Use These VCs' 5-Questions Framework To Create An Elevator Pitch. | VC Jobs

Startups valuations exceed 2021 levels & Sequoia Capital’s framework to extend runway...

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: VCs' 5-Question Framework To Create An Elevator Pitch.

Quick Dive:

Start-ups are the most "overpriced" ever. Far more than 2021. Why?

Sam Altman: Successful Pivots Typically Fall Into Two Category.

Sequoia Capital’s Framework: How To Reduce Burn and Extend Runway?

Major News: Amazon to Invests Billions In Anthropic, OpenAI Acquired Chat.com For Over $15 Million, Canada orders shutdown of TikTok & More

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

FEATURED STARTUP

The Most Emerging Startup You Can't Miss…

You know how finding reliable overseas talent can be a total nightmare? (Been there, done that, got the horror stories!) Well, A Team Overseas is doing something that made me go "Why didn't anyone think of this before?!"

Here's the tea: Most agencies are charging businesses a whopping $3K/month for virtual assistants but only paying them $700-800. Yikes! These folks looked at that system and said "Nope, we're doing better." They're connecting you with Executive Assistants who've crushed it at big agencies but were tired of getting the short end of the stick.

The best part? They're paying their EAs a fair $1,400/month (literally double!) while charging businesses just $2.5K. Math nerds, you're seeing this right - everyone wins!

But wait - it gets better. These aren't your typical "just tell me what to do" VAs. We're talking about pros who've managed complex projects, know how to think three steps ahead, and understand your business goals. The kind who'll message you saying "Hey, I noticed XYZ and here's how we can improve it" before you even spot the issue.

Look, I'm usually sceptical about these things (occupational hazard, sorry!), but this is legit changing the game for both businesses AND talent.

If you're drowning in tasks or tired of micromanaging overseas teams, you must check this out.

Featured Your Startup: Want to get your brand in front of 62,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

Why Your Product Idea Sounds Too Complicated: The 'Simple to WTF' Scale By a16z Partner. (Read)

The gap between pre-seed and seed is getting larger By Hustle Fund Partner. (Read)

VC Megadeals Are Booming, and AI Isn’t the Top Category. (Read)

The Complete Founder's Guide To Creating and Presenting a Pitch Deck. (Read)

: By Jason Partner at SaaStr fund. (Read)

AI startups will need ‘quality of revenue’ to raise in 2025, seed VCs warn. (Read)

How An AI Bot Became a Crypto Millionaire - Marc Andreessen and Ben Horowitz. (Watch)

Why Great Ideas Get Lost in Translation: Do You Know the Three Languages of Modern Business? (Read)

The YC approach on how to pitch your company. (Read)

How to Create A Value Proposition: A Four-Step Framework. (Read)

Are AI Agents the Missing Piece in Social Networks? (Read)

The exact email YC shows Founders to land meetings with investors (plus template). (Read)

TODAY’S DEEP DIVE

Use These VCs' 5-Question Framework To Create An Elevator Pitch.

Every founder dreams of that perfect elevator pitch - a 30-second ride that ends with millions in funding. While this movie scenario is unlikely, crafting a compelling elevator pitch is crucial. It's often your startup's first impression on potential investors, setting the stage for future conversations. A well-honed pitch can open doors, even if it doesn't immediately open wallets. So polish that pitch - you never know when you'll need it.

There are lots of articles surfing on the internet but still, many founders struggle to create elevator pitches for their startups. So in today’s writeup, I am going to share a “5 Question framework” that can help you to create an elevator pitch.

Also, many founders believe that they just need to have one elevator pitch and they can impress anyone. But this is not true, I believe you need to have multiple versions of an elevator pitch like - The emotional benefit version, the Success story version, the pressing call to action version and the version where you reference competitors. I will share more ideas on how to create each version of an elevator pitch. So let’s deep dive into this:

What is an elevator pitch?

