When Should Startups Prioritize PMF Score over NPS? | VC Jobs

"Peer-validated Share Rate" & Do VC Open Cold Emails? - From Leading VC Partners

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Trending AI Tools of the Week

Deep Dive: When should startups prioritize PMF Score over NPS?

Quick Dive:

Writing a Cold Email That Gets VC Funding - Advice from Leading VCs.

How to make sure users share your product - "Peer-validated Share Rate"?

MVP is Over. You Need to Think About MVE.

Venture Curator Hub: Get Access To 10000+ verified investors' email contact database & more.

Major News: Bill Gates Energy Fund Raises $900 Million, Character.AI Founder Rejoining Google After Leaving In 2021, OpenAI Co-founder leaves To Join Anthropic & AI Chip Startup Groq Raised $640 Million…

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

FROM OUR PARTNER CONTRAST STUDIO

Reach product-market fit faster and wow investors by “outdesigning” your competition.

We know building something from nothing is incredibly difficult. Founders need all the help they can get.

One of the best things one can do? Find a strong design partner.

Steve Jobs had Johnny Ive. Apple wouldn't be what it is today without Ive.

Who’s your design partner? - This is where we come in.

Contrast is a design studio specialized in helping start-ups build the right thing, move fast, and set a strong foundation for future growth. All on a flat monthly fee. No commitment. No surprises.

The best part: get 5% off your first 3 months. Exclusive to Venture Curator readers.

→ Book a call and use the code CS+VC24 in the Referral Code input.

PARTNERSHIP WITH US

Want to get your brand in front of 50,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TRENDING AI TOOLS OF THE WEEK

Don’t Miss These AI Tools

Jazon AI: The AI SDR agent that handles reach-out, responses & research. Jazon handles outreach autonomously so you can focus on closing deals. (Try Here for free)

Pickaxe AI: A no-code platform for building AI tools and launching your own GPT store. Sell AI tools and chatbots via paywalled subscriptions. Deploy tools, set usage limits, monitor user activity, & more! (Try Here for free)

TODAY’S DEEP DIVE

When should startups prioritize PMF Score over NPS?

(PMF Score - Product market fit score & NPS - Net Promoter Score)

One of the common mistakes seen with NPS (Net Promoter Score) is that it is used at the wrong time by most of the founders. Combine this with the fact that it is also a lagging indicator and you get not only misrepresented information but you get it, way, way too late. But there is a simple way to help you make it more effective.

Enter Product Market Fit Score

PMF score simply measures how well your product is meeting your users’ needs.

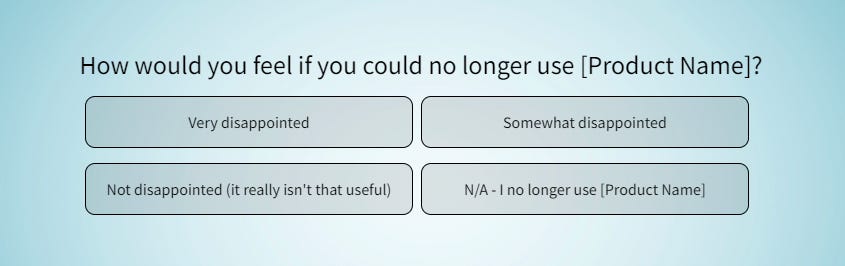

To use it, ask your users how disappointed they’d be if they couldn’t use your product anymore and give them the options of “Very”, “Somewhat”, and “Not at all”

You want over 40% of qualified responses to pick “Very” — that’s an indicator that you’re meeting the core needs of enough users to start hitting actual PMF, which is notoriously tough to measure.

For example -

In 2007, Marc Andreessen, the co-founder of Netscape and a prominent venture capitalist, made a statement that has become a central criticism of the PMF (Product/Market Fit) score.

“You can always feel product/market fit when it’s happening. The customers are buying the product just as fast as you can make it—or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can.”

