How To Find Problem-Solution Fit? (A Framework) | VC Jobs

“How I CEO” by Mercury’s CEO & Brian Chesky (Co-founder & CEO Airbnb) on loneliness.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Framework To Find Problem-Solution Fit.

Quick Dive:

AI Startups Falling Into Silicon Valley's Cargo Culting Problem Trap.

“How I CEO” by Mercury’s CEO.

Brian Chesky (Co-founder & CEO Airbnb) on loneliness.

Major News: Musk Accused in a $7.5 Billion Insider Trading Lawsuit, $305M Bitcoin hack at Japanese crypto exchange DMM Bitcoin., Billionaire Groupon Founder's Startup IPO, Terraform Labs Founder Facing Billion Dollar Fine.

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH PORTLESS

The only thing that should be floating on the water this summer is you, not your inventory 🏖️

With Portless, you can ship orders directly from China in just 6 days, 3x your cash flow, and improve lead time by 10x.

Say goodbye to the lengthy 45-90-day wait for restocks. Now, you can replenish your best-selling items in just 3-5 days.

Ready to skip the ship and go Portless? Contact us today and receive 20% off your pick-and-pack fees during your first three months.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

Framework To Find Problem-Solution Fit.

90% of startups fail within their first year of operation

It is a sobering statistic that highlights just how difficult it can be to get a new business off the ground.

There’s just a lot to consider, from developing your product to finding the right customers. But one of the most crucial aspects of a successful startup is ensuring that your solutions fit the problem you’re trying to solve.

We’ll discuss what Problem-Solution fit is and how startup entrepreneurs can ensure they have it. I’ll also share some tips on how to identify the right problems to solve and offer some tools to do this right.

So if you’re in the midst of building your own venture, read on!

Where Does Problem-Solution Fit in Your Startup Journey?

In The Startup Owner's Manual, Steve Blank highlighted all successful startups start with learning about problems:

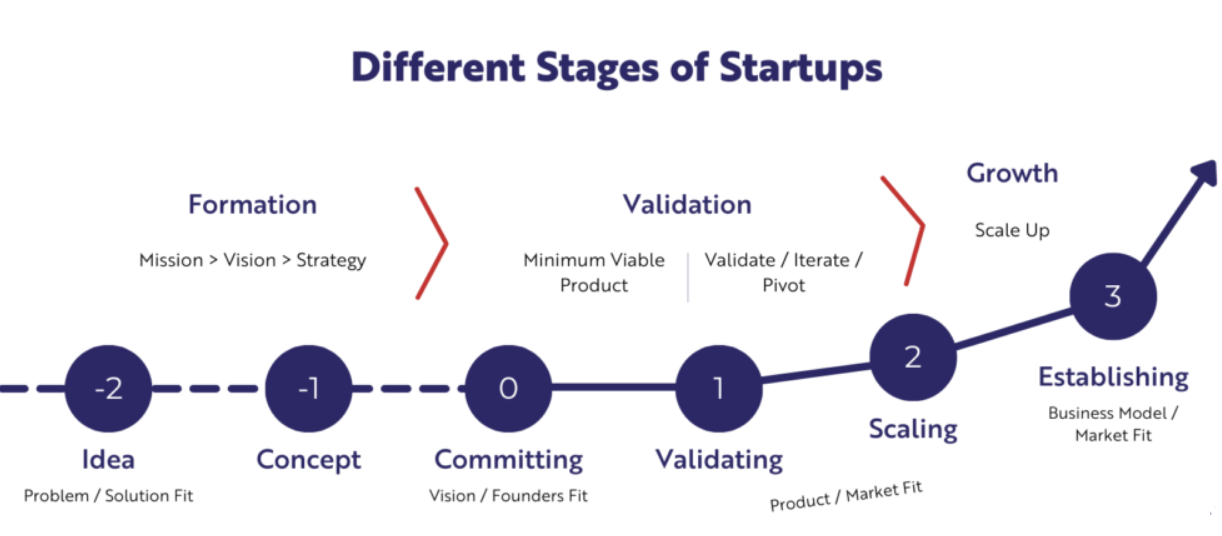

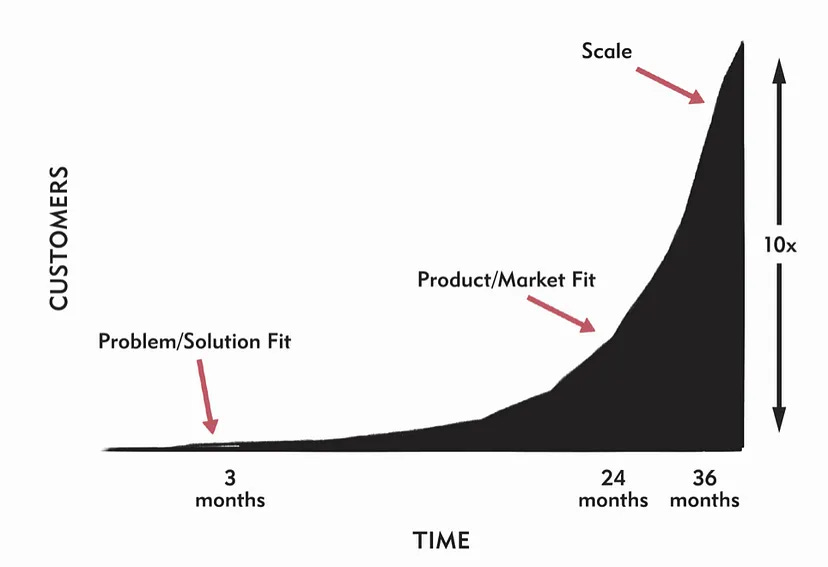

The first stage of a successful startup begins with finding a Problem-Solution Fit. This is when founders have discovered a deep customer problem in an underserved market. There is a lot of pivoting and working closely with a few sets of customers.

Then they move on to Product/Market Fit, where the startup has found a way to sign up customers, retain them and get healthy revenue in a large enough market.

Lastly, the startup moves into the Scale stage, focusing on expansionary growth and telling even more customers about their products.

So, What Is Problem-Solution Fit?

Problem-Solution Fit (PSF) is when founders have discovered a deep customer problem in an underserved market. This stage is generally very early and often in the seed or pre-seed stage.

Image Source: Scaling Lean

Take Airbnb as an example.

The founders identified a problem when they started renting out their rooms to earn extra money. Then, they created a platform to help even more people earn extra income—the solution.

