When Should Startups Prioritize PMF Score over NPS? | VC Jobs

New a16z Investment Thesis: The $250B Shift & The Consumer Subscription Trifecta.

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we -

Deep Dive: When should startups prioritize PMF Score over NPS?

Quick Dive:

The Consumer Subscription Trifecta: What Makes Consumer AI Subscriptions Work?

Marketing's Decay Law: An a16z Partner's Perspective.

New a16z Investment Thesis: The $250B Shift.

Major News: SoftBank Vision Fund co-CEO Misra to leave the firm, Perplexity brings ads to its platform, OpenAI to Launch AI Agents In Early Jan 2025, Apple Faces $3.8B iCloud Lawsuit & More.

Best Tweet Of This Week On Startups, VC & AI.

15+ VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH CONTRAST STUDIO

Design Support for Fast-Moving Start-ups

Move fast without breaking things. Go from idea to polished design faster and safer.

Get our continuous design support for only $5,999/month.

Premium quality

Tasks delivered every 2 days

Daily support in Slack

90 min. per week for calls

Access to our exclusive software discount collection totalling over $1mil.

Partnership With Us: Want to get your brand in front of 62,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

Where OpenAI is Investing? (Read)

Guide To Pitch Deck Storytelling - Free Template & Curated Resources. (Read)

Why your startup shouldn’t announce a seed round (Read)

Observations on what happening currently in pre-seed and seed rounds (Read)

The 4 secret ingredients of the best pitch decks (Read)

Why your product idea sounds too complicated and how to simplify it (Read)

A hiring hack for startups (Read)

All-In-One Guide to Negotiating a Venture Capital Round. (Read)

More thoughts on why founder mode is so effective (Read)

6 things startup founders should avoid doing (Read)

How to build an AI side project (Read)

Mastering TikTok to get millions in ARR (Read)

How to promote your startup with $0 (Read)

Why Do You Work - By David Spinks? (Read)

How Netflix designs products for 250M+ users (growth design framework). (Read)

TODAY’S DEEP DIVE

When should startups prioritize PMF Score over NPS?

(PMF Score - Product market fit score & NPS - Net Promoter Score)

One of the common mistakes seen with NPS (Net Promoter Score) is that it is used at the wrong time by most of the founders. Combine this with the fact that it is also a lagging indicator and you get not only misrepresented information but you get it, way, way too late. But there is a simple way to help you make it more effective.

Enter Product Market Fit Score

PMF score simply measures how well your product is meeting your users’ needs.

