Successful Startups Grow Quadratically, Not Exponentially. | VC Jobs

A Framework For Finding The Right Customers For Your MVP & Understanding Power User Curve...

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Successful Startups Grow Quadratically Not Exponentially.

Quick Dive:

A Framework For Finding The Right Customers For Your MVP.

Understand Your Most-Engaged Users with the Power User Curve.

Duolingo’s VP of Engineering Sean Colombo On Why you should roll out your experiments to as many users as you can, as quickly as you can.

B2C Startup Idea Validation Framework

Major News: Musk Could Leave Tesla Over $56 Billion Package Approval, Hong Kong Launched $8 Billion AI Fund, Robinhood Acquired Global Crypto Exchange & Carta's Valuation Drop From $8.5 Billion to $2 Billion.

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH DRAPER UNIVERSITY

Build your Web3 startup on Stellar & receive $20K in grant funding.

Draper University has partnered with the Stellar Development Foundation to grow 30 Web3 startups on Stellar.

We are the #1 early-stage backers of decentralization and Web3. Our alumni include Lemon Cash, Highstreet, QTUM and more.

Join our 3-week Silicon Valley residency, the Stellar Astro Hacker House. Learn how we support Web3 startups to fundraise, hire elite talent, and grow their user base to the moon.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

Successful Startups Grow Quadratically Not Exponentially

Fast-growing startups are frequently described as “exponential,” especially when the product is “viral.” But “exponential” is an incorrect characterization, even for hyper-growth, “viral” companies like Facebook and Slack.

If your model is incorrect, you don’t understand growth, which means you can’t control it, nor predict it.

— Jason Cohen

In his [long and mathematical] essay, Jason suggests an alternate model for how fast-growing companies grow. I like his thesis, so I’m going to do my best to synthesize it for you today.

Because, in his own words: …understanding the model is useful not only for predicting growth but also because understanding the foundational drivers of growth allows us to take smarter actions to create growth in our own companies.

First, he dispels the notion of “exponential” by looking at some popular companies that grew rapidly, and who often get dubbed as examples of this growth model.

Let’s take a look.

Not exponential

It’s been a minute since high school math…

Exponential growth = growing by a multiple. For example: In year 1 you grow by 10, in year 2 by 100, in year 3 by 1000.

Quadratic growth = growing by adding a constant. For example: Growing in year 1 by 10, then in year 2 by 20, in year 3 by 30.

In both, growth is clearly still accelerating, just at wildly different rates. To drive the point home:

Facebook is the definition of hyper-growth—getting to $50B in revenue faster than any company in history. The product is “viral”—friends bring other friends—which theoretically leads to “exponential growth.” But Facebook didn’t grow exponentially in the number of monthly active users:

Essentially linear for nearly twenty years, only exponential in the first four years.

Slack was the fastest-growing enterprise software company ever, going from $0 to $10M ARR in their first 10 months, and 0 to 10,000,000 active users in just five years. It’s also a “viral” product—organizations invite their members, who then create their own Slack-groups and invite others. So surely Slack has exponential growth?

Slack’s own data shows initial quadratic growth, followed by years of linear growth.

— Jason Cohen

So, given there’s no proof of an exponential growth model in startups — even looking at real-world data from the fastest growing companies (he also investigated HubSpot and Dropbox) — Jason points out that in fact… hyper-growth is quadratic.

But Why Do Products Grow Quadratically?

It’s not enough to just say that growth in real life is quadratic. We have to be able to know why this model makes sense, as this will give us a better understanding of the growth drivers in our own companies.

Luckily, Jason gives us a first-principles explanation so we have that insight, using the life-cycle of a marketing campaign as an example.

In my experience, marketing campaigns follow this pattern:

At the foot of the curve, we’ve launched a new campaign, but it’s ineffective; we haven’t figured out the best design and messaging and calls-to-action for this new medium and audience. Sometimes we never figure it out, and abandon the effort.