Their Problem-Solution Fit moment came when they received their first bookings during the Industrial Design Conference in 2008, then again via the Democratic National Convention in Denver.

They learnt that large events with hotel shortages were their secret sauce for growth. Armed with the problem-solution opportunity, they applied for Y-Combinator and got in. They expanded into New York (where there are always hotel shortages), and the rest is history.

Every successful startup starts from finding Problem-Solution Fit → then Product-Market Fit → then Scale.

Where are you now on that journey?

So, How Do You Find Problem-Solution Fit?

As a founder, the moment you’ve thought of your idea, you’ve subconsciously started looking for PSF.

The Problem-Solution Fit takes shape slowly from a blurry gassy form to a fluid liquid form and eventually a tangible, solid form.

Some founders do this consciously, some intuitively:

Blurry Gas Form:

In this form, founders identify a problem and a solution that makes perfect sense in their minds. They either write it down or keep it in their minds. The product lives in the founder’s imagination, without evidence.

Fluid Liquid Form:

Next, the founders identify a solution and ascertain whether their audience resonates with it. They’ll attempt to attract early-evangelists and iterate through landing pages, demonstrations, or prototypes.

Tangible Solid Form:

In this form, founders leverage demonstrations from digital prototypes, videos, sticky-tape solutions, and experiments to assess the efficacy of their proposed solution. The savvy founders will try to convert some early-evangelists into paying customers.

During these 3 phases, it’s best to use a tool to capture the idea as it evolves from gas, liquid and solid forms. It’s important to highlight the assumptions as the idea evolves and validate them. Here are 3 great tools to help you with this:

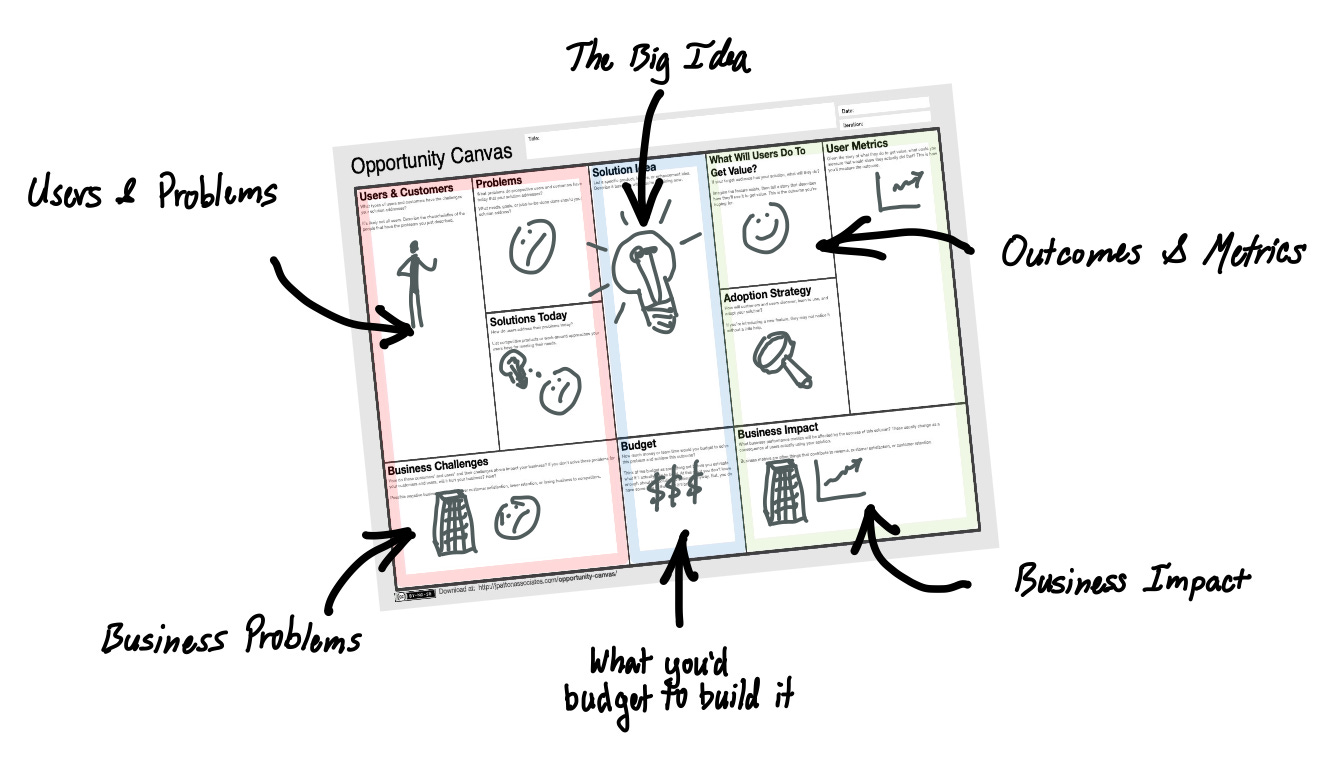

1. Jeff Patton’s Opportunity Canvas tool is my favourite tool as it focuses more on product discovery and customer problems.

