Paul Graham's Views on Competitor Analysis and a Framework for Performing It. | VC Jobs

Inside the AI Unicorn Club, Three Factors for Freemium Strategy & Recognise great problems with high sales potential.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: Paul Graham's Views on Competitor Analysis and a Framework for Performing It.

Quick Dive:

How to recognise great problems with high sales potential?

Framework: The Three-Factor Freemium Assessment for Startups.

Inside the AI Unicorn Club: What Makes These Startups Special.

Major News: Trump's 35% Tax Rattles VCs, Microsoft's $23M Investment in AI Startup, Apple Developing AI Server Chip, Google launches Gemini 2.0. & More

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER - FOUNDERSEDGE

FoundersEdge is a venture fund created by founders who know what it takes to build game-changing companies. We invest at the intersection of AI and user experience, backing ambitious teams redefining how technology can be intuitive, powerful, and accessible.

Our thesis:

The next wave of transformative companies will focus on making AI more accessible and human-centred. These companies aren’t just adding a chatbot—they’re rethinking user experience from the ground up as an AI-first journey. We’re often the first to check into pre-seed startups that share this vision.

For founders:

We’ve been in your shoes. As founders ourselves, we understand the challenges you face. Beyond capital, we offer deep technical expertise in AI/ML, UX design guidance, and access to a strategic network of seasoned founders and operators. At FoundersEdge, we believe founders are the ultimate edge for future founders.

For co-investors:

We partner with those who share our founder-first mindset, collaborating to give early-stage companies the edge they need to succeed.

→ Learn more about us at FoundersEdge.

Partnership With Us: Want to get your brand in front of 70,000+ readers like founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

A Must-Read Guide for Aspiring Venture Capitalists. (Link)

Promise-market fit is an early signal that product-market fit is possible. Why & How? (Link)

Cap Table Guide for Founders (Link)

Access to 10000+ VCs verified email contact database. (Link)

Why you shouldn’t giveaway startup equity to advisors (Link)

9 lessons from 20 years of building successful software and hardware companies (Link)

Why “wrappers” may not get swallowed by foundation models (Link)

Definitive list of things startups did that didn’t scale (Link)

14 ways the tax code is written in favour of business owners (Link)

A few design principles to steal from AirBnB (Link)

Marc Andreessen on the importance of startup timing (Link)

Positive signals to look for when hiring engineers (Link)

The 3 things your company needs to make AI act like an engineer (Link)

Sam Altman on the early, difficult times at OpenAI (Link)

Download Startup Fundraising Pitch Deck Templates. (Link)

TODAY’S DEEP DIVE

Paul Graham's Views on Competitor Analysis and a Framework for Performing It.

Paul Graham on Competition in Early-Stage Startups

Don't Worry about Competitors

When you think you've got a great idea, it's sort of like having a guilty conscience about something. All someone has to do is look at you funny, and you think "Oh my God, they know."

These alarms are almost always false:Companies that seemed like competitors and threats at first glance usually never were when you really looked at it. Even if they were operating in the same area, they had a different goal.

One reason people overreact to competitors is that they overvalue ideas. If ideas really were the key, a competitor with the same idea would be a real threat. But it's usually execution that matters:

All the scares induced by seeing a new competitor pop up are forgotten weeks later. It always comes down to your own product and approach to the market.

This is generally true even if competitors get lots of attention.

Competitors riding on lots of good blogger perception aren't really the winners and can disappear from the map quickly. You need consumers after all.

Hype doesn't make satisfied users, at least not for something as complicated as technology.

Remember, competition can teach you a lot about what not to build or what to prioritize. Many successful companies have been built by executing simple ideas that their competition didn’t pursue. But how should you conduct competitor analysis for your startup? No, I’m not talking about SWOT analysis. You’ll find plenty of articles online explaining why SWOT analysis isn’t worth it. Instead, I’ll share a framework (by Antler) and a practical approach to competitor analysis.

So grab your coffee, and let’s dive in!

The first question you should be asking as you set out to complete a competitor analysis is “Which companies are my competitors?”