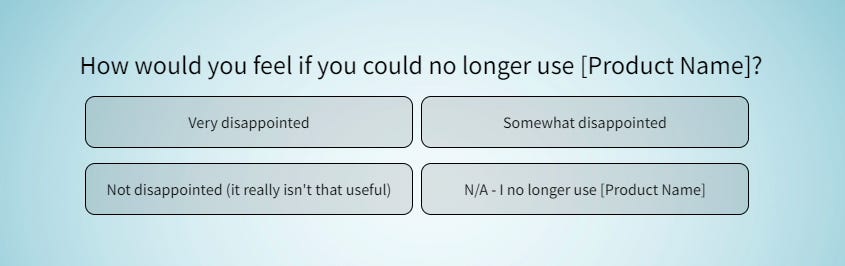

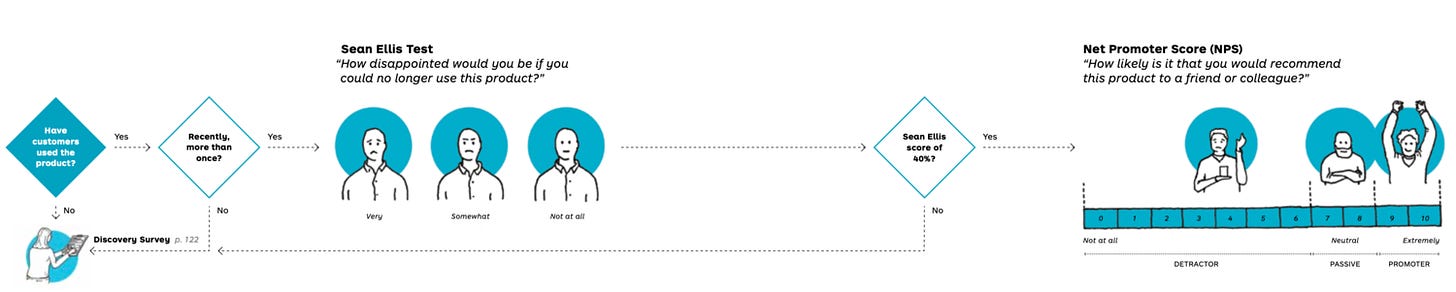

To use it, ask your users how disappointed they’d be if they couldn’t use your product anymore and give them the options of “Very”, “Somewhat”, and “Not at all”

You want over 40% of qualified responses to pick “Very” — that’s an indicator that you’re meeting the core needs of enough users to start hitting actual PMF, which is notoriously tough to measure.

For example -

In 2007, Marc Andreessen, the co-founder of Netscape and a prominent venture capitalist, made a statement that has become a central criticism of the PMF (Product/Market Fit) score.

“You can always feel product/market fit when it’s happening. The customers are buying the product just as fast as you can make it—or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can.”

Basically, you’ll KNOW when you hit PMF without needing a survey to tell you. But the PMF score is still useful as an indicator, before you hit PMF, of whether you’re trending towards it or not. If 28% of responses last month were “Very” but this month it’s 31%, keep doing what you’re doing.

Also — the PMF score was originally created by Sean Ellis, the former Head of Growth at Dropbox who’s also founded multiple startups that were eventually acquired.

When to Use PMF Score

This may seem obvious, but the PMF score is most useful when you’re actively trying to find PMF (either in the early stages of a new idea, or when you’re navigating a pivot).

But this doesn’t only mean in the early days of your startup.

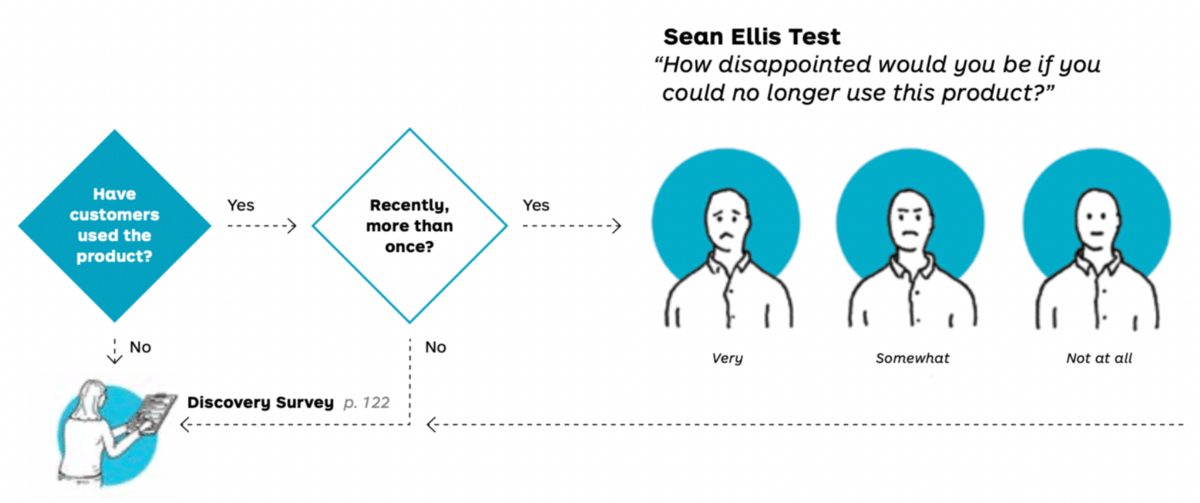

Another, often overlooked point about PMF score is that you should only care about responses given by people who have used your product recently and more than once.

A PMF score from a new user who’s only gone through your signup flow is useless (and not filtering those out can skew the results).

If they haven't experienced the core value proposition recently and more than once, use a discovery survey instead. Include a call-to-action for customer interviews to understand why they signed up. A signup shows the "what" (quantitative), but not the "why" (qualitative).

