Y-Combinator's Framework for Building a Successful MVP. | VC Jobs

The Ladder of Proof: How VCs See Your Startup & Download Cap Table Template

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Y-Combinator's Framework for Building a Successful MVP.

Quick Dive:

Framework: How VCs See Your Startup? The Ladder of Proof.

Building Cap Table As A Founder: Template to Download.

Major News: Neuralink competitor says its eye implant restored vision, Boeing is exploring sale of space business, General Catalyst Launches $8 Billion VC Fund & Ex-OpenAI researcher says company destroyed the internet.

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER CONTRAST STUDIO

Design Support for Fast-Moving Start-ups

Move fast without breaking things. Go from idea to polished design faster and safer.

Get our continuous design support for only $5,999/month.

Premium quality

Tasks delivered every 2 days

Daily support in Slack

90 min. per week for calls

Access to our exclusive software discount collection totalling over $1mil.

Partnership With Us: Want to get your brand in front of 62,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form or reply to this email as “Advertise” and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

How much time should founders typically allocate to fundraising, from Elizabeth Yin (Hustle Fund Cofounder)? (Read)

How many hours do Y Combinator founders work? A poll from YC’s internal forum. (Read)

Why LTV Matters More in 2024 by Tomasz Tunguz. (Read)

8 lead generation pillars and 24 tools For Startup Founders. (Read)

Duolingo on how to win with gamified design. (Read)

Sam Altman - ‘Don't Run Toward Ideas Where There Is Oversupply of Founder Relative To Market Demand.’ (Read)

The Best Time to Invest in a Company is When it Most Violates a Popular Narrative… (Read)

Building a VC fund is harder than you think - Wischoff Fund Journey (Read)

The playbook teams are using to crush viral app growth (Link)

TODAY’S DEEP DIVE

Y-Combinator's Framework for Building a Successful MVP.

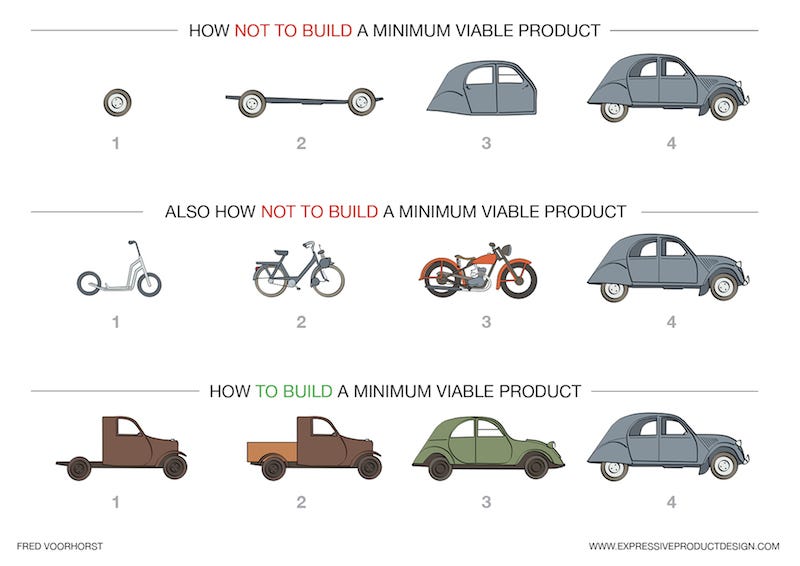

When it comes to building a startup, one of the things that comes to a founder’s mind is creating a Minimum Viable Product (MVP) to test whether their solution to a particular problem is valid or not. However, one of the common mistakes I observe founders making is forgetting about the "Viable" part and just focusing on the product.

This common mistake is observed in 90% of startup founders and the rest 10% of founders who know how to build MVP become startups like Airbnb, twich & stripe etc.

Also, most of the founders mistaken the meaning of MVP - that it’s about considering one feature and building a product. Actually - It’s more than that!

So - In this, we will deep dive into -

Real Meaning of Building Minimal Viable Product (MVP)

How did Airbnb, Twitch, and Stripe build their MVPs?

How did these startups use the Y-Combinator MVP building strategy?