That might sound like a ridiculously rudimentary statement on the surface, and to an extent it is. People generally assume that a startup founder will have some kind of intuitive understanding of the competitive landscape at the moment that they have the idea. However, in practice it’s very easy to make a mistake in both directions; to assume that a company is a competitor when it’s not (this is often the case when a startup entrepreneur looks at a massive global company as a competitor), and to be simply unaware of another startup that is their biggest and most challenging rival.

The best way to build your list of competitors is to ask three simple questions:

Who (The Customer):

Who are your target customers (and/or companies)? Chances are any other company that has an overlap in target customer segments is a competitor.

What (The Problem):

If your product, service or solution solves the same problem as another company, then it’s a sign that you’re competitors.

How (Product Category):

How you solve the problem is also an important consideration, and if your technique is comparable to another company, then it’s a sign that you’re a competitor.

So, for example, say that you’re looking to start a small security-managed services organization. You’re promising 24/7 protection for your client’s IT environment, and the associated consulting services that go with that.

You might be offering security, but Norton, McAfee, and the other security vendors are not your competitors. Those companies offer solutions that individuals and companies install themselves, with their IT teams, to secure their environments.

Nor are your competitors the big consulting firms like Deloitte or EY. They help organizations with security, but only as consultants. These companies will then go and source and maintain solutions based on their consultant’s guidance.

Your actual competitors will be the national and local managed services providers. What you are providing to your customers is IT skills and the peace of mind of not having to think about their IT environment. Based on that, your closest competitor might not even have a security focus!

How to find your competitors

The most effective competitor analysis process will account for the startups and small businesses that don’t necessarily dominate the media cycle and may not even appear on the front page of a Google search. There is a broader range of research tools that you should use to generate your list for comparison:

Customer insights: Chat with potential clients to uncover recurring names in your industry.

Social media exploration: Use LinkedIn's "Similar Pages" feature to discover related businesses.

Keyword analysis: Go beyond Google's first page. Use tools like Semrush for deeper competitor research.

Role-play as a customer: Solve the problem your business addresses and note the solutions you find.

Industry events: Attend trade shows and conferences to spot emerging competitors.

Local business directories: Check listings for similar companies in your area.

App store research: If applicable, explore apps solving similar problems to yours.

Patent searches: Look for innovations in your field to identify potential future competitors.

Investor portfolios: Examine what similar startups venture capital firms are funding.

Online forums: Monitor discussions where your target audience seeks solutions.