But in the case that we unlock the secret of efficacy, the campaign rapidly reaches a natural level of contribution; in this example, a number of “sales per week.” The specific level depends on many things: ad inventory, our budget, audience receptivity, and the consonance between the audience and our target market. Next, we enter the optimization phase.

We A/B Test our way to incrementally better results. Also, we enjoy the result of multiple exposures—most people need to see the ad more than once before they act.

Finally, we enter a phase of decline. There are various causes, all instructive:

The audience is saturated. Everyone in the channel has seen the ad more times than is required to act; it’s now falling on deaf ears. Even if the audience is growing, the number of new people is small compared to the number of people who were new to us when we began the campaign

The channel declines. A popular media site loses readers through over-monetization. An event that was well-attended loses favour. A newsletter that is frequent and insightful becomes less frequent or other writers take over. A podcast moves to a closed platform and loses many listeners.

The auction becomes uneconomical. For auction-based systems like Google and Facebook advertisements, or other zero-sum programs like affiliates or limited-inventory spots on newsletters or podcasts, the winner is the one who will pay the most. What is cost-effective for one bidder will be laughably overpriced for another, due to better conversion rates, higher revenue per customer, higher profitability per customer, or due to categorization as a “loss leader” or other way of ascribing value beyond immediate pay-back.

In my experience, marketing campaigns follow this pattern:

He calls this…

Whether it’s a marketing campaign or a new product release, growth initially accelerates as early issues are solved, then grows roughly linearly as things are optimized, and then starts dipping over time. That slowdown/decay is natural as things scale.

But, we don’t do single campaigns or releases, do we…we add new ones. Some end up being bigger than others, some can be better optimized, or decline sooner, and some decay more steeply than others.

So, companies that want to continue growing quickly after their first product reaches scale, must launch new products into new markets.

This leads to a variety of Elephant Curves across time —which, if plotted together — look very quadratic.

Okay, so what? What’s the advice for founders?

The consequence of knowing that the growth we encounter at work is quadratic is important, as we’re all trying to understand (and likely change) growth drivers. So, “getting the right language, and the right model, will lead to correct analysis, and right action.”

And to leave you with something more actionable here:

It’s great to add a feature to an existing product, but significant additional growth comes from increasing carrying capacity or creating a new avenue of growth. Early on you should focus on winning market share in one space, creating the first Elephant Curve, but after the product matures, something more drastic is required: Wholly new products, or updates significant enough to address new markets.

It’s well-known that companies need to add additional products to continue fast growth after achieving scale. However, the second product is highly unlikely to achieve the same market share and monetary scale as the first, so there needs to be multiple, not just one. This requires serious investment, parallel efforts, and the chutzpah to kill off the ideas that aren’t working.

Because word-of-mouth-driven growth is so much more effective than marketing-driven growth (both in cost-per-customer and in that unlike direct advertising it grows automatically as the company grows), it is worth a great deal of time trying to figure out how to build that into the product, rather than relying only on the marketing team.

QUICK DIVES

1. A Framework For Finding The Right Customers For Your MVP.

The foundation of any MVP is a problem, but it’s also critical that the user is aware of this problem.

While building MVP (Minimal Viable Product), Founders act like the “minimal” part is the goal. Or worse, that every potential customer should want it. In the real world, not every customer is going to get overly excited about your minimum feature set (i.e. Minimal Viable Product). Only a special subset of customers will and what gets them breathing heavy is the long-term vision for your product.

The reality is that the MVP is -

a tactic to reduce wasted engineering hours (code left on the floor) and

to get the product in the hands of early visionary customers as soon as possible.

You’re selling the vision and delivering the minimum feature set to visionaries not everyone.

Why A Minimal Viable Product (Minimum Feature Set)?

The MVP is the inverse of what most sales and marketing groups ask of their development teams. Usually, the cry is for more features, typically based on “Here’s what I heard from the last customer I visited.”

