How To Find Problem-Solution Fit? (A Framework) | VC Jobs

Create Founders Agreement, Answering "Why now" & Write Monthly Investors Updates.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: Framework To Find Problem-Solution Fit.

Quick Dive:

How to Create a Founders Agreement That Works?

How To Answer 'Why Now’?

Struggling to raise funding: Write Monthly/Bi-weekly Investors Updates.

Major News: China’s AI model beats OpenAI, xAI now worth more than what Musk paid for Twitter, OpenAI considers taking on Google with browser, Microsoft unveils a cloud mini PC, FTX CTO avoids prison time despite guilt.

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

THE MOST EMERGING STARTUP YOU CAN'T-MISS

Peony: The Smart Way to Share Files

Ever sent a file and thought, "I hope they look at this"? (Yeah, we’ve all been there!) Enter Peony, the startup that’s redefining how we share files. Imagine personalising your attachments with AI and tracking exactly how your audience engages with them. No more guessing games!

Peony is built for founders, VCs, and sales teams who want to make every interaction count. It’s not just about sending files; it’s about creating connections that lead to faster deals.

Partnership With Us: Want to get your brand in front of 66,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

A Must-Read Guide for Aspiring Venture Capitalists. (Link)

Promise-market fit is an early signal that product-market fit is possible. Why & How? (Link)

Cap Table Guide for Founders (Link)

Access to 10000+ VCs verified email contact database. (Link)

Why you shouldn’t giveaway startup equity to advisors (Link)

9 lessons from 20 years of building successful software and hardware companies (Link)

Why “wrappers” may not get swallowed by foundation models (Link)

Definitive list of things startups did that didn’t scale (Link)

14 ways the tax code is written in favour of business owners (Link)

A few design principles to steal from AirBnB (Link)

Marc Andreessen on the importance of startup timing (Link)

Positive signals to look for when hiring engineers (Link)

The 3 things your company needs to make AI act like an engineer (Link)

Sam Altman on the early, difficult times at OpenAI (Link)

Download Startup Fundraising Pitch Deck Templates. (Link)

TODAY’S DEEP DIVE

Framework To Find Problem-Solution Fit.

90% of startups fail within their first year of operation. It is a sobering statistic that highlights just how difficult it can be to get a new business off the ground.

There’s just a lot to consider, from developing your product to finding the right customers. But one of the most crucial aspects of a successful startup is ensuring that your solutions fit the problem you’re trying to solve.

We’ll discuss what Problem-Solution fit is and how startup entrepreneurs can ensure they have it. I’ll also share some tips on how to identify the right problems to solve and offer some tools to do this right.

So if you’re building your venture, read on!

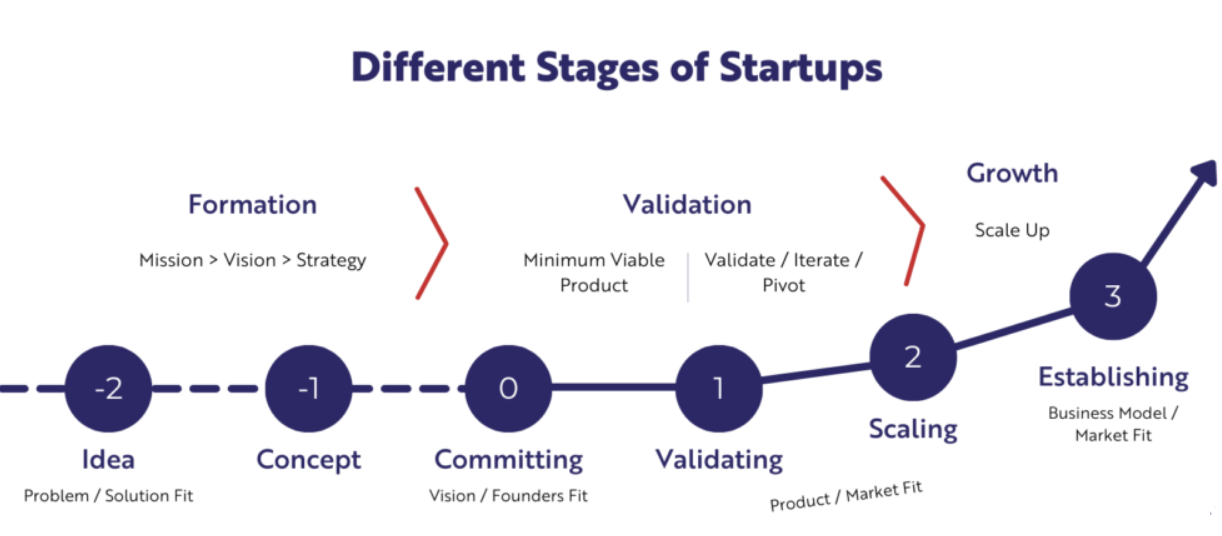

Where Does Problem-Solution Fit in Your Startup Journey?

In The Startup Owner's Manual, Steve Blank highlighted all successful startups start by learning about problems:

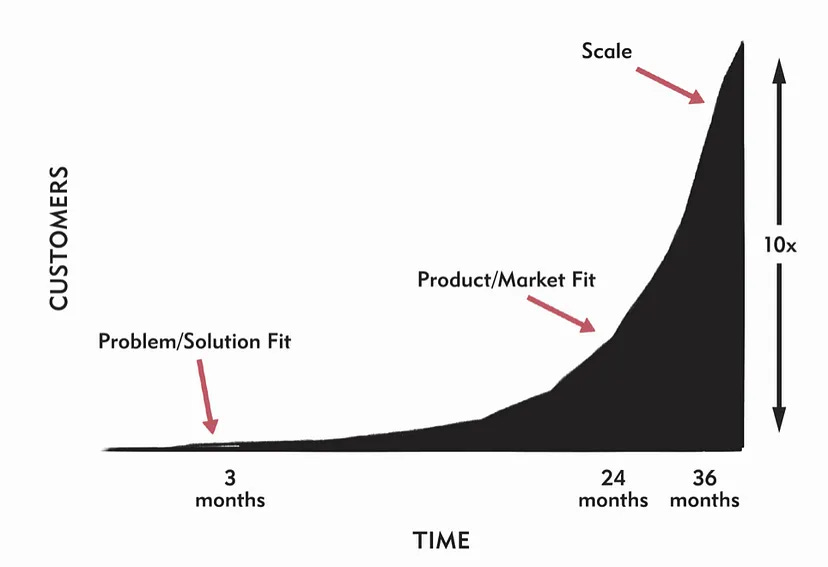

The first stage of a successful startup begins with finding a Problem-Solution Fit. This is when the founders discovered a deep customer problem in an underserved market. There is a lot of pivoting and working closely with a few sets of customers.