How to conduct a competitive analysis

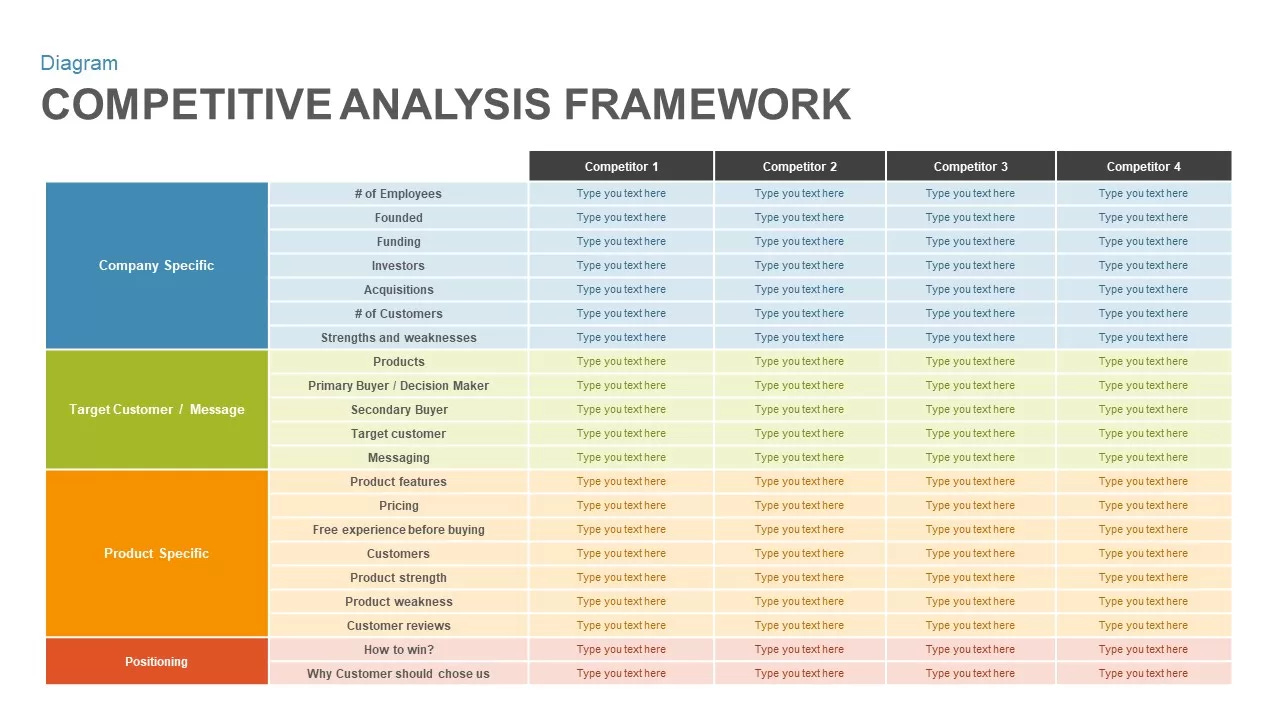

Now that you've identified your key competitors, it's time to dive into the analysis. The cornerstone of this process is creating a competitor matrix - a powerful tool that gives you a bird's-eye view of your market.

You can easily create this framework in spreadsheet. OR Download the spreadsheet here

Start with a simple spreadsheet. Each column represents a competitor, with your own business included. The rows will contain various metrics and information categories. Here's what to include:

Business Overview

Founding date

Company size

Revenue & customers

It is worth understanding the maturity of the businesses that you’re going to be competing against. As a general rule, the lengthier the incumbency, the more difficult it is going to be to win customers, even if there’s mild dissatisfaction with what’s currently on offer, so this information is relevant to the competitive analysis.

GTM/Customer Acquisition

Customer awareness

Customer sentiment

Acquisition channels

In this section, you’ll track how well-developed the market is (just how aware are customers of what is on offer), their mood towards the current offering, and how those customers are engaged and acquired.

Product Offering

Pricing (ASP)

Features

Sales model

Understanding where your product/service’s pricing sits is without a doubt critical in determining your go-to-market, but just as important is understanding how the features compare (since customers usually are willing to pay a premium for excellent features), and how your competitors approach the sales process.

Where can you get this information from?

This is the sticking point; companies will be less than forthcoming with the kind of information that you need to run a competitive analysis at times. However, there are research hacks and tricks that you can use to, at least, arrive at a reasonable ballpark figure.

Public Companies: Check annual reports and investor presentations for financial data and strategic plans.

Private Companies: Estimate revenue by multiplying employee count (from LinkedIn) by $150K-$200K, depending on funding level.

Funding Info: Use Crunchbase or Dealroom to track investment rounds and valuations.

Product Details: Sign up for free trials or demos to experience competitors' offerings firsthand.

Customer Sentiment: Read app store reviews, social media comments, and online forums for unfiltered feedback.

Employee Insights: Explore Glassdoor reviews for internal perspectives on company culture and operations.

Tech Stack: Use tools like BuiltWith to see what technologies competitors are using on their websites.

Marketing Strategies: Follow competitors on social media and sign up for their newsletters to track campaigns.

Pricing: Check public pricing pages or request quotes as a potential customer.

Partnerships: Look for press releases or "Partner" pages on company websites.

Job Listings: Review open positions to gauge growth areas and strategic priorities.

Patent Filings: Search patent databases for insights into R&D focus.