The premise is that a very small group of early visionary customers will guide your product features until you find a profitable business model. Rather than asking customers explicitly about features X, Y or Z.

One approach to defining the minimum features set is to ask “What is the smallest or least complicated problem that the customer will pay us to solve?”

This rigour of “no new features until you’ve exhausted the search for a business model” counters a natural tendency of people who talk to customers – you tend to collect a list of features that if added, will get one additional customer to buy. Soon you have a ten-page feature list just to sell ten customers.

Your true goal is to have a feature list that’s just a single paragraph long that you can sell to thousands of customers. Your mantra becomes “Less is more.”

Most customers will not want a product with a minimal feature set. In fact, the majority of customers will hate it. So why do it? Because you are selling the first version of your product to Earlyvangelists.

Earlyvangelists = Early Adopter + Internal Evangelist

“Earlyvangelists are a special breed of customers willing to take a risk on your startup’s product or service. They can actually envision its potential to solve a critical and immediate problem—and they have the budget to purchase it. Unfortunately, most customers don’t fit this profile.”

Earlyvangelists can be identified by these characteristics:

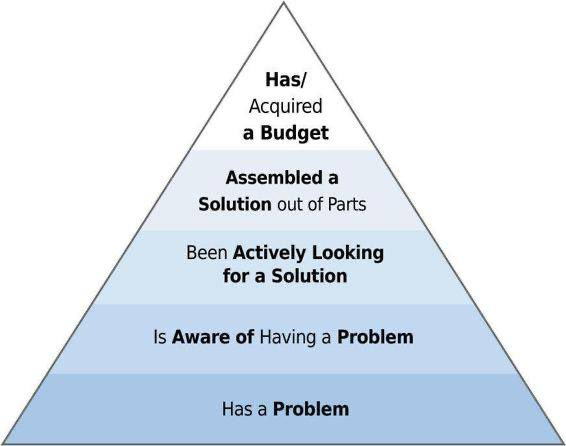

Image Credit: Steve Blank

They have a problem.

They understand they have a problem.

They are actively searching for a solution and has a timetable for finding it.

The problem is painful enough that they have cobbled together an interim solution.

They have, or can quickly acquire, dollars to purchase the product to solve their problem.

(The higher up a customer is in the pyramid, the more they feel the pain of this problem. Those that feel the pain the most, are the best candidates for your early adopters, and those who you should engage with for initial feedback and sales.)

These early evangelists are first buying the vision and then the product. They need to fall in love with the idea of your product. It’s the vision that will keep them committed the many times you screw up. You’ll have bugs, your product will eat their data, you’ll get the features wrong, performance will be bad, you’ll argue about pricing, etc.

But early evangelists will stick with you through good and bad because they share your vision. That means your Product and Customer Development groups must agree that:

The minimum feature set is spaced with Earlyvangelist interaction,

You will provide a one-page product vision or roadmap (typically 18 months to 3 years out) that’s shared with Earlyvangelists

Everyone (including the Earlyvangelists) understands the vision is subject to change.

2. Understand Your Most-Engaged Users with the Power User Curve.

LI JIN, Consumer Investment Partner @ Andreessen Horowitz:

Usually, when products want to see how engaged their users are, they look at the (Daily Active Users) / (Monthly Active Users) ratio metric. And while that’s useful, it only gives a single, blended average. It doesn't show where users fall across the activity spectrum.

By looking at the Power User Curve, a 30-day histogram that graphs user engagement by the total number of days per month they were active, you can see a more detailed breakdown of engagement to identify and understand power users.

When The Curve Smiles - A curve that looks like a smile - with high bars on the left and right - it shows that users are highly engaged and returning to the app daily. As the product can create more power users, the curve will shift further towards the right side of the smile. Facebook has a very right-leaning smile curve, with more than 60% of its MAUs coming back daily.