How can you build the MVP for your startup?

So grab your coffee and let’s deep dive into it!

What is an MVP (Minimum Viable Product)?

A minimum viable product (MVP) is a version of a product with just enough features to be usable by early customers …— Wikipedia

What should be your MVP mindset In the Pre-Launch Stage?

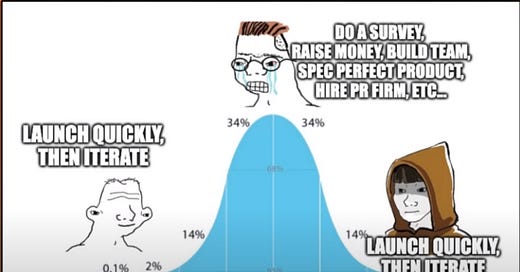

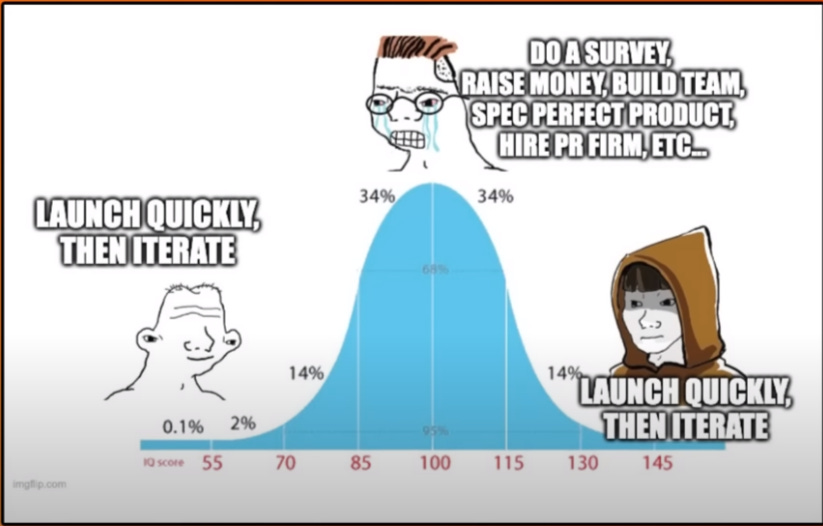

Let’s start with the meme above. It’s called the midwit meme.

Many first-time founders (the guy to the left of the bell curve) launch quickly and iterate (continue launching quickly). This is the same for the expert founder (the guy to the right of the bell curve).

But the guy in the middle is the “smart founder”. Let’s call him Benny. Benny wants to do surveys, raise money, build a team, etc. He wants to do it all. Benny learns after a while he should have been like the “dumb guys”.

As a founder, you want to build an MVP, get it to customers, and learn if it helps them or not. Then iterate.

You only really start learning about your users when you put a product in front of them. Not by doing 1000 surveys, gathering a mailing list, or fundraising for half a year.

The amazing thing, your MVP might not even work how you want it to.

Your goal as an early-stage founder:

Launch quickly. (MVP)

Get your first customers.

Talk To Customers & Get Feedback

Iterate (Improve the product)

These goals need to be your guiding principle.

Expect that after 3–5 iterations, your MVP would have changed so much. But that’s a good thing. It means you’ve been listening to your customers.

Try and remember that you are not the hero of your customer’s story. You’re not Harry Potter, you’re Dumbledore who gives him the tools to be the hero of his own story. You serve at the pleasure of the customer.

Is an MVP really the way to go?

Many founders want to build a product (like the iPhone) that blows people out of the water at once. That’s a very steep hill to climb though.

The MVP approach is best. You might have a question that -

But What If My MVP Is Rubbish and they Never Want To Talk To Me Again?

Even the biggest startups had this same fear. YC deals with it every time. It’s okay that you feel this fear. But never act on it.

FEAR- False Expectations Appearing Real

Think about it. If one customer doesn’t like your product, does that kill your startup? No. You can reach out to another customer. You can reach out to the same customer after you’ve made the product better.

The more amazing thing is that most people who speak with startups at an early stage are early adopters. They try out products that are in their rubbish phase. They are used to products not working quite as well as they should.