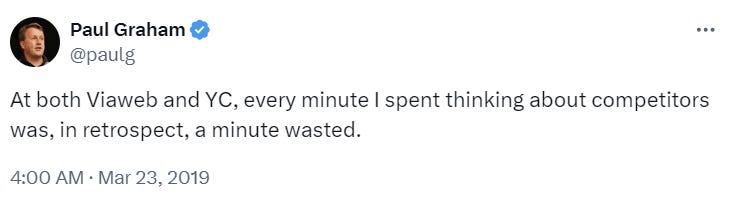

You can leverage this competitive analysis in your pitch deck or business planning. But do investors care about the competitor analysis slide? YES…. but Paul Graham has a different opinion -

Agree or disagree? most Y Combinator startups attendee, spend more time doing competitive analysis. 👀

You can download the Competitor Analysis Excel Sheet Here.

PARTNERSHIP WITH US

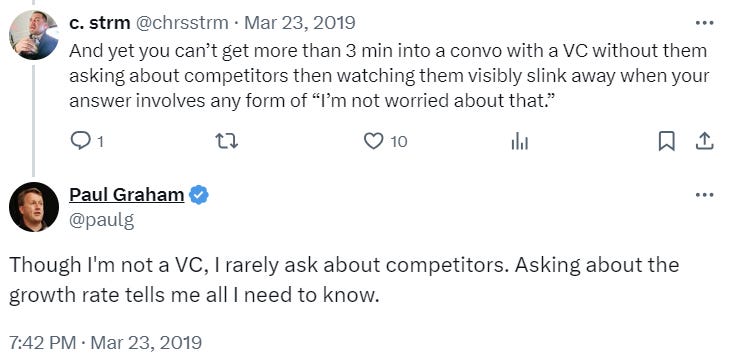

We Write, Design & Model Your Pitch Deck.

Decks get you meetings. Without meetings, you have no shot at getting funded. Investor meetings get you funded.

However, most founders fail to impress investors through their pitch decks. Many make mistakes by adding the wrong content and including too many - around 10-15 - slides. Investors don't like that.

If you're feeling confused while building a pitch deck, we can help. We've created an internal team of experts, designers, and investors to build and review your pitch deck.