An elevator pitch won’t get someone to invest in your company, but it’s going to whet their appetite and get you in the door. It’s thirty seconds long. That’s the usual “rule” given for elevator pitches. You’ve got 30 seconds to share an enormous amount of information about the company.

Your elevator pitch isn't about speed-talking; it's about impact. Every word should count. This brief but powerful message isn't just for investors - it's the essence of your company's identity. It'll shape your website's "About Us" section and become the go-to description for everyone in your organization, from the CEO to the newest intern. Think of it as your startup's movie poster: a quick glimpse that tells your whole story and leaves people wanting more.

One of the most common questions that every founder has is - “How long should an elevator pitch be? Do I really only have 30 seconds?”

Look, nobody's gonna time your pitch with a stopwatch. If it takes 31 seconds, no biggie. But here's the thing: you can pack a lot into 30 seconds if you're smart about it. If you're rambling on, it might be time to tighten things up.

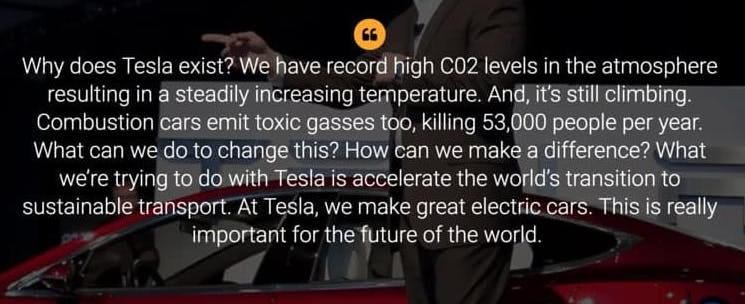

Now, rules are made to be broken, right? Take Tesla. Their pitch is longer, but damn if it isn't effective. Elon Musk might be in hot water lately, but the guy knows how to sell an idea. Some folks can keep you hooked for a full minute and leave you sold.

But let's be real - not everyone's Elon Musk. The 30-second thing is just a guideline, not a hard rule. What matters is nailing your audience, the situation, and your startup's value. That's the secret sauce.

So why bother with elevator pitches? Simple. They force you to boil down your big idea into something snappy and memorable. It's like a first impression for your business - make it count!

Why elevator pitches are such a big deal?

First off, it's all about grabbing attention. You've got this killer idea, right? The elevator pitch is how you make someone else go "Whoa, tell me more!" in just a few seconds.

It's not just for impressing investors, though that's a big part. Think bigger. Remember how Steve Jobs lured John Sculley away from Pepsi with that line about changing the world? That's the power of a great pitch.

Your elevator pitch is like your secret weapon. It's how you stand out at crowded conferences, how you snag those first crucial customers, and how you get top talent interested in joining your team. Hell, it's even what makes your LinkedIn profile pop.

The key thing? It's gotta work on people who've never heard of you before. That's where it differs from your pitch deck. It's your first impression, your hook, your "here's why you should care" moment.

5 Question Framework To Create An Elevator Pitch -

To re-iterate, the five basic pieces of information that will be contained in an elevator pitch are:

Who you are

What you do

How you do it

Who you do it for (i.e. the customer) and

Why now (the urgency of your idea)

And then, sitting on top of this is the need to make it accessible to the listener. This means you need to assume that they’re not aware of your business, or anything about the sector that you’re in.

Here's a great example of this. Here’s a pitch that was proving unsuccessful for a startup:

“I work on nanotechnology to deliver medical therapies to targeted cells.”

It has all five of the elements of an elevator pitch in there. It covers:

Who you are (a medical science company)

What you do (medicine)

How you do it (nanotechnology innovation)

Who you do it for (people who need medicine)

Why now (it improves the delivery of medicine)

Now, technically, it hits all the marks. But let's be real, unless you're deep into nanotech, your eyes are probably glazing over already.

So they went back to the drawing board and came up with this: "We are using the manufacturing techniques of the computer industry to make better vaccines."

