Y-Combinator Tips: Avoid These Startup Ideas | VC Jobs

VC Fund Decks That Raised $500M, Track LTV & CACD, Not LTV/CAC Ratio & More

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Y-Combinator Tips: Avoid These Startup Ideas

Quick Dive:

13 Successful VC Fund Decks That Raised Over $500M From LPs...

Antler’s Framework to Create a Successful ESOP Plan for Your Early-Stage Startup.

Track LTV & CACD, Not LTV/CAC Ratio - Here's Why?

Major News: FTX sues Binance for $1.8 billion, SpaceX practices ISS destruction, Google experiments with real-time Search conversations & More.

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

FEATURED STARTUP

The Most Emerging Startup You Can't Miss…

You know how finding reliable overseas talent can be a total nightmare? (Been there, done that, got the horror stories!) Well, A Team Overseas is doing something that made me go "Why didn't anyone think of this before?!"

Here's the tea: Most agencies are charging businesses a whopping $3K/month for virtual assistants but only paying them $700-800. Yikes! These folks looked at that system and said "Nope, we're doing better." They're connecting you with Executive Assistants who've crushed it at big agencies but were tired of getting the short end of the stick.

The best part? They're paying their EAs a fair $1,400/month (literally double!) while charging businesses just $2.5K. Math nerds, you're seeing this right - everyone wins!

But wait - it gets better. These aren't your typical "just tell me what to do" VAs. We're talking about pros who've managed complex projects, know how to think three steps ahead, and understand your business goals. The kind who'll message you saying "Hey, I noticed XYZ and here's how we can improve it" before you even spot the issue.

Look, I'm usually sceptical about these things (occupational hazard, sorry!), but this is legit changing the game for both businesses AND talent.

If you're drowning in tasks or tired of micromanaging overseas teams, you must check this out.

Featured Your Startup: Want to get your brand in front of 62,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

Paul Graham's Framework to Get Startup Ideas... (Read)

All-In-One Guide To Pitch Deck Storytelling - Free Template & Curated Resources. (Read)

Y-Combinator startup timeline. (Read)

An analysis of US venture capital valuations in Q3, highlighting trends and shifts in investor sentiment and valuation metrics. (Read)

Y-Combinator request for startups 2024. (Read)

Why it's important to meet investors when you aren’t fundraising, as a founder? (Read)

VCs Would Rather Discuss Founder Mode Than Fix Their Fee Structure. (Read)

How Sam Altman got into the first Y Combinator batch. (Read)

Clouded Judgement 10.25.24 - Misaligned Incentives. (Read)

All-in-One Guide to Venture Capital Valuation Method. (Read)

VCs' 5-Question Framework To Create An Elevator Pitch. (Read)

A simple framework to better understand your market and competition. (Read)

TODAY’S DEEP DIVE

Y Combinator Tips: Avoid These Startup Ideas

In the search for startup ideas, it often happens that founders come across some seemingly obvious and simple ideas. These are ideas that seem great at first, but end up being a major drain on your time and resources. You might be thinking what’s the difference between a bad idea and a Tarpit idea?

The only difference between a bad idea and a Tarpish idea is that you would know when to stop pursuing a bad idea. A Tarpit Idea is identified a little bit too late - when money is already spent on developing it. Looks scary, right?

Most founders fall under the Tarpish Ideas trap - assuming it to be a good idea. . In this writeup, we'll be discussing the common "tar pit" ideas that founders often pivot into and away from, and provide some tips on how to avoid them.

What’s The ‘Tarpit Idea’?

A tarp, in nature, is where petroleum seeps through the Earth. It's a hotbed for finding fossilized remains like dinosaurs. Because animals mistake the tar pits for freshwater ponds. They step in, get stuck due to the sticky tar, and unfortunately perish. The interesting thing is - “Scent attracts more animals, creating a domino effect.”

Interestingly, this mirrors a phenomenon in the startup world

where some ideas lure entrepreneurs in, but the challenges and failures cascade, trapping them in a cycle much like the unsuspecting animals in a tar pit.

How Is This Related To The Startup World?

Tarpits in the startup world lure founders with seemingly brilliant and unexplored ideas.

The absence of famous companies tackling these issues makes them more attractive. It's like discovering a pristine freshwater pool that appears wide open for success. However, beneath the surface lies a hidden danger.

Many startup founders unknowingly fall into the tarpit trap, where the graveyard of failed attempts is not immediately apparent. Recognizing this trap is crucial because awareness significantly increases the probability of your startup's success. In essence, avoiding the allure of deceptive ideas can be the key to steering your entrepreneurial journey toward triumph rather than failure.