Schedule a call with us today →

QUICK DIVES

1. How to recognise great problems with high sales potential?

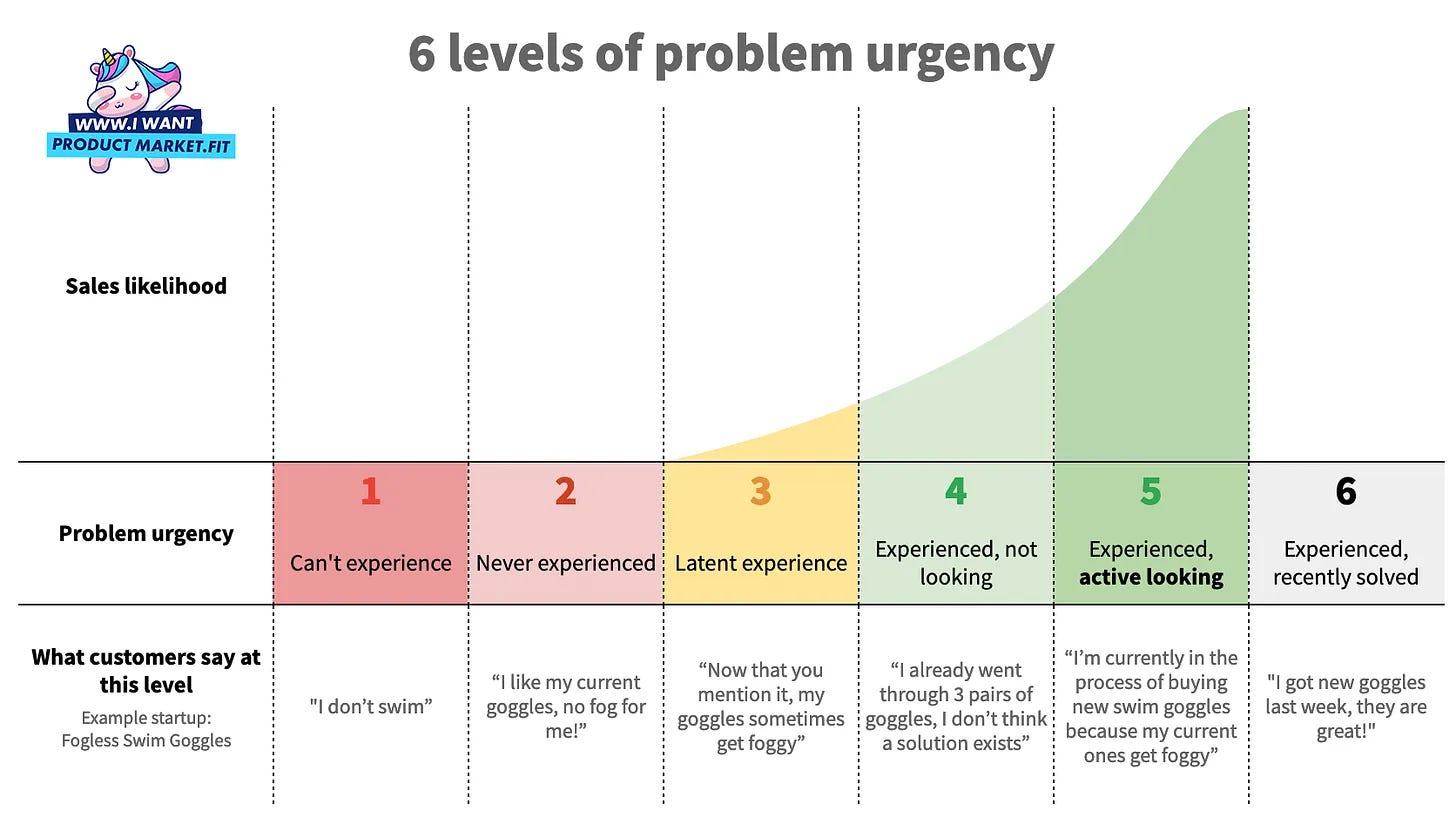

Everyone talks about solving customer problems, but not all problems are worth solving, as some lack sales potential. Consider this: while some customers may be indifferent to your solution, others are desperate for help. Understanding this difference is crucial. Jeroen Coelen has shared 6 ways people relate to problems, and only some of them lead to actual sales. Let me break it down:

Level 1: Cannot Experience

These people don't understand the problem at all

Skip them - their feedback won't help

Level 2: Never Experienced

They've never faced the problem

Not worth pursuing as customers

Level 3: Just Realizing

Have the problem but hadn't noticed it before

Good for testing your marketing message

Can become customers if your pitch works

Level 4: Gave Up Looking

Have the problem but stopped trying to fix it

High sales potential if your solution is better

They're tired of bad solutions

Level 5: Actively Looking

Best potential customers

Ready to buy now

Hard to find and decide quickly

Level 6: Just Found Solution

Don't try to sell to them

Learn from what solution they chose

What to do based on who you find:

Finding Level 1-2: Wrong target market. Change who you're talking to.

Finding Level 3: Adjust your target market or wait for them to realize they need help

Finding Level 4-5: Perfect! Focus on selling.

Finding Level 6: You're too late. Find ways to reach people earlier.

Remember: Only Levels 3, 4, and 5 are likely to buy. Focus on them.

Also, many founders became discouraged and demotivated when they couldn't find customers to try their product at an early stage. I highly recommend focusing on customers who are at Levels 4-5 i.e. people with hair on fire.

Jeroen Coelen has shared two more articles where he discusses how to use this model to identify launch customers for your beachhead market, including a case study. I highly recommend reading these articles.

2. Framework: The Three-Factor Freemium Assessment for Startups.

Deciding whether to offer a freemium model is a common dilemma for founders. Many try out freemium strategies, but not all SaaS companies can replicate the success of Dropbox or Typeform. Done wrong, freemium can end up cannibalizing your paid user base while also draining your company’s precious engineering and customer support resources.

So how can you determine if it's the right move for your company? The most reliable way to find out is through A/B testing. However, getting solid results can take a long time, especially if you're looking at the impact on virality and your viral cycle is six months or longer.