Boom! Way more accessible, right? It's less jargon but packs a bigger punch. It's the kind of thing that makes people go, "Huh, tell me more."

And get this - that new pitch? It landed them an investment from the Bill Gates Foundation. No joke.

The takeaway? Keep it simple, make it interesting, and for the love of all that's holy, don't assume everyone knows what the hell you're talking about. Your grandma should be able to get the gist of it, you know?

While building an elevator pitch, start by asking yourself these four questions:

Who's your audience?

What's bugging them?

How are you fixing it?

How'll they know you've helped?

Now, here's a neat trick. There's this formula you can use to get started:

"You know how [your people] struggle with [their problem]? I've got [your solution]. It helps them [the benefit] so they can [their goal]."

Let's say you've got this cool gadget that helps people find their lost stuff. Your pitch might go something like:

"Ever been late 'cause you can't find your keys? Happens to tons of folks. I've made this nifty Bluetooth thingy that helps you find lost stuff in seconds. Makes mornings way less stressful, ya know?"

But here's the deal - don't just copy-paste this. Make it your own. Tweak it. Play with it. The last thing you want is to sound like every other startup out there.

Oh, and a pro tip? Don't BS your numbers. Investors can smell that a mile away. Stick to the facts you know are solid. It'll make you sound way more legit.

Remember, this is just your starting point. You'll want different versions for different situations. Keep it fresh, keep it real, and most importantly, keep it you.

Why You Need Different Elevator Pitches

Your elevator pitch shouldn't be one-size-fits-all. Having multiple versions lets you tailor your message to different situations and audiences. Here are a few types to consider:

The Emotional Appeal: Focus on how your product makes people feel. This can be powerful for early customers and marketing.

The Success Story: Once you have clients, share real-world examples of how you've helped them. This proves your value.

The Urgent Call-to-Action: Sometimes you need to push for immediate interest. Craft a version that creates a sense of urgency.

The Competitor Comparison: If you're entering a market with big players, explain how you're similar but different. "We're like X, but for Y."

The One-Liner: Have a super-short version ready for quick encounters or social media.

Remember, context is key. The pitch you use with an investor in an actual elevator will differ from the one you give after a conference presentation. By preparing various approaches, you'll be ready to adapt on the fly and make the most of every opportunity.

VENTURE CURATOR HUB

Access Essential Resources Curated by Leading Founders & Investors…

Early Stage Startup Financial Model Template For Fundraising (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

