How to Validate Consumer Startup Ideas with 'Do Things That Don't Scale’? | VC Jobs

Monthly Investors Update, The Buyer's Pyramid that every founder should aware of....

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Trending AI Tools of the Week

Deep Dive: How to Validate Consumer Startup Ideas with 'Do Things That Don't Scale’?

Quick Dive:

How to Write Your Monthly Investor Update - Template To Download.

How to Ask VCs for Money? - A Framework From VC Partner.

The Buyer’s Pyramid

Venture Curator Hub: Get Access To Early-stage startup financial modelling Excel sheet, 10000+ verified investors' email contact database & more.

Major News: Humane AI Pin's Daily Returns Outpacing Sales, Techstars, Dell Fires Thousands Of Employees, OpenAI Appoints veteran AI professor Zico Kolter to Board & FTX to Pay $12.7 Billion To Customers..

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

FROM OUR PARTNER JAZON AI

Transform your sales outreach with Jazon

The revolutionary AI SDR works autonomously to handle prospecting, responses, and research. This powerful tool allows your sales team to focus on what they do best—closing deals.

Experience the efficiency of Jazon, which operates 24/7 to book more meetings and personalize communication.

→ Try Jazon for free today and see how it can elevate your sales strategy!

PARTNERSHIP WITH US

Want to get your brand in front of 53,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TRENDING AI TOOLS OF THE WEEK

Don’t Miss These AI Tools

Simple AI: Explore the wonders of AI with Dharmesh Shah, HubSpot's Co-founder & CTO, as he simplifies complex AI concepts into easy-to-grasp insights. (Sign Up For Free)

Pickaxe AI: A no-code platform for building AI tools and launching your own GPT store. Sell AI tools and chatbots via paywalled subscriptions. Deploy tools, set usage limits, monitor user activity, & more! (Try Here for free)

TODAY’S DEEP DIVE

How to Validate Consumer Startup Ideas with 'Do Things That Don't Scale’?

“Do things that don't scale" - Paul Graham made this idea famous in his 2013 essay. But I've noticed a lot of founders still don't get it. I see many of them, right from the start, trying to build products that are fully automated or can handle tons of users. Here's the thing - that's often a mistake.

Instead, why not focus on making your product or service the absolute best it can be, even if it means doing things by hand? Maybe you're personally answering every customer chat or writing each social media post yourself. That's okay! This hands-on approach lets you understand what your users want and if your idea works. It's way easier to figure out how to grow something people love than to fix something that flopped because you automated too soon. Start by doing things in a way that might not work long-term, but gives users an amazing experience.

Then, once you know what people care about, you can work on making those parts more efficient. Most founders ignore this path because they think this can’t be how the big, famous startups got started. However, they underestimate the power of compound growth. In this video (A Conversation with Paul Graham), he explains -

I have studied 50+ successful startups' early journeys and found the same trend. They follow the 'Do things that don't scale' strategy early on, which sets them apart from others in their domain.

To get clarity on this, let’s see how some startups used this strategy :

DoorDash

DoorDash, backed by Y Combinator, is one of numerous digital businesses that employ logistical services to provide on-demand meal delivery from restaurants. Here’s a little extract from the founder, Stanley Tang, on how to get started and avoid doing things that don’t grow.

“They created a landing page in the afternoon and were conducting restaurant pick-ups and deliveries by the evening (while still in college!). Yes, within a single day.

Consider this an experiment; just put it out there and see what happens! In the beginning, your goal should be to gather input and ensure that you’re not dealing with a personal bias! The greatest aspect is that you will be able to communicate with your consumers and gain real-time feedback! This may not work for everyone, but for the other 90% of ideas, you’re sitting on waiting to construct a “polished & shiny” product before launching, well…”

You don’t need algorithms or flawless web pages to solve a genuine issue. All you need is a clean landing page and some tinkering to make things work.

Airbnb

Airbnb probably has the most talked about articles, podcasts, and videos in the how-they-did-things-that-didn’t-scale-but-got-them-to-where-they-are-now category.

Take one out of the book “Hacking Growth” by Sean Ellis:

“Brian and Joe were astonished to find, when establishing the company, that New York City, despite its tourist appeal, was underachieving. ‘The graphics were fairly horrible,’ co-founder Joe Gebbia recalls after browsing over their posts. People were taking Craigslist-style images with their phones. Surprise! No one was booking because you couldn’t see what you were paying for.” One of their early backers, Paul Grahan of YC, advised that the two attempt a low-tech, high-effort hack to boost bookings — but it was fast to deploy and was incredibly effective.