Early users usually have a problem. They are the only ones brave enough to try untested products that could solve the problem. They are usually there for the long haul to give you feedback on how to make the product better.

Fake Steve Jobs -

These types of founders think they know exactly what the customer needs. Let’s call them fake Steves.

In their minds, Steve Jobs built the iPhone and iPod, such amazing products in one go. The mistake they're making is that’s not true. Many of them remember the 3rd or 4th iteration of these products. The first iPhone had 2G internet, no app store, etc.

You don’t know what the customer needs. The customer alone knows what they need. If you ask them, they will tell you. How you ask them is by showing them your MVP.

Examples of Successful MVPs

1. Airbnb:

This is the first version of AirBnB. They didn’t have a lot of features. If you were an early adopter, here was what you enjoyed.

No payment system.

No map view. You couldn’t see where the house was in the city.

You had to sleep on an airbed. The whole house could not be rented to you.

It was only for conferences.

2. Twitch:

Twitch was the world's leading video platform and community for gamers.

They began as Justin TV with one page.

Only 1 streamer, Justin.

Their video was low res.

But they’re now one of the most popular streaming websites in the world.

Do you know what thing they focused on at the pre-launch stage?

Software MVP

Very fast to build (weeks not months)

Very limited functionality

Appeal to a small set of users

They built a product that people loved, not one that everyone loved. It didn’t solve all the problems. Solve problems step by step.

Who Are These Early Adopters? Why Do They Want To Go Through So Much Pain?

“You want to build your product for customers who have their hair on fire.” What product would you want to buy from me?

Maybe a hose, bucket of water, or something that can bring water. Well, all I have is a brick (my MVP). Walking away won’t even cross your mind. You’re desperate, you’ll buy the brick and hit yourself on the head to kill the fire.

The early adopters are the desperate ones. Forget the ones that are not desperate.

Why surveys don’t work.

You might have had a formal business school education. Now you’re thinking let’s do a survey and learn everything the user needs. Then we build it.

That won’t work either. The customer doesn’t know everything about the answer to their problem. They don’t even know everything about the problem itself. If they did, don’t you think they would build the solution on their own or hire people to do it for them?

It’s your job to know. Surveys help you find out your users' pain but not how to solve it. Only a product can do that.

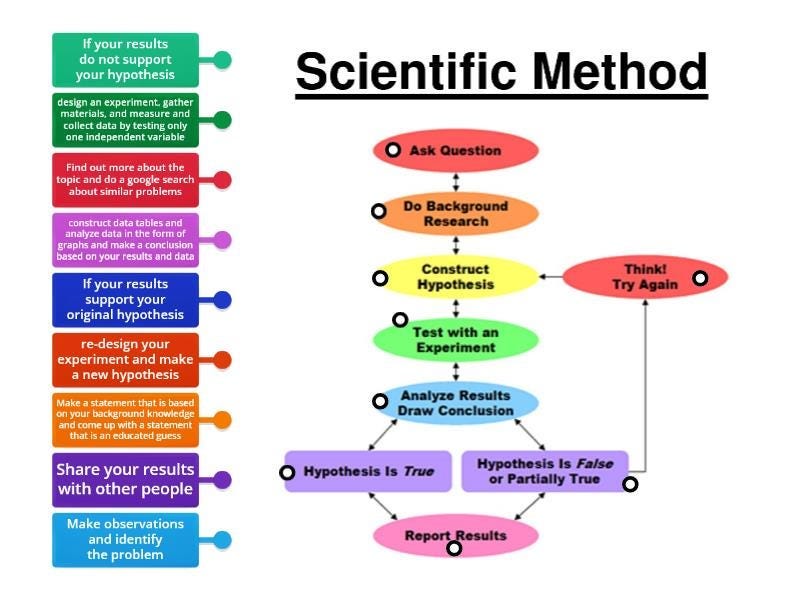

You give them a product and ask, does this solve your problem? Yes or no and

you go down the scientific method flow chart from there.

How To Build An MVP Quickly!

Set a specific deadline for completion.

