How to Negotiate a VC Funding Round: What to Expect and How to Respond? | VC Jobs

Three Feature Buckets Framework & Selecting the right Product Metric (KPIs)....

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: How Can You Negotiate VC Funding Round? What to Expect and How to Reply?

Quick Dive:

Selecting the right Product Metric (KPIs).

Double Diamon Framework.

Three Feature Buckets Framework: Prioritize New Features

Major News: Tech Giant's $1 Trillion AI Investment, Apple Joins OpenAI Board, Jeff Bezos Plans To Sell $5 Billion Worth Of Shares, Figma Disable AI Feature Amid Plagiarism & Chinese Firm Develops Brain-Computer Interface, Rival Neuralinks…

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH HONEYBOOK

Enter To Win A $25,000 Business Grant

If you’re an early-stage marketing and creative business struggling to break through to that next level of growth, this program is for you.

The Breakthrough Grant from HoneyBook provides $25,000 in cash, tools, resources, and training to help up-and-coming businesses unlock their potential.

Simply share why you started your business and what winning this grant would help you achieve for your chance to win!

PARTNERSHIP WITH US

Want to get your brand in front of 50,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

How Can You Negotiate VC Funding Round? What to Expect and How to Reply?

Top Founders know that fundraising is a critical skill that’s much harder than meets the eye. But what’s rarely discussed is

Fundraising is a learned skill

And VCs almost always have the upper hand because they deal with it all day, every day.

In reality, knowing what to expect from VCs – the negotiation dynamics Founders are likely to encounter – is half the battle.

Before you start communicating with VCs, take the time to learn how to detect and manage these 8 little-known fundraising dynamics. Let’s dig in. ( We are sharing this in more conversation format….)

Image credit: Abderrahim Boutorh

The Portfolio Trap

VC: "I'd like you to meet with one of our portfolio companies in your space. They can provide valuable insights, and we'd appreciate their perspective on your venture."

This request often puts founders in a tricky position. Sharing your plans with a potential competitor can be risky, and the existing portfolio company has little incentive to endorse your startup. They may tell the VC they're planning to expand into your area, making it challenging for the investor to back you. While VCs might have good intentions, this practice can sometimes backfire or be used to gather intelligence for their existing investments.

Founder’s Reply: If the suggested company is too close to your business, politely decline:

"I appreciate the offer and value your network. However, given the significant overlap between our business and this portfolio company, I'm not comfortable sharing our strategic plans. Perhaps we could meet with other industry experts who aren't directly in our space?"

If the portfolio company isn't a direct competitor, consider accepting:

"Thank you for the introduction. I'd be happy to meet with them. It would be valuable to hear about their experience working with your firm and get their industry insights."

Remember, your goal is to protect your business interests while maintaining a positive relationship with the potential investor. If you do meet, use it as an opportunity to learn about the VC's support and working style from an existing portfolio founder's perspective.

The Valuation Conversation

VC: "What valuation are you looking for in this round?" or "What's your target price for the company?"

This question is a common tactic used by VCs to gauge your expectations and potentially anchor negotiations at a lower point. While it's a legitimate inquiry, it can be a pitfall for founders who, in an attempt to appear reasonable, might suggest a valuation below their company's true worth. Remember, any figure you mention could become the ceiling, not the floor, for further discussion.

Founder’s Reply: Unless you're dealing with a priced extension round or a convertible note with predetermined terms, it's wise to defer to market dynamics. A tactful response might be:

"We're open to letting the market determine our valuation. We're more focused on finding the right partners who can add value beyond just capital."

If you've had a previous funding round, you can provide context without committing to a specific number:

"Our last round valued the company at $X million post-money. Since then, we've achieved significant milestones, including [brief mention of key metrics or achievements]. We believe these developments have substantially increased our value, but we're eager to hear the market's perspective."

This approach demonstrates confidence in your company's progress while leaving room for negotiation and avoiding the trap of undervaluing your startup prematurely.

Turn Into Home Run

VC: "Based on our analysis, we'd like to offer you $X million at a valuation of $Y million."

This initial offer might seem disappointingly low. It's a common strategy in VC negotiations, often serving as a starting point rather than a final stance. Inexperienced founders sometimes react emotionally, potentially derailing a deal that could have been salvaged with the right approach.