If they answer "somewhat" or "not at all" disappointed, don't give up. Segment them into groups and dig into why by interviewing them, and looking at referral sources, to understand why the value proposition isn't resonating.

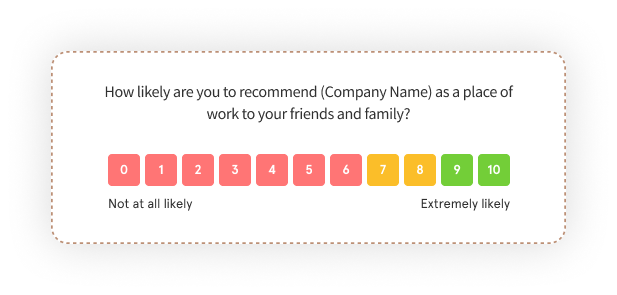

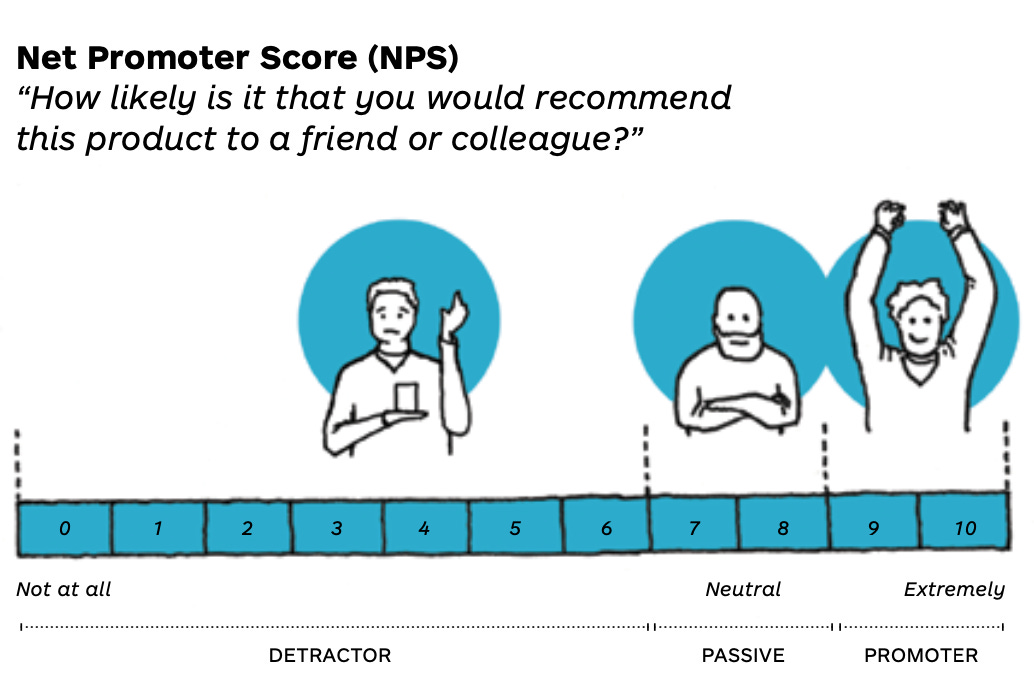

On the other hand, Net Promoter Score (NPS) measures how likely customers are to recommend you and classifies users as Promoters (9-10), Passives (7-8), or Detractors (0-6) based on their responses. A higher percentage of Promoters indicates stronger customer loyalty. If they do recommend it, it drives growth and saves on paid marketing costs.

For Example -

There is much debate on what a good NPS score is depending on the industry, but basically, you are looking at the following calculation:

% PROMOTERS - % DETRACTORS = NPS

If 50% are Promoters, 30% are Passives, and 20% are Detractors, the NPS would be 30 (50% - 20%).

Even with NPS tests, teams often face the situation of customers being extremely likely to recommend the product, yet not being disappointed if the product goes away, resulting in an awkward silence.

This situation happens all too frequently because we aren’t using the appropriate forms of customer research in the correct sequence. You also need to go way beyond surveys but I digress. You can solve this issue only by asking NPS after you’ve found product market fit, which you can help diagnose using the Sean Ellis Test.

If customers recently experienced your core value, use the Sean Ellis Test for fit. If they're not disappointed if your product went away, find out why. If disappointed, use a Net Promoter Score survey later to see if they'd recommend it.