A Left-weighted Curve - When the curve is left-weighted, most users only have activity one day a month. By this activity metric, the product has very few power users. That's okay, not every product is built on daily returning users. An investing product like Wealthfront or a professional network like LinkedIn is bound to have a more left-weighted Power User Curve. Low engagement simply means the company must extract more value from each engagement and create revenue with a business model that isn't tied to daily usage.

Trends & Cohorts - Seeing how the curve changes over time will show if a product getting more engaging and why. A positive shift towards the right means a cohort of users is finding value in the product. This can illustrate how a new release or feature is bringing users back more often. Likewise, products like Uber or Thumbtack would want to look at cohort trends by geographic location to see how their product is developing in different areas and building network effects.

Customizing Your Curve - To get the most from your curve, customize it to your business. It doesn't need to be viewed on the 30-day scale. A SaaS/productivity product focused on the workweek and weekly active users might want to look at their power users on a 7-day histogram, and the activity doesn't need to be app opens or logins.

The curve can look beyond visits by using a deeper action that is more likely to show users getting or creating value. A publishing platform might want to look at “posted content” activity to identify its small contingent of power users. This is how YouTube could look at its creators, or eBay at its sellers.

There's No One Perfect Chart

There's no silver bullet for how to look at user engagement, but the Power User Curve is a helpful way to get away from a blended average of engagement numbers and visualize your users across the activity spectrum, which helps identify and create more power users and understanding how to monetize your product around them.