Founder’s Reply: The key is to remain composed and professional. A strategic response might look like this:

"Thank you for your offer. We appreciate your interest in our company. While this valuation is considerably below our expectations, we'd like to take some time to review it in detail. We'll get back to you soon with our thoughts."

This response acknowledges the offer without accepting or rejecting it outright. It buys you time to explore other options and potentially leverage them.

If you receive more attractive offers later, you can circle back:

"We've had some time to consider your offer and explore the market. We've received interest at significantly higher valuations that better align with our growth trajectory and potential. We value our relationship and wanted to allow you to revisit your offer if you're interested. If not, we completely understand and hope to stay in touch for future opportunities."

This approach keeps the door open while signalling that you have other options. It gives the VC a chance to improve its offer without burning bridges. Remember, maintaining positive relationships in the VC world can be beneficial for future funding rounds or networking opportunities.

Deflect the Friendly Lowball

VC: After a warm, engaging meeting filled with enthusiasm and positive feedback, the VC follows up with a surprisingly low offer. This unexpected contrast between their friendly demeanour and the underwhelming valuation can catch founders off guard.

This scenario often leads founders to doubt their judgment or feel pressured to accept a subpar offer due to the perceived rapport. It's a subtle tactic that leverages the positive connection established during the meeting.

Founder’s Reply: The key is to maintain your composure and separate your emotions from the business decision at hand. A balanced response might look like this:

"Thank you for the offer. We truly enjoyed our meeting and appreciate your enthusiasm for our vision. However, the proposed valuation is significantly lower than what we believe reflects our company's current value and potential. We'd like to take some time to carefully consider this offer in the context of our market research and growth projections. We'll get back to you soon with our thoughts on how we might bridge this gap."

If the VC doesn't adjust their offer, you can follow up with:

"We've given your offer careful consideration. While we greatly value the potential of working together, we feel that this valuation doesn't align with our company's trajectory and the current market. We're open to further discussion if there's room for adjustment. If not, we hope to keep the door open for future opportunities as our company grows."

This approach maintains a positive relationship while firmly asserting your company's value. It leaves room for negotiation without committing to an undervalued deal. Remember, a good partnership should be mutually beneficial, balancing enthusiasm with fair terms.

Focus on Pre-Money Valuation

VC: "We're looking at investing $2M at an $8M post-money valuation."

VCs often frame discussions in post-money terms, which can lead to confusion and potentially reduced founder ownership if the round size changes.

Founder’s Reply: "Thank you for the offer. To ensure we're on the same page, let's discuss this in terms of pre-money valuation. Based on your proposal, we're looking at a $6M pre-money valuation. Is that correct? We prefer to focus on pre-money valuation as our fundraising target may adjust."

ESOP Negotiations

VC: "We'd like to see a 20% ESOP allocation before the round."

VCs often push for large ESOP pools to reduce their future dilution. They may request excessive allocations, sometimes up to 20% or more, which can significantly impact founder ownership.

Founder’s Reply: "We've analyzed our hiring needs until the next funding round. Based on our projections, a 10% post-round ESOP pool should suffice. This includes 2% for a key hire we've identified and 5% for additional team members over the next 18 months. This aligns with market standards for seed rounds and ensures we have enough to attract top talent without over-diluting existing shareholders. We're open to discussing specific concerns you may have about our hiring plan."

Distinguish Genuine Interest

VC: "We're interested in investing, but we'd need you to find a lead investor first," or "We'd like to commit, contingent on you raising the rest of the round."

VCs often use these tactics to keep their options open without fully committing. They're expressing interest but aren't ready to take the lead or make a firm commitment.

Founder’s Reply: "We appreciate your interest in our company. We're currently focusing on investors who are ready to commit without contingencies. Once we secure our lead investor, we'll reach out if there's still room in the round. In the meantime, would you be open to introducing us to any potential lead investors in your network?"

This response politely acknowledges their interest while prioritizing more committed investors. It also leaves the door open for future participation and potentially leverages their network.

That’s it.