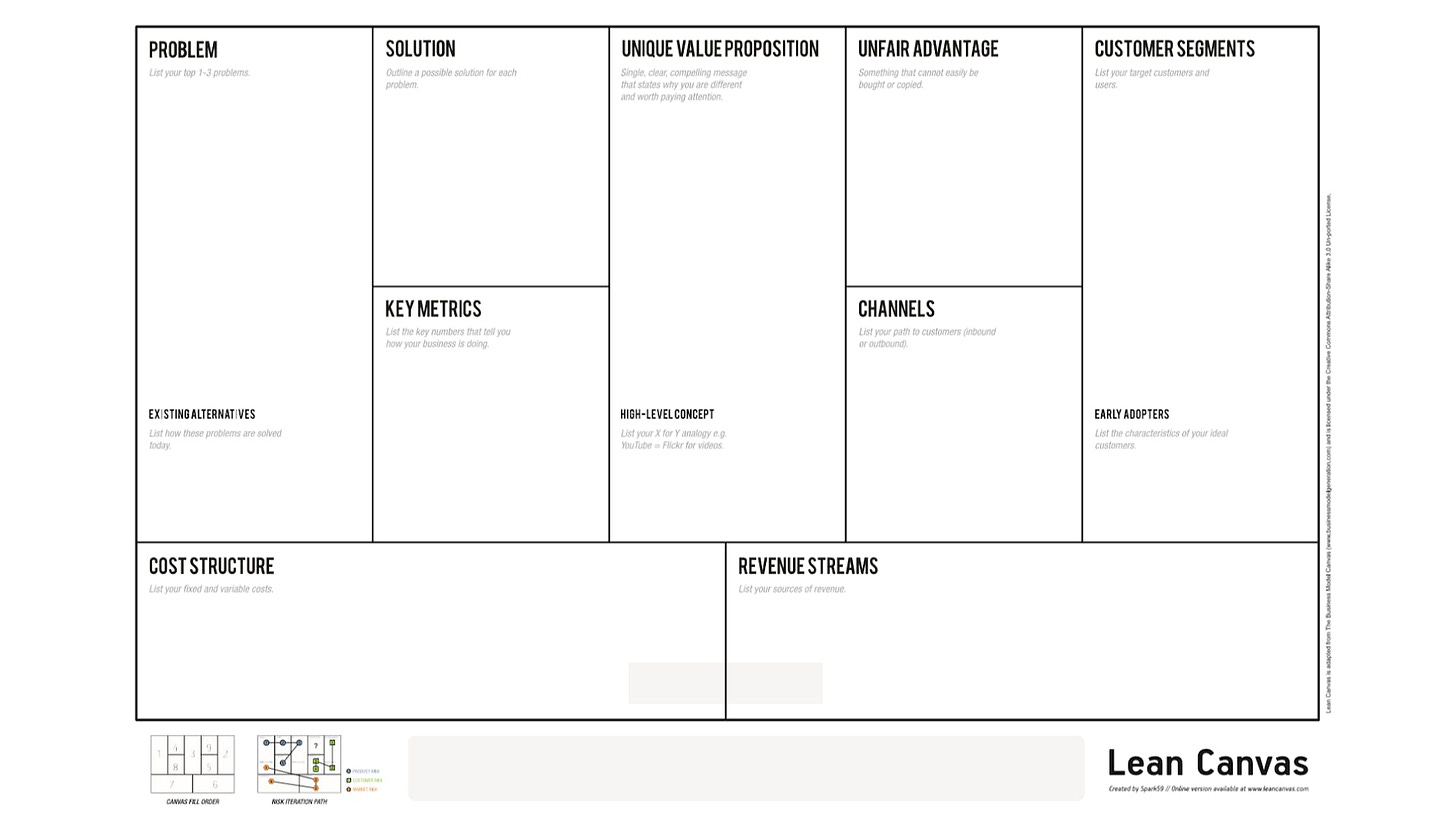

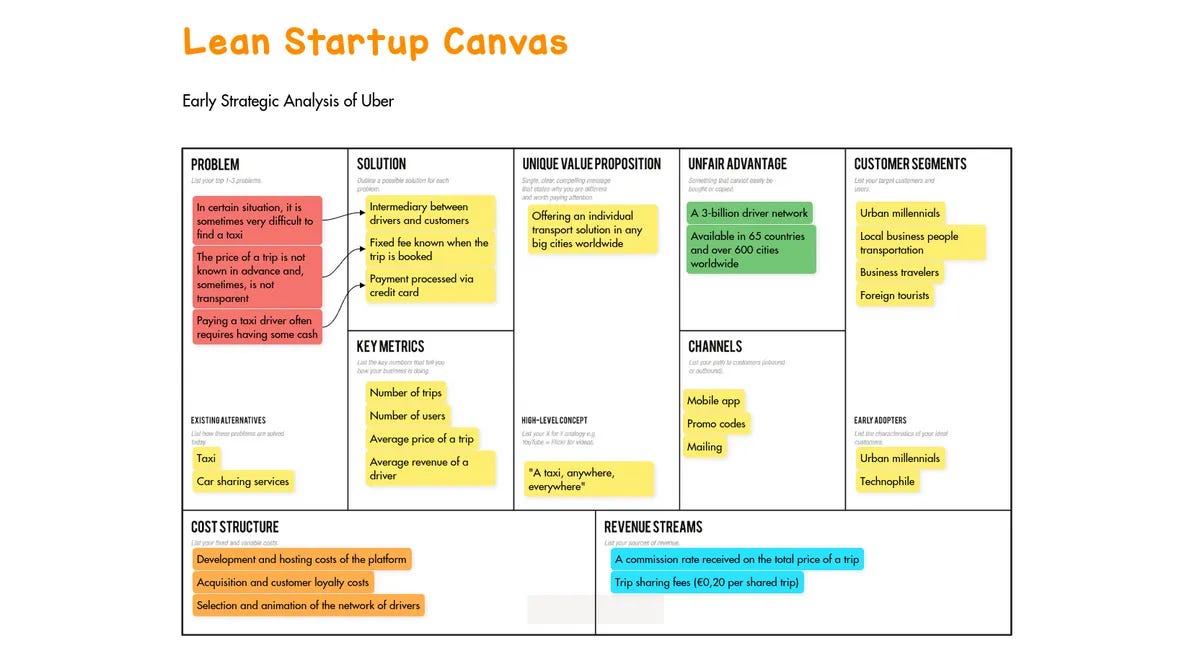

2. The Lean Canvas tool is always a great choice for startup founders. The Lean Canvas is more holistic for your startup, whilst the Opportunity Canvas focuses more on the product.