Then they move on to Product/Market Fit, where the startup has found a way to sign up customers, retain them and get healthy revenue in a large enough market.

Lastly, the startup moves into the Scale stage, focusing on expansionary growth and telling even more customers about their products.

So, What Is Problem-Solution Fit?

Problem-Solution Fit (PSF) is when founders have discovered a deep customer problem in an underserved market. This stage is generally very early and often in the seed or pre-seed stage.

Take Airbnb as an example.

The founders identified a problem when they started renting out their rooms to earn extra money. Then, they created a platform to help even more people earn extra income—the solution.

Their Problem-Solution Fit moment came when they received their first bookings during the Industrial Design Conference in 2008, then again via the Democratic National Convention in Denver.

They learnt that large events with hotel shortages were their secret sauce for growth. Armed with the problem-solving opportunity, they applied for Y-Combinator and got in. They expanded into New York (where there are always hotel shortages), and the rest is history.

Every successful startup starts from finding Problem-Solution Fit → then Product-Market Fit → then Scale.

Where are you now on that journey?

So, How Do You Find a Problem-Solution Fit?

As a founder, the moment you’ve thought of your idea, you’ve subconsciously started looking for PSF.

The Problem-Solution Fit takes shape slowly from a blurry gassy form to a fluid liquid form and eventually a tangible, solid form.

Some founders do this consciously, some intuitively:

Blurry Gas Form:

In this form, founders identify a problem and a solution that makes perfect sense in their minds. They either write it down or keep it in their minds. The product lives in the founder’s imagination, without evidence.

Fluid Liquid Form:

Next, the founders identify a solution and ascertain whether their audience resonates with it. They’ll attempt to attract early evangelists and iterate through landing pages, demonstrations, or prototypes.

Tangible Solid Form:

In this form, founders leverage demonstrations from digital prototypes, videos, sticky-tape solutions, and experiments to assess the efficacy of their proposed solution. The savvy founders will try to convert some early evangelists into paying customers.