But before getting to the negotiation part, the most important is having a great pitch deck…

Deck help you to a call from investors. Without meeting you have no shot at getting funded. Investor meetings get you funded. If you are struggling to create a great storytelling pitch deck. My expert team is here to help you. More Info Here

QUICK DIVES

1. Selecting the right Product Metric (KPIs)

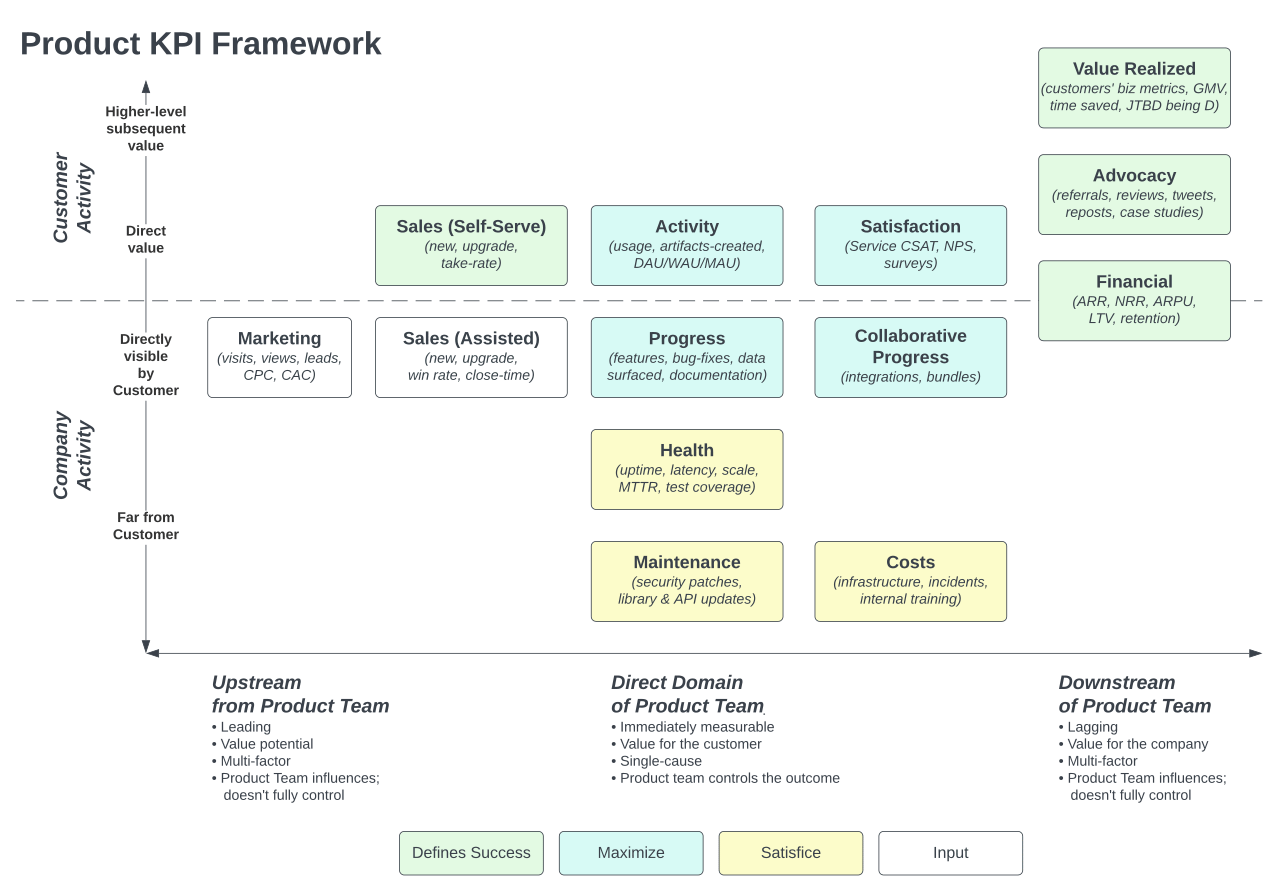

One of the biggest challenges founders face is choosing the right metrics for their startup. Jason Cohen of “A Smart Bear” has shared this interesting approach to selecting KPIs that resonate with all of your stakeholders, not just the product or sales team.

Quite a few of the common KPI mistakes I see:

No alignment with business objectives

Not SMART (Specific, Measurable, Achievable, Reliable, Time-bound)

Not understood or agreed to by stakeholders

There are lots of frameworks to help you define your KPIs: Objectives & Key Results (OKRs), North Star Metric, or Balanced Scorecard.

