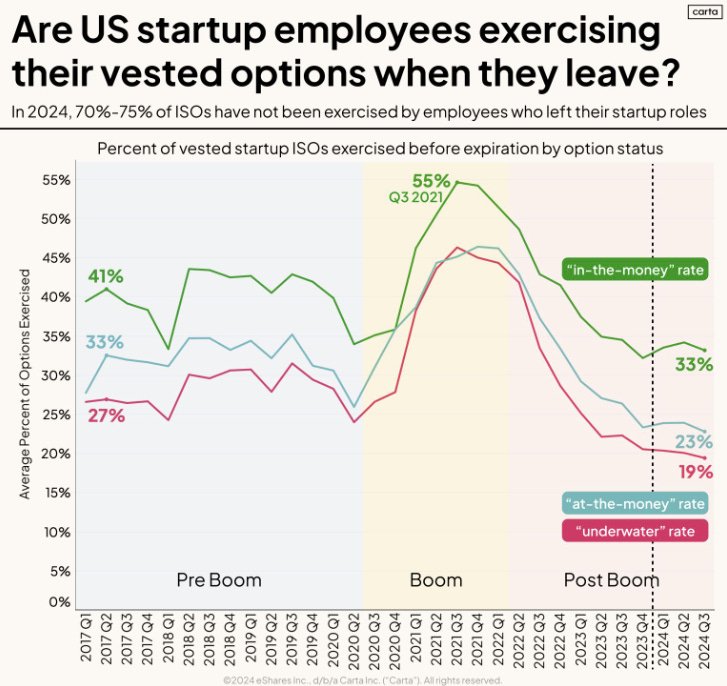

The chart below shows the quarterly exercise rate for vested options since 2017 across US employees whose companies use the Carta. We split the exercise rate into three separate lines to reflect the "status" of the option when it expires.

𝗜𝗻-𝗧𝗵𝗲-𝗠𝗼𝗻𝗲𝘆: options where the strike price at expiration is higher than when it was issued.

𝗔𝘁-𝗧𝗵𝗲 𝗠𝗼𝗻𝗲𝘆: options where the strike price at expiration and issuance was identical.

𝗨𝗻𝗱𝗲𝗿𝘄𝗮𝘁𝗲𝗿: options where the strike price at expiration is below the strike at issuance.

Most stock options have a 10-year expiration window—but that gets cut short if the employee leaves the company, either by choice or through layoff. So you can think of this chart as showing "what per cent of employees exercise their options when they leave".

In the pre-boom period, exercise rates hovered around 44% for in-the-money options. Today that same figure has fallen to 33%.

Now this drop is probably to be expected. Startups have had a rough go over the past few years with down rounds, layoffs, and curtailed fundraising.

But there are some signs things are changing. Super late-stage secondary activity has picked up. The IPO forecasts for 2025 are getting brighter. ServiceTitan just popped up on public day 1.

Equity in startups has this beautiful promise to it - but paying money now for the chance of a windfall in the future is not an easy sell.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Meta asks California AG to block OpenAI’s conversion to for-profit. (Read)

G2 Ventures Partners is raising $750 million for a third fund. (Read)

OpenAI fires back against Elon Musk. (Read)

Trump’s Silicon Valley advisers have AI ‘censorship’ in their crosshairs. (Read)

Apple Intelligence generates false BBC headlines. (Read)

Lawmakers tell Apple, and Google to prepare for TikTok ban. (Read)

→ Get the most important startup funding, venture capital & tech news. Join 31,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

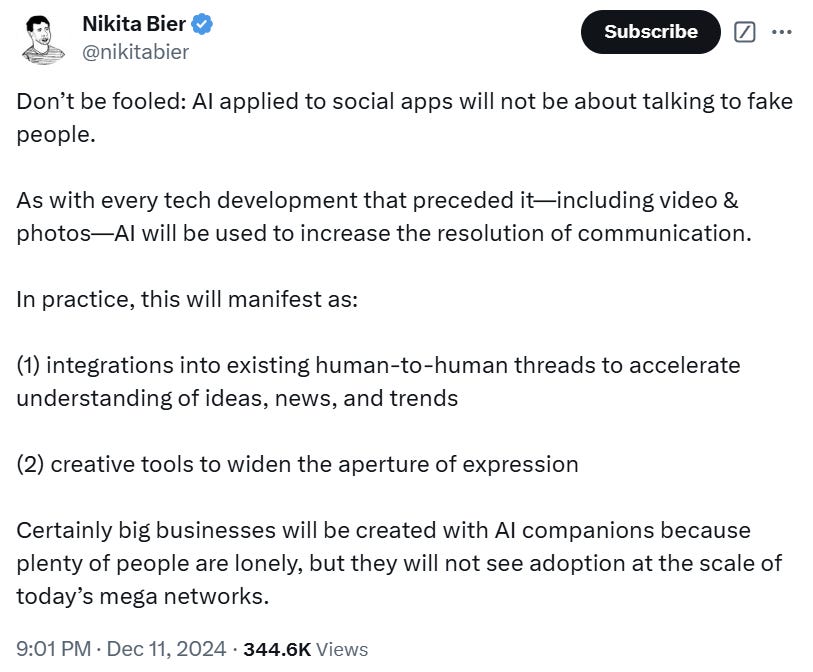

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Get Access to our all-in-one VC interview preparation guide — For a limited time, we are offering a 30% discount. Don’t miss this. (Access Here)

Investment Associate - Nextgen Venture | Australia - Apply Here

Design Lead - Nextgen Venture | Australia - Apply Here

Partner 32, Deal Counsel - a16z | USA - Apply Here

Manager, Venture Builder - Venture Studio - USA - Apply Here

Visiting Analyst Portfolio Success - Speedinvest | Germany - Apply Here

Associate - Ivycap Venture | India - Apply Here

Associate - Adam Street Partners | USA - Apply Here

Business Development - Techstar| Italy - Apply Here

Senior Director of Marketing and Communications -Aegis Venture | USA - Apply Here

Accelerator and Sales Director - Plug and play tech centre | USA - Apply Here

Events & Community Associate - TDK Venture | USA - Apply Here

Program Manager - Plug and play tech center | USA - Apply Here

Head of TS Bridge - Turbostart | India - Apply Here

Partner 18, Deal Operations - a16z | USA - Apply Here

Portfolio Analyst Intern - plug and play tech centre | USA - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)