Interesting Fact - Most Tarpit Ideas Are Consumer Ideas!

Why Consumer Ideas Are Tarpit Ideas?

People often lean towards consumer ideas because we're all consumers! From the products marketed to us throughout our lives, our problems and interests naturally revolve around things we use or think our friends would.

“Most startup stories we hear are about consumer successes like Steve Jobs or Mark Zuckerberg, creating a default association between startups and consumer-focused ventures.”

Unlike the consumer realm, it's rare to find someone head over heels for enterprise solutions like Cisco or Oracle. Essentially, our familiarity and exposure make consumer ideas the default go-to when diving into the startup world.

The most interesting thing is that - most consumer-based idea seems to be so simple but it’s really difficult to build a good startup. There is a reason why there is no solution for a simple idea…..

Why It’s Difficult To Build A Consumer Startup?

It’s tough for two reasons -

First, many underestimate the high bar set by successful consumer products. They often don't realize how good those products are and how many others have tried and failed.

Second, timing is crucial in the consumer space. Sometimes, founders do understand when the timing is in their favour or working against them. Additionally, existing big players have an edge, creating an almost unfair advantage.

For instance, imagine someone with an idea for an un-launched consumer social network. They might believe it's groundbreaking without knowing the real standards.

Let's take Google as an example to understand the high bar – it wasn't just about launching; it was about creating something so exceptional that users couldn't resist.

Google:

In its early days, there was no advertising or growth hacking – just a website. They relied on incredible word of mouth. Users had to manually discover it, often through internet forums like Slashdot.

Without spending on user acquisition, branding, or marketing, Google attracted millions of users daily. The product's quality was so high that people not only wanted it but evangelized it.

The founders initially weren't keen on running a startup; they even tried to sell the technology. However, the demand was so intense that they got pulled into the startup world.

This highlights a key aspect of successful consumer ideas – creating something people are obsessed with and of exceptional quality, so much so that users pull the founders into the journey.

The same case with the facebook…

Facebook

Facebook's journey mirrors Google's success. Within 48 hours of its Harvard release, 75% of the campus was using it.

Investors like Peter Thiel and Reed Hoffman witnessed users spending an average of two hours daily on the site.

The striking part? No money was spent on marketing or growth hacking.

The truth about these iconic consumer companies is often overlooked. They started with excited users who pulled the product themselves. Users were passionate, even demanding the product at their universities.

The lesson here is clear: successful consumer companies have in common genuinely enthusiastic users. They didn't rely on aggressive marketing tactics but rather created products that people became obsessed with early on. This sets a high bar for what defines a compelling consumer idea.

Why Timing is So Important?

If you look closely into the data…

Making a consumer or mobile company in the mid-2000s and early 2010s was easier due to specific circumstances. During the 2000s, many people had broadband and computers, and the lack of competition for attention made launching something cool quite successful.

For instance, Facebook gained traction without battling numerous social networks. In the smartphone era, having an app store and the novelty of mobile apps meant even basic creations could attract users.

Back in college, everyone had a computer screen, and with limited TVs, people were more engaged with computers. The absence of major web incumbents and the dominance of TV in entertainment created a sweet spot for web-based startups. Similarly, the early smartphone era allowed for simpler apps to thrive, unlike today's highly competitive app landscape.

“The key takeaway is - Success often depends on being in the right place at the right time.”

So - How To Identify Tarpit Ideas?

Ideas that have survivor bias:

user problems that may look solvable from a posterior, results-oriented perspective. For example, discovery problems help people find new restaurants to try and new places to go.

Ideas that are second-order on widely adopted innovations.

Innovations that have step function improvements bring many low-hanging second-order opportunities. For example, in today's environment, a "social network for X" might be a Tarpit Idea.Ideas that are more difficult for startups to scale.

For example, hardware start-ups require a lot of funding before seeing the first results, and although they can scale eventually, they require the right approach.

Some tarpit ideas might not be so with the right founders and business model. At the same time, good ideas that were launched years ago might be a tarpit idea now.

Based on the above factors, if you find that you are targeting Tarpits (unproductive or overcomplicated ideas), then as a founder, how can you make a great pivot?

Before understanding - how can someone make a great pivot? Let’s understand a concept called - Supply-Demand in Founders & Ideas.