QUICK DIVES

1. Start-ups are the most "overpriced" ever. Far more than 2021.

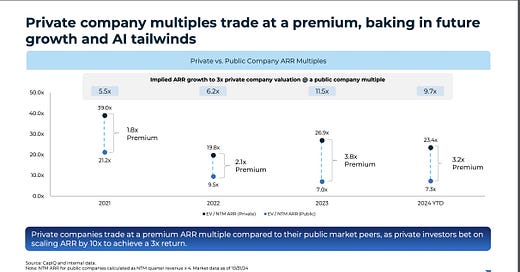

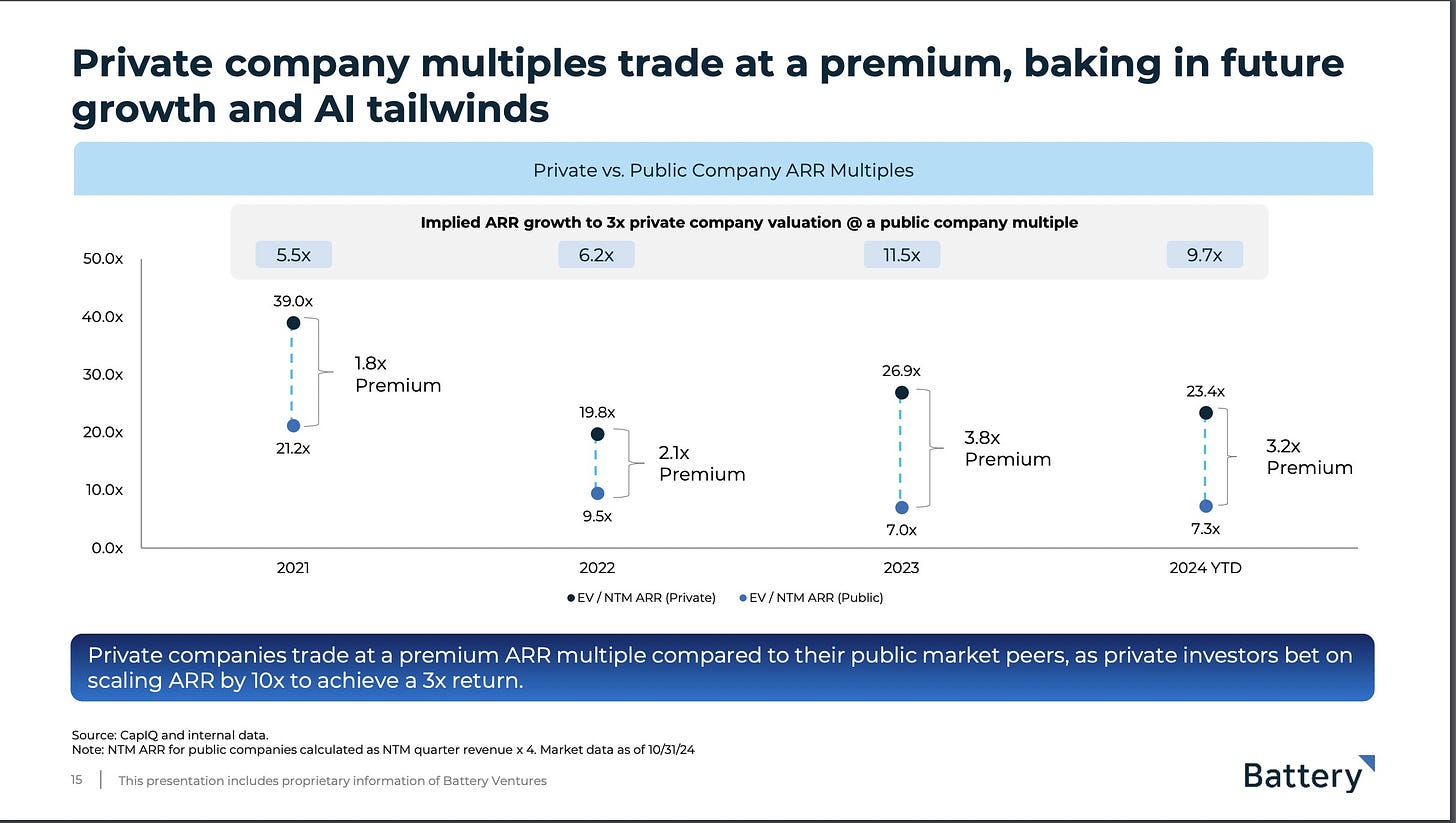

A super interesting slide from Battery Ventures’s latest report: “Start-ups are the most "overpriced" ever. Far more than 2021,in fact.” Why?

Because while start-up valuations have stayed high, or even grown since 2021 for AI, YC and other hot categories -- public valuations are just 33% of what they were in 2021.

Net net, hot start-ups now are priced at 3.2x higher than the public comps.

That was only 1.8x in 2021. 2021 was nuts for start-ups, but public valuations were also 3x higher than today.

So net, start-ups are far more expensive to invest in today than 2021. We'll see how it shakes out.

If $2 Trillion of services revenue flows into software spend because of AI, it makes sense.

If the existing $300B of SaaS spending just gets reallocated, it probably doesn't make much sense.

Net net, the Unicorns of 2024 are far more expensive than the ones of 2021.

We knew that, and the data supports it.