If likely to refer, make it easy with referral programs and make them product ambassadors.

With tweaks to sequencing experiments and discovery, you'll understand customers better.

Nobody wants customers who don't care if your product goes away, but will still recommend it to friends.

So Overall:

PMF (Product Market Fit) Score

Definition: The PMF score measures how well a product is meeting users' needs.

Key Question: "How disappointed would you be if you could no longer use this product?"

NPS (Net Promoter Score)

Definition: NPS measures customer loyalty by asking how likely they are to recommend the product.

Key Question: "How likely are you to recommend this product to a friend or colleague?"

When to Use Each Metric

PMF: Most useful when seeking product-market fit, especially in the early stages or during pivots.

NPS: Suitable for measuring customer satisfaction and loyalty at any stage of product development.

QUICK DIVES

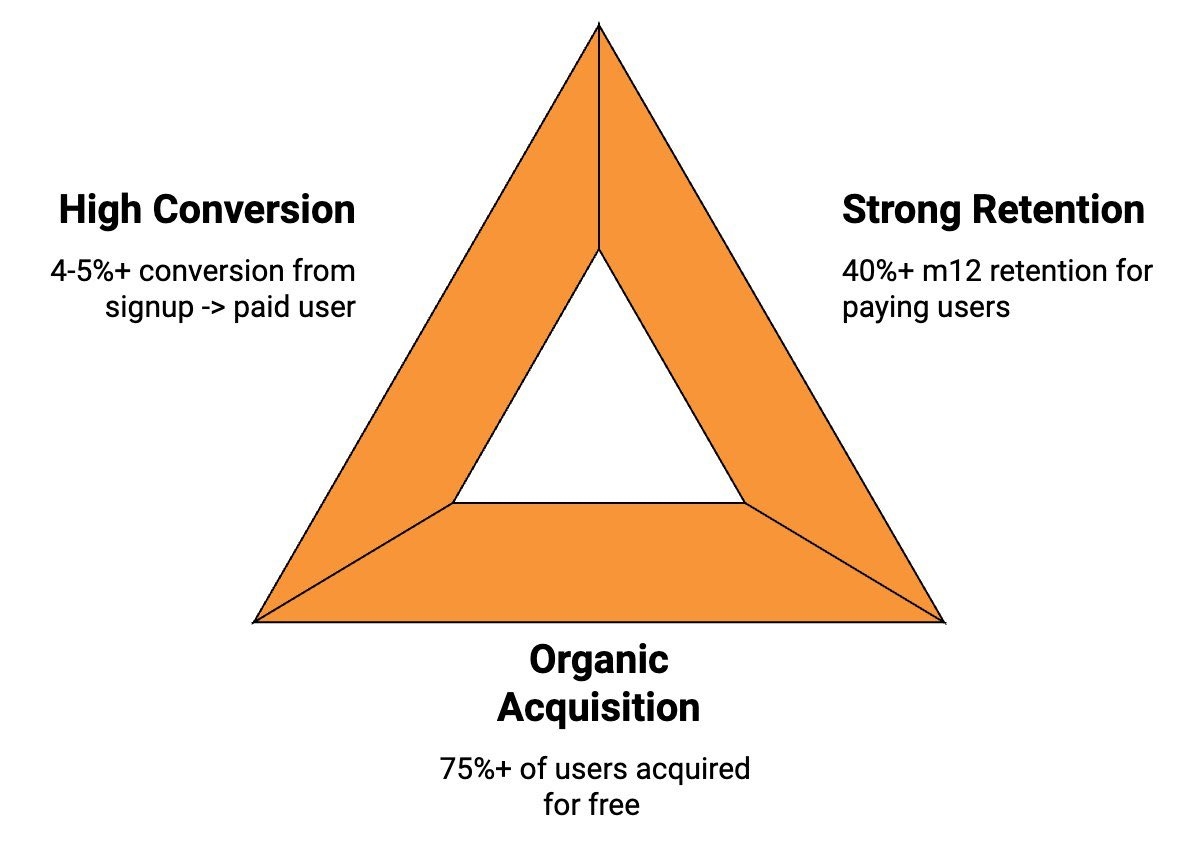

1. The Consumer Subscription Trifecta: What Makes Consumer AI Subscriptions Work?

After working with founders in the Consumer AI space - Olivia, a partner at a16z, noticed a clear pattern that makes subscription businesses work. She shared -