Let’s look for Uber example -

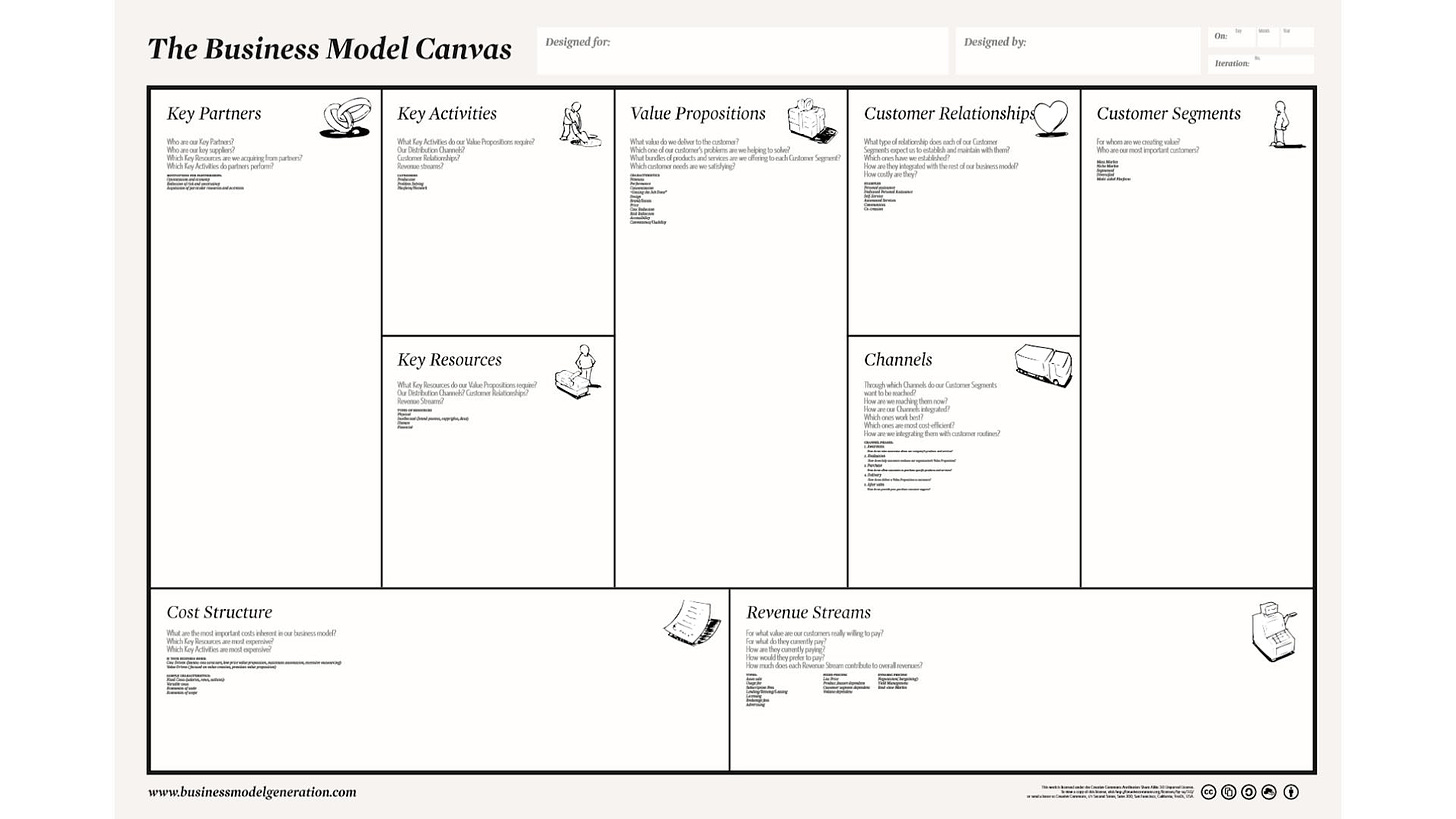

3. If you’re building a B2B product, the Business Model Canvas is a great option as it highlights partner channels and key resources you need to get you started.

Write down your idea, and spend the time to validate your problem-solution with your early customers. From my experience, it takes 3 -5 rounds of validation to arrive at a clearer understanding of the problem, the customer, and the solution.

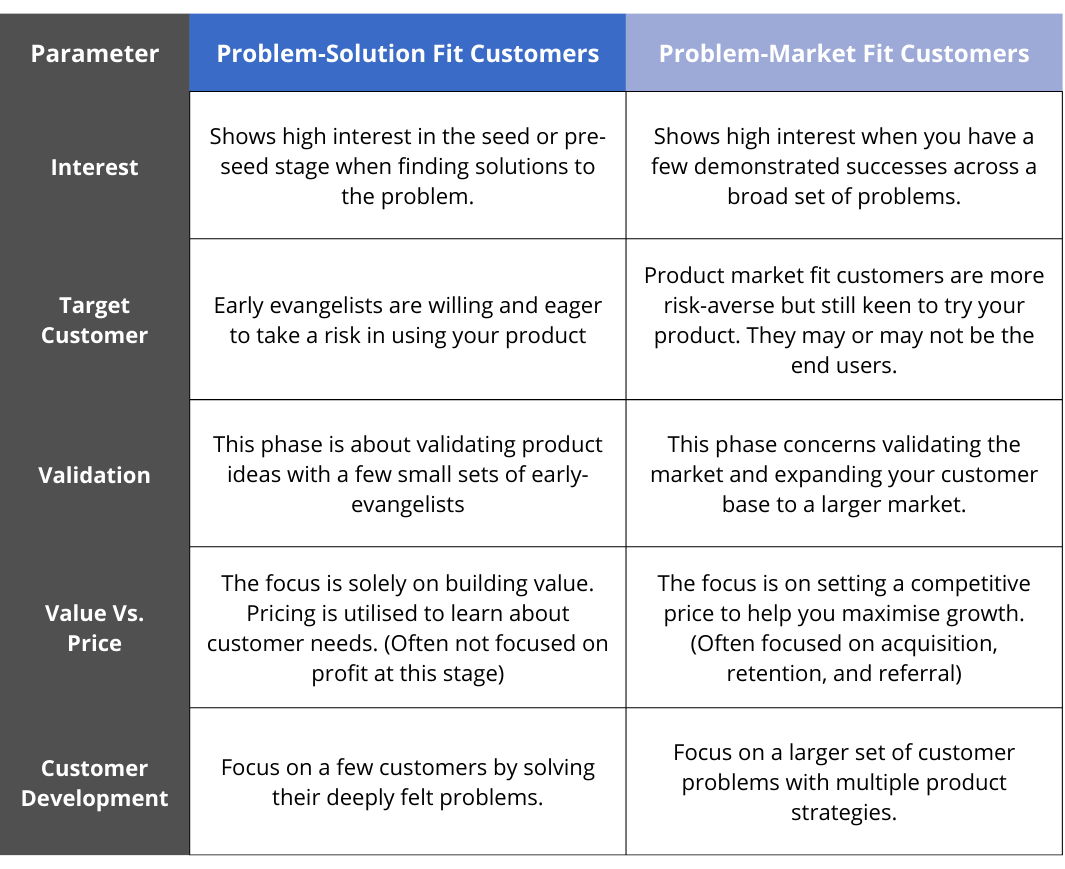

Problem-Solution Fit vs Product-Market Fit

Problem-Solution Fit and Product-Market Fit are often a point of confusion for early founders. On the surface, these two definitions are virtually identical = find a valuable product in a big enough market. However, the solutions in the Problem-Solution Fit stage are often different to those in the Product-Market Fit stage.