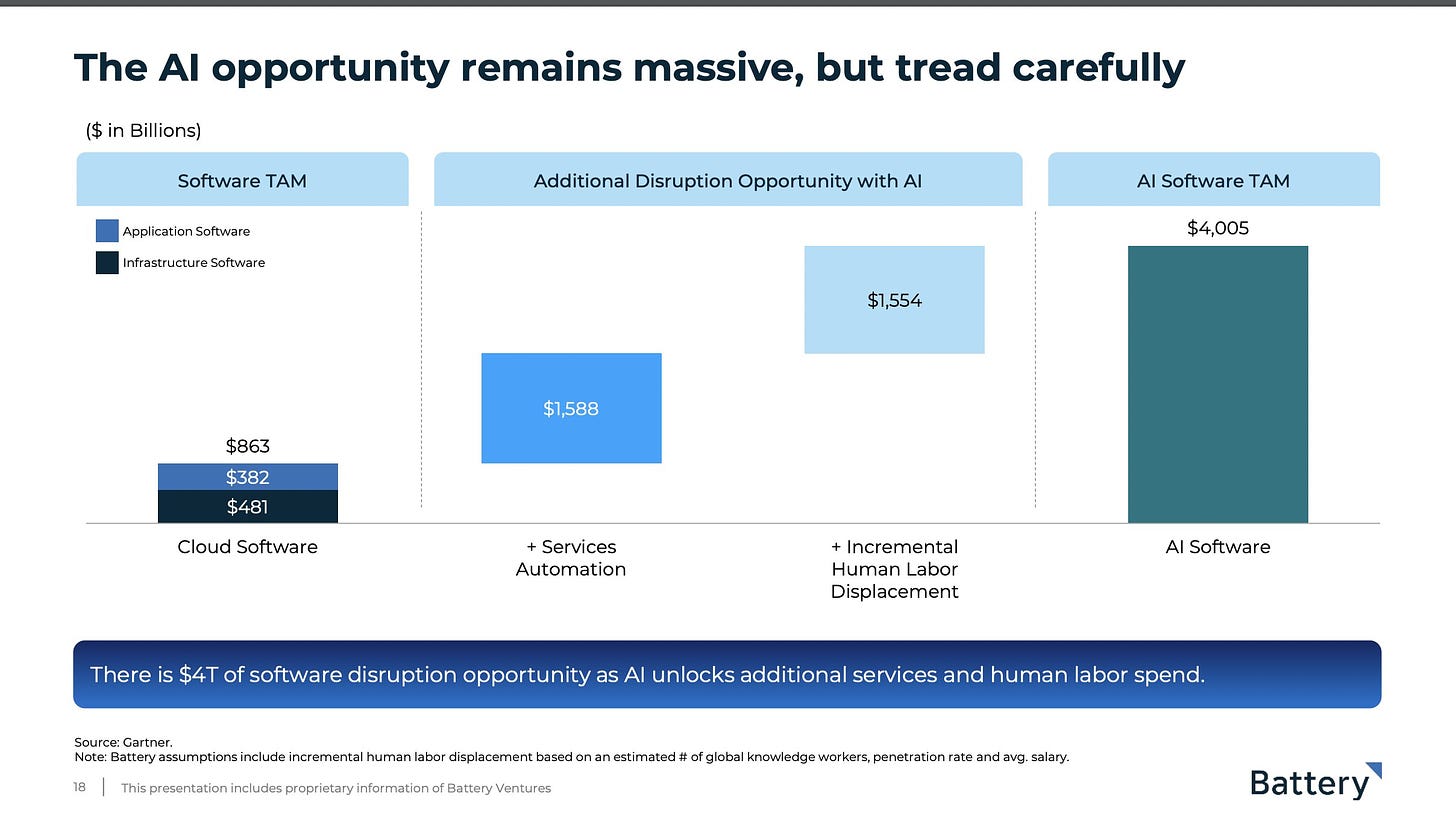

Also, Battery has another good slide here:

per Gartner, there is $300B of SaaS spend. Battery has $380B. Close enough.