But, even choosing the right framework can be challenging. Jason’s visual is particularly effective:

Image Credit: Jason Cohen (A Smart Bear)

Addressing multiple stakeholder needs and securing their buy-in

Making a clear distinction between top-line must-measure metrics and the supporting detail-oriented operational data (he calls them “maximisers” and “satisficers”)

But as essential as KPIs are, it’s too easy to get lost in trying to define the “perfect set of KPIs”. There’s no such thing. Here’s why.

Marketing is a science. This is how to approach a campaign:

Hypothesis → Experiment → Analyze → Improve → Iterate

The same approach applies to your KPIs. Just as important as KPIs are your business fundamentals. There’s nothing to measure if your business fails to get off the starting block.

How aware is your target customer of your brand? Brand awareness is key to growing your customer base, fostering trust and emotional connections, and driving engagement.

How is your brand perceived? Entire businesses are built (or lost) on reputation. Delivering a reliable, high-quality product, following through with your promises, and communicating honestly put your business in good standing with your customers and help reduce churn.

How loyal are your customers? Long-term retention strategies offer better payback than short-term customer acquisition strategies. Ensuring your value proposition is clear and understood by the end user and that you consistently deliver a great UX/UI are major factors to keep customers coming back for more.

KPIs are the common language that all of your stakeholders should be speaking – your teams, executives, investors, and to a degree, customers. But numbers are just numbers. You also need a healthy dose of intuition and willingness to take action.

Want the full breakdown? Check out the pdf for more details.

2. Double Diamon Framework

Founders know their product strategy will change early and often as they learn more about their users.

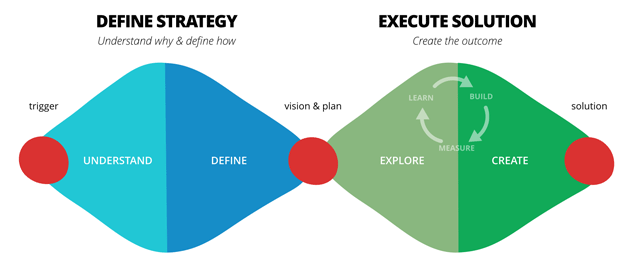

The Double Diamond framework provides the required adaptability — particularly for software products and services:

Image Credit: Jonny Schneider

Understand → When you’re triggered by a new idea, learning from users, macro change in the market, or new technology you return to this phase. Understanding the why behind these changes is essential. Consider how they’ll impact customer behaviour going forward.

Define → Once you understand a shift, define the promising opportunities and create an initial strategy. Don’t skip this stage, as your solution should be rooted in this vision. It’s what sets you apart.

Explore → This phase is all about finding a solution that will work in your market, and for your users. Many founders make the mistake of setting a vision and jumping right into creating. Don’t be that founder. You don’t want to build any more than you need to in the early days. Building too much too soon is expensive and limits flexibility.

Create → Only after you’ve explored pathways with your users, move on to creating a full solution. But even as you progress through this phase, build in as small increments as possible, and then return to the Explore phase frequently to get new feedback. It may change your assumptions in unexpected ways.

3. Three Feature Buckets Framework: Prioritize New Features

Adam Nash’s Three Feature Buckets framework helps founders classify and prioritize new features:

Metric Movers → Features that will significantly move your metrics. Typically features that drive engagement, growth, or revenue.

Customer Requests → Features that customers are requesting. You won’t implement every request but understanding what’s in this bucket will help you keep a pulse on how users are feeling.

Customer Delight → Features your customers aren’t asking for but will create an unexpected and delightful experience.

Another way to think about this is that metric movers are focused on the business, while the other two are focused on the customer (with the difference being whether customers know they want the feature or not).

Your priorities between these three buckets will shift over time — typically in the early days you’ll want to prioritize the latter two and worry more about metrics as your startup grows.

Join 29000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Elon Musk's $56 billion Tesla pay package was successfully challenged in court by shareholder Richard Tornetta. Now, three law firms are seeking a record $7 billion in attorneys' fees.

Amazon founder Jeff Bezos plans to sell $5 billion worth of shares after stock hits record high. He'll retain 8.8% of Amazon's stock post-sale.

Sidney Scott, solo GP of Driving Forces, a $5 million fintech and deep tech VC fund, has announced the closure of his fund after four years of operation.

Figma temporarily disabled its "Make Design" AI feature after it reproduced Apple's Weather app design, sparking accusations of training on existing apps.