This is because Problem-Solution Fit focuses on a tiny group of early-evangelists who are comfortable with missing features, as long as it solves their core problem. (Bad UX, no onboarding, and manual work-arounds are part of the fun!)

Whilst solutions during the Product-Market Fit stage focus on selling your product to a larger mainstream market. These solutions need to have a more robust set of features. (Reliability, Security, Reporting, and a decent UX is a common ask for these customers).

Problem-Solution Fit Example

David Wang, founder of product academy shared this example - “A great example I’ve experienced recently was assessing a content moderation tool for the company I currently work for.

My company is on a mission to create the most trusted destination on the internet. We want to moderate all content hosted on our platform to protect visitors.

Our team scoured the internet to find a tool that fit our requirements. After weeks of searching, we came across a startup that friends in the industry highly recommended. Their product was easy to use, had an AI engine that makes our lives easier, and had a few customers using it - a great demonstration of Problem-Solution Fit!

However, due to the size of our remote-first workforce, information security was a key need for us. We require features like Single-Sign-On and specific security certifications that the startup didn’t offer.

As a result, we ended up choosing another tool with fewer features but focused on a more robust set of features on information security. When we broke the news to the founders, they were disappointed but understood their product wasn’t right for us.

We departed amicably, and the startup will reach out again when they have the security features we require.

Now… could the startup have built the security features that we need? Absolutely.

But more importantly, was my company the right customer for them? Probably not.

They were focused on smaller startups with different sets of needs. To change their product just for my company would’ve meant overheads that were not worth it for them.

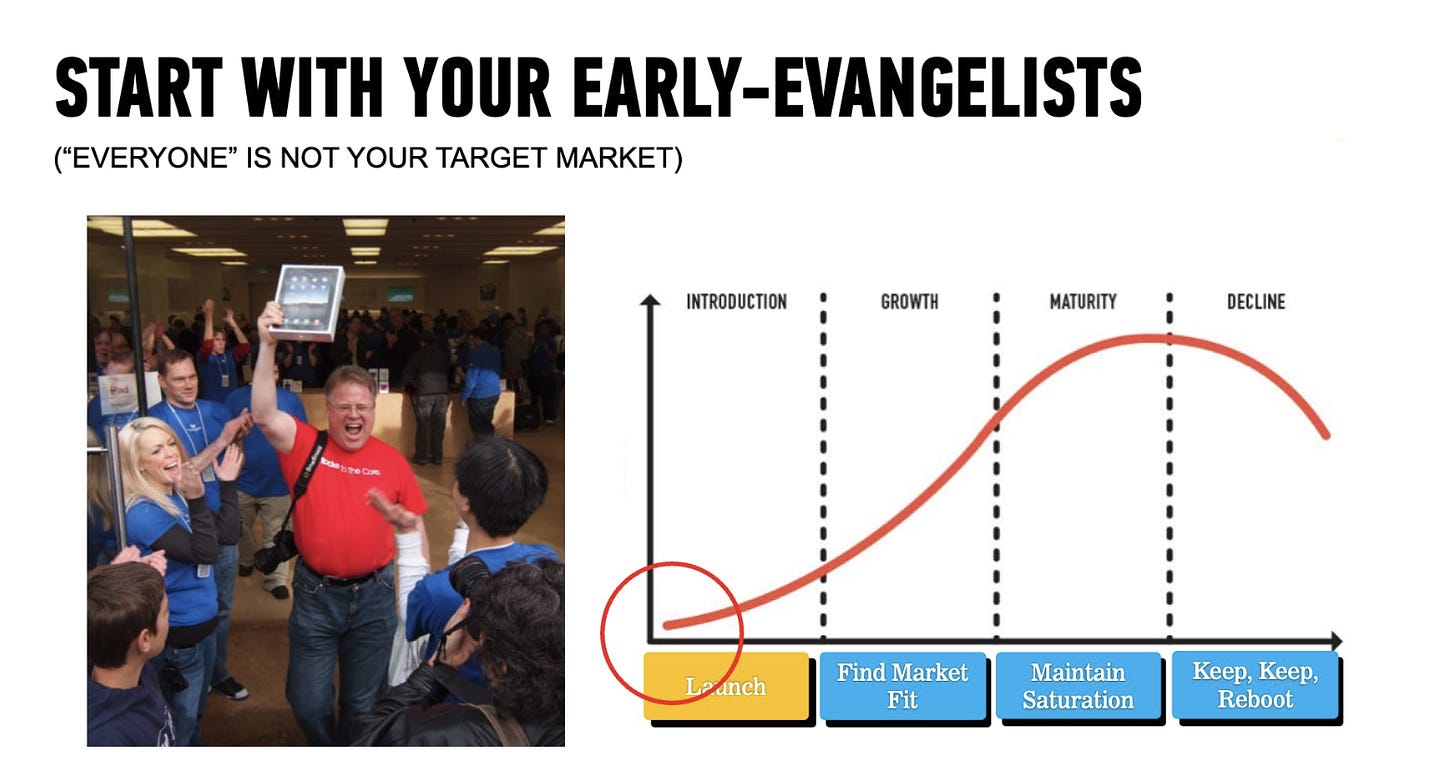

The moral of the story is that “everyone” is not your customer.

When you’re trying to find Problem-Solution Fit, your customers must be your “early-evangelists”—these are customers that would scream and shout about your product.

Once you’ve found a strong base of “early-evangelists" you can move into a bigger market to find Product-Market Fit.

Here is a quick comparison between your PSF customers vs your PMF customers:

Selling to your early evangelists

Your early-evangelists are the catalysts of your product. These customers are willing to risk buying an unfinished product to gain an early competitive advantage or purely for bragging rights. (P.s. Bragging rights are never long-term strategies but it can get you off the ground).

In the B2C space, they might be your techy friends who are always trying out new things.

In the B2B space, this could be an executive testing a new business opportunity or a head of a function trying to solve a burning problem.

The ultimate test for early-evangelists is their willingness to pay for your product. When presenting your product idea to your ‘evangelists’— don’t be afraid to ask for a sale. If there are signs of hesitation (from both sides), you are not solving a problem deep enough.

Go deeper and ask: “What would make you pay a small deposit for this product?”