Most successful companies nail at least two of these three metrics, but the truly exceptional ones hit all three:

High Conversion (4-5%+ from signup to paid)

Strong Retention (40%+ of paying users still active after 12 months)

Organic Acquisition (75%+ of users coming in for free)

Let's break down what happens when you have different combinations:

High Conversion + Strong Retention (but paid acquisition): You can make money and potentially turn a profit, but everything hinges on managing your customer acquisition costs (CAC). Your growth will be limited by how quickly you can recoup your marketing spend.

High Conversion + Organic Acquisition (but poor retention): You'll build both users and revenue, but low lifetime values are your Achilles' heel. There's not much room for error since each customer isn't worth as much in the long run.

Strong Retention + Organic Acquisition (but low conversion): You'll grow your user base quickly, and people clearly love your product. The challenge? Turning that love into revenue. You've built a great product, but haven't quite cracked the business model yet.

The Dream Scenario - All Three: This is what investors get excited about. You have a business that fills itself with users, converts them efficiently, and keeps them around. Even if these numbers dip as you scale beyond early adopters, you have enough cushion to stay healthy.

Think of it like a bucket - you want it to fill itself (organic acquisition), not leak much (retention), and actually contain something valuable (paying users). Hit all three, and you've got something special.

2. Marketing's Decay Law: An a16z Partner's Perspective

Andrew Chen (partner at a16z) shared a fascinating analysis of why marketing strategies inevitably lose their effectiveness - what he calls "The Law of Shitty Clickthroughs." The premise is simple yet powerful: over time, all marketing strategies result in declining clickthrough rates.

Let's look at a striking example: The first-ever banner ad on HotWired in 1994 achieved an incredible 78% clickthrough rate.

Compare that to Facebook banner ads in 2011, which averaged just 0.05% - that's a staggering 1,500x decrease! The same pattern appears across email marketing, with open rates steadily declining while daily email volume has exploded to over 30 billion.

Chen identifies three key factors driving this decline:

The Novelty Factor Customers naturally respond to novelty, but it inevitably fades. When banner ads first appeared, people clicked just to experience something new. The same happened with the first product invite emails. But humans are pattern-recognition machines - once the novelty wears off, they develop "banner blindness" and start filtering out marketing unless it provides genuine value.

The First-Mover Advantage is Temporary Success attracts imitators. Today's marketing intelligence tools make it incredibly easy to copy successful strategies. Chen notes that with a simple query, you can discover Airbnb's entire search marketing playbook - from their $10,638 daily ad budget to their 62,729 keywords. When competitors flood in, everyone's marketing performance suffers.

The Scale Paradox Following the Technology Adoption Lifecycle, early adopters actively seek out new products and respond better to marketing efforts across all metrics (signup rates, CTR, CPA). As you scale to reach mainstream customers, these metrics naturally decline. This is particularly crucial for SaaS and e-commerce companies - projections based on early adopter responses often prove too optimistic at scale.

So what's the solution? Chen suggests two approaches:

Short-term: Take a "nomad strategy" - continuously develop new creative, test new publishers, and focus on maintaining base performance. This doesn't avoid the law but slows its impact from months to years.

Long-term: Hunt for untapped marketing channels. Chen's counter-intuitive advice? When someone asks, "Have you ever seen anyone do XYZ to acquire customers?" the best answer is "No, I haven't" - because that means you might have found your next high-performing channel.

As of Chen's writing, he pointed to mobile notifications and Open Graph as relatively uncontested territories. The key insight? Don't fight the inevitable decay - instead, stay ahead by discovering new channels while they're still effective.

This raises an interesting question for marketers: Are you spending more time optimizing existing channels or searching for the next untapped opportunity?

Note: While this pattern holds for traditional marketing tactics, Chen acknowledges that marketing with genuinely useful information tends to maintain higher engagement rates over time. The law primarily affects advertising that relies on novelty rather than value.