Give yourself a timeframe. It’s easier to move on if you do. If you allow endless time to build, you’ll never stop building the MVP.

Write down the MVP features.

Don’t keep doing a double take while building. Write everything you want to build down now. Then you won’t have to rethink everything later.

Cut unnecessary features.

At this point, you will cut many features. Think how important is this to solve the user’s problem.

A startup to solve overseas payments doesn't need a chat feature in the MVP. Neither does it need APIs connected to every bank in the world. Both are important but can be skipped for the MVP.

Don’t fall in love with your MVP.

Have you heard married couples say something like: this is not the person I married or fell in love with?

Please please please don’t fall in love with your MVP.

It will change so much as you’re iterating.

If you’re in love with it, you won't want it to change. You’re building an emotional barrier to your growth.

Final Thoughts

“It’s better to have 100 customers that really love your product than 100k that are just ok with it.” — Michael Seibel, Y-Combinator

Those 100 will give you rich feedback that you need to grow. Build for them and the others will come when you have a shiny product.

All these concepts are covered in the Video by Michael Seibel!

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

QUICK DIVES

1. Framework: How VCs See Your Startup? The Ladder of Proof

Successful investors often unconsciously use a mental framework when evaluating startups - a set of predictors for risk and success that can be visualized as a "Ladder of Proof." (Coined By NFX Fund).

The Ladder of Proof is dynamic and unique to each situation. While investors may prioritize different aspects, understanding this framework helps founders communicate effectively with potential investors, recruits, and media contacts.

Core Principles of the Ladder:

Each rung represents a predictor of risk or success.

The further up the ladder a startup climbs, the more signals it’s sending to investors that it’s a sizable opportunity and a worthwhile investment.

Some rungs — like rapid growth, a great team, or paying customers — are more powerful than others. And hitting on those rungs (marked in red) can level a startup up to a place where I’m willing to overlook some of the lower rungs (for now).

Different VCs will emphasize different rungs. The key is to understand your audience — which VC you’re talking to — in order to determine whether you fit their preferences.

The rungs listed above are representative, not exhaustive. This is an ever-evolving list.

For founders, understanding the Ladder of Proof serves multiple purposes. First, it helps identify the current position of their startup and plot the path forward. Second, it enables more effective communication with specific investors by aligning with their priorities. Third, it provides a framework for self-assessment and validation of the opportunity being pursued.

Success in fundraising often comes down to demonstrating risk reduction and opportunity validation. While vision and conviction are essential, concrete metrics and progress up the Ladder of Proof ultimately build the strongest case for investment. This framework helps founders focus their energy on the most impactful activities that will advance their startups and attract the right investors.

The power of this model lies in its adaptability - each investor and founder may emphasize different aspects, but understanding where a startup stands on its specific Ladder of Proof creates clarity and alignment in the fundraising process.

Rather than operating on gut feel alone, founders who consciously track their progress up the Ladder of Proof can better gauge their readiness for fundraising and identify the investors most likely to resonate with their current stage of development. This systematic approach transforms fundraising from an opaque process into a clear roadmap for startup growth and investor alignment.

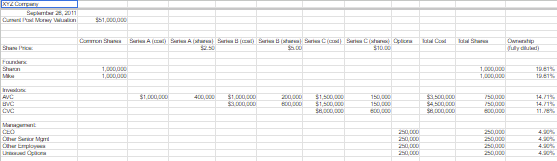

2. Building Cap Table As A Founder: Template to Download.

A cap table, or capitalization table, is a chart typically used by startups to show ownership stakes in the business. It lists your company's securities (i.e., stock, options, warrants, etc.), how much investors paid for them, and each investor's percentage of ownership in the company.

You can obtain a stockholder ledger from your lawyer, which lists all stockholders and shows how many shares or options they hold. However, I don't consider this document a comprehensive cap table. In this, I am sharing a cap table template that is used by various leading VC firm’s partners.

The basic outlines of this cap table are:

It shows all the major stockholders of the company listed on the left side. It also shows the major option holders and buckets of option holders

It shows all of the classes of stock and how much was paid for them across the top of the columns

For each investor, you show how much of each class was bought and how many shares of that class they own as a result

You total up the cost and shares and then calculate ownerships on a fully diluted basis (which means you include the options, whether issued or non-issued or vested or non-vested).