Chesky and Gebbia rented a $500 camera and went door to door throughout the city, capturing as many listings as they could. They then compared the number of reservations for the upgraded image listings to the rest of the Updated York ads and found that the updated photos led to two to three times more bookings, instantly doubling their profits from New York.

After establishing their concept, they extended it to Paris, London, Vancouver, and Miami, with similar results. As a response, Airbnb decided to create a photography service that would allow hosts to hire a professional photographer to come to their home and photograph it. It began in the summer of 2010 with 20 photographers and grew to over 2000 freelance photographers by 2012, documenting 13,000 listings across six continents.”

All of the other tactics would have likely aided scaling, but Brian Chesky and Joe Gebbia stuck to things that didn’t scale at all but did help them find the true challenges that consumers were experiencing. It’s easy to lose sight of your North Star Metric in the chase of vanity or needless growth measures, but sticking to the basics and focusing on where you want to go is crucial.

Groupon

Andrew Mason and the Groupon team debuted the initial iteration as a WordPress site. Everything else, apart from posting a transaction, was done by hand.

It was completely ghetto. On the early version of Groupon, we would offer t-shirts. In the [write-up], we’d state, ‘This t-shirt will be available in red, size big.’ Please contact us if you want a different colour or size.’ We didn’t have a form for that… It was sufficient to demonstrate the idea and demonstrate that it was something that people enjoyed… It got to the point where we’d sell 500 sushi vouchers in a day while also sending 500 PDFs to individuals through Apple Mail.

Even Reddit has used this strategy “Do Things That Don’t Scale” to just get a lift from the ground…

Reddit

On Reddit's first day, “Steve and Alexis (Co-Founders) had to start with no users and a blank page. Their strategy involved creating subreddits before the official launch. They ran ads to attract users interested in various topics and implemented an influencer strategy to have influencers moderate subreddits. On launch day, they aimed for a big splash with hundreds of thousands of signups. They used a tool to submit fake links with invented usernames to create the illusion of a thriving community. Even when emailing their initial six friends, it seemed like there was already a page full of users.

But both of them found that someone other than them submitted a link on a non-launch day. After a night out, he forgot to load fake links the next morning. To his surprise, the site wasn't blank because there were already a significant number of other users submitting links. This early success, with 20 or 30 people participating, marked a major milestone for Reddit.”

Cruise

Cruise, during its time at Y Combinator, developed the first version of its driverless car in just three months. Kyle and his small team retrofitted an Audi, though calling it fully "driverless" would be an exaggeration. The car had a mysterious red button on the floor, limited functionality to highways, essentially working like adaptive cruise control, and struggled even with simple challenges like shadows. In contrast to Google's advanced retrofitted cars, Cruise's initial version highlighted the humble beginnings of autonomous vehicle technology.

Zappos

It wasn’t obvious in 2000 that buying shoes online was a lucrative business. Shoes come in a variety of sizes and comfort levels, and many people believed they had to be worn before they could be sold. “Will people purchase shoes online?” was the most dangerous question for founder Nick Swinmurn’s young firm. One solution would be to acquire millions of dollars in finance, construct a massive warehouse, load it with shoes, construct a full e-commerce system, staff a slew of workers, and cross your fingers and hope customers make orders.

Nick thought there had to be a simpler method to de-risk his company. Instead, he went to FootLocker and photographed their inventory. He uploaded images of the shoes on the internet. When someone made an order, he went to Foot Locker and bought the shoes, then sent them to the customer.

Is this a scalable model? Nope. Did he profit from each order? No way. Was he successful in demonstrating that consumers will buy shoes online and gain early traction? Yes.

”founders ability to embrace the less glamorous work, low-status work and focus on getting shit done.”

So as a Founder of a startup

What Does It Take To Implement “Do Things That Don’t Scale” For Your Startup?

In the early days of a startup, especially before hitting the sweet spot where your product meets the market's needs, being a co-founder is a far cry from the image of a high-flying, visionary leader. Forget about the grand ideas and the spotlight; it's time to dive into the nitty-gritty.

Instead of chasing after the glamorous and high-status tasks, the real deal is to roll up your sleeves and embrace the less-than-exciting work that needs to be done. The mantra here is to "do things that don't scale."