Basically, you’ll KNOW when you hit PMF without needing a survey to tell you. But the PMF score is still useful as an indicator, before you hit PMF, of whether you’re trending towards it or not. If 28% of responses last month were “Very” but this month it’s 31%, keep doing what you’re doing.

Also — the PMF score was originally created by Sean Ellis, the former Head of Growth at Dropbox who’s also founded multiple startups that were eventually acquired.

When to Use PMF Score

This may seem obvious, but the PMF score is most useful when you’re actively trying to find PMF (either in the early stages of a new idea, or when you’re navigating a pivot).

But this doesn’t only mean in the early days of your startup.

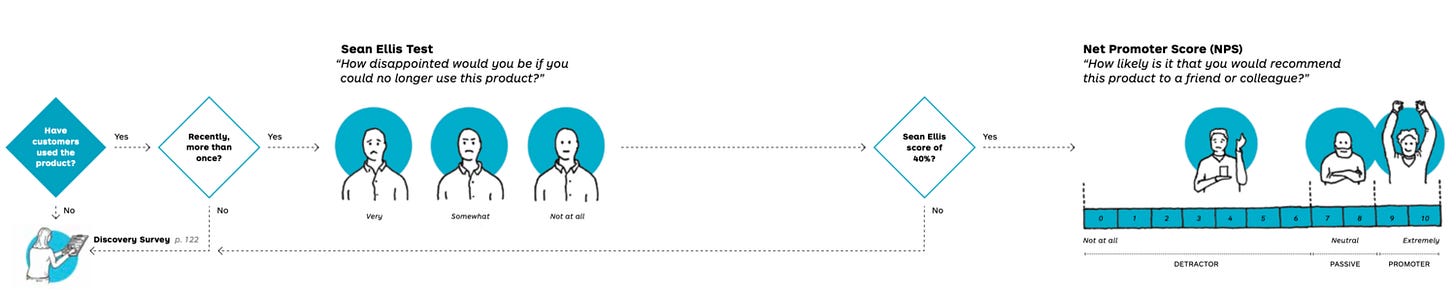

Another, often overlooked point about PMF score is that you should only care about responses given by people who have used your product recently and more than once.

Source: Testing Business Ideas by David Bland

A PMF score from a new user who’s only gone through your signup flow is useless (and not filtering those out can skew the results).

If they haven't experienced the core value proposition recently and more than once, use a discovery survey instead. Include a call-to-action for customer interviews to understand why they signed up. A signup shows the "what" (quantitative), but not the "why" (qualitative).

If they answer "somewhat" or "not at all" disappointed, don't give up. Segment them into groups and dig into why by interviewing them, and looking at referral sources, to understand why the value proposition isn't resonating.

Source: Testing Business Ideas by David Bland

On the other hand, Net Promoter Score (NPS) measures how likely customers are to recommend you and classifies users as Promoters (9-10), Passives (7-8), or Detractors (0-6) based on their responses. A higher percentage of Promoters indicates stronger customer loyalty. If they do recommend it, it drives growth and saves on paid marketing costs.

For Example -

There is much debate on what a good NPS score is depending on the industry, but basically, you are looking at the following calculation:

% PROMOTERS - % DETRACTORS = NPS

Source: Testing Business Ideas by David Bland

If 50% are Promoters, 30% are Passives, and 20% are Detractors, the NPS would be 30 (50% - 20%).

Even with NPS tests, teams often face the situation of customers being extremely likely to recommend the product, yet not being disappointed if the product goes away, resulting in an awkward silence.

This situation happens all too frequently because we aren’t using the appropriate forms of customer research in the correct sequence. You also need to go way beyond surveys but I digress. You can solve this issue only by asking NPS after you’ve found product market fit, which you can help diagnose using the Sean Ellis Test.

If customers recently experienced your core value, use the Sean Ellis Test for fit. If they're not disappointed if your product went away, find out why. If disappointed, use a Net Promoter Score survey later to see if they'd recommend it.