3. New a16z Investment Thesis: The $250B Shift

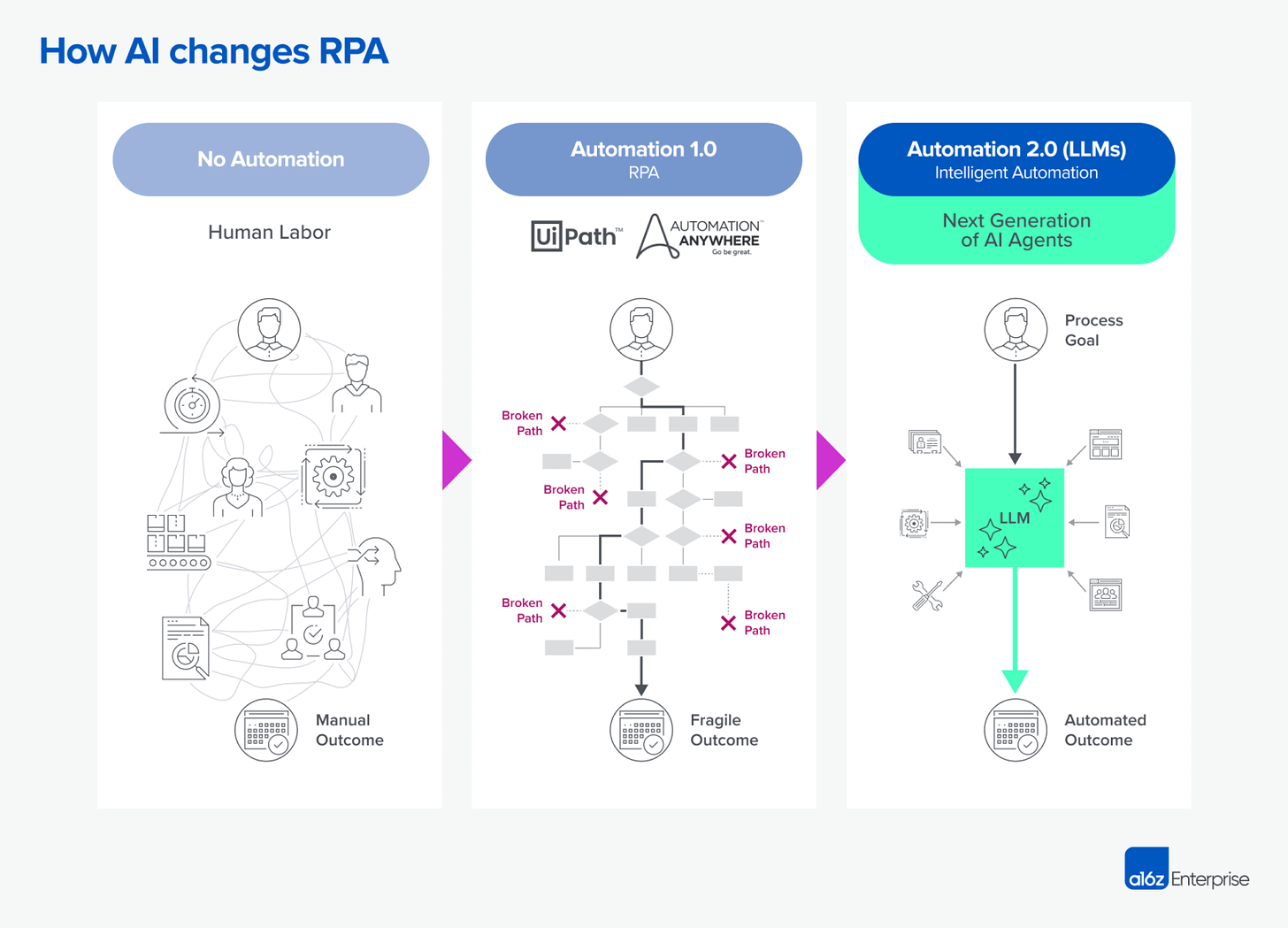

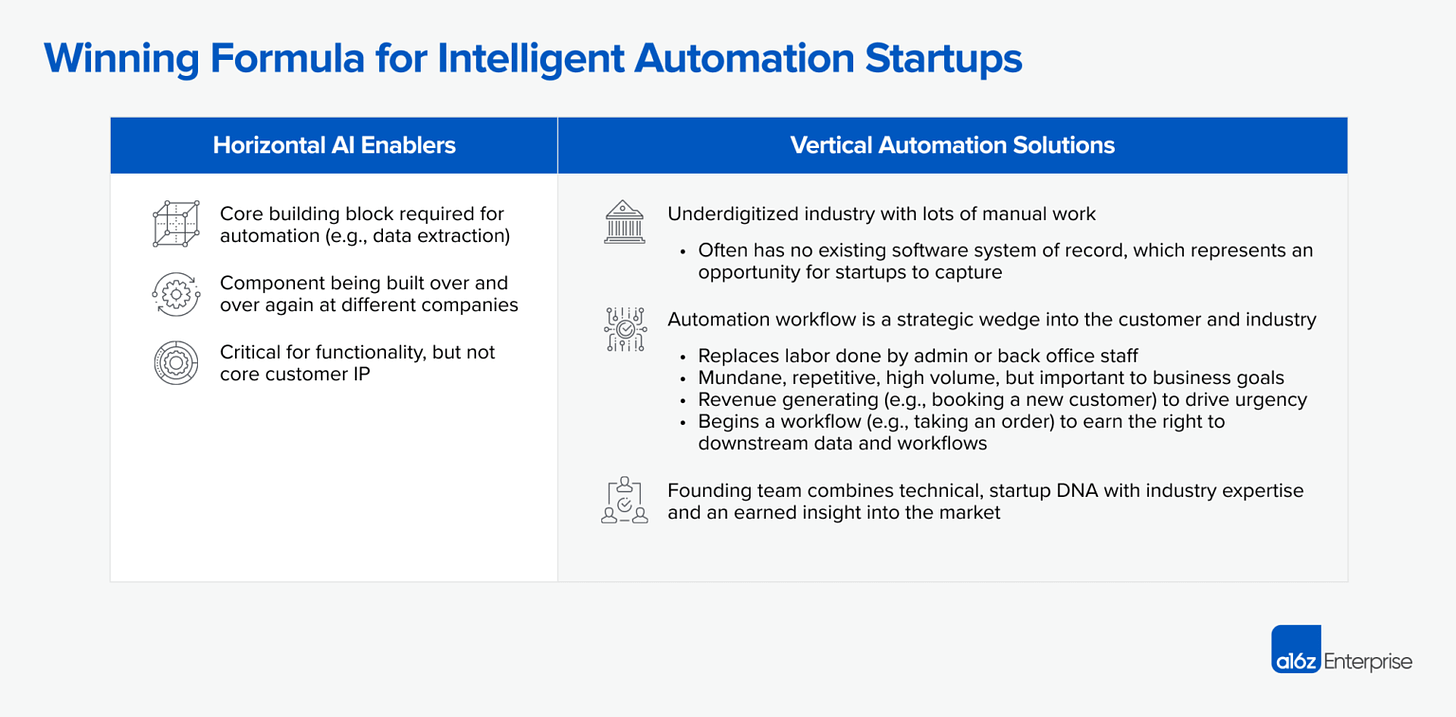

Recently, a16z shared their new investment thesis that might be interesting to study. They're betting big on "intelligent automation" - and saying goodbye to traditional RPA (Robotic Process Automation). Here's why this matters:

The Old World: RPA's Broken Promise

Remember when UiPath (a company worth $17B that makes automation software) and others promised to automate all our tedious work?

Reality check: These bots were too rigid, expensive, and needed constant babysitting

Only big companies could afford the expensive consultants needed to implement them

The New Wave: AI-Powered Automation

Thanks to LLMs (think ChatGPT & friends), we're finally getting what RPA promised

Instead of programming every little step, AI agents can now understand and execute tasks on their own

Example: They can handle everything from booking appointments to managing customer support

Why This Is Huge:

Massive Market: We're talking about 8 million ops/clerk roles and a $250B business process outsourcing market

Wide Open Field: Unlike other sectors, there aren't established software giants to compete with

Two Big Opportunities:

Horizontal Tools: Building the basic building blocks other companies can use

Vertical Solutions: Creating industry-specific automation (like Tennr for healthcare referrals)

Real-World Examples:

Healthcare: Companies like Tennr are automating patient referrals, turning faxes into digital records automatically

Logistics: Startups are handling everything from load tracking to automated price quotes

The Bottom Line: AI is finally delivering what RPA could only dream of - true automation that's flexible, affordable, and actually works. For businesses, this means less time on paperwork and more time on what matters. For investors and entrepreneurs, it's a gold rush waiting to happen.