As a CEO in these early stages, your job is to get your hands dirty, tackle the toughest and least appealing tasks, and personally make sure every part of the startup is running like a well-oiled machine.

Unlike the typical picture of a CEO as a powerful and big-picture thinker, the truth in a startup's “early days is about doing whatever it takes to keep the whole system running smoothly.” Founders need to shift their mindset away from mimicking the leaders of giant, established companies and instead focus on the hands-on, gritty work needed to make things happen in the initial phases of their startup journey.

I come across a bunch of super smart people, but when it comes to finding their own thing? Not their favourite. Why? Well, brainiacs usually avoid the not-so-fun tasks, like dealing with customer service or handling angry customers.

But for founders, it's a different story. They have to get their hands dirty, especially in the early days.

Sure, it might not be the most efficient way of doing things, but here's the deal: “Diving into the messy stuff pays off big time. Founders learn directly from the source, creating better products because they understand what customers need.”

They experience the challenges firsthand, unlike big companies shielded by layers of managers."

So, if you want to be a founder, get ready for the not-so-pretty, unglamorous work. It's the secret ingredient to learning, building, and serving customers the right way. Embrace the tough parts, founders – that's how the magic happens.

Check this list of 100+ startups’ strategies on - “Do things that don’t scale”. Access Here.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

All-In-One Guide To Venture Capital Interview Questions (And How to Answer Them) - Access Here

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

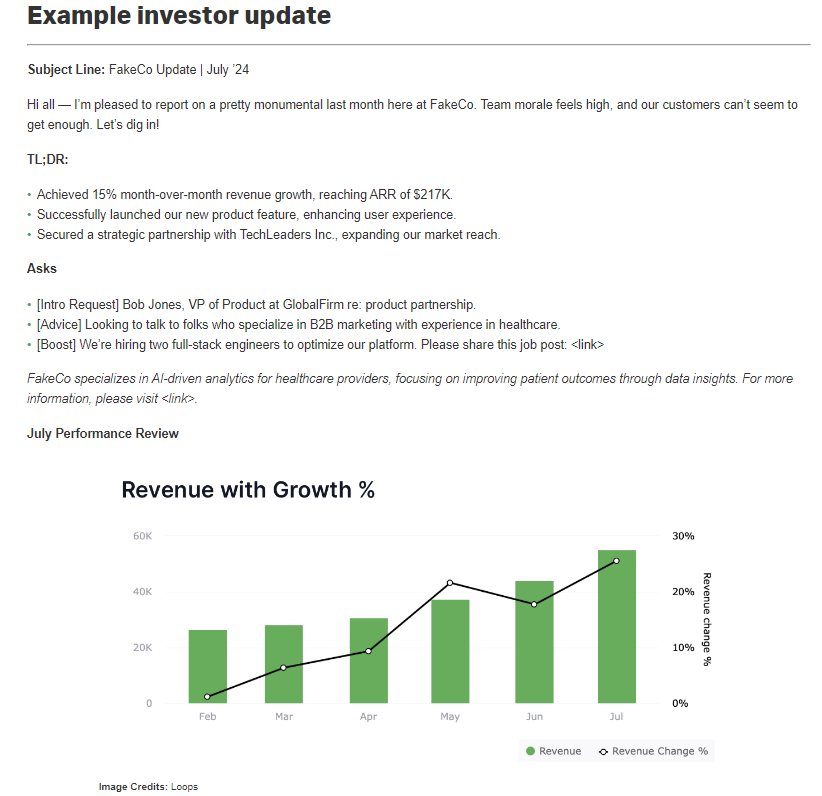

1. How to Write Your Monthly Investor Update - Template To Download.

Pitching investors is a big part of running your startup, but no matter the outcome of the meeting, the opportunity does not end there. You should not only be logging your hard-earned contacts into a CRM but also keeping these relationships warm through investor updates.

But what exactly is an investor update?

It’s a regular email a startup sends to its investors to inform them about the company’s recent progress, key metrics, challenges and plans.

These updates demonstrate to investors your commitment to progress and learning through trial and error. Over time, this builds trust while allowing you to leverage investor expertise and their networks. With enough trust, these investors may participate in your next round and refer you to new potential investors too.

Although it may sound like a simple email, there is an art to writing an effective investor update. The following is everything you need to know about how to craft and send an update that keeps investors engaged, communicates momentum, and garners support on your journey.

So what should you include in your investor’s updates?