I like this presentation for its simplicity and because it shows the progression of financing activity. It also has the benefit of showing how much each investor has put in on a cost basis, which many cap tables leave out.

If you want to make a cap table for your company, feel free to replicate this format. If you have angel investors, put them in the angel section. I would include the largest ones and bucket all the rest into “other angels.”

Click here to download the cap table template.

Join 36000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Neuralink competitor says its eye implant restored vision. (Read Here)

Boeing is exploring a sale of space business. (Read Here)

Alphabet's Self-Driving Unit secures $5.6 Billion. (Read Here)

General Catalyst launches $8 Billion VC Fund. (Read Here)

Apple's $1 M bounty to hack its private AI cloud. (Read Here)

Ex-OpenAI researcher accuses the company of copyright violations. (Read Here)

→ Get the most important startup funding, venture capital & tech news. Join 26,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

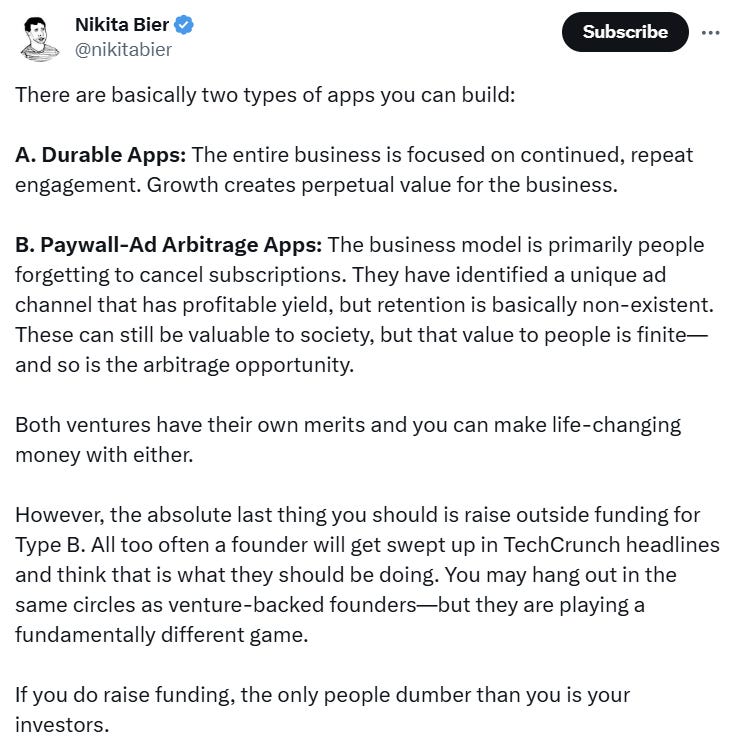

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Get access to our all-in-one VC interview preparation guide—check it out here. For a limited time, we are offering a 30% discount. Don’t miss this.

VC Associate - Breega | UK - Apply Here

Associate -Entrepreneur First | India - Apply Here

Partner 18, Deal Operations - a16z | USA - Apply Here

Venture Capital Intern - Avondale Insurtech Ventures | USA - Apply Here

Associate & Platform Manager - 8 Capital | USA - Apply Here

Analyst - Climate Tech - Germany - Apply Here

Associate / Senior Associate - Fine structure capital | USA - Apply Here

Investor - Celestica Venture | USA - Apply Here

Investment Manager (AI Sector) - Samsung Venture | USA - Apply Here

Community Associate - Volition Capital | USA - Apply Here

Partner - Early Growth - Level Venture | USA - Apply Here

Associate - Generalist Level Venture | USA - Apply Here

MBA - Ventures Intern - Paypal Venture | USA - Apply Here

Associate - Thomson Venture | USA - Apply Here

Senior Associate - Rockstud Capital | India - Apply Here

That’s It For Today! Happy Tuesday. Will meet You on Friday!

✍️Written By Sahil R | Venture Crew Team

YC need to be more democratic and help more diverse founders

Really good newsletter! Thank you!