If likely to refer, make it easy with referral programs and make them product ambassadors.

With tweaks to sequencing experiments and discovery, you'll understand customers better.

Nobody wants customers who don't care if your product goes away, but will still recommend it to friends.

So Overall:

PMF (Product Market Fit) Score

Definition: The PMF score measures how well a product is meeting users' needs.

Key Question: "How disappointed would you be if you could no longer use this product?"

NPS (Net Promoter Score)

Definition: NPS measures customer loyalty by asking how likely they are to recommend the product.

Key Question: "How likely are you to recommend this product to a friend or colleague?"

When to Use Each Metric

PMF: Most useful when seeking product-market fit, especially in the early stages or during pivots.

NPS: Suitable for measuring customer satisfaction and loyalty at any stage of product development.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

Excel Template: Competitor Analysis Framework For Early Stage Startups (Access Here)

Early Stage Startup Financial Model Template For Fundraising (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

1. Writing a Cold Email That Gets VC Funding - Advice from Leading VCs

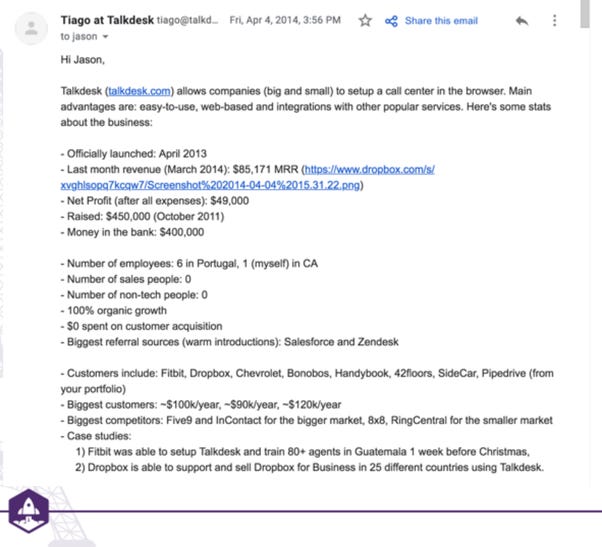

Recently, Brett Adcock, the founder of Figure Robot, shared a tweet in which he listed several reasons why he believes cold emails work better than referrals.

Outbound cold email scales several orders of magnitude better than referrals - you can find 99.9% of anybody’s email.

Raising capital is a shots-on-goal game; you want to maximize top-of-funnel pitches. Optimizing your fundraising for referrals will put you at a local maximum.

It’s a challenge finding somebody who will stick their neck out to refer you. People rarely want to use their political capital referring you to a *highly important person* in their network, therefore at best you’re left with lousy double opt-in email.

Although I completely agree with these points, many founders struggle with writing cold emails to investors. Some founders even question whether investors open cold emails. Here's what investors said:

Keith Rabois prefers a deck, and he reads most of them.

Aileen Lee or her partners read every email pitch that comes into Cowboy Ventures.

David Sacks of Craft prefers a short email pitch that summarizes the opportunity.

Satya Patel of Homebrew reads everything sent to him

Jason (Founder of SaaStrfund) said - “I do get behind on email, but I love an amazing cold email and have funded maybe ~50% of my investments from them. I like an email pitch that is so amazing that I’d fund it just based on the email alone. “

So yes, is a perfect warm intro better? Yes. But even the top, most famous Seed VCs are hunting. Hunting unicorns and decacorns. And they can’t wait for them all to come from their networks.

Here’s the email from two startups to which Jason gave million-dollar funding…

Email Template: Jason SaaStrfund

So put together the very, very best cold email you can. Make it awesome in every way. And send it to your top VCs. At least seed and probably Series A VCs, too.\

They may not respond. But if it’s awesome, including the title, I bet they open it. And if it’s super awesome, you have a better chance than you might think of getting a meeting.