TLDRs - Start the update with this. One paragraph max. You want your investor to in 30 seconds get a [green, yellow, red] pulse on the co and determine whether they should invest 30 more minutes, a few hours, or 1+ days to dig in to help.

Asks - Next have 2 or 3 bullet point asks, the more specific the better. The easiest asks are intros. Investors are well-networked. Firing intros takes me ~5 minutes and are high value. Jumping on a call takes ~30 mins.

KPIs - bar chart - Immediately get to this. Two high-level numbers. Usually monthly revenue, plus another key KPI. Show a monthly growth graph of each. If you're hiding this, something is wrong.

2nd order KPIs - table - 8 to 10 metrics you keep an eye on. Usually in a table, by month. If your investor is an expert in your area, this can help them debug and catch things you don't see (ie. give you benchmarks across their portfolio on default rates, etc)

Hi's / Low's - Typically 3 bullets on wins, 3 bullets on what can be better. Most will scan the wins. Helpful investors will give some help or feedback on the challenges.

Optional things - Then it's all optional stuff. I've seen updates on key initiatives, bullet points on key PR to help with sharing, maybe some feel-good team photos, etc. Rotate interesting things in/out to keep it interesting.

What's next - End with targets for next month or quarter as well as key initiatives. Shows you know what game you're playing and how to keep score. Helps build investor trust.

Here’s is example (Tech Review Source)

Think of your investor update as a chance to show investors what you’re made of. It’s not just about the numbers and milestones — it’s about giving them a peek into how you think, how carefully you’re paying attention to the details, and just how far you can take your startup.

Also if you are struggling to raise funding, I would always suggest trying to send monthly updates to all investors. Here’s why?

Investors invest in the trajectory of companies & people. It's impossible to get a trajectory without watching a narrative unfold with time

If you do what you say you are going to do and document it, this puts you in the top 5% of founders.

Embrace this tool, and I guarantee that you’ll quickly see its impact.

2. How to Ask VCs for Money? - A Framework From VC Partner

When an investor asks you why you need to raise money, the worst thing you can reply with is that it’s to extend your runway.

Investors care about growth and having a clear set of milestones you think you can hit. They see a lot of opportunities, and the most exciting ones are fires that are already growing that they can throw gasoline on top of.

This is similar to how your customer doesn’t care about your product, they care about the benefit or transformation your product provides for them.

Show them an opportunity that’s growing quickly but could grow faster with some help, rather than one that needs more money to survive a little longer in the hopes of striking gold.

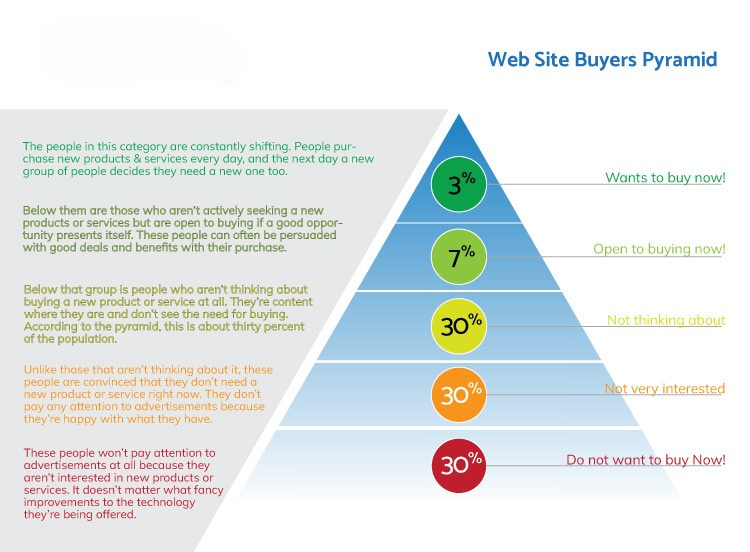

3. The Buyer’s Pyramid

“Figuring out” your startup’s TAM is somewhat useless. Most of the time it’s made up, or at least very generous, and everyone knows it. But the real sin about TAM is that it’s just one giant number.

Sure, you have SAM and SOM as well but those aren’t much better. They don’t tell you anything actionable like, for example, how ready to buy your market is.

The Buyer’s Pyramid does, though, and I’ve found it pretty helpful. It’s broken down into five states a potential customer can be in:

Buying / ready to buy

Open to buying

Not thinking about buying

Don’t think they’ll buy

Know they won’t buy

The numbers below are just arbitrary. What I like about the framework is that you can use different strategies for each distinct user group, track performance with simple tagging when potential customers are in your funnel, and audit whether you’re spending your time and money most effectively with sales and marketing.