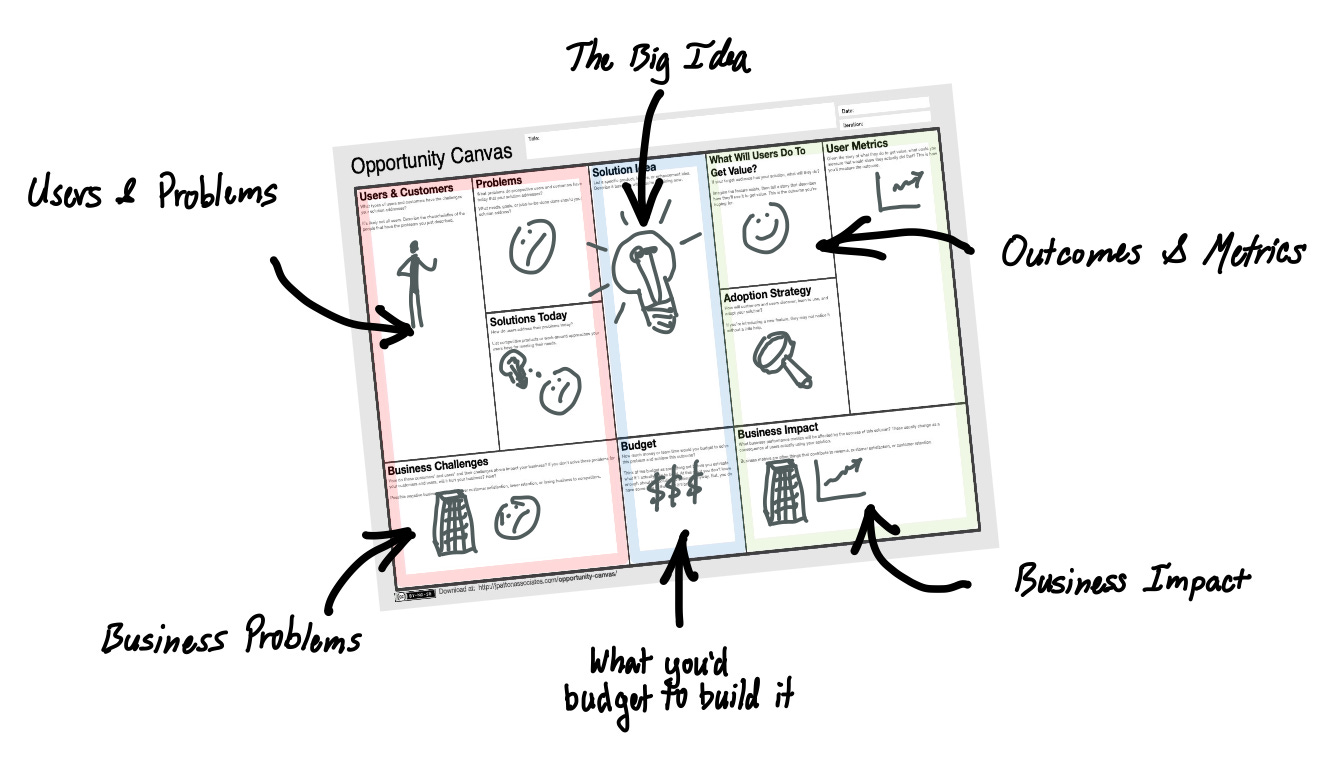

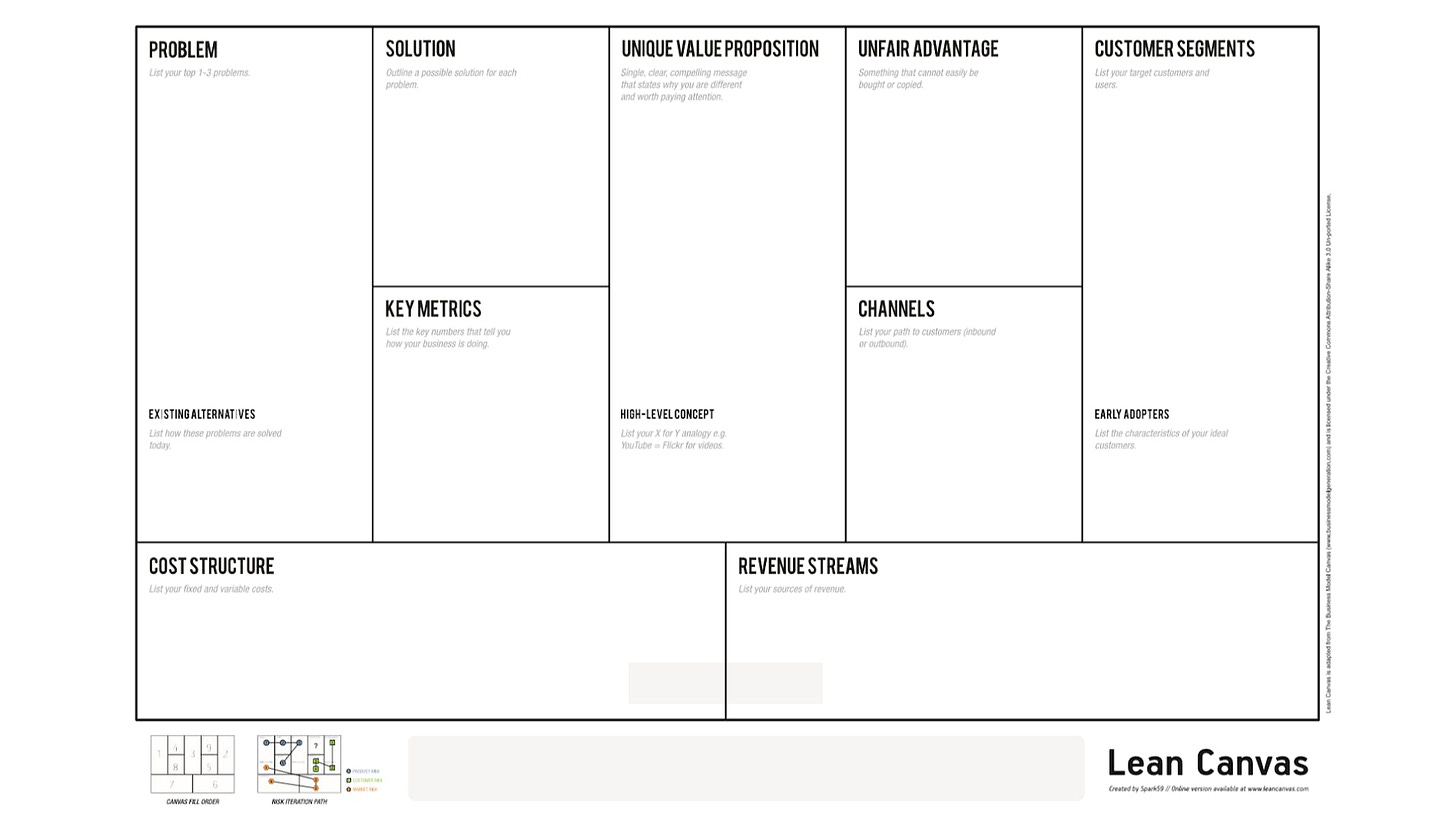

During these 3 phases, it’s best to use a tool to capture the idea as it evolves from gas, liquid and solid forms. It’s important to highlight the assumptions as the idea evolves and validate them. Here are 3 great tools to help you with this:

1. Jeff Patton’s Opportunity Canvas tool is my favourite tool as it focuses more on product discovery and customer problems.

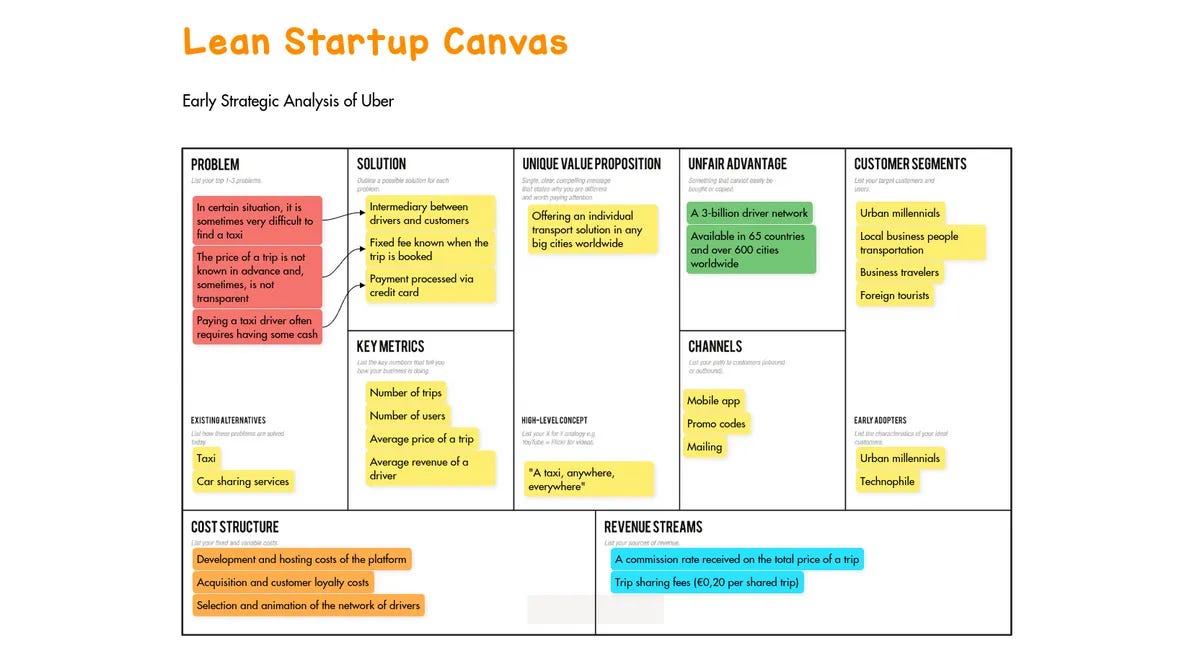

2. The Lean Canvas tool is always a great choice for startup founders. The Lean Canvas is more holistic for your startup, whilst the Opportunity Canvas focuses more on the product.