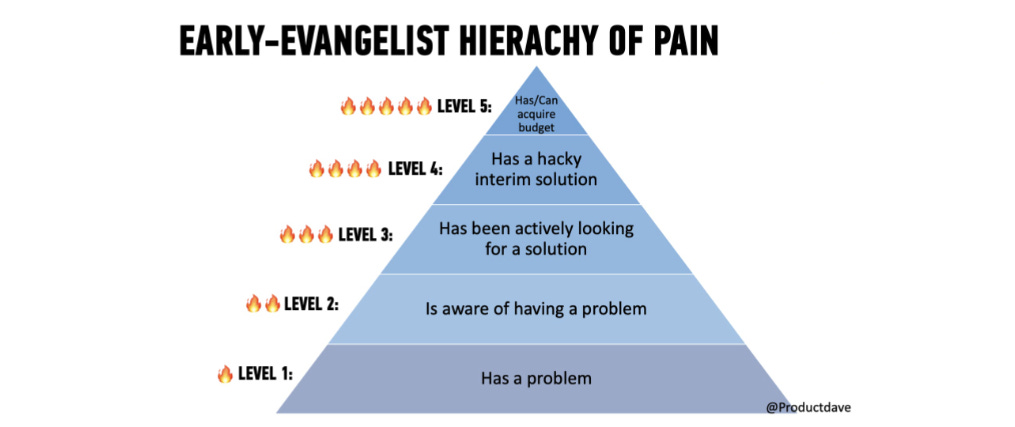

Early-evangelist hierarchy of needs

Like a product, the early-evangelist goes through 5 stages of pain. The ideal customer is someone who is at the highest level and has the budget ready to buy something to solve their problem.

These are the five stages of pain your early-evangelists goes through:

Pain Level 1: They have a problem or a need

Pain Level 2: They understand they have a problem (or you’ll need to help them discover a problem)

Pain Level 3: They are actively searching for a solution to the problem, and have a timeline for finding it

Pain Level 4: They problem is so painful that have cobbled together an interim solution

Pain Level 5: They have committed budget or can quickly acquire budget to purchase a solution

Source: Productdave

The closer to the top of the pyramid, the more likely they will buy your product, and even spread your vision for you.

So, where do these early evangelists hang out?

Let’s think about the last time you were in a market to purchase a property or looking for a place to rent. Where did you go?

You’d probably start with a google search on a suburb or use a real estate website. You might ask your friends and family or even walk into your local real estate agency.

If you’re looking for your early-evangelists, they won’t come to you directly—you need to go where they are looking. Cold-calling rarely works because it’s hard to identify your customer's pain level in one single call. Better to invest your luck in one of the five strategies below.

These are 5 Key Strategies To Find Early-Evangelists:

1. Leverage your network

Ask your existing friends, family, colleagues, investors or even LinkedIn to connect with people experiencing the problem you’re trying to solve. Offer to advise, free work, kudos, or anything your network finds valuable in return.

Practice give-give-get. Always give more value to your network than you get from them, and people are willing to help you.

2. Find the virtual “Gathering places”

These are online or offline gatherings where your early evangelists go to find a solution to solve their problems. Places like forums, social media groups, Twitter, slack groups or even shared offices.

Be active and generate conversations around the problem you’re trying to solve, and of course, give-give-get.

3. Events

Attend conferences, seminars, trade shows and meetups where your early-evangelists go for pleasure or work. Or, if there are no events for your problem space, create one yourself and use your network and the ‘gathering place’ above to spread the word.

You’ll make a conversation topic that shows you deeply care about helping your customers solve their problems.

Pro Tip

Find a way to access the attendees' list so you can reach out beforehand and set up 1:1 time with potential prospects. The networking starts BEFORE the event begins.

4. Paid advertising

In some instances, paid advertising might be a great way to get your startup in front of people. I’m broadly using the term ‘paid advertising’ to involve more than just google ads. Think about paid sponsorships, paid ads in a newsletter, paid influencers, or anything that you can use the money to acquire attention. Make sure you have a clear “what’s-in-it-for-me” call to action to turn your prospects into conversations.

5. Agents, partners or consultants

For more complex industries, you might have to go through agents, consultants or partners that already have an established footing with your customers.

A typical example is breaking into the enterprise sector would require you to go through a few ‘approved’ vendors for you to have a ‘ticket to play’. You can sell your product through existing vendors/consultants or build apps through a marketplace like Slack Apps or Salesforce Marketplace. Partnerships are great for getting your foot in the door and finding early customers.

Play long-term games with long-term people. Grow with your early evangelists, and they’ll spread your product for you.

Finally, develop the product for the Few, not the Many

The sweet spot for startup success lies in the intersection of a meaningful problem and a right solution. In a startup, the first product is not designed to satisfy a mainstream customer, and that’s okay. No startup can afford to build a product that suits every customer and be successful at it.

All great products starts with finding a Problem-Solution Fit. Be prepared to pivot, persevere and even kill off bad ideas. Always remember:

You’re creating a product for your customers, not your ego.

Find your early-evangelists to pay for the problem you solve, and solve it well.

As a founder, time is your most valuable resource, not money. Do everything to preserve it.

If you're a founder seeking guidance, look no further than the must-follow resources meticulously developed by Antler's Academy. (Featured Article)

QUICK DIVES

1. AI Startups Falling Into Silicon Valley's Cargo Culting Problem Trap.

“Wearing A Black Turtleneck, Doesn’t Make You Steve Jobs!”

When it comes to building a startup you’re never doing it entirely from scratch. Inspiration and ideas can come from a variety of places, including other successful startups.

But there’s a thin line between borrowing smart ideas and copying them blindly - otherwise known as Cargo Culting.

In simple words, Cargo Culting is copying something without understanding why you're copying it. That’s where most founders fall into the trap. Even in recent times, startups are following blindly other AI startups that are not even successful because they raise millions of dollars.

If you are wondering about the Cargo Culting word - This term originated from the practice of creating fake landing strips to attract aeroplanes without understanding the reasons for the attraction.

In the classic variety of cargo cutting, the founder’s mentality is “It's just I'm going to copy something, don't know why but I'm going to copy it and then I will be as successful as the thing I'm copying.” Almost all founders think this.

However, in the modern new age of Cargo Culting, there is a question of whether the thing being copied is worth copying at all. This one misses some obvious aspects because they don't deeply understand the product they are copying.

If you look at some of the companies that had classically covered Culting:

In 2000, Every Startup Was Obsessed With Google.

“Everyone seemed fixated on Google's practices – whether you were the next Google or striving to emulate their success. Ideas, good or not, were trained to lean towards mimicking what Google did.