Join 31000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

A U.S. court has ordered bankrupt cryptocurrency exchange FTX to pay $12.7 billion in relief to its customers, as announced by the Commodity Futures Trading Commission. (More Here)

OpenAI appoints veteran AI professor Zico Kolter to the board (More Here)

Kenneth Stanley, co-founder of Maven (Former OpenAI Researcher) backed by Sam Altman, is stepping down three months after its public launch due to insufficient growth to attract further investment. (More Here)

Humane AI Pin sales fell short with only 10,000 units shipped out of a targeted 100,000, and more returns than purchases between May and August left 7,000 units in circulation. (More Here)

A group of tech investors called "VCs for Kamala" raised $176,000 to support Vice President Kamala Harris. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 22,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

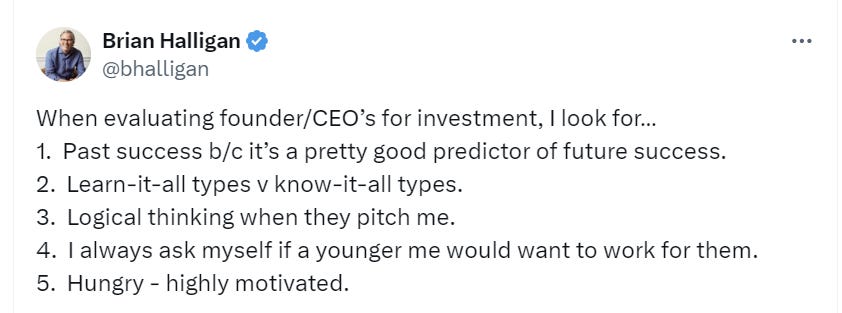

TWEET OF THIS WEEK

Best Tweet I Saw This Week

HubSpot's Cofounders' Ways to Evaluate a Startup Founder -

How Can I Help You?

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 50,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Venture Capital Internship - Jan 2025 - b2 venture | Germany - Apply Here

Director, Investments - Pivotal Venture | USA- Apply Here

Head of Communications - Norrsken VC | Sweden - Apply Here

Ventures Analyst I Mobility - Plug and play tech centre | Spain - Apply Here

Ventures Analyst | Enterprise & AI - Plug and play tech centre | Spain - Apply Here

HealthTech Investment Manager exceptional venture - UK - Apply Here

Investment Associate - Blumberg Capital | USA - Apply Here

Venture Capital Off-Cycle Analyst Paladin Capital Group - UK - Apply Here

Managing Director - New community transformation fund | USA - Apply Here

Senior Associate, Investment - Technology/AI - B Capital Group | USA - Apply Here

Associate/Sr. Associate - Aquiris Capital | India - Apply Here

Head of Communications - Project A | UK - Apply Here

Executive Assistant - RET Venture | USA - Apply Here

Investing Teams - Alumni Venture | USA - Apply Here

Vice President-Investments - Ivycap venture | India - Apply Here

Partner 22, Content Marketing, Investor Relations - a16z | USA - Apply Here

Venture Partner - Biotech - NLC | Netherland - Apply Here

Ventures Analyst - Plug and play tech centre | Brazil - Apply Here

Investment Partner - M12 | USA - Apply Here

🧐 All In One VC Interview Question Guide (How To Answer Them)

Under the “Break Into VC” initiative we have launched our all-in-one VC Interview guide (how to answer) for aspiring venture capitalists.

We have shared some of the popular questions in our “Break Into VC” newsletter. With this, you can access our guide pdf, which contains -

Roles, Related Skills and Reasons for Interest

Intro / About You / Why VC Questions - Include 8 questions and answers.

Previous Professional - Include 7 questions and answers.

Role/Responsibilities/Passion Questions - Include 10 questions and answers.

Potential “Technical” Q’s - Include 13 questions and answers.

Questions You Can Ask VC - 5 questions you can ask VC to stand out from the crowd.

All of these questions and answers are curated from VC partners… So don’t miss this chance to access our resources.

For the first 50 aspiring venture capitalists, we are offering a 50% discount. Check out here…

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

That’s It For Today! Happy Friday. Will meet You on Tuesday!

✍️Written By Sahil R | Venture Crew Team