2. How to make sure users share your product - "Peer-validated Share Rate"?

"Peer-validated Share Rate" describes how people's sharing behaviour in apps is influenced by seeing others share.

3. MVP is Over. You Need to Think About MVE.

(Hint: V isn’t for viable — it’s for valuable)

Most startups fail because first-time founders either under-invest and create something untested based on gut instinct, or over-invest without validating if it provides value.

The crucial question is not "how can I solve this problem?" but "how can I create a valuable experience that people desperately need and will pay for?"

The example of Thomas Edison's light bulb invention highlights this - existing bulbs were viable but not valuable as they didn't last long. Edison focused on creating a Minimum Valuable Experience (MVE) by making affordable, durable bulbs that provided the illumination people craved.

To identify an MVE, use the A.C.T. framework:

Audience - Deeply understand your ideal customer segment, their behaviours, goals, and what they seek.

Communication - Craft messaging using language and formats that resonate with your audience.

Touchpoints - Design triggers and channels to move your audience to action effectively.

The startup Webflow exemplifies mastering A.C.T. The founders envisioned empowering designers through no-code web design. They intimately knew this audience, positioned Webflow's unique value and gained explosive traction via platforms like Hacker News. Though facing numerous setbacks, their clarity of vision and customer focus ultimately led to billions in valuation.

Startups must relentlessly pursue creating meaningful experiences, not just viable products. Continuously adapt based on audience feedback. Success stems from this laser focus on delivering an MVE that genuinely improves customers' lives in ways they'll pay for. Must recommend reading this article by Pete Sena.

Join 31000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

John Schulman, co-founder of OpenAI, has left to join rival AI startup Anthropic. OpenAI president Greg Brockman is taking an extended leave. (More Here)

Elon Musk's social media platform X (formerly Twitter) will close its San Francisco office. (More Here)

Breakthrough Energy Ventures, launched by Bill Gates, is raising its third fund of $839 million. (More Here)

Founders of Character.AI, Noam Shazeer and Daniel De Freitas, along with other team members, are rejoining Google’s AI unit DeepMind. (More Here)

Open AI has developed a text watermarking tool to detect ChatGPT-written assignments. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 22,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

From Paul Graham

How Can I Help You?

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 50,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Investment Partner - M12 | USA - Apply Here

Marketin - Iconiq Growth | USA - Apply Here

Impact Investment Associate - Massmutual catalyst fund | USA - Apply Here

Pre-MBA Analysts - 12 Flags | India - Apply Here

Marketing & Communication Internship - Velocity Venture | Singapore - Apply Here

Partnerships Manager - Techstars | USA - Apply Here

Investment Associate - Koch Disruptive Tech | USA - Apply Here

Deal Sourcing Analyst - Censie Capital Partner | India - Apply Here

Partner 22, Content Marketing, Investor Relations - a16z | USA - Apply Here

Ventures Analyst - Plug and play tech centre | Brazil - Apply Here

Investment Associate - Perot Jain | USA - Apply Here

Analyst | India - Apply Here

Partner 18, Deal Operations - a16z | USA - Apply Here

Investment Partner - Aduna Capital | Nigeria - Apply Here

Investment Manager - CDP | Italy - Apply Here

Portfolio Managers & Product Specialists - Cervin Family Office | India - Apply Here

🧐 Guy Kawasaki’s The Venture Capital Aptitude Test (VCAT).?

Use this test to find out if a job in venture capital is for you. ...👇

Guy Kawasaki created this test while working at Garage Technology Ventures. It can help you figure out if you're suited for a job as a venture capitalist.

Source: Break Into VC Newsletter

He divided this test into three parts -

Part I: Work Background

Part II: First-Hand Experiences

Part III: Necessary Knowledge

Results

We have shared a detailed guide and curated resources in our “Break Into VC” newsletter.

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

That’s It For Today! Happy Tuesday. Will meet You on Friday!

✍️Written By Sahil R | Venture Crew Team

wow, this is a goldmine!!