The most apparent trend was replicating their office culture: open spaces, bright colours, and free snacks. This "Googly" vibe became a benchmark for startups, as if mirroring Google's office culture was the key to real success.

The absence of traditional offices, the flat organizational structure, and the mantra of hiring as many smart engineers as possible were also part of this emulation.

Even down to the details like cute startup names with dropped vowels and logos reminiscent of Google's style, complete with lens flares, were considered crucial. In the pursuit of building the world's best search engine, it became evident that replicating Google's office culture and aesthetics played a vital role.”

The second one is Facebook.

“They're the pioneers of going viral. So for every startup founder/investor “going viral” became the question and everyone tried to follow Facebook’s playbook without thinking this copy was good or bad.

Also, Facebook introduced the concept of the share button – a must-have on everything. Another classic from Facebook was avoiding direct user revenue and focusing on building a massive user base, then transitioning into an ads business.

This was the mantra, universally accepted – follow the Facebook Playbook, regardless of the business type. Charging users was frowned upon; the goal was to accumulate vast user data. The prevailing belief was that privacy didn't matter, a notion blindly followed by many without thinking it was right or wrong.”

The last one is “Spend Like Uber.”

“It all started with the notion of spending as much money as possible – a strategy that, amusingly, became a key takeaway.

The concept of cargo cutting emerged, where people imitated Uber's actions without understanding the reasons behind them. Uber did well in what it did, but the folly lay in blindly copying its superficial actions – scaling without comprehension, burning through funds, ignoring laws, and neglecting unit economics.

The desire to be like Uber led to some rather silly endeavours by those who didn't truly grasp the essence of Uber's success.”

The most interesting thing is that all these startups - Google, Facebook or Uber worked very well and are pioneers today but the startup that followed Cargo cutting just died in a few years. So what makes these three startup to be pioneers?

Because - they knew what they were doing without copying/following the Cargo Culting strategy.

For Google, hiring really smart people was crucial because they were tackling a challenging problem. Before Google, there was a misconception that search was a commodity, but Google proved otherwise with its technical breakthroughs. They hired talented engineers after the dot-com bubble crash, making perfect sense in a historical context.

Facebook's decision not to charge users but to focus on building an ad business made sense for their scale. However, blindly copying their playbook didn't lead to the same success. Going viral, a great strategy for Facebook, might not work for everyone. It's easier when users spend hours daily on your platform, unlike products with shorter usage times.

Uber's common beliefs were often inaccurate. Investors funded markets with good unit economics, not ones burning money. Copying Uber's expansion strategy without understanding market dynamics didn't work. Uber succeeded because it provided immediate value, not by superficial imitation. Replicating success is challenging; it requires genuine understanding and smart execution.

So “Wearing A Black Turtleneck Doesn’t Make You Steve Jobs or Successful like Apple.” If you are copying someone, the most important thing to understand is whether it’s good or bad.

Also even if you look at current AI hype, What worries me more with the surge in valuations is - founders copying companies that haven't succeeded yet. It's alarming when founders adopt strategies simply because a company raised a significant round or gained attention.

When I asked about some companies in pitching, the common response is often "I have no idea." As a CEO, betting your company's strategy on limited information from fundraising announcements or podcast interviews seems risky.

Copying something that's working might bring luck, but copying something that's not working is questionable. The inflated valuations seem to have skewed perceptions. Assuming a company is successful just because investors value it at a billion dollars is misguided.

I've seen many influenced by the likes of WeWork or Zoom Pizza, blindly copying strategies based on fundraising rather than business success.

Unfortunately, this often leads to flameouts for the founders who followed such trends.

Interestingly, there's a growing trend among startups where they engage in modern cargo quilting. The focus shifts towards the superficial – how the startup appears to others. It's all about the logos, as we discussed earlier.

Founders feel the need to mimic other startups to create a certain perception. The superficial checklist includes raising money, having notable advisors, and even getting a patent. A killer pitch deck becomes crucial, along with the ability to pitch the company anywhere. Attending conferences and securing press coverage are deemed essential. These are actions taken by founders not necessarily for the users but to impress themselves and other founders.

It's all about creating a startup image that aligns with what's perceived as successful.

The key takeaway here is that while innovation is important, it's also crucial to recognize the value of learning from existing successful companies.

Founders should begin by understanding what users want and identify the companies that users are currently paying for similar services. By studying these successful companies, founders can gain valuable insights.

It's essential to view the business through the eyes of the user. For example, do users prioritize the Google logo, or do they value getting accurate search results quickly? Similarly, for Facebook, is the focus on the platform itself or on staying connected with friends and receiving timely updates? When founders prioritize understanding user needs, they are more likely to make essential decisions.

Starting with a user-centric approach avoids getting caught up in superficial details and allows for a more meaningful assessment of what truly matters to the users.

This user-focused mindset is a more effective way to navigate the complexities of building a successful business compared to starting with fundraising announcements, which can be challenging and may lead to overlooking the core aspects that drive user satisfaction.

2. “How I CEO” by Mercury’s CEO

Recently, Mercury's CEO Immad shared a tweet titled "How I CEO," which I found really interesting and suggest founders should follow. He shared:

“Treat your investors as partners not parents.

Something a lot of founders forget is that investors are in service to your company. Founders often treat investors like a boss. But thats a mistake.

The problem is that it’s human nature that if you’re treated like something, you end up becoming that thing to an extent. If someone comes to you and asks you to tell them what to do next and to basically make a decision for them, you might take on that role.

3 problems with this:

your investors don't work at the company and don't know enough of the details. Their advice should only be taken as one of many data points

creates bad power dynamics. Investors act as a boss rather than as a partner to help you make the startup successful

creates toxic relationships. Founders end up seeking praise and validation and reporting rosy status updates rather than working on the real problems.

As an investor, I can confirm that being treated like a boss or parent isn’t really what most of us want. I personally dislike it when I see an investor update or have a conversation and it’s just all very positive. Makes me wonder what’s actually going on in the business.

You should setup the investor-founder relationship as a partnership.

Ex - for board meetings make them into authentic collaborative sessions, around the problems you’re tackling next, and picking your board’s brain about how to address those things.

To set the tone for a balanced founder-investor relationship early on, I think it’s really important to shift mode straight after closing an investment.

The process of fundraising is unique — you’re trying to create a sense of FOMO, you’re putting your best foot forward, and you’re essentially selling your company. But once you’ve closed a deal and the money is in the bank, it’s good to have a meeting with the investor and just have a very authentic interaction.