Another $480B of Infrastructure Spend

This is growing 20% -- a lot -- but alone cannot justify what VCs are paying and investing. It's not enough.

Nor can 3 Cloud IPOs since 2021

But, if $1.5T of services spent can be turned by AI into high gross margin software ... along with another $1.5T of human labour into software ... that would 3x the TAM for software

To $4T overall

Certainly, the AI Proponents are claiming this will happen quickly

There is already some evidence in B2B software. Layoffs and conversion of human capital to software spending are already happening at every leader in the contact centre.

But will >enough< of this happen because of AI?

Will $3 Trillion of non-software spending migrate to software spend because of AI?

That's the bet VCs are making

We will see.

2. Sam Altman: Successful Pivots Typically Fall Into Two Category.

“Pivoting in the business world has become a bit of a buzzword, hasn't it?

It's almost like a shiny badge of honour that some wear proudly. The whole concept revolves around changing course when things aren't going as planned, and there are people out there who actually brag about how many times they've pulled off a pivot. But let's just pause for a moment and really think about what this means.

Pivoting, in essence, is a sign that things didn't go according to plan, in simple words - it’s a failure!

It's a recognition that the initial strategy or idea didn't pan out as expected. And you're right, failure is undeniably part and parcel of the entrepreneurial game. It's important to be tolerant of failure, not holding it against anyone, and certainly not turning it into a celebration.

However, there's a fine line between acknowledging failure and glorifying it as a success. Some entrepreneurs proudly wear the badge of multiple pivots, almost boasting about how many times they've changed direction.

But here's the thing – pivoting a startup is sucks, plain and simple.

The focus should be on learning from it and avoiding the repetition of the same mistakes, rather than treating it as a badge of honour.

Great startups, the ones that truly succeed, don't necessarily see pivoting as a badge of honour. They view it as a learning experience that contributes to building a potentially successful business.

Not all pivots are created equal, and the distinction lies in the reasons behind them.

If you look at some great startups that pivot you will find that - there are two types of pivots that tend to be more successful and make total sense.

First, there's the pivot where the founder ends up building something they were passionate about from the start.

Take Instagram's Kevin Systrom, for example. His initial venture, Bourbon, wasn't working out. During a vacation, he built something he was genuinely passionate about—photography with filters. This pivot worked because it aligned with his true interests.

The second type of pivot that makes sense is born out of necessity.

Consider Airbnb's founders during the financial crisis. They were broke, maxed out credit cards, using plastic sheets to keep track of them—real desperation. In this dire situation, they rented out a spare room to make ends meet. This pivot was out of sheer survival, and it worked. Today, Airbnb is known for more than just spare rooms; it's a significant player in affordable housing.

However, the common type of pivot, where founders sit down, realize their startup isn't working, and brainstorm a new idea on a whiteboard, rarely succeeds.

Why? Well, if you're rushing to come up with an idea, chances are it won't be a good one. Moreover, if you already have investors, you need a plausible-sounding idea to present to them.

It's fine to have a good idea that initially sounds bad, but pivoting into such an idea is tougher.” Sam Altman Here

3. Sequoia Capital’s Framework: How To Reduce Burn and Extend Runway?

The first step in getting very tactical is to understand your current state.

This means looking deeply into your P&L. If you're talking about runway, that means you're losing money every month. So you have to figure out where the net loss comes from. Once you’ve identified the specific places in your P&L causing your burn, you can start thinking about which dollars yield efficient growth and which are not as helpful

To understand which parts of your P&L need to be addressed, begin with the big picture and break it down into parts. Starting with net loss, you can break that into two parts: gross margin and opex.

Then break each of those down into component parts:

What are all the drivers of your gross margin? What is the cost of sales, etc?

What are all the drivers of compensation opex and non-compensation opex?

How much of the Opex is dedicated to computer hardware, hosting subscriptions, etc?