Some ideas attract a large pool of founders (more supply) due to their appeal—think partying with celebrities. On the flip side, ideas like building open-source developer orchestration tools have a lower supply because of the specific skills required.

The demand side is crucial too. Unlaunched, undifferentiated social apps face minimal demand in a saturated market. On the other hand, there's a high demand for high-quality software that solves significant business problems, making companies more efficient.

In essence, tarpit ideas refer to those with an oversupply of founders relative to market demand.

It's akin to the job market – having unique, differentiating skills sets you apart. The plea here is for experienced individuals who might not see themselves as startup material; if you've solved a niche problem or have industry insights, you could be a startup person. The startup world isn't limited to consumer apps or social networks; it embraces diverse perspectives to solve real-world problems.

So if you find that you are solving the Tarpit Problem and You want to pivot your business then follow this “Supply & Demand Rule”. How?

The best pivots occur when a founding team recognizes the supply and demand dynamics. It involves moving from an idea with an oversupply of founders and low customer demand to an idea with a lower founder supply and higher customer demand.

Examples include Brex and Retool. Instead of heading to the easy freshwater pond, which is a trap, successful pivots lead toward less explored areas like the mountains or desert. It's about moving away from the common tar pit ideas and embracing challenges.

For aspiring founders, it's crucial to do thorough research, understand the bar for success, and consider the supply and demand aspect. Creating luck involves recognizing these dynamics and making strategic moves to increase the odds of success.

QUICK DIVES

1. 13 Successful VC Fund Decks That Raised Over $500M From LPs...

Raising money is tough for both founders and VCs, but it’s even harder for VCs. They must persuade limited partners (LPs) to invest in their venture capital funds.

I've analyzed how successful VCs craft pitch decks that help them raise massive amounts of capital. Here's what I learned.

Think of fund managers as salespeople. Their pitch deck (or memo) is their most powerful sales tool. It needs to do two things really well: hook LPs enough to get that crucial first meeting, and serve as a compelling narrative during and after the pitch.

Here are four main takeaways to consider when creating a deck for LPs:

The purpose of your pitch deck is to convince LPs of your ability to make outlier investments. Show how you access, make sound decisions on, and win exceptional deals.

Your pitch deck should tell a clear, concise, and convincing version of your fund's story.

Show, don't tell, using examples, numbers, and visuals to add credibility.

Let others speak to your strengths with quotes from founders, testimonials from references, and committed LPs to establish social credibility.

But what Goes Into a $500M+ Fund Deck? Here's the winning structure I've seen work:

Title: So, what's this fund called? Which fund is it?

Team: Who is the GP? Who else is on the team?

Access: How do you get access to high-quality investment opportunities? What's your advantage?

Ability to win: How will you win competitive deals? What's your value-add to founders?

Investment Focus: What are you investing in? Why? Do you have a unique insight into that focus?

Track record: Do you have investment experience? What's your past track record? What are your most impressive investments?

Fund structure: What's the size of the fund, the stage you're investing in, the number of expected investments, and other details on the fund structure?

Network: Who's in your orbit? Which founders, investors, and others do you collaborate with and can you show examples?

Appendix: Additional materials that might be useful to include

You can access all 13 VC fund decks here.

2. Antler’s Framework to Create a Successful ESOP Plan for Your Early-Stage Startup.

Early-stage startups struggle to attract talent when competing with bigger companies' high salaries. The key? Smart use of ESOP (employee stock options).