Let’s look for Uber example -

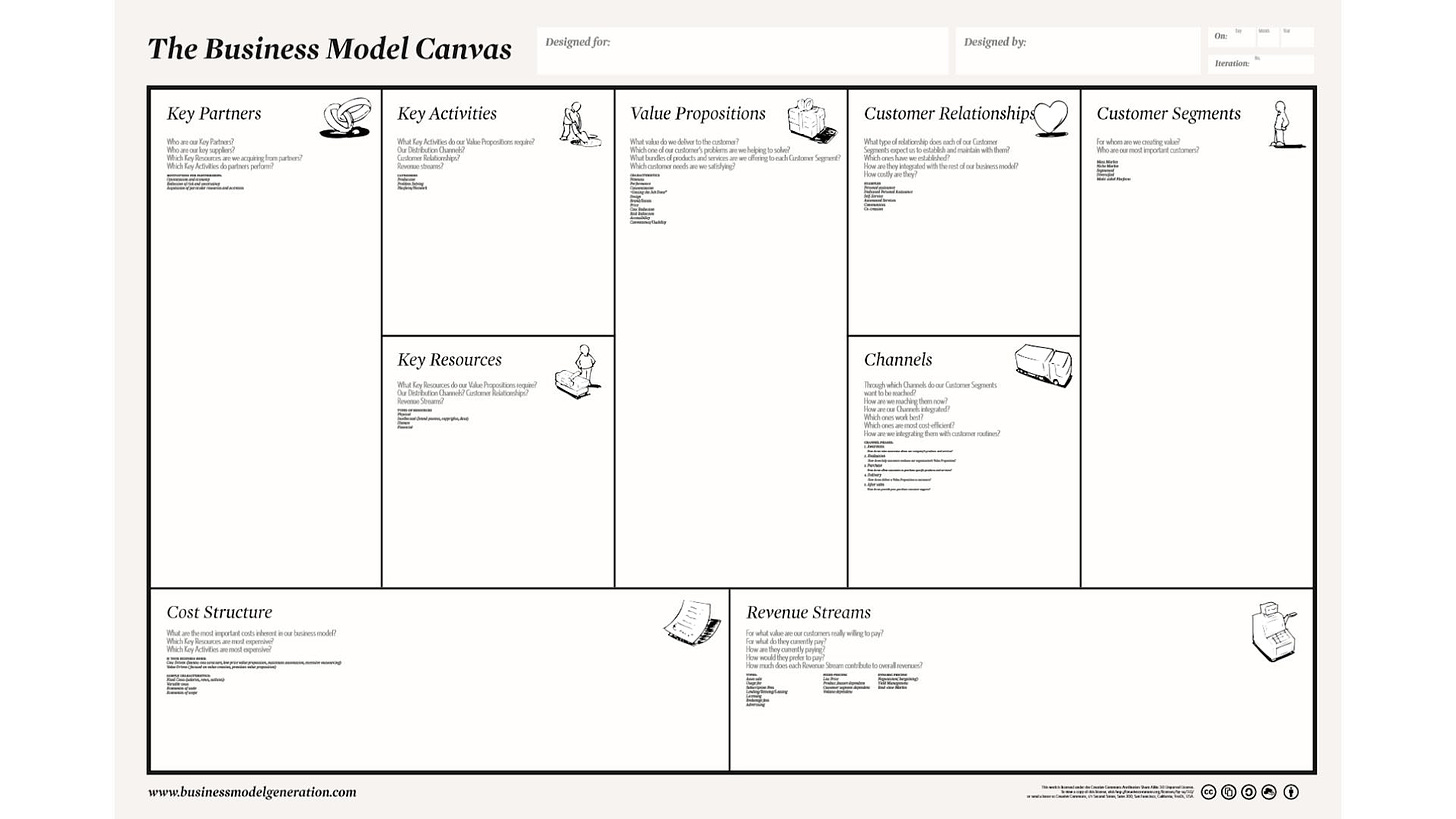

3. If you’re building a B2B product, the Business Model Canvas is a great option as it highlights partner channels and key resources you need to get started.

Write down your idea, and spend the time to validate your problem-solution with your early customers. From my experience, it takes 3 5 rounds of validation to arrive at a clearer understanding of the problem, the customer, and the solution.

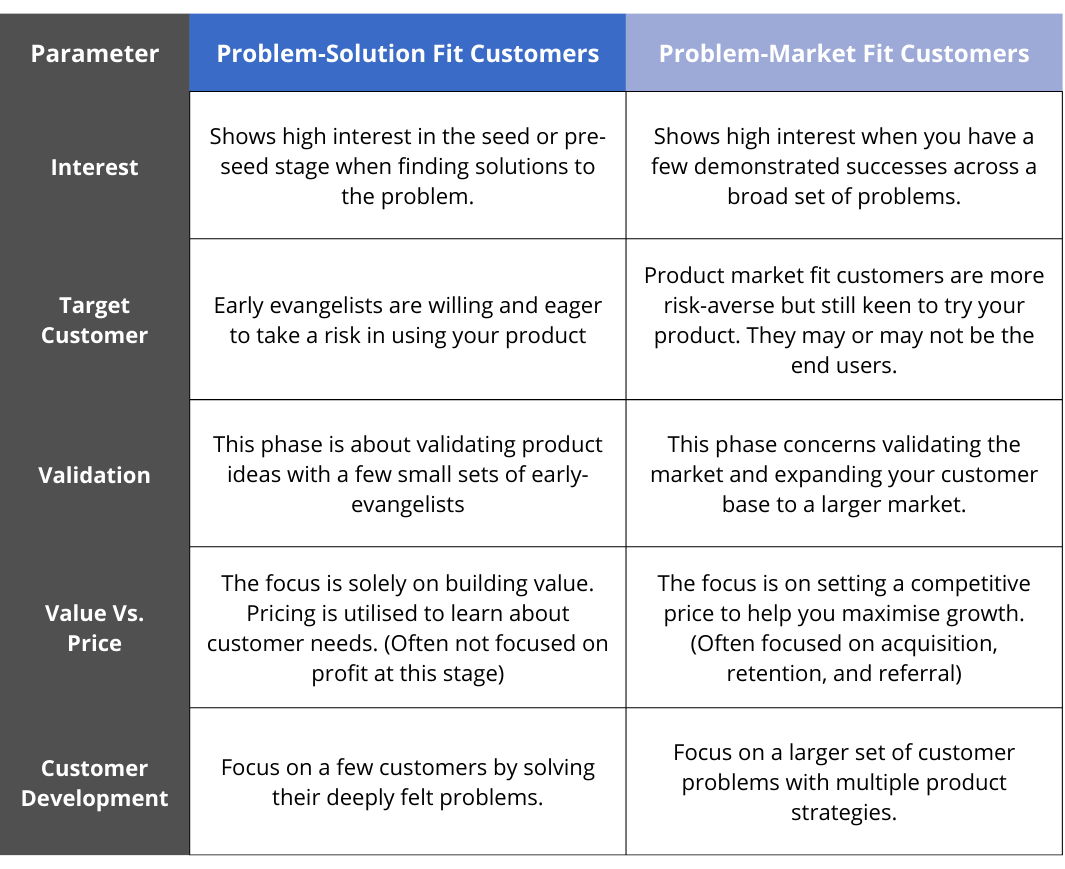

Problem-Solution Fit vs Product-Market Fit

Problem-Solution Fit and Product-Market Fit are often a point of confusion for early founders. On the surface, these two definitions are virtually identical = find a valuable product in a big enough market. However, the solutions in the Problem-Solution Fit stage are often different to those in the Product-Market Fit stage.