If you can't wait that long or aren't set up for a full A/B test, consider these "Three Factors for Freemium Strategy":

Does your paid plan have a gross margin of 80–90%?

If you have a lower gross margin — for example, because your product is not fully self-service, requires extensive customer support or is extremely costly in terms of tech infrastructure — freemium will probably not work for you.Does your free plan attract the right audience?

If your free users are too different from your paying users, your free-to-paying conversion will be low — and you’ll risk developing your product for the wrong audience.Is your product inherently viral?

If your answer is no, that doesn’t make it a complete no-go, but it does mean that it’s much less likely that freemium is right for you.

In the end, freemium only makes sense if a certain percentage of your free users do one of three things: 1) Eventually convert to paid, 2) refer paying customers, or 3) provide the kind of valuable feedback that will improve your product. A freemium product that fails to achieve any of these effects will merely saddle you with extra costs and distract you from servicing your most important users.

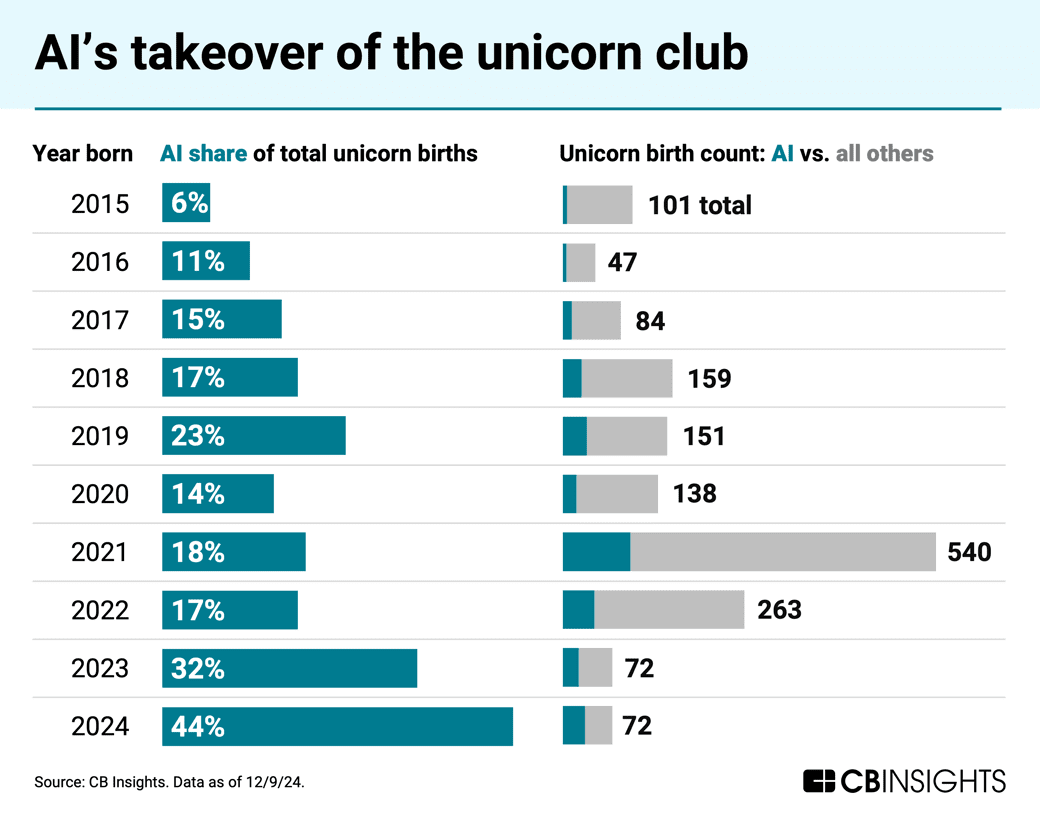

3. Inside the AI Unicorn Club: What Makes These Startups Special.

According to the CBInsights report, There are 1,249 unicorns (private companies valued at $1B+). Nearly one in two new unicorns is an AI company.

AI dominates new unicorn creation

Nearly half (44%) of new unicorns in 2024 are AI companies.