Grab lunch and pick your investor’s brain on your main challenges and what you’d love input on. Talk about higher-level ideas in a relaxed setting, and start building the foundation for a partnership. Do these meetings regularly — plan catchups between board meetings, either in person or over the phone, to ensure that you’re building a relationship that feels solid and less transactional.”

3. Brian Chesky (Co-founder & CEO Airbnb) on loneliness.

“As I became a CEO, I started leading from the front at the top of the mountain, but then, you know, the higher you get to the peak, the fewer the people there are with you. No one ever told me how lonely you would get, and I wasn't prepared for that. I had this guilt about not working because so much of my life was about being successful, probably if I were to dig deep because I thought that would make people love me.

And the day of our IPO, we reached a hundred billion dollar valuation. I remember after going public, it was like, 'Oh my God, there's this like amazing exaltation.' It was amazing like I'd gone to the mountain and then I wake up the next day, and my life is exactly the same. I'm alone. I wake up, I put on sweatpants, I go onto iMac, and I have like 10-12 hours of Zoom meetings and I just don't really have much of my life outside of work. My work was my life.

I didn't know at the time that I was lonely. I knew I was isolated, but I didn't know that that also meant loneliness. And I thought I have all these people around me, how could I possibly feel this way? And there were a couple people that entered my life that gave me some awareness and consciousness, one at the deeply personal level and one more at the professional level.

And the other person I met is the now and former Surgeon General of the United States, Dr. Vivek Murthy. We hired him during the pandemic because a lot of people were afraid to go into Airbnbs and they were worried about germs on surfaces. I remember having a conversation with him, and he said something to me. He said, 'Brian, do you know what the number one killer in America is?' I'm kind of paraphrasing our conversation. And I said, 'I don't know, is it like heart disease? Is it cancer?' And he goes, 'No, the number one killer in America is loneliness.” More Here

Join 25000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

A Tesla shareholder filed a lawsuit accusing Elon Musk of insider trading, claiming he sold $7.5 billion in Tesla shares before disappointing production numbers were made public. More Here

Billionaire Groupon founder Eric Lefkofsky's company Tempus, a genomic testing and data analysis firm, is preparing for an IPO. More Here

Terraform Labs and Do Kwon reached a settlement with the SEC over misleading investors before TerraUSD's collapse, avoiding potential billions in fines and a crypto ban. More Here

Japanese crypto exchange DMM Bitcoin confirmed a massive hack resulting in the theft of around 4,502.9 bitcoins worth approximately $305 million, one of the largest crypto thefts in history. More Here

Microsoft is investing 33.7 billion Swedish crowns ($3.2 billion) to expand its cloud and artificial intelligence infrastructure in Sweden over a two-year period. More Here

→ Get the most important startup funding, venture capital & tech news. Join 20,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

Reminder for founders.

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Analyst / Associate - Decacorn | Singapore - Apply Here

Program Manager - Brightedge | USA - Apply Here

Associate - Brightedge | USA - Apply Here

Associate, New Ventures | USA - Apply Here

Junior and Senior Analyst /Associate – Investment Team - BIF | India - Apply Here

Ventures Investment Portfolio Analyst - Capital One Ventures | USA - Apply Here

Executive Assistant - Morrison seger partner | USA - Apply Here

Executive Assistant - Arboretum Venture | USA - Apply Here

Investment Manager - Antler | UK - Apply Here

Associate Director - Scouting - Antler | UK - Apply Here

Research Fellow - Leonis Capital | USA - Apply Here

Analyst/Associate - Pi Venture | India - Apply Here

🧐 Some Tips To Break Into VC:

Start Helping Founders Right Away

Of all the assets you can have to break into VC, one of the most important ones is being referred to as 'someone very helpful' by entrepreneurs, other investors and peers.

In fact, "Let me know how I can be helpful" is a sentence that VCs use very often. So often that it's become the biggest meme in the history of VC:

If you don't do it hypocritically and genuinely prove helpful to founders, they will remember you. It can become your superpower.

While it is one of the hardest assets to build, it also generally requires no financial capital and is worth trying out. Here are a few ways to do it:

Directly Helping Founders

Whether you have a lot of founders in your network (e.g. university friends, LinkedIn connections etc.) or you don't, you can always reach out to them (e.g. via cold emails) and find ways to make yourself helpful. Depending on your skills (whether you're good at sales, finance etc.), you could help founders:

Close deals

By making introductions to other investors

Prepare their fundraising materials

Train their pitch

With specific tasks such as accounting

While this will help you learn all about the startup-specific issues they will be facing, it will also help you build a great reputation in the founder world. Win-win.

Building An Asset Or Network That Will Make You Helpful To Founders

Another way to give VCs the idea that they'll be invaluable to founders is to build an asset or network that will give you an edge over others when it comes to helping. For instance, you could be:

Working at an iconic tech company and running their alumni group or their angel syndicate

Running your university's startup society, accelerator or fund, and helping founders in the network

Running an event series or a conference

Running a community

Running a media outlet that gives you an edge (e.g. The Twenty Minute VC → can help founders raise money; "The 20 min Blockchain Engineer" → can help founders recruit in that space)

Being deep in a very local ecosystem

Working at a company like Product Hunt or in tech journalism (can help founders with distribution / PR)

Whatever approach you decide to take to help founders, the process will teach you about the importance of being able to sell yourself. Venture Capital is about seeing deals, picking deals and winning deals. As obvious as that sounds - if you think about it - that is also the definition of a sales job....

While most people see VC as sitting comfortably on the 'right' side of the table and having amazing founders pitch to you all the time and just having to pick the ones you like, it very often ends up being the opposite.

Since the number of VC funds out there is on the rise every single year - and founders are increasingly becoming selective as to who they want to work with - staying relevant and having a seat at the table for top-tier deal flow is a very difficult game. It implies pitching your fund in unique ways in every single conversation you have, constantly building a brand, and hustling to get the best entrepreneurs to engage with you and love everything about you and your fund.

💡 Helping founders before you land your dream VC job is the first way to train in 'selling yourself'. Here are a few resources that can help you understand what selling involves:

Looking To Break Into Venture Capital?

Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

FROM OUR PARTNERS

Build your Web3 startup on Stellar & receive $20K in grant funding with Draper University’s Stellar Program: Apply Here

The Venture Crew helps You Write, Design And Model Your Pitch Deck Into a Storytelling Book. Contact Us Today