This is because Problem-Solution Fit focuses on a tiny group of early-evangelists who are comfortable with missing features, as long as it solves their core problem. (Bad UX, no onboarding, and manual work-arounds are part of the fun!)

Whilst solutions during the Product-Market Fit stage focus on selling your product to a larger mainstream market. These solutions need to have a more robust set of features. (Reliability, Security, Reporting, and a decent UX is a common ask for these customers).

Problem-Solution Fit Example

David Wang, founder of product academy shared this example - “A great example I’ve experienced recently was assessing a content moderation tool for the company I currently work for.

My company is on a mission to create the most trusted destination on the internet. We want to moderate all content hosted on our platform to protect visitors.

Our team scoured the internet to find a tool that fit our requirements. After weeks of searching, we came across a startup that friends in the industry highly recommended. Their product was easy to use, had an AI engine that makes our lives easier, and had a few customers using it - a great demonstration of Problem-Solution Fit!

However, due to the size of our remote-first workforce, information security was a key need for us. We require features like Single-Sign-On and specific security certifications that the startup didn’t offer.

As a result, we ended up choosing another tool with fewer features but focused on a more robust set of features on information security. When we broke the news to the founders, they were disappointed but understood their product wasn’t right for us.

We departed amicably, and the startup will reach out again when they have the security features we require.

Now… could the startup have built the security features that we need? Absolutely.

But more importantly, was my company the right customer for them? Probably not.

They were focused on smaller startups with different sets of needs. To change their product just for my company would’ve meant overheads that were not worth it for them.

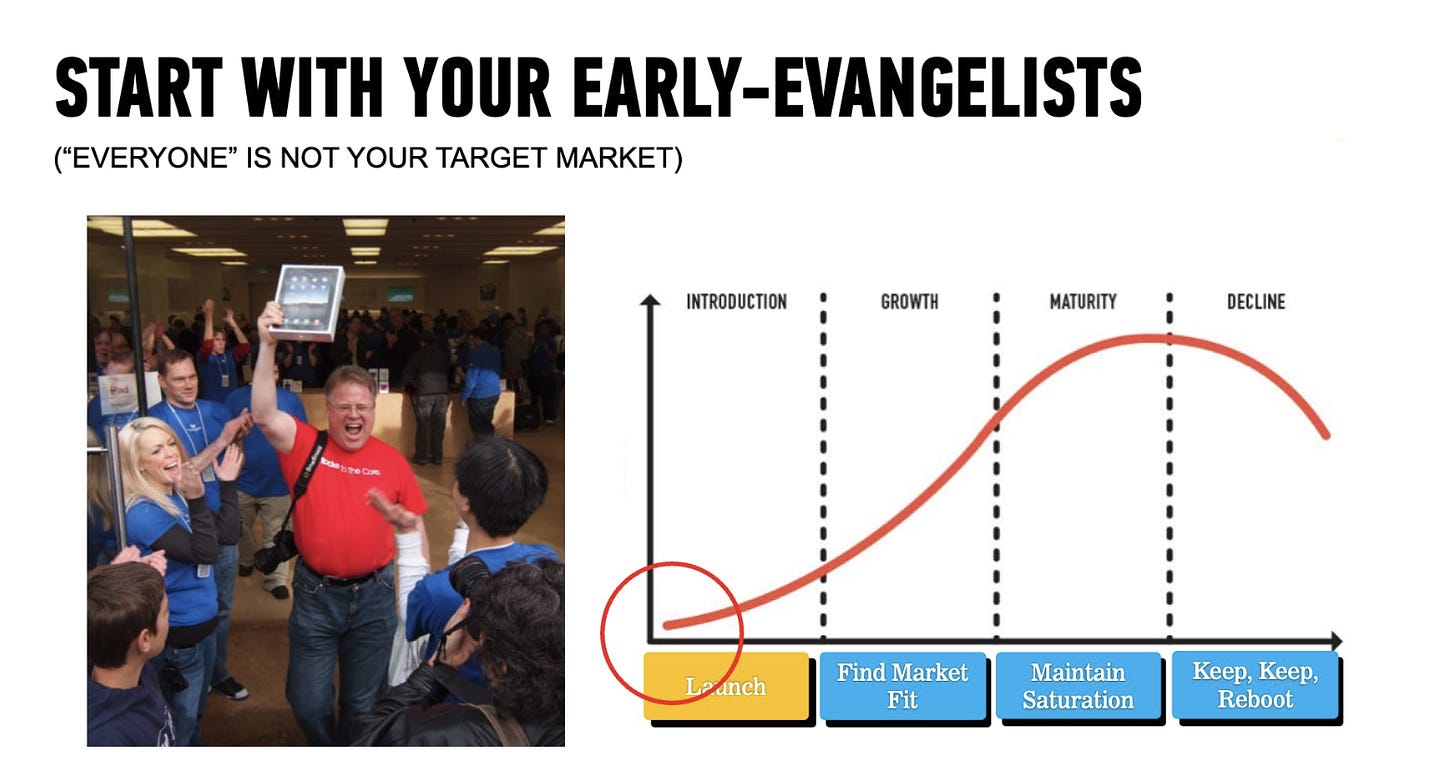

The moral of the story is that “everyone” is not your customer.

When you’re trying to find Problem-Solution Fit, your customers must be your “early-evangelists”—these are customers that would scream and shout about your product.

Once you’ve found a strong base of “early-evangelists" you can move into a bigger market to find Product-Market Fit.

Here is a quick comparison between your PSF customers vs your PMF customers:

Selling to your early evangelists

Your early evangelists are the catalysts of your product. These customers are willing to risk buying an unfinished product to gain an early competitive advantage or purely for bragging rights. (P.s. Bragging rights are never long-term strategies but it can get you off the ground).

In the B2C space, they might be your techy friends who are always trying out new things.

In the B2B space, this could be an executive testing a new business opportunity or a head of a function trying to solve a burning problem.

The ultimate test for early evangelists is their willingness to pay for your product. When presenting your product idea to your ‘evangelists’— don’t be afraid to ask for a sale. If there are signs of hesitation (from both sides), you are not solving a problem deep enough.

Go deeper and ask: “What would make you pay a small deposit for this product?”