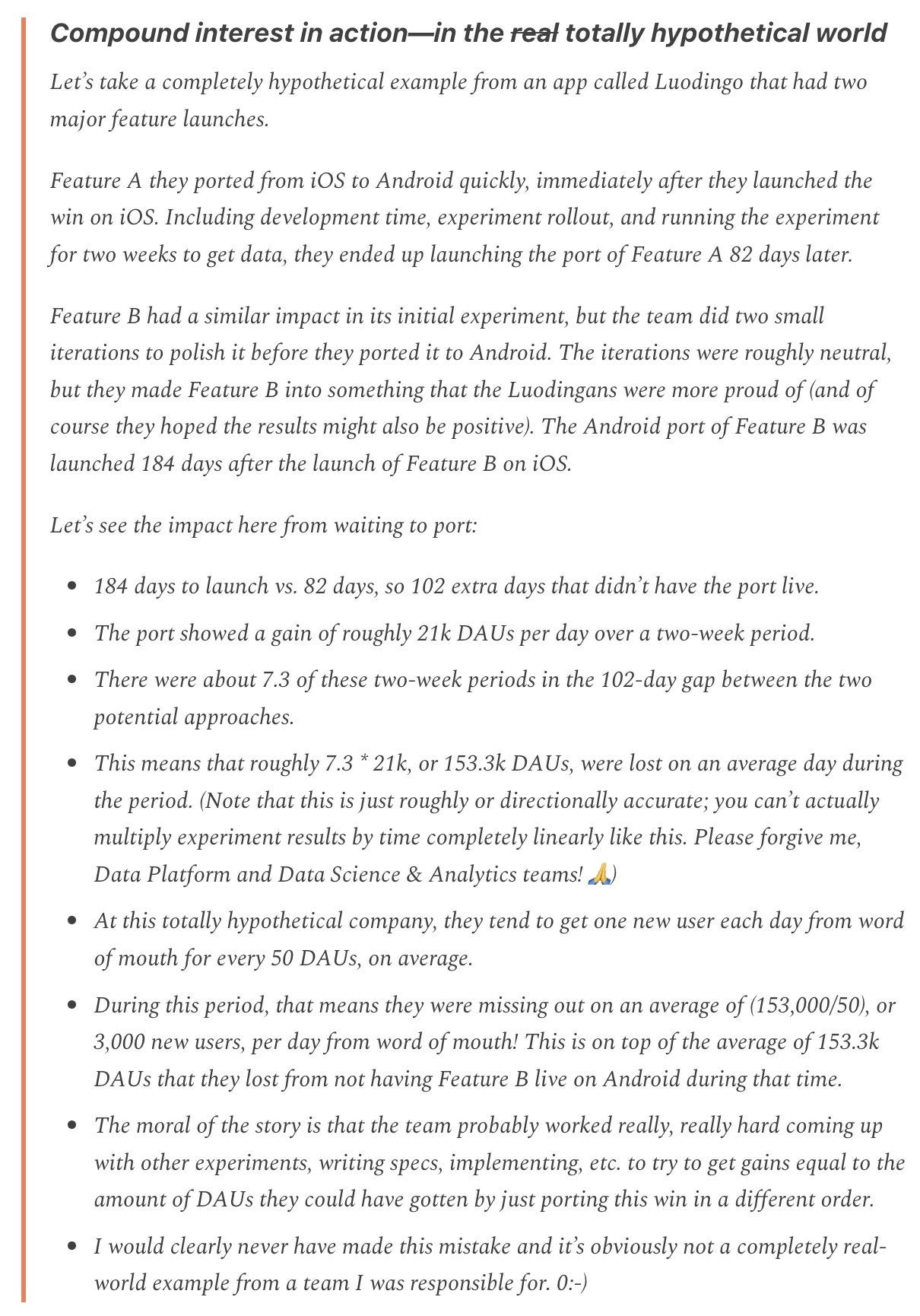

3. Duolingo’s VP of Engineering Sean Colombo On

Why you should roll out your experiments to as many users as you can, as quickly as you can -

Source: Lenny’s Newsletter

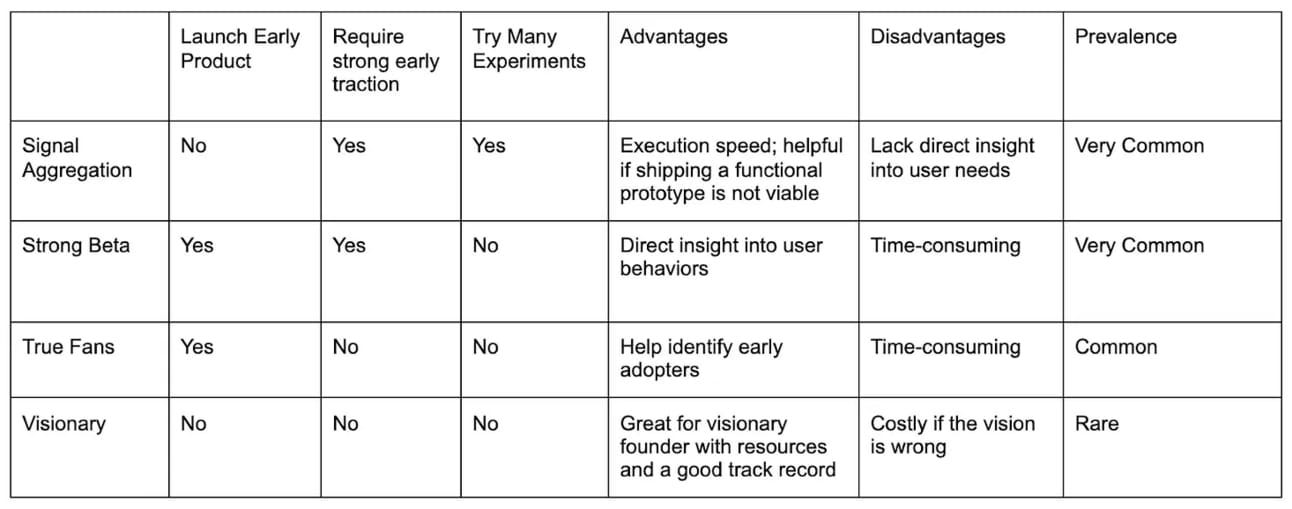

4. B2C Startup Idea Validation Framework.

Most ideas, especially in B2C, get validated in one of four ways:

This framework defines the differences between each path to validation.