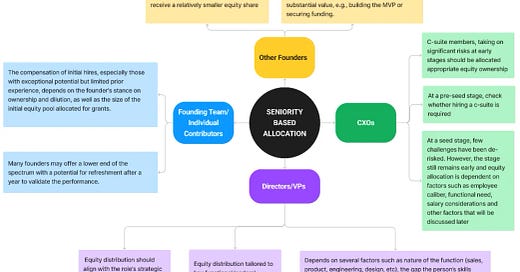

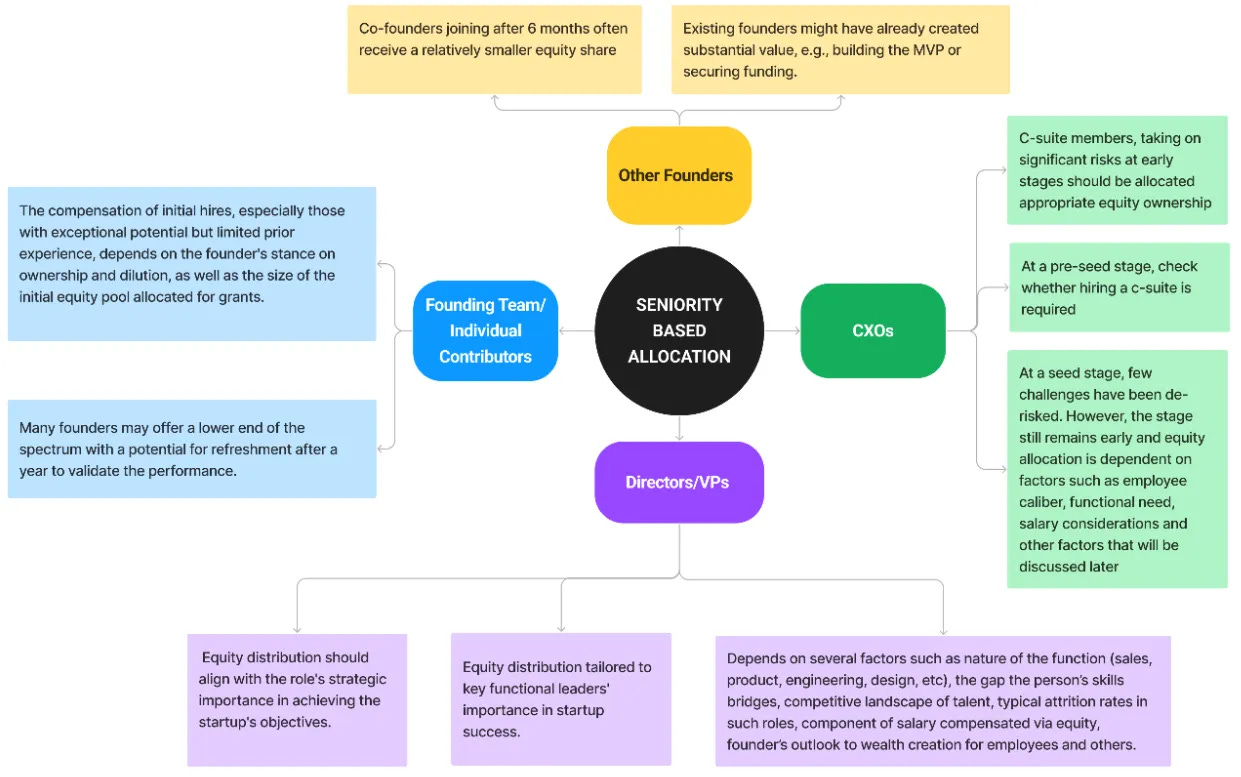

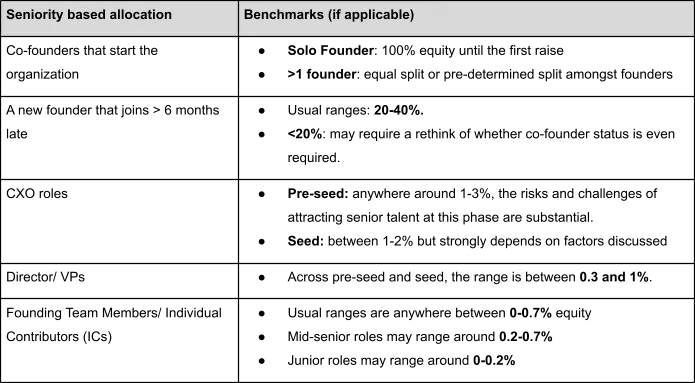

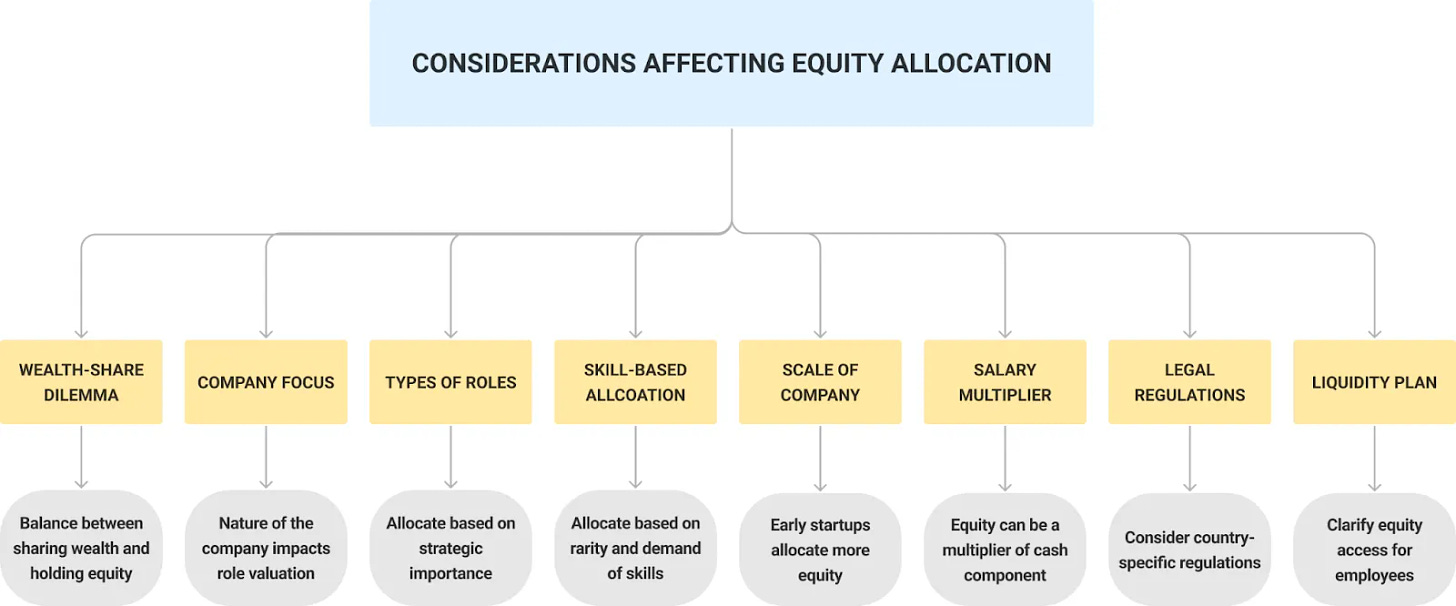

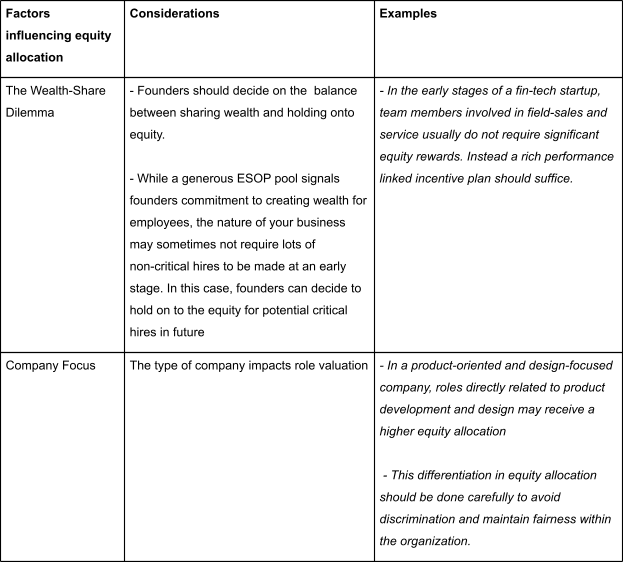

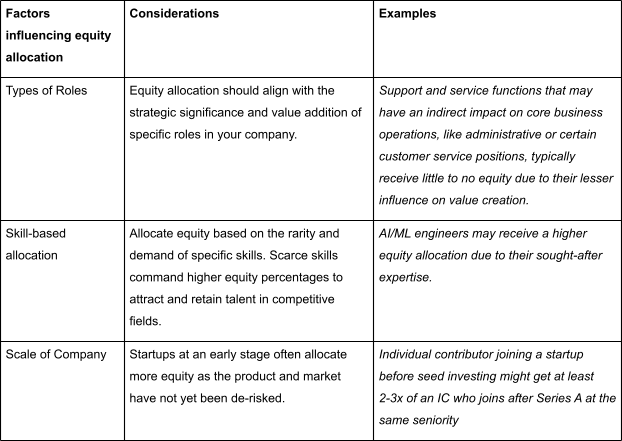

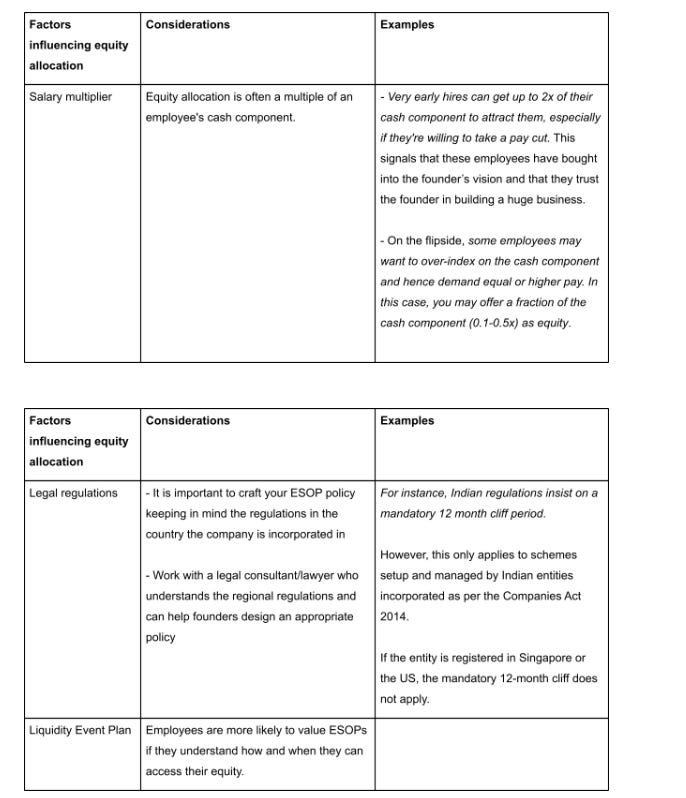

The trick is balancing equity with cash compensation. Antler shared a few decision-making frameworks that can help you design a successful ESOP plan:

It's important to note that there is no one-size-fits-all approach and there are several factors beyond the seniority levels of employees that need to be considered before rolling out employee equity.

Equity allocation is a complex yet critical aspect of building a startup's team. Antler has interviewed several portfolio founders and early-stage people success leaders to learn about what are some of the best practices in arriving at the right quantum of ESOPs for a critical hire. You can check the detailed write-up on Antler’s website.

3. Track LTV & CACD, Not LTV/CAC Ratio - Here's Why?

For a business to be viable and sustainable, the cost of acquiring a new customer (Customer Acquisition Cost/CAC) should be lower than the total value that the customer generates over their lifetime (Lifetime Value / LTV).

Startups often fail because their CAC exceeds LTV. Investors obsess over the LTV/CAC ratio as it represents potential ROI.