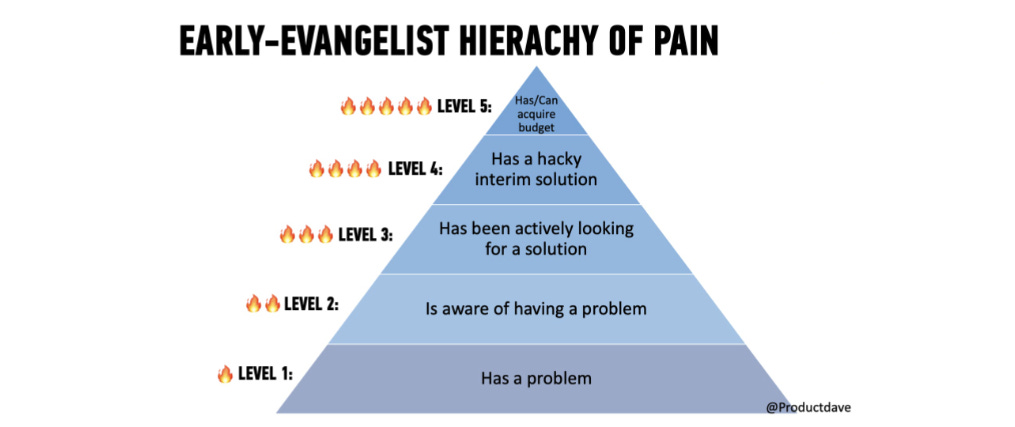

Early-evangelist hierarchy of needs

Like a product, the early evangelist goes through 5 stages of pain. The ideal customer is someone who is at the highest level and has the budget ready to buy something to solve their problem.

These are the five stages of pain your early evangelists go through:

Pain Level 1: They have a problem or a need

Pain Level 2: They understand they have a problem (or you’ll need to help them discover a problem)

Pain Level 3: They are actively searching for a solution to the problem, and have a timeline for finding it

Pain Level 4: The problem is so painful that have cobbled together an interim solution

Pain Level 5: They have committed budget or can quickly acquire a budget to purchase a solution

The closer to the top of the pyramid, the more likely they will buy your product, and even spread your vision for you.

So, where do these early evangelists hang out?

Let’s think about the last time you were in a market to purchase a property or looking for a place to rent. Where did you go?

You’d probably start with a Google search on a suburb or use a real estate website. You might ask your friends and family or even walk into your local real estate agency.

If you’re looking for your early evangelists, they won’t come to you directly—you need to go where they are looking. Cold calling rarely works because it’s hard to identify your customer's pain level in one single call. Better to invest your luck in one of the five strategies below.

These are 5 Key Strategies To Find Early-Evangelists:

1. Leverage your network

Ask your existing friends, family, colleagues, investors or even LinkedIn to connect with people experiencing the problem you’re trying to solve. Offer to advise, free work, kudos, or anything your network finds valuable in return.

Practice give-give-get. Always give more value to your network than you get from them, and people are willing to help you.

2. Find the virtual “Gathering places”

These are online or offline gatherings where your early evangelists go to find a solution to solve their problems. Places like forums, social media groups, Twitter, slack groups or even shared offices.

Be active and generate conversations around the problem you’re trying to solve, and of course, give-give-get.

3. Events

Attend conferences, seminars, trade shows and meetups where your early evangelists go for pleasure or work. Or, if there are no events for your problem space, create one yourself and use your network and the ‘gathering place’ above to spread the word.

You’ll make a conversation topic that shows you deeply care about helping your customers solve their problems.

Pro Tip

Find a way to access the attendees' list so you can reach out beforehand and set up 1:1 time with potential prospects. The networking starts BEFORE the event begins.

4. Paid advertising

In some instances, paid advertising might be a great way to get your startup in front of people. I’m broadly using the term ‘paid advertising’ to involve more than just Google ads. Think about paid sponsorships, paid ads in a newsletter, paid influencers, or anything that you can use the money to acquire attention. Make sure you have a clear “what’s-in-it-for-me” call to action to turn your prospects into conversations.

5. Agents, partners or consultants

For more complex industries, you might have to go through agents, consultants or partners that already have an established footing with your customers.

A typical example is breaking into the enterprise sector would require you to go through a few ‘approved’ vendors for you to have a ‘ticket to play’. You can sell your product through existing vendors/consultants or build apps through a marketplace like Slack Apps or Salesforce Marketplace. Partnerships are great for getting your foot in the door and finding early customers.

Play long-term games with long-term people. Grow with your early evangelists, and they’ll spread your product for you.

Finally, develop the product for the Few, not the Many

The sweet spot for startup success lies in the intersection of a meaningful problem and the right solution. In a startup, the first product is not designed to satisfy a mainstream customer, and that’s okay. No startup can afford to build a product that suits every customer and be successful at it.

All great products start with finding a Problem-Solution Fit. Be prepared to pivot, persevere and even kill off bad ideas. Always remember:

You’re creating a product for your customers, not your ego.

Find your early evangelists to pay for the problem you solve, and solve it well.

As a founder, time is your most valuable resource, not money. Do everything to preserve it.

If you're a founder seeking guidance, look no further than the must-follow resources meticulously developed by Antler's Academy. (Featured Article)

PARTNERSHIP WITH US

We Write, Design & Model Your Pitch Deck.

Decks get you meetings. Without meetings, you have no shot at getting funded. Investor meetings get you funded.

However, most founders fail to impress investors through their pitch decks. Many make mistakes by adding the wrong content and including too many - around 10-15 - slides. Investors don't like that.

If you're feeling confused while building a pitch deck, we can help. We've created an internal team of experts, designers, and investors to build and review your pitch deck.

Schedule a call with us today →

QUICK DIVES

1. How to Create a Founders Agreement That Actually Works? - Download Template

Starting a business with co-founders is like embarking on a long road trip together. While the journey can be more enjoyable with partners who complement your skills, even the strongest relationships need ground rules. This is where a founder agreement comes in.

Simply put, a founders agreement is a legal contract between company founders that sets clear guidelines for their business relationship. Think of it as a roadmap that outlines everyone's rights, roles, responsibilities, and expectations from day one.

Why You Need One

While not legally required, having a founder agreement is crucial because it:

Prevents misunderstandings by getting everyone on the same page

Provides a clear structure for handling disputes

Shows potential investors you're serious and well-organized

Protects both your business and personal relationships

As Simon Bacher, CEO of Ling, puts it: "My wife and I co-founded our startup, and we saw a founders agreement as essential - think of it like a prenup for your business."