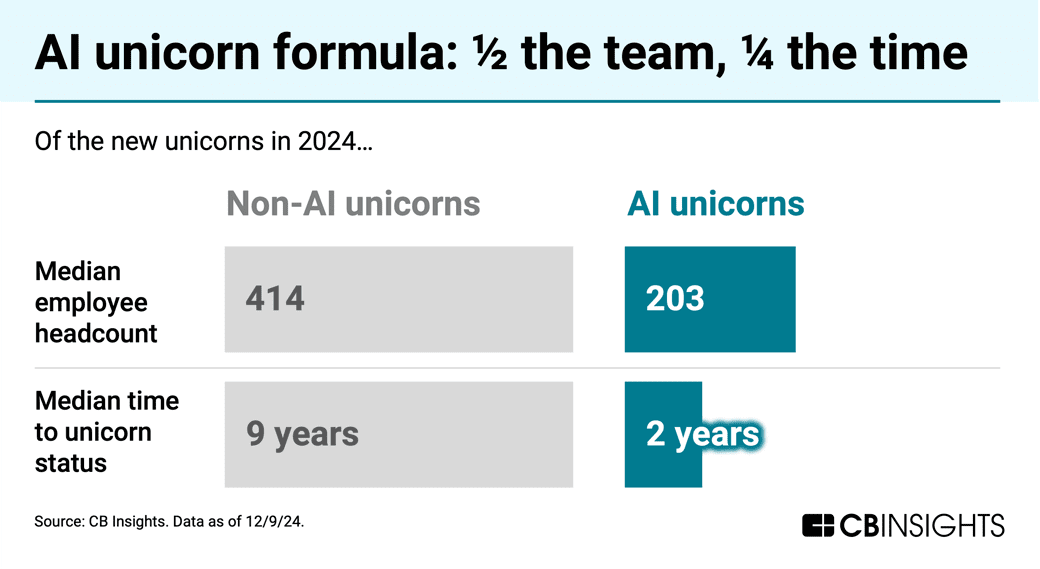

And the median AI company is reaching unicorn status in just 2 years.

That’s far faster than the 9 years it takes for non-AI companies.

AI unicorns have smaller headcounts

Today’s AI unicorns are hitting unicorn status with much smaller teams. Among unicorns born in 2024, the median non-AI unicorn has 414 employees.

For AI unicorns, it’s just 203 employees per CBI headcount data.

Across the landscape, valuations are under pressure

Over one-third of unicorns haven't raised funding since 2021. Over 100 of these were last valued at exactly $1B. This creates opportunities for PE investors to acquire companies at favourable terms.

You can read the detailed report here.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Microsoft's $23M Investment in AI powered IT Operation Startup. (Read Here)

Trump’s proposed university endowment tax could hurt funding, VC warns. (Read Here)

Google urges US government to break up Microsoft-OpenAI cloud deal. (Read Here)

Apple reportedly developing AI server chip with Broadcom. (Read Here)

OpenAI likely trained Sora on game content — and legal experts say that could be a problem. (Read Here)

Microsoft begins testing the ability to share files between iPhones and Windows PCs. (Read Here)

Google launches Gemini 2.0. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 30,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Venture Partner - Maroon Invest Global | USA - Apply Here

Visiting Analyst Venture Capital - Neotech venture | Germany - Apply Here

Investment Associate - TCV | UK - Apply Here

Velocity Investment Associate - TCV | UK - Apply Here

Blockchain Accelerator Program Manager - Brinc | Hongkong - Apply Here

Office Manager - 645 Venture | USA - Apply Here

Venture Capital Associate - Connecticut Innovation | USA - Apply Here

Associate - Aureolis Venture | USA - Apply Here

Program Manager - Plug and play tech center | USA - Apply Here

Head of TS Bridge - Turbostart | India - Apply Here

Partner 18, Deal Operations - a16z | USA - Apply Here

Portfolio Analyst Intern - plug and play tech centre | USA - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Get access to our all-in-one VC interview preparation guide—check it out here. For a limited time, we are offering a 30% discount. Don’t miss this. (Access Here)

Early Stage Startup Financial Model Template For Fundraising (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)