You can read the detailed article here.

PARTNERSHIP WITH US

Venture Curator Opens 3 Slots to Help Founders Build Pitch Deck

Decks get you meetings. Without meetings, you have no shot at getting funded. Investor meetings get you funded.

However, most founders fail to impress investors through their pitch decks. Many make mistakes by adding the wrong content and including too many - around 10-15 - slides. Investors don't like that.

If you're feeling confused while building a pitch deck, we can help. We've created an internal team of experts, designers, and investors to build and review your pitch deck.

Schedule a call with us today →

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

OpenAI is reportedly preparing to launch an AI agent tool called "Operator" in January 2025, which will allow AI to directly perform tasks on users' computers, primarily through web browser interactions. (Read Here)

OpenAI, Google, and Anthropic are facing hurdles in developing more advanced AI models due to diminishing returns from their significant investment efforts. (Read Here)

U.K. consumer rights group 'Which?' has filed a £3 billion ($3.8 billion) legal claim against Apple on behalf of 40 million iCloud users, alleging the company abused its iOS monopoly to lock users into its cloud storage service. (Read Here)

Rajeev Misra, co-CEO of SoftBank Vision Fund and former Deutsche Bank executive, is stepping down from his leadership roles at SoftBank's technology investment vehicles (SoftBank Investment Advisers and SoftBank Global Advisers). (Read Here)

OpenAI co-founder Greg Brockman has returned to the company after a three-month leave, announcing on the X platform, "longest vacation of my life complete." (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 28,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

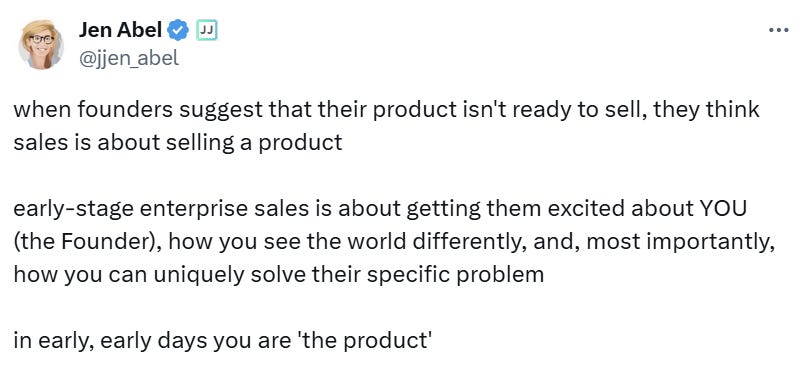

TWEET OF THIS WEEK

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Founder's Office Associate -Forest Hill Venture | India - Apply Here

Associate - Redalpine | Germany - Apply Here

Associate - Redalpine | UK - Apply Here

Associate - Corporate Innovation - Ivy Cap Venture | India - Apply Here

Head fifty years | UK - Apply Here

Manager, Venture Investing - Technical Investing Associate - Capital One | USA - Apply Here

Marketing & Content Leader Kalaari Capital - India - Apply Here

Investment Manager /Director -Enbw | Germany - Apply Here

Associate - Bloomberg Beta | USA - Apply Here

Investor Relations Analyst - B Capital Group | USA - Apply Here

Ventures Associate, AI Investing - Point 72 Venture | USA - Apply Here

Reporting Analyst - Very early venture | Swiss - Apply Here

Ventures Associate, AI Investing - Point 72 Venture | USA - Apply Here

Investment Analyst Intern - Motion Venture | Singapore - Apply Here

Principal - Africa Climate Ventures | Kenya - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Get access to our all-in-one VC interview preparation guide—check it out here. For a limited time, we are offering a 30% discount. Don’t miss this. (Access Here)

Early Stage Startup Financial Model Template For Fundraising (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)