Key Components of a Strong Founders Agreement

1. Basic Company Information

Company name and founders' details

Business mission and goals

Ownership structure

2. Roles and Responsibilities

Each founder's specific duties and areas of authority

Clear job titles and their limitations

Flexibility for role changes as the company grows

3. Decision-Making Powers

Voting rights

Process for major decisions (hiring, firing, strategic changes)

How to handle deadlocks

Veto powers

4. Equity and Vesting

Each founder's ownership percentage

Vesting schedule (typically four years with a one-year cliff)

Conditions for receiving full rights to shares

Compensation plans

5. Commitments and Resources

Expected time commitment from each founder

Initial capital contributions

Intellectual property rights

Other resources (industry connections, expertise)

6. Exit Planning

Conditions for dissolving the company

What happens during an IPO

Handling of unvested shares

Non-compete and non-solicitation terms

Now that you know what goes into this document, here are a few founder’s agreement templates and examples to help you craft your own.

University of Pennsylvania Law: Includes provisions about ownership structure, transfer of ownership, decision-making and dispute resolutions, representations and warranties, and choice of law

Harvard Business School: Includes provisions on ownership, competition restriction, and exit situations

You’re going to go through many ups and downs with your partners. Creating a founders agreement is an excellent way to ensure you’re all protected throughout your business journey.

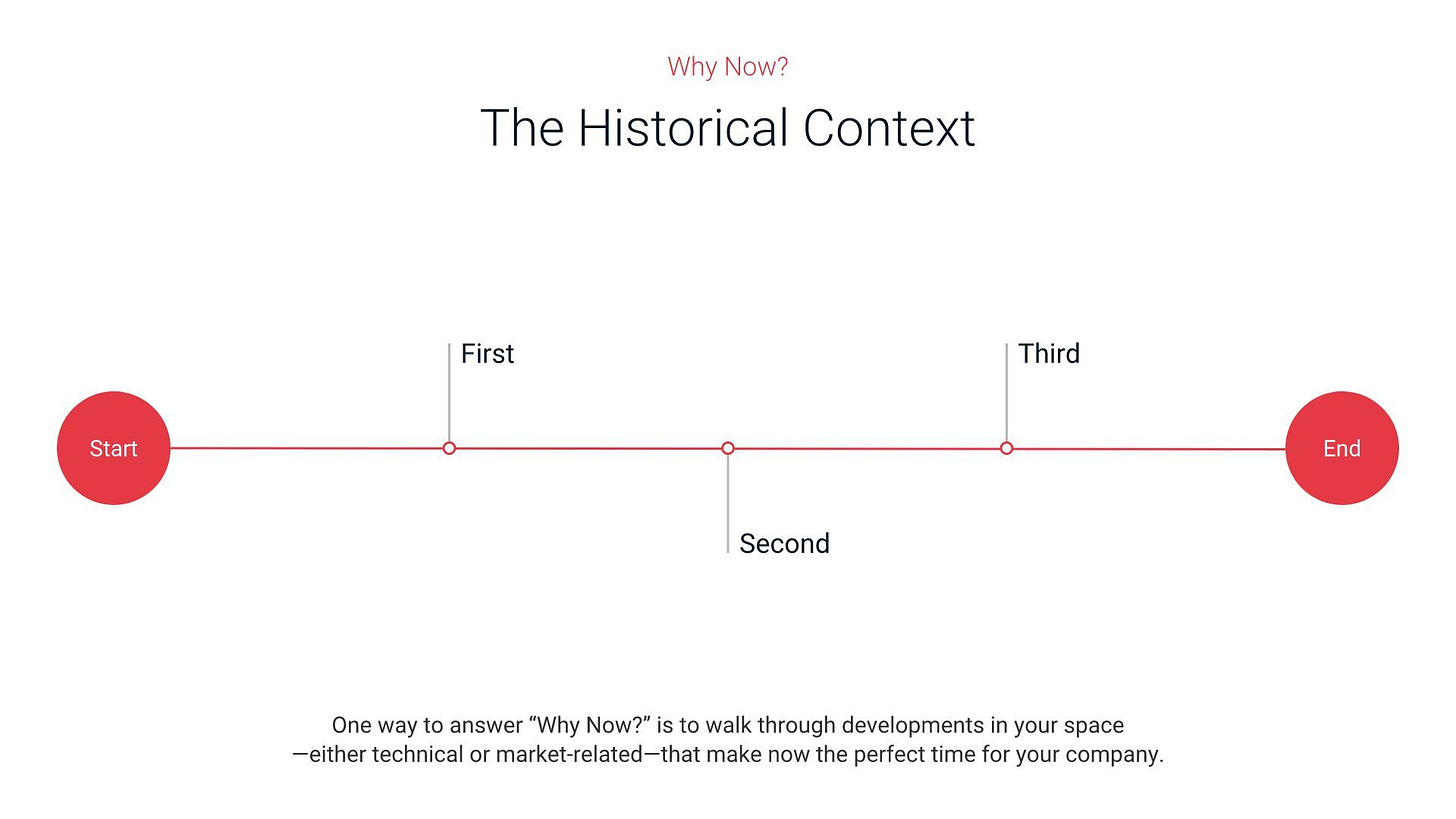

2. How To Answer 'Why Now’?

When talking to investors, you’re answering the what (product), why (mission), where (if relevant) and how (strategy and go-to-market).

But founders often ignore another important question: Why now?

Why wouldn’t it have been possible to have built the company five years ago? Why would five years from now be too late? The answer is often related to something that is shifting and changing, either in the market or with the technology layer.

Successful companies usually have these things in common: "They were the right company, solving the right problem at the right time.

Showing that you know why you’re launching now will create a sense of urgency & Investors won’t want to miss out on a business that’s solving immediate problem.

It’s your job to highlight the ways your company can address those issues and why now is the right time to do so.

The “Why now?” question can be answered in some ways, but it usually boils down to at least one of these three things:

technology timing,

market timing or

regulatory timing.

Some examples are that electric Vehicles Are becoming mainstream as lithium-ion battery costs have dropped, enabling longer range and affordable pricing parity with gas vehicles.

Successful companies like Google, Facebook, and Apple capitalized on identifying trends early and offering user-friendly solutions, ultimately dominating their industries.

So you can use your timing narrative to reiterate some of the biggest strengths of your startup. You should explain the macro dynamics of your space, how the market is evolving and how new technological innovations make your company possible when it wouldn’t have been before.

Remind the investors how changes in regulatory frameworks are opening new opportunities. That includes demographic shifts, technology shifts, market shifts & significant changes in how work is done (the gig economy, working from home, remote-first companies).

Many of these trends are somewhat predictable, and the best startup founders know how to spot them and leverage them to their advantage.

Also, It’s an opportunity to remind investors how your team has been in this industry for a long time. Something like, “I saw all of these shifts happen when I was a VP of investment banking at Goldman Sachs for 15 years,” is a great way to remind the investors that you have both experience and in-depth domain knowledge.