Keep breaking it down until you have a detailed view of the components that contribute to total net loss.

Once you’ve identified the important contributions to your burn, you can plot them in terms of their burn impact on the y-axis. Then there’s the ease of execution:

how easy is it to address and how big an impact does it have? Unfortunately, you’re not likely to find many items that are high-impact and easy to execute. Changes that extend your runway a lot will almost certainly be difficult. This plot is important because it will set your roadmap for the actions you take to extend your runway

Once you understand the levers available to impact the runway, you can use them to set a goal. Your goal should be oriented around how long it’s going to take for you to reach a rational milestone. Let's say your goal is a flat round. Given the market conditions, for many of us, that’s going to take us three years.

To unpack why that is:

Say you hypothetically raised your last round at a billion dollars, and you have five to 10 million of ARR.

if you want to raise your next round at a billion dollars, you might need 75 to 100 million of ARR, which might mean you need to grow about 10 to 15X.

It takes time to do that. It very well might take three or four years

If it takes three years, recommend you have four years of runway. The reason: as mentioned earlier, you want to raise 12 months before running out of money. Generally, investors view it as a bad sign to have a very short runway, so you want to avoid being in this situation when raising a round. So the time you need to hit your goal plus 12 months is the ideal runway that would suggest.

One recommendation: When you decide how long it will take to reach your goal, be very realistic. Use public comps and ask the toughest board member. Ask her what it will take to reach a flat round based on rational milestones, and then add 12 months.

So now you've taken the steps to understand where you are, and you’ve broken down your P&L to understand where the money goes. You've plotted your options in terms of ease-to-execute versus burn impact. And you’ve set a goal based on rational milestones.

So let's say hypothetically you need to cut your burn from $3 million a month to $2 million. We don’t want to sugarcoat this: It's going to be hard. Of course, a people-related cut is the hardest decision any leader makes. Beyond this, you may face many challenging and nuanced decisions:

If you're a global company, you might need to reevaluate certain markets.

If you're a company that's relied on a marketing or sales investment in order to grow, you might have to reevaluate your strategy.

You might have to increase pricing. This is scary, especially if you don’t have time to fully test the value proposition.

The big thing to remember is this: If you take the steps necessary to extend your runway in line with rational milestones, confident you and your whole company will be better on the other side.

Join 36000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Amazon’s multi-billion-dollar bet on Anthropic after last year's $4B deal. (Read Here)

OpenAI's $15M acquisition of Chat.com from HubSpot’s co-founder. (Read Here)

what a Trump 2.0 could mean for the tech industry. (Read Here)

Canada orders TikTok shutdown over security concerns, and (Read Here)

SpaceX gears up for its sixth Starship launch this month. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 26,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Executive Assistant - Transition VC | India - Apply Here

Investment Manager, Techstars London - Apply Here

Ventures Associate - Morgan Health Venture | USA - Apply Here

Venture Analyst - Cambridge Future Tech | UK - Apply Here

Venture Analyst - Capital Factory | USA - Apply Here

Senior Investment Associate - Forum Venture | USA - Apply Here

Investor Relations Analyst - B Capital Group | USA - Apply Here

Ventures Associate, AI Investing - Point 72 Venture | USA - Apply Here

Investment Analyst Intern - Motion Venture | Singapore - Apply Here

Visiting Analyst - Very Early Venture | Swiss - Apply Here

Principal - Africa Climate Ventures | Kenya - Apply Here

WORKING STUDENT Venture Capital - Venture Star | Germany - Apply Here

VC Analyst Intern Fable Investments | France - Apply Here

Investment Principal - K3 Venture | Singapore - Apply Here

Get access to our all-in-one VC interview preparation guide—check it out here. For a limited time, we are offering a 30% discount. Don’t miss this.

That’s It For Today! Happy Friday. Will meet You On Tuesday!

✍️Written By Sahil R | Venture Crew Team