However, looking at the overall LTV/CAC provides limited insights. Businesses should analyze LTV/CAC by customer cohort since not all customers are equal in lifetime value. Tracking cohort-level LTV/CAC allows for optimizing acquisition efforts towards high-value customers.

However, focusing solely on the LTV/CAC ratio is not enough.

PARTNERSHIP WITH US

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 62,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

The FTX bankruptcy estate has filed a lawsuit against Binance and its former CEO, Changpeng Zhao, seeking to recover $1.8 billion allegedly transferred fraudulently from FTX. (Read Here)

SpaceX is testing its Dragon cargo spacecraft's engines while docked at the ISS to prepare for the space station's eventual retirement around 2030.

Bitcoin reached a new record high of $82,216 as the cryptocurrency rally continued after Donald Trump's presidential election win

Google is developing a real-time, conversational voice-to-search feature within its Search app that allows users to verbally interact and receive dynamic search results.

OpenAI, amidst delays in large language model advancements, is developing new methods that mimic human reasoning to overcome the limitations of scaling with data and computing power.

→ Get the most important startup funding, venture capital & tech news. Join 28,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

VC Investment Intern - First momentum venture | Germany - Apply Here

Investment Analyst - Velocity Venture | Singapore - Apply Here

Senior Associate - Motley Fool Venture | USA - Apply Here

Founder Associate - Allocator One | UK - Apply Here

Executive Assistant - Transition VC | India - Apply Here

Senior Investment Associate - Forum Venture | USA - Apply Here

Investor Relations Analyst - B Capital Group | USA - Apply Here

Ventures Associate, AI Investing - Point 72 Venture | USA - Apply Here

Investment Analyst Intern - Motion Venture | Singapore - Apply Here

Principal - Africa Climate Ventures | Kenya - Apply Here

WORKING STUDENT Venture Capital - Venture Star | Germany - Apply Here

VC Analyst Intern Fable Investments | France - Apply Here

Investment Principal - K3 Venture | Singapore - Apply Here

Access Essential Resources Curated by Leading Founders & Investors…

Get access to our all-in-one VC interview preparation guide—check it out here. For a limited time, we are offering a 30% discount. Don’t miss this. (Access Here)

Early Stage Startup Financial Model Template For Fundraising (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)