Signal Aggregation

Founders should test an idea's viability through small experiments that provide evidence (signals) of potential success before building a full product. Common signals include landing page sign-ups, social media engagement, ad click-through rates, and customer interview feedback.

Strong Beta

Achieving strong early traction with a beta product is another popular validation approach for founders. Success metrics vary across industries, e.g., high user numbers and retention for consumer social apps, and healthy revenue for B2C marketplaces.

The process typically starts with a hypothesis for solving a problem. The founder builds a basic version to test the hypothesis. Beta products are often rudimentary, lacking polish, due to the emphasis on speed over perfection. This approach aligns with the lean methodology of launching quickly and iterating based on feedback.

True Fans

This approach is similar to the Strong Beta approach, as it involves launching a beta product. However, instead of focusing on significant traction metrics like revenue or user acquisition, the founder seeks to identify a small group of fanatic users who deeply love the product despite its limited features. The key is finding 20-50 users who would be disappointed if the product were to go away. These passionate fans, rather than large user numbers, serve as the validation signal.

Visionary

This approach is the least common among the founders interviewed, as it requires a clear vision and plan for the product from the outset. Typically, the founder has a close personal connection to the problem being solved and a strong understanding of what needs to be done to address it.

Join 26000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Elon Musk could leave Tesla if the $56 billion pay package is not approved by investors. More Here

Y-Combinator & Microsoft Ventures led an $8 Million funding round in a UK-based startup Unify that automatically finds the best LLM for every prompt. More Here

The Hong Kong government plans to sign a cooperation pact between its HK$62 billion ($8 billion) Hong Kong Investment Corp. and a local "unicorn" startup focused on large AI models and intelligent manufacturing. More Here

Robinhood, a Menlo Park, CA-based financial services company, acquires Bitstamp Ltd., a global cryptocurrency exchange for $200 Million in cash. More Here

Carta, a Silicon Valley startup, is working on a secondary sale that would value the company at $2 billion, a massive drop from its previous $8.5 billion valuation. More Here

Musk's AI startup X.AI Corp. plans to build a massive AI supercomputer in Memphis with an estimated cost of $9 Billion. More Here

→ Get the most important startup funding, venture capital & tech news. Join 20,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

Indeed!!

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Venture Capital-Intern - Redstone | Germany - Apply Here

Manager - Coinswitch venture | India - Apply Here

Finance Manager - HV Capital - Apply Here

Head of Platform - 43 North | USA - Apply Here

Vice President of Marketing and Public Relations - 43 NNorth | USA - Apply Here

Vice President of Operations & Administration - Good Friend | USA Remote - Apply Here

Associate/ Senior Associate – Investments - Sixth Sense Venture | India - Apply Here

Partner 36, Corporate Development, Bio + Health - a16z |USA - Apply Here

Fund Operations Specialist -Cocoon Capital | Singapore - Apply Here

Investor - Root venture | USA - Apply Here

Investor/Analyst (Singapore) - White venture capital - Apply Here

Summer Internship - Sequoia Capital | USA - Apply Here

Menlo Labs Associate -Menlo Venture | USA - Apply Here

Principal - Virtue VC | USA - Apply Here

🧐 Some Tips To Break Into VC:

On Younger VCs and a Focus on Emerging Markets

Advice by Michael Dempsey (Managing Partner at Compound)

“Focusing on emerging markets as a young venture capitalist is a minimally creative and non-durable way to build an edge against average investors. This approach may seem intellectually interesting but fails to offer a consistent path to driving venture-scale returns.

Young VCs should concentrate on developing a categorical/technological edge or leveraging network-driven advantages, rather than pursuing opportunities in new geographies. Spinning the flywheel of new geographical ecosystems is a challenging task that requires substantial activation energy and may introduce hard-to-underwrite risks. At the growth stage, understanding and fueling companies in need of rapid scaling could be a viable strategy.” (X Link)

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

Great stuffs man! Thanks for writing this.

Wow I had never heard of the elephant curve. Super interesting read!