The “Why now?” is partially about history, but remember that it’s not a history lesson; it’s about trends. You can use past data and innovation to draw a trend line toward the future. Combine that with what your company is doing and where it is going.

The perfect “why now” slide has a fast-moving puck and a startup moving at breakneck speed to intercept it where it’s going to be in five years.

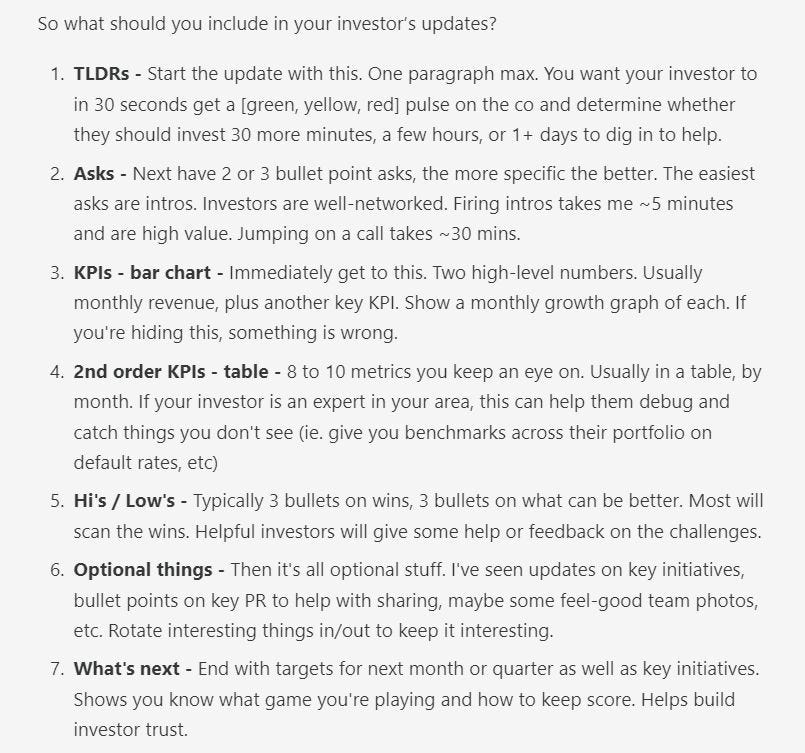

3. How to Write Monthly/Bi-weekly Investors Updates? - Email Template.

Struggling to raise money for your startup? Do this: Write a monthly/bi-weekly update with all the progress you are making on the business.

When someone passes on the company, ask them if they would like to be put on your updates. Send every single update on time.

This works for two reasons:

Investors invest in the trajectory of companies & people. It's impossible to get a trajectory without watching a narrative unfold with time.

If you do what you say you are going to do and document it, this puts you in the top 5% of founders.

You can include 7 things in your Monthly Update email :

Think of your investor update as a chance to show investors what you’re made of.

It’s not just about the numbers and milestones — it’s about giving them a peek into how you think, how carefully you’re paying attention to the details, and just how far you can take your startup.

Most founders believe that cold outreach is not the best way to connect with investors. As an investor, I can say that this method (cold emails) consistently outperforms referrals by a long shot. Why?

Outbound cold email scales several orders of magnitude better than referrals — you can find 99.9% of anybody’s email. Raising capital is a shots-on-goal game; you want to maximize top-of-funnel pitches. Optimizing your fundraising for referrals will put you on a local maximum

It’s a challenge finding somebody who will stick their neck out to refer you. People rarely want to use their political capital referring you to a *highly important person* in their network, therefore at best you’re left with lousy double opt-in email.

In the same period, you can get 1 referral, I can set up 50 investor pitches. I hope you get the points.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Blue Bear Capital, a software-focused climate tech venture firm, raised $160M for its third fund. (Read Here)

DeepSeek, a Chinese AI research company, has introduced DeepSeek-R1 to compete with OpenAI’s o1 by effectively fact-checking itself. (Read Here)

Elon Musk's AI company, xAI, is now valued at $50 billion, which is $6 billion more than the amount Musk paid to purchase Twitter. (Read Here)

OpenAI is reportedly exploring the development of a web browser integrated with ChatGPT and discussing search partnerships. (Read Here)

OpenAI engineers accidentally deleted crucial search data from a virtual machine being used by NYT to investigate potential copyright infringement in AI training sets. (Read Here)

SpaceX launched its sixth suborbital test of the Starship from the Boca Chica site, but chose a water landing for the booster, avoiding the 'chopsticks' catch for safety. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 30,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

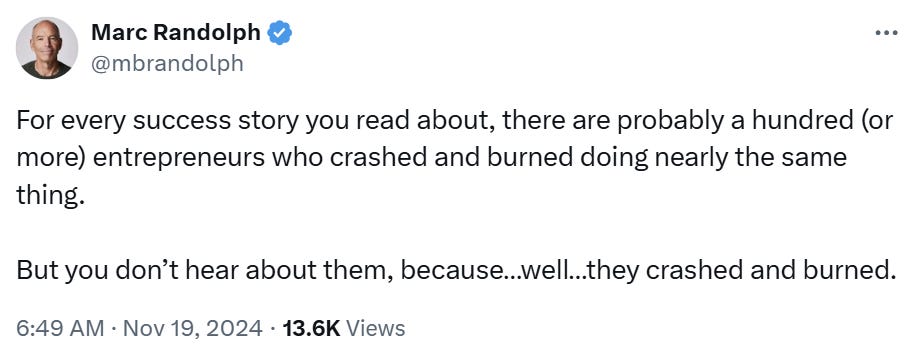

TWEET OF THIS WEEK

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Accelerator and Sales Director - Plug and play tech centre | USA - Apply Here

Operations Associate - Techstar | Japan - Apply Here

Chief of Staff - Akkadian Venture | USA - Apply Here

Growth Associate - B Capital Group | USA - Apply Here

Ventures Analyst I Mobility - Plug and play tech centre | Spain - Apply Here

Portfolio Management Lead - Atlassian Venture | USA - Apply Here

Internships - Dallas Ventrue Capital | India - Apply Here

MBA Associate - Founder Collective | USA - Apply Here

Internship/Stage - VC Analyst & Program Manager - Sopra Venture | France - Apply Here

Chief of Staff - First Round Capital | USA - Apply Here

Associate - 360 Once | India - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Get access to our all-in-one VC interview preparation guide—check it out here. For a limited time, we are offering a 30% discount. Don’t miss this. (Access Here)

Early Stage Startup Financial Model Template For Fundraising (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)