China is forming a committee tasked with drafting standards for brain-computer interfaces, indicating its intention to develop technology comparable to Elon Musk's Neuralink.

→ Get the most important startup funding, venture capital & tech news. Join 20,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

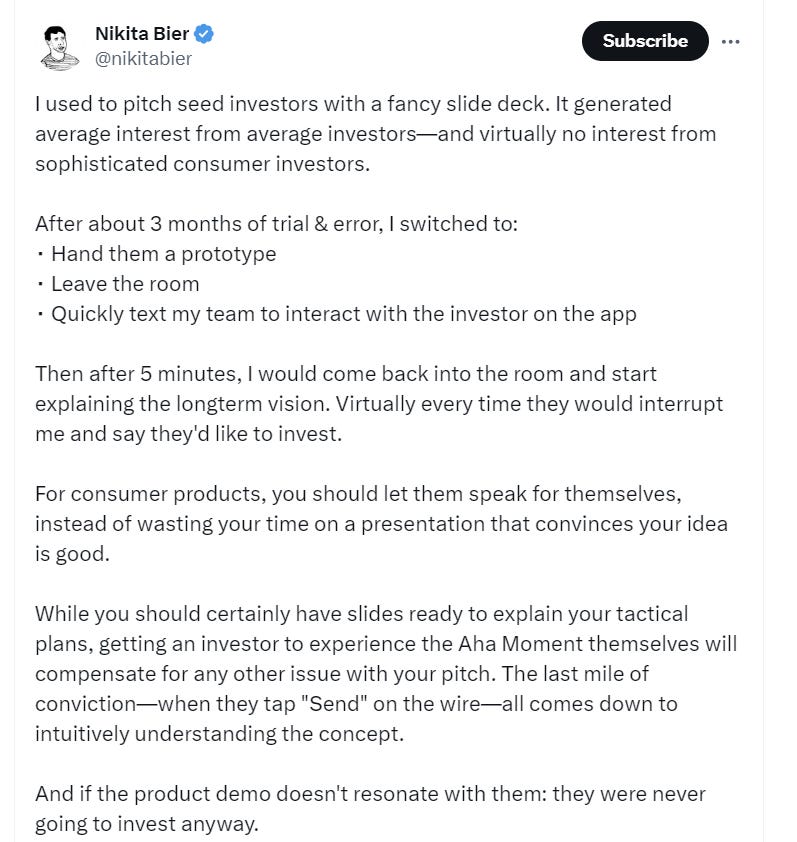

Great advice for consumer startups….

For consumer products, you should let them speak for themselves (investors), instead of wasting your time on a presentation that convinces your idea is good.

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Managing Partner - Forest Hill partner | USA - Apply Here

Director, Investments - Pivotal Venture | USA - Apply Here

Investment Partner - Hivemind | USA - Apply Here

Senior Associate - Rakuten Capital | Singapore - Apply Here

Legal Intern - Turbostart | India - Apply Here

Marketing Manager - Matrix partner India - Apply Here

Analyst - S4 Venture | India - Apply Here

Analyst / Associate Internship - Venture Capital (Fall 2024) - TNB Aura - Singapore Apply Here

Investment Associate - Blackwood Venture | Denmark - Apply Here

Fintech- Venture Capital Investing Senior Vice President - Citi venture | UK - Apply Here

Program Associate - Plug and Playtech venture | Apply Here

Platform Marketing - Symbolic Capital | USA - Apply Here

🧐 Trying to break into tech VC? Worried about your background?

VC is full of people from all over the place. Tech, non-tech, consulting, non-operators... you name it.

But when you're just starting, it's normal to stress about whether you've got the 'right' experience. I get it. So I thought I'd share some cool articles and stories from folks who made it into VC from totally unexpected backgrounds. Trust me, these are good.

Article: Matt Turck of FirstMark Capital on Playing Fake VC

Article: Chris Dixon of Andreessen Horowitz on Getting A Job In VC

Article: Sarah Tavel of Greylock (formerly of BVP) on VC Pre-MBA Hiring

Article: Adam Ludwin, formerly of RRE on So You’re an MBA Student that Wants to Work in VC?

Article: Brittany Laughlin of Union Square Ventures on Finding A VC Job

Article: Gaurav Jain of Founder Collective on How To Be A VC Without Any Capital

Article: David Teten of ffVC with ideas For Students Interested in Venture Capital

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….